Why Bother With A Backdoor Roth Ira

Both Roth and traditional IRAs let your money grow within the account tax-free. However, Roth IRAs have a couple of advantages over traditional IRAs.

First, they dont have required minimum distributions . You can leave your money in your Roth for as long as you want, which means it can keep growing indefinitely. This characteristic may be valuable to you if you expect to have enough retirement income from another source, such as a 401, and you want to use your Roth as a bequest or an inheritance.

The lack of RMDs also simplifies record-keeping and makes tax preparation easier. It will save you time and headaches in retirement when youd rather be enjoying your free time.

Second, Roth distributionswhich include earnings on your contributionsare not taxable. Future tax rates may be higher than current tax rates, so some people would rather pay taxes on their retirement account contributions, as one does with a Roth, than on their distributions, as one does with a traditional IRA or 401. Other people want to hedge their bets by making both pretax and post-tax contributions, so they have a position in both options.

The Build Back Better Actpassed by the House of Representatives and currently stalled in the Senateincludes provisions that would eliminate or reduce the use of Roth conversions for wealthy taxpayers in two ways:

A Tax Loophole Lets High Earners Contribute Indirectly To A Roth Ira

InvestopediaForbes AdvisorThe Motley Fool, CredibleInsider

High-income earners cant contribute directly to a Roth IRA. But thanks to a tax loophole, they can still make contributions indirectly. If you take advantage and maximize your retirement savings, you can save tens or even hundreds of thousands of dollars on taxes over the years. Let’s delve deeper into this loophole and the benefits of setting up a backdoor Roth IRA.

Should I Roll Over My Old 401 Into A Roth Ira

It can sometimes make sense to roll your standard 401 into a Roth IRA. This is true at any time when you think your current income will be lower than your future income.

Lets say you quit your job in April and dont anticipate getting another one for at least a year. Your total taxable income for the year will likely be very low since you were only working for a few months. This extends to the income calculated by rolling your 401 into a Roth IRA.

It may also make sense to roll your plan over when you have significant losses during the tax year. With enough losses, you can lower your total taxable income and your tax burden.

In contrast, rolling over your 401 may not make sense if you anticipate having less taxable income in the future. Lets say you fall into the 35% marginal tax bracket for 2022 thanks to a generous bonus from your employer. However, youd generally fall into the 24% tax bracket and will likely owe even less tax when youre retired.

In this situation it wouldnt be a good idea to roll your account into a Roth IRA as youd pay more tax on it now than you would in the future.

Also Check: Should You Use 401k To Pay Off Debt

K To Roth Ira Rollovers

People who leave their jobs have several options when considering what to do with the assets in their 401k plans. They can:

· Leave them with their previous employer, if permitted

· Transfer them to their new employers 401k, if available

· Roll them over to a traditional IRA or to a Roth IRA

· Cash out

For those looking to take the opportunity to transform their 401k assets to a Roth IRA, this article will discuss the reasons why that may be beneficial, what the considerations are, and how to go about it.

There are a number of reasons why people consider rolling their 401k plan into a Roth IRA when they leave their employer:

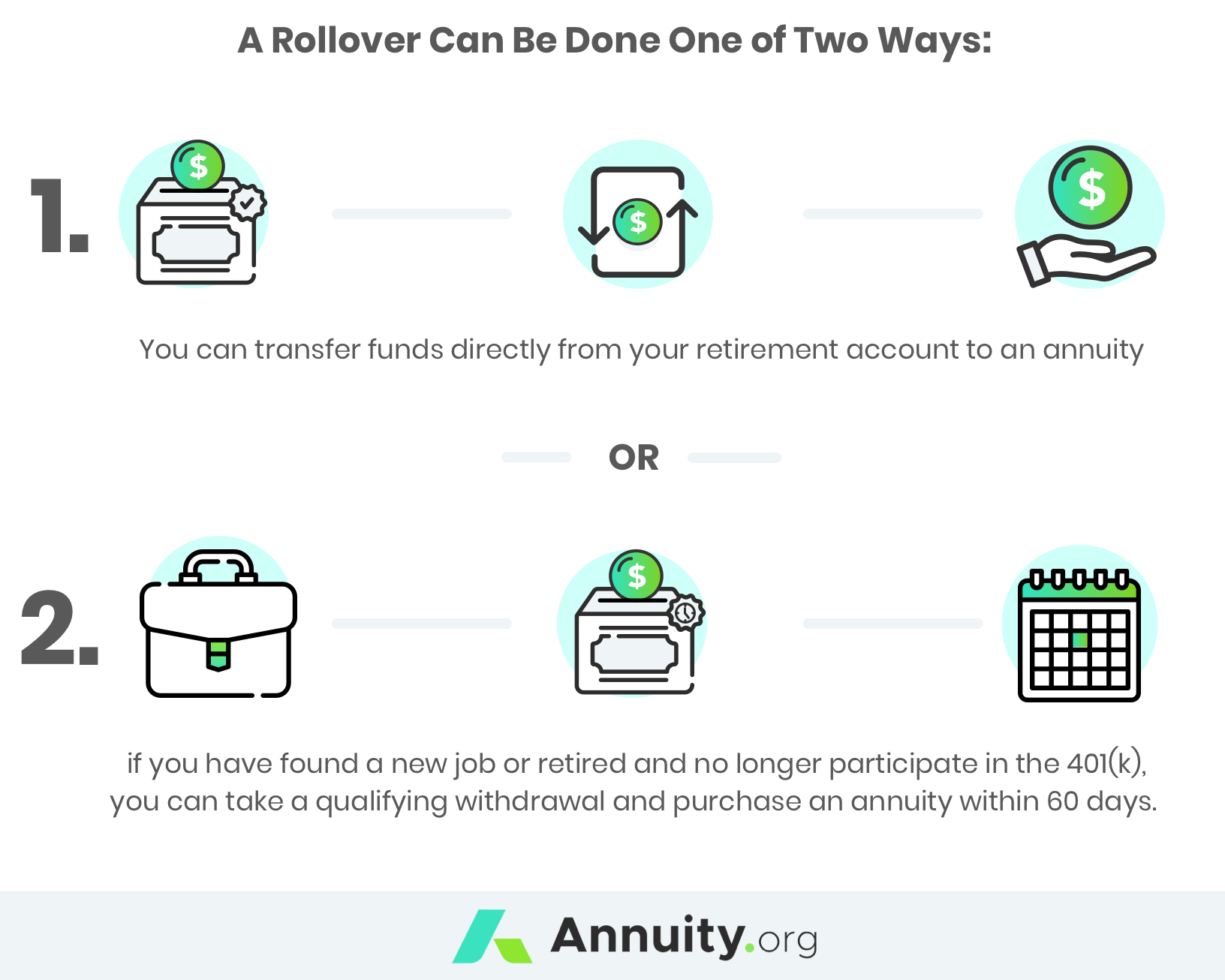

What Are My Options For The Money In My 401 Or Pension Plans

Generally, there are four broad options.

- Keep it invested in the companys plan.

- Receive a lifetime income by annuitizing.

- Withdraw the account balance, pay taxes, and then invest it.

- Rollover to an IRA or other pension fund. If you do, you wont have to pay taxes. And, youll continue to defer the income tax.

You May Like: What To Do With 401k When You Retire

What Are The Benefits Of A Roth Ira

A major benefit of a Roth individual retirement account is that, unlike traditional IRAs, withdrawals are tax free when you reach age 59½. You can also withdraw any contributions, but not earnings, at any time regardless of your age.

In addition, IRAs typically offer a much wider variety of investment options than most 401 plans. Also, with a Roth IRA, you dont have to take required minimum distributions when you reach age 72.

Rolling Into A New 401

If your new employer also offers a 401 plan, you may be able to roll your existing account into the new one. In order to do so, youll want to contact the plan administrator of your new employers to see if they accept transfers. There may be restrictions for doing so for example, you may have needed to work at your company for a full year before being permitted to do so.

Like rolling into a traditional IRA, you wont owe taxes on this money until it comes time to withdraw from your new 401 plan.

Don’t Miss: How Do I Find Previous 401k Accounts

What About 401 To Roth Ira Conversions

A 401 is an excellent way to save for retirement through tax deductions today and tax-deferred growth until you start making withdrawals in retirement. However, with tax rates at historical lows today, many people want to take advantage of the current tax rules and convert their traditional 401 into a Roth IRA to have tax-free growth and withdrawals in the future.

While tax-free income is appealing, you will have to pay taxes on the amount you convert, and converting your 401 to a Roth IRA requires extra steps.

How To Create A Backdoor Roth Ira

In 2021, single taxpayers with a modified adjusted gross income of $125,000 start to face lower and lower Roth IRA contribution amounts as their income increases. If they make $140,000 or more, they cant contribute at all.

In 2022, the limits rise slightly. For singles, the phase-out range becomes $129,000 to $144,000. For marrieds filing jointly, it becomes $204,000 to $214,000.

A traditional IRA, on the other hand, doesnt limit or prevent people with higher incomes from contributing. The backdoor Roth takes advantage of this fact.

Read Also: How To Use Your 401k In Retirement

Immediately Convert Your Traditional Ira To A Roth Ira

Why do you want to take this step immediately? Because if you leave the money in your traditional IRA, you could have earnings, and if you have earnings, you have to pay taxes on those earnings when you do your conversion. If you accumulate enough earnings and then convert your entire account balance, youll have an excess contribution you will have to correct by paying taxes. Any untaxed amounts in the traditional IRA will result in taxation after the conversion. Keep life simple: Dont procrastinate on your conversion.

Disadvantages Of A 401 Rollover Into An Ira

Rolling over a 401 into an IRA does have some disadvantages, so youll have to weigh these against the advantages.

Read Also: When Can I Withdraw From 401k

Should You Convert To A Roth Ira Now

Once youâve decided a Roth IRA is your best retirement choice, the decision to convert comes down to your current yearâs tax bill. Thatâs because when you move money from a pre-tax retirement account, such as a traditional IRA or 401, to a Roth, you have to pay taxes on that income. Another issue is that the Build Back Better bill, currently before the Senate, could limit or ban some types of conversions.

-

You pay tax on the conversionâand it could be substantial.

-

You may not benefit if your tax rate is lower in the future.

-

You must wait five years to take tax-free withdrawals from the Roth after a rollover, even if youâre already age 59½.

It makes sense: If you had put that money into a Roth originally, you would have paid taxes on it for the year when you contributed.

A Roth IRA rollover is most beneficial when:

Considering A 401 Rollover Consider Your Options First

If you decide a 401 rollover is right for you, we’re here to help. Call a Rollover Consultant at .

One great thing about a 401 retirement savings plan is that your assets are often portable when you leave a job. But what should you do with them? Rolling over your 401 to an IRA is one way to go, but you should consider your options before making a decision. There are several factors to consider based on your personal circumstances. The information provided here can help you decide.

Also Check: How Do I See How Much Is In My 401k

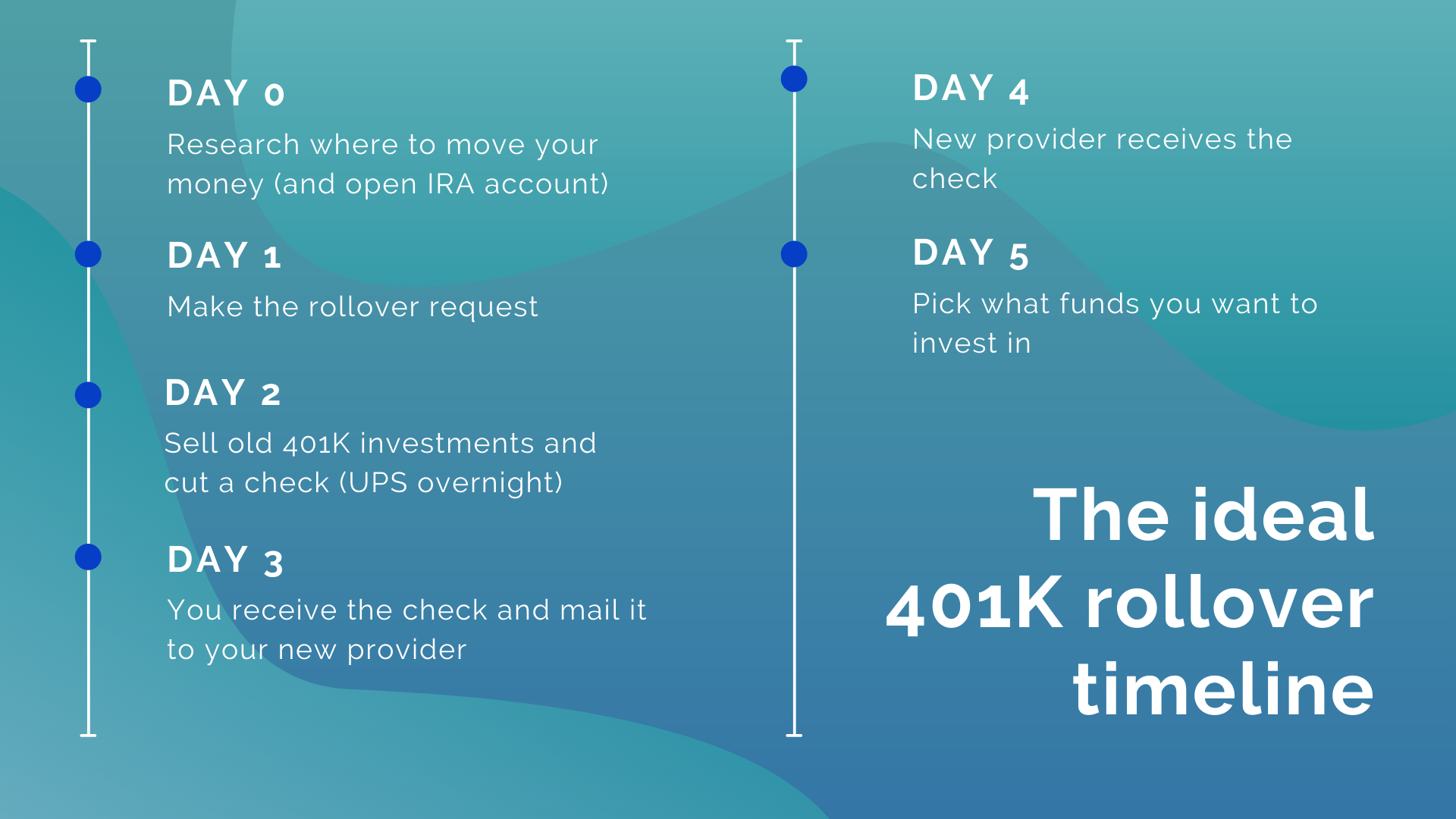

How To Roll Over Your 401 In 4 Simple Steps

If you change jobs, or even if you dont, you can keep your 401 where it is, cash it out, or roll it over. There are plenty of reasons to roll over an employer-based retirement plan to consolidate far-flung accounts, because your current plans fees are too high or its options are too few, or, of course, because you got a new job with a new 401 plan.

No matter the reason, the things you do or dont do could literally affect the rest of your life and your ability to retire comfortably. Follow this guide to rolling over your retirement plan the right way.

Are There Limits On The Amount I Can Roll Over Into My Roth Ira

No, there are no limits on the total amount you can roll from your other retirement account into a Roth IRA. However, it may be beneficial to spread out your rollovers over multiple tax years depending on your tax situation and marginal tax bracket.

To contrast, if you were to contribute directly into your Roth IRA, the annual contribution limit as of 2021 is $6,000 per year .

Also Check: How To Open A 401k Self Employed

Contact Your Former Employers 401 Plan

This is something that can be done in one of two ways. In certain cases, you can simply call your new Roth IRA provider and have them do most of the work some will be able to contact your former employers 401 plan for you, but theres also a chance youll be responsible for coordinating. If youd like assistance with this process, Capitalize is here to assist.

In the event that you do need to proactively reach out to your previous employer, read on for instructions.

You should be able to find contact information in the document packet you received when you left your job, or, alternatively, you can find the phone number to reach 401 support on your previous employers HR website.

Youll want to call them and request a direct transfer of your Roth 401 plan to the Roth IRA mentioned in the previous step.

The important part here is to ensure that the transfer of assets is a direct transfer or a trustee-to-trustee transfer. This ensures that you dont receive plan assets directly, and they are instead sent to the provider that handles your Roth IRA. In an ideal rollover process, you shouldnt receive a check, and the money should simply transfer electronically from your previous employers Roth 401 plan to your Roth IRA.

Remember to ensure that the entire amount of your Roth 401 must find its way to your new Roth IRA within 60 days if youve received a check made out to you!

How Do I Avoid Taxes On A Roth Ira Conversion

Because traditional 401 balances were contributed pre-tax, when the money is withdrawn or converted to a Roth IRA, taxes are due. While you cannot avoid these taxes, you can minimize the taxes owed in a few ways. The first is to make conversions in years where you have a low income. Another way is to convert only enough to stay within your current tax bracket. Reducing your income through tax deductions and tax credits provides more capacity to convert your retirement accounts into a Roth IRA.

You May Like: Who Offers Roth Solo 401k

Roll Over An Ira To A : The Pros And Cons

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks or securities.

In the world of retirement account rollovers, theres one type that doesnt get much love: the IRA-to-401 maneuver, which allows you to roll pretax traditional IRA assets into a 401. Its frequently overshadowed by rollovers in the other direction 401 to a rollover IRA because theyre more common. But in some cases, this less common move is also worth considering.

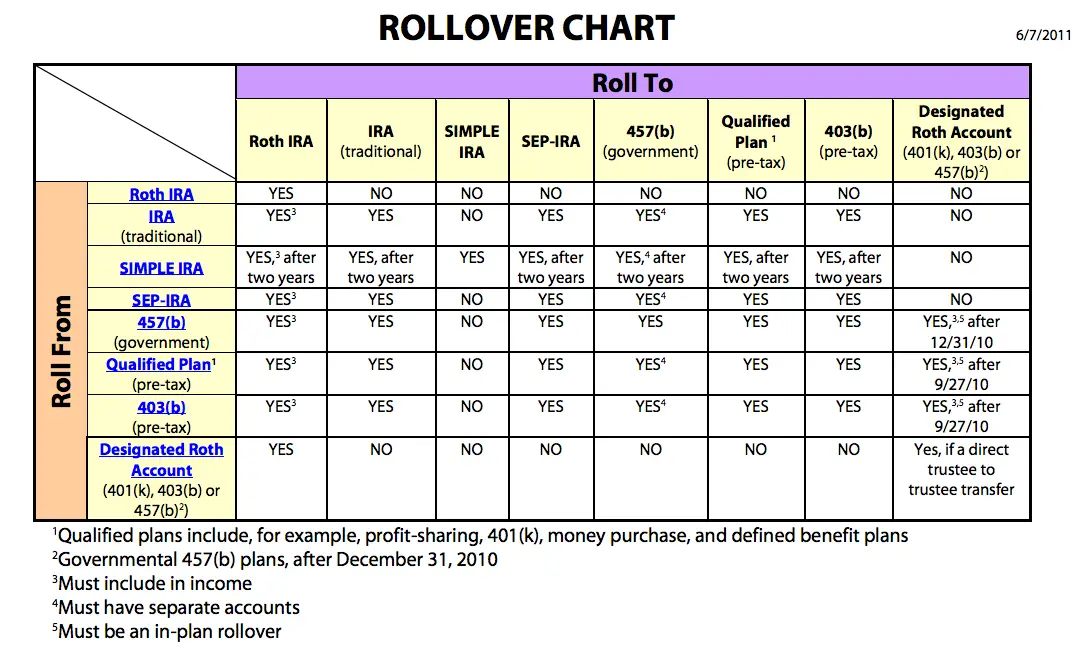

Rollovers To Multiple Destinations

Distributions sent to multiple destinations at the same time are treated as a single distribution for allocating pretax and after-tax amounts . This means you can roll over all your pretax amounts to a traditional IRA or retirement plan and all your after-tax amounts to a different destination, such as a Roth IRA.

Example: You withdraw $100,000 from your plan, $80,000 in pretax amounts and $20,000 in after-tax amounts. You may request:

A direct rollover of $80,000 in pretax amounts to a traditional IRA or a pretax account in another plan, A direct rollover of $10,000 in after-tax amounts to a Roth IRA, and A distribution of $10,000 in after-tax amounts to yourself.

You May Like: How To Move Your 401k To An Ira

Reasons You May Want To Wait To Roll Over Your 401

- Temporary ban on contributions. Some plan sponsors impose a temporary ban on further 401 contributions for employees who withdraw funds before leaving the company. You’ll want to determine if the gap in contributions will significantly impact your retirement savings.

- Early retirement. Most 401s allow penalty-free withdrawals after age 55 for early retirees. With an IRA, you must wait until 59 ½ to avoid paying a 10% penalty.

- Increased fees. IRA investors may pay more fees than they would in employer-sponsored plans. One reason: The range of more sophisticated investment options you may choose can be more expensive than 401 investments. Your advisor can help identify what extra cost a rollover may incur and if the benefits of the rollover justify those additional costs.

- Can take loans out. Your 401 may permit you to take out a loan from the account, but this is typically only for active employees. And you may have to pay in full any outstanding loan balances when you leave the company. You cannot take loans from IRAs.

What Is A 401 To Roth Ira Conversion

A Roth IRA conversion is when you roll over retirement assets from a Traditional IRA, SEP IRA, or SIMPLE IRA or a qualified former employer retirement plan, such as a 401, 403 or 457, to a Roth IRA. You are converting your retirement assets from a retirement account that is funded with pre-tax dollars to a retirement account that is funded with post-tax dollars.

This process can also be called a backdoor conversion when used to avoid income limits on Roth IRAs.

In the process of converting these assets, you will have to pay income taxes. One of the biggest advantages of making a Roth IRA conversion is that your contributions and earnings are able to grow tax-free. You are then able to withdraw money tax-free from your Roth IRA in retirement after the age of 59 ½, assuming converted funds and earnings have been in the account for at least five years.

You May Like: Can I Borrow From My 401k Without Penalty