If You’re Required Minimum Distribution Age* Take Your Distributions

*The age at which you must begin taking RMDs differs depending when you were born:

- If you were age 70½ before January 1, 2020 , you were required to begin taking RMDs for each year beginning with the year you turned age 70½.

- If you were not age 70½ before January 1, 2020 , you must begin taking RMDs for each year beginning with the year you reach age 72.

If you haven’t reached RMD age, you can skip this step. But if you have, you’re now required to withdraw a certain amount from many types of retirement accounts so that you can start paying the taxes you’ve been deferring all these years.

Consider moving your yearly RMD amount into your money market fundunless you don’t need it to cover your expenses. If that’s the case, you can move the money into any taxable account.

Just don’t leave it in your retirement account. There are steep IRS penalties if you don’t take your RMDs.

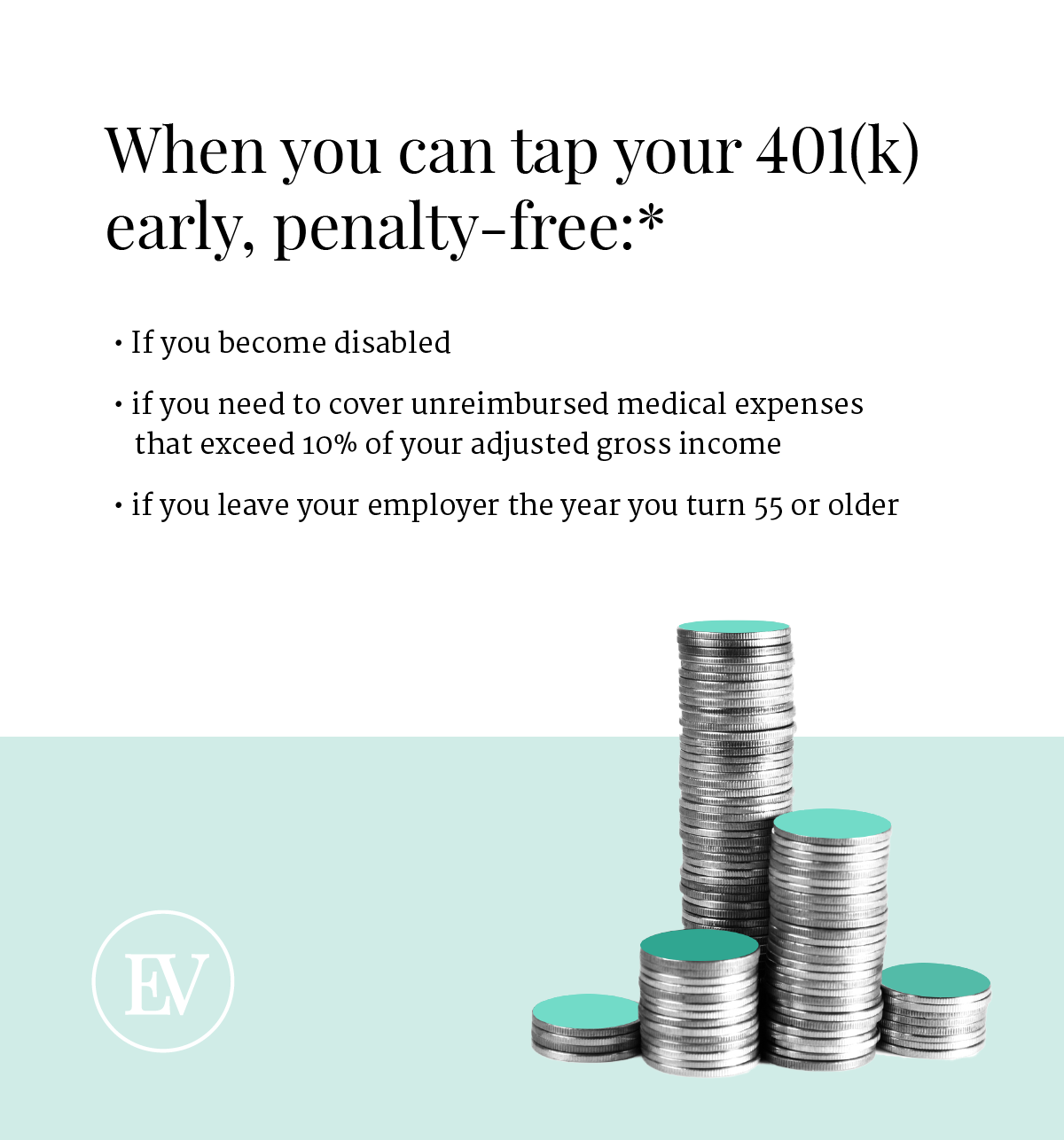

Can I Withdraw From My 401 At 55 Without A Penalty

If you leave your job at age 55 or older and want to access your 401 funds, the Rule of 55 allows you to do so without penalty. Whether you’ve been laid off, fired or simply quit doesn’t matteronly the timing does. Per the IRS rule, you must leave your employer in the calendar year you turn 55 or later to get a penalty-free distribution. So, for example, if you lost your job before the eligible age, you would not be able to withdraw from that employer’s 401 early you’d need to wait until you turned 59½.

It’s also important to remember that while you can avoid the 10% penalty, the rule doesn’t free you from your IRS obligations. Distributions from your 401 are considered income and are subject to federal taxes.

What Are Qualified Distributions

Qualified distributions are those that can be taken made tax-free and penalty-free. They’re taken after age 59 1/2 or under some other allowed circumstances.

There’s no penalty for withdrawing your money after you reach age 59 1/2, but you’ll pay income tax on the money you take out if you’ve invested in a traditional pre-tax 401 or a traditional IRA with untaxed dollars. You took a tax deduction at the time you made the contributions.

Roth IRAs and Roth 401 contributions are made with after-tax dollars. These distributions aren’t taxed when you take withdrawals, but you must have owned the Roth account for five years or longer.

It’s best to begin taking money from tax-deferred accountsthose for which you claimed tax deductionsafter you retire. You might be in a lower tax bracket at that time, because you’ll no longer be earning income from working.

Read Also: What Percentage Should I Be Putting In My 401k

What If I Withdraw Too Little Or Dont Take An Rmd

If you dont make a proper RMD by the appropriate deadline, Uncle Sam will tax you 50% of the difference between the amount you withdrew that year and the amount you were supposed to take out that year.

However, you dont have to take your RMD in one lump sum. You can take it in increments throughout the year. Just make sure you withdraw the total RMD amount for the year by December 31. In some cases, however, you can delay RMDs.

Read Also: Where Can I Find My 401k Balance

Options For Borrowing From A 401 While Still Working

If youre still in the workforce and need to access your 401 funds for one reason or another, you may still have options. These pre-retirement withdrawal options include in-service distributions, hardship withdrawals, and plan loans.

In-service distributions allow you to withdraw your vested money before retirement and are sometimes referred to as an early retirement option in the plan. This is generally allowed at age 59 ½ because distributions of your 401 deferrals before that age are subject to a 10 percent penalty tax.

Hardship distributions are allowed for special reasons such as medical care, purchase of your home, tuition, funeral expenses, payments to prevent eviction, and damage to your principal residence. The distribution is limited to the amount you need, and your employer will need to see some proof of the hardship. Hardship distributions are subject to income tax and the 10 percent penalty tax for distribution before 59 ½.

Plan loans occur when you borrow money from your 401 balance, but the amount you can withdraw is limited to the half of your vested balance and cannot be more than $50,000. The loan will have to be paid back to the plan with interest, and the loan period cannot exceed five years in most cases. That being said, loans taken out for principal residence can be longer than five years.

You May Like: How Do I Roll Over My 401k

Is There A New Rmd Table For 2020

The new tables are not effective until 2022. RMDs are waived for 2020, and RMDs for 2021 will be calculated under the current tables. The IRS revised the current tables, which have been in effect since 2020, to reflect the fact that Americans are now living longer.

What Information Do I Need To Give To My Employees

Before the beginning of each annual election period, you must notify each employee of:

If you haven’t timely given your employees the notice, find out how you can correct this mistake.

The election period is generally the 60-day period immediately preceding January 1 of a calendar year . However, the dates of this period are modified if you set up a SIMPLE IRA plan in mid-year or if the 60-day period falls before the first day an employee becomes eligible to participate in the SIMPLE IRA plan.

If you set up your SIMPLE IRA plan using either Form 5304-SIMPLE or Form 5305-SIMPLE, you can give each employee a copy of the signed forms to satisfy the notification requirement.

If the deferral limitations aren’t released timely and you normally include the deferral amount for the upcoming year in your notice, you can mention the current limit and advise participants to check the COLA Increase table for next year’s amount. The notice isn’t required to include the salary deferral limitation for the upcoming year.

Read Also: How Does 401k Retirement Work

Is It A Good Idea To Use The Rule Of 55

Just because you can take distributions from your 401 or 403 early doesn’t mean you should. Depending on your financial situation, it might be better to let your money continue to grow. Holding off withdrawals could help you better position yourself for a financially sound future. If you’re tempted to withdraw retirement funds before you’re eligible, instead consider finding another job, drawing from your savings or using other sources of income until you need to tap into your retirement savings.

If you decide to begin withdrawing funds from your 401 early, the long-term value of your portfolio will likely decrease. It’s essential that you time your withdrawals carefully and take into account how much they would cost you in taxes. To create a strategy that makes sense in your situation, consider working with a financial advisor or a retirement planner.

When Employees Want To Stop Contributions

Employees may elect to terminate their salary reduction contributions to a SIMPLE IRA plan at any time. If they do so, the SIMPLE IRA plan may preclude them from resuming salary reduction contributions until the beginning of the next calendar year. Employers that are making nonelective employer contributions must continue to make them on behalf of these employees.

Recommended Reading: Can I Roll A Roth Ira Into A 401k

If I Participate In A Sep Plan Can I Contribute To A Roth Ira In Addition To Receiving Contributions Under The Sep Plan

A SEP-IRA is a traditional IRA that holds contributions made by an employer under a SEP plan. You can both receive employer contributions to a SEP-IRA and make regular, annual contributions to a traditional or Roth IRA. Employer contributions made under a SEP plan do not affect the amount you can contribute to an IRA on your own behalf.

Because a SEP-IRA is a traditional IRA, you may be able to make regular, annual IRA contributions to this IRA, rather than opening a separate IRA account. However, any dollars you contribute to the SEP-IRA will reduce the amount you can contribute to other IRAs, including Roth IRAs, for the year.

Example 1: Nancy’s employer, JJ Handyman, contributes $5,000 to Nancy’s SEP-IRA at ABC Investment Co. based on the terms of the JJ Handyman SEP plan. Nancy, age 45, is permitted to make traditional IRA contributions to her SEP-IRA account at ABC Investment Co., and she contributes $3,000 in 2019. If Nancy also wants to contribute to her Roth IRA at XYZ Investment Co. for 2019, she can contribute $3,000 by April 15, 2020.

What Is A Systematic Withdrawal Plan

In a systematic withdrawal plan, you only withdraw the income created by the underlying investments in your portfolio. Because your principal remains intact, this is designed to prevent you from running out of money and may afford you the potential to grow your investments over time, while still providing retirement income. However, the amount of income you receive in any given year will vary, since it depends on market performance. Theres also the risk that the amount youre able to withdraw wont keep pace with inflation.

Potential advantages: This approach only touches the income not your principal so your portfolio maintains the potential to grow.

Potential disadvantages: You wont withdraw the same amount of money every year, and you might get outpaced by inflation.

For illustrative purposes only.

Recommended Reading: How Much Will My 401k Grow If I Stop Contributing

Which Employees Are Eligible To Participate In My Sep Plan

Employees must be included in the SEP plan if they have:

- attained age 21

- worked for your business in at least 3 of the last 5 years

- received at least $650 in 2021 and 2022 $600 in compensation from your business for the year.

Your plan may use less restrictive requirements, for example age 18 or three months of service, to determine which employees are eligible.

Are You Still Working

You can access funds from an old 401 plan after you reach age 59 1/2, even if you haven’t retired. The best idea for old 401 accounts is to roll them over when you leave a job. If you are 59 1/2 or older, you will not be hit with penalties if you withdraw from your old accounts. However, you need to check with your human resource department about the rules around withdrawing from your current 401 if you are still in the workplace.

Check with your 401 plan administrator to find out whether your plan allows what’s referred to as an in-service distribution at age 59 1/2. Some 401 plans allow this, but others don’t.

Also Check: How Do I Withdraw Money From My 401k Fidelity

What Are The Pros And Cons Of Withdrawal Vs A 401 Loan

A withdrawal is a permanent hit to your retirement savings. By pulling out money early, youll miss out on the long-term growth that a larger sum of money in your 401 would have yielded.

Though you wont have to pay the money back, you will have to pay the income taxes due, along with a 10% penalty if the money does not meet the IRS rules for a hardship or an exception.

A loan against your 401 has to be paid back. If it is paid back in a timely manner, you at least wont lose much of that long-term growth in your retirement account.

How To Calculate Required Minimum Distribution

Required minimum distributions are withdrawals you have to make from most retirement plans when you reach the age of 72 . The amount you must withdraw depends on the balance in your account and your life expectancy as defined by the IRS. If you have more than one retirement account, you can take a distribution from each account or you can total your RMD amounts and take the distribution from one or more of the accounts. RMDs for a given year must be taken by December 31 of that year, though you get more time the first year you are required to take an RMD. If youre not sure whether to return the RMD or you need help with other retirement decisions, a financial advisor could help you figure out the best choices for your needs and goals.

Also Check: How Does A 401k Retirement Plan Work

The History Of The 401

The first 401 retirement plan was founded in the 1970s by employees of the Kodak corporation. You remember them: the guys who made all of those old-style cameras and film?

So, in the early 1970s, according to Wikipedia, a group of high-earning Kodak employees went to Congress. They wanted Congress to pass a law stating they could invest part of their salary into the stock market and have that money be exempt from income taxes.

This law eventually morphed into what we now know as the 401. Todays 401 is used by individuals all over the world as a way to save for retirement.

Keeping Your Money In A 401

You are not required to take distributions from your account as soon as you retire. While you cannot continue to contribute to a 401 held by a previous employer, your plan administrator is required to maintain your plan if you have more than $5,000 invested. Anything less than $5,000 will trigger a lump-sum distribution, but most people nearing retirement will have more substantial savings accrued.

If you have no need for your savings immediately after retirement, then theres no reason not to let your savings continue to earn investment income. As long as you do not take any distributions from your 401, you are not subject to any taxation.

If your account has $1,000 to $5,000, your company is required to roll over the funds into an IRA if it forces you out of the planunless you opt to receive a lump-sum payment or roll over the funds into an IRA of your choice.

Don’t Miss: What Is Ira And 401k

Take Advantage Of Your Employers Match Program

If you work for an employer that offers a 401 matching program, and youre not already doing so, you should be contributing up to the maximum match percentage.

For instance, lets your employer will match your 401 deposits 100 percent up to six percent of your income. If youre only contributing 3 percent of your income to your 401, youre leaving money on the table.

Increase your contributions up to that 6 percent and take full advantage of your employers generous match offer. Your employers benefits center should be able to help you do that.

What Are The Consequences To Employees If I Make Excess Contributions

Excess contributions are included in employees’ gross income. Employees who withdraw the excess contribution before the due date for their federal return, including extensions, will avoid the 6% excise tax imposed on excess SEP contributions in an IRA. Excess contributions left in the employee’s SEP-IRA after that time will be subject to the 6% tax on the employees’ IRAs, and the employer may be subject to a 10% excise tax on the excess nondeductible contributions. If you’ve contributed too much to your employees’ SEP-IRA, find out how you can correct this mistake.

You May Like: How Do I Transfer My 401k To A Roth Ira

Withdrawing Funds Between Ages 55 And 59 1/2

Most 401 plans allow for penalty-free withdrawals starting at age 55. You must have left your job no earlier than the year in which you turn age 55 to use this option. You must leave your funds in the 401 plan to access them penalty-free. But there are a few exceptions to this rule. This option makes funds accessible as early as age 50 for many police officers, firefighters, and EMTs.

Make sure to understand the rules around the age requirement for penalty-free withdrawals. For example, the age 55 rule won’t apply if you retire in the year before you reach age 55, and your withdrawal would be subject to a 10% early withdrawal penalty tax in this case.

The age 55 and up retirement rule won’t apply if you roll your 401 plan over to an IRA. The earliest age to withdraw funds from a traditional IRA account without a penalty tax is 59. 1/2.

You might retire at age 54, thinking that you can access funds penalty-free in one year. It doesn’t work that way. You must wait one more year to retire for this age rule to take effect.

How Are Withdrawals Of Roth 401 Deferrals Taxed

Because Roth 401 deferrals are contributed to your account on an after-tax basis, they are never taxable upon withdrawal. Their earnings can also be withdrawn tax-free when theyre part of a qualified withdrawal. A qualified withdrawal is one that occurs 1) at least five years after the year you made your first Roth deferral and 2) after the date you:

- Attain age 59½

- Become disabled

- Die

If you withdraw Roth 401 deferrals as part of a non-qualified withdrawal, their earnings are taxable at applicable Federal and state rates and may be subject to the 10% premature withdrawal penalty.

Additional answers to Roth questions can be found in our Roth FAQ.

You May Like: How Do You Split A 401k In A Divorce