How Does 401 Matching Work For Roth 401

If you contribute to a Roth 401 account, your employer will match your contributions at the same rate as traditional 401s. A Roth 401 has a lot of similarities with a traditional 401 plan, except that its contributions are taxed upfront, and you won’t be required to pay taxes on withdrawals.

If your employer matches traditional 401 plans, it should offer a match for Roth 401 plans. When matching Roth 401 contributions, the contributions are made before taxes are paid for it. Therefore, you will owe taxes on the portion of the employer’s contribution when you take a distribution. In simple terms, the employer’s matching contributions go into a traditional 401, and you will be required to pay taxes on the employer’s contributions and any investment growth associated with the match when you make a withdrawal.

Tags

How Do 401 Matches Work

Every 401 plan is different, so youll have to check your employers plan for the details on exactly how yours works. But there are two common types of matches:

Partial matching

Your employer will match part of the money you put in, up to a certain amount. The most common partial match provided by employers is 50% of what you put in, up to 6% of your salary. In other words, your employer matches half of whatever you contribute but no more than 3% of your salary total. To get the maximum amount of match, you have to put in 6%. If you put in more, say 8%, they still only put in 3%, because thats their max.

Heads-up that you might see this written in a lot of different ways. 50 cents on the dollar up to 6%, 50% on the first 6%, 3% on 6% you get the picture. All various ways to describe a partial match.

Dollar-for-dollar matching

With a dollar-for-dollar match , your employer puts in the same amount of money you do again up to a certain amount. An example might be dollar-for-dollar up to 4% of your salary. In this case, if you put in 4%, they put in 4% if you put in 2%, they put in 2%. If you put in 6%, they still only put in 4%, because thats their max.

Understanding Employer Match Schedules

Just because your employer is giving you money for retirement, that doesn’t mean you’ll get that money right away or that you’ll get to keep it when you leave the company.

Employers can determine when they match your contributions, says McClanahan. You may have to work for the company for a few months, or even a year, before you’re eligible to start receiving the employer match.

And once you’re eligible, how often the company deposits matching funds into your account can vary. In 2017, about 46% of employers awarded matching funds every pay period, according to data from T. Rowe Price, while 4% paid out the match on an annual basis. In that case, if you leave the company before your matching funds are awarded, you may not receive that money.

Some employer matches also “vest” over time, meaning the company uses a schedule to determine how much of the matching funds in your 401 you’re entitled to if you leave. Some companies use a “cliff” vesting schedule, meaning once you reach a particular anniversary, the money becomes yours to keep all at once. Others use a “graded” schedule, meaning the money slowly vests over a set number of years.

Vesting is a tool companies offer to retain employees, says O’Hara. If you leave the company before key dates in the vesting schedule, you will leave behind some, or even all, of that money.

Don’t Miss: How To Find Out 401k Balance

How 401 Matching Works

The terms of a 401 plan vary across employers, and you will have to discuss with your employer to know the specific details of the employerâs 401 plan and the matching program.

The sponsoring employer determines the terms of its 401 matching program, but it must observe the required contribution limits rules provided by the ERISA act. Generally, the employer may use either of these two types of matching methods:

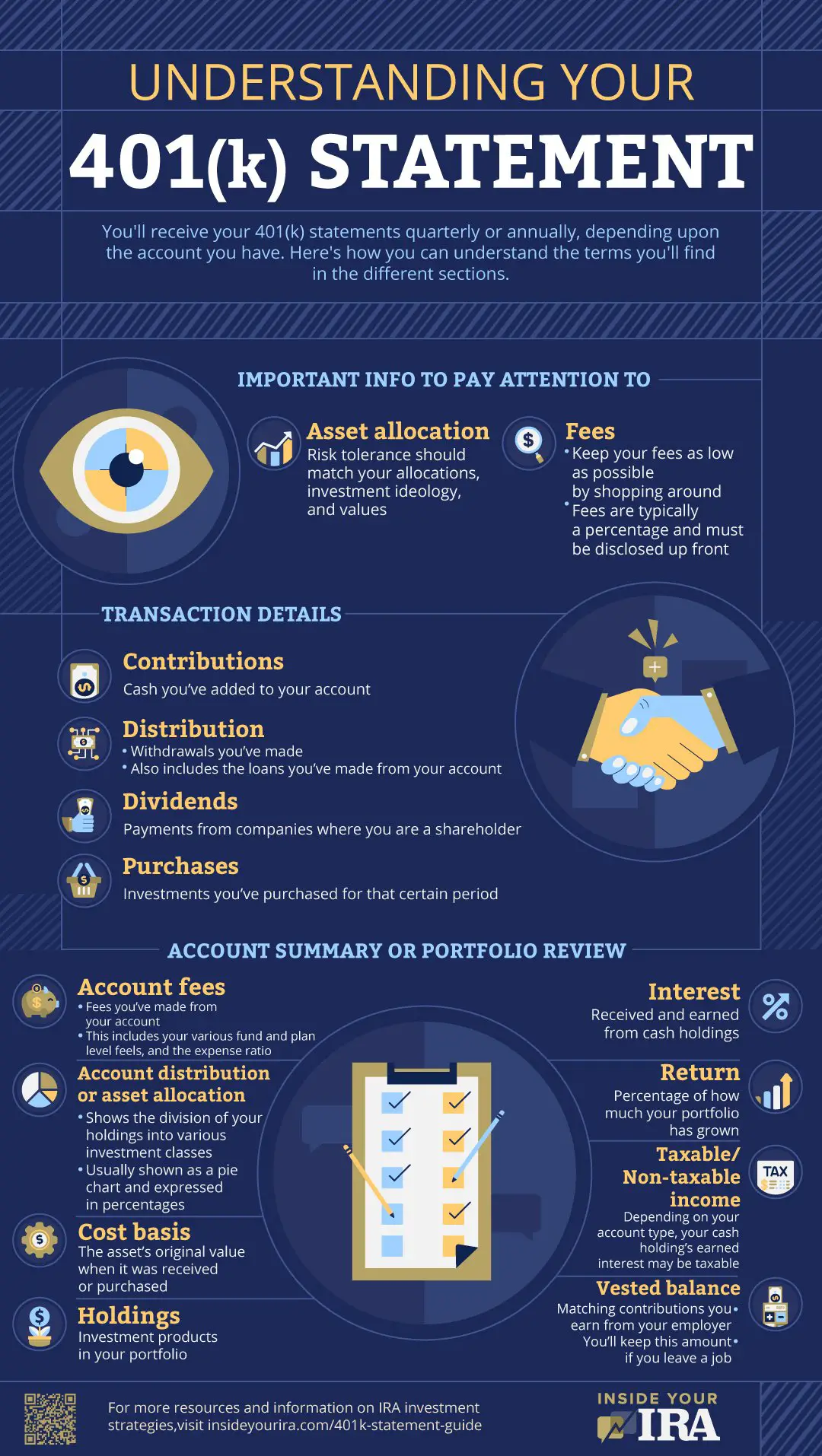

Does Matching Count Towards Contribution Limits

The short answer is no, says Winston. But theres a separate IRS rule that limits the amount of total contributions to a 401 from both the employee and employer combined.

In 2022, most people can divert up to $20,500 per year to a 401 account$1,000 higher than in 2021. If youre age 50 or older by year-end, you can add an additional $6,500 in catch-up contributions.

However, the overall limit from all sources is $61,000 in 2022. That means that no matter who contributes to your account, you cant exceed that amount for the year. If your employer offers a match in the above scenario, the maximum amount youd reach is $41,000. Its therefore unlikely that youll exceed the overall contribution limit.

If your companys 401 plan offers a match, try to contribute enough to capture the full amount. From there, you can assess whether you want to contribute above that amount toward your retirement fund.

You May Like: What Is The Penalty For Taking Money Out Of 401k

Transfer The Money To A New Employer

If your new employer has a retirement plan, you may be able to transfer your existing 401 funds, which is called a rollover. You may also be able to roll over as much of your money as you like into an alternative savings plan, such as an Individual Retirement Account .

Rolling over an existing account to your new employer’s plan means you don’t need to pay any taxes or penalties. The rollover process is designed to make it easy for you to move your 401 with you as you change jobs. It’s an ideal option if your new employer offers a retirement plan.

Can You Contribute More Than The Match

Its smart to contribute at least the amount your employer will match. But you can usually contribute more. In 2019, you can contribute up to $19,000. If youre turning 50 by years end, you can also make a catch-up contribution of $6,000, for a total of $25,000.1

Check with your employer about the best way to size and schedule your contributions. In some cases, contributing the max before years end can cause you to miss out on matching for the rest of the year.

Don’t Miss: How To Close Out Your 401k

What Is 401k Matching

For most employees, a defined contribution plan is one of the primary benefits offered by their employer, with a 401k being the standard employer-sponsored retirement plan used by for-profit businesses. Employer matching of your 401k contributions means that your employer contributes a certain amount to your retirement savings plan based on the amount of your annual contribution.

Similarly, some employers use 403b or 457b plans. While there are some minor differences between these plans, they are generally treated in a similar manner, and they usually have the same maximum contribution limits.

The type of plan is based on the type of entity:

- 403b plans are used by tax-exempt groups, such as schools or hospitals.

- 457b plans are for government workers, although there are some non-governmental organizations that also qualify to use these plans.

Whether youre on your first job or are thinking about retirement, here are a few considerations to keep in mind when offered an employer match to your 401k contributions.

Formulas For 401 Matches

Employers use matching funds as incentives to get employees to put aside more for retirement, says Carolyn McClanahan, a certified financial planner and the director of financial planning at Life Planning Partners in Jacksonville, Florida.

There are different formulas, and it’s not always easy to figure out how much you need to contribute to get the full match. If you’re not sure, ask HR.

Also Check: How To Get 401k Money After Quitting

Can Employees Enroll In A 401 Employer Match Plan As Soon As They Are Hired

Employers are able to define their own specifications regarding when employees are eligible for 401 enrollment. Some companies choose to allow for registration immediately, while others require a certain amount of time to pass, such as the probation period, six months of employment and so on. Employers should make these regulations clear during the hiring process, so employees arent surprised if they need to wait.

Annual Limits For An Employers 401 Match

The 2021 annual limit on employee elective deferralsthe maximum you can contribute to your 401 from your own salaryis $19,500. The 2022 elective deferral limit is $20,500. The 2021 annual limit for an employers 401 match plus elective deferrals is 100% of your annual compensation or $58,000, whichever is less. In 2022, this total rises to $61,000 or 100% of your compensation, whichever is less.

Considering that surveys suggest many Americans dont have enough money saved for retirement, meeting or exceeding the amount needed to gain your employers full 401 matching contribution should be a key plank in your retirement savings strategy.

Taking into account the power of compounding and a 6% annual rate of return, contributing enough to receive the full employer match could possibly be the difference between retiring at 60 versus 65, said Young.

Use Fidelitys 401 match calculator to find out how matching contributions can impact your retirement savings.

Recommended Reading: How Do You Split A 401k In A Divorce

What Is 401 Employer Matching

401 employer matching is the process by which an employer contributes to an employee’s retirement account based on the employee’s contributions. Employers tend to set their 401 contribution limits based on the employee’s annual salary. In other words, an employer’s contribution rate may be at most a certain percentage of the employee’s salary. For example, an employer may be willing to match 50% of an employee’s contribution, up to 6% of their annual salary. So, if the employee contributed 6% to their 401 plan, the employer would contribute an additional 3% to the employee’s retirement savings.

Rarely, some employers instead set a contribution limit of a predetermined dollar amount that’s unrelated to the employee’s annual salary.

Key takeaway: 401 employer matching is when an employer also contributes to an employee’s retirement account.

Other Amazon Benefits To Consider

A mix of benefits you receive from a company can have a significant impact on your future wealth. When considering a job offer, you need to think about various aspects and how they compare to competitors.

Other benefits offered by Amazon include:

See page to learn more about the variety of benefits Amazon offers.

Don’t Miss: What’s The Max You Can Put In A 401k

What If I Have A Roth 401

If you have a Roth 401, you pay income taxes on your contributions now, rather than when you take that money out during your retirement. But your employer isnt likely to pay the taxes on matching contributions , so if you have a Roth, their matching contributions usually go into a separate, traditional 401. Youll pay the taxes on the traditional when you withdraw the money.

Matching Contributions For A Roth 401

If you choose to save money in a Roth 401, matching contributions must be allocated to a separate traditional 401 account. This is because IRS rules require you to pay regular income tax on employer contributions when they are withdrawnand Roth 401 withdrawals arent taxed in all but a few cases.

Remember, with a traditional 401 account, your contributions are made pre-tax, and you pay regular income tax on withdrawals. And with a Roth 401 account, your contributions are made using after-tax dollars, and qualified withdrawals are generally tax free.

You May Like: How To Use 401k To Start A Business

How Does A 401k Match Work

Each employer has different 401k employer match rules. No matter the rules, though, your contributions to your 401k are pre-tax. You decide how much to contribute when you sign up for the 40kK. You can change your contributions by talking to your HR department throughout your time there too.

Lets say you make $1,500 a week and elect a 5% contribution. Your employer would deduct $60 a week BEFORE taxes for your contributions.

Your employers match rules determine how and when they match your contributions. Talk to your plan sponsor or HR department about the timing of your employers contributions. Each employer has different employer match rules too.

What Is A 401 And How Does It Work

As soon as you start working, you can start preparing for retirement. In other words, it doesn’t matter what age you are as most experts agree, starting early is the best route to saving for retirement. Many employers offer 401 contributions as part of a benefits package, so it is important to understand what that means so you can assess a job offer. In this article, we’ll explain what a 401 is and how it works.

Don’t Miss: How To Grow 401k Fast

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

How Much Can You Contribute

For 2022, you can contribute up to $20,500, and an additional $6,500 if you are age 50 or older, or a total of $27,000. Note that employer matching contributions dont count toward this limit, but there is a limit for employee and employer contributions combined: Either 100% of your salary or $57,000 , whichever comes first.

When it comes to matching, specific terms of a 401k plan can vary widely. Your employer may use a very generous matching formula, or choose not to match employee contributions at all. Additionally, not all employer contributions to an employees 401k plan are the result of matching. Employers may make regular deferrals to employee plans regardless of employee contributions, though this is not particularly common.

Make sure you check your employers plan documents for the details on exactly how your 401k works.

Following are two common types of company contributions.

Recommended Reading: How Much Can I Draw Monthly From My 401k

What Is A 401 Employer Match

A 401 plan is a retirement account sponsored by employers, while a 401 employer match is a type of added employee benefit.

Employees can contribute part of their salary towards a 401 retirement account. This is typically done via a percentage amount, but can also be done by an employee choosing a dollar amount. But when employers match 401 contributions, they also contribute to their employees accounts.

So, if an employee contributes to their 401, employers will match this contribution up to a certain amount. Put simply, a 401 match program is essentially free money for employees.

The average employer 401 match is at an all-time high at 4.7%. This means that, on average, companies will match 4.7% of an employees salary toward their retirement.

Employee contributions to 401 plans vary greatly. But on average, employees contribute 8.8% yearly. This percentage, combined with a 4.7% match from an employer, means an employee could save 13.5% of their total salary in their 401 plan.

So, if you make $45,000 per year, you can expect to save an average of $6,075 per year in your 401 savings account.

Its important to note that not everyone has a savings account. About 54% of millennials dont have a retirement account.

Transfer The Money Yourself Through An Indirect Rollover

You can opt to transfer your 401 to your own IRA, which is an indirect rollover. As long as you complete the process within 60 days, it still counts as a rollover for the purposes of administering the new plan.

You can use this money for a 60-day period between withdrawing it and completing the rollover. This means that your 401 plan must withhold 20% of the total for federal taxation which will be credited on your income tax return for the year. The amount withheld will be treated as a taxable distribution unless you have the funds to make up the additional 20% when depositing the funds. There may also be a 10% premature distribution penalty and if you don’t deposit within 60 days, then the entire sum will be subject to tax.

It’s usually best to only use an indirect rollover if you plan to transfer the funds to an IRA immediately.

Read Also: Can You Use 401k To Buy Stocks

Keep The Money In Your Existing 401

You may have the option to leave the money in the same 401, usually if you have more than $5,000 in the account. If you have less, your employer may ask you to withdraw it. Assuming you have completed the vesting period, this will include the contributions made by your employer, your contributions and the income generated as a return on the investments.

Leaving your 401 with your previous employer can be helpful if you’re comfortable with the returns you’re receiving. You can usually choose to transfer the funds to another account at any time, so you could leave it there until you make alternative arrangements. The money keeps its tax-deferred status the entire time. You can select this option if you’re satisfied with the amount you’re receiving or if you still need to make different arrangements.