Difference Between Ira And 401k

December 10, 2010 Posted by Olivia

The key difference between IRA and 401k is that IRA is planned by the employee, whereas, 401k is planned by the employer.

IRA and 401k are two retirement plans that come under the tax law of the United States. Although both are retirement plans, they have some differences between them. In this article, we refer to the traditional IRA by the term as IRA. Both IRA and 401k retirement plans are tax-saving plans as they fall under the lower income tax bracket. Moreover, both get favourable tax treatment.

What Is A Simple Ira And How Does It Work

A SIMPLE IRA plan allows employees and employers to make contributions to Individual Retirement Arrangements set up for employees. SIMPLE IRA plans allow smaller employers to avoid the more complex structure and regulations surrounding traditional retirement plans and still provide a desired benefit to their staff.

Under a SIMPLE IRA plan:

- The employer makes contributions to an individual account set up for each eligible employee

- Employees defer a part of their salaries into the plan for retirement

- The plan is funded both by employer and employee contributions and

- Each employee is always 100 percent vested.

An employer is required to make a contribution to the plan and can choose to:

- Make a non-elective contribution of at least 2% of compensation for all eligible employees earning at least $5,000 or

- Make a matching contribution of at least 100% up to the first 3% of compensation.

When You Are Between Jobs

There may well be times in your life when your IRA is the only option.

Not every company has a 401, and people are not always employed. There may well be times in your life when your IRA is the only option. If you have self-employment income, you can make higher contributions to a or a Solo 401 you set up for yourself.

Read Also: How To Cash Out 401k After Leaving Job

Plans May Offer An Employer Match

While they might be harder to obtain, 401 plans make up for it with the potential for free money. That is, many employers will match your contributions up to some level.

401s sometimes will have a match depending on the employers generosity and financial position, says Michael Lackwood, founding principal of New York City-based Spring Delta Asset Management. If your employer does offer a match, it makes most sense to contribute to the 401 at least up to the maximum percentage match.

For example, if you contribute 4 percent of your salary, your employer may offer 2, 3 or 4 percent, as an inducement to help you save. Thats free money and an immediate return on your investment.

In contrast, youre on your own with an IRA, and your funds will consist only of what you contribute and any earnings on those contributions.

Its Easier To Set Up A Roth With An Ira

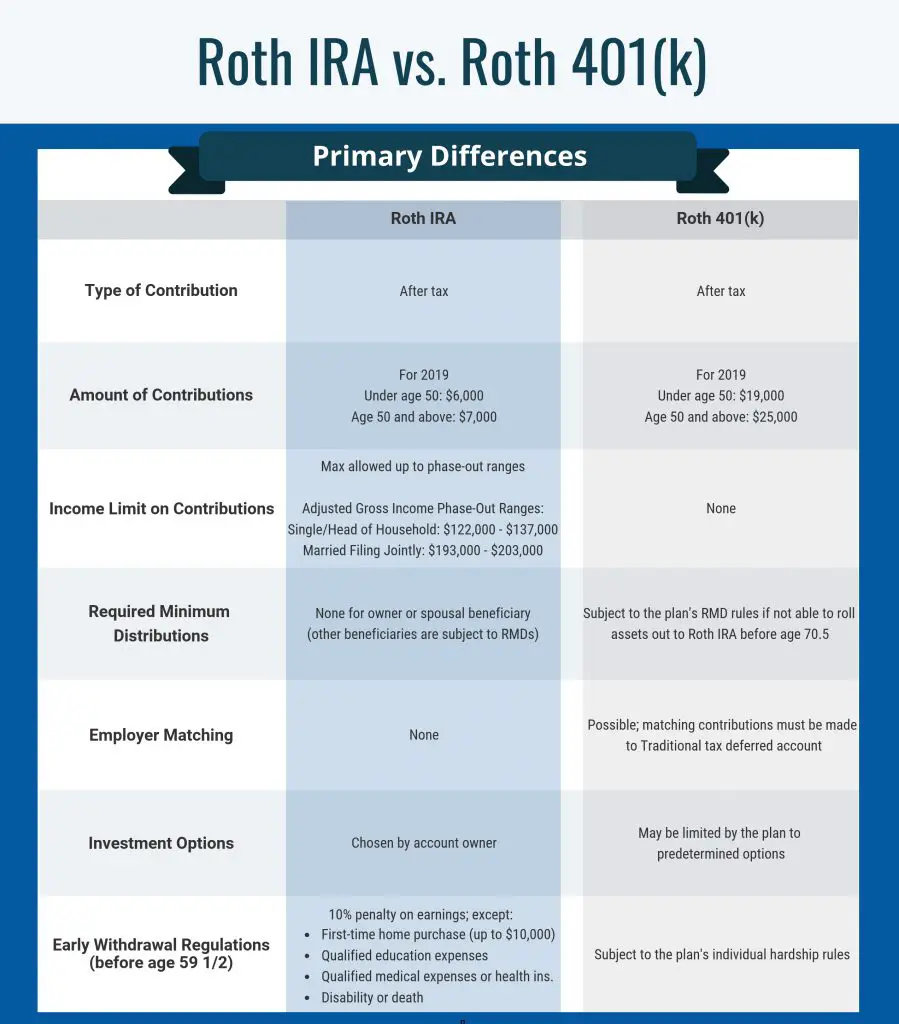

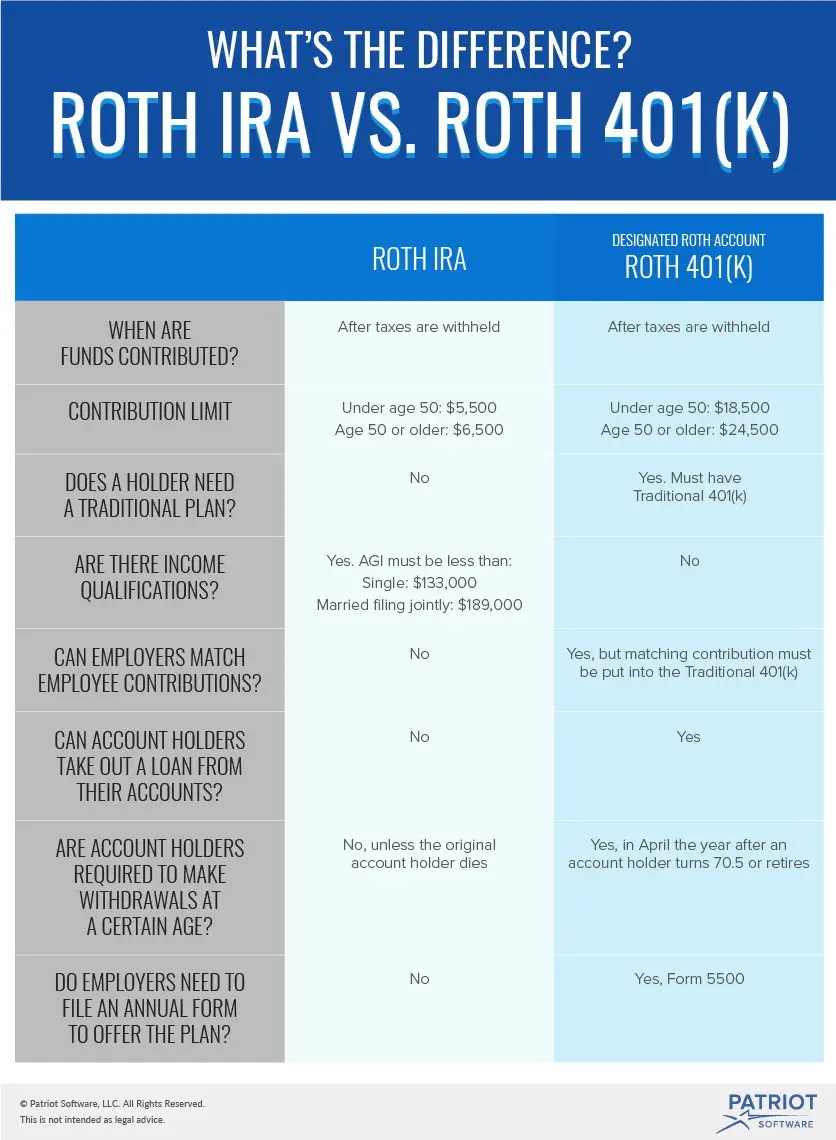

Both the 401 and the IRA have a variation called a Roth, which provides special tax advantages. The key advantage of either Roth account is that participants will not have to pay any tax on withdrawals at retirement. In exchange, their contributions are made with after-tax money, so they dont receive a tax break on todays taxes as they do with traditional plans.

However, not all employers offered a Roth 401 just 75 percent in 2019. If your company doesnt offer the Roth version, you dont have that alternative.

But anyone who can open an IRA can open the Roth variant. While the Roth IRA technically has an income limit that prevents participants from opening it, theres a legal way to do so anyway called a backdoor Roth IRA.Here are the details on the backdoor Roth.

Don’t Miss: Is It Worth Rolling Over A 401k

A 401k And An Ira Can Work Together

Contents

The most important difference between a 401k and an IRA is that a 401k has to be set up by an employer, and an IRA is a personal retirement account that anyone can create for themselves. The amount that can be saved on a tax-deferred basis is also much higher with a 401k.

If you want to have a 401k, you will need to work for a company that creates them for its employees. Assuming you have a 401k from your work, you can also set up an IRA, and save even more money that can grow without being taxed.

Ira Vs : The Quick Answer

Both 401s and IRAs have valuable tax benefits, and you can contribute to both at the same time. The main difference between 401s and IRAs is that employers offer 401s, but individuals open IRAs . IRAs typically offer more investments 401s allow higher annual contributions.

If the IRA vs. 401 comparison is weighing on you, heres the quick answer:

-

If your employer offers a 401 with a company match: Consider putting enough money in your 401 to get the maximum match. That match may offer a 100% return on your money, depending on the 401. For example, some employers promise a 100% match up to 3% of salary. That means, if your salary is $50,000, your employer will put in $1,500, as long as you also contribute at least $1,500. Once you get the match, then consider maxing out an IRA for the year, return to the 401 and resume contributions there.

-

If your employer doesnt offer a company match: Consider skipping the 401 at first and start with an IRA or Roth IRA. You’ll get access to a large selection of investments when you open your IRA at a broker, and you’ll avoid the administrative fees that some 401s charge. After contributing up to the IRA limit, think about funding your 401 for the pre-tax benefit it offers. Here’s how and where to open an IRA.

Here’s more on the pros and cons of the IRA vs. 401 question:

» Want to turn a 401 into an IRA? See our guide to rollover IRAs

Also Check: How Much Can We Contribute To 401k

Ira Vs 401k: Understanding The Difference Between The Two

There are several tax advantaged retirement plans out there. They are IRA, Simplified Employee Pension aka SEP, a Keogh Plan, or a 401k plan.

Each of these plans that can help you save for retirement. And the money you invest in them grows free of taxes. However, they have their own unique benefits.

So, knowing which ones fit your individual needs can be difficult. Therefore, its always a good idea to compare several plans to make the right choice.

But for purpose of this article, I will only focus on IRA vs 401k.

Ira And 401 Basics: What Are Withdrawals Vs Distributions

March 16, 2020 By Claudia Chang

The world of terms associated both with retirement finances as well as taxation can quickly seem overwhelming, which is why weve put together this primer. Its intended to help you start to work through the differences between retirement account withdrawals and distributions in our next post, well tackle how these retirement accounts are taxed.

Since withdrawals and distributions are situations commonly encountered at some point by nearly all retirement account holders, it can be helpful to understand what exactly each entails.

Recommended Reading: How To Rollover Old 401k To New 401k

Iras Offer A Better Investment Selection

If you want the best possible selection of investments, then an IRA especially at an online brokerage will offer you the most options. Youll have the full suite of assets on offer at the institution: stocks, bonds, CDs, mutual funds, ETFs and more.

Generally, for investment selection and overall management of your funds, I would say IRAs have a clear advantage, says Lackwood.

In contrast, 401 plans usually offer only a relatively small selection of investments, even if it does offer the key fundamental types, such as a money market fund and a Standard & Poors 500 index fund.

Usually, employers restrict the 401 the choice of investments to 15-20 positions whereas an IRA allows thousands of different choices, says Lackwood.

IRAs tend to allow significantly more investment options than the average 401 plan does and can therefore be better tailored to each individual, says Burke.

There Are Lots Of Ira Investment Options

If you do decide to open up some form of IRA, there are loads of options out there to choose from. Most stock brokerages have a variety of IRA account types, and these accounts can be used to buy just about anything that trades on stock exchanges.

Just because something can be bought on a stock exchange, it doesnt mean that it is risky. There are many bond ETFs you can buy with a brokerage account, so you can create a diversified portfolio.

The last few years have also seen a rise in robo advisers, many of which have IRA and 401k options. The term robo adviser is vague, and there are a tremendous number of different kinds of automated investment platforms you can use to invest for your future.

You May Like: How Much In 401k To Retire

Pros And Cons Of Rolling Over 401k To Ira

Learn the pluses and the minuses of getting all of your IRA and 401k ducks in a row.

According to the Bureau of Labor Statistics, on average, individuals between the ages of 18 and 52 may change jobs as frequently as 12 times. Some of those jobs probably came with some type of employer sponsored retirement plan such as 401k or an IRA account . When switching jobs, many people choose to rollover any accounts to their new employers plan rather than taking them as a withdrawal. When you roll over a retirement plan distribution, penalties and tax are generally deferred. So let’s look at a few of the pros and cons of consolidating them into one IRA with one institution.

Which Retirement Plan Is Better

Yet 401k plans might be too good to overlook assuming an employer offers a match.

In essence, your employer is giving away free money, says Michael Turner, a risk strategist at Charlotte Wealth Group.

If there is employer matching involved, place into the 401k whatever is matched, Mr Turner told The Sun.

Furthermore, if an individual has $500 to put into a retirement account and is eligible to be matched then Turner recommends putting all into a 401k.

Early on in your career, you might want to take as much advantage as you can with 401k.

However, you might need an IRA later in your life if you leave your employer offering the 401k plan.

If you leave an employer before retirement and go to work somewhere else you still have the option to roll your 401k into an IRA, Brandon Renfro, a financial planner specializing in retirement income planning, said.

He added that there isnt any concern about your employer having control of your retirement money.

While the better plan might go to 401k, it will be important to utilize both retirement savings accounts.

You May Like: How Do I Look At My 401k

A 401 Is More Secure From Creditors

What happens to your retirement money in the event of a bankruptcy or an adverse lawsuit? The 401 is more secure from creditors than the IRA.

The real advantage of a 401 is that in most states the 401 is protected from creditors and lawsuits, except for the IRS and a spouse, says Lackwood. Otherwise, the individual is protected and should keep funds in a 401 until the lawsuit or any concerns are removed.

Individuals can roll over a 401 into an IRA when they leave an employer, but many may choose not to do so, because of the relative lack of security in an IRA, says Lackwood.

S To Take If Your Employer Offers A 401 Match

If your employer offers a matching contribution to your 401, its important to make that your top priority. Employer matches are essentially free money. Before planning your retirement strategy, review your 401 plan documents to see if your employer offers a match and what amount you need to contribute to maximize that contribution.

Next, max out your IRA. Most individuals will need to choose between a traditional or Roth IRA. The right choice will depend on your current income tax bracket and your expected lifestyle during retirement. You can only contribute a total of $6,000 between your traditional and Roth IRAs, but you can split that total amount between the two accounts.

Then, return to investing in your 401. While you wont see the same immediate return in investment, 401s are still robust tax-advantaged retirement accounts. The contributions and your earnings will grow tax-free until you make withdrawals.

After that, consider investing in a taxable account. These savings can form your emergency stash or be an additional source of taxable income.

Finally, strategize your portfolio allocation. Each of the funds you invest in through the different tax-advantaged and taxable accounts will have a certain amount of risk. Regularly reconsider the amount of risk you are willing to accept as you get older.

Also Check: How To Opt Out Of Fidelity 401k

What Is The Difference Between Roth Ira And 401k

The primary distinction between a Roth IRA and a 401 is how they are taxed. You invest pretax cash in a 401, lowering your taxable income for the year. A Roth IRA, on the other hand, allows you to invest after-tax cash, which means your money will grow tax-free.

Is anyone else feeling like theyve been drinking from a firehose? That was quite a bit of data! Lets go over the key distinctions between a Roth IRA and a 401 so you can compare their benefits:

Employer-sponsored programs are the only way to get it. Before enrolling, there may be a waiting time.

Earned income is required, although restrictions apply after a certain amount of income, depending on your filing status.

$20,500 per year in 2022 . Highly compensated employees may be subject to additional contribution limits .

You must begin drawing out a specific amount each year at the age of 72.

May An Employee Participate In A Simple Ira Plan If He Or She Also Participates In A Plan Of A Different Employer For The Same Year

An employee may engage in a SIMPLE IRA plan even if he or she is already a participant in another employers plan for the same year. The employees salary reduction contributions, on the other hand, are subject to the limitations of section 402, which imposes a maximum aggregate exclusion for voluntary deferrals for any individual. Similarly, an employee who contributes to both a SIMPLE IRA and a 457 deferred compensation plan is subject to the limitations set forth in section 457. . You are not responsible for ensuring that either of these restrictions are followed.

Also Check: Can You Use 401k To Buy Stocks

Disadvantages Of An Ira Rollover

A rollover is not for everyone. A few cons to rolling over your accounts include:

- . You may have credit and bankruptcy protections by leaving funds in a 401k as protection from creditors vary by state under IRA rules.

- Loan options are not available. The funds may be less accessible. You may be able to get a loan from an employer-sponsored 401k account, but never from an IRA.

- Minimum distribution requirements. You can generally withdraw funds without a 10% early withdrawal penalty from a 401k if you leave your employer at age 55 or older. With an IRA you generally have to wait until you are age 59 1/2 to withdraw funds in order to avoid a 10% early withdrawal penalty. The Internal Revenue Service offers more information on tax scenarios as well as a rollover chart.

- More fees. You may be responsible for higher account fees as compared to a 401k which has access to lower-cost institutional investment funds because of group buying power.

- Tax rules on withdrawals. You may be eligible for favorable tax treatment on withdrawals if your 401K is invested in company stock.

Neither State Farm nor its agents provide tax or legal advice.

What To Do If You Are Self

In some cases you might be in a situation where you do not even have access to an employer-sponsored 401 at all. If you are a business owner, freelancer, contractor or other self-employed individual, then you should go ahead and open a solo 401 account. As long as your business has no other employees, then you can open this account and begin making contributions. Going this route will maximize the amount of money that you are allowed to put away. Since you are both the employer and employee, you can contribute all the way up to $58,000 into your 401 when you take into account the employer contributions as well. You will also get a big break when it is time to file your tax return as well because your contributions are tax deferred and will not be considered taxable income in the current year.

Once you have maxed out your solo 401, then you should go ahead and open an IRA. It is likely that you will be unable to deduct your contributions if you make enough money to max out your 401, but your investments in the account still grow tax-free. You can also avoid the tax penalty by waiting until age 59 1/2 to withdraw money from the account.

Read Also: Can I Transfer Money From 401k To Ira

Also Check: Can I Move My 401k To An Ira

Overview Of An Ira Vs 401k:

You probably know fundamentally that saving for retirement is one of the single best things you can do financially. You dont want to rely on social security, you dont want to run out of money, you dont want to be a financial burden to your children, and you want to enjoy your golden years. All great reasons to have a retirement plan! So which retirement plan is best for you?

Both IRAs and 401Ks have tax benefits and are among the most common defined contribution plans. The good news is that you dont have to choose one over the other. To maximize your retirement savings, you can and should, if possible, contribute to both an IRA and 401k.

The key to note is that a 401k, named for the section of the tax code that discusses it, is an employer-based plan and an IRA is an individual retirement plan. Got it?

First up lets look at how a 401K and IRA are alike.