Why Does Slavic401k Reimburse All Revenue Paid By The Funds

What Could Be The Cost Of Missed Retirement Savings

A report from the National Institute on Retirement Security found that 95% of millennials arent saving enough for retirement. And a 2017 study from Wells Fargo shows that other generations arent faring much better. So if youve been trying to beat the odds and put aside adequate savings for retirement, taking out a 401 loan can be a triple whammy.

First, some plans dont allow participants to make plan contributions while they have an outstanding loan. If it takes five years for you to repay your loan, that could mean five years without adding to your 401 account. During that time, you may be failing to grow your nest egg and youll miss out on the tax benefits of contributing to a 401.

Next, if your employer offers matching contributions, youll miss out those during any years you arent contributing to the plan. Loan repayments arent considered contributions, so if the employer contribution is dependent upon your participation in the plan, you may be out of luck if you cant make contributions while you repay the loan.

And finally, your account will miss out on investment returns on the money youve borrowed. Although you do earn interest on the loan, in a low-interest-rate environment you could potentially earn a much better rate of return if the money was invested in your 401.

What are the tax benefits of 401s?

How Much Can I Borrow On Margin

While margin can provide flexibility by not locking you into a fixed monthly principal repayment plan, it’s important to understand the amount available to borrow is dependent on the type and value of your eligible securities, which may fluctuate over time. And of course, even without scheduled principal repayments there will still be interest assessed on the loan, so you’ll need to be sure that you have sufficient funds available to cover this interest expense. Find out more about eligibility

Don’t Miss: Can You Rollover A 401k Into An Annuity

Instructions For Loan Application From The Msu 403 Retirement Plan

Please read the following information and instructions carefully, as the requirements for loans have changed.

Effective January 1, 2009, loans are available to active MSU employees from the 403 Retirement Plan . The minimum loan amount is $1,000. Employees may have a maximum of two MSU 403 Retirement Plan loans outstanding at one time. An employee who at any time has defaulted on a loan from the MSU Plan will not be eligible to receive another loan from the Plan unless the defaulted loan is repaid in full. Fidelity is the only MSU approved investment vendor allowed to issue new loans. If you do not have an account with Fidelity, please review step 4 below for further detail. Loans are only available for specific purposes, which are listed in step 1.

Making A 401 Withdrawal For A Home

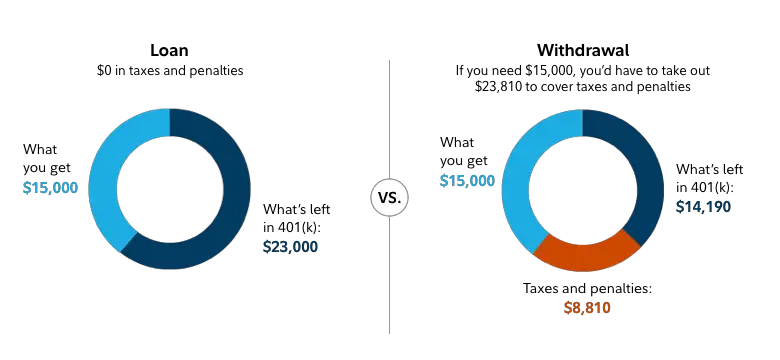

Compared to a loan, a withdrawal seems like a much more straightforward way to get the money you need to buy a home. The money doesnât have to be repaid and youâre not limited in the amount you can withdraw, which is the case with a 401 loan. Withdrawing from a 401 isnât as easy as it seems, though.

The first thing to understand is that your employer may not even allow withdrawals from your 401 plan due to age. If they do allow employees to tap 401 funds early, you may have to prove that youâre experiencing a financial hardship before theyâll allow a withdrawal. Under the IRS rules, consumer purchases generally donât fit the hardship guidelines.

You may be able to withdraw funds from a 401 plan that youâve left behind at a previous employer and havenât rolled over to your new 401. This, however, is where things can get tricky.

If youâre under age 59 1/2 and decide to cash out an old 401, youâll owe both a 10% early withdrawal penalty on the amount withdrawn and ordinary income tax. Your plan custodian will withhold 20% of the amount withdrawn for taxes. If you withdraw $40,000, $8,000 would be set aside for taxes upfront, and youâd still owe another $4,000 as an early-withdrawal penalty.

Recommended Reading: Can You Transfer 401k To Roth Ira

Borrowing Against 401k Answer:

While securities based lines of credit may be an easy way to access extra cash, it is important to recognize that the IRS rules dont allow you to pledge your 401k assets as collateral for a personal loan.

Instead of using a 401 account as collateral, you can borrow the money that you need from the 401 account if the Solo 401k plan documents allow for 401k participant loans.

The maximum amount that the plan can permit as a loan is the greater of $10,000 or 50% of your vested account balance, or $50,000, whichever is less.

For example, if your Solo 401k brokerage account at Fidelity has an account balance of $40,000, the maximum amount that you can borrow from the account is $20,000. There are important technical requirements that apply to Solo 401k participant loans including specific documentation & repayment requirements. Therefore, dont just take the funds out of your Fidelity brokerage account but be sure to coordinate the loan with your Solo 401k plan provider in advance.

For more on the Solo 401k loan requirements, click HERE.

Recommended Reading: Can I Roll A 401k Into A Roth Ira

How To Pay Down 401 Loan Quickly

If you are planning to pay off the 401 loan early, the first thing you should do is to check your plan document and loan policy to see what is allowed. Some plans allow 401 prepayments if the participant plans to pay off the outstanding balance either as one lump-sum payment or as additional payments above the regular periodic payments.

Depending on what your 401 plan allows, you can increase the periodic payments or set aside the extra payments in a savings account until you have accumulated enough balance to pay off the loan in full. If your employer only allows loan payments via payroll deductions, you must adjust the withholding to increase the regular payments. On the other hand, if the employer accepts checks, you can make a lump-sum payment using a check to clear the outstanding balance.

Recommended Reading: What Percentage Should I Be Putting In My 401k

K Withdrawal Rules: How To Avoid Penalties

401k plans, IRAs and other tax-advantaged retirement savings accounts are common ways to save for retirement, and millions of Americans pour money into them every year. Its generally wise to avoid withdrawing money from your 401k, as there are often hefty penalties and taxes to consider for early withdrawals.

Sometimes, however, unplanned circumstances force people to withdraw funds from their 401k early. So if you find yourself in a place where you need to tap your retirement funds early, here are some rules to be aware of and some options to consider.

Withdrawals For Early Retirees

The IRS has a special rule for people who are forced to leave their job or who retire or quit at age 55 or older. In this case, the IRS waives the 10 percent penalty for taking a 401 withdrawal before age 59 1/2. The 401 withdrawal is still taxable as a normal distribution and cannot be rolled over to an IRA to avoid taxes.

Read Also: How To Find Lost 401k

What Is A 401 Loan

If your employer provides a 401 retirement savings plan, it may choose to allow participants to borrow against their accounts although not every plan will let you do so. Borrowing from your own 401 doesnt require a credit check, so it shouldnt affect your credit.

As long as you have a vested account balance in your 401, and if your plan permits loans, you can likely be allowed to borrow against it. Just like with any other loan, youll need to repay a loan from your 401 with interest within a set time frame.

Create A Structured Plan For Repayment

Not all employers offer an automatic option to repay a 401 loan. In some cases, the employee is solely responsible for making loan repayments, and this creates a risk of the borrower falling back on loan repayments. If you do not have an automatic loan repayment option, you should create a structured plan on how you are going to repay the 401 loan in full.

Start by examining your budget to see how much remains to spend after paying all household bills and outstanding debts. If you know the 401 loan term, you can decide how much you will be paying each month to repay the entire 401 loan ahead of the required period. If your 401 plan only allows prepayments in one lump-sum payment, you can set aside the payments in a savings account every month until you have accumulated enough savings to pay off the 401 loan.

Recommended Reading: Can Anyone Open A 401k

Will A 401 Loan Affect My Credit

Taking out a 401 loan has no direct impact on your credit scores.

- You dont need a credit check to qualify for a 401 loan, so taking one out doesnt trigger a hard inquiry and result in a temporary dip in credit scores.

- Payments on 401 loans are not tracked by the national credit bureaus , so they do not appear in your credit reports and cannot factor into credit score calculations. If you miss a payment or even default on the loan, your credit scores will not change.

Note, however, that the extra tax and penalty expenses that come with a 401 loan default can make it difficult to pay your credit bills, which can jeopardize your credit standing indirectly.

How The Coronavirus Changed 401 Loans

The CARES Act that was signed into law last month doubles the amount you can borrow from your 401 or 403 to $100,000, or up to 100% of your account, whichever is lower.

Borrowers also can defer loan payments for a year. So you essentially have six years to pay back your loan. The additional year for paying back the loan also applies to existing loans, but check with your plan administrator before you delay any repayments.

Note that interest will still accrue during this time. But you wont owe income tax out the amount you borrowed as long as you pay it back within the loan timeframe.

You May Like: How Do I Find My Old 401k

When To Do It

Ironically, the best time to borrow against your 401 to pay closing costs or cover a down payment is when you can well afford to, suggests David Hultstrom, a financial adviser in Woodstock, Georgia. Otherwise, you are stretching yourself to the point where you couldnt weather an emergency.

If you lose your job and couldnt repay the 401 loan, you would have to take that amount as a distribution. That would cost you income tax and a 10 percent penalty on the amount and it would also leave your retirement plan permanently lighter, as you wouldnt be able to replace that money when you got onto more solid ground.

Borrowing From 401 Can Cost More Than You Think

More investors are taking out loans against their 401s, and that could hurt their retirement income by hundreds of dollars a month, according to an analysis by Fidelity Investments released Wednesday.

The number of investors borrowing from their 401s has been steadily increasing for more than a decade. Today, more than one in five people, or 22.5% of Fidelity’s 401 investors, borrow against their retirement savings, up from 18.7% in 2000, according to Fidelity’s analysis of 13 million investors.

More than 2 million investors have outstanding loans, and nearly 1 million took out loans in the past year.

What’s most concerning, says Jeanne Thompson, vice president of thought leadership for Fidelity, is that the analysis finds that a significant portion of those who borrow aren’t able to maintain their previous savings rate: 40% of borrowers reduce their savings rate, and of those, more than a third stop contributing to their 401 altogether within five years of taking a loan.

Half of borrowers go on to take out another loan. Fidelity calls them “serial borrowers.”

“They’re almost treating their 401 like a checking account,” Thompson says. “If you’re never paying a loan off in full, you’re constantly playing catch-up.”

Currently, 401 investors are contributing an average of 8% of their incomes.

“I don’t think that’s something people think about when they take out the loan,” Thompson says. “Think about what you could do with $690 a month in retirement.”

Recommended Reading: How Much Can I Put In 401k

How To Get A Pension Loan

Getting a pension loan is an easy way for an employee to borrow money against their vested contribution. A pension plan is a retirement plan that is sponsored by an employer for the purpose of providing retirement income to employees. The most common type of pension plan is a defined benefit plan, which provides retirees with guaranteed lifetime payments. An employee who borrows against their pension is essentially borrowing their own retirement money and in most cases the proceeds of the loan are treated as a distribution which you do not have to claim on your income taxes unless you go into default.

Dont Miss: How To Cash Out 401k After Leaving Job

If You Are Under 59 1/2

Making a withdrawal from your Fidelity 401k prior to age 60 should always be a last resort. Not only will you pay tax penalties in many cases, but youre also robbing yourself of the tremendous benefits of compound interest. This is why its so important to maintain an emergency fund to cover any short-term money needs without costing yourself extra by making a 401k early withdrawal.

However, life has a way of throwing you curveballs that might leave you with few to no other options. If you really are in a financial emergency, you can make a withdrawal in essentially the same way as a normal withdrawal. The form is filled out differently, but you can find it on Fidelitys website and request a single check or multiple scheduled payments.

If you jump the gun, though, and start making withdrawals prior to the age of 59 1/2, youve essentially broken your pact with the government to invest that money toward retirement. As such, youll pay tax penalties that can greatly reduce your nest egg before it gets to you. A 401k early withdrawal means a tax penalty of 10 percent on your withdrawal, which is on top of the normal income tax assessed on the money. If youre already earning a normal salary, your early withdrawal could easily push you into a higher tax bracket and still come with that additional penalty, making it a very pricey withdrawal.

Know: The Best Roth IRA Accounts

Recommended Reading: Should I Buy An Annuity With My 401k

Reasons To Borrow From Your 401

Although general financial wisdom tells us we shouldnt borrow against our future, there are some benefits to borrowing from your 401.

- With a loan from a commercial lender such as a bank, the interest on the loan is the price you pay to borrow the banks money. With a 401 loan, you pay the interest on the loan out of your own pocket and into your own 401 account.

- The interest rate on a 401 loan may be lower than what you could obtain through a commercial lender, a line of credit, or a credit card, making the loan payments more affordable.

- There are generally no qualifying requirements for taking a 401 loan, which can help employees who may not qualify for a commercial loan based on their credit history or current financial status.

- The 401 loan application process is generally easier and faster than going through a commercial lender and does not go on your credit report.

- If you are taking a loan to buy a home, you can have up to 10 years to repay the loan with interest.

- Loan payments are generally deducted from your paycheck, making repayment easy and consistent.

- If you are in the armed forces, your loan repayments may be suspended while you are on active duty and your loan term may be extended.

You May Like: How Is 401k Paid Out

Borrowing From Your 401 To Buy A House

Buying a home is an exciting milestone, but it often requires a significant financial investment. While itâs important to calculate how much home you can afford and how your monthly mortgage payments will affect your budget, there are other costs to consider.

Two of the most important are your down payment and closing costs. According to the National Association of Realtors, the median home down payment was 12% of the purchase price in 2019. That would come to $24,000 for a $200,000 home. Closing costs, which include administrative fees and other costs to finalize your mortgage loan, add another 2% to 7% of the homeâs purchase price.

While the seller may pay some of the closing fees, youâre still responsible for assuming some of the costs. You can borrow from a 401 to buy a house if you donât have liquid cash savings for the down payment or closing costs. Hereâs what to consider before you make that move.

Also Check: Why Choose A Roth Ira Over A 401k