High Unreimbursed Medical Expenses

This particular exception is similar to the hardship distributions mentioned earlier, and these medical bills might qualify you under either category. You should know that a hardship withdrawal for medical bills will not entitle you to a waiver of the 10% penalty in all cases. To qualify for a penalty-free withdrawal, the amount of the bills must be greater than 7.5% of your adjusted gross income . You must also take the distribution in the same year in which the bills were incurred. You cannot take money for estimated future bills either. The bills must be currently due for services already provided.

Also note the requirement that the bills be unreimbursed. If your insurance covers part of the bills or will reimburse you for the payments, then you cannot use money from your 401 to pay them. Likewise, the bills must be for you, your spouse, or a qualified dependent. You cannot use the money to pay bills for a parent, sibling, or any other family member. The limit to the amount of money you can withdraw for medical bills was recently removed, so you are allowed to withdraw as much as is needed to cover all the expenses.

How Do You Take A Withdrawal Or Loan From Your Fidelity 401

If you’ve explored all the alternatives and decided that taking money from your retirement savings is the best option, you’ll need to submit a request for a 401 loan or withdrawal. If your retirement plan is with Fidelity, log in to NetBenefits®Log In Required to review your balances, available loan amounts, and withdrawal options. We can help guide you through the process online.

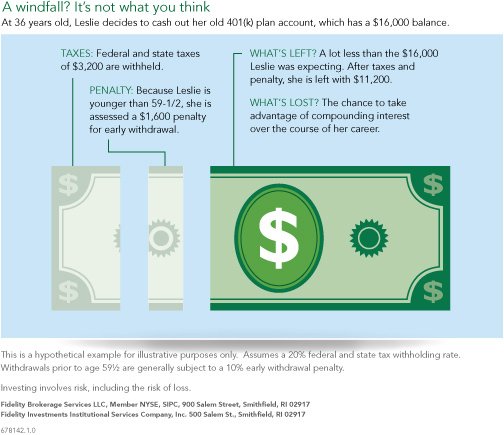

The Costs Of Early 401k Withdrawals

Early withdrawals from an IRA or 401k account can be an expensive proposition because of the hefty penalties they carry under many circumstances.

The IRS allows penalty-free withdrawals from retirement accounts after age 59 ½ and requires withdrawals after age 72 . There are some exceptions to these rules for 401ks and other qualified plans.

Try to think of your retirement savings accounts like a pension. People working towards a pension tend to forget about it until they retire. There is no way they can access it before retirement. While that money is locked up until later in life, it becomes a hugely powerful resource in retirement. The 401k can be a boon to your retirement plan. It gives you flexibility to change jobs without losing your savings. But that all starts to fall apart if you use it like a bank account in the years preceding retirement. Your best bet is usually to consciously avoid tapping any retirement money until youve at least reached the age of 59 ½.

If youre not sure you should take a withdrawal, you can use this calculator to determine how much other people your age have saved.

You May Like: Where Can You Rollover A 401k

Ing Shot: Dont Attempt This At Home

Its possible that Nick from Michigan, or others reading this, still find the prospect of tapping a 401 or retirement account tempting, especially if you have debt hanging around your neck like an albatross. Weve said it before here, and Blayney will say it again as our last word on the subject:

When it comes to taking money out of an IRA or 401, Im always reminded of the TV commercials showing stunts men or racing car drivers that warn DONT ATTEMPT THIS AT HOME! Yes, it might seem like taking money from your retirement account is an easy, even attractive, thing to do after all its your money, right? But there are many pitfalls and adverse consequences for the unwary, and it is imperative that anyone considering this, first talk to a competent qualified professional a CFP professional before doing this.

Rolling Over Funds In A Roth 401

You can avoid taxation on your earnings if your withdrawal is for a rollover. If the funds are simply moving into another retirement plan or a spouse’s plan via direct rollover, no additional taxes are incurred.

If the rollover is not direct , the funds must be deposited in another Roth 401 or Roth IRA account within 60 days to avoid taxation.

When you do an indirect rollover, the portion of the distribution attributable to contributions cannot be transferred to another Roth 401 but it can be transferred into a Roth IRA. The earnings portion of the distribution can be deposited into either type of account.

You May Like: Can I Rollover 401k To Ira While Still Employed

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most how to save for retirement, understanding the types of accounts, how to choose investments and more so you can feel confident when planning for your future.

Use A Professionally Managed Fund Or Get Advice

Investing too conservatively could also jeopardize your lifestyle or cause you to run out of money. Striking the right balance sometimes requires professional management. Your 401 plan may offer professionally managed fund options, such as target-date funds, for retirees. And your 401 provider might offer personalized investment advice. Ask your provider about your options for getting help. And if you think face-to-face advice might be better for your needs, find a financial professional with experience helping retirees.

Also Check: Can I Withdraw From My 401k To Buy A House

Special Considerations For Withdrawals

The greatest benefit of taking a lump-sum distribution from your 401 planeither at retirement or upon leaving an employeris the ability to access all of your retirement savings at once. The money is not restricted, which means you can use it as you see fit. You can even reinvest it in a broader range of investments than those offered within the 401.

Since contributions to a 401 are tax-deferred, investment growth is not subject to capital gains tax each year. Once a lump-sum distribution is made, however, you lose the ability to earn on a tax-deferred basis, which could lead to lower investment returns over time.

Tax withholding on pre-tax 401 balances may not be enough to cover your total tax liability in the year when you receive your distribution, depending on your income tax bracket. Unless you can minimize taxes on 401 withdrawals, a large tax bill further eats away at the lump sum you receive.

Finally, having access to your full account balance all at once presents a much greater temptation to spend. Failure in the self-control department could mean less money in retirement. You are better off avoiding temptation in the first place by having the funds directly deposited in an IRA or your new employers 401 if that is permitted.

Also Check: How To Borrow Against My 401k

How Are Withdrawals Of Roth 401 Deferrals Taxed

Because Roth 401 deferrals are contributed to your account on an after-tax basis, they are never taxable upon withdrawal. Their earnings can also be withdrawn tax-free when theyre part of a qualified withdrawal. A qualified withdrawal is one that occurs 1) at least five years after the year you made your first Roth deferral and 2) after the date you:

- Attain age 59½

- Become disabled

- Die

If you withdraw Roth 401 deferrals as part of a non-qualified withdrawal, their earnings are taxable at applicable Federal and state rates and may be subject to the 10% premature withdrawal penalty.

Additional answers to Roth questions can be found in our Roth FAQ.

Also Check: How Do You Get Money From Your 401k

When Do I Have To Start Making Withdrawals From My Ira

You cant keep your funds in a retirement account indefinitely. Generally, youre required to start taking withdrawals from your traditional IRA when you reach age 70 ½ . Roth IRAs, however, dont require withdrawals until the owner of the account dies.

The amount that youre required to withdraw is called a required minimum distribution . You can withdraw more than the RMD amount, but withdrawals from a Traditional IRA are included in your taxable income. If you fail to make withdrawals that meet the RMD standards, you may be subject to a 50% excise tax. Roth IRAs do not require RMDs. Your money grows tax-free, since contributions are made from after-tax dollars, and your withdrawals in retirement aren’t taxed.

What You Need To Know To Avoid Costly Mistakes

Andy Smith is a Certified Financial Planner , licensed realtor and educator with over 35 years of diverse financial management experience. He is an expert on personal finance, corporate finance and real estate and has assisted thousands of clients in meeting their financial goals over his career.

In an ideal world, everybody would leave their 401 funds alone until they need the money for retirement. That might mean rolling your account over to an Individual Retirement Account , but it also means not cashing out the funds prior to reaching retirement age, to allow the money to grow to its maximum potential amount. In investing, time truly is your best asset. At some point though, you will begin taking distributions, and here’s what you need to know.

The best way to take money out of your 401 plan depends on three things:

Also Check: How To Sign Up For 401k On Adp

You Can Spread Your Tax Liability Out Over Three Years

You usually have to pay taxes on 401 withdrawals in a single year. You still have the option to do this in 2020, but if doing so would significantly raise your tax bill, you can choose to spread the tax liability over three years instead. So if you withdraw $3,000 this year, you could pay taxes on just $1,000 of your withdrawal in 2020, then another $1,000 in 2021, and the final $1,000 in 2022.

It’s up to you to decide if this is advantageous. If your income is lower this year than normal, it might make more sense to pay taxes on your full withdrawal this year rather than potentially paying more in a future year when your income is higher and you may be in a higher tax bracket. But the added flexibility available in 2020 is a plus for those who are worried about the potential effect of the withdrawal on their taxes.

Traditional Ira Vs Roth Ira

Like traditional 401 distributions, withdrawals from a traditional IRA are subject to your normal income tax rate in the year when you take the distribution.

Withdrawals from Roth IRAs, on the other hand, are completely tax free if they are taken after you reach age 59½ and see out a five-year holding period. However, if you decide to roll over the assets in a traditional 401 to a Roth IRA, you will owe income tax on the full amount of the rolloverwith Roth IRAs, you pay taxes up front.

Traditional IRAs are subject to the same RMD regulations as 401s and other employer-sponsored retirement plans. However, there is no RMD requirement for a Roth IRA, which can be a significant advantage during retirement.

Read Also: How To Choose 401k Investment Options

Can I Withdraw From My 401 At 55 Without A Penalty

If you leave your job at age 55 or older and want to access your 401 funds, the Rule of 55 allows you to do so without penalty. Whether you’ve been laid off, fired or simply quit doesn’t matteronly the timing does. Per the IRS rule, you must leave your employer in the calendar year you turn 55 or later to get a penalty-free distribution. So, for example, if you lost your job before the eligible age, you would not be able to withdraw from that employer’s 401 early you’d need to wait until you turned 59½.

It’s also important to remember that while you can avoid the 10% penalty, the rule doesn’t free you from your IRS obligations. Distributions from your 401 are considered income and are subject to federal taxes.

Your 401 K And Income Tax

You may be wondering if your 401 k is subject to income tax. Once youve withdrawn the money from the 401 k, you need to pay tax on it. It is considered part of your taxable estate. This is why you must check the terms of your 401 k before you get any money from it. Terms like these should be clearly outlined in the plan. Withdrawing funds without understanding the implications of doing so is one common mistake that people make when changing employers in the USA. Its important to consider the other options you have.

If youre changing employers, you still have plenty of time to build up passive capital via investment and your 401 k. Youre unlikely to get much out of rushing into a decision that you arent completely ready for. Roll all of the funds out of your 401 k at once, and you might end up drowning in taxes.

Read Also: How To Sign Up For 401k On Adp

Don’t Miss: Can I Use My Fidelity 401k To Buy Stocks

For Many This Relief Simply Isnt An Option

Only about half the workforce has a retirement account, says Olivia S. Mitchell, professor of insurance/risk management and business economics and public policy, and executive director of Whartons Pension Research Council at the University of Pennsylvania.

And many have far less than $100,000 saved. A recent report found pre-retirees, Americans 56 to 61, had a median balance of $21,000 in their 401 accounts in 2016, which is the most up-to-date data on file. That total reflects almost 30 years of savings. Younger generations do not fare much better. Older millennials have about $1,000 saved in their 401s.

Not only that, but employees with retirement accounts tend to be the higher paid, better educated and longer-term workers. Therefore allowing people to tap into their retirement accounts wont help the millions who have no accounts, Mitchell says. Those with no accounts are also likely to be the people that will be needing the most help.

Additionally, Mitchell predicts that the U.S. will see an increase in applications for early Social Security benefits, particularly if the recession is long and hard. People taking early benefits will end up with a lifetime of lower payouts, and if they already ate into their 401s, theyll be more likely to face shortfalls in their later years, she says.

Withdrawals After 59 1/2

To encourage retirement saving, the IRS slaps you with a 10 percent penalty if you siphon money from your 401 before reaching 59 1/2, even if you can prove a financial hardship. This is on top of regular income taxes on the withdrawal. While the penalty disappears after 59 1/2, you’ll still be liable for the income taxes. If you have a Roth 401 account, the contributions are made with after-tax dollars. Roth withdrawals are tax-free, as long as you’ve had the account open at least five years.

Read Also: How To Move 401k To Another Company

You Don’t Really Need The Money

The government may have eased the restrictions on 401 withdrawals, but you should only take advantage of this if you absolutely need the money. Taking money from your retirement account sets you back. That forces you to save more money per month going forward in order to afford to retire according to your original schedule.

Say you have $25,000 saved for retirement and you’re hoping to get to $1 million. If you’re 35 and hope to retire at 65, you must save about $653 per month, assuming you earn a 7% average annual rate of return. Now let’s say you withdraw $5,000 this year, leaving you with only $20,000 in your retirement savings. If you still want to have $1 million by 65, you must save about $753 per month — $100 more — every year thereafter to have enough. It’s doable, but you can save yourself a lot of hassle by just leaving your retirement savings alone if you don’t actually need the money.

See If You Qualify For An Exception To The 10% Tax Penalty

Generally, the IRS will waive it if any of these situations apply to you:

-

You choose to receive substantially equal periodic payments. Basically, you agree to take a series of equal payments from your account. They begin after you stop working, continue for life and generally have to stay the same for at least five years or until you hit 59½ . A lot of rules apply to this option, so be sure to check with a qualified financial advisor first.

-

You leave your job. This works only if it happens in the year you turn 55 or later .

-

You have to divvy up a 401 in a divorce. If the courts qualified domestic relations order in your divorce requires cashing out a 401 to split with your ex, the withdrawal to do that might be penalty-free.

Other exceptions might get you out of the 10% penalty if you’re cashing out a 401 or making a 401 early withdrawal:

-

You become or are disabled.

-

You rolled the account over to another retirement plan .

-

Payments were made to your beneficiary or estate after you died.

-

You gave birth to a child or adopted a child during the year .

-

The money paid an IRS levy.

-

You were a victim of a disaster for which the IRS granted relief.

-

You overcontributed or were auto-enrolled in a 401 and want out .

-

You were a military reservist called to active duty.

You May Like: Is 401k A Pension Plan