Benefit Of A Backdoor Roth Ira

The reason some investors want their money in a Roth IRA rather than a traditional IRA is for the tax benefit in retirement. Whereas both pre-tax contributions and all earnings in a traditional IRA are taxable upon distribution, neither contributions nor earnings are taxable when you withdraw them from a Roth IRA.

Although youll pay a 10 percent penalty if you take your money out before age 59.5 just as you would with a traditional IRA your money always grows tax-free in a Roth. Another benefit is that there are never any mandatory distributions from a Roth IRA with a traditional IRA, mandatory distributions begin after you turn age 72.

Covering Your Bases Through Tax Diversification

If youre not sure where your tax rate, income, and spending will be in retirement, one strategy might be to contribute to both a Roth 401 and a traditional 401. The combination will provide you with both taxable and tax-free withdrawal options. As a retired individual or married couple with both Roth 401 and traditional 401 accounts, you could determine which account to tap based on your tax situation.

You cant really know what future tax rates will look like, so building in the flexibility to use multiple accounts to manage taxes is important and helpful, says Rob.

For example, you could take RMDs from your traditional account and withdraw what you need beyond that amount from the Roth account, tax-free. That would mean you could withdraw a large chunk of money from a Roth 401 one yearsay, to pay for a dream vacationwithout having to worry about taking a big tax hit.

Besides the added flexibility of being able to manage your marginal income tax bracket, reducing your taxable income in retirement may be advantageous for a number of reasons, including lowering the amount you pay in Medicare premiums, paring down the tax rate on your Social Security benefits, and maximizing the availability of other income-based deductions. Be sure to weigh all your available options to maintain your retirement goals.

1Individuals must have the Roth 401 account established for five years and be over the age of 59½ for tax-free withdrawals.

5The Tax Foundation, 3/22/2017.

Maximum Income For Roth Ira

The IRS uses your modified adjusted gross income to determine if you qualify to make the maximum Roth IRA contribution, which is $6,000, or $7,000 if youre age 50 or older.If you exceed the Roth IRA max income to make a full contribution, theres a range of income in which the IRS allows you to make a reduced contribution. And there are Roth IRA limits above which you cant make any Roth contribution at all. The ranges, based on different filing statuses, are as follows:

- MAGI less than $204,000, full contribution

- MAGI at least $214,000, no contribution

Also Check: How Much Can One Contribute To 401k

Which Is Better The 401 Or The Roth Ira

This is a case where neither is better than the other. Instead, if you can afford it, you can do both and really maximize your retirement savings. That way you do not miss out on your employer matching benefits and can save on taxes until retirement.

It is possible to open up a Roth IRA and also make contributions to your employers 401 plan at the same time. Since the maximum contribution you can make is between $6 & 7,000 dollars for the IRA, this plan should work for you.

After all, you get to decide the amount of money that is deducted from your payroll check. Pick a comfortable percentage rate and then sit back and watch your retirement savings grow.

The only problem with this plan is if you make too much money each year and you cannot open a Roth IRA. Do some more research on this topic and see which plan or combination of plans will work for you.

Also, before you make the leap, talk to a retirement specialist who knows these plans inside and out. Get their expert advice first before making your decision. Knowing everything you can will help you when you reach retirement age.

Remember, retirement comes fairly quickly so it is best to make your plans now. That way you will be prepared when your career ends at age 65. Who knows, you may have saved enough to retire early.

Max Out Both To Boost Your Nest Egg

Kirsten Rohrs Schmitt is an accomplished professional editor, writer, proofreader, and fact-checker. She has expertise in finance, investing, real estate, and world history. Throughout her career, she has written and edited content for numerous consumer magazines and websites, crafted resumes and social media content for business owners, and created collateral for academia and nonprofits. Kirsten is also the founder and director of Your Best Edit find her on LinkedIn and Facebook.

Read Also: What To Do With Your 401k When You Retire

Trustee And Investment Selection

This is another area that usually favors Roth IRA plans. As a self-directed account, a Roth IRA can be held with the trustee of your choosing. That means you can decide on an investment platform for the account that meets your requirements for both fees and investment selection. You can choose a platform that charges low fees, as well as offering the widest variety of potential investments.

But with a Roth 401, since its part of an employer-sponsored plan, gives you no choice as to the trustee. This is one of the biggest issues people have with employer-sponsored plans. The trustee selected by the employer may charge higher than normal fees.

They also commonly restrict your investment options. For example, while you might choose a trustee for a Roth IRA that has virtually unlimited investment options, the trustee for a Roth 401 may limit you to no more than a half a dozen investment choices.

Frequently Asked Questions On What Are The Benefits Of Roth Iras

1. Should I open a Roth IRA or a 401?

There are many factors to consider when choosing between these two accounts. Each account presents you with its unique pros and cons, which you need to weigh upon before making your ultimate decision. generally, however, most settle on 401 because they have higher contribution limits than Roth IRAs. With Roth IRAs, on the other hand, investors get the opportunity to invest through a tax-advantaged structure in which their investments grow tax-free and in which they are not required to pay taxes when taking withdrawals. Investors can also check out Roth Gold IRAs, which have more benefits, including more control over the account as well as access to a wider variety of alternative assets to invest in.

2. How much can I contribute to my Roth IRA?

In 2022, the maximum amount you can contribute to your Roth IRA annually is $6000, if you are below 50 years. Those aged over 50 can contribute up to $7000 annually. You can decide to deposit about $500 monthly to your account, or you can contribute any amount that you see fit, provided you do not exceed the annual contribution limits.

3. What are the downsides of a Roth IRA?

The main downside of a Roth IRA is perhaps the fact that it does not give you an upfront tax break. Also, in comparison to retirement plans such as 401s, these accounts have significantly lower contribution limits and do not have automatic payroll deductions .

4. How can I protect my Roth IRA against a stock market crash?

Don’t Miss: Can You Rollover A 401k Before Leaving Your Job

What Does It Mean To Max Out Your 401 And Roth Ira

The IRS restricts how much you can contribute to 401 plans each year because they provide such significant tax benefits. However, the potential for earning a 401 is still very substantial due to the fact that it allows for investment, compounding interest, and tax deferrals.

In 2021, 401 plan participants can contribute up to $19,500 to their accounts. If youâre at least 50 years old, the IRS will allow you to contribute more money. These are called âcatch-upâ contributions.

In 2021, a $6,500-catch-up-contribution is allowed by the IRS. This is an addition to the $19,500 base which is equal to the total limit of $26,000 for 50-years-olds and up.

For Roth IRAs, younger people can only contribute a maximum of $6,000 to their IRAs. American citizens age 50 and up can contribute up to $7,000 in an IRA.

How Much Should I Contribute To My 401

Most financial experts say you should contribute around 10%-15% of your monthly gross income to a retirement savings account, including but not limited to a 401.

There are limits on how much you can contribute to it that are outlined in detail below.

There are two methods of contributing funds to your 401.

The main way of adding new funds to your account is to contribute a portion of your own income directly.

This is usually done through automatic payroll withholding ).

The system mandates that the majority of direct financial contributions will come from your own pocket.

It is essential that, when making contributions, you consider the trajectory of the specific investments you are making to increase the likelihood of a positive return.

The second method comes from deposits that an employer matches.

Usually employers will match a deposit based on a set formula, such as 50 cents per dollar contributed by the employee.

However, employers are only able to contribute to a traditional 401, not a Roth 401 plan.

This is especially important to keep in mind if you want to utilize both types of plans.

A key variable to keep in mind is that there are set limits for how much you can add to a 401 in a single year.

For employees under 50 years of age, this amount is $19,500, as of 2020. For employees over 50 years of age, the amount is $25,000.

If you have a traditional 401, you can also elect to make non-deductible after-tax contributions.

Plan in Advance

Read Also: How Much Can You Contribute To 401k

The Best Choice: Work With A Pro

Heres the deal: Investing is worth the hard work. If you dont save and invest now, you wont have anything to live on in retirement. It can be intimidating and complex, but you dont have to do this alone.

Talk with an investment professional like our SmartVestor Pros. Get someone on your team who will help you stay focused and chasing your dreams. They can walk you through your 401 and Roth IRA contribution options and create a plan for your situation.

About the author

Ramsey Solutions

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners.

Traditional And Roth 401 Plans

Individuals who want to save for retirement may have the option to invest in a 401 or Roth 401 plan. Both plans are named for the section of the U.S. income tax code that created them. Both plans offer tax advantages, either now or in the future.

With a traditional 401, you defer income taxes on contributions and earnings. With a Roth 401, your contributions are made after taxes and the tax benefit comes later: your earnings may be withdrawn tax-free in retirement.

Also Check: How To Divide 401k In Divorce

How Much Should I Contribute To Retirement

Experts suggest putting aside 15% of your pre-tax income for retirement, but you may need to work up to this amount. That’s OK the important thing is to get started.

You may also want to open a Roth IRA and contribute to both that and your 401 to max out your retirement savings. If you do this, choose an IRA that allows you to invest in mutual funds as opposed to one that just offers CDs, like the ones you may find through your bank. Mutual funds will give you a higher rate of return and help you build your retirement savings more quickly.

A Roth Conversion Will Trigger A Tax Bill But This Year’s Stock Market Volatility May Work In Your Favor

If you’ve been thinking about converting money from a traditional individual retirement account to a Roth IRA, this may be a prime time to bust a move.

Last Monday, the Dow Jones Industrial Averageplunged 876 points following a stomach-churning inflation report. The S& P 500 stepped into bear-market territory after dropping 3.9%, or 151.23 points. On top of that, the Federal Reserve raised interest rates by 75 basis points during June’s Federal Open Market Committee meeting.

The recent market moves may not be good for your portfolio, but it could be a potential win if you decide to do a Roth conversion. Here are a few items to consider before you shift funds from a traditional to a Roth IRA.

Read Also: Can You Use Your 401k For A House Down Payment

Should You Consider A Roth 401

Many companies now offer employer-sponsored Roth 401 retirement accounts alongside traditional 401 plans, giving employees another way to save for retirement. What’s the difference between the two accounts? And should you consider opening a Roth 401?

Here, well take a look at how Roth 401 plans stack up against their traditional counterparts and what to consider before contributing to one.

Roth Ira Vs : What Are The Major Differences

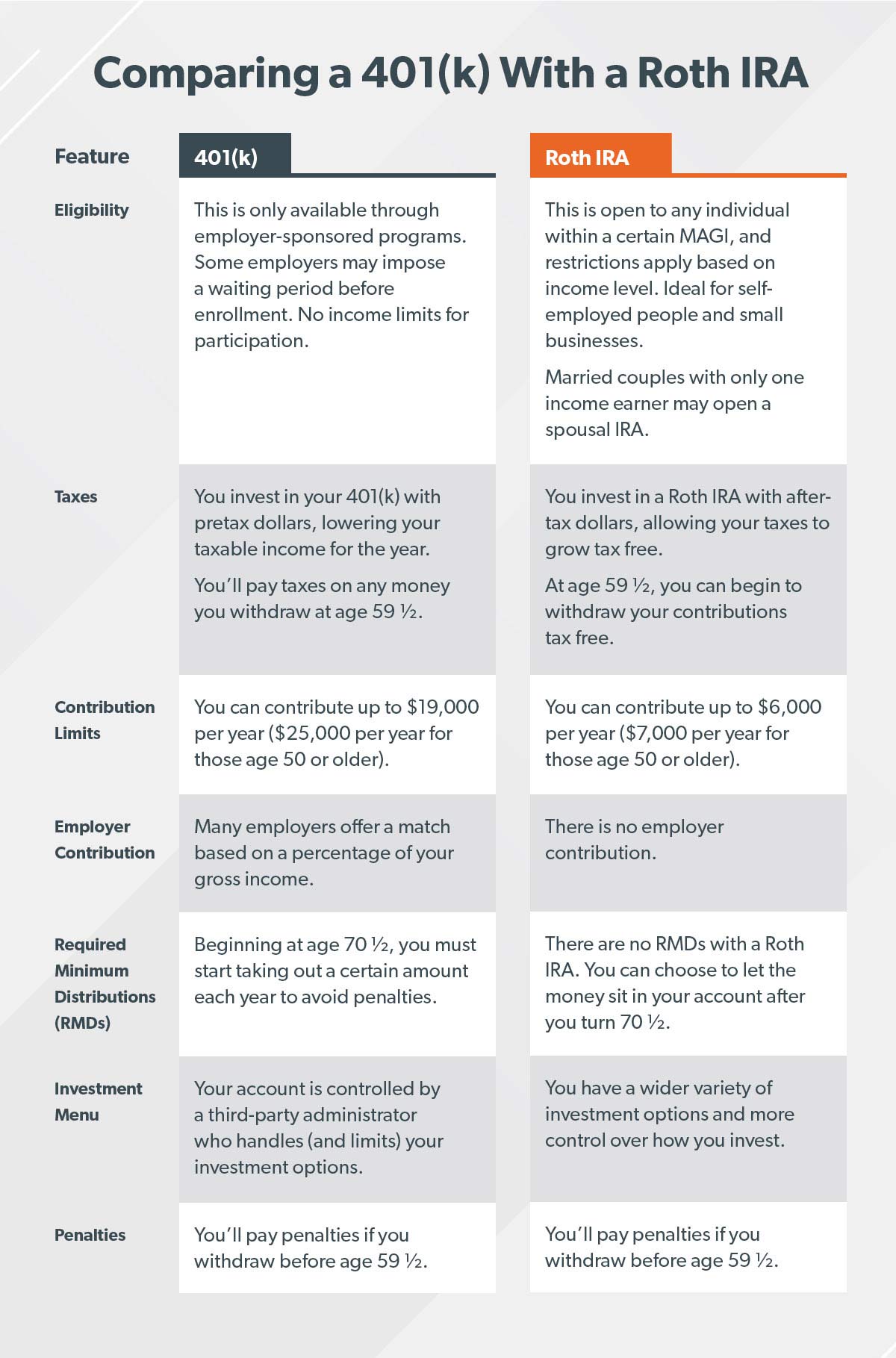

The main difference between a Roth IRA and 401 is how the two accounts are taxed. With a 401, you invest pretax dollars, lowering your taxable income for that year. But with a Roth IRA, you invest after-tax dollars, which means your investments will grow tax-free.

Okay, folks, does anybody else feel like theyve been drinking water from a firehose? That was a lot of information! Lets review the main differences between the Roth IRA and the 401 so you can easily compare their features:

|

Feature |

|

|

Penalties for withdrawals before 59 1/2. |

Penalties for withdrawals before 59 1/2. |

Don’t Miss: Do You Pay Taxes On 401k Withdrawals

May Be Worth A Second Look

There are many aspects of a Roth that make the option worth a second look for many participants.

As your employees come to you and ask questions about their retirement planning needs, understanding the differences could help you to financially empower your workforce.

If you have questions, feel free to reach out to your Morgan Stanley Financial Advisor to discuss your options. You should also consult with your legal and tax advisor.

Who Is The Roth 401 Best For

When you’re choosing between a traditional 401 and a Roth 401, you should consider whether you want a tax advantage now or later on in life. Sturgeon emphasizes making a long-term plan for saving for retirement in order to reduce your tax bill.

“The idea is when your earnings put you in a lower bracket, then maybe they will be in the future, the Roth option is typically better,” says Sturgeon. “And the reason is that you’re just taking advantage of the lower bracket that you’re in, versus potentially being in a higher bracket later on”

If you anticipate having a lower salary in retirement, a traditional 401 may be a better choice.

Additionally, if your employer doesn’t offer you a Roth 401 option, you might consider opening your own Roth IRA. However, there are income limits on a Roth IRA if you make more than $144,000 as an individual or more than $204,000 as a married couple filing jointly , you’re not eligible for a Roth IRA.

Select ranked Charles Schwab, Fidelity Investments, Ally Invest and Betterment as offering some of the best Roth IRAs based on factors like fees, investment options offered and whether a minimum deposit was required.

Don’t Miss: How To Find Out If I Have A 401k

When Should I Switch From Roth To Traditional

The main thing you’ll want to consider when choosing between Roth and Traditional accounts is whether your marginal tax rate will be higher or lower during retirement than it is now, says Young. … If your tax rate is likely to be lower in retirement, you can use Traditional contributions to defer taxes instead.

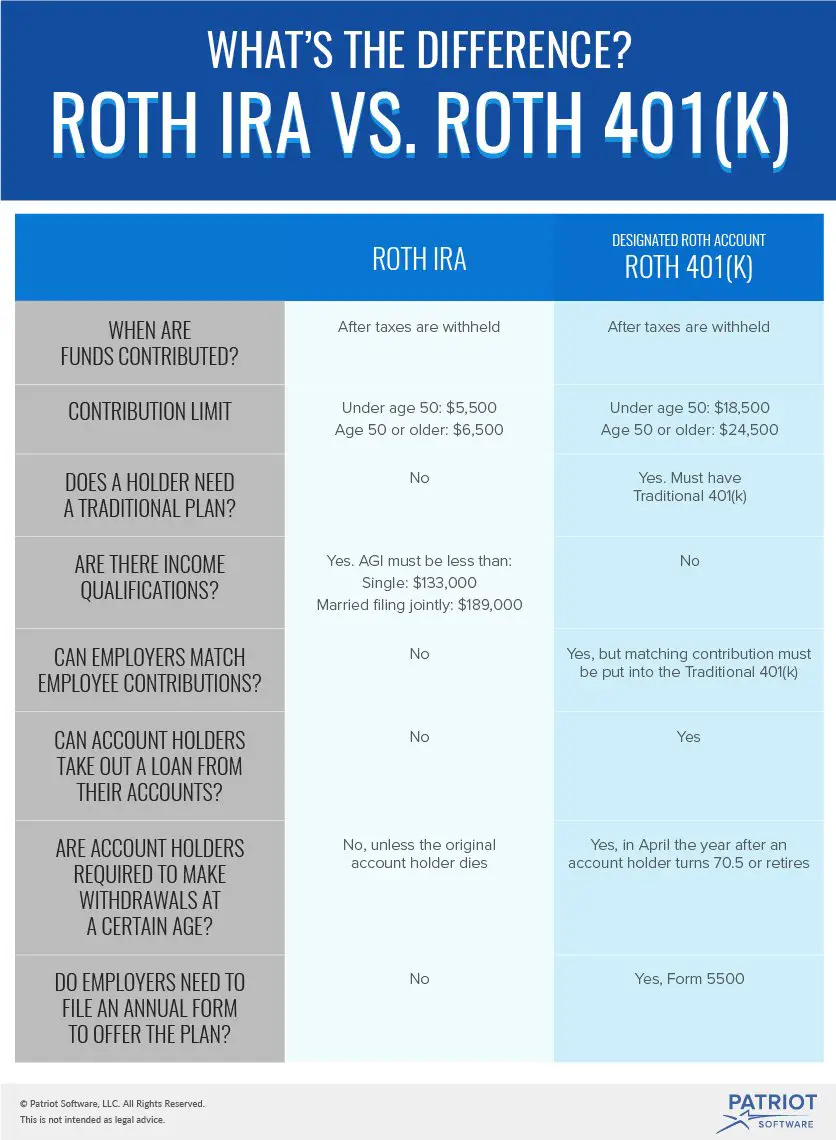

How A Roth 401 Works

If your employer chooses to offer a Roth 401 option, you’ll be able to select how much you want to contribute each pay period from your after-tax income. These contributions will go into an account and grow tax-free. Any matching contributions your employer makes will go into a separate, standard 401 account and grow tax-deferred until you take distributions.

The annual contribution limits for a Roth 401 are the same as they are for a traditional 401: $19,500 in 2021 or $20,500 in 2022. This increases to $26,000 in 2021 for employees 50 and over. This is much higher than a Roth IRA, which maxes out at $6,000 in 2021 and 2022 .

Withdrawals from the employee-contributed account are tax-free as long as you have been contributing to the plan for at least five years and one of the following is true:

- You are at least 59 1/2 years old.

- You become disabled.

- Beneficiaries take distributions upon your death.

As with a traditional 401, you must begin taking minimum distributions from your Roth 401 by age 72 unless you are still working and don’t own 5% or more of the business.

Also Check: What Will My 401k Be Worth At Retirement