How To Protect Your 401 From A Stock Market Crash

Stock market crashes are impossible to predict. However, you can protect your 401 from losing money if the market does crash.

Making sure you have enough money for retirement is the primary goal of contributing to a 401. Your 401 will inevitably go through a series of ebbs and flows throughout your working years. Some years youâll see tremendous growth, others you may even lose money. However, as you near retirement, youâll want to protect your 401 from down years, even a stock market crash.

To protect your 401 from stock market crash, invest more in bond, which has a lower rate of return but also much lower risk. To gain as much value as you can, investments heavier in stocks give you the best chance of multiplying your money. However, with stocks comes increased risk. Shifting the percentage of your investments to a more bond-heavy allocation can help shield you if the stock market crashes as you get closer to retirement.

Capturing as much of the good times as possible while avoiding significant losses isnât an exact science there are strategies to help shift the odds in your favor. Letâs take a look at the basics of investing your 401, so you can protect your retirement nest egg.

How To Withdraw Money From Your 401

The 401 has become a staple of retirement planning in the U.S. Millions of Americans contribute to their 401 plans with the goal of having enough money to retire comfortably when the time comes. Whether youve reached retirement age or need to tap your 401 early to pay for an unexpected expense, there are various ways to withdraw money from your employer-sponsored retirement account. A financial advisor can steer you through these decisions and help you manage your retirement savings.

The Benefit Of A 401k

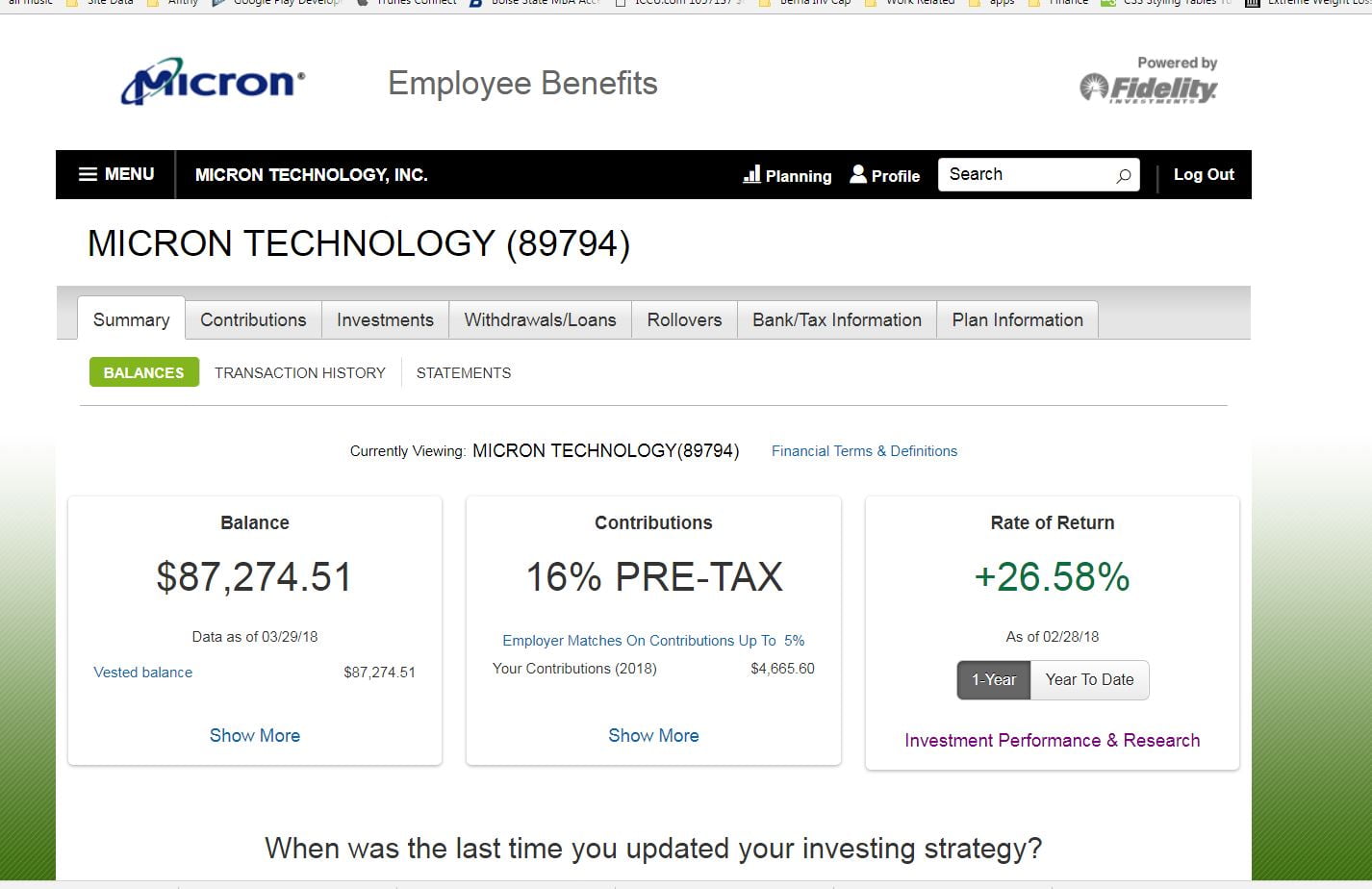

The largest benefit of a 401k, and the only reason I say it is worth your time, is the employer match. Most employers offer to match your contribution to your 401k up to a certain percent. That is FREE money. And you should never walk away from free money. The power of the match is that it can double your investment.

If your employer matches your contribution to your 401k, you should invest up to the point of the match.

You May Like: Can You Withdraw Your 401k If You Quit Your Job

Processing Solo 401k Loan Question:

I received the rollover check from John Hancock for my former employer 401k and will go into the local Fidelity Investments office tomorrow to deposit the check into the new brokerage account that you helped me set up for the self-directed solo 401k that you provide. I would like to make sure I understand the process to create a solo 401k participant loan against the balance. I think you all create the paperwork. Whats the method to move the loan amount from the fidelity account into my personal checking account. Do I just use the fidelity transfer functionality, get a check drafted or ?

Also, I will be rolling over an IRA account as well. Am I limited to 1 loan or can I take out a second loan against the additional amount?

How Do You Take A Withdrawal Or Loan From Your Fidelity 401

If youve explored all the alternatives and decided that taking money from your retirement savings is the best option, youll need to submit a request for a 401 loan or withdrawal. If your retirement plan is with Fidelity, log in to NetBenefits®Log In Required to review your balances, available loan amounts, and withdrawal options. We can help guide you through the process online.

Recommended Reading: What Is The Difference Between 401k And 403b

Don’t Miss: What Happens To My 401k If I Retire Early

Winners And Losers With 401 Brokerage Accounts

It is easy to see who could come out ahead by trading securities in a 401 brokerage account. Highly educated investors, such as medical professionals and specialists, engineers, accountantsand those with previous trading and investing experiencecan use these accounts to achieve returns far beyond what they might be able to achieve using traditional plan options, such as mutual funds.

But lower-income participantsfactory workers, retail or food-service employees, and others who work in jobs that dont require such skillslikely will not have the same education and expertise. And plenty of people with higher incomes and more education don’t know much about investing, either. Employees without adequate knowledge and guidance could easily be enticed into making foolhardy choices, such as buying and selling mutual funds with front- or back-end sales charges or choosing investment options that contain risks they do not understand.

So far most studies and data released on this subject seem to indicate that a relatively small percentage of employees choose to invest material amounts of their plan savings into brokerage accounts. Only about 3% to 4% of those with access to a 401 brokerage window use it, the Aon Hewitt study found the PSCA survey reported that only 1.3% of total plan assets are accounted for by investments through brokerage windows.

How To Protect Your 401k From A Stock Market Crash 2021

Diversification, Dollar Cost Averaging, Indexing, Cash-rich Stocks, CD’s, Bank Stocks or Gold. There Are Many Strategies, But Which Are The Best?

Moving to Cash, Diversification, Dollar Cost Averaging, Indexing, Cash-rich Stocks, CDs, Bank Stocks, or Gold. There Are Many Strategies: Here is a Selection of Options To Choose From?

The total protection of your money from a market crash is impossible. However, you can minimize your risks and protect most of your investments with a few precautions. Thus, keeping most of the assets in your 401K safe in a bear market is possible. However, you must be careful not to sacrifice your portfolios ability to grow to avoid risks.

Instead, you need to balance security and growth. Fortunately, achieving such a balance is easier than most people realize.

Don’t Miss: How Can I Withdraw My 401k Without Penalty

Pros And Cons Of Using 401 Brokerage Accounts

It is fairly easy to see both the benefits and drawbacks of using brokerage accounts in 401 plans.

-

Employees who aren’t experienced investors can lose significant retirement money through badly chosen trades.

-

More difficult to construct a sound portfolio, especially given transaction fees and commissions.

-

Higher risk of emotion-driven trading, which can lead to buying high and selling low.

Need Help Call Fidelity

Most questions related to your Nazarene 403 Retirement Savings Plan account can be answered by phoning a Fidelity retirement services specialist at 866-NAZARENE . If you still have questions after doing this, phone Pensions and Benefits USA at 888-888-4656.

Also, Fidelity has a broad array of valuable tools, such as calculators and informational videos to assist in managing your financial life. We encourage you to explore their many resources.

Unless otherwise noted, transaction requests confirmed after the close of the market, normally 4 p.m. Eastern time, or on weekends or holidays, will receive the next available closing prices.

The investment options available through the plan reserve the right to modify or withdraw the exchange privilege.

Read Also: How Much In 401k To Retire

Also Check: Should I Transfer My 401k To An Annuity

How Often Can You Reallocate 401k

Rebalancing How-To Financial planners recommend you rebalance at least once a year and no more than four times a year. One easy way to do it is to pick the same day each year or each quarter, and make that your day to rebalance. By doing this, you will distance yourself from the emotions of the market, Wray said.

Roth Iras Have No Required Minimum Distributions

One significant advantage of a Roth IRA is that these accounts do not have required minimum distributions. That means you are not forced take out a certain amount each year so these funds can remain in the Roth IRA, earning tax-free. Other types of retirement accounts, including traditional IRAs and most 401s, do have RMDs.

Read Also: How To Set Up My 401k

A Quick Review Of The 401 Rules

A 401 account is earmarked to save for retirementthat’s why account holders get the tax breaks. In return for giving a deduction on the money contributed to the plan and for letting that money grow tax-free, the government severely limits account holders’ access to the funds.

Not until you turn 59½ are you supposed to withdraw fundsor age 55, if you’ve left or lost your job. If neither is the case, and you do take money out, you incur a 10% early withdrawal penalty on the sum withdrawn. To add insult to injury, account holders also owe regular income tax on the amount .

Still, it is your money, and you’ve got a right to it. If you want to use the funds to buy a house, you have two options: borrow from your 401 or withdraw the money from your 401.

Calculate Your Risk Tolerance

All investing is risky and returns are never guaranteed, but it can actually be more risky to keep too much of your savings in cash, thanks to inflation.

Still, you don’t want to go all in on one stock or investment, particularly if a rocky market makes you uneasy and anxious, or likely to do something drastic, like pull your money out of your account.

You’ll want to determine an appropriate asset allocation, or how much of your investments will be in stocks and how much will be in “safer” investments, like bonds. Stocks have the potential for greater returns, but can be more volatile than bonds. Bonds are more stable, but offer potentially lower returns over time.

Financial advisors often recommend using the following formula to determine your asset allocation: 110 minus your age equals the percentage of your portfolio that should be invested in equities, while the rest should be in bonds.

But think about your investing horizon. If you have decades until you’re going to retire , then you can afford a bit more risk. You might choose an 80-20 stock mix for now. When you’re older, you’ll start scaling that back, depending on your goals and, again, your appetite for risk. Experts suggest checking that your investments are properly aligned with your risk tolerance each year and rebalancing as necessary, though how often you actually do will vary based on personal preference.

Read Also: What Is The Tax Penalty For Early 401k Withdrawal

You Are Viewing This Page As An Investor

Advisors, switch views to see more relevant content.

TFSA basics

Regardless of what youre saving for, a TFSA is a great way to reach any financial goal.

RRSPs 101

You can reduce tax on your current income when you save for the future. Here are six RRSP tips.

For you and your goals

Over 1.5 million

To business leaders around the world

Over 25,000

Commissions, fees and expenses may be associated with investment funds. Read a funds prospectus or offering memorandum and speak to an advisor before investing. Funds are not guaranteed, their values change frequently and investors may experience a gain or loss. Past performance may not be repeated.

Read our privacy policy. By using or logging in to this website, you consent to the use of cookies as described in our privacy policy.

This site is for persons in Canada only. Mutual funds and ETFs sponsored by Fidelity Investments Canada ULC are only qualified for sale in the provinces and territories of Canada.

88747-v202076

You can use the search box above to compare up to 4 additional funds.

Please contact Fidelity Client Relations for assistance.

Alternatives To Cashing Out

If you want to make a more conservative decision, you can leave your money in your 401 k when you change to a different company or employer. Cashing out your 401 k isnt a requirement, after all. If youre happy with your old employers 401 k, we recommend that you leave the money where it is. You can withdraw it once you retire. This is also a great way to avoid paying excessive income tax.

You can also stretch out the time that you withdraw money from your 401 k. The funds dont have to come out in a lump payment. A plan participant leaving an employer typically has four options , each choice offering advantages and disadvantages. You can leave the money in the former employers plan, if permitted Roll over the assets to your new employer plan if one is available and rollovers are permitted Roll over the funds to an IRA or cash out the account value. The more time between your payments, the easier it is to avoid paying extra tax on the money. This is because funds from your 401 k are considered part of your taxable estate.

Read Also: How To Get Your 401k Out

Go With The Simplest Option

Alternatively, you can opt for a target-date fund, which takes most of the guesswork out of the equation. With these funds, you select a “target” retirement year and risk tolerance, and the fund is automatically set to an appropriate asset allocation for you. These are great options for beginner investors.

“Most people aren’t interested in researching selecting funds for their 401,” Charles C. Weeks, a Philadelphia-based CFP, tells CNBC Make It. “Target date funds will help people avoid blowing up their portfolios by making avoidable mistakes like putting too much in one asset class, chasing returns by investing based on past performance and/or letting greed and fear dictate their investment strategy.”

Over time, the fund will automatically rebalance, becoming more conservative as you near retirement. If you choose a target-date fund, you only need to choose the one fund otherwise you’re essentially canceling out its benefits. Another mistake to avoid with target-date funds is choosing a year without researching how it will change its mix of stocks and bonds over time, Howard Pressman, a Virginia-based CFP, tells CNBC Make It.

Scenario : Don’t Utilize An Nua Approach Because Taxes Are Estimated To Be Lower In The Future

In some scenarios, however, income in retirement may be much lower than the current level and the effective ordinary income tax rate may be lower, so the investor may be better off not doing an NUA but by simply rolling the company stock directly into an IRA.

In the following hypothetical scenario, consider Irwin, age 65. He’s had a long career in biotech as a senior executive and earns about $500,000 a year, putting him in the estimated federal tax bracket of 35%.

He just retired from one company with $2,500,000 in his 401 plan, of which $500,000 was invested in company stock. NUA is $250,000. Although, that’s a nice nest egg, Irwin is at the peak of his earnings capacity, loves what he does, and will almost certainly continue working for another 5 years after he leaves his current position and company this year.

Looking a few years down the road, Irwin would retire at age 70. Assuming all assets from his former employers 401 were rolled into an IRA, he would have projected annual income from his investments of $170,000, and estimated RMDs of $154,000 at age 72. That should put him in the 24% federal tax bracket vs. his current tax bracket of 35%.

In Irwin’s case, if he exercised NUA, it would put him in a 37% bracket today and further increase the taxes to be paid on NUA. So, NUA doesn’t make sense, given his high level of current income, along with the anticipation that his tax bracket will likely be lower in the future.

Recommended Reading: How To Find My 401k Balance

Picking The Stock To Buy

Well assume that youve already opened a Fidelity taxable brokerage account and deposited cash in the account to invest.

In taxable accounts, I highly recommend investing in index exchange-traded funds, which are the stock version of index funds. In a taxable account, they are more tax-efficient than the mutual fund equivalent at Fidelity. If youre following my simple guide to owning a three-fund or similar index fund portfolio at Fidelity, here are the ETF ticker symbols that I prefer:

| Asset Class |

| 0.08% |

Roth Ira Statement From Fidelity Representative: Question:

Can you confirm whether this statement is true or not . The IRS does not allow for Roth IRA money to be rolled into any 401k plan. That is only allowed on pre-tax IRA and retirement accounts. I was hoping to roll over a Roth IRA into my solo 401k roth account. Is this allowed?

The Fidelity representative is correct that a Roth IRA cannot be transferred to a Roth solo 401k. This is a Roth IRA rule. Visit here for more on this rule. I suspect this rule was put in place because the distribution rules are different for a Roth IRA vs a Roth solo 401k.

Recommended Reading: How To Close Your 401k Early

What Are Your Choices For A Rollover

In general, once you leave a job you have three choices for how to deal with your employer-sponsored retirement plan:

- Leave it with your old employers 401 plan: This approach requires the least amount of work, but may require you to have a minimum amount if you plan to maintain the account there.

- Roll it over into your new employers 401 plan: This approach will require you to file some paperwork, but youll have all your 401 money in one place. This choice can make sense if you like your new employers plan.

- Roll it over into an IRA: This move will require you to file some paperwork, but then youll have the complete freedom to invest the money as you see fit. If you liked the investment options you held in a previous plan, you may still be able to access those via an IRA.

, thats another option for a rollover. But this option is not typical for most individuals.)

If you roll over your 401 into an IRA, youll also want to consider the kind of rollover you need.

- With a Roth 401, youll likely be more interested in a Roth IRA, so that you can maintain the substantial advantages of that plan.

- If you have a traditional 401, then youll probably opt for a traditional IRA.