Merrill Lynch Walmart 401k Terms Of Withdrawal

The merging of the former employers 401k is very simple. The IRA for the renewal of Wrath is the choice you want to get an IRA, and then just contact them to combine with an IRA rollover. The main reason why the IRA rollover is very simple to set up is because financial organizations really need your organization. The IRS knows this, and in the end, the end of age will be exactly the same, so what is the purpose of wasting time and money on this problem.The plan will create another account for alternative beneficiaries and will provide alternative beneficiaries with the right investment opportunities available to the various participants. Or search for your online business plan in BrightScope. The plan may be that it meets your definition of difficulty, such as funds to prevent expulsion or confiscation in your principal residence.

How 401 Hardship Withdrawals Work

A hardship withdrawal is an emergency removal of funds from a retirement plan, sought in response to what the IRS terms an immediate and heavy financial need. Its actually up to the individual plan administrator whether to allow such withdrawals or not. Manythough not allmajor employers do this, provided that employees meet specific guidelines and present evidence of the hardship to them.

According to IRS rules, a hardship withdrawal lets you pull money out of the account without paying the usual 10% early withdrawal penalty charged to individuals under age 59½. The table below summarizes when you owe a penalty and when you do not:

A 401 hardship withdrawal isnt the same as a 401 loan, mind you. There are a number of differences, the most notable one being that hardship withdrawals usually do not allow money to be paid back into the account. You will be able to keep contributing new funds to the account, however.

Also Check: Can I Borrow From My 401k Without Penalty

Roll Money Into An Ira

If you are not satisfied with the 401 investment options, you can rollover the money into an IRA since the latter has more investment options and offers greater control. You can reallocate your portfolio of investments to help you grow your investments further in years to come.

If you have a string of old 401s when you retire, you should consolidate them into an IRA for better management of your retirement savings. Also, you can reduce the administration fees of your retirement money, and even qualify for discounts on sales charges.

Also Check: How To Access An Old 401k Account

Withdraw At The Right Time

If you wait until age 59 1/2 to withdraw money from your 401, you could avoid the 10% early withdrawal penalty. However, youd still be required to pay income tax on your withdrawals.

You may be in a lower tax bracket as a retiree than you were when you made your 401 contribution. As a result, the taxes you end up paying on withdrawals may be lower than the amount you saved by making the contributions when your tax rate was higher.

For example, you could be in the 22% tax bracket when you contributed to your account, so youd pay 22% on your $5,000 account contributions. If youre in the 12% tax bracket and you make a $5,000 withdrawal as a senior, you would pay less income tax.

Youll also want to make sure you follow the rules for taking required minimum distributions. These are mandated withdrawals you must begin taking from your 401 after reaching age 72. If you do not take out the required minimum amount, you could face a tax penalty of 50% of the amount you should have withdrawn.

Recommended Reading: Should I Move 401k To Ira

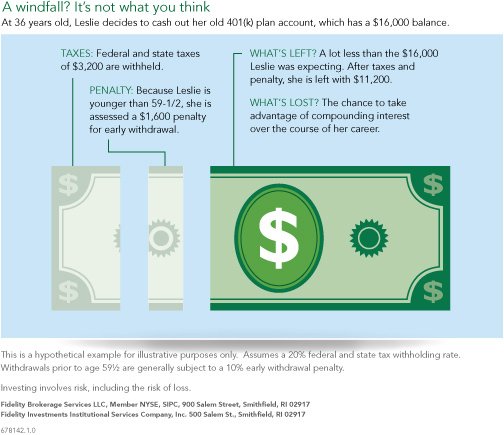

Disadvantages Of Closing Your 401k

Whether you should cash out your 401k before turning 59 ½ is another story. The biggest disadvantage is the penalty the IRS applies on early withdrawals.

First, you must pay an immediate 10% penalty on the amount withdrawn. Later, you must include the amount withdrawn as income when you file taxes. Even further down the road, there is severe damage on the long-term earning potential of your 401k account.

So, lets say at age 40, you have $50,000 in your 401k and decide you want to cash out $25,000 of it. For starters, the 10% early withdrawal penalty of $2,500 means you only get $22,500.

Later, the $25,000 is added to your taxable income for that year. If you were single and making $75,000, you would be in the 22% tax bracket. Add $25,000 to that and now youre being taxed on $100,000 income, which means youre in the 24% tax bracket. That means youre paying an extra $6,000 in taxes.

So, youre net for early withdrawal is just $16,500. In other words, it cost you $8,500 to withdraw $25,000.

Beyond that, you reduced the earning potential of your 401k account by $25,000. Measured over 25 years, the cost to your bottom line would be around $100,000. That is an even bigger disadvantage.

Read Also: How To Change My 401k Contribution

Review Your 401s Payout Policy

One key question in retirement is how youll create an income stream that is, a retirement paycheck from your savings. If your 401 lets you set up regular withdrawals or an installment payment plan, then it might make sense to keep your money in the plan.

If your 401 doesnt allow for periodic payouts, consider rolling your savings over to an IRA.

A growing number of employers allow retiring workers to say, Pay out X dollars per month, says Steve Vernon, author of Retirement Game-Changers and a research scholar at the Stanford Center on Longevity.

But 401 plans vary widely. Some allow lump-sum disbursements only. Others might offer partial withdrawals, but the number is limited. If and when you need periodic payments, youll need an account that allows that. If your 401 doesnt, consider rolling your savings over to an individual retirement account. See this quick-start guide on 401 rollovers for more on this process.

Read Also: How To Roll Your 401k Into A Self Directed Ira

The Costs Of Early 401k Withdrawals

Early withdrawals from an IRA or 401k account can be expensive.

Generally, if you take a distribution from an IRA or 401k before age 59 ½, you will likely owe:

- federal income tax

- 10% penalty on the amount that you withdraw

- relevant state income tax

Calculate It:401k Withdrawals Before Retirement

The 401k can be a boon to your retirement plan. It gives you flexibility to change jobs without losing your savings. But that all starts to fall apart if you use it like a bank account in the years preceding retirement. Your best bet is usually to consciously avoid tapping any retirement money until youve at least reached the age of 59 ½.

If youre not sure you should take a withdrawal, use this calculator to determine how much other people your age have saved.

You May Like: How Can I Get A Loan From My 401k

How To Withdraw Money From A 401k After Retirement

Finance Writer

During your working years, you’ve probably set aside funds in retirement accounts such as IRAs, 401s, or other workplace savings plans. Your challenge during retirement is to convert those accounts into an income stream that can continue to provide adequately throughout your retirement years.

If youâre approaching the age that you want to hang your hat from working, you may be wondering how to withdraw money from your 401 after retirement. It isnât always exactly straightforward, which is why weâve broken down some of the basics of using your 401. Hereâs what you need to know.

How Do I Close My Merrill Lynch 401k Account

4.6/5closeMerrill Lynch accountcloseaccount

Also know, how do I close my Merrill Lynch account?

You should send a closure request to the broker by logging into the Merrill Edge site and using the internal messaging system. You could also call the broker at 1-877-653-4732 and speak with a live agent. If youre outside the United States, you should call 1-609-818-8900 instead.

Furthermore, how do I contact Merrill Lynch 401k? If you do not receive your User ID, or have any questions, please the Merrill Lynch Retirement and Benefits Contact Center at 1-866-820-1492 or 609-818-8894 .

Also know, how do I withdraw my 401k early from Merrill Lynch?

To start your withdrawal youll need a One Time Distribution form from Merrill Lynch. You must fill it out with your personal information, including your name, date of birth, phone number and Merrill Lynch retirement account number. This information must be accurate to avoid delays in getting your funds.

How long can an employer hold your 401k after termination?

If you get terminated from your job, you have the ability to cash out the money in your 401 even if you havent reached 59 1/2 years of age. This includes any money youve contributed and any vested contributions from your employer plus any investment profits your account has generated.

Don’t Miss: How Do I Set Up A 401k For My Employees

Tips On 401 Withdrawals

- Talk with a financial advisor about your needs and how you can best meet them. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- If youre considering withdrawing money from your 401 early, think about a personal loan instead. SmartAsset has a personal loan calculator to help you figure out payment methods.

Have Diverse Retirement Income Sources

To be truly efficient with your taxes in retirement, itâs best to have a diverse mix of assets to work with â which means saving for retirement using more than just a 401. This allows you to make strategic withdrawals in retirement that can help you lower your tax burden overall because different assets like Roth accounts, whole life insurance and even annuities have different attributes, including their tax treatment.

Also Check: When Can I Withdraw From 401k

How To Borrow From Your 401k

If you’ve decided that borrowing from your retirement plan is right for you, here’s how to get money from a 401 loan.

What Else Do I Need To Know

- If your employer makes contributions to your 401 plan you may be able to withdraw those dollars once you become vested . Check with your plan administrator for your plans withdrawal rules.

- If you are a reservist called to active duty after September 11, 2001, special rules may apply to you.

Important Note: Equitable believes that education is a key step toward addressing your financial goals, and this discussion serves simply as an informational and educational resource. It does not constitute investment advice, nor does it make a direct or indirect recommendation of any particular product or of the appropriateness of any particular investment-related option. Your unique needs, goals and circumstances require the individualized attention of your financial professional.

Equitable Financial Life Insurance Company issues life insurance and annuity products. Securities offered through Equitable Advisors, LLC, member FINRA, SIPC. Equitable Financial Life Insurance Company and Equitable Advisors are affiliated and do not provide tax or legal advice, and are not affiliated with Broadridge Investor Communication Solutions, Inc.

Take the next step

You May Like: How To Divide 401k In Divorce

You May Like: Can A Sole Proprietor Have A 401k

What Is The Penalty For Taking Out 401k Early

If you withdraw money from your 401 before you’re 59½, the IRS usually assesses a 10% penalty when you file your tax return. That could mean giving the government $1,000 of that $10,000 withdrawal. Between the taxes and penalty, your immediate take-home total could be as low as $7,000 from your original $10,000.

How Much Tax Will I Pay On A 401 Withdrawal

Because you donât pay taxes on your contributions, your withdrawals will be taxed at your ordinary income rate in retirement. But if you withdraw money from your 401 prior to age 59½, not only will you have to pay taxes, youâll also be hit with a 10 percent penalty. , you wonât pay taxes on your withdrawals in retirement because the money you put in was already taxed â however, you can still be assessed taxes and penalties for taking out your money prior to 59½.)

You May Like: When Can I Transfer My 401k To An Ira

What Is A 401 Plan

Traditional 401 plans are employer-sponsored retirement accounts. They allow you to contribute pre-tax earnings through automatic payroll deductions. Employers can also contribute to your account by matching your contributions or making non-matching donations.

Your 401 account balance grows over time, not only from contributions but thanks to interest yields. However, the Internal Revenue Service restricts how much you can contribute each year and when you can take penalty-free distributions.

The Risks Of A Rollover

Before people roll over their 401 funds to an IRA, however, they should consider the potential consequences. Consider the costs inside the 401 funds versus the total cost of an IRA, including advisor fees and commissions, urges Terry Prather, a financial planner in Evansville, Ind.

Prather raises another, noteworthy scenario. A 401 typically requires a spouse to be named as the primary beneficiary of a particular account unless the spouse signs a waiver provided by the plan administrator. An IRA doesnt require spousal consent to name someone other than the spouse as the primary beneficiary.

If a participant is planning to remarry soon and wants to name someone other than the new spouse as the beneficiarychildren form a prior marriage, perhapsa direct rollover to an IRA may be desirable, Prather says.

You May Like: How To Self Manage Your 401k

How Your 401 Contribution Can Reduce Your Tax Bill

As an employee, you might be paying between 10% to 37% of your income in taxes every year. These taxes put your take-home pay at a lower level than your gross income. However, using a 401 plan might allow you to reduce the taxes you pay and enable you to keep more money for your retirement.

Employees who make contributions to 401 plans benefit from the tax savings these accounts offer. Thats why its important to understand how much 401 contributions could reduce your taxes.

Read Also: Where Can You Rollover A 401k

How Does A 401k Loan Work

When you take out a 401 loan, that portion of your balance is liquidated from your investments. Typically this is done proportionately from each of your different investments. Some plans allow you to designate which investments to use for the loan.

The loan proceeds are either deposited into your bank account or a check is mailed to your home address. Once the funds are in your bank account, there are no restrictions on how that money can be spent.

The typical 401 loan term is five years, which is the maximum repayment term that the government allows. However, you can request a shorter term, you may be able to request one. If you are using the money to buy a home, some plans allow your loan to be up to 25 years.

Your loan payments are generally taken automatically from your 401 contributions each pay period. By law, you must make at least one substantially equal payment every quarter.

401 loans charge interest on the outstanding balance. Generally, the rates are 1% to 2% higher than the Prime Rate. The interest that you pay is credited to your 401 account, so you are actually paying yourself the interest on the loan. These interest payments help to offset the loss of market returns on the amount liquidated to fund your loan.

Also Check: How To Cash Out 401k After Leaving Job

Taking 401 Distributions In Retirement

The 401 withdrawal rules require you to begin depleting your 401 savings when you reach age 72.

At this point, you must take a required minimum distribution each year until your account is depleted. If you are still working for the employer beyond age 72, you may be able to delay required minimum distribution until you stop working if your plan allows this delay. The delay option is not available to you if you own 5% or more of the business.

You have until April 1 of the year after you turn 72 to take your first required minimum distribution. After that, you must take a minimum amount by December 31 each year. Your 401 plan administrator will tell you how much you are required to take each year.

The amount is based on your life expectancy and your account balance. If you dont take your required minimum distribution each year, you will have to pay a tax of 50% of the amount that should have been taken but was not. If you participate in more than one employer plan, you must take a required minimum distribution from each plan.