Option : Roll Over Your Old 401 Into An Individual Retirement Account

Still another option is to roll over your old 401 into an IRA. The primary benefit of an IRA rollover is having access to a wider range of investment options, since youll be in control of your retirement savings rather than a participant in an employers plan. Depending on what you invest in, a rollover can also save you money from management and administrative fees, costs that can eat into investment returns over time. If you decide to roll over an old 401 into an IRA, you will have several options, each of which has different tax implications.

Tax On A 401k Withdrawal After 65 Varies

Whatever you take out of your 401k account is taxable income, just as a regular paycheck would be when you contributed to the 401k, your contributions were pre-tax, and so you are taxed on withdrawals. On your Form 1040, you combine your 401k withdrawal income with all your other taxable income. Your tax depends on how much you withdraw and how much other income you have. If you have a $200,000 account, you could legally withdraw it all the year you turn 70. The amount of a 401k or IRA distribution tax will depend on your marginal tax rate for the tax year, as set forth below the tax rate on a 401k at age 65 or any other age above 59 1/2 is the same as your regular income tax rate.

Vested Versus Unvested Amounts

When you find your 401 balance, you might notice that some of the account is vested and some of it isn’t. Amounts that are vested are yours no matter what if you leave the company, you get to take that money with you, but you would lose any unvested amounts. You’re always 100 percent vested in your contributions. However, your employer may make contributions to your 401 plan on your behalf but might put vesting requirements on the money. According to federal law, contributions must vest at least as fast as either the cliff vesting or graded vesting schedules. With cliff vesting, you must be fully vested at the end of three years of service. With graded vesting, you must be 20 percent vested by the end of your second year of service, and must vest an additional 20 percent each year after that, making you fully vested by the end of your sixth year.

You May Like: When Do I Get My 401k After I Quit

Option : Leave It Where It Is

You don’t have to move the money out of your old 401 if you don’t want to. You won’t ever lose the funds provided you don’t lose track of your old account again. But this option is usually the least desirable.

For one, it’s more difficult to manage your retirement savings when they’re spread out over many accounts. You also get stuck paying whatever your old 401’s fees were, and these can be higher than what you’d pay if you moved your money to an individual retirement account, for example.

But if you like your plan’s investment options and the fees aren’t too high, you could consider leaving your old 401 funds where they are. Just make careful note of how to access them again so you don’t forget.

How To Calculate Required Minimum Distribution For An Ira

To calculate your required minimum distribution, simply divide the year-end value of your IRA or retirement account by the distribution period value that matches your age on Dec. 31st each year. Every age beginning at 72 has a corresponding distribution period, so you must calculate your RMD every year.

For example, Joe Retiree, who is age 80, a widower and whose IRA was worth $100,000 at the end of last year, would use the Uniform Lifetime Table. It indicates a distribution period of 18.7 years for an 80-year-old. Therefore, Joe must take out at least $5,348 this year .

The distribution period also decreases each year, so your RMDs will increase accordingly. The distribution table tries to match the life expectancy of someone with their remaining IRA assets. So as life expectancy declines, the percentage of your assets that must be withdrawn increases.

If you need further help calculating your RMD, you can also use Bankrates required minimum distribution calculator.

RMDs allow the government to tax money thats been protected in a retirement account, potentially for decades. After such a long period of compounding, the government wants to be sure that it eventually gets its cut in a clear timeframe. However, RMDs do not apply to Roth IRAs, because contributions are made with income that has already been taxed.

You May Like: How To Avoid Taxes On 401k

Read Also: What Happens To My Roth 401k When I Quit

But Why Would I Max Out My Roth Ira Before My 401k If Its So Good

Theres a lot of nerdy debate in the personal finance sphere about this very question, but our position is based on taxes and policy.

Assuming your career goes well, youll be in a higher tax bracket when you retire, meaning that youd have to pay more taxes with a 401k. Also, tax rates will likely increase in the future.

The Ladder of Personal Finance is pretty handy when considering what to prioritize when it comes to your investments, but it is just a tool. For more about the Ladder of Personal Finance and how to make it work for you, check out THIS video where I explain it.

PRO TIP: The video is less than three minutes long. It is worth your time.

So How Much Should You Invest In Your 401k

Okay. So, while investing is highly personal and financial goals should be personalized, you are here so we can teach you to be rich. We have some advice to get you started.

How much you should actually be investing each month depends on a system we call the Ladder of Personal Finance. Check out this video, or read about the Ladder below:

1. Your employers 401k match. Each month you should be contributing as much as you need to in order to get the most out of your companys 401k match. That means if your company offers a 5% match, you should be contributing AT LEAST 5% of your monthly income to your 401k each month.

Weve already discussed the importance of this dont throw away free money and the returns from that free money.

2. Whether youre in debt. Once youve committed yourself to contributing at least the employer match for your 401k, you need to make sure you dont have any debt. Remember, if you have employee matching, you are effectively earning a 100% return on every penny you invest in your 401k that is significantly more than the interest you would save by paying down your debt.

If you dont, great! If you do, thats okay. You can check out my system on eliminating debt fast to help you.

Also Check: How Can I Get My 401k Money Without Penalty

What Is Considered A Hardship Withdrawal

Hardship distributions A hardship distribution is a withdrawal from a participants elective deferral account made because of an immediate and heavy financial need, and limited to the amount necessary to satisfy that financial need. The money is taxed to the participant and is not paid back to the borrowers account.

How Can I Find Out My 401k Balance

Over $5.3 trillion is held in 401 plans as of September 2017, according to the Investment Company Institute. If you’re using a 401 to help you save for retirement, it’s important to know how much you have in your plan so you can determine if your savings are in line with the amount you’ll need to fund your golden years. If you don’t receive paper statements with your 401 balance, there are other ways you can check how much you’ve saved.

Don’t Miss: How To Set Up A 401k Plan

How Much Tax Do You Pay On 401 Distributions

A withdrawal you make from a 401 after you retire is officially known as a distribution. While youve deferred taxes until now, these distributions are now taxed as regular income. That means you will pay the regular income tax rates on your distributions. You pay taxes only on the money you withdraw. If you withdraw $10,000 from your 401 over the course of the year, you will only pay income taxes on that $10,000. Its possible to withdraw your entire account in one lump sum, though this will likely push you into a higher tax bracket for the year, so its smart to take distributions more gradually.

The good news is that you will only have to pay income tax. Those FICA taxes only apply during your working years. You will have already paid those when you contributed to a 401 so you dont have to pay them when you withdraw money later.

State and local governments may also tax 401 distributions. As with the federal government, your distributions are regular income. The tax you pay depends on the income tax rates in your state. If you live in one of the states with no income tax, then you wont need to pay any income tax on your distributions. So depending on where you live, you may never have to pay state income taxes on your 401 money.

How To Find Out If I Have A 401

The best way to make sure you donât lose track of your 401 is to periodically keep tabs on it. Although, checking your retirement accounts too frequently can lead to overkill and alarm if the market takes a dive. Aim for quarterly or semi-annual checks of your funds to make sure everything is in order.

Actively managing your 401 is a good habit to get into. Making sure your retirement accounts are being properly funded and youâre on track to meet your retirement goals should be etched into your overall personal finance plan.

However, if youâve let it slip for the past couple of years, no need to worry. Contact your human resources department to get information on how you can monitor your account.

You may be given access to an online portal for you to log in and manage your account.

Verify your statements are being sent to the correct address. Bookmark the account information so you always know where to log into your account from. Also, consider updating your login and password to make sure your account is more secure.

Read Also: What Happens To 401k When You Switch Jobs

Rolling Over Your Old 401 To A New Employer

Many companies offer 401 plans, so people often end up having multiple 401s over their years in the workforce. If youd rather keep your funds in a single 401 or dont want to open an IRA, you might have the option of transferring assets from your old 401 to your new one at your current job. If not, youll need to keep an eye on how each is performing individually.

The process for this is as simple as talking to both your current and past plan providers to make sure they will both accept a transfer of assets. While the providers can offer more specific instructions, youll likely use one of the methods above to complete the rollover.

Note that not all plan providers will accept employees past 401 funds as a rollover. This is because they may not be willing to add more assets to the plan, which could overwhelm it.

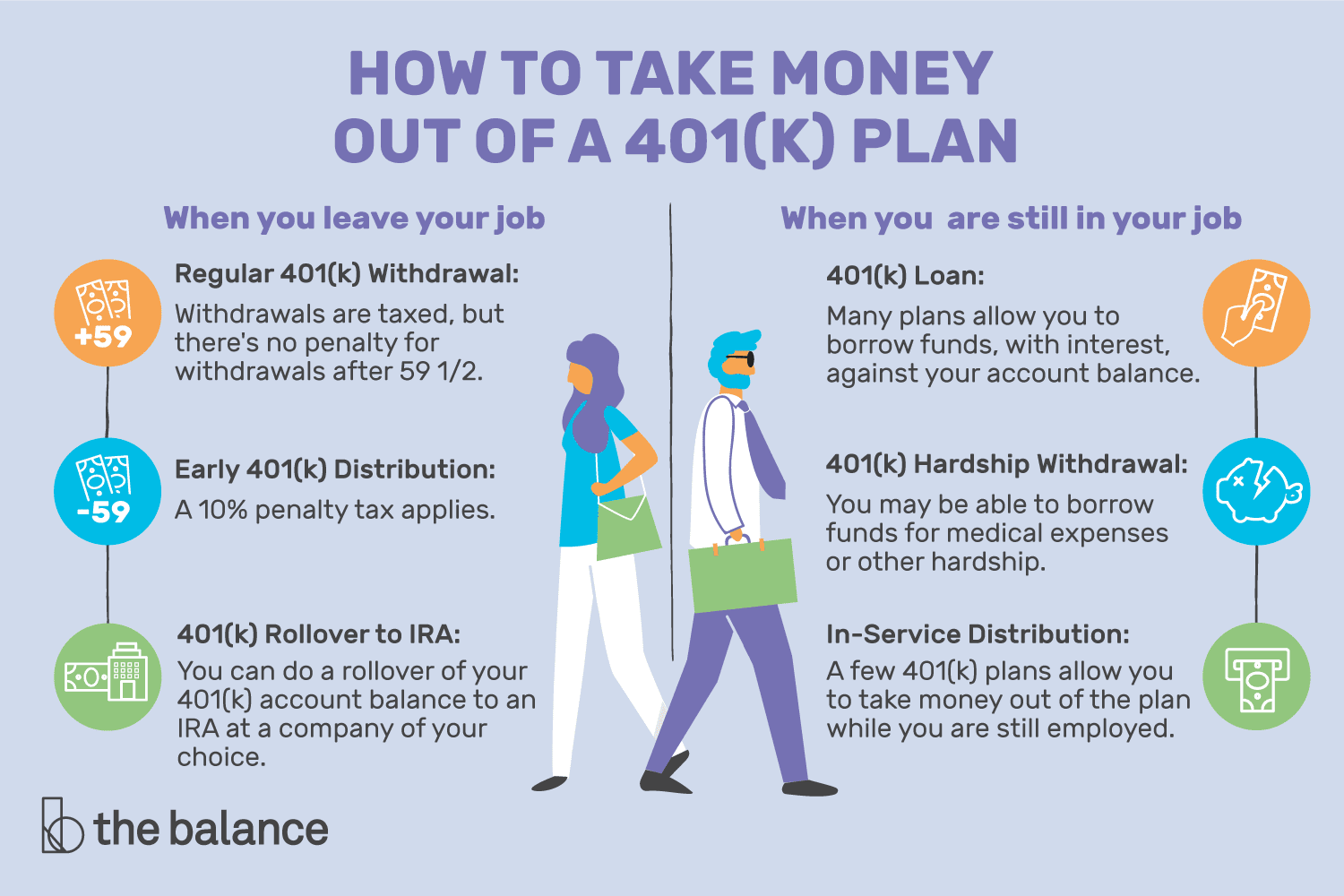

Can I Cash Out My 401k After Termination

Even if you are not yet 59 1/2 years old, if you get terminated from your job, you can cash out the money in your 401k plan. However, unless an exception applies, you have to pay not only the income taxes on the distribution, but also a 10 percent early distribution penalty.

What Happens to My 401 If I Quit My Job? You have several choices. You can leave your 401 with your former employer or roll it into a new employers plan.You can also roll over your 401 into an individual retirement account .

Also Check: Can You Withdraw From Fidelity 401k

What Is A Required Minimum Distribution And Why Should I Care About It

An RMD is the smallest amount you must withdraw from your tax-deferred retirement accounts every year after a certain age. At some point in your life, you may have put money into tax-deferred retirement accounts, such as Individual Retirement Accounts and 401 workplace retirement accounts. The key words here are tax-deferred. You postponed taxes on your contributions and earnings you didnt eliminate them. Eventually, you must pay tax on your contributions and earnings. RMDs make sure that you do that.

Required Minimum Distribution Rules For Non

Under IRC Section 401, when a retirement account owner dies prior to their RMD Required Beginning Date and has named a Non-Designated Beneficiary , that Non-Designated Beneficiary is required to distribute all the assets in the inherited retirement account within 5 years. Conversely, IRC Section 401 provides that when the owner dies on or after their Required Beginning Date with a Non-Designated Beneficiary, annual minimum distributions are calculated using the decedents remaining single life expectancy .

The SECURE Act made no direct change to these rules . However, as a result of the change in the age at which RMDs begin, an IRA owners Required Beginning Date is now pushed back to April 1, of the year following the year that they turn 72 . Thus, for Non-Designated Beneficiaries, the 5-Year Rule will still apply if death occurs at an even later age, requiring full distribution of the inherited account within 5 years of the retirement account owners death if they die prior to April 1st of the year after they reach age 72.

Also Check: Should I Keep My 401k Or Rollover To Ira

Also Check: How Much Can You Save In 401k Per Year

Use Fidelitys Rule Of Thumb As A Guide

According to Fidelitys viewpoint, retirees should have ten times their income saved by the time they retire at 67. They further explain that you should have:

- 1x your salary by age 30.

- 2x by 35.

- 8x by 60.

- And 10x by 67.

With these numbers, Fidelity is assuming that retirees are targeting to replace 45% of their income from their nest egg and using Social Security to cover the rest of their needed expenses.

These are rough milestones, but use the numbers to see if you need to add more or less to your 401k.

Is 500k Enough To Retire At 65

The short answer is yes $ 500,000 is enough for some retirees. The question is how it will work. With money like Social Security, low spending, and good luck, this is possible.

How long will 500k last in retirement?

It may be possible to retire at the age of 45, but it depends on a variety of factors. If you have $ 500,000 in savings, according to the 4% rule, you will be able to earn up to $ 20,000 for 30 years.

Prev Post

Read Also: How Do 401k Investments Work

Do I Make Too Much Money For A Roth Ira

So you have too much money to qualify for a Roth individual retirement account. If your adjusted gross income exceeds $ 131,000 or $ 193,000 , you cannot contribute to a Roth IRA directly. To get around this, you finance a traditional IRA, and then convert the money into a Roth.

How much income is too much for Roth IRA?

To contribute to the Roth IRA in 2022, single tax filers must have a modified adjusted gross income of $ 144,000 or less, up from $ 140,000 in 2021. If married and filing jointly, your combined MAGI must be under $ 214,000 . in 2021).

Does Roth IRA make sense for high income?

A Roth IRA can be a good option for those hoping in a higher tax bracket once the withdrawal begins. However, unlike traditional IRAs, there is a limit to contributing to Roth IRAs based on income. For married couples, the phase-out is $ 198,000- $ 208,000.

Do I make too much money to open a Roth IRA?

You can contribute to a traditional IRA no matter how much money you earn. But you dont have the right to open or contribute to a Roth IRA if you make too much money. There are still ways around the Roth IRA contribution limit.

What If I Withdraw Too Little Or Dont Take An Rmd

If you dont make a proper RMD by the appropriate deadline, Uncle Sam will tax you 50% of the difference between the amount you withdrew that year and the amount you were supposed to take out that year.

However, you dont have to take your RMD in one lump sum. You can take it in increments throughout the year. Just make sure you withdraw the total RMD amount for the year by December 31. In some cases, however, you can delay RMDs.

Read Also: Where Can I Find My 401k Balance

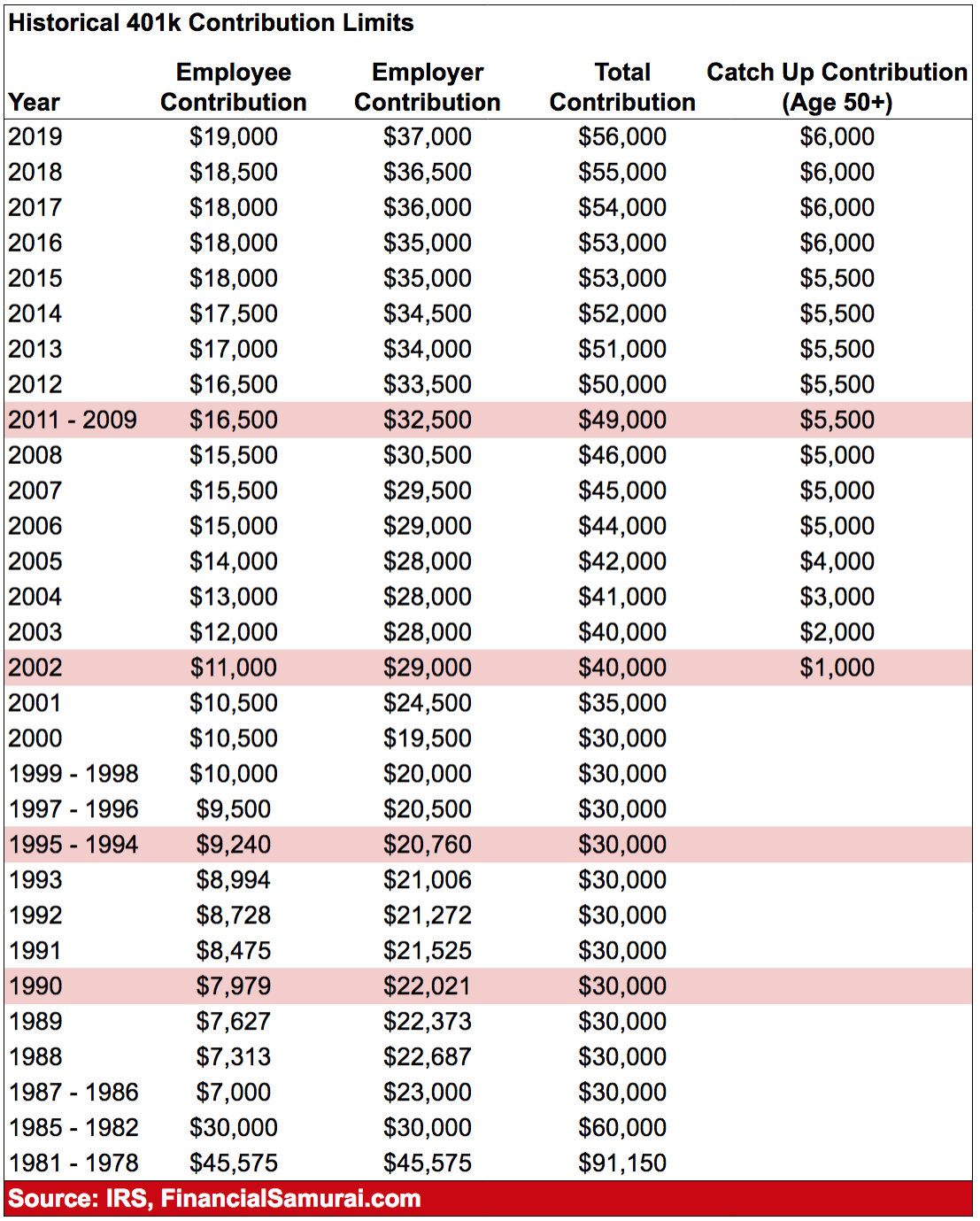

Recommended Reading: What’s The Most You Can Contribute To A 401k

Can You Swap Your 401k For A Life

- 14:10 ET, Dec 6 2021

AS the year comes to a close, you may be considering various money moves.

Among them is swapping your 401k for a life-long monthly check through annuities.

While many folks rely on Social Security during retirement, it often isn’t enough to live on.

Annuities offer another option to fund retirement years, with a guarantee that you won’t outlive your income.

Below, we explain what annuities are and how they can provide a steady stream of income during your retirement years.

S To Take Now To Improve Your Retirement Readiness

While the average 401k balance at pre-retirement age is around $600K, that balance still falls far below even the no growth column of the savings potential chart for the same age. And while $600,000 is no chump change, its also probably not enough to retire comfortably for most people.

Needless to say, many people are falling way below their savings potential. But the good news is, its not too late to turn things around.

Recommended Reading: How Do I Roll Over My 401k To An Ira