Other Sources Of Retirement Income

Home Equity and Real Estate

For some people in certain scenarios, preexisting mortgages and ownership of real estate can be liquidated for disposable income during retirement through a reverse mortgage. A reverse mortgage is just as it is aptly named â a reversing of a mortgage where at the end , ownership of the house is transferred to whoever bought the reverse mortgage. In other words, retirees are paid to live in their homes until a fixed point in the future, where ownership of the home is finally transferred.

Annuities

A common way to receive income in retirement is through the use of an annuity, which is a fixed sum of periodic cash flows typically distributed for the rest of an annuitant’s life. There are two types of annuities: immediate and deferred. Immediate annuities are upfront premiums paid which release payments from the principal starting as early as the next month. Deferred annuities are annuities with two phases. The first phase is the accumulation or deferral phase, during which a person contributes money to the account . The second phase is the distribution, or annuitization phase, during which a person will receive periodic payments until death. For more information, it may be worth checking out our Annuity Calculator or Annuity Payout Calculator to determine whether annuities could be a viable option for your retirement.

Passive Income

Inheritance

Provisions For Changing Jobs

Most 401 plans permit the employee who terminates employment the options of receiving the 401 balance in a lump sum or to receive periodic payments or to roll over the proceeds to an IRA or other employer-sponsored retirement plan. Additionally, some 401 plans permit the terminated employee to retain their 401 balance in their former employer’s plan. Amounts that are retained in a former employer’s 401 plan or transferred to another employer’s plan or IRA postpone the taxation until amounts are subsequently distributed from the plan or IRA the money was rolled into.

When receiving funds from a 401 with the intention to roll the amount to an IRA:

- The rollover must be completed in 60 days.

- Employers must withhold 20% of the proceeds as a withholding tax. It is up to the participant to make up this 20%, or it will be treated as a distribution. The money withheld will be used as a credit against any income tax liability.

- Neither the 60-day rule nor the 20% withholding apply to amounts directly transferred to an IRA or other qualified plan.

Average 401k Balance At Age 22

The average 401k balance at ages 22-24 is actually pretty impressive, and indicates that young people using the Personal Capital Dashboard are taking their retirement savings seriously. When youre in your early 20s, if youve paid down any high-interest debt, endeavor to save as much as you can into your 401k. The earlier you start, the better. As you can see from the potential savings chart, compounding interest is no joke.

Read Also: Can Self Employed Get 401k

How Much You And Your Employer Can Contribute For You In 2022

If your employer offers a 401 plan, it can be one of the easiest and most effective ways to save for your retirement. But while a major advantage of 401 plans is that they let you put a portion of your pay automatically into your account, there are some limits on how much you can contribute.

Each year, usually in October or November, the Internal Revenue Service reviews and sometimes adjusts the maximum contribution limits for 401 plans, individual retirement accounts , and other retirement savings vehicles. In November 2021, the IRS made updates for 2022.

Saving For Retirement: Where Are You Now

Whether you plan to live lavishly or frugally, youll need to have a certain amount of money saved by the time you retire. Think of this figure as a mountain summit, reachable by several different paths. If youve done everything right so far, that summit is still in plain view youve followed the most direct and least difficult path, and all you need to do is continue on in the same direction. If, however, your savings arent where they should be, its as if youve wandered in the wrong directionyoull need to recalibrate and start climbing in order to reach the summit.

To determine your current financial coordinates, you need to answer three questions:

- How much have I saved thus far?

- How many years until I retire?

- Whats my annual income ?

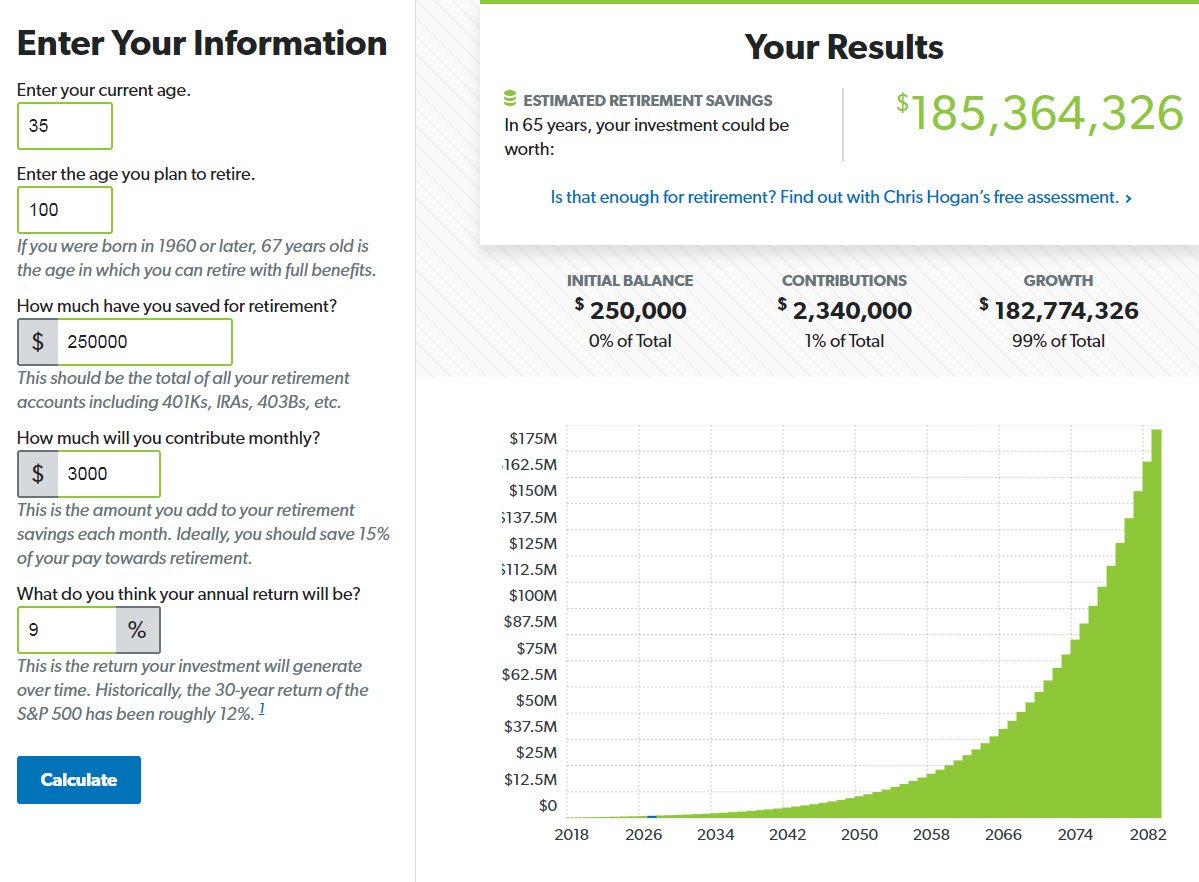

The answers to those questions will determine how much work you have to do to reach that mountaintop. If youve saved plenty and youre still young, greatyoure well on your way. If youve saved nothing and your sixties are just around the corner, not so much. Lets check out some examples using our retirement calculator to see how this works in reality.

Read Also: Do Employers Match Roth 401k

Get The Maximum Match

If your company matches, you should always contribute at least enough to get the full match amount every year. Heres an example of what that might look like:

If your company has a 100% up to 5% match, this means they will match you dollar for dollar, up to 5% of your pay that you deposit into your 401 account. If you make $100,000, you will need to contribute at least $5,000 to get the maximum match of $5,000 annually. If you dont contribute at least $5,000, you will be leaving money on the table that otherwise would have been yours. Dont cheat yourself out of this money! Your future self will thank you.

If you are only contributing the minimum to get the maximum match, keep aware of any increases your company may make to their matching contributions. If you can, you should increase your contributions accordingly to continue to receive the maximum match.

Figure Out How Much Money You Need In Retirement

An often cited rule of thumb is to save 10-15% of your income for every year you work to have enough for a comfortable retirement. For a person making $50,000 per year this would mean saving $5000 to $7500 per year. Financial advisors usually want to be more precise with the calculation saying that youll need 70% of your current pay for every year in retirement .

Read Also: Is There A Limit On Employer 401k Match

What Is The Average Nest Egg In Retirement

If you’re wondering what’s a normal amount of retirement savings, you’re probably one of the 64% of Americans who either don’t think their savings are on track or aren’t sure, according to the Federal Reserve’s Report on the Economic Well-Being of U.S. Households in 2020. Among all adults, median retirement savings …

When To Start Saving For A 401k

Not everyone gets the opportunity to invest in their 401k early on. As soon as it becomes available, consider taking advantage of this benefit. As of 2017, individuals under 49 could legally contribute $18,500 per year. Those 50 years or older, can save an additional $6,000 for a total annual $401k contribution of $24,500.

Many 20-something-year-olds have student debt, changed jobs a handful of times, have not started saving, or are not in a job where a 401k plan is offered. In this case, well look at the amount you should have saved starting at age 30.

A good rule of thumb is to add on one year of salary saved for every five years of age for example, at age 30 youd want to have saved one year of salary, at age 35, two years, at age 40, three years, and so on. Use these guidelines along with your post-retirement budget to gauge if you are on track for a comfortable retirement.

Also Check: What Is Ira And 401k

An Ira Might Be A Better Option

If you are already contributing up to your employer match, another way to invest additional cash is through a traditional or Roth individual retirement account. The IRA contribution limit is much lower $6,000 in 2021 and 2022 so if you max that out but want to continue saving, go back to your 401.

Some 401 plans, typically at large companies, have access to investments with very low expense ratios. That means youll pay less through your 401 than you might through an IRA for the very same investment. In other cases, the opposite is true small companies generally cant negotiate for low-fee funds the way large companies may be able to. And because 401 plans offer a small selection of investments, youre limited to what’s available.

Lets be clear: While fees are a bummer, matching dollars from your employer outweigh any fee you might be charged. But once youve contributed enough to earn the full match or if youre in a plan with no match at all the decision of whether to continue contributions to your 401 is all about those fees. fee analyzer.) If the fees are high, direct additional dollars over the match to a traditional or Roth IRA.

Start Lower And Increase Later

If you find that you cant contribute as much as you think you will need based on whats outlined above, because of your living expenses or debts, figure out what you can contribute. Start by making a budget. Separate out your necessary expenses from your discretionary expenses and see where you can decrease your discretionary spending. Based on your budget, look to contribute as much as you feel comfortable with.

You can also look to increase your contributions later on, consider doing so when you get a raise, a promotion, or on a set periodic basis. For example, you could increase your contributions by 1% each year until you reach 15% of your pay or you could increase one percent for every 4% you get in compensation increases. It’s important to start saving as early as possible.

Read Also: How To Find Out If I Have Old 401k

S To Take Now To Improve Your Retirement Readiness

While the average 401k balance at pre-retirement age is around $600K, that balance still falls far below even the no growth column of the savings potential chart for the same age. And while $600,000 is no chump change, its also probably not enough to retire comfortably for most people.

Needless to say, many people are falling way below their savings potential. But the good news is, its not too late to turn things around.

What Is The Maximum 401k Contribution Amount

Starting in 2020 , you can contribute up to $19,500 each year to your 401k if you are under 50. If you are over the age of 50, you may be able to make catch-up contributions. This provision lets you invest up to an additional $6,500 in your 401k .

PRO TIP: You need to be behind in your 401k contributions to make catchup contributions.

When compared to a Roth IRA, where you can only contribute up to $6,000/year, this is an amazing opportunity especially since your pre-tax money is being compounded over time.

Also Check: What Year Did 401k Start

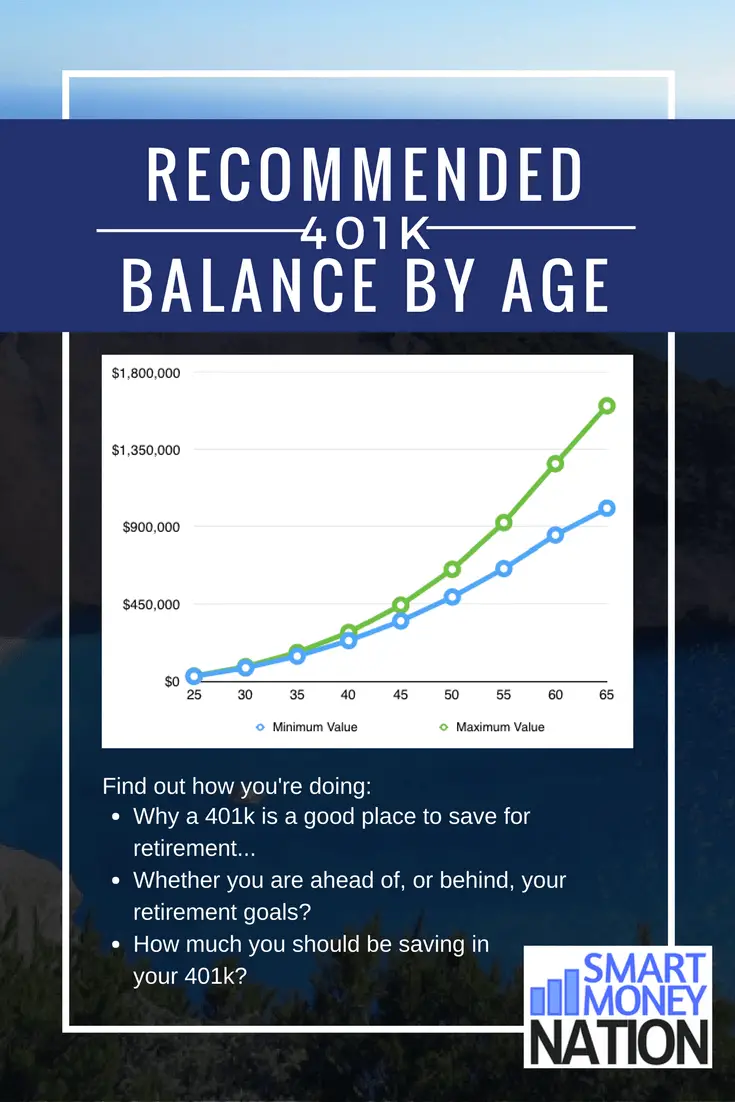

A Look At The Benchmarks

Considering all this, here are some savings benchmarks for people in the following age groups:

Savings Benchmarks by AgeAs a Multiple of Income

Key Assumptions: Household income grows at 5% until age 45 and 3% thereafter. Investment returns before retirement are 7% before taxes, and savings grow tax-deferred. The person retires at age 65 and begins withdrawing 4% of assets . Savings benchmark ranges are based on individuals or couples with current household income approximately between $75,000 and $250,000.

Investor’s Age and Savings Benchmarks| Investor’s Age | |

|---|---|

| 6x to 11x salary saved today | |

| 65 | 7.5x to 14x salary saved today |

We assume the household starts saving 6% at age 25 and increases the savings rate by 1% annually until reaching the necessary savings rate. Benchmark ranges reflect the higher amounts calculated using federal tax rates as of January 1, 2020, or the tax rates as scheduled to revert to pre-2018 levels after 2025. Inflation adjustments to brackets effective in 2021 do not significantly affect the analysis and, therefore, are not reflected. Approximate midpoints for age 35 and older are rounded up to a whole number within the range. Target multiples at retirement reflect estimated spending needs in retirement Social Security benefits state taxes and federal taxes.

What If You Can’t Meet Your Employer Match

If you aren’t yet in a position to contribute enough to meet your employer’s match, and thus not enough to reach the desired 15% savings rate, aim to boost your retirement contributions by 1% to 2% each year. If you opt in to do so, some companies will automatically raise your contribution rate annually, so it’s worth making sure you are signed up for what is called an “auto-escalation” feature.

Ivory Johnson, a CFP and founder of Delancey Wealth Management, recommends increasing your contribution rate as you get pay raises until you max out the limit. There is a limit to how much you can contribute annually to your 401. In 2021, the standard annual contribution limit is $19,500 for 401 plans. And those over age 50 can use catch-up contributions to add an extra $6,500 in their 401 account. Employer contributions don’t count towards those specific limits.

Lynch reminds retirement savers to be strategic with the magic number they would like to contribute to their 401 before automatically trying to max it out, however.

“Situations can arise where you may need to prioritize your cash savings in your emergency fund or save for a different reason, such as for a down payment on property or a vehicle,” she adds. “$19,500 isn’t a small chunk of change.”

Keep in mind that although you don’t pay income taxes on the money you set aside in a 401, you’ll have to pay taxes later on when you eventually withdraw the funds in your nonworking years.

Don’t Miss: Why Rollover Old 401k To Ira

Learn From Your 401 Balance

Although learning about the average 401 balance by age might help you understand where you stand compared to others, it wont help you analyze your retirement situation altogether. Since everyone has different finances, lifestyles, and unexpected emergencies, its important not to use 401 balance by age as your only benchmark.

Instead, you can use it as a way to motivate yourself to start making better financial decisions and contribute more each year. One way to benchmark your savings is by using a retirement calculator that will give you more information on how much you will have saved by a certain age and how much you should be saving monthly to achieve your retirement goals.

Bottom line: Saving early can help you plan for financial success and set you up to be more prosperous later in life.

Plan For Unexpected Expenses In Retirement

Unexpected events can have a big impact on your retirement savings.

It’s possible that you could face:

- having to retire earlier than expected because of personal, professional, or health reasons

- major unplanned expenses such as home or car repairs

- health emergencies, or a need for additional care, for yourself or a loved one

- having to move or make changes to your home because of a change in your health or the health of a loved one

To help plan for unexpected events, set up a bank account or another type of investment or savings tool to use as an emergency fund. Have a percentage of your income automatically deposited into the account. The fund should be enough for you to live on for 3 to 6 months.

Don’t Miss: How To Close Your 401k Early

Scoring The Saverss Credit

As an incentive to get more people to save for retirement, the IRS offers a special credit for people who make below a certain amount and contribute to an employers plan or IRA. The income limits used to qualify are going up slightly for 2021.

The credit is good for 50% of your contribution at the following income levels: single filers who earn $39,500 or less, heads of household making $29,625 or less, and married couples who file a joint return that make $19,750 or less.

Choosing Health Insurance Bills Or Your 401

If you cant afford to pay your monthly bills, you cant afford to make 401 contributions. If there are unexpected expenses or loss of income, you may even need to withdraw retirement money early. If possible, focus on putting in the minimum to get your employers match, then use the additional money to pay off any high-interest debt, like credit cards.

One option, if youre struggling to afford your 401 contributions, is to choose a cheaper health insurance plan. People who overpay for health insurance are 23% more likely to forgo their employers retirement match, a TIAA Institute study found.

A health savings account can help you reduce health costs and save for retirement at the same time. You can only fund one if you have a high-deductible health plan, which often leads to higher out-of-pocket costs. You fund an HSA with pre-tax money. When you spend it on Internal Revenue Service -approved qualified medical expenses, your distributions for those are also tax-free and penalty-free.

An HSA is a good supplement to your 401 contributions because if you have unused money in the account when you turn 65, you can withdraw it without penalty for any purpose, though youll owe income taxes for distributions made for non-qualified medical expenses.

You May Like: How Do I Withdraw Money From My 401k