How Much Tax Do I Pay On An Early 401 Withdrawal

The money will be taxed as regular income. That’s between 10% and 37% depending on your total taxable income.

In most cases, that money will be due for the tax year in which you take the distribution.

The exception is for withdrawals taken for expenses related to the coronavirus pandemic. In response to the coronavirus pandemic, account owners have been given three years to pay the taxes they owe on distributions taken for economic hardships related to COVID-19.

Rolling 401k Into Ira

When you leave an employer, you have several options for what to do with your 401k, including rolling it over into an IRA account.

Its possible to do the same thing while still working for an employer, but only if the rules governing your workplace 401k allow for it.

The negative for rolling the money into an IRA is that you cant borrow from a traditional IRA account.

Another option when you leave an employer is to simply leave the 401k account where it is until you are ready to retire. You also could transfer your old 401k into your new employers retirement account.

If you are at least 59 ½ years old, you could take a lump-sum distribution without penalty, but there would be income tax consequences.

Traditional Approach: Withdrawals From One Account At A Time

To help get a clearer picture of how this could work, lets take a look at a hypothetical example: Joe is 62 and single. He has $200,000 in taxable accounts, $250,000 in traditional 401 accounts and IRAs, and $50,000 in a Roth IRA. He receives $25,000 per year in Social Security and has a total after-tax income need of $60,000 per year. Lets assume a 5% annual return.

If Joe takes a traditional approach, withdrawing from one account at a time, starting with taxable, then traditional and finally Roth, his savings will last slightly more than 22 years and he will pay an estimated $69,000 in taxes throughout his retirement.

Withdrawing from one account at a time can produce a tax bump midway in retirement

Note that with the traditional approach, Joe hits an abrupt tax bump in year 8 where he pays over $5,000 in taxes for 11 years while paying nothing for the first 7 years and nothing when he starts to withdraw from his Roth account.

In this scenario, a proportional withdrawal strategy in retirement cuts taxes by almost 40%

Read Also: How To Take Out 401k Money For House

Also Check: When Can You Take Out 401k Without Penalty

Withdrawals After Age 59 1/2

Age 59 1/2 is the magic number when it comes to avoiding the penalties associated with early 401 withdrawals. You can take penalty-free withdrawals from 401 assets that have been rolled over into a traditional IRA when you’ve reached this age. You can also take a penalty-free withdrawal if your funds are still in the 401 plan, and you’ve retired.

You can take a withdrawal penalty-free if you’re still working after you reach age 59 1/2, but the rules change a bit. Check with the plan administrator about its specific rules if you’re still working at the company with which you have your 401 assets.

Your plan might offer an “in-service” withdrawal that allows you to access your 401 assets penalty-free, but not all plans offer this option. And remember, the withdrawal will still be subject to income taxes, even if it’s not penalized.

Withdrawing From A Roth 401k

Most 401k plans involve pre-tax contributions, but some allow for Roth contributions, meaning those made after taxes already have been paid.

The benefit of making a Roth contribution to your 401k plan is that you already have paid the taxes and, when you withdraw the money, there is no tax on the amount gained as long as you meet these two provisions:

- You withdraw the money at least five years after your first contribution to the Roth account

- You are older than 59 ½ or you became disabled or the money goes to someone who is the beneficiary after your death

Read Also: What Is Max Amount To Contribute To 401k

Don’t Miss: How To Rollover Vanguard 401k

Qualifications For Hardship Withdrawals

The IRS defines some criteria for a hardship withdrawal. These include:

- The withdrawal is due to an immediate and heavy financial need.

- The withdrawal is necessary to satisfy this immediate and heavy financial need. This means that you dont have another source of funds available to you that will allow you to meet this need.

- The amount of the hardship withdrawal cannot exceed the amount that you need to satisfy this financial need.

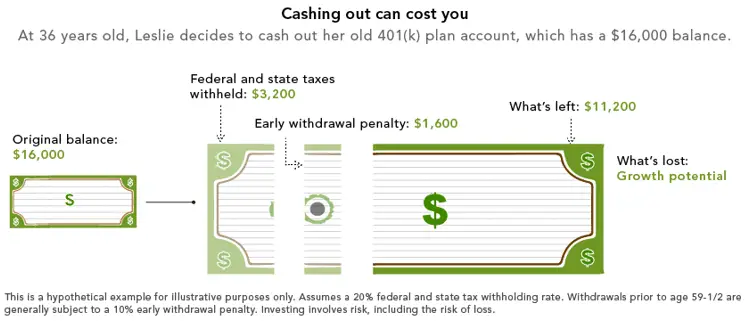

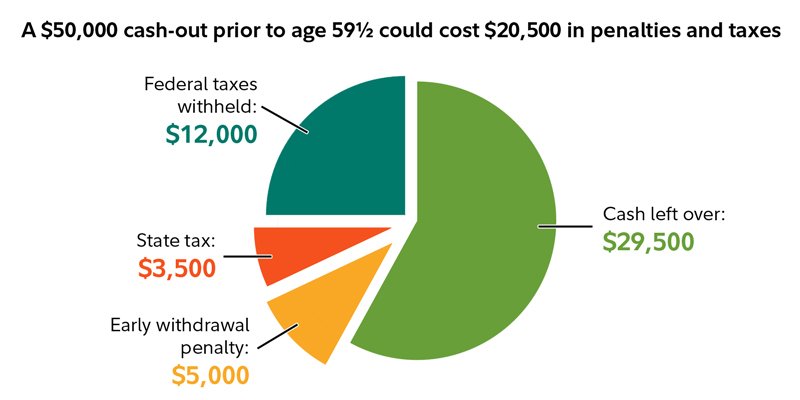

Withdrawing Money From A : Taking Cash Out Early Can Be Costly

An unexpected job loss, illness or other emergencies can wreak havoc on family finances, so its understandable that people may immediately think about taking a withdrawal from their 401. Tread carefully as the decision may have long-range ramifications impacting your dreams of a comfortable retirement.

Taking a withdrawal from your traditional 401 should be your very last resort as any distributions prior to age 59 ½ will be taxed as income by the IRS, plus a 10 percent early withdrawal penalty to the IRS. This penalty was put into place to discourage people from dipping into their retirement accounts early.

Roth contribution withdrawals are generally tax- and penalty-free contribution and youre 59 ½ or older). This is because the dollars you contribute are after tax. Be careful here because the five-year rule supersedes the age 59 ½ rule that applies to traditional 401 distributions. If you didnt start contributing to a Roth until age 60, you would not be able to withdraw funds tax-free for five years, even though you are older than 59 ½.

Recommended Reading: How To Pull From 401k

Also Check: How To Invest 401k Fidelity

Confirm A Few Key Details About Your 401 Plan

First, get together any information you have on your old 401. Its okay if you dont have a ton, but any details like an old account statement or an offboarding e-mail from your former HR team can help. 401 paperwork can be confusing, so just focus on identifying the following three items:

Why Can’t I Withdraw Funds From An Ira And Direct Them To Another Retirement Account

You can withdraw funds from an IRA and direct them to another retirement account, but this functionality is not available online.When you withdraw money from one IRA and contribute it to another, the transaction is called a 60-day rollover. A rollover typically occurswhen moving an IRA from one institution to another. For more information about account options, see Products > Retirement.

Also Check: What Age Can I Draw My 401k

Who Qualifies To Take A Cares Act 401k Withdrawal

To qualify for the tax penalty exemption:

- The account owner, their spouse, or dependent must have been diagnosed with COVID-19 by a CDC-approved test, or

- The account owner must have experienced adverse financial consequences as a result of COVID-19-related conditions. For example, adverse financial consequences might include a delayed start date for a job, a rescinded job offer, quarantine, lay off, job furlough, reduction in pay or hours, a reduction in self-employment income, the closing of a business, an inability to work due to lack of child care, or other factors.

The IRS explains those qualifications in more detail in Notice 2020-50, Guidance for Coronavirus-Related Distributions and Loans from Retirement Plans Under the CARES Act.

Alternatives To Tapping Your 401

If you must tap into retirement savings, it’s better to look at your other accounts firstspecifically IRAsespecially if you’re buying a first home .

Unlike 401s, IRAs have special provisions for first-time homebuyerspeople who haven’t owned a primary residence in the last two years, according to the IRS.

First, look to take a distribution from your IRAif you have one. You may be able to withdraw IRA contributions without penalty due to a qualified financial hardship. You can also withdraw up to $10,000 of earnings tax-free if the money is used for a first-time home purchase. As a first-time homebuyer, you can take a $10,000 distribution without owing the 10% tax penalty, although that $10,000 would be added to your federal and state income taxes. If you take a distribution larger than $10,000, a 10% penalty would be applied to the additional distribution amount. It also would be added to your income taxes.

Also Check: How To Rollover 401k When You Change Jobs

Keeping Your Money In A 401

You are not required to take distributions from your account as soon as you retire. While you cannot continue to contribute to a 401 held by a previous employer, your plan administrator is required to maintain your plan if you have more than $5,000 invested. Anything less than $5,000 will trigger a lump-sum distribution, but most people nearing retirement will have more substantial savings accrued.

If you have no need for your savings immediately after retirement, then theres no reason not to let your savings continue to earn investment income. As long as you do not take any distributions from your 401, you are not subject to any taxation.

If your account has $1,000 to $5,000, your company is required to roll over the funds into an IRA if it forces you out of the planunless you opt to receive a lump-sum payment or roll over the funds into an IRA of your choice.

How Do You Take A Withdrawal Or Loan From Your Fidelity 401

If you’ve explored all the alternatives and decided that taking money from your retirement savings is the best option, you’ll need to submit a request for a 401 loan or withdrawal. If your retirement plan is with Fidelity, log in to NetBenefits®Log In Required to review your balances, available loan amounts, and withdrawal options. We can help guide you through the process online.

Also Check: Do I Have A 401k From A Previous Employer

Exceptions To The Penalty

The IRS permits withdrawals without a penalty for certain specific uses. These include a down payment on a first home, qualified educational expenses, and medical bills, among other costs.

As with the hardship withdrawal, you will still owe the income taxes on that money, but you won’t owe a penalty.

How Many Vacation Days Do Bank Of America Employees Get

Bank of Americas PTO and Vacation policy typically gives 20-30 days off a year. Paid Time Off is Bank of Americas 2nd most important benefit besides Healthcare when ranked by employees, with 28% of employees saying it is the most important benefit.

Recommended Reading: How Many Loans Can I Take From My 401k

Also Check: How Much Can Be Put Into A 401k Per Year

Withdrawals After Age 72

Many people continue to work well past age 59 1/2. They delay their 401 withdrawals, allowing the assets to continue to grow tax-deferred. But the IRS requires that you begin to take withdrawals known as required minimum distributions by age 72.

Those who are owners of 5% or more of a business can defer taking their RMDs while theyre still working, but the plan must have made this election. This only applies to the 401 of your current employer. RMDs for all other retirement accounts still must be taken.

If I Place A Request For An Ira Withdrawal After December 15 Will My Withdrawal Be Processed For The Current Or Next Year For Whatyear Will This Withdrawal Be Reportable

The IRS refers to the date a withdrawal is processed to determine the year to which it is applicable. The amount oftime it takes for an IRA withdrawal request to be processed varies by the withdrawal method selected .

If your IRA withdrawal affects your taxes or is intended to satisfy your minimum required distribution for the current year, make sure that:

- You allow adequate processing time. Submit your online request by December 15thof the current year

- Your brokerage IRA Core account has sufficient funds to cover the withdrawal

- You are not requesting a second brokerage IRA withdrawal on the sameday, or if an earlier request is still pending

- You are not requesting a second IRA withdrawal from the same mutual fund ina mutual fund IRA when there is another request pending for the same mutual fund

If you are requesting a distribution after December 15, please call a Fidelity representative at 800-544-6666 to determine the best wayto process your IRA distribution to satisfy any applicable deadlines.

Don’t Miss: Can You Move Money From Ira To 401k

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most how to save for retirement, understanding the types of accounts, how to choose investments and more so you can feel confident when planning for your future.

How To Close A Fidelity 401k

Although closing a Fidelity 401 account before you reach retirement age is not difficult, you need to understand the tax implications, which are the same regardless of whether you’re switching jobs or facing a dire financial situation. First, the plan administrator will deduct and send 30 percent of the proceeds to the Internal Revenue Service. Of this amount, 20 percent is federal income tax withholding and 10 percent is a penalty fee. You’ll also be responsible for paying state income tax and any federal tax that the withheld amount doesn’t cover.

Don’t Miss: What To Do With 401k Upon Retirement

What’s The Maximum I Can Request To Withdraw From My Account

The maximum you can request to withdraw from your account online or by telephone is $100,000 per account. To request a withdrawal greater than $100,000, you must complete a paper form. You can obtain a copy of that form by going to Customer Service > Find a Form, or by contacting a Fidelity representative at 800-544-6666. If you’ve changed your mailing address within the past 15 days, the most you can request to withdraw by check online or by telephone is $10,000.

Is Your 401k A Security Blanket

Most of us look at our 401k as a security blanket â something that we intend to pull out when we are suffering in the cold. There are a number of financial hardships that might tempt you to consider taking an early withdrawal:

- Urgent medical emergencies

- Rising college tuition costs

- Pressing home improvement needs

This 401k withdrawal calculator will help you decide whether to take a lump-sum distribution or to rollover to a tax-deferred account. Its side-by-side comparison of data gives you the information you need to make a decision that is right for you.

Also Check: Can I Roll An Old 401k Into A New One

What Are The Pros And Cons Of Withdrawal Vs A 401 Loan

A withdrawal is a permanent hit to your retirement savings. By pulling out money early, youll miss out on the long-term growth that a larger sum of money in your 401 would have yielded.

Though you wont have to pay the money back, you will have to pay the income taxes due, along with a 10% penalty if the money does not meet the IRS rules for a hardship or an exception.

A loan against your 401 has to be paid back. If it is paid back in a timely manner, you at least wont lose much of that long-term growth in your retirement account.

Request A Hardship Withdrawal

In certain circumstances you may qualify for whats known as a hardship withdrawal and avoid paying the 10% early distribution tax. While the IRS defines a hardship as an immediate and heavy financial need, your 401 plan will ultimately decide whether you are eligible for a hardship withdrawal and not all plans will offer one. According to the IRS, you may qualify for a hardship withdrawal to pay for the following:

- Medical care for yourself, your spouse, dependents or a beneficiary

- Costs directly related to the purchase of your principal residence

- Tuition, related educational fees and room and board expenses for the next 12 months of postsecondary education for you, your spouse, children, dependents or beneficiary

- Payments necessary to prevent eviction from your principal residence or foreclosure on the mortgage on that home

- Funeral expenses for you, your spouse, children or dependents

- Some expenses to repair damage to your primary residence

Although a hardship withdrawal is exempt from the 10% penalty, income tax is owed on these distributions. The amount withdrawn from a 401 is also limited to what is necessary to satisfy the need. In other words, if you have $5,000 in medical bills to pay, you may not withdraw $30,000 from your 401 and use the difference to buy a boat. You might also be required to prove that you cannot reasonably obtain the funds from another source.

You May Like: How Do I Transfer My 401k To A Roth Ira

Read Also: How To Use Your 401k