Are 401ks Traditional Or Roth

Roth 401 is an after-tax retirement savings account. This means that your contributions were already taxed before they were credited to your Roth 401 account. On the other hand, a traditional 401 is a pre-tax savings account.

Ira vs 401kWhat is the difference between a 401k and Ira? The main difference between a 401k and an IRA is that a 401k must be created by an employer, while an IRA is a personal retirement account that anyone can create for themselves. The amount that can be saved with deferred tax is also significantly higher: 401 thousand.Is 401k better than IRA?Objectively speaking, 401 is simply better in this category. Wit

Dont Miss: How Much Can You Contribute To 401k Per Year

Benefits Of Having Both A 401 And A Roth Ira

Using both a 401 and a Roth IRA to save can be a great option for someone looking to put as much money as possible into tax-advantaged retirement accounts.

If you’re a higher-income earner on the edge of qualifying for a Roth IRA contribution, making a 401 contribution could push you under the income limitations, since those contributions don’t count toward your AGI. That would open the door for more flexibility with short-term savings in a Roth IRA.

Ultimately, an employer-sponsored 401 shouldn’t prevent you from getting money into a Roth IRA. While you should consider any other options at your disposal, maximizing the amount of money in your tax-advantaged savings accounts is usually a good strategy for a healthy retirement.

Limiting Taxes With A Simple Ira Rollover

You will normally pay income tax on withdrawals you take from your SIMPLE IRA plan. You’ll have to pay an additional 10% penalty if you take withdrawals before you reach age 59½ unless you qualify for an exception, such as if you have a disability or you receive the withdrawal as an annuity.

You can avoid either of these financial losses if you roll your SIMPLE IRA assets into a 401 when you leave your employer. Your age isn’t a factor in this case, either, because the rollover isn’t considered to be a withdrawal when you time it properly.

Don’t Miss: Can A Small Business Set Up A 401k

Pros Of Roth 401 To Roth Ira Rollovers

A unique fact that only applies to Roth 401s is that, beginning at age 70.5, you must take required minimum distributions from your account. This is similar to a traditional 401 or IRA. So if you would rather let your retirement funds grow tax-free until you need them, rolling them into a Roth IRA might be the best move for you.

In fact, you can leave rollover funds in a Roth IRA indefinitely if need be. That may be something of interest to you, particularly if youre looking to maximize the assets you leave for your beneficiaries.

Rolling Over Your 401 To A Traditional Ira Vs A Roth Ira

You have the option of rolling your 401 into either a traditional IRA or a Roth IRA. One isnt better than the other, and ultimately its up to you and your investment goals.

You do have to worry about a few things, though, and the major difference is this: Roth IRAs require after-tax contributions. If youre rolling over money from a traditional 401, then you havent paid taxes on that money as it came out of your salary before you got your paycheck. As a result, rolling your traditional 401 balance over to a Roth IRA will require you to pay income taxes on the entire balance in the year that you do the rollover. This could mean thousands of dollars in taxes. So just be cautious of this.

However, rolling a traditional 401 into a traditional IRA is easier, since both contain pre-tax dollars. You dont have to worry about triggering a taxable event.

On the same note, a Roth 401 and Roth IRA are both funded with after-tax dollars, meaning rolling one into the other wouldnt require a tax payment.

Paying income taxes by rolling a traditional 401 into a Roth IRA isnt necessarily a reason not to do it: Roth IRAs can be a powerful retirement savings tool, and some investors may prefer to pay the tax bill now for the benefit of withdrawing the money tax-free during retirement.

But whatever decision you make, its important that you understand the consequences and have your budget ready.

Read Also: What To Invest My 401k In

Paying Taxes On Your Contributions

The point of a Roth IRA is that the money gets taxed as income upfront, then grows tax-free. But the money in your 401 was shielded from taxes. So youll now need to pay income tax on that money so that it qualifies for a Roth.

The funds you roll over are added to your taxable income for the year you do the rollover. Income taxes you owe will be calculated from that new total. Since the income from your IRA isnt coming from a paycheck, though, the tax you owe on it wont be withheld. Itll have to come out of your pocket, and to avoid a penalty, you may need to make an estimated tax payment before filing your taxes for the year.

Youll need to make an estimated tax payment if the taxes withheld from your paycheck arent enough to cover at least a) 90% of the taxes youll owe for the tax year of your rollover or b) 100% of the taxes you paid for the previous tax year . Once you know your estimated payment, you can either pay it all at once or split the amount between the quarters remaining in the tax year. Quarterly estimated tax payments are due on or before April 15, June 15, Sept. 15 and Jan. 15 of the next year.

If you overestimate how much your tax bill is going up and overpay your estimated tax payments, thats OK. Youll get a refund if you end up paying more than you owe.

You Want To Increase Your Tax Diversification

Contributions to traditional IRAs are tax-advantaged, meaning you wont pay taxes on your invested funds until you begin taking withdrawals at retirement. Roth IRAs, on the other hand, are taxed up front but offer tax-free withdrawals after age 59 ½. If youre unsure how your tax and income situation might pan out in the future, having both types of accounts a traditional IRA and a Roth IRA is a smart move in terms of diversifying your future tax exposure.

Read Also: How Can I Get Money Out Of My 401k

What Are The Benefits Of A Roth Ira

A major benefit of a Roth individual retirement account is that, unlike traditional IRAs, withdrawals are tax free when you reach age 59½. You can also withdraw any contributions, but not earnings, at any time regardless of your age.

In addition, IRAs typically offer a much wider variety of investment options than most 401 plans. Also, with a Roth IRA, you dont have to take required minimum distributions when you reach age 72.

Saving For Retirement In A Roth Ira

If you meet the income requirements for contributions, there are two compelling reasons to use a Roth IRA for retirement savings.

You May Like: What Should You Invest Your 401k In

Roll Over An Ira To A : The Pros And Cons

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks or securities.

In the world of retirement account rollovers, theres one type that doesnt get much love: the IRA-to-401 maneuver, which allows you to roll pretax traditional IRA assets into a 401. Its frequently overshadowed by rollovers in the other direction 401 to a rollover IRA because theyre more common. But in some cases, this less common move is also worth considering.

What Is A 401 Rollover

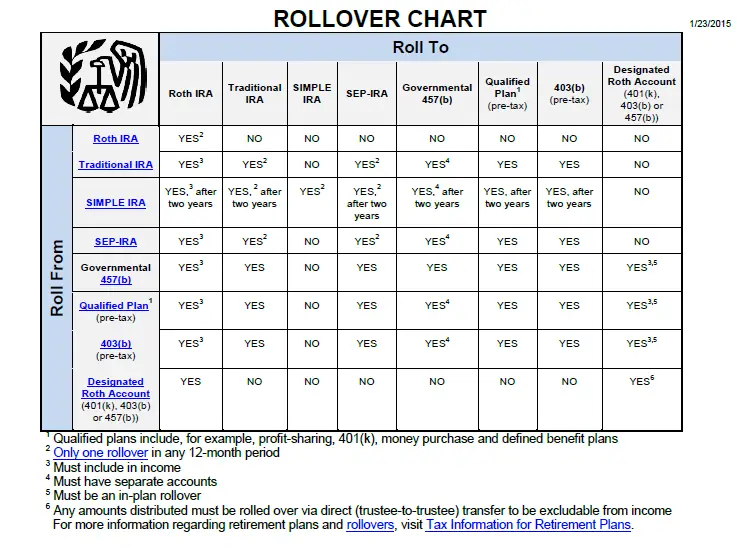

A rollover simply allows you to transfer your retirement savings from one retirement account to another without having to pay any taxes on the money youre rolling over.

The most common type of rollover is the 401 rollover, which lets you transfer money from a 401 you had at a previous job into an IRA or the 401 at a new job. This is the type of rollover were going to focus on.

You could also transfer money from an IRA into a 401sometimes called a reverse rolloverbut in most cases, its not a good idea. Thats because you usually have fewer investing options in a workplace retirement plan than with an IRA.

Don’t Miss: How To Take Money From 401k

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most how to save for retirement, understanding the types of accounts, how to choose investments and more so you can feel confident when planning for your future.

Why Roll Over An Ira Into A 401

There are a few reasons you might want to roll a traditional IRA into a 401, though it should be noted you can do this only if your company plan accepts incoming transfers . Here are the pro IRA-to-401 rollover highlights:

-

Potential for earlier access to that money: If you leave your job, you could start tapping your 401 as early as age 55. Qualified distributions from traditional IRAs cant begin until 59½ unless you start a series of substantially equal distributions a commitment to take at least one distribution per year for at least five years or until you turn 59½, whichever comes last. The distribution amount is based on IRS calculation methods that take into account your IRA balance, age, life expectancy and, in some cases, interest rates. It could mean taking more than you need, for longer than you want to.

Compare costs among your retirement plans to find out where youre getting the better deal.

» See how a 401 could improve your retirement: Try our 401 calculator.

You May Like: Can I Have 2 401k Plans

Direct And Indirect 401 Rollovers

Before you roll over your 401, youll need to open an IRA account. You can do this at virtually any major brokerage firm, mutual fund company or robo-advisor. Do some research, then head to your financial institutions website to open your account. At some point, youll want to talk to a customer representative to find out whether the rollover and conversion can be done at once or if they are done sequentially. If its the former case, youll just have to pick your investments once. If its the latter, youll want to keep the money liquid in the IRA before converting to a Roth.

Once youve opened the IRA, you can contact the company managing your 401 account to begin the rollover process. You can do this online or over the phone. Your 401 plan administrator will then transfer your funds into your new IRA account. This is called a trustee-to-trustee or direct rollover, and its the easiest way to do it.

Another path is an indirect rollover. In this case, the balance of the account is distributed directly to you, typically as a check. Youll have 60 days from the date you receive the funds to transfer the money to your custodian or IRA company. If you dont deposit the funds within the 60 days, the IRS will treat it as a taxable withdrawal, and youll face a 10% penalty if youre younger than 59.5. This risk is why most people choose the direct option.

These Roth Ira Mistakes Can Have Costly Tax Consequences

A Roth IRA is a type of retirement account where you contribute after-tax money. Since you’ve already paid taxes on these funds, you can withdraw them tax-free in retirement. Unlike other retirement funds, you aren’t required to take minimum distributions from a Roth IRA. This means you can let your money grow tax-free for as long as you want.

This type of account can be a great way to save for retirement. To make sure you’re getting the most from your account, let’s look at the most common mistakes people make with Roth IRAs. Avoiding these missteps can help you keep more of your money.

Read Also: Can I Borrow From My 401k

Should You Do A Reverse Rollover

Now that you understand how an IRA to 401k reverse rollover works, and how to do it, should you consider it for your situation? Well, if you’re planning to do a backdoor Roth IRA conversion, or you’re looking to retire early, it could make a lot of sense to do it.

However, the process can be complicated, and over 30% of employer-sponsored 401k plans don’t even allow you to do it. However, the IRS has issued guidelines making the process more forgiving for 401k providers, and as such, more and more are allowing them.

The biggest takeaway here is to always check with your 401k provider before you start the process. You don’t want to go down this path only to realize you can’t do it.

Have you considered doing an IRA to 401k reverse rollover? If you’ve done it, what was your experience?

How To Roll Over An Old 401

8 Minute Read | September 27, 2021

Back in the old days, it was pretty common for someone to work for the same company for 40 years before retiring with a nice pension and a gold watch. Well, those days are long gone.

A recent study found that the youngest baby boomers worked 12 different jobs over the course of their careers.1 Did you hear that? Twelve! And younger generations are even more likely to look for greener employment pastures. In fact, almost a third of millennials say they would quit their jobs as soon as possible if they could.2

But in the process, many American workers are leaving behind a trail of forgotten 401s, sometimes with thousands of dollars in retirement savings left behind!

Theres even a name for those retirement accounts that are left behind: orphan 401s. Even the name is sad! Its time to stop for a minute and think about giving the money in those long-forgotten accounts a new home.

Thats where rollovers come in.

Don’t Miss: Do I Need Ein For Solo 401k

How Do I Know If I Am Eligible For A Rollover

The eligibility requirements for a rollover depend on a number of different factors. Itâs important to check with the planâs administrator to see what is allowed and any limitations that may exist. In general, though, sponsored retirement accounts can be rolled into an IRA without penalty or taxes, as long as the employee moves those funds within 60 days of leaving the employer.

Forgetting To Name Beneficiaries

When you pass away, your beneficiaries receive the benefits of your Roth IRA. But if you dont have a living beneficiary named on your account, this money typically ends up in your estate. Once there, your Roth IRA must go through probate before your heirs can access it.

When your Roth IRA goes into probate, its lumped together with your other assets. Then, before it gets distributed to your heirs, all your debts are paid. This means your heirs might not end up with as much money as you wanted them to.

To avoid this problem, regularly review all of your accounts to ensure your named beneficiaries are up to date.

Recommended Reading: How Do You Find Lost 401k Accounts

How To Start Saving For Retirement

One of the best ways to start saving for retirement is to make sure you’re enrolled in your employer’s 401 plan. You can decide what percentage of each paycheck you’d like to defer into this account and some companies will even match all or a portion of what you contribute so you grow your balance even faster. Pay extra close attention to the terms required for matching, though, as some employers have a minimum percentage amount that is required. For example, if your employer matches contributions of at least 3%, you’ll need to contribute at least 3% of each paycheck to your 401 in order to receive the match.

401 accounts also come with annual maximum contribution limits that change slightly each year for 2022, you’re allowed to contribute up to $20,500. Keep in mind, however, that it can be very difficult to max out your account. If you’re not able to hit the $20,500 mark, make sure you’re at least contributing enough to receive your employer’s match.

Another way to make sure you’re growing your retirement savings is to contribute to a Roth IRA, a powerful tool you can use when it comes to saving for retirement since you can contribute after-tax money that gets invested and grows over time. When you withdraw the money at retirement anytime after age 59 1/2 you won’t have to worry about paying any taxes on it either.

Terms apply.