Less Than 25 Years Old

- Average 401 balance: $6,718

- Median 401 balance: $2,240

- Contribution rate: 8.1%

Although many people younger than 25 years old are new to the workforce or are not in a job where a 401 plan is offered, their average 401 balance increased 23 percent in 2020 compared to 2019, and 49 percent of those who are eligible for a 401 plan are participating in it. This indicates that this generation is indeed planning for retirement early on.

Start Living On A Budget And Tracking Your Expenses

The fact is that until you know where your money is going each month youre going to have a hard time finding money to set aside for retirement savings.

The reason its so important to discover and track where your money is going each month is so that you can identify wasteful spending and reroute it toward causes that are more important to you.

Many people find when they start tracking expenses that they are spending money in $5, $10 and $20 increments that seems like its not a lot but adds up to hundreds or thousands of dollars each month.

When my family started tracking expenses in 2013, we were able to cut them down by nearly $1,000 a month and we were making well under $100,000 per year at the time.

By trimming grocery expenses, cutting back on entertainment costs and being more mindful of each purchase, we found a lot of waste in our spending. We were able to use what we were wasting for much more important things, such as paying off our debt.

The Contribution Limit For 2022

Pretty much all retirement accounts ‘s, IRA’s, 403’s, etc.) have specific contribution limits that change almost every year due to cost of living adjustments. A lower contribution limit can feel like there’s a little less leg work to be done to max out the account.

According to the IRS, you can contribute up to $20,500 to your 401 for 2022. By comparison, the contribution limit for 2021 was $19,500. This number only accounts for the amount you defer from your paycheck your employer matching contributions don’t count toward this limit.

Some companies provide a dollar-for-dollar match on your 401 contributions, up to a certain percentage of your total salary, usually between 3% and 7% . So let’s say you contribute 7% of every paycheck to your 401, which works out to be $200 per paycheck. If your company matches your contributions dollar-for-dollar up to 7%, that means your employer is giving you an additional $200 per paycheck into your 401. If you get paid twice per month, that works out to be a total 401 contribution of $800 per month, or $9,600 per year.

In this scenario, you can still contribute beyond 7% of your paycheck, but anything beyond 7% will not be matched by your employer. You’ll need to double check with your HR department if you aren’t sure how much of a match your company provides.

Don’t Miss: Does 401k Count As Income

Breaking It Down: Where Do You Fit In

There are many reasons you might think this chart seems totally reasonable, or, conversely, totally unreasonable. And thats understandable. Life presents us all with different challenges. We have unexpected medical expenses, decide to go back to school, or have kids and want to pay their college tuitions. These are all perfectly valid excuses as to why you might be falling behind where this chart says you should, or could, be.

Based on this chart, you would think that most Americans should be retiring as multi-millionaires at age 65. This probably seems way off-base, and in reality, it is most people retire with very little in the way of savings and investments. The point is that this chart shows what is possible if you are disciplined and strategic about your 401k savings.

If you are on the younger end of the ages shown on the chart, you may be daunted at the prospect of contributing $8,000 per year to your 401k, not to mention $19,500. Where you live, what your first-year salary is, or what loans you may be paying can make it difficult for this contribution to seem realistic. Its crucial, however, to recognize the importance of saving as much as you can for retirement as early as you can.

So, lets determine, based on the two scenarios in the potential savings chart, whether these figures would be sufficient to support your lifestyle for the rest of your retirement.The average life expectancy for men is around 84 years old, and 86.5 years old for women.

How Much Could Your 401 Grow If You Stop Contributing

Now lets examine what happens to your 401 when you stop contributing and your employer does not make any matching contributions either. Using most of the same parameters as before, lets use our 401 Growth Calculator to see how much your 401 will be worth if you stop contributing at age 30, after you have already accumulated $10,000 in your account:

- You are 30 years old right now.

- You have 37 years until you retire.

- You make $50,000/year and expect a 3% annual salary increase.

- Your current 401 balance is $10,000.

- You get paid biweekly.

- You expect your annual before-tax rate of return on your 401 to be 5%.

- Your employer match is 100% up to a maximum of 4%.

- Your current before-tax 401 plan contribution is now 0% per year.

What happens to your previous 401 balance of $795,517? It plummets to $63,485 $732,032 less than before. When you stop contributing to your 401 and have no employer matching contributions, your total 401 balance in year 37 is 92% less. Procrastinating with your retirement savings and your 401 contributions means you have to work much harder and save even more to catch up to where you need to be in order to reach your retirement goals. Learn more about the cost of waiting to save for your retirement.

Also Check: Should I Keep My 401k Or Rollover To Ira

What Is A Required Minimum Distribution

The government imposes penalties for making early withdrawals from retirement accounts. After a certain age, however, youre required to take some money out every year. A mandatory 401k withdrawal is called a required minimum distribution.

In general, 401k withdrawal rules from the IRS require you to start withdrawing money from your 401k by April 1 of the year following the year that you turn 70.5, and your age and account value determine the amount you must withdraw. If youre 70.5 or older and still working, you might be able to delay taking RMDs if your plan is sponsored by the company for which youre still working. Known as the still working exception, you can apply if you:

Related: How to Master Your 401k in Your 60s

How Much Should You Have In Your 401k By Age

Now that we have established that you need a 401k in your life and explained how much you can contribute, lets talk cash. Aside from investing enough to meet your employer match, how much should you have in your 401k, really?

One way to answer that question is to look at your age.

While there is no one-size-fits-all answer to the question, How much should I have in my 401k? there are some best practices you can keep in mind to guide your efforts. Yes, while you should start investing in a 401k as soon as possible, some people might not get that opportunity right away and thats okay. The point is to do it when you can.

When you do finally start investing, there are a few good rules of thumb to help you make a sound decision on how much you should have in your 401k.

Read Also: How To Open 401k For Small Business

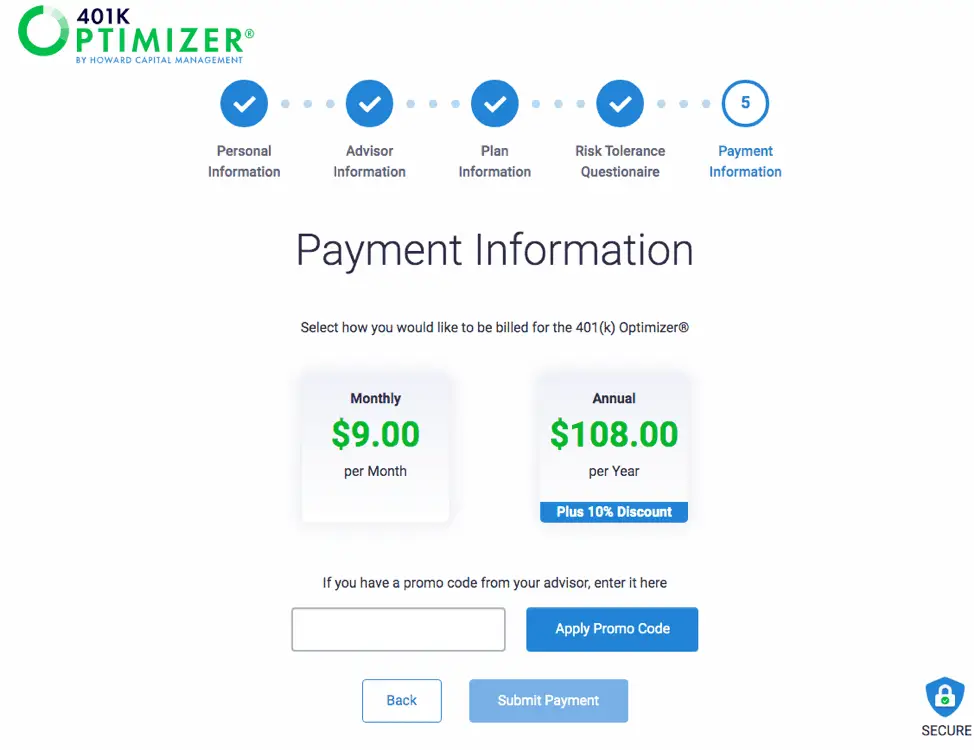

Using Ubiquitys 401 Calculator

The Ubiquity 401 calculator paints a picture of what your retirement savings will look like when youre ready to stop working. Start by entering your age, household income, and any current savings.

Enter the amount you currently save towards your 401 each month, the amount you expect to spend each month when you retire, and the age you plan to retire. Then, Ubiquitys 401 calculator will show you what to expect, and if there is a deficit. Unlike other 401 calculators, you might find online, the Ubiquity 401 calculator also accounts for hidden fees associated with your retirement savings that you may not be aware of.

You will see:

- The monthly income you can expect to need when you retire

- The amount you will actually receive from your retirement based on your current savings and monthly contributions

- How close you are to achieving your retirement goalswhether youre on the right track, ahead of the game, or need to beef up your savings

Average Current Retirement Savings Balance

Unfortunately, many people are woefully under-prepared for retirement from a financial standpoint.

Here are some statistics on the median current retirement savings balances of Americans based on their age.

| Families Between |

|---|

| 70+ | 12.3% |

Workers save more for retirement as they get older and pay off other debts like student loans and a home mortgage.

At a minimum, many experts recommend saving at least 10% of your income for retirement. Dave Ramseys Baby Steps recommend saving at least 15% into retirement accounts after getting out of debt and building an emergency fund.

You can use a retirement calculator like NewRetirement to review your personal progress and project how long your nest egg will last. This tool is free but paid plans are available too.

Read our NewRetirement review to learn more about this interactive retirement planner.

Don’t Miss: Can I Borrow From My 401k To Start A Business

Contribute As Much As You Can

You have emergency savings. You met your employers 401 match and then you maxed out a Roth IRA . Then what? How much should you really contribute to your 401 now?

Your goal at this point should be to save as much as you can for retirement while still living comfortably now. For some people, that will mean another 1% of their salary into their 401. For others it will mean maxing out their 401.

The key is to put as much as you can toward retirement. Some people spend their money frivolously and save only a little bit. If youre spending thousands of dollars every month on unnecessary purchases, you should find a way to cut that spending and put it toward retirement instead. It might not sound fun, but remember that the goal is to have financial security when you retire.

Your Employer’s Contribution Limit

Some employers may have a set limit for the percentage you can contribute toward your 401 each paycheck and, depending on how much you get paid, maxing out your employer’s limit may still not be enough for you to max out the federal contribution limit.

For example, a company may allow employees to contribute up to 50% of their paycheck to their 401 account . Or, they may allow up to a 20% contribution per paycheck. It depends on your company, so be sure to double check.

If you’re maxing out your employer’s contribution limit but you still worry that it’s not enough to help you reach your retirement goals, you can also contribute your post-tax income to a Roth IRA account.

A Roth IRA is another type of retirement account but with slightly different rules s which differ from a Roth IRA). You must open the account on your own is). And instead of contributing pre-tax dollars that you’re taxed on when you make withdrawals in retirement, you contribute after-tax dollars and won’t pay taxes on withdrawals later on.

Also, the contribution limits for an IRA are different from that of a 401 you can contribute up to $6,000 per year to a Roth IRA if you’re under age 50, and $7,000 per year if you’re age 50 or older.

Don’t Miss: Can I Rollover A 401k To A 403b

What Are My 401 Options After Retirement

Generally speaking, retirees with a 401 are left with the following choices: Leave your money in the plan until you reach the age of required minimum distributions convert the account into an individual retirement account or start cashing out via a lump-sum distribution, installment payments, or purchasing an annuity through a recommended insurer.

How Much Do You Need To Retire Comfortably

How much you need to retire comfortably isnt black-and-white because the cost of living looks different for each individual. Consider what it takes to live comfortably and maintain your lifestyle. Many experts suggest that youll need roughly 80 percent of your salary after retirement to avoid making sacrifices.

Don’t Miss: How To Move Your 401k To An Ira

Impact Of Inflation On Retirement Savings

Inflation is the general increase in prices and a fall in the purchasing power of money over time. The average inflation rate in the United States for the past 30 years has been around 2.6% per year, which means that the purchasing power of one dollar now is not only less than one dollar 30 years ago but less than 50 cents! Inflation is one of the reasons why people tend to underestimate how much they need to save for retirement.

Although inflation does have an impact on retirement savings, it is unpredictable and mostly out of a person’s control. As a result, people generally do not center their retirement planning or investments around inflation and instead focus mainly on achieving as large and steady a total return on investment as possible. For people interested in mitigating inflation, there are investments in the U.S. that are specifically designed to counter inflation called Treasury Inflation-Protected Securities and similar investments in other countries that go by different names. Also, gold and other commodities are traditionally favored as protection against inflation, as are dividend-paying stocks as opposed to short-term bonds.

Our Retirement Calculator can help by considering inflation in several calculations. Please visit the Inflation Calculator for more information about inflation or to do calculations involving inflation.

Contribute Up To The Employer Match

You have enough saved up to cover your expenses. You emergency fund is there in case you need it. Now youre starting to think about 401 contributions. Where do you you start?

The first thing you should figure out is if you have an employer matching program with your 401. With an employer match, your employer will match your 401 contributions up to a certain percentage of your gross salary. Say your employer offers 100% match on the first 5% you contribute. That means if you contribute 5% of your gross salary to your 401, your employer will contribute an amount equal to 5% of your gross salary. The total contribution to your 401 would then equal 10% of your gross salary.

An employer match allows you to increase your contribution, and you should always take advantage of matching programs. Unfortunately, many people pass up free money by not contributing up to their employer match.

Don’t Miss: Is It Better To Contribute To 401k Or Roth 401k

Average 401k Balance At Age 45

When you hit your 50s, you become eligible to make larger contributions towards retirement accounts. These are called catch-up contributions. Make sure that you take advantage of them! Catch-up contributions are $6,500 in 2021. So if you contribute the annual limit of $19,500 plus your catch-up contribution of $6,500, thats a total of $26,000 tax-deferred dollars you could be saving towards your retirement.

Average 401k Balance At Age 22

The average 401k balance at ages 22-24 is actually pretty impressive, and indicates that young people using the Personal Capital Dashboard are taking their retirement savings seriously. When youre in your early 20s, if youve paid down any high-interest debt, endeavor to save as much as you can into your 401k. The earlier you start, the better. As you can see from the potential savings chart, compounding interest is no joke.

Read Also: How To Change 401k Contribution Fidelity

Improve Your 401 Balance

Improving your 401 balance depends on how well you can handle your finances and how much you can contribute to it. Doing your research for the best interest options for your 401 plan can be a good way to start building compound interest, which will result in a higher balance.

If you think youre at a good place with your finances and making sure your living expenses and debts are being paid off, it might be worth considering maxing out your 401 contributions. According to Vanguard, only 12 percent of 401participants maxed out their contribution limit of $19,500 in 2020, and you could be one of them.

Whether you start small or contribute close to the limit, consistently contributing to your 401 and making sure your plan meets your goals will help you improve your average 401 balance and save more for retirement.

If You Start At Age :

With a 4% rate of return: $1,641.62 per month

- Annual salary needed if you save 10% of your income: $196,995

- Annual salary needed if you save 15% of your income: $131,336

With a 6% rate of return: $1,052.85 per month

- Annual salary needed if you save 10% of your income: $126,341

- Annual salary needed if you save 15% of your income: $84,231

With an 8% rate of return: $653.91 per month

- Annual salary needed if you save 10% of your income: $78,470

- Annual salary needed if you save 15% of your income: $52,316

You May Like: How To Take Money Out Of 401k Without Penalty

Is Your 401k Savings On Track

Have you met your mark? If you arent there yet, dont panic. These are just rules of thumb. That means they only give you a rough estimate of what you should ideally have by the time you hit these ages. They do not take into account your individual income and experiences or other investments you might have in play.

In reality, theres no one hard answer to how much you should have in your 401k and anyone who tells you otherwise is either lying to you or just doesnt know much about finance. We could pull up a bunch of figures and show you how much someone in their 20s or 30s is saving but that would be a complete waste of time for two reasons:

1. Its impossible to compare two investors fairly. Everyone has their own unique savings situation. Thats why itd just be dumb to compare the Ph.D. student saddled with thousands in student loan debt with the trust fund baby who just snagged a cushy six-figure corporate gig the first month out of college. Theyre both going to save very differently, so its not worth comparing.

2. Most people arent financially prepared for retirement. The American Institute of CPAs recently released a study that found that nearly half of all Americans arent sure if theyll be able to afford retirement. Thats even scarier when you consider the fact that many people underestimate how much theyll need for a comfortable retirement.