Automatic Enrollment And Aip

As an eligible associate, youâre automatically enrolled in the 401 on the first of the month coincident with or following 60 days of employment at a contribution rate of 3% of eligible pay. As part of automatic enrollment, youâre also enrolled in the automatic annual increase program , which increases your contribution by 1% each year until you reach 6%.

- If you want to change the automatic contribution elections before they begin, visit NetBenefits.com or call Fidelity at 1-800-635-4015 before 60 days of employment and make your own choices.

- If you donât actively enroll and choose investment funds for your account, Syscoâs contributions will be invested in the Vanguard Target Retirement Fund thatâs closest to your projected retirement date .

If you wish to contribute to the Plan before you are automatically enrolled or to opt out of automatic enrollment, log in to NetBenefits.com or call Fidelity at 1-800-635-4015. Note that youâll need to sign up for AIP if you choose to actively enroll. To do so, log in to NetBenefits.com and click Contribution Amount.

Best Fidelity Funds For Your 401k: Low

Manager: Joel TillinghastExpenses: 0.82%

Still inimitable, still head and shoulders above even the best crop of giants you can find in the space, lead manager Joel Tillinghast is about as far a cry from leveraged stocks as you can get.

Fidelity Low-Priced Stock invests in low-priced stocks, which for his purpose are stocks $35 or less. While that sounds like a gimmick, its the secret to this funds genius, and was Joels brainchild, making him of one of the best managers of any generation. It can lead to a small-/mid-cap tilt, but it also can lean toward even mega-caps in ultra-bear markets .

FLPSX began trading in December 1989 and has a market value of over $30 billion. The fund is heavily weighted toward consumer discretionary , with ample weight given to information technology and financials . Top holdings for now are UnitedHealth Group Inc. , Seagate Technology PLC and Next plc. Its noteworthy that of the funds weve discussed so far, FLPSX is the only one with more than 5% of the fund currently in cash .

Joel is a stock pickers stock picker if hes around the water cooler, other managers are keen to hear what he has to say. While unsung by the media, he is a manager that compares with Peter Lynch, his mentor while Joel was learning the trade. His stealth advantage: Hes always been a global investor.

Types Of 401 Investments

The most common type of investment choice offered by a 401 plan is the mutual fund. Mutual funds can offer built-in diversification and professional management, and can be designed to meet a wide variety of investment objectives. Be mindful that investing in a mutual fund involves certain risks, including the possibility that you may lose money.

Your 401 plan may offer other types of investments. Some of the more common ones include:

Recommended Reading: What Is A 401k Annuity

The Potential Tax Consequences On Retirement Plan Distributions

Apart from my own rollover, and according to the IRS, there are three permitted methods for doing a rollover of any kind:

Facts About Required Minimum Distributions You Need To Know

Youve likely been salting away money in tax-deferred IRAs and employer-sponsored retirement accounts for decades. But once you reach your early seventies, you must start taking withdrawals and paying taxes on the money. These Required Minimum Distributions can be sizable and might even push you into a higher tax bracket. Here is what you need to know.

You May Like: Can You Roll A 401k Into An Existing Roth Ira

Scale Up Contributions Over Time

Once you’ve picked your investments, the best thing you can do is leave your account alone and let the contributions build.

In addition to low costs and diversity, consistently investing over time i.e., every paycheck will make the biggest difference in the size of your savings. Low-cost funds are only effective if you continuously invest in them and don’t try to time the market, or pull money out when it starts to drop, a recent report from Morningstar says.

Experts also advise increasing your contributions each time you get a raise or bonus by a percentage point or two, helping you reach your goals faster.

Finally, remember that while the stock market has historically increased around 10% per year, that’s not guaranteed, and there will be periods when it falls. Experts also expect returns to be lower, around 4%, over the next decade than they have been the previous 10 years.

Still, no one knows what will happen, except that the best course of action is typically to invest in low-cost index funds consistently, over many decades. Do that, and you’ll be on the path to building real wealth.

How Do I Avoid Tax On Ira Withdrawals

Heres how to minimize 401 and IRA withdrawal taxes in retirement:

Read Also: How To Select 401k Funds

You May Like: How Much Can You Put Into A 401k Per Year

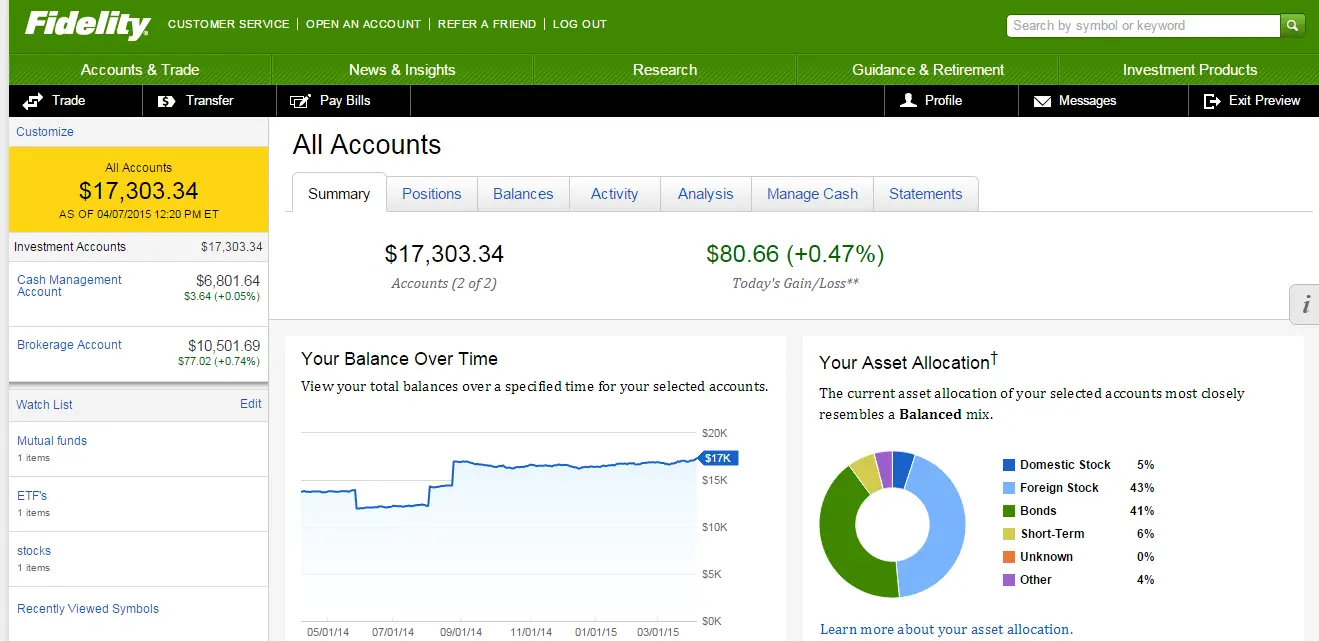

Look At The Whole Investment Pie

A frequent mistake investors make is not looking at their whole investing pie. When considering your asset allocation, imagine that the assets in every one of your investment accounts are actually in one account. The one big account includes your 401, Roth, or traditional individual retirement account and your taxable investment brokerage account holdings.

Picture your investments and accounts like a strawberry, banana, and rhubarb pie. You dont have one section for the strawberries, another for the banana, and a third for the rhubarb. All the ingredients in your accounts go into the asset allocation pie.

Fidelity To Allow Retirement Savings Allocation To Bitcoin In 401 Accounts

A sign marks a Fidelity Investments office in Boston, Massachusetts, U.S. September 21, 2016. REUTERS/Brian Snyder

Register now for FREE unlimited access to Reuters.com

The family controlled asset manager said MicroStrategy Inc , a major bitcoin corporate backer, will be the first employer to use the new product, which will be made available to other employers by the middle of the year.

Through the new offering, employees will be able to invest in bitcoin through a Digital Assets Account within the core lineup of their 401 plans, Fidelity said.

Register now for FREE unlimited access to Reuters.com

Fidelity also said that Newfront, a retirement consulting services provider, has indicated that the DAA will help address a growing need among their client base.

Plan sponsors will be able to decide on employee contribution in the DAA and set limits on exchanging such contribution to bitcoin, Fidelity said, adding that additional updates on the new offering will be made available in the coming months.

Dave Gray, head of workplace retirement offerings and platforms at Fidelity, said the plan will initially be limited to bitcoin, but expects other digital assets to be made available in the future, according to a report by the Wall Street Journal, which was the first to report the news.

Register now for FREE unlimited access to Reuters.com

Also Check: Can I Rollover Solo 401k To Ira

Go With The Simplest Option

Alternatively, you can opt for a target-date fund, which takes most of the guesswork out of the equation. With these funds, you select a âtargetâ retirement year and risk tolerance, and the fund is automatically set to an appropriate asset allocation for you. These are great options for beginner investors.

âMost people arenât interested in researching selecting funds for their 401,â Charles C. Weeks, a Philadelphia-based CFP, tells CNBC Make It. âTarget date funds will help people avoid blowing up their portfolios by making avoidable mistakes like putting too much in one asset class, chasing returns by investing based on past performance and/or letting greed and fear dictate their investment strategy.â

Over time, the fund will automatically rebalance, becoming more conservative as you near retirement. If you choose a target-date fund, you only need to choose the one fund otherwise youâre essentially canceling out its benefits. Another mistake to avoid with target-date funds is choosing a year without researching how it will change its mix of stocks and bonds over time, Howard Pressman, a Virginia-based CFP, tells CNBC Make It.

Grasp Opportunities As They Come

Throughout your employment years you’ll likely experience wage increases. On average, people get two year-over-year increases exceeding 20%, and one at 10%. If you can manage to put some of that increase toward strengthening your investment positions, or to ramp up a pre-tax deduction into a company-matched 401, it can lead to larger gains over the long term.

If you’re one of many who might have had limited funds earlier in life, or just didn’t think retirement age would creep up so quickly, don’t feel like you’ve missed the opportunity to invest for those golden years. Taking advantage of catch-up opportunities can have a positive impact on your retirement planning. Turning 50 can have a deer-in-the-headlights effect — take it from me. You wonder where the time went, and begin to wonder what to do with the time left. It’s also a point at which the average salary begins to level off, meaning many people are at peak salary. But it can also present opportunities for savvy investors.

The 401 contribution limit jumps from $20,500 per year to $27,000 when you turn 50. If you put that extra $6,500 a year into a plan that earns a 6% annual return, the additional $97,500 in contribution will be worth $160,000 by the time you’re 65. It’s also a good time for a portfolio wake-up call.

Also Check: When Do You Need A 401k Audit

Fidelity Investments And Paylocity Team Up To Provide Integrated Payroll Capabilities For Fidelity Advantage 401 Clients

Integration Will Drive Efficiency by Enabling Employers to Automate Contributions, Reduce Risk, and Deliver More Competitive Benefits

BOSTON-Fidelity Investments®, the countrys largest1 401 provider, and Paylocity, a leading provider of cloud-based HR and payroll software solutions, announced today that seamless access to payroll capabilities is now available with the Fidelity Advantage 401SM pooled employer plan . This enhancement will reduce the administrative burden on small- and mid-sized businesses offering retirement plans for their employees and help workers start saving towards their retirement goals.

Retirement benefits have traditionally been cost-prohibitive to smaller businesses, and workers are seeking financial security more than ever. According to a report2 by the Georgetown University Center for Retirement Initiatives, there are roughly 57 million private sector workers who do not have access to a retirement plan through their employers. This access gap more heavily impacts smaller businesses and disproportionately affects lower-income workers, younger workers, underrepresented communities, and women. At the same time, retirement planning is top-of-mind for workers, according to the Fidelity Investments 2021 State of Retirement Planning Study, which found that seven out of 10 workers in the U.S. are making changes to improve their retirement preparedness.

About Fidelity Investments

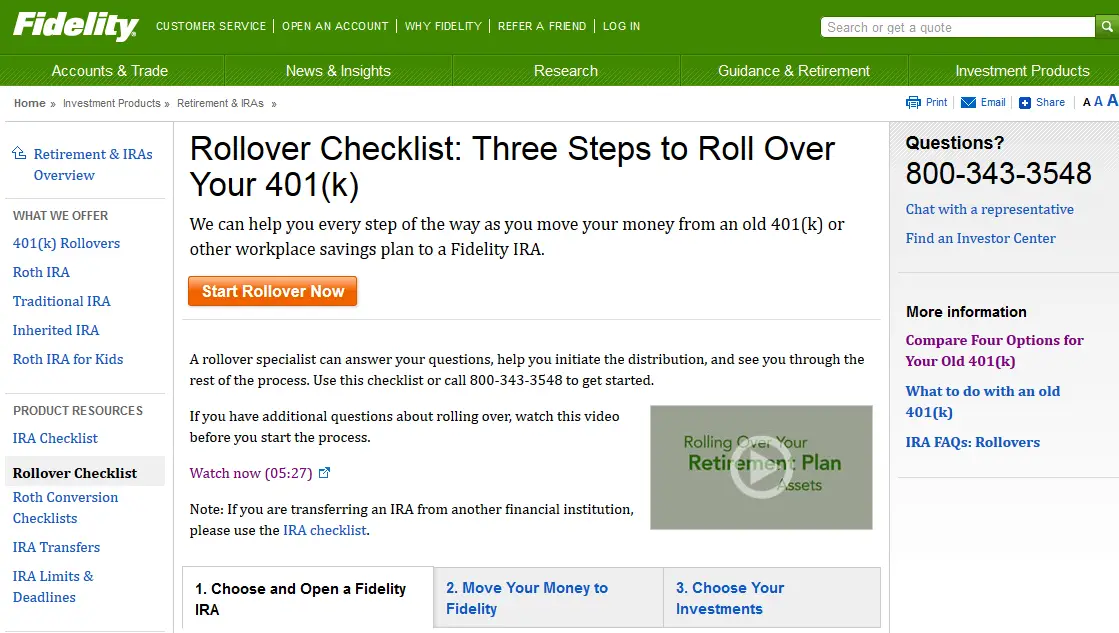

Open Your Fidelity Account

Already have an IRA open at Fidelity? Great skip this step

In order to move the money out of your 401 account, youll need to have an account opened for that money to move into. If youve decided to move your funds to Fidelity, you have two main options:

Weve written a full guide on the five key differences between 401s and IRAs if youre trying to understand all of the differences.

Ultimately, most people who roll over an old 401 do so into an IRA for a few key reasons:

Think of your IRA as helping you do two key tasks:

The good news? Opening an IRA at Fidelity can be done online and should take you less than 10 minutes, if you dont already have one.

Donât Miss: What Is The Difference Between Roth 401k And Roth Ira

Also Check: How To Get Your Money Out Of 401k

Bitcoin Has A Short History And Uncertain Value

The first Bitcoin transaction in history was completed just 13 years ago, so it doesnt have the long-term track record of success that stocks and bonds do. Bitcoin is also prone to extreme periods of volatility that retirement investors may wish to avoid, such as its roughly 80% crash in late 2017 and 2018.

Owen Murray, director of investments for Horizon Wealth Advisors, says its still extremely difficult to determine the true values of Bitcoin and other cryptocurrencies from a fundamental perspective. Bitcoin does not represent ownership of physical assets or intellectual property. It does not generate cash flow and does not pay interest rates or dividends, meaning its price is tied exclusively to investor sentiment and demand.

I think it is reckless for firms like Fidelity to make crypto available to retirement plans, Murray says. It appears to be opportunism at its worst, and the consequences could be severe for those who jump in without really understanding the risks.

Jamie Cox, managing partner at Harris Financial Group, says Bitcoin is a fiduciary lawsuit waiting to happen for retirement plan sponsors, and Fidelitys decision could put the firm under heavy regulatory scrutiny for the time being.

Adding speculative asset classes to 401s isnt in keeping with the intent of qualified plans, Cox says.

Fidelity 401k Investment Options

You have two main choices for your 401k investment options: fixed annuities and variable annuities. Fixed annuities are backed by a guarantee that the fund owner will receive at least some interest, if not all of it. Variable annuities are more risky, however, because the owner can invest up to ninety five percent of his or her salary into the portfolio. If you want to maximize the amount of money that you invest in a 401K plan, you should consider a variable annuity.

A diversified portfolio is best when there is low volatility, and the Fidelity Low-Priced Stock offers both. Both of these funds are able to generate substantial returns, but they offer different levels of risk. If you arent comfortable with this risk, you should consider a professional management program. With this option, Edelman Financial Engines researches your plan options and monitors them for you. This service costs money, but you dont have to pay it out of pocket.

The Fidelity Puritan fund is best for moderate investors. It offers an all-in-one portfolio solution and has consistently produced above-average returns and low volatility over the last three years. You can learn more about this fund by visiting the provider website of Fidelity. It is currently the number one 401k investment option available and ranks in the top 100 funds. You can find it at Fidelitys provider website.

Recommended Reading: How To Calculate 401k Minimum Distribution

Timing Of The Brokerage Account Setup

After submitting the Fidelity brokerage forms to Fidelity Investments, between 5-7 business days , you should receive an email from Fidelity Investments that their system has updated your email address. This indicates the application is in processing.

When you start receiving emails from Fidelity, you can check if the account has been fully setup without having to wait on the Fidelity Welcome Letter in the mail which includes your new account number. Please try to log in using one of the following methods:

- If you have an existing Fidelity login , you should see the new Non-Prototype account appear under your portfolio with an account number that starts with the letter Z.

- If you do not have an existing Fidelity login, you can try to register to Fidelity.com at the following link: You will need to create a username and password.

Fidelity Zero Extended Market Index Fund

Expense ratio: 0%

For investors looking to fill in the gaps created by large-cap blend funds, the Fidelity ZERO Extended Market Index Fund is one of the best Fidelity mutual funds to consider and as is the case with the aforementioned FZROX, FZIPX is basically free as it has a 0% and no transaction costs.

However, there is utility beyond the low/non-existent cost structure. Returning to the idea that FZIPX fills in gaps ignored by large-cap funds, this index fund includes a broad universe of mid- and small-cap stocks usually arent found in large-cap benchmarks such as the S& P 500. Due to that strategy, FZIPX is a mid-cap blend fund.

One advantage of FZIPX is badly lagging energy ranking as its smallest sector weight. Down almost 40% year-to-date, FZIPX is another example of an attractive Fidelity that has been severely dislocated from recent highs that could morph into a winner for long-term investors when better market conditions return.

Read Also: Should I Roll Over 401k Into Ira