What Is The Best Possible 401 Employer Match

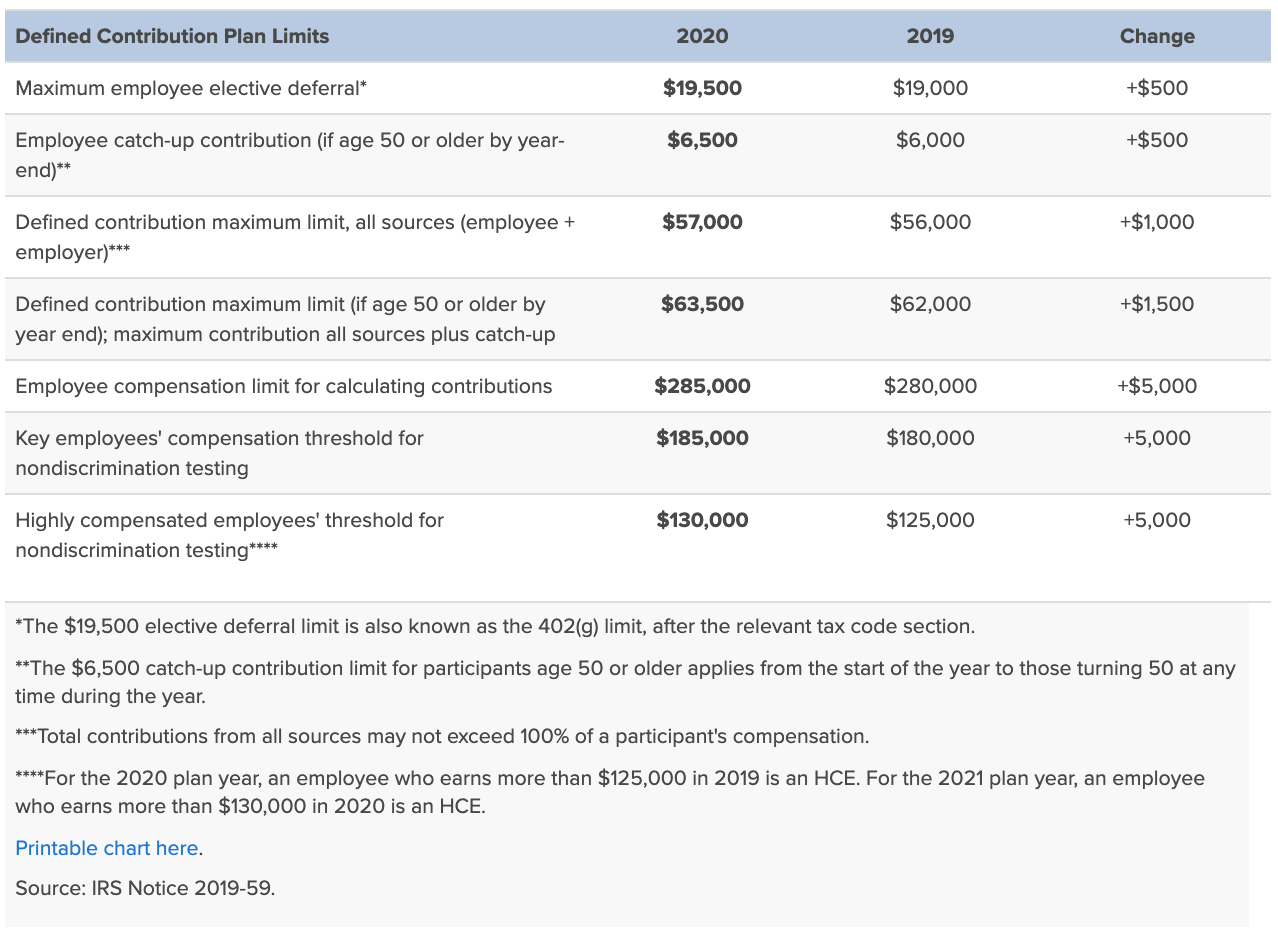

Employers rarely match 100% of employee contributions. Even if they do, there is a limit mandated by the IRS. For 2020, employees can contribute up to $19,500 to their 401 accounts. Employers can contribute up to $37,500 to reach a combined employee/employer total of $57,000. Employees over 50 can add $6,500 in catch-up contributions as well. So that would represent the best possible match an extra $37,500 put toward your retirement.

Engage Employees And Encourage Them To Save With A 401 Match This Year

The employer match is an excellent incentive tool to encourage employees to participate in your small business 401 plan. Matching not only helps employees create better financial security, but allows you and higher-paid executives the opportunity to max out your retirement savings as well.

Ubiquity is a leading provider of 401 plans geared specifically to small businesses. We are happy to help you set up an easy and affordable small business retirement plan with matching and educate your workforce so they understand what a great and valuable benefit youre offering. Contact us to learn more.

Allocating Employee Contributions Question:

In short yes. It is important to first understand the total contribution limit to a solo 401k cannot exceed $58,000 for 2021, not counting the catch-up contributions for those age 50 and over. The contributions made to the Roth solo 401k designated account will reduce the amount of contributions that you can make to the pretax solo 401k designated account. Only employee contribution may be made to the Roth solo 401k therefore, if you make the full $19,500 employee contribution to the Roth solo 401k for 2021, then you wont be able to make any employee contribution to the pretax solo 401k because you will have exhausted the full $19,500 employee contribution on the Roth solo 401k. Note that you can also split up the $19,500 employee contribution between both the pretax solo 401k and Roth solo 401k designated accounts. Lastly, you also have an additional $6,500 of catch-up contributions to work with if you are age 50 or older in 2021 since the catch-up contribution falls under the employee contribution umbrella and can thus be allocate between the Roth solo 401k and the pretax solo 401k designated account.

Read Also: What Is My Fidelity 401k Account Number

Read Also: Can I Transfer 401k To Roth Ira

How Much Do Companies Typically Match On 401 In 2022

Dylan Telerski / 9 Mar 2022 / Business

Employer matching contributions are a common feature of many company 401 plans, with 98% of employers adding partial or full matching bonuses. The typical American company is matching 6% of employee contributions in 2022.

Employers are also increasingly recognizing the 401 employer match as a powerful incentive to encourage loyalty to the company in 2022, 59% have vesting schedules ranging from one to six years before employees are entitled to walk away with the full amount of employer-matched funds.

If you own a small business or work for one, keeping tabs on what other companies are matching on their 401s can help you gauge how competitive your own plan is and better adjust your contributions for the year.

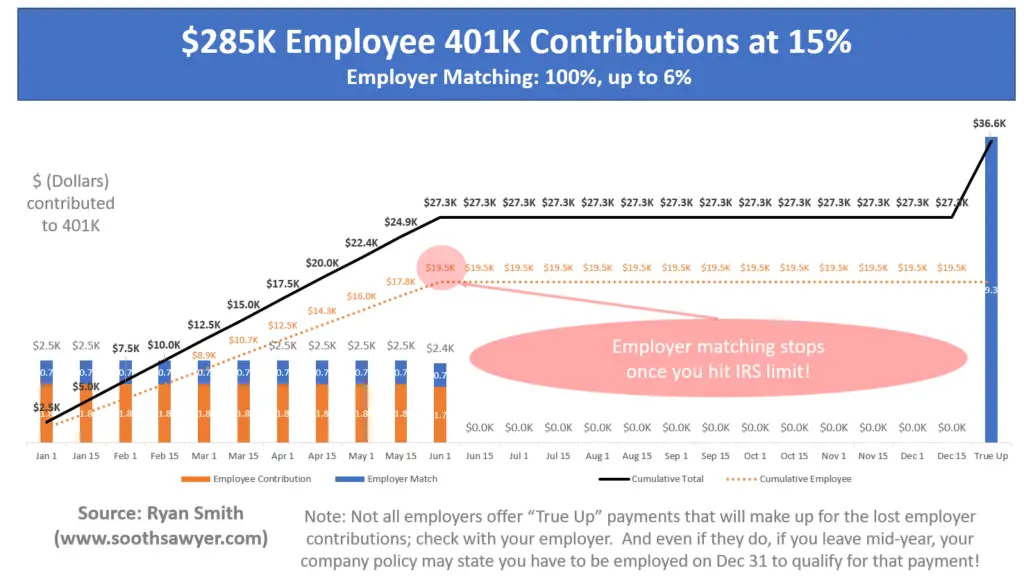

How You Could Be Missing Out On Your Match If Youre Maxing Out Your 401

There are really two issues at hand here:

1. How your employer contributes the match lump sum or every paycheck.

2. When you max out your 401 during the year.

So, lets start with number one. If your employer is simply putting in one lump-sum of matching contributions for you typically at the beginning of the following year then you are all good, and theres nothing to worry about. You are very likely getting your full match and can stop reading but youve made it so far, so you might as well expand your knowledge just in case you change jobs.

The issue is if your employer is making their matching contributions on a paycheck-to-paycheck basis, which I would say is much more common than the lump-sum matching. So, if your employer matches every paycheck, then you definitely need to keep reading.

Now, lets look at issue number two. If your employer makes their matching contributions every paycheck, but you dont max out your 401 at some point during the year, then youre in the clear.

But, if your employer makes their matching contributions every paycheck and you max out your 401 at some point during the year, this is where there could be an issue.

Just think about it for a second.

Okay, if you didnt have that aha moment yet, then let me help. If youre no longer contributing to your 401 because youve maxed it out for the year, then youre no longer going to be receiving your match because youre not making any more contributions!

You May Like: Should I Rollover My Old 401k To An Ira

Full 401 Matches In 2022

Full 401 matching means employers put in dollar-for-dollar what employees contribute, up to a set default rate or the IRS maximum. While 3% was the norm at one time, 65% of plans are now using a default rate higher than 3% in order to significantly boost savings for participants over time. In 2022, the most common default rate is now 6% of pay, according to the Plan Council Sponsor of America.

Treatment Of Excess Deferrals

You have an excess deferral if the total of your elective deferrals to all plans is more than the deferral limit for the year. Notify your plan administrator before April 15 of the following year that you would like the excess deferral amount, adjusted for earnings, to be distributed to you from the plan. The April 15 date is not tied to the due date for your return.

Excess withdrawn by April 15. If you exceed the deferral limit for 2020, you must distribute the excess deferrals by April 15, 2021.

- Excess deferrals for 2020 that are withdrawn by April 15, 2021, are includable in your gross income for 2020.

- Earnings on the excess deferrals are taxed in the year distributed.

The distribution is not subject to the additional 10% tax on early distributions.

Excess not withdrawn by April 15. If you don’t take out the excess deferral by April 15, 2021, the excess, though taxable in 2020, is not included in your cost basis in figuring the taxable amount of any eventual distributions from the plan. In effect, an excess deferral left in the plan is taxed twice, once when contributed and again when distributed. Also, if the entire deferral is allowed to stay in the plan, the plan may not be a qualified plan.

Reporting corrective distributions on Form 1099-R. Corrective distributions of excess deferrals are reported to you by the plan on Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc.

Don’t Miss: How To Find Fidelity 401k Fees

Does Employer Contribution Count Towards Limit

The short and simple answer is no. Matching contributions made by employers do not count toward your maximum contribution limit. But the IRS does place a limit on the total contribution to a 401 from both the employer and the employee.

What is the minimum wage in NZ 2020? Minimum wage rates from May 2013 to April 2020

| In force from: |

|---|

| $12.60 |

What is the minimum wage NZ 2021?

A minimum wage increase of $1.20, 6 percent, bringing it to $21.20 per hour has been confirmed for 1 April by the government. The starting-out and training minimum wage will also increase from $16 to $16.96 per hour.

Whats the minimum wage in NZ 2020? The adult minimum wage will increase $1.20 from $17.70 to $18.90 per hour on 1 April 2020. The new rate equates to an extra $48 per week before tax for employees on a 40-hour working week.

Maximum 401 Company Match Limits

The employee and employer match limits for 401s fluctuate each year to account for inflation. Since inflation is projected to rise, the 401 max contribution is increasing as well.

According to the IRS, the employee contribution amount 401 limits per year include:

- 2020: $57,000

- 2021: $58,000

Therefore, in 2021, an employee can contribute up to $19,500 toward their 401. The employer can match the employee contribution, as long as it doesnt exceed the separate $58,000 employer-employee matching limit.

Since matching $19,500 in full would only total $39,000, most employees dont have to worry about this dilemma. This problem typically arises for individuals who are contributing to more than one employer-matched 401 plan or have switched or are switching to a new employer within the year. Employers should continue to communicate limits with employees each year to avoid misunderstandings.

If you have employees who are aged 50 or older, they may be eligible for additional contributions to their 401 accounts, also known as catch-up contributions. Catch-up contributions remained the same in both 2020 and 2021.

- 2020: $285,000

- 2021: $290,000

The key employees compensation threshold didnt change from 2020 to 2021, remaining steady at $185,000. Known as the nondiscrimination testingthreshold, these limits apply to specific individuals within a company to ensure they remain within specific 401 contribution limits.

Key employees are defined as any employee who:

Recommended Reading: How Do You Access Your 401k

Transparency Is Our Policy Learn How It Impacts Everything We Do

Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams. And we have unwavering standards for how we keep that integrity intact, from our research and data to our policies on content and your personal data.

Wed like to share more about how we work and what drives our day-to-day business.

Why Always Investing To Get The Full Match Is So Smart

Okay, you probably have a lot of different money goals , and retirement might feel a long way off. But consider this: The stock market has historically earned an average return of 9.8% a year. The key word here is average. In any given year, it might be more, it might be less. Theres risk involved. At Ellevest, we assess your risk and recommend an investment portfolio aimed to get you to your goal in 70% of market scenarios or better but still. Risk.

On the other hand, with an employer match of 50%, youre earning a 50% return on everything you put in . Fifty percent. Thats kind of amazing. And then, because that itself gets invested in the market, your 50% gets the chance to earn even more returns compounded. In case youre counting, thats returns on returns on returns.

And heres the situation: Grabbing that match is even more important for women, because the data shows that were behind as it is women retire with two-thirds as much money as men . So this is one opportunity you usually want to jump on.

Ready to jump in? Heres our lead CFP® Professionals advice on how to get started planning for retirement.

Read Also: How Does A 401k Loan Work

How Are 401 Employer Contribution Limits Different In 2022

Employer 401 plan contributions face the following rules in 2022:

- The maximum employee elective deferral increased by $1,000 to $20,500

- For those age 50 and older, catch up contributions remain the same at $6,500

- The employee/employer maximum limit increased $3,000 from $58,000 to $61,000 for those under age 50

- The employee/employer maximum limit increased $3,000 from $64,500 to $67,500 for those age 50 and older

- The employee compensation limit for calculating contributions increased $15K from $290K to $305K

- The Key Employee compensation limit for nondiscrimination increased $15K from $185K to $200K

- The Highly Compensated Employee limit for testing increased $5K from $130K to $135K

- The maximum SIMPLE 401 contribution limit increased $1,000 from $13,500 to $14,500

Contribution Limit For Highly Compensated Employees

Some 401 plans may provide additional contribution limits for highly compensated employees . For a 401 plan to remain ERISA-compliant, HCEs in the plan cannot contribute 2% more than the non-highly compensated employees. For example, if regular employees contribute 5% of their salary to 401, an HCE cannot contribute more than 7% of their cumulative salary.

For an employee to qualify as a highly compensated employee, they must meet certain conditions. They must own 5% or more of the business sponsoring the 401 plan during the past year and must exceed the annual compensation limit provided by the IRS. For 2021, they must have earned $130,000 or more from the company sponsoring the 401 plan.

Read Also: Should I Roll My 401k Into A Roth Ira

Can You Contribute More Than The Match

Its smart to contribute at least the amount your employer will match. But you can usually contribute more. In 2019, you can contribute up to $19,000. If youre turning 50 by years end, you can also make a catch-up contribution of $6,000, for a total of $25,000.1

Check with your employer about the best way to size and schedule your contributions. In some cases, contributing the max before years end can cause you to miss out on matching for the rest of the year.

How Does An Employer Match Work

Some employers will match a portion of your retirement contributions, up to a certain limit. For example, they might put 50 cents into your account for every dollar you put in, up to 6% of your salary. If you contribute at least 6% of each paycheck, youll get the full match.

Some employers also set up a default contribution to help employees get the full match automatically.

Heres an example of how this could look over a year:

Read Also: Can You Withdraw Your 401k When You Leave A Company

How Employer Matching Works

With employer matching, your employer will match your 401 contribution up to a certain match limit. Employers rarely match all of your contributions, and even if they do, theres a limit on how much you, as an individual, can contribute. The most common employer matching scheme is for the employer to match the first 6% of your contributions every year.

Because plans vary dramatically from company to company, its a good idea to talk to your HR department or your employer to learn precisely how much theyll match. Depending on your earnings, this amount can change from year to year as well. But even if your employer only matches part of your 401 contribution, its still a smart idea to contribute as much as you can, since all of those savings are tax-deferred in the meantime.

Can I Contribute 100 Percent Of My Salary To A 401

If your earnings are below $20,500, then the most you can contribute is the amount you earn. It should also be noted that a 401 plan document governs each particular plan and may limit the amount that you can contribute. This applies especially to highly compensated employees, which in 2022 is defined as those earning $135,000 or more or who own more than 5 percent of the business.

Sponsors of large company plans must abide by certain discrimination testing rules to make sure highly compensated employees dont get a lopsided benefit compared to the rank and file. Generally, highly compensated employees cannot contribute higher than 2 percentage points of their pay more than employees who earn less, on average, even though they likely can afford to stash away more. The goal is to encourage everyone to participate in the plan rather than favor one group over another.

There is a way around this for companies that want to avoid discrimination testing rules. They can give everyone 3 percent of pay regardless of how much their employees contribute, or they can give everyone a 4 percent matching contribution.

Recommended Reading: How To Get My 401k Early

What Are 401 Matching Contributions

If your employer offers 401 matching contributions, that means they deposit money in your 401 account to match the contributions you make, up to a certain threshold. Depending on the terms of the 401 plan, an employer may choose to match your contributions dollar-for-dollar or offer a partial match. Some employers may also make non-matching 401 contributions.

Matching contributions arent required by law, and not all employers offer them as part of their 401 plans. But according to Katie Taylor, vice president of thought leadership at Fidelity Investments, a 401 match can be a core employee benefit that helps an organization retain talent and build strong teams.

About 85% of the employers we work with offer some sort of matching contribution, said Taylor. The average employer contribution dollar amount into 401s in 2019 was $4,100, which equates to a little bit more than $1,000 per quarter.

Some 401 plans vest employer contributions over the course of several years. This means you must remain at the company for a set period of time before you fully take ownership of your employers matching contributions. Employers use vesting to incentivize employees to remain at the company. When you complete the schedule, you are said to be fully vested.

What Matching Amount Will The Employer Need To Contribute

The most common partial match provided by employers is 50% of what you put in, up to 6% of your salary. In other words, your employer matches half of whatever you contribute but no more than 3% of your salary total. To get the maximum amount of match, you have to put in 6%.

How is employer match calculated? An employer 401 match is typically a dollar-for-dollar contribution match up to 6 percent of the employees salary or 50 cents on the dollar. For example, if your staffs total salaries are $500,000, a dollar-for-dollar match would be $30,000 if every employee maxed out their contribution.

What is 6 employer match? One common amount that employees decide to put into a 401 matching program is 6%. When you commit 6% of your pre-tax annual income to your plan, your employer will put money into your account. Thats because 6% of $50,000 is $3,000, and your employer will put in half that amount, which is $1,500.

How are employer contributions calculated? Employers can add to their employees savings by matching a percentage of their contribution. With a partial-match arrangement, the usual approach is that you contribute half what the employee does: If an employee makes $80,000 a year and contributes 4 percent of their salary, youd contribute 2 percent or $1,600.

You May Like: Does Mcdonald’s Offer 401k