How Much Should You Have In Your 401k By Age

Now that we have established that you need a 401k in your life and explained how much you can contribute, lets talk cash. Aside from investing enough to meet your employer match, how much should you have in your 401k, really?

One way to answer that question is to look at your age.

While there is no one-size-fits-all answer to the question, How much should I have in my 401k? there are some best practices you can keep in mind to guide your efforts. Yes, while you should start investing in a 401k as soon as possible, some people might not get that opportunity right away and thats okay. The point is to do it when you can.

When you do finally start investing, there are a few good rules of thumb to help you make a sound decision on how much you should have in your 401k.

What Is A Good Monthly Retirement Income

The median retirement income for seniors is about $ 24,000 however, the average income can be much higher. On average, seniors earn between $ 2,000 and $ 6,000 per month. Older retirees tend to earn less than younger retirees. It is recommended that you save enough to replace 70% of your monthly income before retirement.

Can I retire with $ 5,000 per month? Typically, you can generate at least $ 5,000 per month in retirement income, guaranteed for the rest of your life. This does not include social security benefits.

Solo 401k Retirement Calculator

A Solo 401k can be one of the best tools for the self-employed to create a secure retirement. First, all contributions and earnings to your Solo 401k are tax-deferred. You only pay taxes on contributions and earnings when the money is withdrawn. Second, it has very high contribution limits allowing you to contribute more to your Solo 401k each year. The combined result is a retirement savings plan you cant afford to pass up.

Disclaimer: Information and interactive calculators are made available to you as self-help tools for your independent use and are not intended to provide investment advice. We cannot and do not guarantee their applicability or accuracy in regards to your individual circumstances. All examples are hypothetical and are for illustrative purposes. We encourage you to seek personalized advice from qualified professionals regarding all personal finance issues.

Ready to take control of your financial future?

Start where you are. Use what you have. Invest in what you want.

Also Check: Where Can You Rollover A 401k

How Much Could Your 401 Grow If You Stop Contributing

Now lets examine what happens to your 401 when you stop contributing and your employer does not make any matching contributions either. Using most of the same parameters as before, lets use our 401 Growth Calculator to see how much your 401 will be worth if you stop contributing at age 30, after you have already accumulated $10,000 in your account:

- You are 30 years old right now.

- You have 37 years until you retire.

- You make $50,000/year and expect a 3% annual salary increase.

- Your current 401 balance is $10,000.

- You get paid biweekly.

- You expect your annual before-tax rate of return on your 401 to be 5%.

- Your employer match is 100% up to a maximum of 4%.

- Your current before-tax 401 plan contribution is now 0% per year.

What happens to your previous 401 balance of $795,517? It plummets to $63,485 $732,032 less than before. When you stop contributing to your 401 and have no employer matching contributions, your total 401 balance in year 37 is 92% less. Procrastinating with your retirement savings and your 401 contributions means you have to work much harder and save even more to catch up to where you need to be in order to reach your retirement goals. Learn more about the cost of waiting to save for your retirement.

Get Your Employees On Track For A Healthy Retirement

Right now, saving for retirement may be the furthest thing from your employees minds. Setting money aside for the future when its needed for everyday bills and living expenses may seem like a poor choice. However, it may be one of the best decisions they can make.

Saving $100 a month in a 401 account gives the balance the chance to grow through the power of compounding growth. And putting money aside or increasing contributions now can mean the difference between a comfortable retirement and just getting by. As you can see below, even a little can go a long way.

Don’t Miss: When Should You Rollover Your 401k

What If You Always Maxed Out Your 401k

Whats the surest way to become a millionaire? I can tell you right now max out your 401k contribution every year. It will take a while, but I guarantee you will get there. This is the easiest way to build wealth. The problem is you have to start investing young and most of us didnt know that when we were 22. We all spent too much money and didnt invest enough in our 20s. Even I didnt want to contribute to my 401k when I started working in 1996. To that young guy, retirement was 40+ years away. Why should I put so much money aside? I wanted to go out, have fun, replace my junky old car, and buy nicer clothes. Fortunately, my dad convinced me to start contributing to my 401k and saved me from a huge mistake. The compounding effect of investing early is absolutely amazing. Its too bad so many young people dont understand this concept and put off investing until later.

Key Takeaways: Are You On Track To Retire

- 401 balances can average roughly $6,000 at the age of 24 to more than $255,000 at the age of 65.

- Knowing the average and median 401 savings by age can help you figure out where you stand and how you can be better prepared for the future.

- As soon as a 401 becomes available to you, its best to consider taking advantage of this benefit.

- There are various ways to prepare for retirement, such as:

- Improve your 401 balance

- Prioritize your retirement savings

- Learn from your 401 balance

You May Like: Does Allied Universal Have 401k

Review Your 401k Plan To See If It Is Worth Contributing Too

I want you to take a few minutes and pull out your most recent 401K or IRA statement and look for some of the following information:

- How much are your annual/quarterly broker fees?

- If your funds are managed by a brokerage firm it will be around .75-2.25%

Hopefully, you arent shocked with some of the numbers you find once you start digging. If you have problems locating the informationdrop me an emailand Ill see what I can do to help you dig through the statements.

Once youve dug through your statement and looked at the numbers you need to do some projections.

What If You Always Maxed Out Your 401

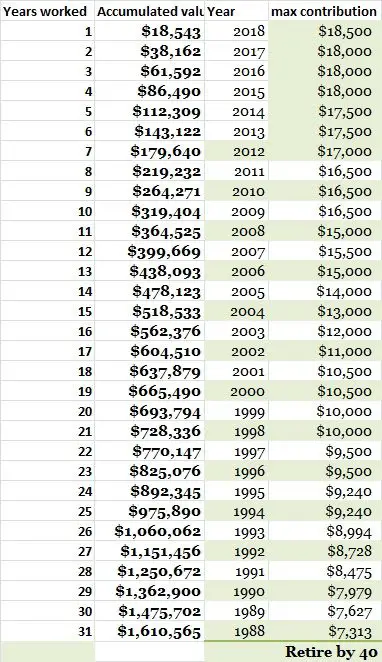

If you only invested in the S& P 500, started working in January 1999, and always maxed your 401 you’d have around $825,000 today.

Maximizing a 401 for every career start year

If you had started maxing out your 401 back in 1995 or earlier in an S& P 500 fund, we estimate you’d be a 401 millionaire!

A roughly 60 year old worker who started contributing the max in 1982 would have a massive $3.2 million account. Even a roughly 35 year old worker who started maxing out a 401 in 2007 would have about $485,000.

Here’s the graph showing career start dates and maxed out 401 balances for every career start year back to 1982:

As you can see, no matter what year you started your account, after a few years it was a tremendously great deal.

You not only built a tax-free reservoir of wealth, but also shielded all of those contributions and gains from state and federal taxes!

Recommended Reading: Can You Do A 401k On Your Own

What Will Be The Future Value Of Your 401k

Will your 401k savings be enough to secure your financial future?

The last thing you’d want is to reach retirement age realizing that you’re going to need to work for another 20 years.

Proper financial planning results in a secure future, and your 401k can be a key contributor. This simple 401k Calculator will show what role your 401k will play in plotting your path to your golden years.

What Is A 401

A 401 is a retirement plan offered by some employers. These plans allow you to contribute directly from your paycheck, so theyre an easy and effective way to save and invest for retirement. There are two main types of 401s:

-

A traditional 401: This is the most common type of 401. Your contributions are made pre-tax, and they and your investment earnings grow tax-deferred. Youll be taxed on distributions in retirement.

-

A Roth 401: About half of employers who offer a 401 offer this variation. Your contributions are made after taxes, but distributions in retirement are not taxed as income. That means your investment earnings grow federally tax-free.

Recommended Reading: What Is The Difference In A 401k And An Ira

Rollover To A New 401

If you switched jobs and the new employer has a 401 plan, you can choose to rollover the 401 into the new employerâs 401 plan. Once you are eligible to join the 401 plan, you can request a direct rollover from the old employerâs plan to the new employerâs plan to avoid owing income taxes on the transfer.

Anything Else I Should Know

Yep. A few things, actually.

Once you contribute to a 401, you should consider that money locked up for retirement. In general, distributions prior to age 59½ will be hit with a 10% penalty and income taxes.

If you leave a job, you can roll your 401 into a new 401 or an IRA at an online brokerage or robo-advisor. The IRA can give you more control over your account and allow you to access a larger investment selection.

401s typically force you to begin taking distributions called required minimum distributions, or RMDs at age 72 or when you retire, whichever is later. You may be able to roll a Roth 401 into a Roth IRA to avoid RMDs.

Also Check: Can You Transfer Your 401k

How To Turn It Around

That most Americans dont have nearly enough savings to sustain them through retirement is sad but true.

How do you avoid that fate? First, become a student of the retirement savings process. Learn how Social Security and Medicare work, and what you might expect from them in terms of savings and benefits.

Then, figure out how much you think you’ll need to live comfortably after your 9-to-5 days are over. Based on that, arrive at a savings goal and develop a plan to get to the sum you need by the time you need it.

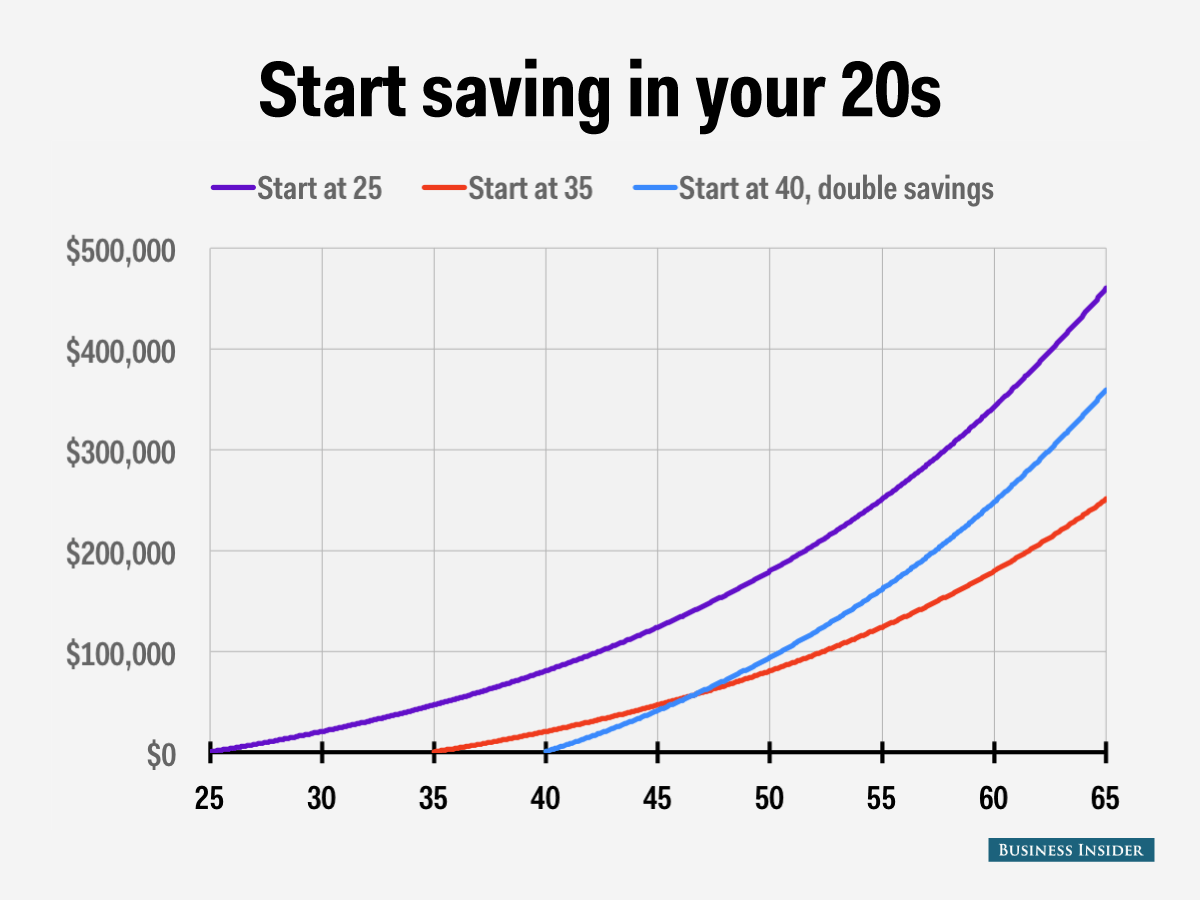

Start as early as possible. Retirement may seem a long way away, but when it comes to saving for it, the days dwindle down to a precious few, and any delay costs more in the long run.

Retirement Savings In Your 20s

Fresh out of college or other post-secondary education, you are probably starting out with an entry-level job in your 20s.

If you are aiming for a traditional retirement age of 65, your investment timeframe could be up to 40 years or more at this point, which is great.

Start saving if you can. However, if you are carrying high-interest debt , my advice is to pay that off first.

Thereafter, focus on building an emergency fund thatâs equivalent to 3-6 months of your expenses. Use a high-interest saving account to hold your emergency funds so you can easily access them if needed.

If your employer offers a retirement or pension plan and offers to match your contributions, take them up on the offer.

Personally, I saw my 20s as an opportunity to get an education, develop marketable skills, and invest in myself. It was a time for taking risky bets that would eventually make it possible for me to earn a decent income later on.

If you end up with limited savings in your 20s, donât fret. Thereâs still time to catch up.

Recommended Reading: How Can I Get My 401k Money Without Penalty

What Else Can You Learn From Maxed Out 401s

From our study, we learned some interesting things about maxed out 401s:

- Ignoring recent account start dates, if you always maxed out your 401 starting in 2009 you have best results out of any year. You’d have seen a huge 12.95% annual return!

- Maxed out 401s that started in 1996 performed the “worst”… but still boast an awesome 8.35% annual return.

- The median annual return if you always maxed out your 401 and started between 1982 and 2018 was 9.46%

- The average annual return if you consistently maxed your 401 and started between 1982 and 2018 was 10.09%

- If you always maxed out your 401, your leverage becomes massive after enough time. Accounts started in 1982 have $3.2 million balances on only $500,000 in personal contributions!

One of the features you can see in our chart is that we estimated annual return percentages if you always maxed out your 401.

This used a function called ‘XIRR’, which we built into our S& P 500 Periodic Investment tool. XIRR allows you to find out the actual return on money based on periodic investments, as opposed to ‘simple’ returns based on a lump sum up front. XIRR is a weighted average, so each month’s contributions matter in the final result.

Keeping Up With Inflation

Some annuities offer a guaranteed lifetime income with the ability to increase your income regularly to keep up with inflation. Once the income increases, the payment amount is locked in and can never go backward from that point forward.

Example

A 40-year-old purchases a $1,000,000 annuity with a lifetime income rider to retire at age 60. At age 60, the lifetime income amount may be guaranteed $105,380 initially but hypothetically increases to $288,439 by age 67. Once the income has increased to $288,439 annually, this payment is locked in and can never go below $288,439 in the future.

On the other hand, a performance-based annuity may hypothetically generate an income of $381,349 a year for life starting at age 60, increasing to $636,610 a year by age 70. Once the income has increased to $636,610 annually, this payment is locked in and can never go below $636,610 in the future.

Also Check: How Can I Rollover My 401k To Roth Ira

Other Important Financial Goals To Consider

You should keep a few other things in mind as you decide how much to contribute to your 401 based on your own unique financial situation.

- Do you have a formal estate plan with a will and other critical papers ?

- Can you cover health care expenses? Make sure you’re putting enough into your health savings account , both now and in the future, to cover medical expenses if you have a high-deductible health plan with an HSA combo.

- Do you have proper disability insurance coverage to protect you and your family if you miss work for six months or more due to illness or injury?

- Do you have long-term care plans in place if you’re nearing retirement?

Lessons Learned Along The Way

Over that 30-year period, there were a lot of things the market taught investors. The 1990s were extremely kind to retirement savers, and the portfolio would’ve hit the $100,000 mark by 1995. Similarly, the size of the nest egg doubled between 2002 and 2007 and more than tripled from 2009 to 2019.

Yet you would’ve had to be willing to endure long periods of tough performance. In 2002, after three tough years, your retirement account balance would’ve been less than it was in 1999 — even though you would’ve contributed $32,000 extra into your 401 during that period. Similarly, the market meltdown in 2008 would’ve lopped $90,000 off the value of your 401 even after considering the $21,000 you contributed during that year.

One clear lesson is how important the last years of your career are to your retirement savings. 2019 was better than any other year, adding more than $350,000 to the value of your 401 account. Those investment returns had the same impact that 16 years’ worth of contributions from 2004 to 2019 had in pushing your account balance higher. That $350,000 figure is also higher than the value of the entire account back in 2003 — after 15 long, hard years of maxing out contributions.

Read Also: How Does Company Match Work For 401k