Hardship Distributions From 401k Plan

If you are younger than 59 ½, youre going to have to demonstrate that you have an approved financial hardship to get money from your 401k account. And thats only if your employers retirement plan allows it. They are not required to offer hardship distributions, so the first step is to ask the Human Resources department if this is even possible.

If it is, the employer can choose which of the following IRS approved categories it will allow to qualify for hardship distribution:

- Certain medical expenses

- Certain expenses for repairs to a principal residence

The only other way to get access to your funds is to leave your employer.

You May Like: How Many Loans Can I Take From My 401k

Cover Any Gaps In Health Insurance

You have a couple of options.

- COBRA continuation coverage: You and your family can continue to have health insurance for a while after losing your coverage through work. Because you pay the full premium, it can be pricey, but going without coverage, even for a short time, can be a risk. Previous dental and/or vision insurance is included as part of COBRA, too.

- A Health Insurance Marketplace plan: Cost varies based on your household income and available plans vary from state-to-state. Visit healthcare.gov to learn more.

- A spouse/partner insurance plan: Usually you need to sign up within 30 days of your last day on the job.

What Happens Next After You Have Stopped Working For That Employer

When you stop working for an employer, the next question is what will happen to your account with that employers 401k plan. You generally have three options in such a scenario.

The first is to simply leave your account with that employer 401k plan. Some employers allow you to keep your account with the companys 401k plan even if you no longer work for the company. In that scenario, your holdings would remain the same and your funds would stay with the employer until you found them a new home.

Depending on the plan, you may receive a distribution of the proceeds of the amounts in your 401k account once you leave the employers service whether you want one or not. Some employers will have certain account minimums below which they will just automatically send you a check if you leave the employer. For example, on lower balances under $5,000, you may receive a check for the balance or roll your 401kbalance over into an IRA.

You may also have the option of rolling your 401k plan into your new employers 401k plan. Take a look at the new plan and determine if this would be the better route for you to take than rolling your existing 401k plan into an IRA.

Don’t Miss: How Long Do You Have To Transfer 401k

Should I Cash Out My 401k

You may be wondering, if you should cash out your 401k plan. And the answer to that question is it depends. You see, there is no right or wrong answer, rather the answer is nuanced based on your particular situation.

Cashing out early can make you subject to taxes and penalties. So you need to keep that in mind. However, you also have to weigh the negatives of cashing out early with the potential advantages.

Advantages such as:

Recommended Reading: Can I Move Money From 401k To Ira

There Are Several Situations In Which This Could Happen

Eric is currently a duly licensed Independent Insurance Broker licensed in Life, Health, Property, and Casualty insurance. He has worked more than 13 years in both public and private accounting jobs and more than four years licensed as an insurance producer. His background in tax accounting has served as a solid base supporting his current book of business.

You May Like: How Much Money Can You Put In 401k Per Year

On And After Your Last Day

Youre firing off your last emails and riding off into the sunset. Even if youre crying good riddance inside, make sure to leave on a positive note. Reach out to the people youve worked with to tell them about your move. And make sure your goodbyes are gracious and appreciative.

Careers are long, and you never know when you might cross paths with someone again or end up needing a reference. Burning bridges only means youll have fewer paths open to you in the future, so leave them standing strong.

Decide Quickly Or Your Employer Might Decide For You

You want to make an informed choice, but don’t wait too long before deciding or your employer might make the choice for you and stick you with an unwanted outcome.

If your account balance is below $5,000, your former employer can force you out of the plan and into an IRA account that they designate if you drag your feet. The expenses of these accounts are usually high, and the investment choice is usually limited.

If your account is worth less than $1,000, they can send you a check, even though that isn’t what you want done, and it subjects you to taxes and perhaps penalties.

Also Check: What Should I Do With My 401k After Retirement

The Benefits Of Contributing To Your 401 Account

401s sit within a certain class of accounts specifically designed for stashing away money for the long term to be eventually used in retirement. Other types of retirement accounts include IRAs, Roth IRAs, Roth 401s, and 457s, but for the sake of this article, well keep our focus on 401s .

Because 401 accounts were created with saving for retirement in mind, they offer certain advantages over other types of accounts that are designed to help the money you contribute to them grow more quickly over time. Here are a few of those advantages.

You May Like: How To Cash Out Your 401k Fidelity

How To Cash Out A 401 After Quitting

You may follow this type of action plan for your 401 when you quit your job:

If your new employer offers a 401 plan, check your eligibility and enroll yourself.

Once enrolled, get the funds and investments in your old account directly transferred to your new account. You can opt for a direct administrator-to-administrator transfer through simple documentation to avoid potential taxes and penalties.

Instead of direct transfer, you can also cash out your old account and deposit the proceeds in your new account within 60 days of cashing out. That way, you dont have to pay income tax on the amount of the withdrawal .

You must start taking 401 distributions after you turn 70 ½ years old and you are not working anymore. However, unlike traditional plans, in a new retirement plan with your current employer, you cannot be forced to take the required minimum distributions even after you reach the age of 70 ½.

If your new employer does not have a 401 plan or you do not like the plan your new employer has, you may roll over your old 401 account to an IRA. The rollover process is like the process of rolling over to a new account. You can either get it done directly through your plan administrator or take out the proceedings and deposit them in your IRA within 60 days.

Dont Miss: What Are Terms Of Withdrawal 401k

Don’t Miss: Why Roll 401k Into Ira

Leave Your Money In The Former Employers Plan

You wont be able to make contributions anymore, but this is an option. This is acceptable as a temporary solution while you look for a new job or research where to open your rollover IRA. But its not recommended for the long term, because the company may change their investment options over time, and it wont be easy to ask questions or make changes if youre no longer working there. If your account balance is less than $5,000, the company may not allow you to leave your money in their plan at all.

Cash out. WARNING! If you take a lump-sum distribution instead of rolling your retirement savings account over to an IRA or a new employers plan, you will have to pay income taxes on the money. You will also pay a 10% early withdrawal penalty if youre under age 59 ½. Not only do you lose money, but you lose valuable time in building savings, and may never catch up.

Also Check: How Do I Get My 401k

Decide What To Do With Health Savings Account Funds

If youre enrolling in a high deductible health plan at your new employer, you can often transfer a balance in your HSA. If you dont plan to enroll in a HDHP, you can generally leave remaining funds and use as needed for future eligible healthcare expenses.

Tip: If you use HSA funds for unapproved health care expenses, youll face tax implications.

Also Check: How Much Can You Put In Your 401k A Year

When Youre Between Jobs:

-

Stick to your budget. When you dont have a paycheck coming in, the last thing you want to do is run up debt . Do your best to stick to the budget youve laid out for yourself while between jobs, even if it means cutting back on fun. In the long run, youll be glad you did.

-

If youre planning to roll your 401 over into an IRA, get the process started. Contact your new plan administrator to set up an IRA account and begin the rollover. Remember that if your old plan administrator cuts you a check with the proceeds from your 401 plan, you only have 60 days to deposit it into your rollover IRA to avoid substantial taxes and early withdrawal penalties. If you decide a rollover is right for you, were here to help. Call a Rollover Consultant at .

Recommended Reading: How To Cancel 401k Plan

Roll It Over Into A New Employers 401k Plan

This assumes the new plan that the employer offers would allow you to bring the old balance into the new plan.

Pros: Like option 1, if the costs are low and the investment options strong, then this may be a good option, and also make it easier to monitor both plan balances on one statement.

Cons: Also like option 2, you may be moving your money from one high-fee, low-option plan into another high-fee, low-option plan.

Don’t Miss: How Do I Withdraw Money From My 401k Fidelity

What Happens To A 401k When You Quit

So, youve decided to quit your job. What now? Very often, employees leave their jobs without considering what to do with their retirement account. As a result, they end up leaving that account behind, in the 401 plan of the former employer. The thing to keep in mind in this situation is that you will not be able to contribute to the account anymore if you quit. The money you contributed still belongs to you, though, so you have to think about what to do with it.

Usually, plans let employees who leave their job keep the funds in their accounts as long as there is more than $5,000 saved. When there is less than $5,000 in your account, you can get a check from the plan sponsor so your account can be closed.

Other people choose to leave the money they saved behind. After all, its very easy to simply walk away and forget about the 401 plan you made with the former employer. But its not the best thing to do. Basically, when you leave the account behind, you dont monitor it anymore. Because of that, you dont know what happens with your money, and this is not good considering that its money you worked for every month. Moreover, if you leave money in various 401 plan accounts you made with different employers, the issue may become even worse.

Roll The Money Into Your New 401

If you’ve been offered a new job and it comes with a 401, you may be able to just move your money out of your old retirement plan and into a new one. The benefit of going this route, assuming you plan to participate in your new employer’s 401, is that you’ll have all of your retirement funds in a single account. That should, in turn, make your money easier to manage and make your savings progress easier to track.

That said, you’ll want to do what’s known as a direct rollover into your new 401. That way, the money will move from your old plan right into your new one, as opposed to you getting a check and having to make that transfer.

If you don’t do a direct rollover, but instead get a check for your old 401 balance, it’ll be on you shoulders to transfer it into your new plan in a timely fashion. Otherwise, you may face tax-related consequences. Plus, you may not get your entire 401 balance, as your employer may be required to withhold some of it for tax purposes, even if your intent is to transfer your entire balance over to another 401. That’s a hassle you’re better off avoiding.

Recommended Reading: What Is The Interest Rate On A 401k

What Happens To Your 401 When You Leave Your Employer

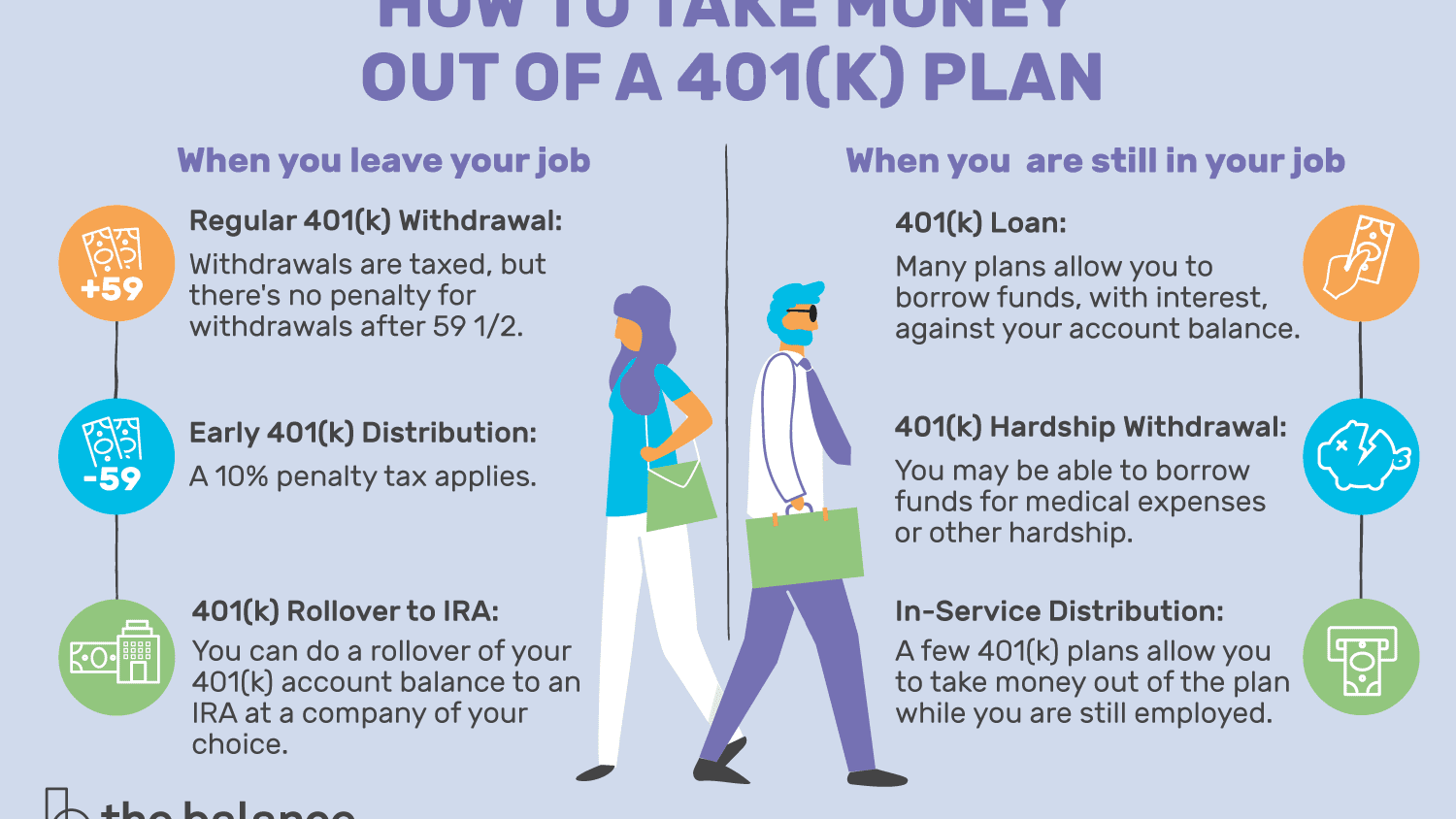

You dont lose your 401 if you quit your job. You have a few options.

-

Leave It With Your Former Employer: You may be able to leave your 401 alone. The disadvantage of this is that its one more place to look for funds when you get ready to retire. Generally, its best to roll it over into a new plan.

-

401 Rollover to Your New Employers Plan: You can move your funds from an old employer to a new one without any tax penalties.

-

401 Rollover to IRA: You can also move your 401 into a traditional or Roth IRA. If you choose a Roth, youll need to pay taxes on what you move.

-

Cash It Out: If youre younger than age 59 ½, you can cash out your 401. However, this usually isnt the best idea unless you can prove financial hardship, since you may have to pay an early withdrawal penalty.

What Is A 401

Before we get into it, lets remember what a 401 account is. A 401 is a type of retirement account that allows an individual to start saving money for years in preparation for retirement. The investing account comes with several tax benefits, and you have the option of either getting a traditional account or a Roth account.

Employers offer this type of savings account in order to allow workers to save towards their retirement. You are able to contribute up to a certain amount every year, and it is possible to contribute to both a 401 account and an IRA in one year. The contributions you make to your savings account will be taken from your paycheck. Its also possible to have money put into the account by the employer on your behalf if you get a 401 employer match.

Usually, a 401 plan does not tax the investment earnings until you decide to withdraw the amount from your account. Usually, this happens after you retire, as youll not always be allowed to withdraw any amount from it before your retirement. When it comes to Roth 401 plans, though, withdrawals have no tax.

Read Also: Can You Transfer 401k To 403b

Cases Where You Might Need To Do This Anyway And How To Minimize The Damage

If you absolutely must take the money to cover an emergency , you can do so. In some cases, you may not owe the 10% penalty, and if the plan was a Roth 401 you wont even owe taxes.

If this is your situation, here are your three steps:

Cashing Out A 401 In The Event Of Job Termination

In case you are fired, you can cash out your 401 plan even if you are below the age of 59 ½ years. You just need to contact the administrator of your plan and fill out certain forms for the distribution of your 401 funds. However, the Internal Revenue Service may charge you a penalty of 10% for early withdrawal, subject to certain exceptions.

Also Check: Is It Good To Convert 401k To Roth Ira

Take Distributions From The Old 401

After youve reached age 59½, you may withdraw funds from your 401 without paying a 10% penalty.

Its possible that youve decided to retire and are considering withdrawing funds from your account. If youre retiring, it may be a good time to start drawing on your savings for income. Youll have to pay tax at your regular rate on any distributions you take out of a traditional 401. Annuities are a solid tool for spending your 401 without running out of money.

If you have a designated Roth 401, any payments you take after youre 59 1/2 are tax-free if youve held the account for at least five years. Only the earnings portion of your distributions is taxed if you do not fulfill the five-year requirement.

When you reach age 72, you must begin taking RMDs from your 401 if you leave your employment. The amount of your RMD is determined by your expected life span and 401 account balance.

Disadvantages Of Closing Your 401k

Whether you should cash out your 401k before turning 59 ½ is another story. The biggest disadvantage is the penalty the IRS applies on early withdrawals.

First, you must pay an immediate 10% penalty on the amount withdrawn. Later, you must include the amount withdrawn as income when you file taxes. Even further down the road, there is severe damage on the long-term earning potential of your 401k account.

So, lets say at age 40, you have $50,000 in your 401k and decide you want to cash out $25,000 of it. For starters, the 10% early withdrawal penalty of $2,500 means you only get $22,500.

Later, the $25,000 is added to your taxable income for that year. If you were single and making $75,000, you would be in the 22% tax bracket. Add $25,000 to that and now youre being taxed on $100,000 income, which means youre in the 24% tax bracket. That means youre paying an extra $6,000 in taxes.

So, youre net for early withdrawal is just $16,500. In other words, it cost you $8,500 to withdraw $25,000.

Beyond that, you reduced the earning potential of your 401k account by $25,000. Measured over 25 years, the cost to your bottom line would be around $100,000. That is an even bigger disadvantage.

Don’t Miss: How Do I Cancel My 401k With Fidelity