Allied Universal Interview Tips

Find 4 simple Allied Universal interview tips below:

An Allied Universal interview, particularly one for jobs in corporate support, sales, and leadership, is likely to involve both traditional and behavioral interview questions. Well cover the latter in the next section. To nail traditional Allied Universal interview questions, you primarily just need to do your research and follow the method described above. Here are some example traditional interview questions you might see:

- Tell me about yourself.

- What are your career goals?

- What is your greatest strength?

- What is your greatest weakness?

- What do you know about Allied Universal?

You should prepare for the types of questions above. You can miss out on a job offer by answering these types of questions poorly. But behavioral interview questions are often more important when a company is choosing between its final few candidates for a position.

Welcome To The G4s Pension Scheme Website

The G4S Pension Scheme is G4S’s defined benefit pension scheme and is almost entirely closed to future accrual. The content of this page is determined by the trustee.

Current and new employees are automatically enrolled into the G4S Personal Pension Plan.

The G4S Pension Scheme is made up of 3 sections:

- The Securicor section

- The GSL section

- The Group 4 section

How Much Can You Contribute To An Individual 401

According to Allec, the contribution limits have both an employee and employer component. You fill both those roles. In 2021, an employee can contribute up to $19,500 if they are under 50. For those 50 or older, the maximum is $26,000. The $6,500 difference is a catch-up provision, meaning older individuals can save more for their retirement.

As for the employer component, you can make a nonelective contribution to the 401 of 25% of your Form W-2 wages. For example, if you earn $100,000 in wages in 2021, you can contribute $19,500 as an employee and $25,000 as an employer for a total of $44,500. For a sole proprietorship, the employer component is 20% of your net income from self-employment, which is calculated as your self-employment income as reported on Schedule C, less your deduction for half of the self-employment taxes paid.

When you contribute as both an employee and an employer, the threshold amount in 2021 is $58,000 if you’re under 50 and $64,500 if you’re 50 or older.

These limits usually change every year, and typically they go up to adjust for inflation. The increase is usually a round number, not a percentage.

If your spouse works for your business and is compensated, he or she can participate in your business’s solo 401 at the same limits as above.

You May Like: What Is The Difference Between A Pension And A 401k

Can You Contribute A Lump Sum To A Self

According to Bergman, a self-employed individual can usually make an employee deferral lump-sum contribution to a plan so long as he or she has sufficient earned income. However, in the case of a W-2 owner/employee, the employee deferral contribution should not be more than the income earned for that income period. In the case of employer profit-sharing contributions, those can be made by the employer in a lump sum.

Does Allied Universal Have Retirement

ALLIED UNIVERSAL CORPORATION 401 RETIREMENT PLAN is a DEFINED CONTRIBUTION PLAN. Some examples of this type of plan are 401, 401, Employee Stock Ownership Plan , Savings Plans and Profit-Sharing Plans.

What companies still match 401K?

Many firms offer to match employee contributions to the 401 plan.Here are examples of several companies with generous employer 401 matches:

- Citigroup.

- Walmart.

Does Allied Universal have good benefits?

Allied Universal will continue to offer healthcare benefit options to our employees that meet or exceed the benefit options required by the ACA. Many of our employees find that lower price, fixed-indemnity plans are an attractive, cost-effective option for their healthcare needs.

Also Check: How Much Will My 401k Be Worth In 20 Years

Boon I Fringe Benefit Solutions For Government Contractors

Flexible, cost effective, customized fringe benefit solutions for government contractors, compliant with SCA, DBA. Get a quote today.May 17, 2021 For full time positions, company benefits include medical and dental coverage, life insurance, 401, holidays and more. Allied Universal is an Dec 24, 2019 Company benefits include medical and dental coverage, life insurance, 401 and bonus plans, holidays and more. Allied Universal is an

Q Does Allied Universal Offer Any Company Discounts Or Perks

A Allied Universal has negotiated special discounts for employees for a wide array of products and services. Allied Universal has partnered with vendors to offer exclusive prices, discounts, and offers from thousands of local and national merchants. Additionally, our employees are eligible for a discount on tuition for childcare at all KinderCare locations nationwide.

Recommended Reading: How To Find Out If I Have Money In 401k

Salaries By Allied Universal Competitors

| Rank |

|---|

Allied Universal offers comprehensive benefits including health and wellness, paid time off, financial benefits, and employee perks. The top rated benefits that Allied Universal has to offer include their health insurance and employee perks.

Health Wellness:

-

Employees are eligible for health and welfare benefits 1st of the month following 60 days of employment

-

For full-time employees, benefits often include healthcare

-

Aflac, life insurance, dental and vision insurance

Paid Time Off:

-

Paid holidays such as, Presidents’ Day, Memorial Day, Independence Day, Labor Day, Thanksgiving, Christmas, and New Years

Financial Benefits:

- Allied Universal Salary

Allied Universal may also be known as or be related to Allied Universal, Universal Protection Service and Universal Security Concepts, Inc.

How Much Do Companies Typically Match On 401 In 2022

Dylan Telerski / 9 Mar 2022 / Business

Employer matching contributions are a common feature of many company 401 plans, with 98% of employers adding partial or full matching bonuses. The typical American company is matching 6% of employee contributions in 2022.

Employers are also increasingly recognizing the 401 employer match as a powerful incentive to encourage loyalty to the company in 2022, 59% have vesting schedules ranging from one to six years before employees are entitled to walk away with the full amount of employer-matched funds.

If you own a small business or work for one, keeping tabs on what other companies are matching on their 401s can help you gauge how competitive your own plan is and better adjust your contributions for the year.

Read Also: How Do I Cash Out My 401k

Q Does Allied Universal Have A Reward And Recognition Program

A Allied Universal offers recognition programs and awards, including the Hero-of-the-Year award Youre Phenomenal On-the-Spot Reward and Community Service Award, demonstrating the huge value that Allied Universal places on the good deeds and heroic acts employees perform daily in the communities they serve. Our Service Anniversary Award Program recognizes the achievement of various milestones and celebrates the longevity and commitment shown by our employees. Allied Universal offers a scholarship program for employees student dependents, and personal development training programs for self-improvement opportunities and career navigation.

Simple 401 Limits In 2022

Employers offering a SIMPLE 401 allow employees to save up to $14,500 in 2022, which is up by $1,000 from 2021. Those age 50 and older may contribute another $3,000 for a total of $17,000.

Employers can contribute dollar-for-dollar up to 3% of a workers pay or contribute a flat 2% of compensation regardless of the employees own contributions. Employer 401 contributions are subject to an employee compensation cap of $305,000 for 2022.

Also Check: How To Fill Out A 401k Enrollment Form

Q What Does Allied Universal Do For The Community

A Allied Universal is committed to supporting the people and businesses of the communities we serve. We are dedicated to creating safer campus communities by partnering with non-profit training and policy organizations to develop training tools for line campus public safety personnel. By hosting free Plan to Live seminars, we educate healthcare providers on best practices to handle an active shooter situation and other threats. We are dedicated to hiring seniors. In 2017 Allied Universal was a featured presenter at a Capitol Hill briefing on employment needs of unemployed older Americans. In 2017, Allied Universal hired nearly 11,000 seniors as security professionals and in administrative roles. Thats over 7 percent of our workforce. We hire thousands of veterans annually and supports veterans causes with many initiatives, such as job placement assistance, career preparation and employment retention aid.

Recruitment Fraud Alert: Since 1957, Allied Universal has been keeping people safe and providing peace of mind. Please be aware of phishing scams involving phony job postings on external sites to protect yourself from Recruitment Fraud. Allied Universals Careers page URL is . If you receive any type of communication on behalf of Allied Universal that seems suspicious or inappropriate, please report this activity to the Better Business Bureau at .

Q What Does A Day In The Life Of A Security Guard Look Like

A – With over 300,000 Security Professionals across the continent, we have 300,000 different typical days. Allied Universal employees act as the eyes and ears of our clients and facilitate day to day public interactions in a safe and secure manner. Whether you are working at lobby of a landmark high rise building, working in a local shopping center, access control in a major metropolitan medical center, campus safety, or working at an industrial facility, Allied Universal commits to training all of our personnel to provide quality services to our customers, day or night.

Also Check: What Is A Roth 401k Vs 401k

How Does The Money Grow In A Self

Bergman says thatdepending on the provider you choose to house your plan, you can invest in almost anything. However, if you select a financial institution to oversee your plan, you must invest in their products. Otherwise, opportunities remain limitless. Go the traditional route with stocks or mutual funds, or turn to alternative investments like real estate, gold or cryptocurrencies.

Allied Universal History & Culture

A foundational knowledge of Allied Universals history and culture is an important part of the equation for acing the Allied Universal interview. It can help tailor your answers to Allied Universal interview questions.

Allied Universal is a leading provider of security systems and services, janitorial services, and staffing that has grown in large part via acquisition. It was formed in 2016 by the merger of two security firms, Universal Services of America and AlliedBarton Security Services. The combined company is the largest provider of security guards in the United States, with 140,000 officers. As of 2020, Allied Universal earned almost $9B annually in revenue and had over 250,000 employees. But in 2021, the firm completed a successful $5.1B takeover of British security firm G4S. This acquisition created a new entity with more than 750,000 employees globally, with revenues of more than $18B USD.

The company takes pride in its extensive knowledge in many specialty sectors such as education, healthcare, retail, commercial real estate, government, and corporate campuses. Serving and safeguarding customers, communities and people is at the core of what the company does.

Its culture places an emphasis on inclusion and diversity, believing that this fuels innovation. As you might expect for a company that provides security and facility management services, safety is an important value of its culture.

Recommended Reading: How To Roll Roth 401k To Roth Ira

What Is A Self

This plan goes by many names, including solo, individual and single-k, but they all refer to a 401 retirement savings plan for a self-employed person. You can contribute a large amount of money to this plan every year and then start taking distributions from the account after you turn 59.5 years of age.

Key takeaway: A self-employed 401 plan is a retirement savings plan started and contributed to by a self-employed person.

Outlines Of 401k Plan:

- The employee contribution is established upon the quantity of profit and annual earnings in the profit-sharing plan.

- If you cant pay the direct amount, the retirement plan uses the default interest account for employees.

- The employee can receive the share of their payment or get their amount in cash by qualified defined contribution.

- Employers can contribute to a plan by parts or whole through a separate account.

Retirement benefit in Allied Universal:

Professional Security officers are eligible for maximum retirement benefits if they retire at age 70. These benefits depend upon employment age and earning history.

Dental and vision insurance:

Allied Universal provides healthcare and welfare benefits for their full-time employment from the first month to subsequent 60 days of hires. Employ can get customize benefits plans for their insurance like healthcare, 401K Retirement Plan, Employee Discount Program, Service Anniversary Bonus, Company-Paid Life Insurance, Company-Paid Life Insurance.

Life insurance in 401k plan:

If you want to avail of insurance in a 401k plan, you have to get employee plan permission. After spending five years in insurance, you can use the account balance in the life insurance policy taxes are applied.

Disability benefits:

Disability pension payment is also available in 401k plans which are taxable. While disability due to terrestrial attack is tax-free.

Reduce tax:

FAQ

What is the contribution for the 401K plan in 2022?

Recommended Reading: What To Do With 401k When You Switch Jobs

See Our Complete Guide To The Best Retirement Plan For Independent Workers

- Individual 401 plans allow you to start taking deductions after you turn 59.5 years old.

- You cannot employ any full-time employees and have a solo 401.

- In 2021, an employee can contribute up to $19,500 in one year, assuming you’re under 50 years old.

- Annual or maintenance fees for solo 401 plans usually run between $20 and $200, and they are tax deductible.

The number of people who run their own business continues to trend up. The most recent data from the Bureau of Labor Statistics found that 9.6 million people worked for themselves in 2016. That is projected to increase to 10.3 million by 2026.

Working for yourself may give you the ability to make more money than you would working for someone else, but it also means you need to have your own retirement plan in place. One of the most popular retirement plans for independent workers is a self-employed 401. We spoke to two financial experts to find out how these retirement plans work.

Logan Allec, CPA and owner of the personal finance site Money Done Right, and Adam Bergman, a trained tax attorney and president of IRA Financial Trust and IRA Financial Group, offered their insights about these plans, including the maximum contributions, taxes, investments and fees.

Editor’s note: Looking for the right employee retirement plan for your business? Fill out the below questionnaire to have our vendor partners contact you about your needs.

What Are The Most Common Mistakes People Make With Their Self

Overcontributing, in Allecs opinion, is the largest mistake. When you discover you’ve put too much money into your plan, call your provider right away. They can help you withdraw the overcontributed amount so you won’t have to pay taxes on it.

Another common error is breaking one of the prohibited transaction rules. For example, your plan buys a house in Florida and rents it out as an investment. If you want to take a family trip to Disney World, you can’t stay in that house. Once you’ve invested in alternative assets and break the rules, you will be subjected to taxes and penalties. Always make sure your provider goes over the prohibited rules with you when you open your individual 401.

The last mistake many people make is not getting their solo 401 set up by the end of the year.

Additional reporting by Max Freedman

Recommended Reading: How Much Tax On 401k After Retirement

Compare Allied Universals Employee Health Insurance

Financial Benefits ALLIED UNIVERSAL offers remarkable financial benefits for employees and their family members. A remarkable 401 plan Insurance, Health & Wellness · Health Insurance · Dental Insurance · Flexible Spending Account · Vision Insurance · Health Savings Account Rating: 2.9 · 20 votes

What Benefits Does Allied Universal Offer

Allied Universal offers comprehensive benefits including health and wellness, paid time off, financial benefits, and employee perks. The top rated benefits that Allied Universal has to offer include their health insurance and employee perks.

Health Wellness:

-

Employees are eligible for health and welfare benefits 1st of the month following 60 days of employment

-

For full-time employees, benefits often include healthcare

-

Aflac, life insurance, dental and vision insurance

Paid Time Off:

-

Paid holidays such as, Presidents’ Day, Memorial Day, Independence Day, Labor Day, Thanksgiving, Christmas, and New Years

Financial Benefits:

Don’t Miss: What Happens To Your 401k When You Quit A Job

Allied Universal Seeks To Increase Workforce By 30000 Over

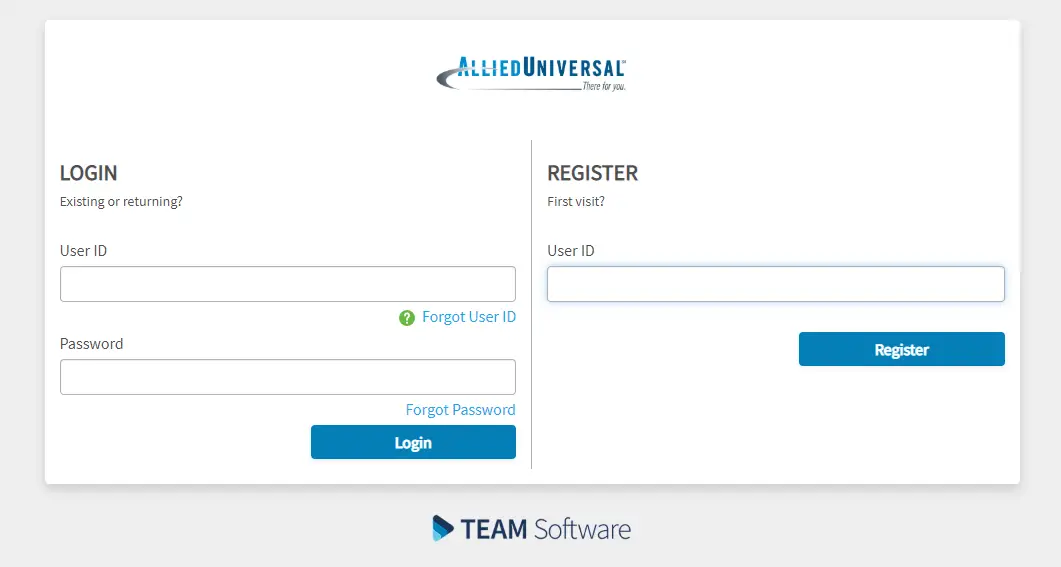

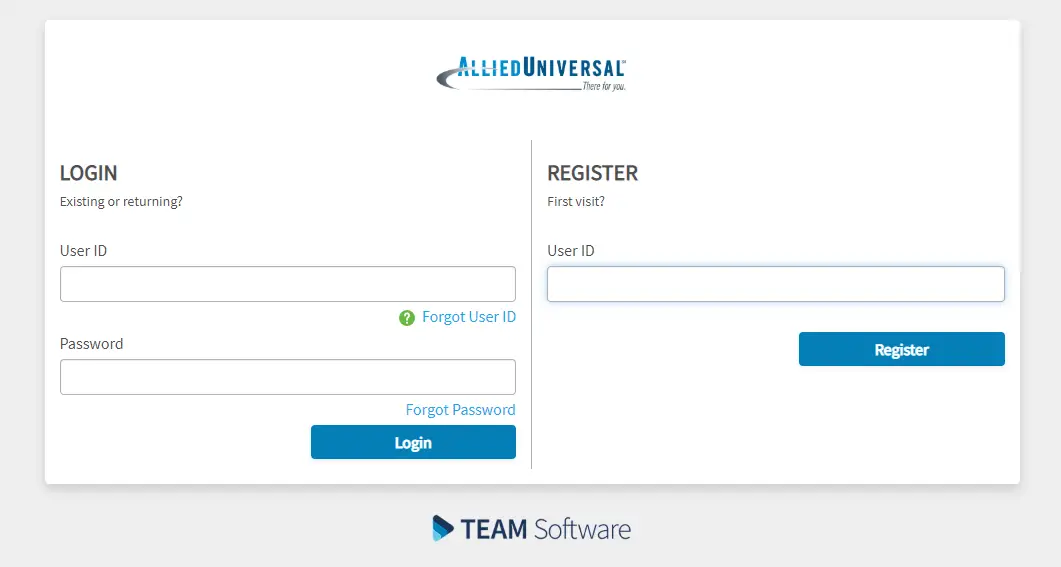

Apr 13, 2020 For full time positions, company benefits include medical and dental coverage, life insurance, 401, holidays and more. Allied Universal is an Apr 15, 2020 Employee Login Access your schedule and pay stubs and update your contact information. eHub site for all employees Previously issued

What Fees Are Associated With A Solo 401

Annual or maintenance fees for these plans, according to Allec, usually run between $20 and $200. You’ll pay the least if your needs are simple you don’t have any employees besides yourself, there’s no rollover and you’re OK with investing in a budget brokerage firm’s products. If you have more interesting investment appetites, another provider can accommodate those. These providers usually charge higher fees to maintain your plan, but you also have more flexibility with your investment and plan options.

Recommended Reading: Which 401k Plan Is Best For Me