There Are Some Situations In Which It Can Be Advisable To Take An Early 401k Withdrawal

- It may be beneficial to cash out a portion of your 401K if you have a loan that has very high interest. For example, taking an early distribution on your 401K be wise to pay down credit card or personal loan with a very high interest rate. In this case, you may be financially better off cashing out the 401K and paying the penalty than continuing to pay that interest. However, it is important to do the math to determine whether its better to cash out a portion of the 401K or not

What About My Current 401 Can I Access That Money At Any Time

You cannot take a cash 401 withdrawal while you are currently working for the employer that sponsors the 401 unless you have a major hardship. That being said, you can cash out your 401 before age 59 ½ without paying the 10% penalty if:

Additionally, you can cash out your 401 and pay the 10% penalty if you need funds for certain financial hardships and have no other source of funds. These hardships include:

Even if you meet these requirements, cashing out your 401 should always be seen as an absolute last resort.

How Long Can A Company Hold Your 401 After You Leave

When you change jobs, it might be unclear how long a company can hold your 401 after you leave. Learn more about your 401 waiting period.

When you leave your job, your employer can choose to hold or disburse your 401 money depending on your age and the amount of retirement savings you have accumulated. How long a company can hold your 401 depends on how much asset you have in the account: the company can hold for as long as you want unless you decide to rollover to a new plan or take a cash out. However, you must have at least $5000 in your 401 if you want the company to continue managing your plan. For amounts below $5000, the employer can hold the funds for up to 60 days, after which the funds will be automatically rolled over to a new retirement account or cashed out.

If you have accumulated a large amount of savings above $5000, your employer can hold the 401 for as long as you want. However, this may be different for small amounts, which the employer can cash out and send in a lump sum, or rollover your 401 into an Individual Retirement Account .

Also Check: What Year Did 401k Start

How Can I Pull Out My Money From My 401

Cashing out a 401 can be a tempting idea, especially if you are facing financial difficulties or need to raise money for a major purchase. But even though the money in the account belongs to you, it is subject to certain rules and restrictions due to the tax advantages it provides account owners. One of the rules related to cashing out a 401 relates to the employment status of the account owner. You are allowed to cash out a 401 while you are employed, but you cannot cash it out if youre still employed at the company that sponsors the 401 that you wish to cash out.

TL DR

You can cash out a 401 while you are employed, but you cannot cash it out if youre still employed at the company that sponsors the 401 that you wish to cash out.

Should I Pull Out My 401k

Asked by: Angie Rath

Cashing out a 401 gives you immediate access to funds. If you lose your job and use the money to cover living expenses until you start a new job, an early 401 withdrawal might help you avoid going into debt. … Leaving money in the account, rather than taking it out, could help you reach those financial goals.

You May Like: How Do I Transfer My 401k To An Ira

What Type Of Situation Qualifies As A Hardship

The following limited number of situations rise to the level of hardship, as defined by Congress:

- Unreimbursed medical expenses for you, your spouse or dependents

- Payments necessary to prevent eviction from your home or foreclosure on a mortgage of principal residence.

- Funeral or burial expenses for a parent, spouse, child or other dependent

- Purchase of a principal residence or to pay for certain expenses for the repair of damage to a principal residence

- Payment of college tuition and related educational costs for the next 12 months for you, your spouse, dependents or non-dependent children

Your plan may or may not limit withdrawals to the employee contributions only. Some plans exclude income earned and or employer matching contributions from being part of a hardship withdrawal.

In addition, IRS rules state that you can only withdraw what you need to cover your hardship situation, though the total amount requested may include any amounts necessary to pay federal, state or local income taxes or penalties reasonably anticipated to result from the distribution.

A 401 plan even if it allows for hardship withdrawals can require that the employee exhaust all other financial resources, including the availability of 401 loans, before permitting a hardship withdrawal, says Paul Porretta, a compensation and benefits attorney at Troutman Pepper in New York.

To Meet Additional Essential Needs

Money for items such as medical expenses, prescriptions, food, or elder care add up fast. If you do decide pulling money from 401 or other retirement funds makes sense in a disaster scenario, consider taking out only what you need and set up a plan to pay back the amount no later than the three-year time frame.

Recommended Reading: How To Transfer 401k To Bank Account

What Are The Penalty

The IRS permits withdrawals without a penalty for certain specific uses, including to cover college tuition and to pay the down payment on a first home. It terms these “exceptions,” but they also are exemptions from the penalty it imposes on most early withdrawals.

It also allows hardship withdrawals to cover an immediate and pressing need.

There is currently one more permissible hardship withdrawal, and that is for costs directly related to the COVID-19 pandemic.

You’ll still owe regular income taxes on the money withdrawn but you won’t get slapped with the 10% early withdrawal penalty.

High Unreimbursed Medical Expenses

This particular exception is similar to the hardship distributions mentioned earlier, and these medical bills might qualify you under either category. You should know that a hardship withdrawal for medical bills will not entitle you to a waiver of the 10% penalty in all cases. To qualify for a penalty-free withdrawal, the amount of the bills must be greater than 7.5% of your adjusted gross income . You must also take the distribution in the same year in which the bills were incurred. You cannot take money for estimated future bills either. The bills must be currently due for services already provided.

Also note the requirement that the bills be unreimbursed. If your insurance covers part of the bills or will reimburse you for the payments, then you cannot use money from your 401 to pay them. Likewise, the bills must be for you, your spouse, or a qualified dependent. You cannot use the money to pay bills for a parent, sibling, or any other family member. The limit to the amount of money you can withdraw for medical bills was recently removed, so you are allowed to withdraw as much as is needed to cover all the expenses.

Don’t Miss: How To Pull Money From A 401k

Is It Smart To Pay Off Your House With Your 401k

Utilizing 401 funds to pay off a mortgage early results in less total interest paid to the lender over time. However, this advantage is strongest if you’re barely into your mortgage term. If you’re instead deep into paying the mortgage off, you’ve likely already paid the bulk of the interest you owe.

Who Is Eligible For Coronavirus

If you, your spouse or a dependent have been diagnosed with COVID-19, you qualify for the above benefits. However, eligibility for coronavirus-related distributions extends well beyond those who have been diagnosed.

According to an IRS notice issued on June 19, qualified individuals include anyone who has encountered “adverse financial consequences” as a result of the individual, the individual’s spouse or a member of the individual’s household experiencing any of the following due to COVID-19:

-

Being quarantined, furloughed or laid off.

-

Having their hours at work cut.

-

Having a job offer rescinded or delayed or their income reduced.

-

Being unable to work because of a lack of child care.

-

Slashing operating hours or shutting down a business due to the outbreak.

This means that if your spouse experiences financial hardship, you may qualify for a coronavirus-related distribution from your retirement account, even if you’re still employed.

Also Check: How Do I Find My Fidelity 401k Account Number

Can I Take All My Money Out Of My 401 When I Retire

You are free to empty your 401 as soon as you reach age 59½or 55, in some cases. Its also possible to cash out before, although doing so would normally trigger a 10% early withdrawal penalty.

If you want to cash out everything, you can opt for a lump-sum payment. Think carefully before taking this approach, though. Withdrawing your savings all at once could result in a hefty tax bill and, if not managed wisely, leave you living in severe poverty later on in retirement.

Withdrawing Funds From 401 After 55 But Before 59

If you are 55 or older and still working for the company managing your retirement savings, you cannot take a penalty-free distribution until you are 59 ½. However, you may still qualify to take a hardship withdrawal if you have a qualified expense. You will owe income taxes and a 10% penalty tax on the distribution you take. You may also qualify for a 401 loan if your retirement plan provides this benefit.

You May Like: How Much Tax On 401k After Retirement

Traditional Ira Vs Roth Ira

Like traditional 401 distributions, withdrawals from a traditional IRA are subject to your normal income tax rate in the year when you take the distribution.

Withdrawals from Roth IRAs, on the other hand, are completely tax free if they are taken after you reach age 59½ and see out a five-year holding period. However, if you decide to roll over the assets in a traditional 401 to a Roth IRA, you will owe income tax on the full amount of the rolloverwith Roth IRAs, you pay taxes up front.

Traditional IRAs are subject to the same RMD regulations as 401s and other employer-sponsored retirement plans. However, there is no RMD requirement for a Roth IRA, which can be a significant advantage during retirement.

Read Also: How To Choose 401k Investment Options

Tax On A 401k Withdrawal After 65 Varies

Whatever you take out of your 401k account is taxable income, just as a regular paycheck would be when you contributed to the 401k, your contributions were pre-tax, and so you are taxed on withdrawals. On your Form 1040, you combine your 401k withdrawal income with all your other taxable income. Your tax depends on how much you withdraw and how much other income you have. If you have a $200,000 account, you could legally withdraw it all the year you turn 70. The amount of a 401k or IRA distribution tax will depend on your marginal tax rate for the tax year, as set forth below the tax rate on a 401k at age 65 or any other age above 59 1/2 is the same as your regular income tax rate.

You May Like: Can I Start A 401k Without A Job

How To Withdraw From A 401k When Leaving The Country

When you leave the United States, its easier to move your belongings and cash accounts than it is to tap into your 401k plan if youre under age 59 1/2. Even though youre leaving the country, IRS tax rules will follow your plan wherever you go. Because penalties for early access are high, you should explore less expensive options if you dont qualify for one of the exceptions available for persons under 59 1/2.

Review your situation. If youre over age 59 1/2, youll only pay income taxes as if you earned the money this year. Those under age 59 1/2 will pay a 10 percent penalty unless the withdrawal qualifies as a hardship, is used for unreimbursed medical expenses, health insurance premiums while unemployed for at least 12 weeks, a total disability or qualifying higher education expenses.

Complete paperwork if the 401k administrator wont allow telephone redemptions. To speed up the process, ask the company to email or fax the forms. Also, ask the 401k administrator if the company accepts faxed or emailed scans of the documents. If so, you may receive your funds more quickly.

File the receipt attached to your check after verifying your withdrawal was completed correctly. Review the withholding and any penalty withholding. If anything is incorrect, dont cash the check. Call the 401k provider and ask questions until youre satisfied that your withdrawal was successfully administered.

References

How Long Does It Take To Cash Out A 401

While the amount of time it takes to receive money differs by plan, administrator and employer, you can often expect to wait several weeks minimum to receive your funds. Some plans may also be bound by rules that prohibit them from distributing these funds more than once a quarter or year, extending this time horizon to 30 90 days or more.

As 401 plans are highly regulated, and subject to strict governance, it can often take a considerable amount of time to ensure that proper guidelines are followed. Complete paperwork must also be in hand in order for requests to process. Noting that any funds withdrawn are unlikely to become immediately available, be sure to consult your summary plan description document to learn more about the rules of your plan, and how long it can take to receive disbursements.

Recommended Reading: How To Roll Your 401k From Previous Employer

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most how to save for retirement, understanding the types of accounts, how to choose investments and more so you can feel confident when planning for your future.

Employers Have Options Under Latest Law

Although the Consolidated Appropriations Act temporarily relaxes rules for eligible individuals to access their retirement funds, businesses don’t necessarily have to include these provisions in their plan provisions. Businesses that had to layoff workers due to business slowdowns also have more time to restore their workforce to at least 80 percent to avoid partial plan termination rules relating to their retirement plan. The partial retirement plan termination rule would be relaxed during a plan year that includes the period between March 13, 2020, and March 31, 2021, deferring assessments until March 2021.

Don’t Miss: How To Make More Money With My 401k

Just Because You Can Cash Out Your 401 Doesnt Mean You Should

Technically, yes: After youve left your employer, you can ask your plan administrator for a cash withdrawal from your old 401. Theyll close your account and mail you a check.

But you should rarelyif everdo this until youre at least 59 ½ years old!

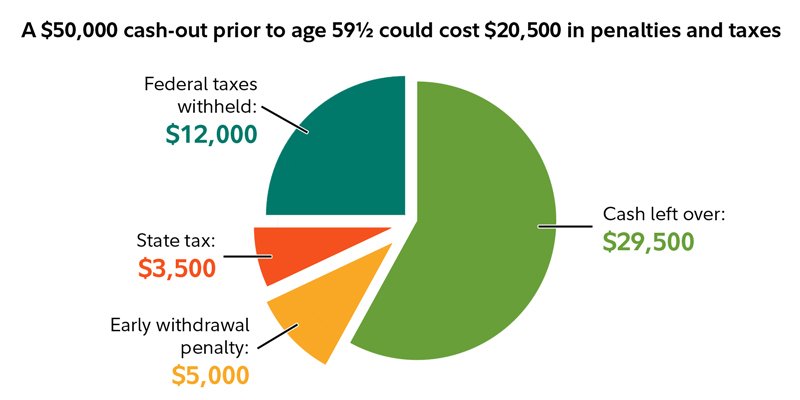

Let me say this again: As tempting as it may be to cash out an old 401, its a poor financial decision. Thats because, in the eyes of the IRS, cashing out your 401 before you are 59 ½ is considered an early withdrawal and is subject to a 10% penalty on top of regular income taxes. Oh, yes, thats another thing: Since the 401 is funded with pre-tax money, you also have to pay taxes on it when you cash out.

In most cases, your plan administrator will mail you a check for 70% of your 401 balance. Thats your balance minus 10% for the withdrawal penalty and 20% to cover federal income taxes .

Its financially prudent to save for retirement and leave that money invested. But paying the 10% early withdrawal penalty is just dumb money its equivalent to taking money youve earned and tossing it out the window.

Is It A Good Idea To Use The Rule Of 55

Just because you can take distributions from your 401 or 403 early doesn’t mean you should. Depending on your financial situation, it might be better to let your money continue to grow. Holding off withdrawals could help you better position yourself for a financially sound future. If you’re tempted to withdraw retirement funds before you’re eligible, instead consider finding another job, drawing from your savings or using other sources of income until you need to tap into your retirement savings.

If you decide to begin withdrawing funds from your 401 early, the long-term value of your portfolio will likely decrease. It’s essential that you time your withdrawals carefully and take into account how much they would cost you in taxes. To create a strategy that makes sense in your situation, consider working with a financial advisor or a retirement planner.

Recommended Reading: Can I Rollover My 401k