Will You Make Changes If Conditions Change

This is the most important issue, and one that trumps all of the issues above. The 4% rule, as we mentioned, is a rigid guideline, which assumes you won’t change spending, change your investments, or make adjustments as conditions change. You aren’t a math formula, and neither is your retirement spending. If you make simple changes during a down market, like lowering your spending on a vacation or reducing or cutting expenses you don’t need, you can increase the likelihood that your money will last.

Do You Have To Calculate Rmds On Your Own

Luckily, no. Most financial institutions will calculate the figure for you. For all my clients that have reached RMD age, my custodian calculates the RMD amount for my clients and then I contact the client to notify them of the amount.

Another thing to consider is that since it is a taxable distribution, your IRA custodian will most likely require you to sign a form to take out the money . If a form needs to be signed, dont procrastinate and wait till the last minute.

Read Also: When Can You Take 401k Out

The Rules For Accessing Your Money Are Determined By Your Employer’s Plan

Whether you can take regular withdrawals from your 401 plan when you retire depends on the rules for your employers plan. Two-thirds of large 401 plans allow retired participants to withdraw money in regularly scheduled installments — say, monthly or quarterly. About the same percentage of large plans allow retirees to take partial withdrawals whenever they want, according to the Plan Sponsor Council of America , a trade association for employer-sponsored retirement plans.

Other plans offer just two options: Leave the money in the plan without regular withdrawals, or take the entire amount in a lump sum. ‘s summary plan description, which lays out the rules, or call your company’s human resources office.) If those are your only choices, your best course is to roll your 401 into an IRA. That way, you won’t have to pay taxes on the money until you start taking withdrawals, and you can take money out whenever you need it or set up a regular schedule.

If your company’s 401 allows periodic withdrawals, ask about transaction fees, particularly if you plan to withdraw money frequently. About one-third of all 401 plans charge retired participants a transaction fee, averaging $52 per withdrawal, according to the PSCA.

Also Check: Can I Borrow Against My Fidelity 401k

When A Problem Occurs

The vast majority of 401 plans operate fairly, efficiently and in a manner that satisfies everyone involved. But problems can arise. The Department of Labor lists signs that might alert you to potential problems with your plan including:

- consistently late or irregular account statements

- late or irregular investment of your contributions

- inaccurate account balance

But Why Would I Max Out My Roth Ira Before My 401k If Its So Good

Theres a lot of nerdy debate in the personal finance sphere about this very question, but our position is based on taxes and policy.

Assuming your career goes well, youll be in a higher tax bracket when you retire, meaning that youd have to pay more taxes with a 401k. Also, tax rates will likely increase in the future.

The Ladder of Personal Finance is pretty handy when considering what to prioritize when it comes to your investments, but it is just a tool. For more about the Ladder of Personal Finance and how to make it work for you, check out THIS video where I explain it.

PRO TIP: The video is less than three minutes long. It is worth your time.

Don’t Miss: How To Invest My 401k Money

How Will You Invest Your Portfolio

Stocks in retirement portfolios provide potential for future growth, to help support spending needs later in retirement. Cash and bonds, on the other hand, can add stability and can be used to fund spending needs early in retirement. Each investment serves its own role, so a good mix of all threestocks, bonds and cashis important. We find that asset allocation has a relatively small impact on your first-year sustainable withdrawal amount, unless you have a very conservative allocation and long retirement period. However, asset allocation can have a significant impact on the portfolio’s ending asset balance. In other words, a more aggressive asset allocation may have the potential to grow more over time, but the downside is that the “bad” years can be worse than with a more conservative allocation.

Withdrawing From Your 401

The 401 is intended to be a retirement plan, so withdrawals are restricted in your younger years. There are a few exceptions, but most withdrawals before age 59 1/2 come with a 10% penalty.

Retirement withdrawals: You can start taking retirement withdrawals once you’ve reached age 59 1/2. You may be able to begin withdrawals at age 55 without penalty if you no longer work for the company. These withdrawals are taxed as ordinary income.

Required minimum distributions: If you don’t need the money, you can leave it in the account until you are 72. In the first quarter of the year after you turn 72, the IRS requires you to take taxable withdrawals annually. These are known as required minimum distributions, or RMDs. The amount of your 401 RMD for each year is based on your age and your year-end account balance.

401 loan: Your plan may allow you to borrow against your 401 balance, which would not incur a penalty. You do pay interest on the loan however, youre paying interest to yourself. And, if you change jobs, you normally must repay the loan by the time your next tax return is due.

Understand all the ways you can take money out of your 401

Also Check: How To Cash In 401k

Traditional Ira Vs Roth Ira

Like traditional 401 distributions, withdrawals from a traditional IRA are subject to your normal income tax rate in the year when you take the distribution.

Withdrawals from Roth IRAs, on the other hand, are completely tax free if they are taken after you reach age 59½ and see out a five-year holding period. However, if you decide to roll over the assets in a traditional 401 to a Roth IRA, you will owe income tax on the full amount of the rolloverwith Roth IRAs, you pay taxes up front.

Traditional IRAs are subject to the same RMD regulations as 401s and other employer-sponsored retirement plans. However, there is no RMD requirement for a Roth IRA, which can be a significant advantage during retirement.

Retirement Spending Calculator Required Assumption

The second most important assumption to your retirement spending calculation is your budget requirement. Your budget determines how much you will spend each month and also determines how much money you must save to support that spending.

Conventional wisdom claims you should plan to save enough money to replace 60 percent to 80 percent of your working income in retirement. Again, this assumption is fraught with controversy.

Early retirees frequently increase spending to support an active lifestyle of travel, hobbies, and personal interests. Other retirees have much less expensive retirement interests and require less spending.

In short, rules-of-thumb are just rough guidelines. Instead, look closely at your plans for retirement before placing a spending assumption based on your actual plans in the retirement withdrawal calculator. Try to make it as accurate as possible .

Finally, don’t forget to take into consideration inflation on spending and distributions because inflation can have a dramatic, long-term, compound effect. With that said, research shows the average retiree spends roughly 25% less with each progressive decade of retirement following age 65, thus largely offsetting inflation and making a static spending estimate surprisingly reasonable.

Recommended Reading: How To Take My Money Out Of 401k

Asset Allocation Can Have A Big Impact On A Portfolios Ending Balance

Assumes a constant asset allocation, a 75% confidence level, and withdrawals growing by a constant 2.47% over 30 years. Assumes a starting balance of $1 million. Confidence level is defined as the number of times the portfolio ended with a balance greater than zero. See disclosures for additional disclosures on allocations and capital market estimates. The example is hypothetical and provided for illustrative purposes only. It is not intended to represent a specific investment product and the example does not reflect the effects of taxes or fees.

Remember, choosing an appropriate mix of investments may not be just a mathematical decision. Research shows that the pain of losses exceeds the pleasure in gains, and this effect can be magnified in retirement. Picking an allocation you’re comfortable with, especially in the event of a bear market, not just the one with the greatest possibility to increase the potential ending asset balance, is important.

Your Employer’s Contribution Limit

Some employers may have a set limit for the percentage you can contribute toward your 401 each paycheck and, depending on how much you get paid, maxing out your employer’s limit may still not be enough for you to max out the federal contribution limit.

For example, a company may allow employees to contribute up to 50% of their paycheck to their 401 account . Or, they may allow up to a 20% contribution per paycheck. It depends on your company, so be sure to double check.

If you’re maxing out your employer’s contribution limit but you still worry that it’s not enough to help you reach your retirement goals, you can also contribute your post-tax income to a Roth IRA account.

A Roth IRA is another type of retirement account but with slightly different rules s which differ from a Roth IRA). You must open the account on your own is). And instead of contributing pre-tax dollars that you’re taxed on when you make withdrawals in retirement, you contribute after-tax dollars and won’t pay taxes on withdrawals later on.

Also, the contribution limits for an IRA are different from that of a 401 you can contribute up to $6,000 per year to a Roth IRA if you’re under age 50, and $7,000 per year if you’re age 50 or older.

Recommended Reading: How Do I Close Out My 401k Account

Beginning At Age 705 You Must Withdraw Money From Your Retirement Accounts

If you have money in an individual retirement account, once you turn 70.5, the Internal Revenue Service requires that you withdraw money from this account every year, even if you still work.

In effect, just after you turn 70, the IRS requires you to stop saving all your money in your individual retirement account IRA or most other employer-based retirement accounts, such as 401, 403 and 457 plans. You must withdraw it over time. Unfortunately, when you withdraw the money, the government gets to tax it. Remember that any money that you put into these accounts went in tax-free, before taxes. And, any money in an IRA can appreciate without any taxes on the appreciation until you withdraw the money.

Heres more from Just Care:

Read Also: When Can You Take Out 401k Without Penalty

For Financial Independence In Retirement

The 401 makes it easy to build wealth for retirement. Once you set your preferences, the work of saving and investing happens behind the scenes. Plus, you have tax savings and, possibly, matching contributions that expedite your savings momentum.

Here’s what it comes down to: The earlier you start contributing to a 401, the more you’ll get from its benefits and the richer you can be when you retire.

Read Also: Can You Withdraw From 401k

Other Factors Affecting Social Security Benefits

In some cases, other types of retirement income may affect your benefit amount, even if you collect benefits on your spouse’s account. Your benefits may be reduced to account for the income you receive from a pension based on earnings from a government job or from another job for which your earnings were not subject to Social Security taxes. This primarily affects people working in state or local government positions, the federal civil service, or those who have worked for a foreign company.

If you work in a government position and receive a pension for work not subject to Social Security taxes, your Social Security benefits received as a spouse or widow/widower are reduced by two-thirds of the amount of the pension. This rule is called the government pension offset .

For example, if you are eligible to receive $1,200 in Social Security but also receive $900 per month from a government pension, your Social Security benefits are reduced by $600 to account for your pension income. This means your Social Security benefit amount is reduced to $600, and your total monthly income is $1,500.

The windfall elimination provision reduces the unfair advantage given to those who receive benefits on their own account and receive income from a pension based on earnings for which they did not pay Social Security taxes. In these cases, the WEP simply reduces Social Security benefits by a certain factor, depending on the age and birth date of the applicant.

Consider The Role Of Guaranteed Income5

Choosing the right withdrawal rate can improve your odds of success, but it won’t guarantee that you won’t run out of money. Some products, like annuities, do offer that guarantee.5 While investing always involves risk, some insurance products guarantee a stream of income until death, thus eliminating the risk of outliving that portion of your savings. Of course, there are trade-offs: Most annuities restrict or even eliminate your access to your assets, and are subject to the claims-paying ability of their issuers. Still, this is one way to deal with the lifetime income challenge, particularly when it comes to essential expenses.

You May Like: Do Part Time Employees Get 401k

When Must I Start Taking Required Minimum Distributions

Many taxpayers wont have to take their first RMDs until April 1 of the year after they reach age 72, but the rule wasnt always this generous.

It was age 70½ before the passage of the Setting Up Every Community for Retirement Enhancement Act in December 2019. Anyone who is covered by the old rules has already begun paying RMDs and must continue to do so. Everyone else can wait until April 1 of the year following the year in which they reach age 72.

If you wait until the last minute for your first RMD, you will effectively have to take two RMDs in the same calendar year. Thats because the deadline for your first RMD is April 1, but all subsequent RMDs are due December 31. Therefore, if you turn 72 in 2021 wait until March 31, 2022 to make your first RMD, youll have to take another RMD in December 2022.

What Is A 401

A 401 is a retirement plan offered by some employers. These plans allow you to contribute directly from your paycheck, so theyre an easy and effective way to save and invest for retirement. There are two main types of 401s:

-

A traditional 401: This is the most common type of 401. Your contributions are made pre-tax, and they and your investment earnings grow tax-deferred. Youll be taxed on distributions in retirement.

-

A Roth 401: About half of employers who offer a 401 offer this variation. Your contributions are made after taxes, but distributions in retirement are not taxed as income. That means your investment earnings grow federally tax-free.

Recommended Reading: Can I Access My 401k If I Lose My Job

Why Should I Use One

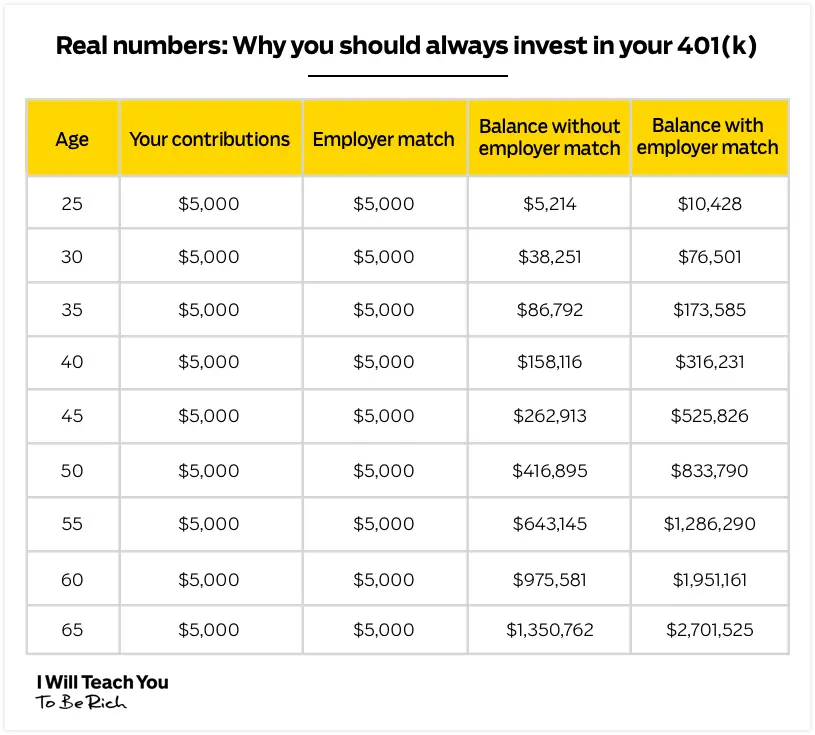

Matching dollars, for one thing. Over 90% of employers that offer a 401 plan also kick in a company match, which means as you contribute, your employer will, too. Commonly, that match will be worth 50% to 100% of your contributions, up to a limit that typically falls between 3% and 6% of your annual salary. If your employer offers up this free money, a good rule of thumb is to do everything you can to contribute enough to take advantage of it.

The other huge benefit of the 401 is that it allows you to put a lot of money away for retirement in a tax-advantaged way. The annual 401k contribution limit is $20,500 for tax year 2022, with an extra $6,500 allowed as a catch-up contribution every year for participants age 50 or older.

Can I Retire At 62 With $400000 In 401k

Shawn Plummer

CEO, The Annuity Expert

Can I Retire at 62 with $400,000 in a 401k? This guide will show you how to retire on $400,000, step-by-step. Well provide estimates on your retirement income at different age brackets.

If you are close to transitioning to retirement, check our Retirement Planning Guide.

If you are not close to transitioning to retirement, check out our Guaranteed Retirement Income Guide.

Use an annuity calculator to get a better idea of the retirement income generated.

This guide will answer the following questions:

- Can I retire at 62?

Don’t Miss: How Can I Check My 401k Online

Withdrawing From Your 401 Before Age 55

You have two options if you’re younger than age 55 and if you still work for the company that manages your 401 plan. This assumes that these options are made available by your employer. You can take a 401 loan if you need access to the money, or you can take a hardship withdrawal., but only from a current 401 account held by your employer. You can’t take loans out on older 401 accounts.

However, you can roll the funds over to an IRA or another employer’s 401 plan if you’re no longer employed by the company. But these plans must accept these types of rollovers.

Think twice about cashing out. You’ll lose valuable creditor protection that stays in place when you keep the funds in your 401 plan at work. You could also be subject to a tax penalty, depending on why you’re taking the money.