Average 401k Balance At Age 45

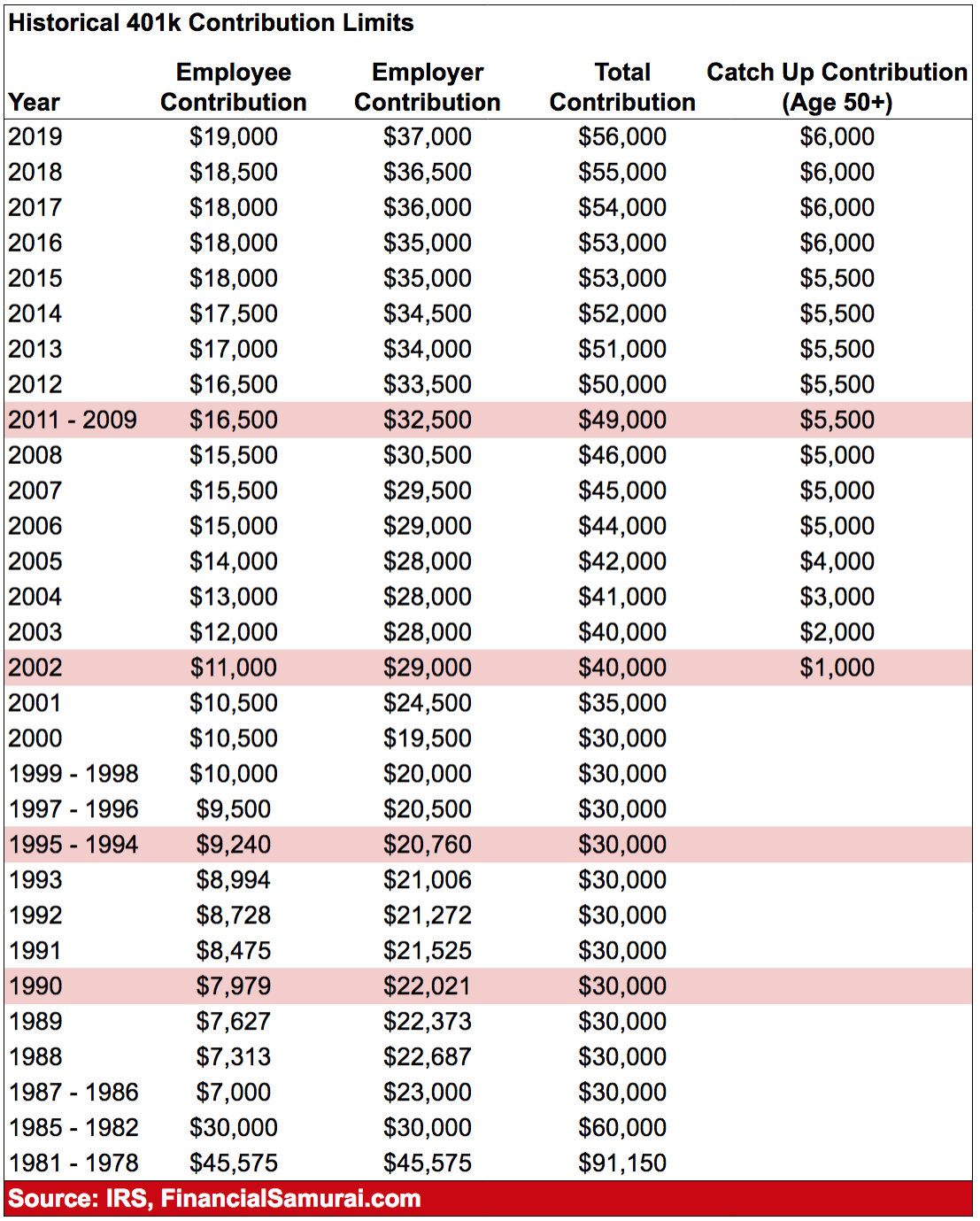

When you hit your 50s, you become eligible to make larger contributions towards retirement accounts. These are called catch-up contributions. Make sure that you take advantage of them! Catch-up contributions are $6,500 in 2021. So if you contribute the annual limit of $19,500 plus your catch-up contribution of $6,500, thats a total of $26,000 tax-deferred dollars you could be saving towards your retirement.

How To Claim Your Retirement Savings

Normally, getting at your money can be difficult, and the rules are often imposed by the plan design rather than regulations.

For instance, regulations allow you to access the money without a bonus penalty by:

- Taking out a loan.

- Getting a hardship withdrawal before age 59 ½.

- Waiting until age 59 ½.

- Leaving your employer in the year you turn 55 or after

While most plans do have loan provisions, many dont allow hardship withdrawals, and some plans require that a person be terminated before accessing their money, even if they are 59 ½ or older.

Last year, due to COVID-19, the Coronavirus Aid, Relief, and Economic Security Act, or CARES Act, made it easier to get at your money up to $100,000 in loans or distributions, if the plan allows. These withdrawals had to be before the end of 2020. If you took a hardship loan in 2020, you can avoid paying the 10 percent penalty on the money, as well as take the option to repay the loan tax-free over the next three years. Consider consulting with a tax professional as you prepare your taxes if youre in this position, since it involves filing amended returns.

Unless youre really in a bind, Brewer advises against taking a distribution or a loan. Theres no replacing time in the market, she points out, and consistent saving over time is one of the best ways to build wealth for the future.

So How Much Should You Invest In Your 401k

Okay. So, while investing is highly personal and financial goals should be personalized, you are here so we can teach you to be rich. We have some advice to get you started.

How much you should actually be investing each month depends on a system we call the Ladder of Personal Finance. Check out this video, or read about the Ladder below:

1. Your employers 401k match. Each month you should be contributing as much as you need to in order to get the most out of your companys 401k match. That means if your company offers a 5% match, you should be contributing AT LEAST 5% of your monthly income to your 401k each month.

Weve already discussed the importance of this dont throw away free money and the returns from that free money.

2. Whether youre in debt. Once youve committed yourself to contributing at least the employer match for your 401k, you need to make sure you dont have any debt. Remember, if you have employee matching, you are effectively earning a 100% return on every penny you invest in your 401k that is significantly more than the interest you would save by paying down your debt.

If you dont, great! If you do, thats okay. You can check out my system on eliminating debt fast to help you.

Read Also: How To Diversify 401k Portfolio

Can I Contribute 100 Percent Of My Salary To A 401

If your earnings are below $20,500, then the most you can contribute is the amount you earn. It should also be noted that a 401 plan document governs each particular plan and may limit the amount that you can contribute. This applies especially to highly compensated employees, which in 2022 is defined as those earning $135,000 or more or who own more than 5 percent of the business.

Sponsors of large company plans must abide by certain discrimination testing rules to make sure highly compensated employees dont get a lopsided benefit compared to the rank and file. Generally, highly compensated employees cannot contribute higher than 2 percentage points of their pay more than employees who earn less, on average, even though they likely can afford to stash away more. The goal is to encourage everyone to participate in the plan rather than favor one group over another.

There is a way around this for companies that want to avoid discrimination testing rules. They can give everyone 3 percent of pay regardless of how much their employees contribute, or they can give everyone a 4 percent matching contribution.

What Is A 401 And How Do They Work

A 401 is a retirement savings plan sponsored by employers. You fund the account with money from your paycheck, you can invest that money in the stock market, and you earn some tax perks for participating.

That’s the basic definition of a 401. The more interesting angle is what a 401 can do for you. The 401 is a powerful resource for achieving financial independence, especially when you start using it early in your career. Said another way, if you like money and wish to have more of it in the future, you can use a 401 to make that happen.

Read on for a closer look at how the 401 works, when you can withdraw funds from a 401, and what happens to your 401 if you change jobs.

You May Like: Who Does Amazon Use For 401k

Workers Saving For Retirement Have A Reason To Rejoice Over The 401 Contribution Limits For 2022

Saving for retirement, at times, can seem like a daunting task. But utilizing a 401 account, if your employer offers one, is one of the best and most tax-friendly ways to build a nest egg. You should start saving in a 401 account as soon as you, though the IRS limits how much you can contribute each year.

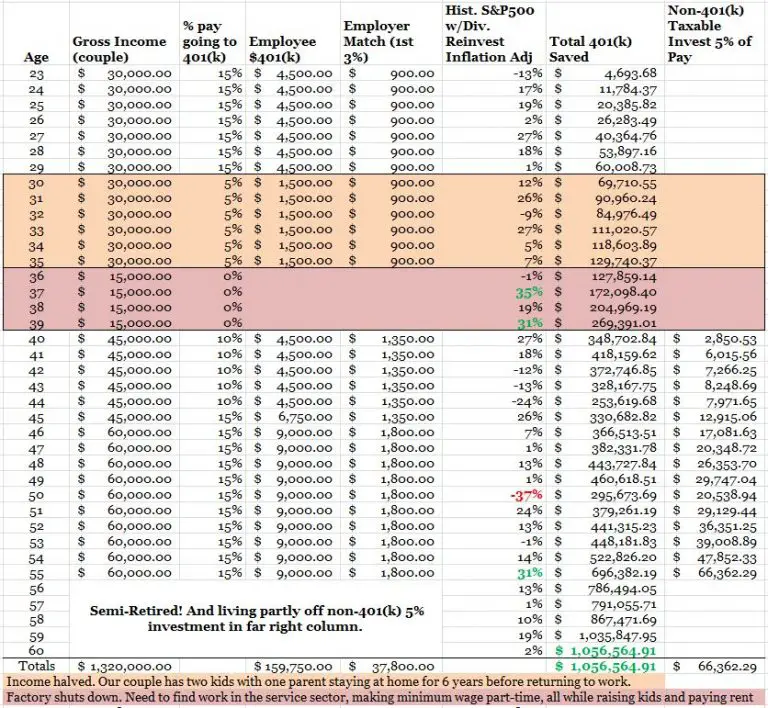

Assume A Realistic Return For Your 401k Contributions

Its common to assume that you will be able to see returns of 10% or even 12% annually. However, even though investing can be a good way to build wealth over time, basing your retirement planning on those types of returns is foolhardy. Stock and bond valuations are very high and its likely that we wont see historical returns in the next 10 or maybe more years. The longer term returns past the next decade is even harder to predict, but shoot for 7% annualized or less over time.

Its better to plan for lower returns and save more than to assume that you will see big returns. Make sure that you have realistic expectations for your returns, and set aside more than you might think you need.

You May Like: When Can I Use My 401k

For Financial Independence In Retirement

The 401 makes it easy to build wealth for retirement. Once you set your preferences, the work of saving and investing happens behind the scenes. Plus, you have tax savings and, possibly, matching contributions that expedite your savings momentum.

Here’s what it comes down to: The earlier you start contributing to a 401, the more you’ll get from its benefits and the richer you can be when you retire.

What If Even 10% Is Too Much

For those who havent saved anything, I know its very hard to get started. But no matter what, you should at least contribute enough to get the employer match. A popular employer matching scheme is to match 50% of your first 6% of your salary. Lets say thats what your employer gives. For someone who make $50,000 a year that can contribute 6% a year, they will get $1,500 for free. $3,000 still sounds like a lot, I know, but do your best. Thats a little over $115 a paycheck. Find ways to spend less on what you already spend money on. Figure out what you can cut out of your budget. Think about it. Saving for retirement is still going to benefit you. Its not like you lose the money you saved in your 401k.

Also Check: What Should You Invest Your 401k In

But Why Would I Max Out My Roth Ira Before My 401k If Its So Good

Theres a lot of nerdy debate in the personal finance sphere about this very question, but our position is based on taxes and policy.

Assuming your career goes well, youll be in a higher tax bracket when you retire, meaning that youd have to pay more taxes with a 401k. Also, tax rates will likely increase in the future.

The Ladder of Personal Finance is pretty handy when considering what to prioritize when it comes to your investments, but it is just a tool. For more about the Ladder of Personal Finance and how to make it work for you, check out THIS video where I explain it.

PRO TIP: The video is less than three minutes long. It is worth your time.

Why Employers Offer 401s

In 1978, when the law authorizing the creation of the 401 was passed, employers commonly attracted and retained talent by offering a secure retirement through a pension . The 401 created an entirely new system, with more flexibility for both employer and employee. One of the ways it did so was by giving employers the option to match employee contributions.

Matching is a very transparent process: for every dollar you put into your 401, your employer also puts in a dollar, up to a certain amount or percentage of your income. Theres no mystery here. If your employer promises to match all 401 contributions up to 5% of your income, and you contribute that amount every month, your employer will match you dollar for dollar, every month. Its a win-win situation. You are doubling your money, and your employer is building a happy workforce.

Also Check: How To Borrow From 401k To Buy A House

How Much Can Someone Over 50 Contribute To A 401k In 2021

There is an upper limit on the combined amount that you and your employer can contribute to defined contribution pension plans. For people aged 49 and under, the limit is $ 61,000 in 2022, from $ 58,000 in 2021. For those aged 50 and over, the limit is $ 67,500 in 2022, compared to $ 64,500 in 2021.

How much can I contribute to my 401k in 2022? Next years taxpayers can put an extra $ 1,000 into their 401 plans. The IRS recently announced that the 2022 contribution limit for 401 plans will increase to $ 20,500. The agency also announced cost-of-living adjustments that could affect the retirement plan and other retirement-related savings next year.

Looking To Reduce Excessive 401k Fees

Sign up for Personal Capital for free and use their Portfolio Fee Analyzer tool. The tool will show you how much in fees youre paying. I had no idea I was paying $1,700 in 401 fees four years ago until I ran the tool.

Now Im only paying about $300 a year in fees. Excessive fees is one of the biggest drags on making more money and retiring earlier.

You can also use Personal Capital to track your net worth, track your cash flow, and optimize your investments.

For more nuanced personal finance content, join 100,000+ others and sign up for the free Financial Samurai newsletter. Financial Samurai is one of the largest independently-owned personal finance sites that started in 2009.

Filed Under: Entrepreneurship

I started Financial Samurai in 2009 to help people achieve financial freedom sooner, rather than later. Financial Samurai is now one of the largest independently run personal finance sites with 1 million visitors a month.

I spent 13 years working at Goldman Sachs and Credit Suisse. In 1999, I earned my BA from William & Mary and in 2006, I received my MBA from UC Berkeley.

In 2012, I left banking after negotiating a severance package worth over five years of living expenses. Today, I enjoy being a stay-at-home dad to two young children. In June 2022, Ill be publishing a new book entitled, Buy This, Not That Spending Your Way To Financial Freedom.

Current Recommendations:

You May Like: What Is The Benefit Of A Roth Ira Vs 401k

How Much You Can Invest

If you’re under age 50, your annual contribution limit is $19,500 for 2020 and $19,500 for 2021.

If you’re age 50 or older, your annual contribution limit is $26,000 for 2020 and $26,000 for 2021.

If you’re under age 50, your annual contribution limit is $6,000 for 2020 and 2021.

If you’re age 50 or older, your annual contribution limit is $7,000 for 2020 and 2021.

Invest In Iras And Roth Iras

If you remember the rule of thumb earlier, experts advise saving 10% to 20% of your gross salary each year for retirement. You could put this all in your 401, but you should consider some other options once you cover your 401 match.

If you earn less than $122,000, you qualify for a Roth IRA in 2019. Youll qualify for a Roth IRA in 2020 if you earn less than $124,000. This is a retirement savings vehicle that you can open at virtually any bank or financial institution. You fund these with after-tax dollars. So your contributions wont reduce your taxable income. However, eligible withdrawals you make after turning 59.5 are tax free. Its good to have a mix of taxable and non-taxable income in your retirement.

Roth IRAs are particularly useful for young people who are just starting their careers. Chances are that if you just graduated from college, youre in a lower tax bracket than you will be in when you retire. Paying the income tax now instead of later can save you money, especially when you need it the most

In 2019, you can contribute up to $6,000 to a Roth IRA. The $1,000 catch-up contribution for those who are at least 50 years old applies here too. You can also contribute up to $6,000 in 2020.

You can also invest in a traditional IRA, which takes pre-tax dollars and lessens your taxable income just like a 401. Some people also have an IRA because when they left a previous employer, they moved their 401 funds into an IRA via an IRA rollover.

Also Check: How Much Does A 401k Cost A Small Business

What Is The Maximum 401k Contribution For 2020 For Over 50 Self Employed

2020 401 Contribution Limits The maximum amount a self-employed person can contribute to a 2020 401 contribution is $ 57,000 if they are under the age of 50. Individuals aged 50 and over can add an extra $ 6,500 per year in payback contributions, bringing the total to $ 63,500.

How much can a 50 year old contribute to 401k in 2020?

The maximum amount workers can contribute to a 401 for 2020 is $ 500 more than in 2019 now its up to $ 19,500 if youre under the age of 50. If you are 50 and older, you can add an extra $ 6,500 per year in payback contributions, bringing your total 401 contributions for 2020 to $ 26,000.

What are the contribution limits for a solo 401k?

401 Only Contribution Limits The 401 Only Contribution Limit total is up to $ 58,000 in 2021 and $ 61,000 in 2022. There is an extra $ 6,500 recovery contribution for those aged 50 or over. .

How much can a 50 year old individual themselves contribute to their 401 K plan?

If you are 50 or older, your maximum 401 contribution is $ 26,000 in 2021 , because you are granted $ 6,500 in payback contributions.

Is Your 401k Savings On Track

Have you met your mark? If you arent there yet, dont panic. These are just rules of thumb. That means they only give you a rough estimate of what you should ideally have by the time you hit these ages. They do not take into account your individual income and experiences or other investments you might have in play.

In reality, theres no one hard answer to how much you should have in your 401k and anyone who tells you otherwise is either lying to you or just doesnt know much about finance. We could pull up a bunch of figures and show you how much someone in their 20s or 30s is saving but that would be a complete waste of time for two reasons:

1. Its impossible to compare two investors fairly. Everyone has their own unique savings situation. Thats why itd just be dumb to compare the Ph.D. student saddled with thousands in student loan debt with the trust fund baby who just snagged a cushy six-figure corporate gig the first month out of college. Theyre both going to save very differently, so its not worth comparing.

2. Most people arent financially prepared for retirement. The American Institute of CPAs recently released a study that found that nearly half of all Americans arent sure if theyll be able to afford retirement. Thats even scarier when you consider the fact that many people underestimate how much theyll need for a comfortable retirement.

Recommended Reading: What Is Max Amount You Can Put In 401k

How Much Should You Contribute To Your 401 Rule Of Thumb

As a rule of thumb, experts advise that you to save between 10% and 20% of your gross salary toward retirement. That could be in a 401 or in another kind of retirement account. No matter where you save it, you want to save as much for retirement as you can while still living comfortably.

Its important to say that this is just a general rule. The actual amount you should save depends on your individual situation. For example, if you are 50 years old and dont have any retirement savings, you should save more than 20% of your gross annual salary. If youre 30 years old and already have $100,000 in retirement savings, you could probably decrease your contributions for a bit in order to pay off a mortgage or loan. Its difficult to create a one-size-fits-all plan, because everyone is in a different place with his or her finances.

Saving 10% to 20% of your salary every year might sound like a lot. Luckily, you dont have to do it all at once. You can spread your contributions out throughout the year and you can contribute more or less some years. You also dont have to save all that money through your 401. Lets take a step back and talk about other factors you should consider when you think about how much to contribute to your 401.

Also Check: Should I Rollover My 401k When I Retire