Advantages Of Borrowing From A 401

Borrowing from your 401 isnt ideal, but it does have some advantages especially when compared to an early withdrawal.

A loan allows you to avoid paying the taxes and penalties that come with taking an early withdrawal. Additionally, the interest you pay on the loan will go back into your retirement account, although on a post-tax basis.

401 loans also wont require a credit check or be listed as debt on your credit report. If youre forced to default on the loan, you wont have to worry about it damaging your credit score because the default wont be reported to credit bureaus.

The Basics Of 401 Withdrawals

The IRS mandates that you leave your money in your 401 until you reach the minimum retirement age of 59 1/2, become permanently disabled, have a specific financial hardship, the plan dissolves or you leave your job. If you meet any of these conditions, you may be able to take funds from your 401, but the amount may be limited and in some cases, you can still be refused. Its also important to be aware that you may or may not be eligible for any additional funds that the company has contributed to your account, depending on the details of your plan and how long you have participated in it.

What Are The Advantages Of Borrowing Money From Your 401

- You won’t pay taxes and penalties on the amount you borrow, as long as the loan is repaid on time.

- Interest rates on 401 plan loans must be consistent with the rates charged by banks and other commercial institutions for similar loans.

- In most cases, the interest you pay on borrowed funds is credited to your own plan account you pay interest to yourself, not to a bank or other lender.

Recommended Reading: How Can I Get Money From My 401k

Why Borrowing From Your 401 Is Almost Always A Bad Idea:

Should You Use Your 401 To Buy A House

There are good reasons for not using your 401 to buy a house. Even if youre comfortable with the 10% early withdrawal penalty, you will still be incurring long-term consequences by reducing your savings. That, in turn, will damage your future growth potential.

Taking out $10,000 from a $20,000 401 account, for instance, leaves you with only $10,000 that will continue accruing interest. With a 7% annualized rate of return, that $10,000 could become $54,000 over 25 years compared to $108,000 had you not withdrawn $10,000.

Withdrawing from your 401 account is essentially taking out a loan against yourself. If you want to pay it back, you also need to pay interest, and the time spent paying it back is time that could have been spent on growth.

You May Like: Can Rollover 401k To Roth Ira

Taking Money Out While Still Employed

If you still work for the organization that handles your 401, it may be more difficult to get your money. Some of the most common approaches for pulling funds out of a 401 are listed below.

Before using those options, its worth a reminder that you should do everything you can to avoid dipping into your 401 before retirement. Its hard to rebuild your retirement nest egg, and 401 plans have benefits that other investments might not offer. For example, your 401 assets might be protected from creditors, but cashing out means you lose that protection.

Finally, talk with your Plan administrator about your options and read through your disclosures carefully. This page provides only enough information to get you started. Find out about any fees, tax consequences, and other effects of using these options.

How Long Do You Have To Repay A 401 Loan

Generally, you have up to five years to repay a 401 loan, although the term may be longer if youre using the money to buy your principal residence. IRS guidance says that loans should be repaid in substantially equal payments that include principal and interest and that are paid at least quarterly. Your plan may also allow you to repay your loan through payroll deductions.

The CARES Act allows plan sponsors to provide qualified borrowers with up to an additional year to pay off their 401 loans.

The interest rate youll pay on the loan is typically determined by the plan administrator based on the current prime rate, but it and the repayment schedule should be similar to what you might expect to receive from a bank loan. Also, the interest isnt paid to a lender since youre borrowing your own money, the interest you pay is added to your own 401 account.

Don’t Miss: What Is Max 401k Contribution For 2021

Youre Close To Retirement

Many employers might reject your application for a 401k if you have less than five years to retirement. The explanation for this has a lot to do with the IRS-stipulated repayment period for such loans, which is five years.

For illustration, lets assume you take a loan two years before your retirement. In this case, your repayment period would stretch beyond your retirement date.

More often than not, repayment periods that stretch beyond the retirement year increase the risk of default. Thats because 401k loans are typically repaid through payroll deductions, and retirees dont receive these.

So if you take out a loan two years before retirement, there will be a three-year period after retirement where youre repaying the loan out-of-pocket. For many individuals, paying out-of-pocket increases the chances of default.

And even if this doesnt apply to you, your employer might not trust you to keep repaying after retirement.

You Have Exhausted Your Loan Limit

Generally, you can borrow a maximum of $50,000 or half of your vested balance. If you already have an old 401 loan that you are paying, you can only be allowed to take a second 401 loan if you have not exhausted your loan limit.

For instance, if your vested balance is $80,000, it means you can only borrow up to $40,000. If you borrow $40,000 in the first loan, you wonât be allowed to take a second loan since you already exhausted your loan limit.

Also, some 401 plans may not allow multiple 401 loans at a time. If you want to take a second 401 loan, you must first pay off the loan fully and wait up to 6 to 12 months before reapplying for a new loan.

Recommended Reading: Can I Roll Money From 401k To Roth Ira

Gift Money After Reviewing The Gift Tax Rules

Beginning in 2018, you can gift up to $15,000 to a person in a year without IRS interfering with your transaction. If you are gifting more than that amount, you need to file a gift tax return. That doesnt mean that you have to pay a tax on the gift. It means that $15,000 is eligible for lifetime exclusion. This is the amount you can gift away during your lifetime without incurring a gift tax. The total lifetime tax exclusion for gifts is $11.2 million per individual so, gift tax rules are not much of a concern for most people.

Temporary Borrowing From A 401 For A Home Addition

Specific rules regarding 401 loans vary by plan administrator. However, many plans do allow participants to take more than one loan out at a time, if you did not take your maximum allowable amount out with the first loan. Total 401 loan limits must not exceed the IRS loan limits that apply to all retirement plans.

Recommended Reading: How To Stop Your 401k

Why You Can’t Borrow From Your 401 And The Only Way You Should

- Publish date: Jul 24, 2014 9:00 AM EDT

Anyone with home or rental payments and a mountain of bills on top can relate to the temptations of borrowing from a 401, but you really shouldn’t.

NEW YORK Anyone with a home or rental payment and a mountain of bills on top of that can relate to the temptations of borrowing from your 401.

The fact is, though, you shouldn’t do it at least almost never.

Not many people take a loan from their 401 plan. According to a recent study from TIAA-CREF, only 29% of Americans have, and of those, 44% say they “regret the decision.”

“Paying off debt was the top reason for taking out a loan from retirement plan savings, cited by 46% of respondents, yet only 26% of respondents said paying off debt was a good reason to take out a loan,” TIAA-CREF says. Women were more likely to take out a 401 loan, by a 51% to 42% margin over men.

Also see: Debt Claims Quarter of the American Dream

Also see: Debt Claims Quarter of the American Dream> >

Pamela Yellen, a consumer financial consultant and two-time New York Times best-selling author, says the 401 has replaced mortgage lending as a “pricey piggy bank” with huge costs for those who borrow from their plans.

“Just because you can take a premature withdrawal or a loan from your 401 doesn’t mean it’s a good deal,” she says. “The Internal Revenue Service collected $5.7 billion in 2011 from penalties, meaning that Americans took about $57 billion from retirement funds that they weren’t supposed to.”

The Net Effect Is Less For You In Retirement

A 401 loan today can mean a big reduction in what you have to live on in retirement. You might either have to work more years to make up for it or be in near-poverty during retirement.

Even though the interest rate on that 401 loan seems really good, the problem is that you are devastating your future. You are taking money out of that account that you will never recover, Clark says.

Recommended Reading: How To Claim 401k Money

Should I Take Out A Loan From My 401

Under the CARES Act, you can take out a 401 loan for up to $100,000, or if lower 100% of the vested account balance for the next six months. Thats up from a prior limit of $50,000, or if lower 50%. Individual retirement accounts dont allow loans.

Typically, you have up to five years to repay a 401 loan. Now the new provision gives Americans an additional year to pay back the loan, raising the time period to six years. Outstanding loans due between March 27 and Dec. 31 will also be extended by a year.

Experts say you could consider taking out a loan to tide you over if youve been furloughed, but are confident that youll be working again in the near future. A 401 withdrawal would make more sense for someone who has been laid off and doesnt have a safety net or enough saved for basic expenses over the next three to six months, they said.

To be sure, if you lose your job, you could be on the hook for taxes for the amount borrowed for a loan.

The loan and withdrawal changes may provide current and future retirees more flexibility, but individuals need to understand the potential long-term financial consequences, experts say.

Youve Already Exceeded Your Loan Limit

As mentioned earlier, theres always a limit to the amount of money you can borrow from your 401k.

If youve previously taken out a loan and are seeking a new one, the new loan should bring the total amount you owe up to 50% of your vested account balance, or $50,000. If it causes your debt to exceed this amount, then the new loan wont be approved.

Some plan administrators wont even allow new loan applications for up to six months after fully repaying your previous loan.

Others wont allow you to take out more than one 401k loan at a time and will reject new applications until you clear the existing debt and wait for at least six months. This might be longer or shorter depending on the employer.

Don’t Miss: How To Transfer 403b To 401k

What Are Alternatives

Because withdrawing or borrowing from your 401 has drawbacks, it’s a good idea to look at other options and only use your retirement savings as a last resort.

A few possible alternatives to consider include:

- Using HSA savings, if it’s a qualified medical expense

- Tapping into emergency savings

- Transferring higher interest credit card balances to a new lower interest credit card

- Using other non-retirement savings, such as checking, savings, and brokerage accounts

- Using a home equity line of credit or a personal loan3

- Withdrawing from a Roth IRAthese withdrawals are usually tax- and penalty-free

Make A 401 Withdrawal

Your second option would be to make a direct withdrawal from your 401 account. As mentioned above, this is the less desirable of the two options.

An early withdrawal would be classified as a hardship withdrawal. The IRS considers any emergency removal of funds from a 401 to cover an immediate and heavy financial need as a hardship withdrawal. Whether or not the purchase of a home using your 401 counts as a hardship withdrawal is a determination that falls to your employer, and you will need to present evidence of hardship before the withdrawal can be approved.

Regardless, you will still likely incur the 10% early withdrawal penalty. There are exemptions in place for specific circumstances, including home buying expenses for a principal residence. Qualifying for such exemptions is difficult by design, however. If you possess other assets that could be used for your home purchase, then you likely wont qualify for an exemption. Even if you do, your withdrawal will still be taxed as income.

Read Also: Can I Invest In 401k And Ira

The Spouse Did Not Consent To The Loan

Though not mandatory, some companies may require spousal consent to approve a 401 loan above a certain threshold, usually $5,000.

If your employer requires spousal consent to approve a loan, they will include a spousal consent form as part of the 401 loan documentation. The spouse must fill this form, and it should be returned alongside your loan application paperwork.

If you return the loan application paperwork without the spousal consent form, the plan administrator will reject the 401 loan application. Since a 401 is considered marital property, plan administrators may require spousal consent to avoid legal tussles.

Why A 401 Loan Should Still Be For Need Not Investing

Ultimately, the key point is simply to recognize that paying yourself interest through a 401 loan is not a way to supplement your 401 investment returns. In fact, it eliminates returns altogether by taking the 401 funds out of their investment allocation, which even at low yields is better than generating no return at all. And using a 401 loan to get the loan interest into the 401 plan is far less tax efficient than just contributing to the account in the first place.

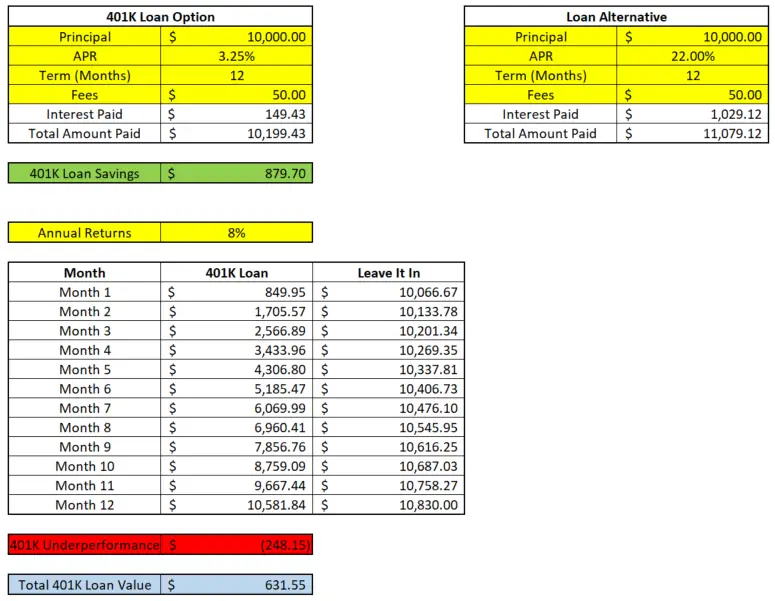

Of course, if someone really does need to borrow money in the first place as a loan, there is something to be said for borrowing it from yourself, rather than paying loan interest to a bank. The bad news is that the funds wont be invested during the interim, but foregone growth may still be cheaper than alternative borrowing costs .

In fact, given that the true cost of a 401 loan is the foregone growth on the account and not the 401 loan interest rate, which is really just a transfer into the account of money the borrower already had, and not a cost of the loan the best way to evaluate a potential 401 loan is to compare not the 401 loan interest rate to available alternatives, but the 401 accounts growth rate to available borrowing alternatives.

Also Check: How Do I Invest My 401k In Stocks

Will A 401 Loan Affect My Credit

Taking out a 401 loan has no direct impact on your credit scores.

- You don’t need a credit check to qualify for a 401 loan, so taking one out doesn’t trigger a hard inquiry and result in a temporary dip in credit scores.

- Payments on 401 loans are not tracked by the national credit bureaus , so they do not appear in your credit reports and cannot factor into credit score calculations. If you miss a payment or even default on the loan, your credit scores will not change.

Note, however, that the extra tax and penalty expenses that come with a 401 loan default can make it difficult to pay your credit bills, which can jeopardize your credit standing indirectly.