Make Changes To Contribution Amounts & Investments

Northwestern University has two 403 retirement savings plans:

- Retirement Plan

- Voluntary Savings Plan

You decide how your account balances are to be invested. You have a selection of two Investment Companies, Fidelity Investments and Teachers Insurance and Annuity Association . You are encouraged to contact the Investment Companies and explore their websites to find information on investment selections, retirement planning, and general investment education. You may also schedule an appointment with a Fidelity or TIAA representative.

Ensure you elect to maximize the Retirement Plan’s 5% match BEFORE contributing to the Voluntary Savings Plan. A Voluntary Retirement Plan Calculator is available to assist you with calculating how much to contribute to the Voluntary Savings plan to reach the IRS limits.

Are You Investing Enough For Retirement

Periodically, you may decide to invest more for retirement. This can be easily done using the following steps:

The Ability To Save More

You may have gotten a raise, or experienced a change in your financial circumstances, and wish to increase the percentage of your savings. Contributions to these plans are typically expressed as a percentage of your annual salary. For example, if you earn $75,000 per year, and your contribution rate is 10%, you would save a total of $7,500 per year. If you got a raise to $80,000 and now wish to contribute 12%, you would save a total of $9,600 per year.

You May Like: Can I Rollover My 401k Into My Spouse’s Ira

What Are The Pros And Cons Of Cashing Out A 401k

- Access to money. The biggest benefit of retiring from your 401 is having money. Everyone would like to have more money in their pocket.

- taxes. Regardless of how you use your 401 withdrawal, you will have to pay withdrawal tax.

- To punish. Even if you qualify to be fired for difficult working conditions before you turn 59 1/2, the IRS will penalize you for doing so.

Is Now A Good Time To Rebalance My 401k

At a minimum, you should rebalance your portfolio at least once a year, preferably on about the same date, Carey advises. You could also choose to do so on a more periodic basis, such as quarterly. An investor who rebalances quarterly would sell bonds and buy stocks to get back to a 60/40 portfolio mix.

Dont Miss: How Do I Find Previous 401k Accounts

You May Like: How To Roll An Old 401k Into A New 401k

Modify Your Investment Elections

Note: Any contributions to your account made after the effective date of this change will be directed into the investments you select.

Modify Your 403 Contribution

Note: All contribution amounts must be in whole percentages and changes will become effective with the current or next pay period, or as soon as administratively possible.

Recommended Reading: How Do You Roll A 401k Into Another

Cares Act 401 Early Withdrawals

The CARES Act contains a provision allowing those who are under age 59 ½ to take a distribution from their retirement plan while working, waiving the 10% penalty that would normally be associated with this type of distribution.

The distributions are still subject to income taxes, but these taxes can be spread over a three-year period. You can re-contribute some or all of the money taken via this route over a three-year period and avoid some or all of these taxes.

These distributions require that you document that COVID-19 has impacted you or a family member. This means that you or a family member has contracted the virus or that you or a family member has been financially impacted by COVID-19 in ways that might include a job loss or reduced income. For a 401 plan, the ability to take these distributions is not automatic, your employer needs to adopt this as a provision of the plan.

You May Like: How Much Will Be In My 401k When I Retire

What Do I Need To Know

- On the 529 Plan Investment Instructions page, you will need to select the account and have the beneficiary’s name, Social Security number, and date of birth available.

- You can change how your future investments are allocated as often as you like. For example, let’s say your plan’s assets are now invested in the moderate growth portfolio, but you want your future contributions to go into an age-based portfolio.

- You can change your current asset allocations twice per calendar year . For example, perhaps you want to exchange your current assets invested in the static portfolio to an age-based portfolio.

- You may find it helpful to review asset allocation choices on our 529 Plan Investment Options page.

- If you have questions about changing your future or current asset allocations, please call us at 800-544-1914.

Don’t Miss: Who Is The Plan Administrator For 401k

Can You Change Your 401 Contribution At Any Time

While the opportunity to make changes to some employee benefits, like health insurance, are generally only offered once a year during so-called open enrollment periods, many plans allow participants to change the amount of their 401 contributions at any point. According to Department of Labor guidelines, an employer must allow plan participants to change investments at least quarterly .

The reasons for making changes to your 401 contributions may vary.

Consider Hsa Contribution Limits

If you do decide to change your level of HSA contributions mid-year, you need to ensure that the change does not put you over the yearly contribution limit. For 2021, you can contribute up to $3,600 if you have an HSA that covers only yourself. If you have a family HSA, you can contribute up to $7,200. Special rules also allow those 55 and older to contribute an extra $1,000 to their HSA plans, for a total contribution limit of $4,600 and $8,200, respectively.

If you go over the annual health savings account contribution allowed by the IRS, you could be subject to taxes and penalties. First, you won’t get any tax deduction for that extra money contributed to the HSA. Second, the IRS will usually make you pay a six percent tax penalty on the amount over the annual HSA limit. The IRS suggests either withdrawing the extra HSA funds as one way to not have to pay the tax penalty, but keep in mind the withdrawn money will be subject to income taxes.

You May Like: Should I Rollover My 401k To A Traditional Ira

Balancing Act: Saving Spending And Paying Debt

Paying down debt and saving for retirement can seem like competing priorities. But if you look at them together, you’ll see how much they influence each other. If you’re finding it hard to save for retirement, solid strategies exist to help you get and stay on track. Here are a few things to consider:

- Create a budget to find balance between competing priorities. Not sure where all the money goes? A budget will help you prioritize essential expenses over discretionary spending. In the process, you may find a few unspent dollars to save for retirement.

- Set aside money for emergencies. Be sure you have a financial safety net in case unexpected expenses or financial emergencies arise. As a rule of thumb, aim to save enough to cover at least three to six months’ worth of living expenses.

- Pay off cards with the highest interest rate first. Tackle the card that’s costing you the most money in interest every month. Continue to make the minimum required payments on other cards. When that first card is paid off, put your extra money toward paying off the next card or other debt.

- Make the most of your retirement plan. Paying down debt and saving for retirement can co-Âexist. If your employer offers matching contributions, and there’s enough left in your budget, be sure to save enough to take advantage of what is essentially “free” money.

How Much To Save For Retirement

The Department of Labor outlined a few best practices for investing in order to save for retirement.

Its estimated that most Americans will need 70% to 90% of their preretirement income saved by retirement, in order to maintain their current standard of living. Doing that math can give plan participants an idea of how much they should be contributing to their 401.

Participants might also consider a few basic investment principles, such as diversifying retirement investments to reduce risk and improve return. These investment choices may evolve overtime depending on someones age, goals, and financial situation.

The DOL recommends that employees contribute all they can to their employer-sponsored 401 plan to take advantage of benefits like lower taxes, company contributions, and tax deferrals.

Read Also: Why Rollover Old 401k To Ira

Education Resources & Tools

Planning & Guidance Center

Model and plan your retirement strategy with interactive tools and calculators.

- Complete the Investor Profile Questionnaire for a comprehensive asset mix review. Learn about your risk tolerance and asset allocation.

- Model different savings scenarios using the Take Home Pay Calculator or Contribution Calculator

- See how changes in your savings habits could change your estimated monthly retirement income with Income Simulator

- Try hypothetical scenarios using the Roth Modeler to see differences between pre-tax and Roth after-tax deferrals

- Use the Fidelity Income Strategy Evaluator® to help build a portfolio for your retirement income.

Library

Search the Library for a variety of multi-media financial resources

- Watch a video about managing your debt

- Read an article to learn more about stocks, bonds and short-term investments

- Listen to a podcast about retirement planning

Life Events

Refer to Life Events to help with timely financial and benefits decisions.

- New Hire Checklist

Employers Are Boosting 401 Benefits To Compete For Workers Amid The Great Resignationyour Browser Indicates If You’ve Visited This Link

The best work perk in 2022 might be your 401 plan a classic job benefit that’s getting even better than usual for many employees. The retirement vehicle created in 1978 is getting a lot more attention in 2022 as companies scramble to retain workers amid a persistent labor shortage.

St. Louis Post-Dispatch

You May Like: Should I Roll My 401k Into An Ira

How Often Can You Reallocate 401k

Rebalancing How-To Financial planners recommend you rebalance at least once a year and no more than four times a year. One easy way to do it is to pick the same day each year or each quarter, and make that your day to rebalance. By doing this, you will distance yourself from the emotions of the market, Wray said.

Rebalancing Your Asset Allocation

If youve held the account for a while, say a year or more, the original allocation of your investments i.e. the balance between equities, cash, and fixed income investments may have shifted. Restoring the original balance of your investments may be a priority, if your strategy and risk tolerance havent changed.

Don’t Miss: When Can I Use My 401k

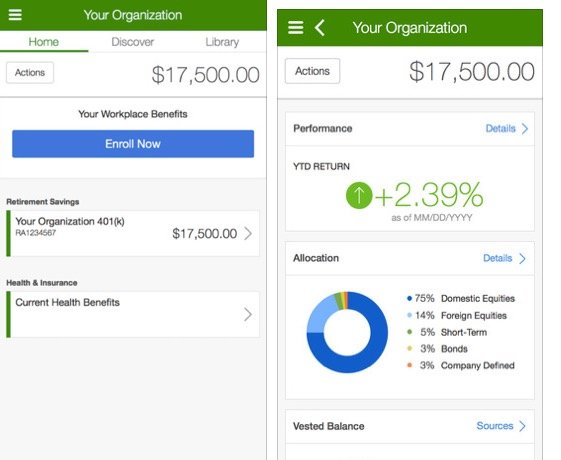

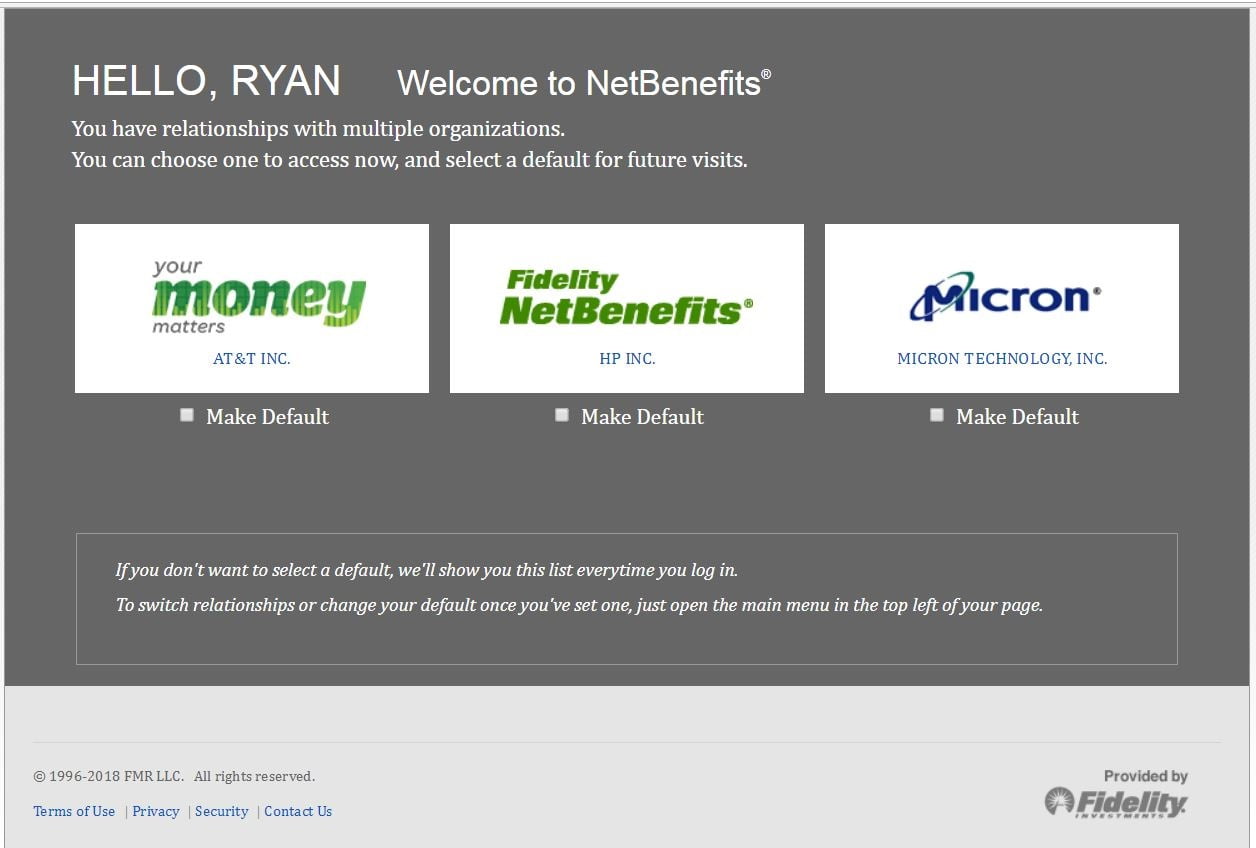

Review And Make Changes To Contribution Amounts

Contribution amount changes can be made at any time during the year. Northwestern utilizes NetBenefits, administered by Fidelity, to provide enhanced services for the Retirement Savings Plans offered to faculty and staff. All contribution amount changes, even if you contribute to TIAA, are made using this system.

There are two ways to make this change for those in both TIAA and/or Fidelity:

- Call NetBenefits at 800-343-0860 to speak with a representative

- Update your contribution amount yourself via myHR. Call NetBenefits at 800-343-0860 for assistance with navigating the portal and maximizing your benefit. See this user guide on how to navigate the system or view the video below.

How To Change Your 529 Plan’s Investment Instructions

Occasionally, you may need to adjust how you’re investing your 529 college savings plan assets. You can change your future investment allocations or your current asset allocations. You can make these changes online, and the steps are easy to follow.

You May Like: Can I Move My 401k To Roth Ira

What Is The Compensation Plan For Employees With Higher Compensation

There are also additional contribution restrictions for employees that are highly compensated defined by the IRS for a 401k plan.

For an employee that is highly compensated, they meet one of these qualifications:

1. They have 5% ownership of the business sponsoring the plan at any point in the previous year. This 5% includes both individual holdings and that of relatives working for the company.

2. They earn more than the slated annual compensation limit by the IRS. For 2021, we have a limit of $130,000. There can also be a specification that states that the individual must be in the top 20% when it comes to compensation.

To maintain the ERISA directives, employees with higher compensation can make contributions from their salary that is 2% more than normal employees. Since the average employee contributes 5%, employees with higher compensation contribute 7%.

That might be a bit difficult since the limit is based on employees contributions and compensation. Also, when you fail to make contributions in the calendar year, you lose the chance to do so. And you will not know your actual contribution limit until the early part of another year.

It is best to contribute an amount that matches the standard contribution limit and let the administrator decide if it is more than you should contribute. When you do this, the excess will be returned to you, and you will owe income taxes on the entire amount. The principal and the earnings are inclusive.

Roper St Francis Healthcare Retirement Plan

Whether your retirement is five or 50 years away, the Roper St. Francis Healthcare 403 retirement plan is a valuable teammate benefit and one of the most powerful ways to enhance your long-term financial well-being. We encourage you to invest in yourself and your future by participating in this plan through Fidelity Investments.

Your retirement savings plan is an important benefit, so you need the right information, resources, and support to help you make decisions with confidence. With more than 65 years of financial services experience, Fidelity can help you put a plan in place that balances the needs of your life today with your retirement vision for tomorrow.

How Do I Contact Fidelity Investments?

For service needs in addition to your RSFH Retirement Plan, stop by one of the Fidelity Investor Centers. To find the Investor Center nearest you, visit www.fidelity.com/branches/branch-locations.

How Do I Log-In To My Online Retirement Account?

If you already have a username and password with Fidelity, you can use your existing login information.

Why Save in the Roper St. Francis Healthcare Retirement Plan?

Who Is Eligible to Participate in the Retirement Plan?

Looking for More Ways to Boost Your Retirement Savings?

Here are just a few examples: *

How Do I Update My Name or Address on My Fidelity Investments Account?

How Do I Change My Investments?

Also Check: Can You Use Your 401k For A House Down Payment

Report Outside Retirement Contributions To The Benefits Office By April 1

To help faculty and staff members avoid tax penalties, Human Resources collects information each spring regarding contributions made to outside retirement plans to help ensure they do not exceed IRS limits.

If a faculty/staff member contributes to a non-Grand Valley State University retirement plan through an outside business in which they are at least a 50 percent owner, they must report the prior years contributions to Human Resources by April 1.

This applies if the answers to the following questions is yes:

If you answered no to any of the above questions, no action is needed.

If you answered yes, please complete and submit the Internal Revenue Code Section 415 Aggregation Form by April 1.

While faculty/staff are responsible for independently reporting retirement contributions to the IRS, HR may be able to help you avoid tax penalties by collecting this information.

See the IRS website for more information about Section 415.

Adding Alternative Investments To A 401

Some savers may find themselves interested in pursuing alternative investments when saving for retirement. An alternative investment takes place outside of the traditional markets of stocks, fixed-income, and cash. This method may appeal to those looking for portfolio diversification. Popular examples of alternative investments are private equity, venture capital, hedge funds, real estate, and commodities.

Self-directed 401s allow participants to add alternate investments to their 401 portfolio. With a self-directed 401, the investor chooses a custodian such as a brokerage or investment firm to hold the amount of assets and execute the purchase or sale of investments on the participants behalf. If an employer offers a self-directed 401, the custodian will likely be the plan administrator.

You May Like: How Do I Move My 401k To An Ira