Contribution Limits For 2021 And 2022

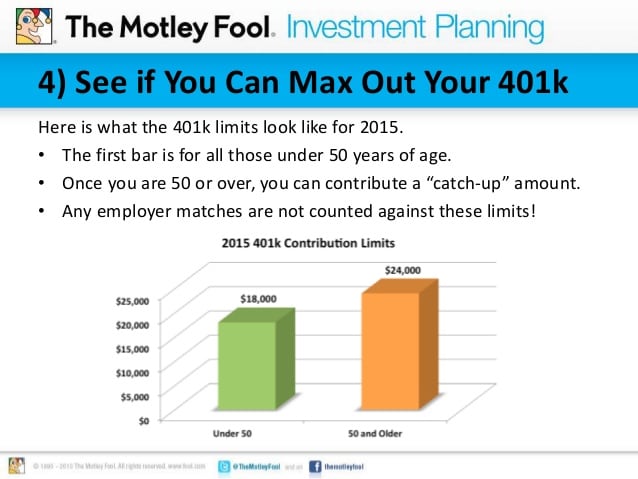

When most people think of 401 contribution limits, they are thinking of the elective deferral limit, which is $19,500 in 2021 and $20,500 for 2022. This is the maximum amount you are allowed to voluntarily defer to your 401 for the year. Adults 50 and older are also allowed $6,500 in catch-up contributions, which are additional elective deferrals, in 2021 and 2022. This brings the maximum amount they can contribute to their 401s to $26,000 in 2021 or $27,000 in 2022.

The IRS also imposes a limit on all 401 contributions made during the year. In 2021, it rises to $58,000 and $64,500, respectively. In 2022, it rises to $61,000 and $67,500, respectively. This includes all your personal contributions and any money your employer contributes to your 401 on your behalf.

Highly paid employees have some additional limitations to keep in mind. Companies can elect to stop a participant’s salary deferrals once that person has earned $290,000 in 2021 or $305,000 in 2022, and companies use only that first amount to calculate employer matching contributions.

For example, say your company matches up to 6% of your salary and you earn $300,000 in 2021. Six percent of $300,000 is $18,000 however, your company can only match you up to 6% of $290,000, the maximum employee compensation limit for 2021. So rather than up to $18,000, you’d get up to $17,400 as an employer match.

Here’s a useful reference chart to help you remember these important limits and thresholds:

|

Type of Contribution |

|---|

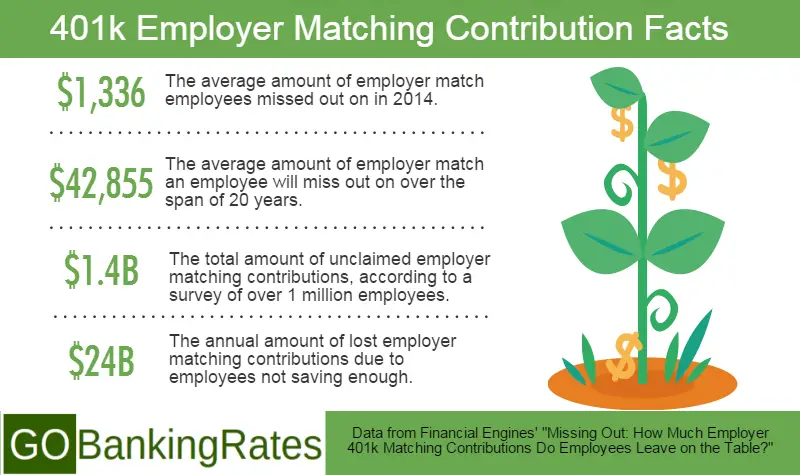

Why Should You Take Advantage Of 401 Matching

Taking advantage of employer matching puts free money toward your retirement income. Let’s say that your employer offers a dollar-for-dollar match on up to 3% of your salary. You make $1,500 per week and contribute 3% to your retirement plan, which is $45. Because your employer offers a full match up to 3%, your employer will contribute another $45 to your retirement account. Youre essentially doubling your contributions. If you do this for a number of years, you can significantly you have in your account when you retire.

Your employers contributions to your 401 are also beneficial because they don’t count against the IRS’ annual contribution limits. There are limits on how much you can put into your retirement account each year. In 2020 and 2021, those limits were $19,500 per employee, and in 2022, it will increase to $20,500. This is the that you can put into your 401 each year.

However, your employer match doesnt count toward this dollar amount. So, let’s say that you max out your contributions in 2022. Through your matching program, your employer contributes another $4,500. Instead of putting $20,500 into your account, you end up putting $25,000 into your account. Your employer match allows you to circumvent the total contributions limit set by the IRS.

Assign The Matching Benefit To An Employee

On the Cards menu, point to Payroll, and then click Benefit.

In the Employee Benefit Maintenance window, type an employee ID in the Employee ID field. In the Benefit Code field, type the benefit code that you created.

When you are asked whether you want to use the default information from the Benefit Setup window, click Default.The default entries from the Benefit Setup window will populate specific fields. However, you may want to change the matching benefit as necessary for specific employees.

Click Save.

Calculation 1

Consider the following scenario:

-

You want to match 50 percent of the deduction up to 4 percent of gross wages

-

The employee wants to withhold 4 percent of gross wages or less on the deduction

In this scenario, the benefit will be 50 percent of the deduction. The benefit is calculated as follows:

benefit = deduction × benefit percentageIn this scenario, the specific benefit is calculated as follows:

benefit = deduction × 0.5

Calculation 2

If the employee wants to withhold more than 4 percent of gross wages, the benefit will match 50 percent up to 4 percent of the gross wages. The benefit will be calculated as follows:

benefit = gross wages × employer maximum × benefit percentageIn this scenario, the specific benefit is calculated as follows:

benefit = gross wages × 0.04 × 0.5

Don’t Miss: How Do I Set Up A Solo 401k Plan

Why Do 401 Limits Change Some Years And Remain Unchanged In Others

The 401 contribution limits are adjusted annually in accordance with changes in inflation. The effects of inflation are measured by the consumer price index for urban wage earners and clerical workers. If inflation increases significantly, 401 matching limits are increased by increments of $500 or $1,000. However, if the increase in inflation isnt significant enough, the limits remain unchanged.

Employer Contributions To 401 Plans How Do They Work

In general, 401 plans depend primarily on money put into them by the workers themselves. You can choose to defer a portion of your wages to the plan, up to certain limits.

In return, you receive an immediate tax deduction plus tax-free investment growth, though you will ultimately have to pay taxes on the money when you withdraw it from the plan in retirement.

Read Also: How To Set Up A Solo 401k For Myself

Maximum 401 Contribution Limits For 2021 And 2022

Many employers offer 401 matching contributions as part of their benefits package. With a 401 match, your employer agrees to duplicate a portion of your contributions, up to a certain percentage of your salary. In addition to matching contributions, some employers may share a percentage of their profits with employees in the form of non-matching 401 contributions.

While an employers 401 match and non-matching contributions dont count toward your $19,500 employee deductible contribution limit , they are capped by total contribution limits.

Total 401 plan contributions by both an employee and an employer cannot exceed $58,000 in 2021 or $61,000 in 2022. Catch-up contributions for employees 50 or older bump the 2021 maximum to $64,500, or a total of $67,500 in 2022. Total contributions cannot exceed 100% of an employees annual compensation.

Limits For Highly Paid Employees

If you earn a very high salary, you may be considered a highly compensated employee , subject to more stringent contribution limits. To prevent wealthier employees from benefiting unfairly from the tax benefits of 401 plans, the IRS uses the actual deferral percentage test to ensure that employees of all compensation levels participate proportionately in their companies’ plans.

If non-highly compensated employees do not participate in the company plan, the amount that HCEs can contribute may be restricted.

Recommended Reading: What Age Can You Take Out 401k

Profit Sharing Contribution Question:

Yes, provided you each spouse separately has the necessary net self-employment income to satisfy said contribution amounts, as solo 401k contributions are based on each participants separate net self-employment income. For example, if the self-employed business is an LLC that is taxed as as sole proprietorship, both spouses will need to file a separate Schedule C and their solo 401k contributions will be based on their respective Schedule C net self-employment income figure, so line 31 of the Schedule C.

What Is A Dollar

With a dollar-for-dollar 401 match, an employers contribution equals 100% of an employees contribution, and the employers total contribution is capped as a percentage of the employees salary.

We commonly see employers offer a 3%, dollar-for-dollar match, said Taylor. They match 100% of your contributions up to 3% of your salary.

Imagine you earn $60,000 a year and contribute $1,800 annually to your 401or 3% of your income. If your employer offers a dollar-for-dollar match up to 3% of your salary, they would add an amount equal to 100% of your 401 contributions, raising your total annual contributions to $3,600.

Also Check: How To Calculate 401k Match

Perks For Older Investors

If you happen to be at least 50 years old, youre entitled to make catch-up contributions by adding an additional $6,500 for a total contribution of $27,000 in 2022. The total maximum that can be tucked away in your 401 plan, including employer contributions and allocations of forfeiture, is $67,500 in 2022, or $6,500 more than the $61,000 maximum for everyone else. Forfeitures come from an account in which company contributions accumulate from departing employees who werent vested in the plan.

What Are The Maximum 401 Company Match Limits For 2021

Although the first 6% rule is expected to remain about average in 2021, some employers can be especially generous. To account for inflation, retirement plan contribution limits can change. Although inflation projected to increase in 2021 vs. 2020, contribution maximums will hold steady at $19,500 per employee. For those aged 50 and up, the catch up contribution limit will hover around $6,500.

In 2021, the employer and employee contribution limits will increase slightly and come to a grand total of $58,000. If you are a highly compensated employee , your minimum contribution in 2020 will remain at $130,000 in 2021.

In 2021, the employer and employee contribution limits will increase slightly and come to a grand total of $58,000. If you are a highly compensated employee , your minimum contribution in 2020 will remain at $130,000 in 2021.

Don’t Miss: Is 401k Required By Law In California

What Companies Offer The Best Employer Match

Not all matches are created equal they vary widely. According to Vanguard, the top 16% of plans provide employer matches worth 6% or more of pay. A few standout examples include:

-

Boeing: Written up time and time again, Boeing is consistently known for a strong 401 offering, including an employer match. Employees can contribute between 1% and 30% of their salaries, and the company matches 75% of the first 8% of the employees contribution. Theres also a discretionary contribution by the company of between 3% and 5% per year based on the employees age.

-

Amgen: It makes a 5% contribution upfront whether or not the employee makes a contribution to the plan. In addition, the company matches employees contributions up to 5% of their salary for a total contribution of 10%.

United Technologies 401k Match

United Technologies has an automatic employee enrollment feature in its 401 plan that starts at a contribution rate of 6%. This rate increases by 1% every year until it reaches 10%.

United Technologies matches 60% of an employeeâs first 6% of their eligible pay contributed to the 401, which is equivalent to 3.5% for employees who contribute at least 6% or more into the plan.

Apart from matching contributions, United Technologies also makes automatic contributions to the 401 plan based on the employeeâs age. Employees below 30 receive 3% in automatic contributions while those above 50 receive 5.5%.

Employees are 100% vested in the matching contributions after three years of employment.

Recommended Reading: How To Open 401k Solo

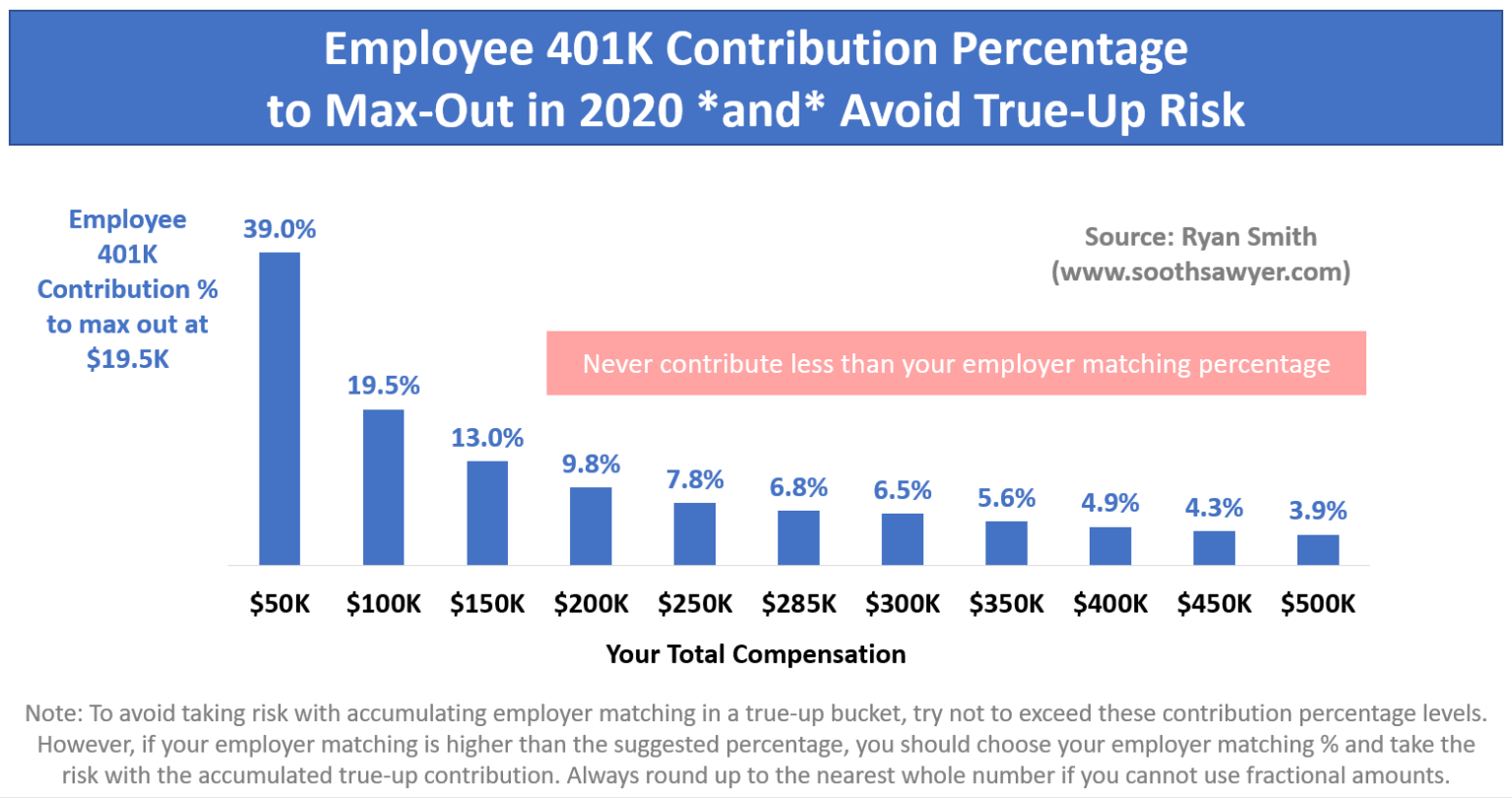

How Much Should I Contribute To My 401 With Employer Matching

Of course, how much you can contribute to a 401 and how much you should contribute can be two different calculations. First, youll want to find out what your employer match is to be sure youre maximizing your savings. Then you may need to crunch a few more numbers to determine how much you should put into your retirement account without overburdening yourself now.

Full 401 Matches In 2021

Employers can also choose a plan with a dollar-for-dollar match, with the most common being dollar-for-dollar, up to a maximum 5% of an employees salary. So, using the same example, the employee earning $100,000 might put in $5,000 as 5% of his salary. The employer would then contribute another $5,000. If the employee put in $2,000, the employer would contribute $2,000. If the employee put in $6,000, the employer would contribute $5,000, as per the policy limit.

Recommended Reading: Can I Roll A 401k Into A Roth Ira

Mega Backdoor Roth Solo 401k Ban Question:

Since the Build Back Better bill did not pass in 2021, yes the solo 401k participant can still make voluntary after-tax solo 401k contributions for both 2021 and 2022 and subsequently convert the contributions to the Roth IRA or the Roth solo 401k. Since congress was not able to pass the BBB in 2021 which would have banned both the backdoor and the mega backdoor starting in 2022, if the bill is passed in 2022 it would be effective at the earliest starting in 2023 as this is how retirement regulation generally works .

Lockheed Martin 401k Match

Lockheed Martinâs 401 plan is one of the most generous plans in the US.

Starting 2020 January, the company increased automatic contribution from 2% to 6%, in addition to the existing 4% match. Therefore, Lockheed Martin contributes up to 10% of the employeesâ compensation i.e. 4% match and 6% automatic. The 4% match applies to salaried employees, who get 50% match up to 8% of their contribution to the 401.

Lockheed Martin employees get immediate vesting of the employerâs contribution.

Also Check: Should I Have An Ira And A 401k

Compensation Limit For Contributions

Remember that annual contributions to all of your accounts maintained by one employer – this includes elective deferrals, employee contributions, employer matching and discretionary contributions and allocations of forfeitures, to your accounts, but not including catch-up contributions – may not exceed the lesser of 100% of your compensation or $61,000 for 2022 . This limit increases to $67,500 for 2022 $64,500 for 2021 $63,500 for 2020 if you include catch-up contributions. In addition, the amount of your compensation that can be taken into account when determining employer and employee contributions is limited to $305,000 for 2022 $290,000 in 2021 .

What Do Small Employers Do

-

Some dont match. According to Vanguard, 25% of 401 plans at small businesses do not provide an employer contribution. Matching is not mandatory but many employers provide this benefit because it helps with recruiting and retaining talented employees and shows theyre investing in their employees future.

-

Some match right away some have a wait. Among small businesses that offer employees a 401 match, 19% of plans provide immediate employer-matching contributions 40% require one year of service before employer-matching contributions kick in.

-

The majority offer immediate vesting: 69% of plans offered by smaller businesses provide immediate vesting for employer-matching contributions .

Recommended Reading: What Happens To My 401k If I Switch Jobs

Is Your Plan Working For You

If your work retirement plan is burdened by high fees and lackluster investment lineup, it may not be worth hitting the maximum contribution. Read over a copy of your summary plan description and annual report before considering your next move. Other tax-advantaged retirement options like Traditional or Roth IRAs may let you contribute up to $6,000 or $7,000 a year with more control over your investment options.

If youre an employer looking out for your workers, you can always contact Ubiquity to discuss starting a new plan or switching plan providers to take advantage of our administrative services without paying AUM fees, per-participant fees, or other unnecessary costs.

Employer Matching Contribution Formulas

Most often, employers match employee contributions up to a percentage of annual income. This limit may be imposed in one of a few different ways. Your employer may elect to match 100% of your contributions up to a percentage of your total compensation or to match a percentage of contributions up to the limit. Though the total limit on employer contributions remains the same, the latter scenario requires you to contribute more to your plan to receive the maximum possible match.

Some employers may match up to a certain dollar amount, limiting their liability to highly compensated employees regardless of income. For example, an employer may elect to match only the first $5,000 of your employee contributions.

The IRS requires that all 401 plans take a nondiscrimination test annually to ensure that highly compensated employees dont benefit more from tax-deferred contributions.

“Your employer could match 100% or even a dollar amount based upon some formula, but this can get expensive and normally owners want their employees to take some ownership of their retirement while still providing an incentive,” says Dan Stewart, CFA®, president, Revere Asset Management Inc., in Dallas, TX.

You May Like: How To Get Your 401k Out

Limits For Highly Compensated Employees

All 401s are subject to annual nondiscrimination tests to ensure the plans don’t provide unfair advantages to HCEs and key employees that lower-earning employees don’t get. These tests ensure HCEs aren’t contributing substantially more of their earnings or receiving more in employer contributions compared to non-HCEs. They also place limitations on how much of a 401 plan’s assets can be in the hands of HCEs. Failing a nondiscrimination test could result in the 401 plan losing its tax benefits, so companies want to avoid this at all costs.

Companies that fail can remedy the situation in a few ways. First, they can provide additional nonelective contributions to lower-earning employees to bring the plan into compliance, or they can place additional limits on HCE contributions, refunding them in some cases if employees have already contributed too much for the year. They can also do a combination of the two.

If a company has to limit HCE contributions, they may not be able to contribute the full sums listed in the table above. Their maximum contribution limits depend in part on how much lower-earning employees are contributing to their 401s. HCEs should talk to their company’s HR department to learn about how much they’re eligible to contribute annually.

What Is Employer 401 Matching

Employer 401 matching is a contribution your employer makes to your 401 retirement account. The contribution matches what you have taken out of your paycheck, usually up to a defined amount. A 401 is an employee-sponsored retirement account that employers offer to help their employees save and invest for retirement in a tax-advantaged way.

The match is the money the employer contributes to the 401 account when the employee is also actively contributing, says Kelly ODonnell, executive vice president and head of workplace at Edelman Financial Engines, a financial planning firm. So in order to get the employer match, you need to contribute, too.

Also Check: How Do I Get My 401k