Option : Move The Money To Your New Employer’s 401 Plan

Moving money to your new employers 401 may be an option, depending on whether your current employer has a 401 plan and the terms of the plan. Like your former employer’s plan, many factors ultimately depend on the terms of your plan, but you should keep the following mind:

- Ability to add money: You’ll generally be able to add money to your new employer’s plan as long as you meet the plan’s requirements. This option also allows you to consolidate your retirement accounts, which may make it easier to monitor your investments and simplify your account information at tax time.

- Investment choices: 401 plans typically have a more limited number of investment options compared to an IRA, but they may include investments you can’t get through an IRA.

- Available services: Some plans may offer educational materials, planning tools, telephone help lines and workshops. Your plan may or may not provide access to a financial advisor.

- Fees and expenses: 401 fees and expenses often include administrative fees, investment-related expenses and distribution fees. These fees and expenses may be lower than the fees and expenses of an IRA.

- Penalty-free distributions: Generally, you can take money from your plan without tax penalties at age 55, if you leave your employer in the calendar year you turn 55 or older.

- Required minimum distributions: Generally, you must take minimum distributions from your plan beginning at age 72, unless you are still working at the company.

Youll Owe Taxes On The Money Now But Enjoy Tax

Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

If you’ve been diligently saving for retirement through your employer’s 401 plan, you may be able to convert those savings into a Roth 401 and gain some added tax advantages.

Can I Roll A 401k Into A Roth Ira

If you have built a nice nest egg, you may consider rolling over your 401 into a Roth IRA. Here are the steps involved when rolling over 401 into a Roth IRA.

If you left your job and you are wondering what to do with your 401, you have several rollover options with the money. The most common rollover option is to rollover from 401 to an IRA, where a taxpayer can continue making tax-deferred contributions to the IRA account. You may also consider rolling over to a Roth IRA. But, is this allowed?

You can rollover your 401 into a Roth IRA if you want to enjoy the benefits of a Roth IRA. Rolling over from 401 to Roth IRA is a taxable event, and you will be required to pay taxes on the contributions, employerâs match, and all investment earnings generated from the account. However, you wonât pay income taxes when you withdraw money from the Roth IRA in retirement.

Recommended Reading: When Leaving A Company What To Do With 401k

View Important Information About Our Fees And Commissions

-

3. Standard online $0 commission does not apply to over-the-counter equities, transaction-fee mutual funds, futures, fixed-income investments, or trades placed directly on a foreign exchange or in the Canadian market. Options trades will be subject to the standard $0.65 per-contract fee. Service charges apply for trades placed through a broker or by automated phone . Exchange process, ADR, and Stock Borrow fees still apply. See the Charles Schwab Pricing Guide for Individual Investors for full fee and commission schedules.

Investors should consider carefully information contained in the prospectus, including investment objectives, risks, charges, and expenses. You can request a prospectus by calling 800-435-4000. Please read the prospectus carefully before investing.

Schwab ETFs are distributed by SEI Investments Distribution Co. . SIDCO is not affiliated with Charles Schwab & Co., Inc.

This tax information is not intended to be a substitute for specific individualized tax, legal, or investment planning advice. Where specific advice is necessary or appropriate, Schwab recommends that you consult with a qualified tax advisor, CPA, financial planner, or investment manager. Depending on the type of account you have, there are different rules for withdrawals, penalties, and distributions. Please understand these before opening your account.

Roth Conversions From Typical Iras

If you will have cash in a traditional IRA, there is no source of revenue restriction on your ability to convert it to a Roth IRA. However, there are tax penalties. To the extent your IRA has money that got here from deductible contributions or earnings, you’ll have to come with the quantity you change in taxable income.

This occurs because you are converting money from a pre-tax to a post-tax status. In addition to expanding your taxable income, a traditional-to-Roth conversion can push you into the next tax bracket. For this reason why, it is vital for you to estimate all your source of revenue for the 12 months prior to completing Roth conversion. This will help you determine the tax value of one of these conversion.

One factor to keep in mind, despite the fact that, is if you happen to made nondeductible contributions to your traditional IRA, you can be entitled to claim a pro rata share of the ones contributions to reduce the amount of taxable income you record. For example, in case you made a nondeductible contribution of $1,000, and you convert part of your overall IRA belongings of $10,000 to a Roth IRA, then you’ll have taxable income of $4,500. That’s half of the $10,000, or $5,000, minus part of the nondeductible $1,000 contribution amount, or $500.

Read Also: How Much Money Can I Contribute To My 401k

Is A Roth Ira Ever A Bad Idea

A Roth IRA isnt necessarily a bad idea if you qualify for a suitable employer through your employers workplace retirement plan, but its not a great first choice. You can contribute up to $19,500 for a 401 in 2020 or $26,000 if you are 50 or older, compared to just $6,000 and $7,000, respectively, for a Roth IRA.

Is Roth IRA for poor people?

Only those fortunate enough to earn less than $140,000 per year as individuals or less than $208,000 for married couples can contribute the full amount of a Roth IRA for 2021. After earning more than $140,000 a year for singles and $208,000 for married couples, you cannot contribute. to a Roth IRA.

Who should not convert to a Roth IRA?

If you are less than five years away from retirement, it may not make sense to switch to a Roth IRA. Roth conversions will trigger taxes, so you must be willing and able to pay those taxes.

Prev Post

Should I Roll My Roth 401 Into A Roth Ira

- Print icon

- Resize icon

Q.: Im thinking of retiring and rolling my Roth 401 to a Roth IRA. A co-worker says if I roll it to a Roth IRA, I cant touch it for five years without penalty. I thought penalties ended at 59½. Im 68. Can you clear this up for me?

Sam in Dallas

A.: Sam, Ill try. My suspicion is your coworker is mixing bits of different rules together.

First, the penalty most people refer to with respect to IRAs, Roth accounts, and retirement plans is the 10% penalty assessed for taxable distributions prior to age 59 ½. There is also a five-year rule that affects conversions from traditional IRAs and retirement plan accounts to Roth accounts that can trigger a penalty but it, too, is only applicable prior to age 59½. At 68, you do not need to worry about these penalties.

Second, there is another five-year rule regarding earnings in a Roth IRA. It needs to be satisfied only once in a taxpayers lifetime. Before you can take earnings tax-free from a Roth IRA, you must be 59½ years old AND it must be at least five tax years since the tax year for which you put the first dollar in your first Roth IRA. That first Roth IRA account does not even need to exist today. You are older than 59½ so if your first Roth IRA was opened more than five years ago, you can access the earnings tax-free. This includes any funds you roll into the Roth IRA from your Roth 401.

If you have a question for Dan, please with MarketWatch Q& A on the subject line.

You May Like: Who Can I Talk To About My 401k

Converting A Traditional 401 To A Roth Ira

Youll owe some taxes in the year when you make the rollover because of the crucial differences between a traditional 401 and a Roth IRA:

- A traditional 401 is funded with the salary from your pretax income. It comes right off the top of your gross income. You pay no taxes on the money that you contribute or the profit that it earns until you withdraw the money, presumably after you retire. You will then owe taxes on withdrawals.

- A Roth IRA is funded with post-tax dollars. You pay the income taxes up front before it is deposited in your account. You wont owe taxes on that money or on the profit that it earns when you withdraw it.

So, when you roll over a traditional 401 to a Roth IRA, youll owe income taxes on that money in the year when you make the switch.

The total amount transferred will be taxed at your ordinary income rate, just like your salary. Tax brackets for 2021 range from 10% to 37% and remain the same for 2022.

Roll Over Your Money To A New 401 Plan If This Option Is Available

If you’re starting a new job, moving your retirement savings to your new employer’s plan could be an option. A new 401 plan may offer benefits similar to those in your former employer’s plan. Depending on your circumstances, if you roll over your money from your old 401 to a new one, you’ll be able to keep your retirement savings all in one place. Doing this can make sense if you prefer your new plan’s features, costs, and investment options.

-

- Any earnings accrue tax-deferred.1

- You may be able to borrow against the new 401 account if plan loans are available.

- Under federal law, assets in a 401 are typically protected from claims by creditors.

- You may have access to investment choices, loans, distribution options, and other services and features in your new 401 that are not available in your former employer’s 401 or an IRA.

- The new 401 may have lower administrative and/or investment fees and expenses than your former employer’s 401 or an IRA.

- Required minimum distributions may be delayed beyond age 72 if you’re still working.

Read Also: What Is A 401k Annuity

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most how to save for retirement, understanding the types of accounts, how to choose investments and more so you can feel confident when planning for your future.

You May Like: How To Calculate Employer Contribution To 401k

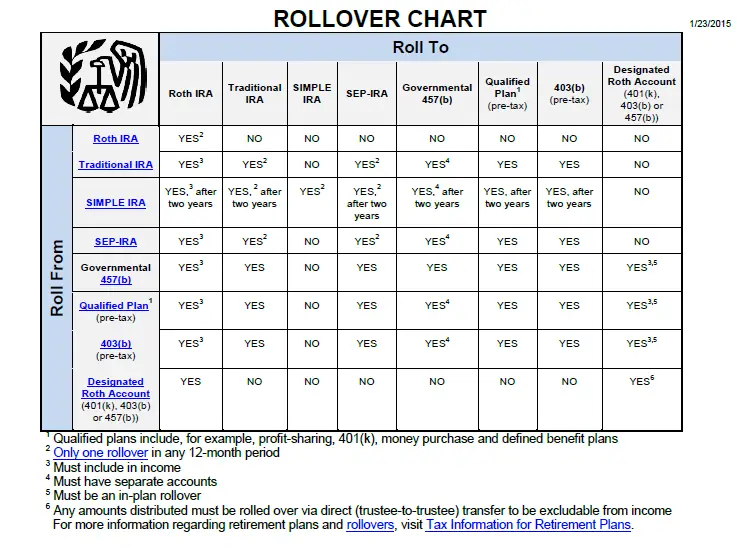

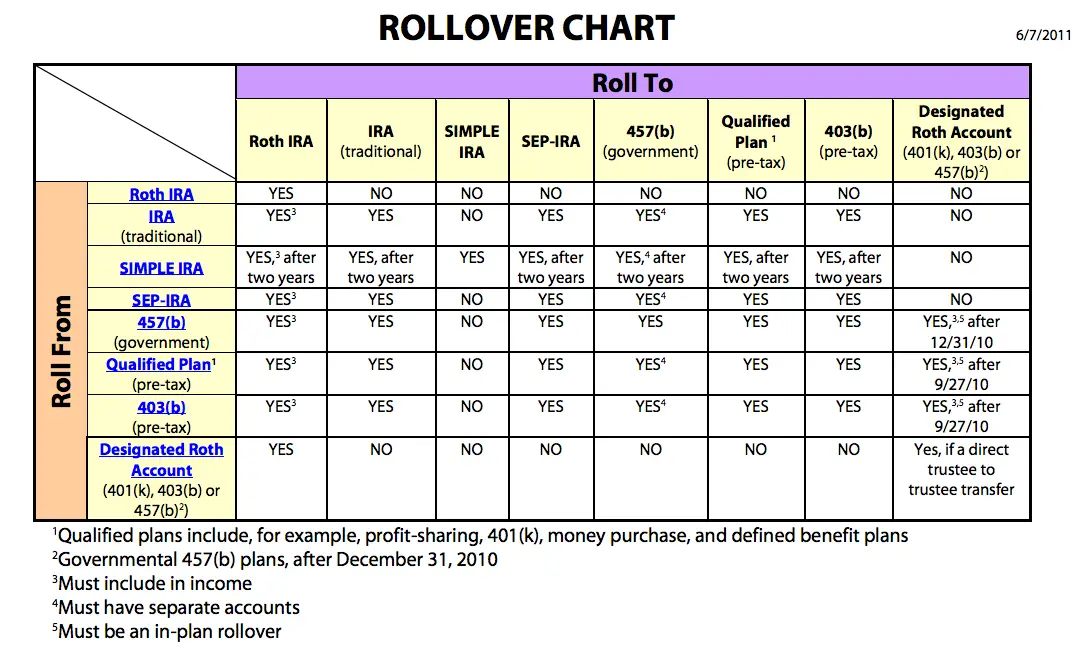

Rollover To An Ira Can Mean Tax

If you rollover to an IRA you may have a wide choice of investment options, including choices that employers might not offer, such as mutual funds, annuities and bank CDs. This option allows your funds to continue growing tax-deferred. And you can simplify your financial life by moving the account to a company where you already have funds or even into an existing IRA.

If you choose a Traditional IRA, you won’t pay any taxes when you conduct a rollover. If you roll money into a Roth IRA, you’ll be taxed on the money going into the account, but pay no federal income taxes when you withdraw the money . Money from a Roth 401k can be rolled into a Roth IRA tax-free.

When rolling over a 401k balance into an IRA it’s important to do a full comparison on the differences in the guarantees and protections offered by each respective type of account as well as the differences in liquidity/loans, types of investments, fees and any potential penalties.

Also Check: What Happens To My 401k After I Quit

The Secure Act And Annuities In 401 Plans

A possible alternative to rolling your 401 into an annuity is to see if your employer-sponsored retirement plan already includes an annuity option. The Setting Every Community Up for Retirement Enhancement Act eliminates many of the barriers that previously discouraged employers from offering annuities as part of their retirement plan options.

For example, ERISA fiduciaries are now protected from being held liable should an annuity carrier have financial problems that prevent it from meeting its obligations to its 401 participants. Additionally, annuity plans offered in a 401 are now portable. This means if the annuity plan is discontinued as an investment option, participants can transfer their annuity to another employer-sponsored retirement plan or IRA, thereby eliminating the need to liquidate the annuity and pay surrender charges and fees.

Should I Rollover My 401k To An Ira

The 401k rollover to IRA is the most common type of rollover. You know that commercial with the little green line? This is the type of rollover they are referring to. You take your money from your 401K and put it directly into whats called a Rollover IRA.

Its a specific type of traditional IRA where you can stash your old 401k funds. Whats great about this move is that there are no penalties, no taxes, and if you use the right broker, you get a lot more control over your money with much few expenses than if you left the money in your 401k.

Note that even though this is the best way for most people to rollover their 401k, there are some reasons not to do a rollover: youre retiring early, there are stock options in your 401k, or youre planning a Roth conversion. If thats the case, discuss it with your CPA before making the rollover.

Read Also: Can I Withdraw My 401k If I Leave My Job

Is It Better To Contribute To 401k Or Roth 401k

Choose a Roth 401 if youd rather pay taxes now and be done with them, or if you believe your tax rate will be greater in retirement than it is now . In exchange, because Roth 401 contributions are made after taxes rather than before, they will cut your paycheck more than standard 401 contributions.

Ask For A Direct Rollover

Contact the 401 plan administrator and explain that you want to rollover directly to the new account provider, and get the appropriate forms. The new account provider should provide instructions of where the check or wire transfer should be made, where it will be sent, and the information to include. Once you provide this information, the plan administrator will send the funds directly to the Roth IRA.

If you do an indirect rollover, where the plan administrator sends the check to you, you must deposit the funds to the account provider’s account within 60 days. However, the plan administrator may withhold 20% of the distribution for taxes. You must get back the money and make a full deposit, including the amount withheld by the plan administrator.

Don’t Miss: How Much Tax On 401k Withdrawal

How To Reduce The Tax Hit

If you contributed more than the maximum deductible amount to your 401, you have some post-tax money in there. You may be able to avoid some immediate taxes by allocating the after-tax funds in your retirement plan to a Roth IRA and the pretax funds to a traditional IRA.

Alternatively, you can choose to split up your retirement money into two accounts: a traditional IRA and a Roth IRA. That will reduce the immediate tax impact.

This is going to take some number crunching. You should see a competent tax professional to determine exactly how the alternatives will affect your tax bill for the year.

The Build Back Better billpassed by the U.S. House of Representatives and currently being considered by the U.S. Senateincludes provisions that would eliminate or reduce the use of Roth conversions for wealthy taxpayers in a few ways.

If passed in its current form, starting in January 2022, employees with 401 plans that allow after-tax contributions up to $58,000 would no longer be able to convert those to Roth IRA accounts. Further limitations would go into effect in 2029 and 2032, including preventing contributions to IRAs for high-income taxpayers with aggregate retirement account balances over $10 million and banning Roth conversions from pretax retirement accounts for high-income taxpayers.

View Important Information About Our Online Equity Trades And Satisfaction Guarantee

-

1. The standard online $0 commission does not apply to large block transactions requiring special handling, restricted stock transactions, trades placed directly on a foreign exchange, transaction-fee mutual funds, futures, or fixed income investments. Options trades will be subject to the standard $.65 per-contract fee. Service charges apply for trades placed through a broker or by automated phone . Exchange process, ADR, foreign transaction fees for trades placed on the US OTC market, and Stock Borrow fees still apply. See the Charles Schwab Pricing Guide for Individual Investors for full fee and commission schedules.

2. If you are not completely satisfied for any reason, at your request Charles Schwab & Co., Inc. or Charles Schwab Bank, SSB , as applicable, will refund any eligible fee related to your concern. Refund requests must be received within 90 days of the date the fee was charged. Schwab reserves the right to change or terminate the guarantee at any time. Go to schwab.com/satisfaction to learn whats included and how it works.

Don’t Miss: What Are The Advantages Of A 401k