How To Check Your 401 Balance

If you already have a 401 and want to check the balance, it’s pretty easy. You should receive statements on your account either on paper or electronically. If not, talk to the Human Resources department at your job and ask who the provider is and how to access your account. Companies dont traditionally handle pensions and retirement accounts themselves. They are outsourced to investment managers.

Some of the largest 401 investment managers include Fidelity Investments, Bank of America – Get Bank of America Corporation Report, T. Rowe Price – Get T. Rowe Price Group Inc. Report, Vanguard, Charles Schwab – Get Charles Schwab Corporation Report, Edward Jones, and others.

Once you know who the plan sponsor or investment manager is, you can go to their website and log in, or restore your log-in, to see your account balance. Expect to go through some security measures if you do not have a user name and password for the account.

Much of this should be covered when you initiate the 401 when you are hired or when the retirement account option becomes available to you. Details like contributions, company matching, and information on how to check your balance history and current holdings should be provided.

Finding a 401 from a job you are no longer with is a little different.

Read more on TheStreet about how to find an old 401 account.

What Is The Average And Median 401 Balance By Age

401 balances can average roughly $6,000 at the age of 24 to more than $255,000 at the age of 65. Both average and median 401 balances can vary greatly depending on a few factors. This can include how long you have been saving for retirement or whether your company provides 401 matching, which is when your employer contributes to your retirement savings based on the amount of your contribution.

While savings are personal, the idea of a nest egg will likely make you contemplate what your financial future holds. Retirement might seem like a long way down the road, but time flies faster than we realize. And the earlier you start saving for retirement, the better off youll be later in life.

Knowing the 401 average by age can help you figure out where you stand and how you can be better prepared for the future. Heres what you can learn from Vanguards research on How America Saves in 2021:

| Age |

|---|

How To Track Down That Lost 401 Or Pension

Can’t Find your old 401 or that old pension? Here is how to track your money down. Shutterstock

At least once every few months a long-term client brings in a retirement account statement and says, I forgot I had this retirement account. Can you help me with it? Sometimes these accounts are tiny but other times they hold a substantial amount of money. All of them are old, and havent been looked at in years. If you find yourself in this position, follow these steps to locating your 401 or other retirement accounts from previous employers.

Do you ever feel like you know you saved more for retirement than your statements indicate? Are you certain you must have forgotten about an old retirement account or pension with a previous employer? You likely arent crazy, and youre definitely not alone.

Americans lost track of more than $7.7 billion worth of retirement savings in 2015 alone by accidentally and unknowingly abandoning their 401.– USA Today, February 25, 2018

The days of graduating college, getting a corporate job and staying with the same employer until the retirement age of 65 are long gone. Today, people are jumping from job to job which often leaves a trail of old retirement accounts and even a few pensions. Because of this, a surprising number of people lose track of these old accounts. Forgetting about these accounts can really hurt your overall retirement security when you factor in compounding interest.

How to Start Your Search for Lost Retirement Assets

You May Like: Should I Borrow From My 401k

How Much Should I Have In My 401k Based On My Age

There are a few different schools of thought on how much a person should have saved in their 401k based on their age.

Every financial expert has a different opinion. When deciding what the right number is for you, I think one thing to keep in mind is that its better to have more saved than less.

Creating a potential post-retirement budget as a guideline will help you determine how much money youll spend after youre retired.

In an ideal world, you will be completely debt free by the time you retire and have minimal housing and other expenses.

Youll want to be prepare for these costs:

- Utility bills

- Travel

- Taxes

A persons income and expenses can make a difference when it comes to how much they should have saved at each interval age, but here are some general guidelines.

Use these guidelines in conjunction with your projected post-retirement budget to find out if you should have more or less saved by the time you retire than what is suggest ed here.

Do you have a 401k from an old employer that you need to rollover? Check out Capitalize which is free and will help take out the hassle of rolling over your 401k!

You Can Choose From A Selection Of Funds In Your 401

In a 401, your employer will select the investment choices available to employees. You, as the employee, can then decide how to allocate your contribution among those available options. If you dont make a selection for your contribution, your money will go to a default choice, likely a money-market fund or a target-date fund.

Most plans will offer actively managed domestic and international stock funds and domestic bond funds, plus a money-market fund. Many plans also offer low-cost index funds. .)

Increasingly popular on the 401 menu: target-date funds, which nearly 70% of plans offer. Over time, this breed of fund typically shifts from a stock-heavy portfolio to a more conservative, bond-heavy portfolio by its target date.

Recommended Reading: What Is The Tax Penalty For Early 401k Withdrawal

What Is A 401

A 401 is an employer-sponsored retirement plan enabling workers to save money in a tax-deferred way. Often employers will match contributions up to a percentage of salary. Its just like any other retirement plan in the sense that youre trying to save money and reduce taxes as you do it. Like an IRA, you will pay taxes once you start taking withdrawals in retirement.

If you opted for it when you were hired, every paycheck a percentage of your salary is taken out and put into a 401 retirement account. Your employer may add some more money, maybe even the same amount, on top of that. That money is usually invested, and has been accumulating. How much is in there?

There are different types of 401s. A Roth 401 operates much in the same fashion as a Roth IRA. While still employer-sponsored, it uses after-tax income to fund itself, so you pay the taxes now, and not later in retirement. While one can deliberate the merits of which to use, the general consensus is that a Roth format is useful if one believes they will be in an higher tax bracket later in life when withdrawing from their retirement accounts.

Conversely, a traditional 401 advocate might argue that the ability to put more money into an account in the beginning and through time, allows the saver to make the most of compound interest.

Read more about how a 401 works in this article from TheStreet.

How To Find A Lost 401 Account

Think you may be one of the millions with forgotten 401 money floating around somewhere? Start by scouring your personal email or laptop for any old 401 plan statements that you may have saved in the past.

“Your statement will provide your account number and plan administrator’s contact information,” Corina Cavazos, managing director, advice and planning at Wells Fargo Wealth & Investment Management, tells Select. Your former coworkers may have old statements that you can reference, too.

If you don’t have any luck, Cavazos says that your best bet is to contact your former employer’s HR or accounting department. By providing your full name, Social Security number and dates of employment with that company, you can have them check their 401 plan records to see if you were once a participant.

If you’ve tried contacting your 401 plan administrator or former employer to no success, you may be able to find old retirement account funds on the National Registry of Unclaimed Retirement Benefits. Upon entering your Social Security number, the secure website allows you to conduct a free database search to see if there’s any unpaid retirement money in your name.

Another search database is the FreeERISA website, which indicates if your former employer rolled your 401 funds into a default participant IRA account on your behalf. FreeERISA requires you to register before performing a search, but it is free to do so.

Don’t Miss: What Does A 401k Match Mean

Contact Your 401s Administrators

Your human resources department or administrator will be able to help you check your 401 balance.

You have most likely been mailed statements of your 401 accounts yearly or quarterly unless there is a different address on file.

Speak with your representative to verify that your contact information and address are up to date to prevent future lapses in correspondences.

If your 401 plan’s administrator uses an online portal, similar to your online banking platform, they can help you get set up.

Online access to your 401 is excellent in checking your 401 balance and how your funds are performing. Some 401 platforms allow you to research the various funds, as well as reallocate your investments right on the platform.

How Much Should I Have In My 401k

Laurie BlankSome of the links included in this article are from our advertisers. Read our Advertiser Disclosure.

If youre wondering how much money you should have in your 401k, your wait is over. Retirement savings is much of the talk in todays personal finance world.

You want to make sure youre saving enough to meet your retirement goals. Otherwise, you may have to find ways to save more or possibly delay retiring.

While each person has a different financial situation, these insights can improve your retirement plan.

In This Article

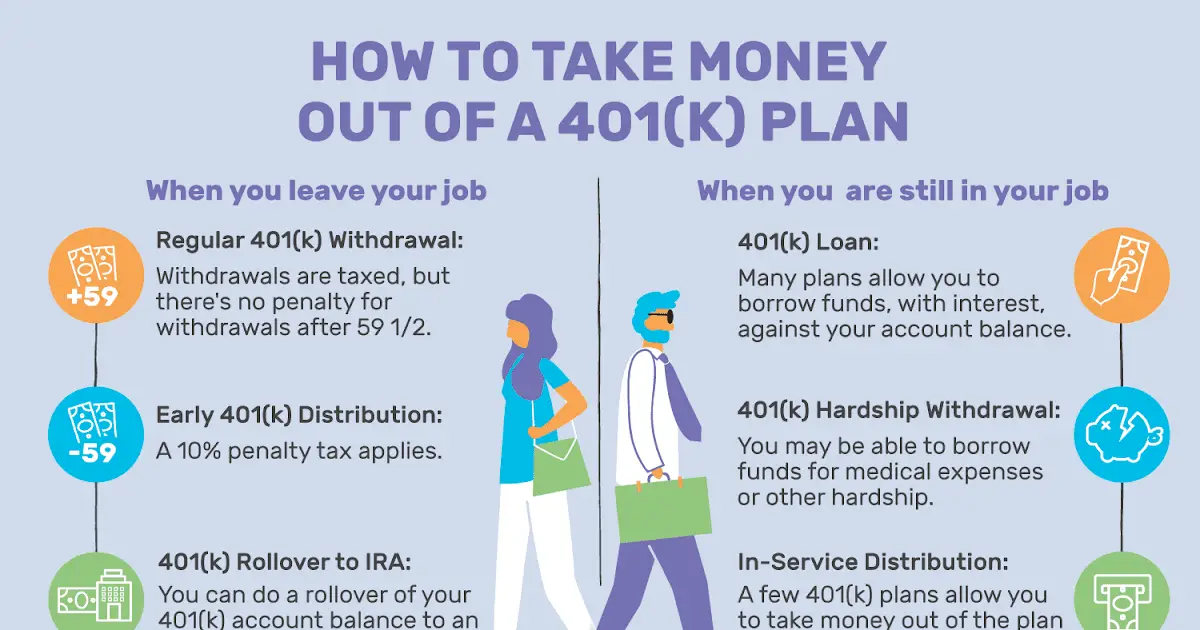

Read Also: Can I Cancel My 401k And Cash Out

Why Do Employers Match 401s Anyways

401s and other defined contribution plans are more cost-effective for the employer than managing a traditional pension plan funded entirely by the company, and are also preferred by most private-sector employees.

While an employer match is not required by the IRS, this company match can be a selling point for recruiting employees particularly if competing firms are offering a generous 401 matching plan.

Employers also get tax benefits for contributing to 401 accounts employer matches can be deducted on their federal corporate income tax returns, and theyre often exempt from payroll taxes and state taxes as well.

How Much Do You Need To Retire Comfortably

How much you need to retire comfortably isnt black-and-white because the cost of living looks different for each individual. Consider what it takes to live comfortably and maintain your lifestyle. Many experts suggest that youll need roughly 80 percent of your salary after retirement to avoid making sacrifices.

Don’t Miss: What’s The Best 401k Investments

How To Prepare For Your Retirement

Not everyone gets the opportunity to invest in a 401 early in life. As soon as it becomes available, its best to consider taking advantage of this benefit.

As of 2022, individuals under 49 can legally contribute $20,500 per year. Those 50 or older can save an additional $6,500 as a catch-up contribution. Starting early will allow you to have more saved by the time of retirement.

Periods Of Low Or No Salary

You might have years of low or no earnings. We will automatically exclude up to 8 years of your earnings history with the lowest earnings when calculating the base component of your CPP retirement pension. This will increase the amount of your pension.

The enhanced component of the retirement pension is based on your contributions to the CPP enhancement. Its calculated using your best 40 years of earnings. This will only affect you if you work and make CPP contributions after January 1, 2019.

Periods of raising children

The child-rearing provisions can help to increase your CPP benefits depending on your earnings during the period you were caring for your children under the age of 7. The provisions may also help you to qualify for other benefits.

Periods of disability

The months when you received a CPP disability payment will not be included in the calculation of the base component of a CPP benefit. This will increase your CPP retirement pension and may help you qualify for other benefits.

When calculating the enhanced component of the CPP , well give you a credit for the months youre disabled before you started collecting your retirement pension. The value of the credit is based on your earnings in the 6 years before you became disabled.

Pension sharing

You can with your spouse/common-law partner. Pension sharing can lower your taxes in retirement by decreasing your taxable income.

You May Like: What Percentage Should I Be Contributing To My 401k

What Is A 401 Account

A 401 plan, named for the section of tax code that governs it, is a retirement plan sponsored by an employer, allowing employees to save a portion of their paycheck for retirement.

The advantage to employees of saving with a 401 plan is they are able to save funds they have earned, before taxes are deducted from a paycheck.

Many employers offer a company match meaning whatever the employee contributes, the company matches.

Although 401 plans were originally born as a supplement to pension plans, they are now often the sole retirement plans offered at companies.

How Much Should I Contribute To My 401

Generally, its a good idea to contribute the maximum amount allowed to your 401. And according to the IRS, this is $20,500 for 2022. But if you combine your contributions with your employers match, the total cant exceed 100% of your salary or $61,000, whichever is less.

If youre turning 50 this year, or if youre already older than that, youre allowed to make catch-up contributions as well. This amounts to an additional $6,500 in 2022 for most plans. In this case, your total limit after employer matching would be $67,500.

But, if you cant contribute the maximum amount, its a good idea to just try to contribute what you can. You can always increase the amount if your financial situation changes.

You May Like: What Is A Simple 401k

Don’t Leave Your 401 Behind Here’s How To Reclaim Your Hard

Switching jobs pulls your mind in several directions at once, and it’s easy for your old 401 to get lost in the shuffle. But you can’t afford to forget about it for good. Building a nest egg to sustain you for decades is tough, so you can’t afford to leave any old retirement accounts behind. If you’ve lost track of your old 401, take these steps to find it and put that money to good use.

What Is The Main Benefit Of A 401

A 401 plan lets you reduce your tax burden while saving for retirement. Not only are the gains tax-free but it’s also hassle-free since contributions are automatically subtracted from your paycheck. In addition, many employers will match part of their employee’s 401 contributions, effectively giving them a free boost to their retirement savings.

Read Also: Can I Open A Roth Ira And A 401k

Your Employer Might Let You Choose Individual Stocks In Your 401

While many employees are fine choosing from limited range of funds, the self-directed brokerage account has been gaining popularity, with about 40% of companies offering these options. They let participants invest in a much broader menu of mutual funds, ETFs and, in some cases, individual stocks. The latest twist is the possibility of investing 401 funds in cryptocurrencies, though the Department of Labor, which oversees 401 administration, has sounded a warning about this option.

As is the case with an IRA, you can trade stocks and funds in your 401 willy nilly without reporting gains and losses to the IRS when you file your tax return. But if you want an SDBA you may have to pay up. Companies may choose to levy an annual maintenance fee, plus transaction fees if you use the account to trade stocks or funds. And remember, the spicier funds you now have access to may charge a higher expense ratio than the plain-vanilla options in your plans regular lineup.

How Much Can I Contribute

Another good reason to take advantage of a 401 match is that it allows you to exceed the annual 401 maximum contribution limits set by the IRS. For 2020 and 2021, you can contribute up to $19,500 of pretax income to a 401. If you are 50 or older, you can contribute another $6,500 in what are called catch-up contributions.

When including employer contributions, the maximum amount you can contribute in 2020 is the lesser of $57,000 for participants 49 or younger or 100% of the participants compensation. In 2021, the limit is $58,000 for participants 49 or younger .

You May Like: Can I Sign Up For 401k Anytime

Read Also: How Much Can I Add To My 401k

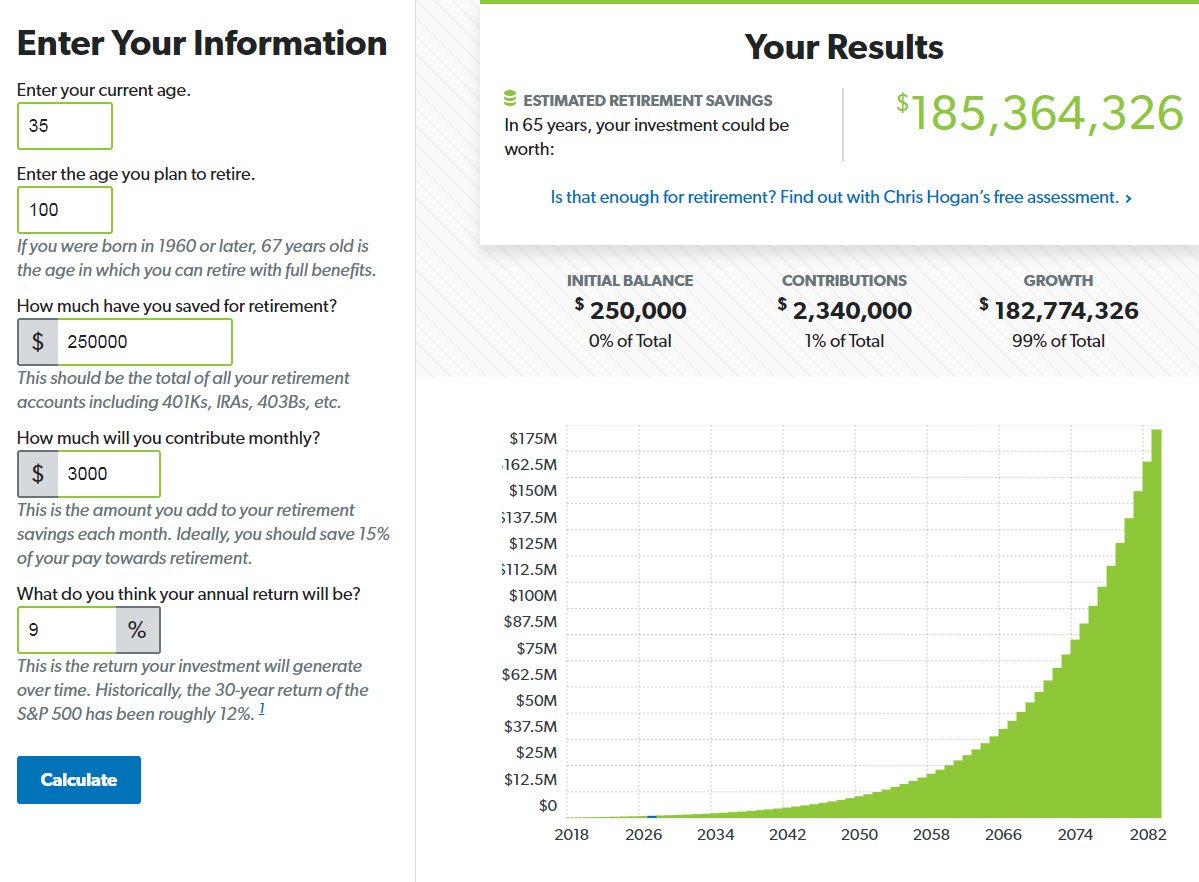

Variables To Consider And Not

To many, what matters most is getting a ballpark figure of how much money they will have when they hit their 60s a simple and matter-of-fact figure in dollars!

While there are only four input variables in this calculator, it’s important to consider how you arrive at each variable. For example, when figuring out your total monthly contributions, include:

- Your average monthly contributions.

- Your employer’s average monthly contributions sometimes called a match.

- Any catch-up contributions in order to reach your desired future goal.

- Limitations due to being a highly-compensated employee.

Only focus on the variables presented in this calculator. Never go into the details of something that is completely out of your control like inflation, salary growth, changes in federal law, or changes in employment policies.

This 401k contribution calculator helps streamline the process of figuring out how much you should contribute toward your 401k to meet your future goal. It simulates that if you contribute X that you’ll end up with Y in a future date, without unnecessary complication.

Simply take a few moments to run a couple of scenarios and figure out how much you should be contributing toward your 401k preparing now will result in a more rewarding retirement later.