Leaving Work With An Unpaid Loan

Suppose you take a plan loan and then lose your job. You will have to repay the loan in full. If you don’t, the full unpaid loan balance will be considered a taxable distribution, and you could also face a 10% federal tax penalty on the unpaid balance if you are under age 59½. While this scenario is an accurate description of tax law, it doesn’t always reflect reality.

At retirement or separation from employment, many people often choose to take part of their 401 money as a taxable distribution, especially if they are cash-strapped. Having an unpaid loan balance has similar tax consequences to making this choice. Most plans do not require plan distributions at retirement or separation from service.

People who want to avoid negative tax consequences can tap other sources to repay their 401 loans before taking a distribution. If they do so, the full plan balance can qualify for a tax-advantaged transfer or rollover. If an unpaid loan balance is included in the participant’s taxable income and the loan is subsequently repaid, the 10% penalty does not apply.

The more serious problem is to take 401 loans while working without having the intent or ability to repay them on schedule. In this case, the unpaid loan balance is treated similarly to a hardship withdrawal, with negative tax consequences and perhaps also an unfavorable impact on plan participation rights.

Request A Hardship Withdrawal

In certain circumstances you may qualify for whats known as a hardship withdrawal and avoid paying the 10% early distribution tax. While the IRS defines a hardship as an immediate and heavy financial need, your 401 plan will ultimately decide whether you are eligible for a hardship withdrawal and not all plans will offer one. According to the IRS, you may qualify for a hardship withdrawal to pay for the following:

- Medical care for yourself, your spouse, dependents or a beneficiary

- Costs directly related to the purchase of your principal residence

- Tuition, related educational fees and room and board expenses for the next 12 months of postsecondary education for you, your spouse, children, dependents or beneficiary

- Payments necessary to prevent eviction from your principal residence or foreclosure on the mortgage on that home

- Funeral expenses for you, your spouse, children or dependents

- Some expenses to repair damage to your primary residence

Although a hardship withdrawal is exempt from the 10% penalty, income tax is owed on these distributions. The amount withdrawn from a 401 is also limited to what is necessary to satisfy the need. In other words, if you have $5,000 in medical bills to pay, you may not withdraw $30,000 from your 401 and use the difference to buy a boat. You might also be required to prove that you cannot reasonably obtain the funds from another source.

Should You Get A 401 Loan

Whether a 401 loan is the right for you depends on your situation. For some borrowers, especially those with poor credit, a 401 loan can help you avoid high-interest debt. As long as you can afford to repay the loan, its generally better to be paying interest to yourself than to someone else.

But 401 loans arent without risks, the greatest being that if you cant afford to repay the loan or leave your job early, you may have your loan converted to an early withdrawal. These carry the same possible 10% penalty and tax consequences as any other early withdrawal from a 401.

Youre also potentially missing out on up to five years of investment gains, depending on the length of your 401 loan. Remember that over the long term, the S& P 500 has gained an average of about 10% every year. While you could get lucky and make your 401 loan during an extended dip or recession, the longer your money is out, the more growth you may miss.

Before taking a loan from your 401, be sure to consider all other options, like emergency funds, taxable investment accounts, low-cost loans from personal lenders, HELOCs if you have home equity or any 0% APR credit cards you may be eligible for. While a 401 loan can make sense in some circumstances, its not the best choice for everyone.

You May Like: What Should My 401k Contribution Be

What Hardship Withdrawals Will Cost You

Hardship withdrawals hurt you in the long run when it comes to saving for retirement. You’re removing money you’ve set aside for your post-pay-check years and losing the opportunity to use it then, and to have it continue to appreciate in the meantime. You’ll also be liable for paying income tax on the amount of the withdrawaland at your current rate, which may well be higher than you’d have paid if the funds were withdrawn in retirement.

If you are younger than 59½, it’s also very likely you’ll be charged at 10% penalty on the amount you withdraw.

Withdrawing From A Roth 401k

Most 401k plans involve pre-tax contributions, but some allow for Roth contributions, meaning those made after taxes already have been paid.

The benefit of making a Roth contribution to your 401k plan is that you already have paid the taxes and, when you withdraw the money, there is no tax on the amount gained as long as you meet these two provisions:

- You withdraw the money at least five years after your first contribution to the Roth account

- You are older than 59 ½ or you became disabled or the money goes to someone who is the beneficiary after your death

You May Like: Can You Have Your Own 401k

Why Do People Get 401 Loans

As long as a plan allows it, participants generally can borrow from their 401 for any reason. Some plans may only allow loans for specific reasons, so be sure to check your plans rules before trying to borrow.

Since youre borrowing your own money, and no credit check is involved, it may be easier to get approved for a 401 loan as long as you meet the plans requirements for borrowing. In some cases, a requirement may be getting approval from your spouse , because your spouse may be entitled to half of your retirement assets if you divorce.

Here are some potential uses for a 401 loan.

- Paying household bills and expenses

- Funding a down payment on a house

- Paying off high-interest debt

- Paying back taxes, or money owed to the IRS

- Funding necessary home repairs

- Paying education expenses

But that doesnt mean 401 loans are always a good idea. In fact, there are some major risks that come with borrowing from your retirement savings. Here are two.

What Are The Terms Of A 401 Loan

The terms of a 401 are usually set by the planâs administrator. However, there are some IRS regulations that must be followed in order to stay compliant.

The IRS caps 401 loan amounts to the lesser of $50,000 or 50% of the 401 account balance. Additionally, the IRS requires 401 loans to be repaid within a five-year term. However, due to the COVID-19 pandemic and the subsequent legislation to help Americanâs that five-year term has been extended to six years. Itâs essential to check the most recent information or discuss it with your planâs administrator if you can extend the repayment term length.

The interest rate on a 401 is typically a point or two above the prime interest rate at the time of application. Remember, the interest you repay towards your 401 loan goes back into your 401 account. Think of it as youâre paying yourself back as the bank for taking the loan out.

Lastly, your planâs administrator may charge fees for you to take out a 401 loan from their plan. Typical origination fees range between $50 and $100. Some 401 plans charge a monthly maintenance fee throughout the term of the 401 loan of $25 to $50.

Don’t Miss: How Much Does A Solo 401k Cost

Home Equity Line Of Credit

Instead of fixed-term repayment, you get a variable repayment and interest rate. You may opt for an interest-only repayment, but most often that comes loaded with a balloon payment, Poorman says, and may be tough to afford. Keep in mind that with a variable interest rate loan, you could see your rates go up over time.

Disadvantages Of Closing Your 401k

Whether you should cash out your 401k before turning 59 ½ is another story. The biggest disadvantage is the penalty the IRS applies on early withdrawals.

First, you must pay an immediate 10% penalty on the amount withdrawn. Later, you must include the amount withdrawn as income when you file taxes. Even further down the road, there is severe damage on the long-term earning potential of your 401k account.

So, lets say at age 40, you have $50,000 in your 401k and decide you want to cash out $25,000 of it. For starters, the 10% early withdrawal penalty of $2,500 means you only get $22,500.

Later, the $25,000 is added to your taxable income for that year. If you were single and making $75,000, you would be in the 22% tax bracket. Add $25,000 to that and now youre being taxed on $100,000 income, which means youre in the 24% tax bracket. That means youre paying an extra $6,000 in taxes.

So, youre net for early withdrawal is just $16,500. In other words, it cost you $8,500 to withdraw $25,000.

Beyond that, you reduced the earning potential of your 401k account by $25,000. Measured over 25 years, the cost to your bottom line would be around $100,000. That is an even bigger disadvantage.

Don’t Miss: Why Cant I Take A Loan From My 401k

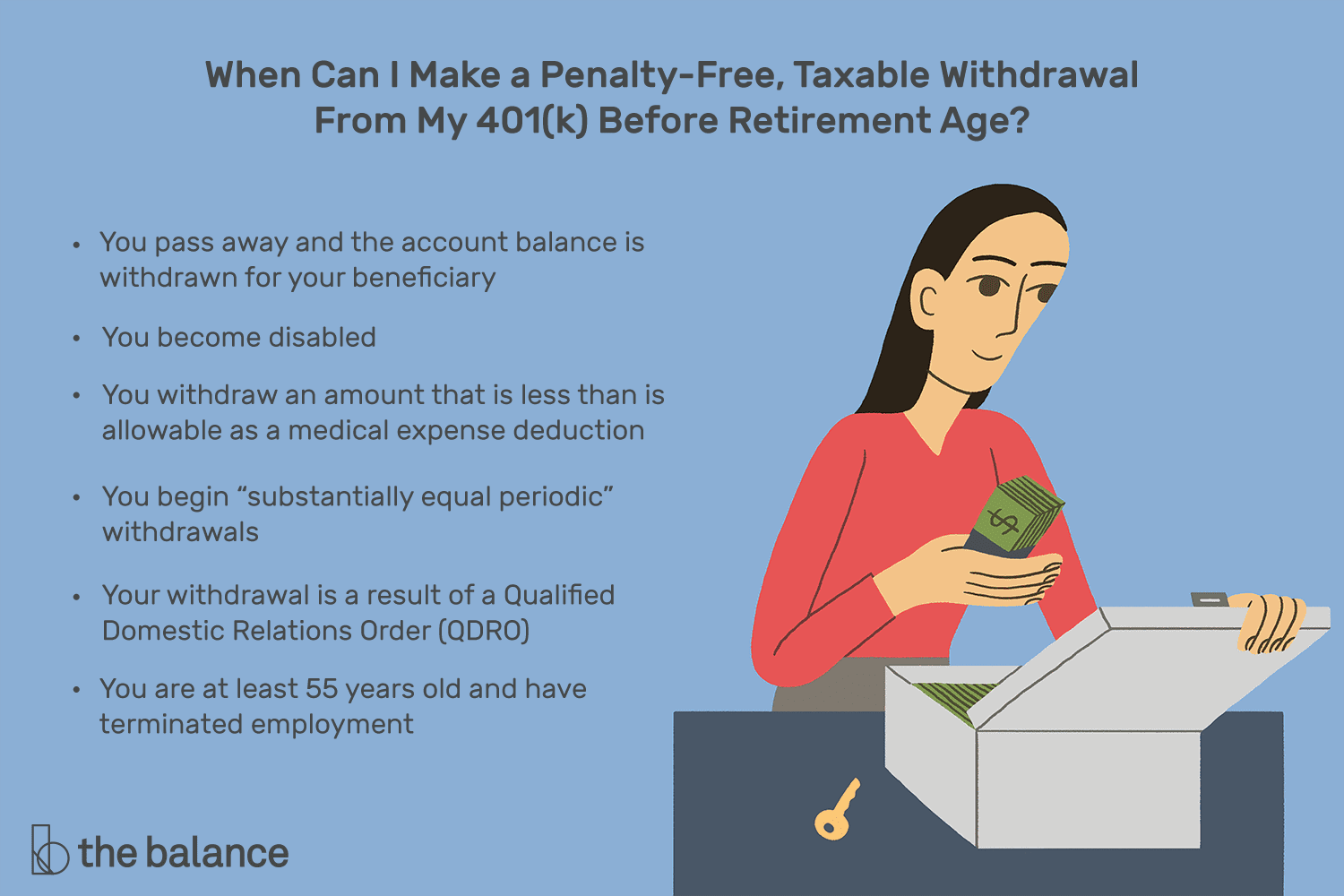

Eligibility For A Hardship Withdrawal

The Internal Revenue Service ‘s immediate and heavy financial need stipulation for a hardship withdrawal applies not only to the employee’s situation. Such a withdrawal can also be made to accommodate the need of a spouse, dependent, or beneficiary.

Immediate and heavy expenses include the following:

- Certain medical expenses

- Home-buying expenses for a principal residence

- Up to 12 months worth of tuition and fees

- Expenses to prevent being foreclosed on or evicted

- Burial or funeral expenses

- Certain expenses to repair casualty losses to a principal residence

You wont qualify for a hardship withdrawal if you have other assets that you could draw on to meet the need or insurance that will cover the need. However, you needn’t necessarily have taken a loan from your plan before you can file for a hardship withdrawal. That requirement was eliminated in the reforms, which were part of the Bipartisan Budget Act passed in 2018.

The $2-trillion coronavirus emergency stimulus bill signed into law on March 27, 2020, allows those affected by the coronavirus situation a hardship distribution to $100,000 without the 10% penalty those younger than 59½ normally owe account owners have three years to pay the tax owed on withdrawals, instead of owing it in the current year.

What Is A Plan Offset Amount And Can It Be Rolled Over

A plan may provide that if a loan is not repaid, your account balance is reduced, or offset, by the unpaid portion of the loan. The unpaid balance of the loan that reduces your account balance is the plan loan offset amount. Unlike a deemed distribution discussed in , above, a plan loan offset amount is treated as an actual distribution for rollover purposes and may be eligible for rollover. If eligible, the offset amount can be rolled over to an eligible retirement plan. Effective January 1, 2018, if the plan loan offset is due to plan termination or severance from employment, instead of the usual 60-day rollover period, you have until the due date, including extensions, for filing the Federal income tax return for the taxable year in which the offset occurs.

You May Like: When Can I Withdraw From 401k

Also Check: How To Rollover 401k Into Fidelity

What Are Some Alternatives To A 401 Loan

When cash is tight, borrowing from your 401 plan and paying yourself interest may seem like a good idea. But before you borrow, weigh all your options. Here are a few.

How To Take Money Out Of Your 401

There are many different ways to take money out of a 401, including:

- Withdrawing money when you retire: These are withdrawals made after age 59 1/2.

- Making an early withdrawal: These are withdrawals made prior to age 59 1/2. You may be subject to a 10% penalty unless your situation qualifies as an exception.

- Making a hardship withdrawal: These are early withdrawals made because of immediate financial need. You may be still be penalized for them.

- Taking out a 401 loan: You can borrow against your 401 and will not incur penalties as long as you repay the loan on schedule.

- Rolling over a 401: If you leave your job, you can move your 401 into another 401 or IRA without penalty as long as the funds are moved over within 60 days of your distribution.

Don’t Miss: Should I Move My 401k To Bonds 2020

Here’s What To Do When Your 401 Is Losing Money

Generally, the best move to make when you see your 401 balance go down is to do nothing at all.

This advice generally echoes investment experts’ guidance when any of your investments are affected by market downturns. Investing is a long-term game you take the short-term dips in exchange for the potential long-term growth, which, history has shown us, is what happens. Though past performance does not predict future performance, historically, any short-term losses have typically been outweighed by larger long-term gains.

“In the long run, stock prices are the world’s way of appraising the value of the underlying companies,” Winsett explains. “In the short term, prices can be chaotically random but over time, prices are firmly rooted in the real value of real companies whose products and services we use regularly, if not daily.”

Making an impulsive move like panic selling your 401 investments or withdrawing early from your 401 would have serious consequences. If you sell only to later jump back in the market, you may time it incorrectly and miss out on an upswing, or big recovery gains. Staying invested means as the market recovers, so, too, does your account balance. Dipping into your 401 funds before reaching the age of 59½, meanwhile, entails a 10% early withdrawal penalty on top of it being taxed.

What Are The Hardship Criteria

If your 401 plan allows for hardship withdrawals, it would be for one of the seven reasons below:

Read Also: Can First Time Home Buyers Use 401k

If You Need Cash Borrowing From Your 401 Can Be A Low

Provided your 401 plan permits loans, borrowing from your 401 may help you pay bills, fund a big purchase or make a down payment on a home.

But youll need to pay interest if you want to tap your retirement account. How much you can borrow right now may depend on whether youve been affected by the COVID-19 pandemic .

Well review how 401 loans and repayment works, as well as the temporary rules implemented by the Coronavirus Aid, Relief and Economic Security Act, or CARES Act.

Borrowing Against Your 401 Is It Ever A Good Idea

Many full-time and part time employees have the benefit of a company-matched retirement plan, referred to as a 401 for the part of the tax code authorizing it. These tax-deferred packages are the principal retirement vehicle for just over half of people in the United States. Americans put away about 6% of their pay in 401 plans to receive employee matching and tax breaks.

One feature many people dont realize about 401 funds is that the account holder can borrow against the balance of the account. About 87% of funds offer this feature. The account holder can borrow up to 50% of the balance or $50,000, whichever is lower, but the whole amount must be repaid within 5 years. Theres no approval process and theres no interest. Its basically a loan you give yourself, and is a popular enough option that 17% of millennial workers, 13% of Gen Xers and 10% of baby boomers have made loans against their 401 accounts.

Despite these benefits, borrowing against a 401 is a risky proposition. There are harsh penalties for failure to repay and taking money away from retirement savings is always risky. Borrowing from a 401 account should not be a decision that is made lightly.

As with most financial moves, there are benefits and disadvantages to borrowing from a 401. It can be difficult to sort through them, particularly if your need for money is acute and immediate. Before you borrow from a 401, though, ask yourself these four questions:

Also Check: Should I Transfer 401k From Previous Employer