Other Ways To Find Lost Money

If you are hoping to find lost money, you might want to start by creating a comprehensive and detailed retirement plan. This enables you to:

- Document what you have right now.

- Take stock and think about what might be missing.

- Learning about what you need for a secure retirement is a great way organize your financial life.

- Discover opportunities to make more out of what you have. People who use the NewRetirement retirement planner typically improve their plans by thousands of dollars in their first session with the tool.

Us Department Of Labor Abandoned Plan Search

If your former employer has filed for bankruptcy, gone out of business, or was purchased by another company, your 401 might be in limbo.

In these cases, employers are required to notify you so you can receive your funds. However, if your contact information has changed or you’ve moved, your plan may have been abandoned.

You can use the Department of Labor’s Abandoned Plan Search tool to locate your old 401s. You will need to enter basic information about your former employer then, you can narrow your search using your social security number.

Like the National Registry of Unclaimed Retirement Benefits, the DOLâs Plan Search tool only located abandoned plan. Thereâs a good chance your old 401s wonât show up in these results.

Follow These 3 Easy Steps

Step 1Select an eligible Vanguard IRA for your rollover*

- If you’re rolling over pre-tax assets, you’ll need a rollover IRA or a traditional IRA.

- If you’re rolling over Roth assets, you’ll need a Roth IRA.

- If you’re rolling over both types of assets, you’ll need two separate IRAs.

Note: You can roll over your assets to a new or an existing Vanguard account.

Step 2Contact the financial institution holding your employer plan

Tell them you want to make a direct rollover from your employer plan to your Vanguard IRA®, and ask what information they need

Need a letter of acceptance?

You’ll be able to create and print a letter of acceptance during our online rollover process.

Note: You may not be eligible to roll over a plan account that you’re still contributing to.

What types of assets do I have in my employer plan account?

Knowing whether you have pre-tax or Roth assets will help you figure out what type of IRA you need to open at Vanguard. If you own company stock in your plan, that may add a layer of complexity to your rollover.

What name did I use on my employer plan account?

A common situation that can delay a rollover is when a check from the current financial institution is made payable to a name that doesn’t match your Vanguard account registration. Examples include use of birth name versus married name, a missing suffix , differing middle initials , etc.

What are your rollover requirements?

Are e-signatures or faxed copies allowed?

Do you need a letter of acceptance ?

You May Like: How To Rollover A 401k Into An Ira

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Tracking Down Your Plan

If you think youve lost track of a savings plan, search your files for old retirement account statements. These should provide some key data to help your search, such as your account number and contact information for the plan administrator. If you dont have any statements, contact your former employers human resources department.

If your employer filed for bankruptcy, your 401 balance is protected from creditors and is likely still held at the investment company that administered your plan. In the case of a pension, it was either taken over by an insurance company or the federal Pension Benefit Guaranty Corp., which protects traditional pensions. You can track down your pension at pbgc.gov/search-all.

Its also possible that your employer turned over your 401 balance to your states unclaimed property fund. Your states treasury department should offer an online service that lets you search for your money. You can also check the National Registry of Unclaimed Retirement Benefits.

You May Like: What’s The Most You Can Contribute To A 401k

How Do I Download My 401k Statement

To view or print your statement, just log into www.principal.com/retirement/statements to view account information. If you have not yet set up an online account at www.principal.com, you will need to complete the following steps first: Under Account Login, select Personal as the login type and click Go.

Find Lost 401k: How To Find Out If You Have Lost Or Forgotten Retirement Accounts

Here is a guide for how to find lost money a lost 401k or other unclaimed retirement benefits.

Finding a lost 401k or other retirement account is more tedious than metal detector treasure hunting,but perhaps more rewarding.

A few years ago, I received a strange notice in the mail: a former employer was discontinuing their retirement plan and I had 30 days to either roll my balance into a different account or receive a distribution from the plan. This sort of thing happens quite often when people change jobs and leave their retirement account in the old employers plan. The strange thing about this notice was, I had no idea Id been participating in the plan while I worked there!

Could the same thing have happened to you? If youre looking for ways to increase your retirement savings, you just may want to look for lost or forgotten retirement accounts.

You May Like: What Time Does Fidelity Update 401k Accounts

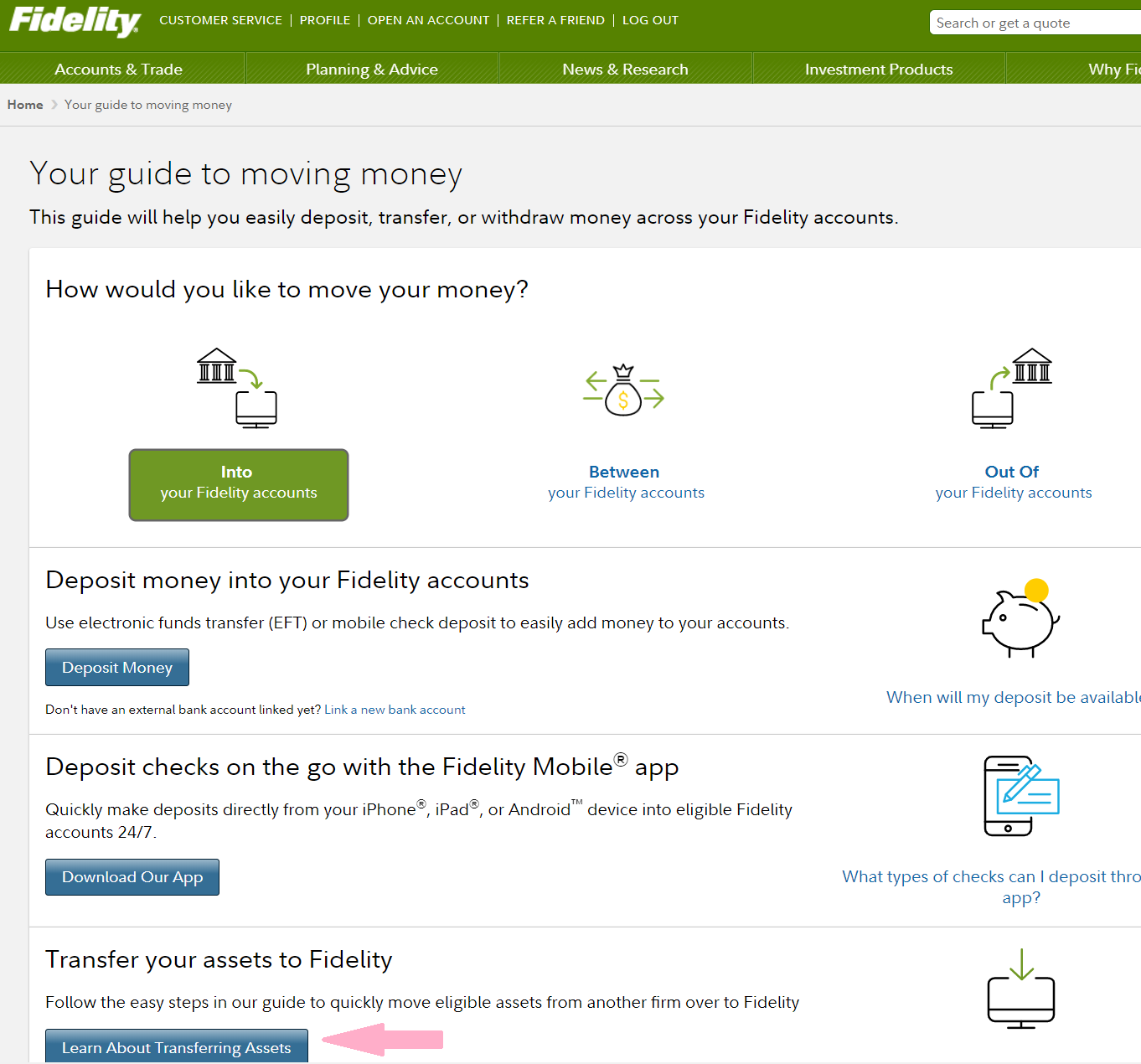

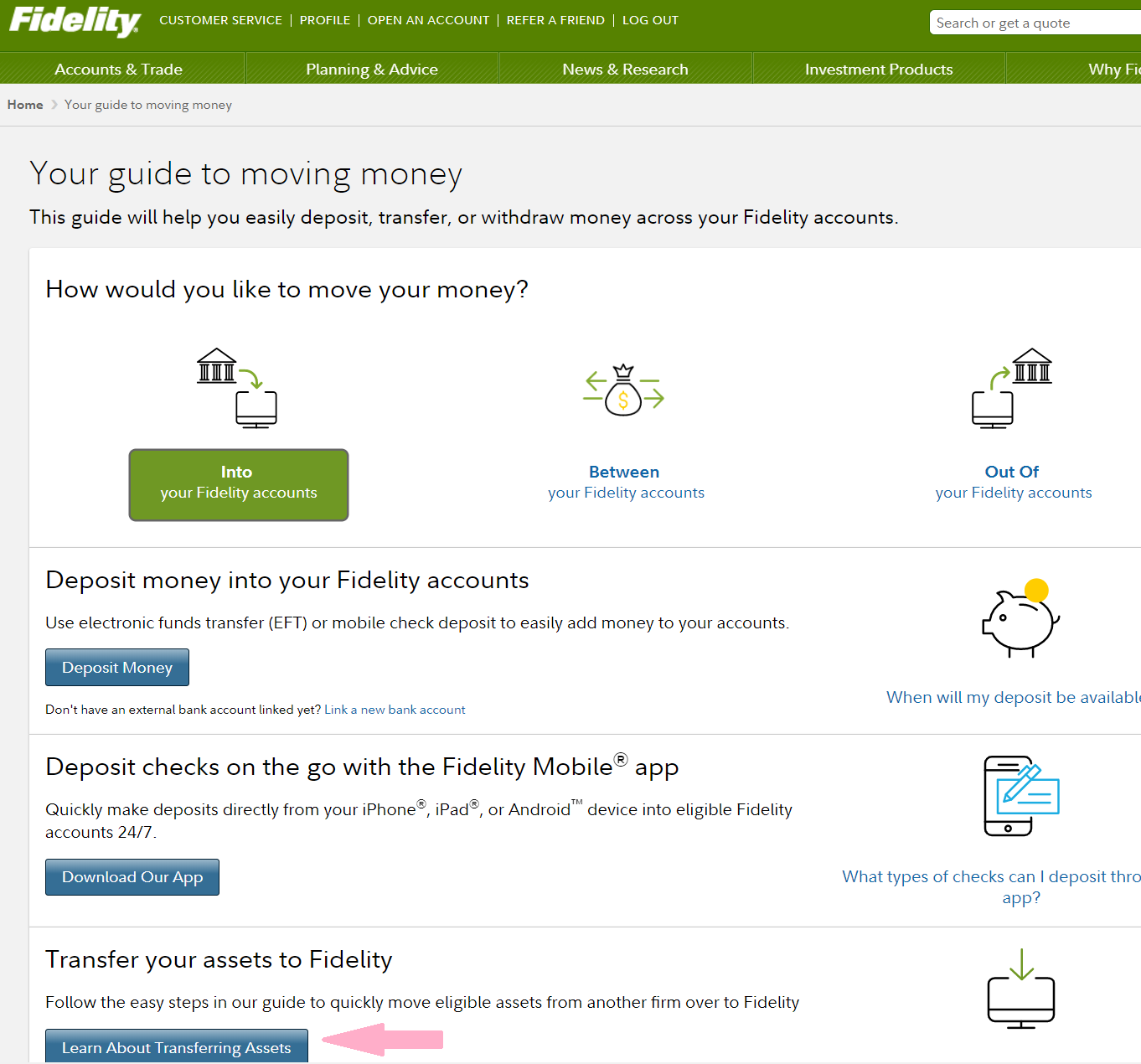

Need Help Call Fidelity

Most questions related to your Nazarene 403 Retirement Savings Plan account can be answered by phoning a Fidelity retirement services specialist at 866-NAZARENE . If you still have questions after doing this, phone Pensions and Benefits USA at 888-888-4656.

Also, Fidelity has a broad array of valuable tools, such as calculators and informational videos to assist in managing your financial life. We encourage you to explore their many resources.

Unless otherwise noted, transaction requests confirmed after the close of the market, normally 4 p.m. Eastern time, or on weekends or holidays, will receive the next available closing prices.

The investment options available through the plan reserve the right to modify or withdraw the exchange privilege.

If You Are Under 59 1/2

Making a withdrawal from your Fidelity 401k prior to age 60 should always be a last resort. Not only will you pay tax penalties in many cases, but youre also robbing yourself of the tremendous benefits of compound interest. This is why its so important to maintain an emergency fund to cover any short-term money needs without costing yourself extra by making a 401k early withdrawal.

However, life has a way of throwing you curveballs that might leave you with few to no other options. If you really are in a financial emergency, you can make a withdrawal in essentially the same way as a normal withdrawal. The form is filled out differently, but you can find it on Fidelitys website and request a single check or multiple scheduled payments.

If you jump the gun, though, and start making withdrawals prior to the age of 59 1/2, youve essentially broken your pact with the government to invest that money toward retirement. As such, youll pay tax penalties that can greatly reduce your nest egg before it gets to you. A 401k early withdrawal means a tax penalty of 10 percent on your withdrawal, which is on top of the normal income tax assessed on the money. If youre already earning a normal salary, your early withdrawal could easily push you into a higher tax bracket and still come with that additional penalty, making it a very pricey withdrawal.

You May Like: Can I Roll Part Of My 401k To An Ira

How Many Lost 401ks And Other Retirement Accounts Are Forgotten

Think lost and forgotten retirement accounts amount to chump change? Although no one keeps data on how much retirement money gets lost or forgotten, in an interview with Bloomberg, Terry Dunne of Millennium Trust Co., made an educated guess based on government and industry data that more than 900,000 workers lose track of 401k-style, defined-contribution plans each year.

That figure doesnt include pensions. According to the Pension Benefit Guaranty Corporation, an independent agency of the U.S. government tasked with protecting pension benefits in private-sector defined benefit plans, there are more than 38,000 people in the U.S. who havent claimed pension benefits they are owed. Those unclaimed pensions total over $300 million dollars, with one individual being owed almost $1 million dollars!

Could that money belong to you?

Need A Loan Get One In 3 Simple Steps

If you are considering applying for a personal loan, just follow these 3 simple steps.

Apply

Apply online for the loan amount you need. Submit the required documentation and provide your best possible application. Stronger applications get better loan offers.

Accept

If your application meets the eligibility criteria, the lender will contact you with regard to your application. Provide any additional information if required. Soon youll have your loan offer. Some lenders send a promissory note with your loan offer. Sign and return that note if you wish to accept the loan offer.

Repay

The loan then gets disbursed into your U.S. bank account within a reasonable number of days . Now you need to set up your repayment method. You can choose an autopay method online to help you pay on time every month.

About Stilt

Stilt provides loans to international students and working professionals in the U.S. at rates lower than any other lender. Stilt is committed to helping immigrants build a better financial future.

We take a holistic underwriting approach to determine your interest rates and make sure you get the lowest rate possible.

Learn what others are saying about us on , Yelp, and or visit us at . If you have any questions, send us an email at

Recommended Reading: How Much Can I Take From 401k For Home Purchase

Contact Your Old Employer About Your Old 401

Employers will try to track down a departed employee who left money behind in an old 401, but their efforts are only as good as the information they have on file. Beyond providing 30 to 60 days notice of their intentions, there are no laws that say how hard they have to look or for how long.

If its been a while since youve heard from your former company, or if youve moved or misplaced the notices they sent, start by contacting your former companys human resources department or find an old 401 account statement and contact the plan administrator, the financial firm that held the account and sent you updates.

You may be allowed to leave your money in your old plan, but you might not want to.

If there was more than $5,000 in your retirement account when you left, theres a good chance that your money is still in your workplace account. You may be allowed to leave it there for as long as you like until youre age 72, when the IRS requires you to start taking distributions, but you might not want to. Heres how to decide whether to keep your money in an old 401.

The good news if a new IRA was opened for the rollover: Your money retains its tax-protected status. The bad: You have to find the new trustee.

Can I Transfer An Existing Debit Balance And/or Options Contracts To Td Ameritrade

If you are transferring a margin and/or options account with an existing debit balance and/or options contract, please make sure you have been approved for margin/options trading in your TD Ameritrade account. Please refer to your Margin Account Handbook or contact a TD Ameritrade representative to ensure that your account meets TD Ameritrades margin requirements.

IRA debit balances:Many firms will charge fees to transfer your account, which may result in a debit balance after your transfer is completed. Debit balances must be resolved by either:

Funding your account with an IRA contribution

Liquidating assets within your account. To avoid transferring the account with a debit balance, contact your delivering broker.

Transferring options contracts:If your account transfer includes options contracts, the transfer of your entire account could be delayed if we receive your properly completed transfer paperwork less than two weeks before the monthly options expiration date. In this case, your contracts may be exercised or assigned by the firm from which you are transferring your account. Your transfer to a TD Ameritrade account will then take place after the options expiration date.

Read Also: Can I Take Out From My 401k

How To Find My Fidelity Account Number

If you have forgotten your fidelity account number, this guide will provide you with all the information you need in order to retrieve it. It is easy for anyone to forget their account number, especially in cases where you have several bank accounts. There are several methods you can use to determine your identity account number as you can see below.

Get Help From Customer Service

This is another simple and straightforward method anyone with the Fidelity account can use to determine their account number. Customer service can be accessed by visiting any Fidelity bank outlets near you or contacting customer care through phone call. Using the live chat feature on the website can also put you through with customer service. The banks social platform is also a good channel for those that want to get in touch with customer care through the internet without having to use the website.

When talking to customer service, you will be required to provide your full names, the phone number that was used to create the account, home address, date of birth, next of kin, and any other information that can help them identify you as the owner of the account.

You May Like: Whats The Most You Can Contribute To A 401k

Read Also: How To Withdraw My 401k

Use An Outside Company Like Beagle

If your search in the above databases doesnât provide any results, utilizing an outside company to find your old 401s and do the difficult work of consolidating them is a great option.

Beagle is the first company of its kind that will do the difficult work for you. We will track down your old 401s and find any hidden fees in your current 401 plan.

Then, they will provide you with options on how best to rollover your 401s into one convenient, low-cost investment option.

This is a great option for anyone who is not sure where to start or even where to begin looking.

How Do I Complete The Account Transfer Form

Open your new account online and follow the step-by-step tutorial.- To transfer to an existing TD Ameritrade account, print the Account Transfer Form and follow the instructions below:

Guidelines and What to Expect When TransferringBe sure to read through all this information before you begin completing the form. Contact us if you have any questions.

Information about your TD Ameritrade Account Write the name/title of the account as it appears on your TD Ameritrade account. If you do not already know the number of the TD Ameritrade account into which you are transferring, leave the account number section blank.- You must complete the Social Security Number or Tax ID Number section because your transfer cannot be processed without this information.

Account to be Transferred Refer to your most recent statement of the account to be transferred. Be sure to provide us with all the requested information.

Transfer Instructions

You May Like: How Does Taking Money Out Of 401k Work

Don’t Miss: How Do I Know Where My 401k Is

If You Are 59 1/2 Or Older

Once you are six months away from your 60th birthday, you can begin making withdrawals from your Fidelity 401k without having to worry about any additional tax penalties. Your 401k is now money thats there for you to start preparing for the next stage of your life as you put the finishing touches on your career and prepare to start drawing Social Security benefits.

However, that doesnt mean you dont have to worry at all about taxes. Money withdrawn from your 401k is taxable income, so you should be careful to consider just how much you need to withdraw in any given tax year to ensure youre not hitting a higher tax bracket and seeing more of your hard-earned money lost to taxes. If you have a Roth IRA or Roth 401k, though, you can make tax-free withdrawals from those, so you can balance withdrawals to minimize the tax impact.

Your Fidelity 401k comes with the option to schedule regular withdrawals so that you can do the paperwork for your withdrawal once and then set up a recurring payment. With structured, regular withdrawals, you can set up a budget that will limit your withdrawals to what you need, and youll be able to have checks showing up on a set schedule.

Recommended Reading: How To Withdraw My 401k From Fidelity