Enter The Roth 401k/403b

Almost 80% of these qualified plans now offer a Roth option for employee contributions. The main difference between Roth 401k contributions and Traditional 401k contributions is when you owe federal income tax on the money. When making Traditional contributions, you get an upfront tax benefit because your taxable income is reduced by the amount you contribute. For example, if youre in the 32% marginal tax bracket and you contribute the maximum $19,500 contribution for 2020, you would reduce your 2020 income tax bill by $6,240 which is significant savings to be sure. It isnt until you begin withdrawing your money that your withdrawals are taxed to you as regular income at whatever your marginal tax rate is for that year.

When you contribute to a Roth 401k/403b the money is taxed in reverse. Youll owe federal income tax on the amount you contribute for the year the contribution was made. However, assuming some basic conditions are met, youll wont owe any taxes on that money when its withdrawn. If youre in the 32% marginal tax bracket and you contribute $19,500 to your Roth account in 2020, youd owe $6,240 in federal income tax however, the IRS will never be able to tax that money, or the decades of compounded growth that it generates over the years, again! This benefit cannot be overstated!

Should I Open A Roth Ira If I Have A Roth 401

If you have the funds to do so and your income allows Roth IRA contributions, you can grow your retirement savings faster by contributing to both! More money into retirement funds is a great idea, and often more money into Roth is an even better one. However, we do recommend you consult your fiduciary financial advisor to make sure your income limits arent in excess of the limits for a Roth IRA, and that contributions to a Roth IRA and Roth 401 fit within your financial plan and goals.

Dont Miss: How To Get Your Money Out Of 401k

Tax Considerations For A 401 And A Roth Ira

While saving in a Roth IRA doesnt offer you any tax advantages today, the future advantages can add up.

Keep in mind how importantor nota present-day tax break from income is to your household, says Whitney. Lets say you earn $80,000 annually. If you put $15,000 into your 401, your taxable income for that calendar year then becomes just $65,000.

However, if you contribute the maximum amount to a Roth IRA, youll still report a household income of $80,000, and the money put into a Roth is never taxed again.

Imagine years of investment compounding in action, and no mandated time to withdraw the funds, nor tax upon withdrawal, she said.

Except for a few scenarioslike a first-time home purchase or college expensesthere are tax implications for Roth IRAs if funds are withdrawn within five years of the initial contribution.

Read Also: What Is The Difference Between Roth 401k And Roth Ira

Is It Better To Invest In A 401 Or Roth Ira

If youre wondering whether its better to contribute to a 401 or a Roth IRA, dont because you should be investing in both. Experts agree that the first account you should take advantage of should be a 401, if youre eligible through one at your job. Make sure you are putting enough to get the employer match first.

As I mentioned earlier, an employer match is free money that you dont want to miss, Yu said.

Then move onto your Roth IRA. Try to max out the $6,000 a year, if you are eligible, and if you have enough money after that, go back to your 401 and max it out to the entire $20,500 annual limit.

Roth 401k Vs Roth Ira: How Are They Different

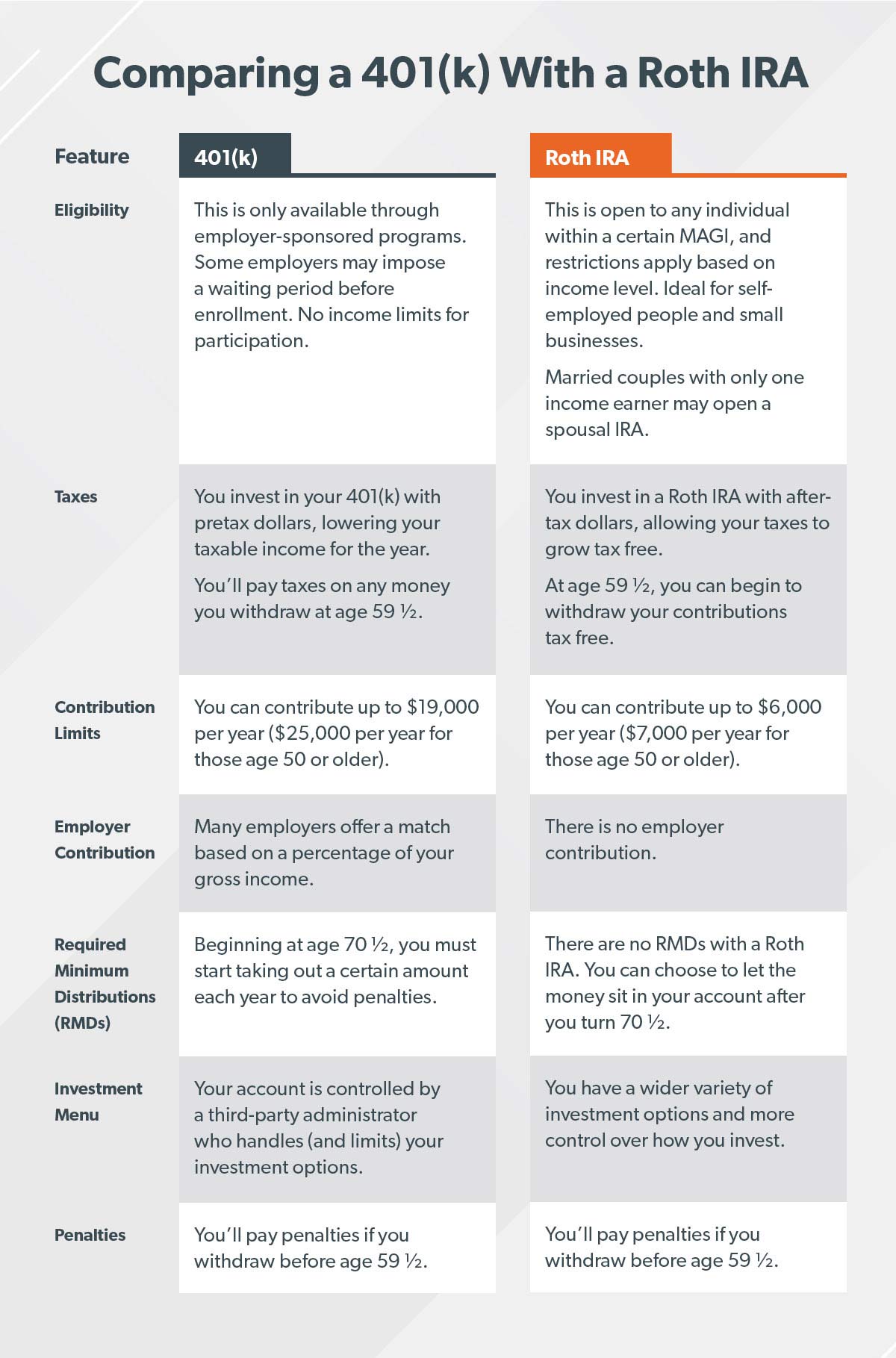

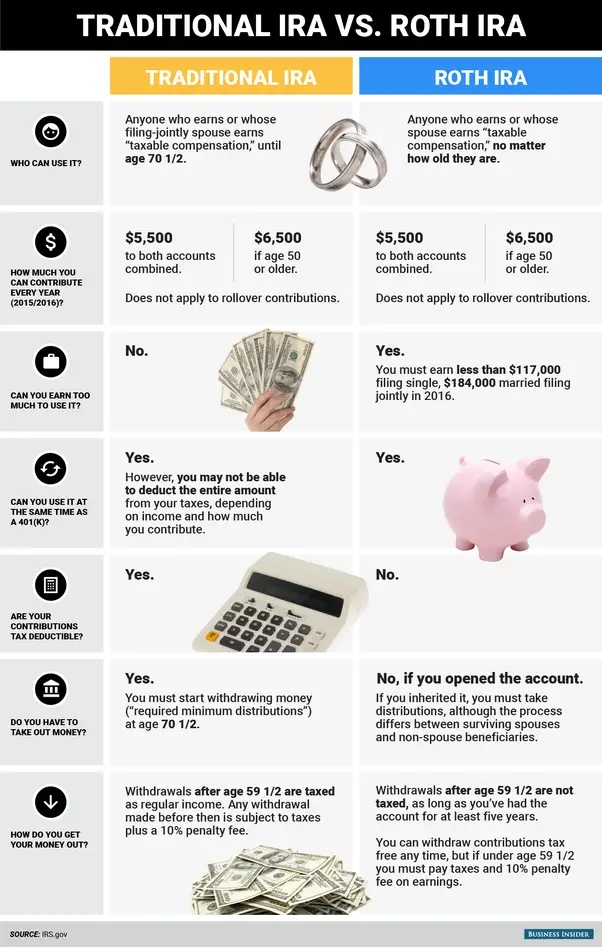

The biggest differences between a Roth 401k and a Roth IRA are their different annual contribution limits, eligibility criteria, and whether or not you will need to take required minimum distributions .

Lets start with the annual contribution limits.

In 2022, you can contribute up to $20,500 per year and a catch-up contribution of $6,500 per year if youre age 50 or over to a Roth 401k. However, the annual contribution limit for Roth IRAs is much lower: just $6,000 per year, or $7,000 if youre 50 years of age or over.

Another big difference between the Roth 401k and the Roth IRA is the eligibility criteria. If you make too much money, you cant open or contribute to a Roth IRA. More specifically, for tax year 2022, you are not eligible for a Roth IRA if your modified adjusted gross income is:

- $144,000 or more if you are single or head of household

- $214,000 or more for married couples filing jointly

With Roth 401ks, the only eligibility criteria is that your employer offers this option.

Another big difference is that you dont need to take Required Minimum Distributions from Roth IRAs. But with Roth 401ks, you must start taking RMDs when you turn 70½ years old.

Don’t Miss: How To Find Out How Much 401k I Have

Roth Ira Or Roth : Which Is Better

Determining which account will best suit your needs depends on your current and future financial situations, as well as your own specific goals.

High earners who want to make contributions to retirement accounts each year should consider a Roth 401, because they have no income caps. Additionally, individuals who want to make large contributions can put more than three times the amount in a Roth 401 as in a Roth IRA.

Those who want more flexibility with their funds, including no required distributions, might lean toward a Roth IRA. This would be especially helpful if you want to leave the account to an heir. But Roth 401 accounts can be rolled over into a Roth IRA later in life anyway.

What Is A Traditional 401

A traditional 401 is the original version of the plan and is usually referred to simply as a 401. This type of plan allows you to make contributions with pre-tax dollars so that you dont pay taxes on money you contribute. So your tax break comes today, rather than later.

In this 401, youll also enjoy deferred taxes on your investment gains. Your money is taxed only when it comes out of the account. That means you can avoid taxes on earnings, such as capital gains and dividends, until you withdraw them from the account at retirement.

Also Check: Who Can Open A Solo 401k

Tip : Money Stylespender Or Saver

Some people spend all of their available money, some people tend to save it. That’s no judgment against spenders: How you manage your money can help you choose which type of account may make sense for you.

Other things equal, and assuming contributions of similar size, traditional accounts preserve more money to spend today while Roth accounts tend to provide more money to spend in the future. Traditional 401, 403, and IRA contributions leave money in your pocket because they generally lower your current taxable income. But these tax savings can help you reach your retirement goal only if you invest them. If you spend your tax savings, it’s not going to help you when you retire.

On the other hand, a contribution to a Roth account reduces the amount of money left in your pocket compared with a similar contribution to a traditional account, because you pay taxes on your contributions up front. If youre like many people who tend to spend their take-home pay, opting for a Roth and thus having less available to spend might be a good thing when it comes to your retirement savings. In other words, because youve already paid your taxes today, you get more to spend tomorrow.

Which type of account may be right for you?

Sam ends up with the most. His Roth IRA, like Sara and Brian’s traditional IRAs, grows to $38,061, but unlike them he doesn’t have to pay any tax when he withdraws the money. The Roth IRA gives Sam 2 advantages over the other 2 investors:

Important Legal Disclosures And Information

1. Modified Adjusted Gross Income is Adjusted Gross Income with some of the items originally subtracted from gross income added back, including the IRA deduction, the student loan interest deduction, foreign earned income and housing exclusions, foreign housing deduction, excluded and savings bond interest, and excluded employer adoption benefits. See, IRS Publication 590-A, Contributions to Individual Retirement Arrangements .

2. Over age 59½ and account open at least five years.

3. With some exceptions, RMDs are not required from 401/403 plans if the participant is still employed by the company after reaching the age when RMDs would otherwise be required.

4. Age for RMDs is 70½ if you were born before July 1, 1949 and age 72 if you were born on or after July 1, 1949.

5. No RMDs are required from your Roth IRAs during your lifetime. Different rules apply to your beneficiaries after your death.

Neither the information presented nor any opinion expressed herein constitutes an offer to buy or sell, nor a recommendation to buy or sell, any security or financial instrument. Accounts managed by PNC and its affiliates may take positions from time to time in securities recommended and followed by PNC affiliates.

PNC Private Bank and PNC Private Bank Hawthorn, are service marks of The PNC Financial Services Group, Inc.

Investments: Not FDIC Insured. No Bank Guarantee. May Lose Value.

Read Also: Can You Rollover A 401k While Still Employed

Roth 401 Vs Roth Ira: An Overview

There is no one-size-fits-all answer as to which is better, a Roth 401 or a Roth individual retirement account . It all depends on your unique financial profile: how old you are, how much money you make, when you want to start withdrawing your nest egg, and so on. There are advantages and disadvantages to both.

Here are the key differences you should consider when comparing the two types of Roths.

Why A Roth Ira May Be Better

More investment options. There is only a short list of investments listed in the tax code that Roth IRAs cannot be invested in: collectibles , life insurance and S corporation stock. All other types of IRA investments are allowed. By contrast, Roth 401s are limited to the options offered by the plan.

No RMDs. Required minimum distributions are not required for either Roth IRA owners or surviving spouses who roll over an inherited Roth IRA to their own Roth IRA. On the other hand, all Roth 401 participants and beneficiaries are subject to RMDs.

Qualified distributions. In order for earnings on either a Roth IRA or Roth 401 to be withdrawn tax-free, the distribution must be considered qualified. A qualified distribution requires a triggering event and satisfaction of a five-year holding period . For both Roth IRA and Roth 401-qualified distributions, triggering events are attainment of age 59½, death or disability. For Roth IRA-qualified distributions , a first-time home purchase is also a triggering event.

TheStreet Recommends: Top Tax Write-offs for the Self-Employed

There is also a difference in the way the five-year clock works for plans and IRAs. For Roth IRA distributions, the clock is satisfied if the IRA owner opened ANY Roth IRA within the last five years. The Roth IRA that received the initial contribution or conversion and started the clock does not have to be the same Roth IRA now being distributed.

Don’t Miss: How Does Taking A Loan From Your 401k Work

Eligibility & Contribution Limits

Whether or not youre eligible for a 401 depends on whether or not your employer offers one. Similarly, different employers will have different eligibility requirements for their employer match program.

Roth IRAs, on the other hand, are theoretically available to anyone who earns less than the maximum income. However, you have to find a financial institution thats willing to work with you. Many banks have high minimum deposit amounts, which can be challenging if youre earning a modest income.

That said, a Roth IRA is still worth considering for lower-income individuals. Because your withdrawals are tax-free, you wont be under as much stress in retirement. Youll be able to experience a higher standard of living with a lower overall account balance.

Along the same lines, Roth IRAs are less beneficial for high earners. With a maximum annual contribution of $6,000, youll often find that you want to save significantly more money. In that case, you can take advantage of a 401s higher limits.

With a 401, you can contribute up to $20,500, or $27,000 if youre over 50. Not only that, but your employer match can put the total amount as high as $58,000 or 100% of your salary, whichever is lower.

Minimizing Taxes To Maximize Your Retirement Contributions

If you dont expect any material change in your income tax rate between your working years and retirement, it generally wont make a difference whether you choose a traditional 401 or a Roth 401. However, if you do expect some variation in your income tax rate, it makes sense to dig a bit deeper before making a final decision.

A major goal when making retirement contributions is to minimize taxes when your tax rate is high. But this is not always an easy thing to know because you must anticipate how your federal, state, and local income taxes could change over time. If you are working in a state with high income taxes, like California or New York, and you plan on retiring in a state with low income taxes, like Florida or Texas, using a traditional 401 would be preferred since the expected savings in state income tax today are likely to exceed the expected increase in federal income taxes in the future.

Though you cannot predict future tax rates, you can estimate how much income you will need in retirement and where you plan to live during your retirement years. Having these two pieces of information can help to clarify whether you should contribute to a traditional 401 or a Roth 401.

Also Check: How To Use Money From 401k

How Much Should I Invest In A Roth 401

No matter what your income is, you should be investing 15% of your income into retirement savingsas long as youre debt-free and have a fully funded emergency fundenough to cover 36 months of expenses. Lets say you make $60,000 a year. That means you would invest $750 a month in your Roth 401. See? Investing for the future is easier than you thought!

If you have a Roth 401 at work with good mutual fund options, you can invest your entire 15% there. Boom, youre done! But if youre not happy with your 401s investment options, then invest up to the match and max out a Roth IRA on your own.

Weighing Now Versus Later

A tax deduction now can seem like a pretty good deal, but you have to think ahead. Under today’s tax rules, every dollar you withdraw from a traditional 401 could be reduced 20 or 30 percent come retirement time, depending on your tax bracket. That means that youll have to save that much more to fund your retirement cash flow.

If you’re young and confident that you’ll be earning more and in a higher tax bracket in the future, the Roth 401 may be a good choice. But even if you’re in your 40s, 50s or 60s, you might want to take a close look at the Roth option.

Why? Because even if you end up in a lower income tax bracket when you retire, withdrawals from your traditional retirement accounts could potentially kick you into a higher tax bracket. That could increase your tax billincluding potential taxes on Social Security benefitsand may reduce your disposable income. Higher taxable income could also increase the costs of your Medicare B premiums in retirement. So giving up the tax deduction now may be well worth having tax-free withdrawals later on.

Read Also: How Do I Get A Loan On My 401k

Why Should I Not Get A Roth Ira

Roth IRAs offer several key benefits, including tax-free growth, tax-free withdrawals in retirement, and no minimum distribution required. The obvious disadvantage is that youre donating post-tax money, and thats a bigger hit on your current income.

Are Roth IRAs still a good idea?

A Roth IRA or 401 makes the most sense if you believe you will earn more in retirement than you are earning now. If you expect your income to be lower in retirement than you currently are, a traditional account is likely a better bet.

What are the disadvantages of a Roth IRA?

Cons of Roth IRA

- You pay taxes up front.

- The maximum contribution is small.

- You have to set it yourself.

- There is an income limit.

- Your savings grow tax free.

- No need for the required minimum distribution.

- You can withdraw your contribution.

- You get tax diversification in retirement.

Advantages Of A Roth Ira

Here are some advantages a Roth IRA has over a 401:

- Tax-free growth. Unlike a 401, you contribute to a Roth IRA with after-tax money. Translation? Since you invest in your Roth IRA with money thats already been taxed, the money inside the account grows tax-free and you wont pay a dime in taxes when you withdraw your money at retirement. And heres the deal: Once youre ready to retire, the majority of the money in your Roth will be growth. So, no taxes on that growth means hundreds of thousands of dollars stay in your pocket. Thats worth a happy dance!

- More investing options. With a Roth IRA, youre not limited by some third-party administrator deciding which funds you can invest inyou literally have thousands of mutual funds to pick and choose from. When you have more options, you have more power to make good choices!

- Not tied to your employer. Unlike a workplace retirement plan, you can open a Roth IRA at any time. And no matter what your employment situation is, it doesnt affect your Roth IRA at all. No need to roll over anything or worry about keeping track of a pile of 401s you left behind from old jobs!

- No required minimum distributions . With a Roth IRA, you can keep your money in the account forever if youd like. That means you can let more of your money keep growing over a longer period of time!

Recommended Reading: Is It Too Late To Start A 401k