You Must Pay Fees On Early Withdrawals

One of the inherent disadvantages of putting money in a retirement account is that youre typically penalized 10% for early withdrawals before the official retirement age of 59½. Plus, you typically cant tap a 401 or 403 unless you have a qualifying hardship. That discourages participants from tapping accounts, so they keep growing.

The takeaway is that you should only contribute funds to a retirement account that you wont need for everyday living expenses. If you avoid expensive early withdrawals, the advantages of using a workplace retirement account far outweigh the downsides.

What Are The Benefits Of A Solo 401

Unlike other options, a Solo 401 account holder can choose between a traditional option and a Roth option. The traditional option allows you to deduct the amount you pay in from your income for that year, giving you an immediate tax break. With the Roth option, the income taxes on that money is paid immediately and you owe no taxes when you withdraw the funds.

The Solo 401 has far higher annual contribution limits than a plain-vanilla IRA, although that is also true for the SEP IRA and the Keogh plan.

The Solo 401 allows you to take loans from your account before you retire. This is not an option with many other retirement plans.

Finally, the Solo 401 is relatively straightforward in terms of paperwork, as it is designed for one-person shops, not corporations.

Plan Allows You To Take Loans From 401 Accounts

401 participants have the option of taking 401 loans, but 401 plan loans must be paid back within a set time period.

401 plan loan terms vary from plan to plan, and plan participants may borrow money from their accounts to use for almost any purpose. Plan participants can also pay loans back with 401 money.

Also Check: Where To Roll Over My 401k

Benefits Of A 401 Plan You Haven’t Considered

As employers phased out traditional pensions, 401 plans were introduced to fill the gaps. Named for the subsection of Internal Revenue Service code that allows for them, these accounts have become the primary retirement savings vehicle for many people.

“They are definitely one of the most coveted benefits when people are taking a job,” says Katie Taylor, vice president of thought leadership for Fidelity Investments.

One reason they are so valuable is that employers often will match a percentage of an employee’s contributions, providing an immediate boost to retirement savings. However, the following lesser known perks of 401 plans also make these accounts an appealing place to save for retirement:

— Multiple options for tax benefits.

— After-tax contributions.

Multiple Options for Tax Benefits

Depending on the plans offered by their employer, workers may be able to choose whether to pay taxes on their retirement funds now or later.

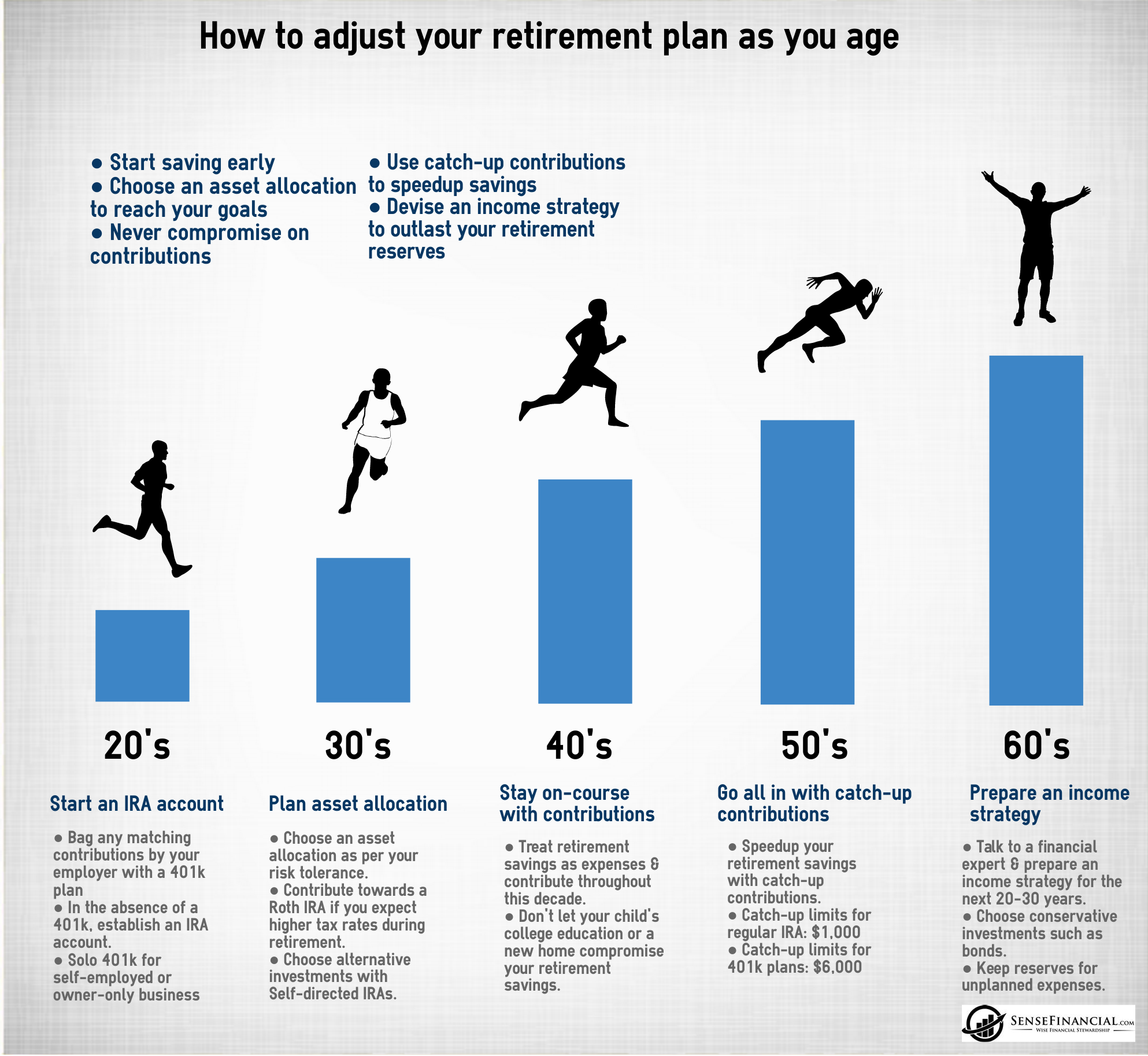

Contributions of up to $19,500 to traditional 401 accounts are tax deductible in 2020. Workers age 50 and older can benefit from catch-up contributions for a total of $26,000 in tax-deductible contributions this year. Money grows tax-deferred and then is subject to regular income tax when withdrawn in retirement. At age 72, retirees must begin taking required minimum distributions, also known as RMDs, regardless of whether they need the money.

After-Tax Contributions

Financial Safeguards

Automatic Enrollment

The Benefits Of A 401 Plan For Employers And Employees

When a small business offers a 401 plan, its often a win-win for business owners and employees. A 401 plan can help businesses attract and retain talent, incentivize performance, and lower taxes, while helping employees including the business owner meet their retirement goals. If you’re a business owner, you’ve probably asked yourself at some point what you and your employees stand to gain by offering a 401 plan. The answer is probably a lot. Here are some of the top benefits.

You May Like: What To Look For In A 401k

Competitive Ability To Recruit And Retain Talent

Retirement benefits are increasingly important to employees. According to a study by Accenture, 68% of workers worldwide ask during the job application process whether a company has a retirement plan like a 401, and 62% seriously consider the availability of such a plan when deciding whether to accept or remain in a job.

There can also be big financial benefits from a 401 in helping to retain and attract top talent and the associated cost savings and productivity gains, said Stuart Robertson, CEO of ShareBuilder 401k.

According to Robertson, research shows that replacing an employee costs 29% to 46% of an employees annual salary, depending on whether that employee is in a managerial position.

Its estimated that an employee who earns $50,000 a year can cost $14,500 on the low end to replace, he said. A 401 plan is a small price to pay, not only for retirement but also for building and keeping a great team.

Brian Halbert, founder of Halbert Capital Strategies, said his business clients have reported significant increases in worker loyalty and productivity when they added a 401 plan to their employee benefits packages.

The single largest benefit coming from a 401 is financially wise employees that have a zeal for working hard for their company, Halbert said. Oftentimes, we see the ROI in productivity and loyalty.

The Many Benefits Of A 401 Plan

The main benefit of 401 plans is that they allow retirement savings to grow tax deferred. But there are more advantages, especially in comparison to individual retirement accounts . Read on for these less-known 401 benefits plus for info about the newer Roth 401. Wish you were more retirement ready? A financial advisor can help.

More people, including part-timers and those who work for small businesses, may soon have access to 401 plans than ever before. That is, if legislation that passed almost unanimously in the House, the Setting Every Community up for Retirement Enhancement Act of 2019, also passes in the Senate. Heres what you need to know about the popular savings vehicle.

You May Like: How To Take My Money Out Of 401k

A Couple Of Things To Remember

You own the money you contribute to your 401 so if you change employers, you can roll it over into your new employers 401 or another qualifying retirement plan account.

Keep in mind that your 401 plan operates on the assumption that you are saving for retirement so once youve put dollars in, there are penalties if you decide to take them out before you reach retirement age.

To withdraw the money means you also miss out on the advantage of time and its effect on compound interest.

Saving early and increasing your contributions as you go can help set yourself up for a secure retirement.

Roth 401s Reduce Taxes Later

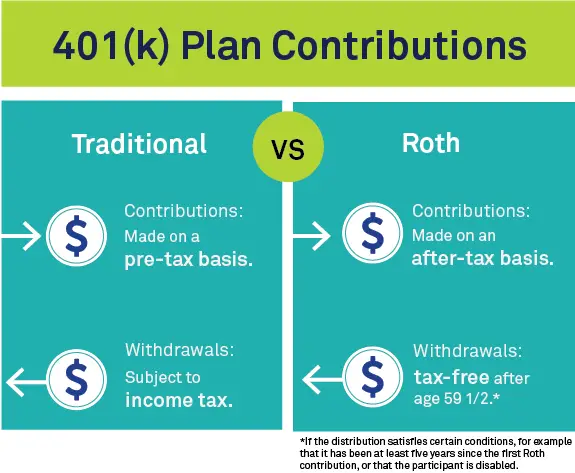

Like tax-deferred 401s, earnings grow tax-free in a Roth 401. However, the Roth 401 earnings aren’t taxable if you keep them in the account until you’re 59 1/2 and you’ve had the account for five years.

Unlike a tax-deferred 401, contributions to a Roth 401 do not reduce your taxable income now when they are subtracted from your paycheck. Contributions to a Roth 401 are after-tax contributions. You are paying taxes as you contribute, so you wont have to pay taxes on the funds or their earnings when you withdraw the money.

- Savers who believe their income and tax rate during retirement will be lower than while working usually opt for a traditional 401.

- Those who predict they will have more income and have a higher tax rate when they retire often prefer the Roth 401.

Among other things, the tax savings you get with a Roth 401 depends partially on the difference between your tax rate while employed and your future tax rate during retirement. When your retirement tax rate is higher than your tax rate throughout your working years, you benefit tax-wise with a Roth 401 plan.

- Taxpayers often have the option of funding both a Roth 401 and a tax-deferred 401.

- The IRS adjusts the maximum contribution amount to account for cost-of-living and announces the annual limits for each type of 401 at least a year in advance.

- Traditionally, the IRS has provided an additional contribution option for savers age 50 and older to enable them to prepare for their pending retirement – $6,500 in 2021.

You May Like: Can I Roll My 401k Into A Brokerage Account

Plans Offer More Investment Options Than Other Types Of Retirement Plans

401 plan participants have the option of choosing investments, which means that 401 plans can adapt to any participant.

401 plans allow you to change investments as often participants want within the account guidelines. Participants also have the option of choosing investment options like stock and bond mutual funds and money market accounts.

Plans Encourage Better 401 Participation

Employers sometimes require 401 contribution levels to be a certain percentage of taxable income, and 401s donât count 401 plans as taxable income.

401 participants who are required to contribute a certain percentage of their accounts often donât have working plans, and plans can help employers increase the participation rates.

Don’t Miss: How Do I See How Much Is In My 401k

Benefits Of A Solo 401

Solo 401s provide some advantages over other types of retirement accounts available to you. One big advantage is the availability of the Roth option as well as the traditional version. Only the traditional option can be used by those who invest using the SEP IRA, a Keogh plan, or a SIMPLE IRA. The plain-vanilla IRA that is available to all who have earned income is available in Roth or traditional versions but the annual contribution limits are far lower.

One of the main advantages of the solo 401 is that it can accept contributions from both an employee and an employer. That is, if you have a solo 401, you wear both hats and can make contributions in both roles.

How Does An Employer Contribution To A 401k Work

Employer contributions, also known as employer matching, are the primary benefit of a 401k for employees. Workers typically choose to enroll in a 401k instead of another retirement option because matching is only allowed through an employer-sponsored 401k. Employer contributions are the portion of retirement dollars given to an employee by the employer.

Companies usually choose to match a percentage of the employees contribution. Organizations can match up to 100 percent of the savings added by staff members. This perk encourages the account holder to contribute larger amounts to receive a greater contribution from their employer.

Its important to note that there are federal regulations for matching, which can be found in the Employee Retirement Income Security Act . These limits were designed to make retirement savings plans fair for every employee.

Don’t Miss: How To Check My Walmart 401k

Benefits Of The Mit 401 Plan

When you enroll in and contribute to your 401 account, you are 100% vested that is you fully own your contributions, MITs matching contributions, and all interest earned on the investments you choose through the Plan.

In addition, you receive tax benefits when you contribute to your MIT Supplemental 401 account. You can choose when you receive your tax benefits right away, with pre-tax contributions, or later on, with Roth post-tax contributions.

Save on a pre-tax basis and receive tax benefits now

- Your 401 contributions are deducted from your paycheck before taxes are applied, reducing your current taxable income and therefore your taxes.

- In retirement, you will pay federal and state income taxes on any amount you withdraw from the plan.

Save on a post-tax basis and receive tax benefits later

- Your 401 contributions are taken out of your paycheck after federal and state income taxes have been applied, so they will not reduce your current taxable income or your taxes.

- In retirement, you will pay no taxes on any amount you withdraw as long as you take the distribution after age 59½ and at least 5 years after the first Roth contribution was made.

You Can Take A Loan From Your 401k

Another great benefit of 401 plans that you probably did not know about is borrowing money from your 401. Many companies allow their employees to take out loans from their 401 savings.

The rules for borrowing money from your 401 vary from one employer to another. Some companies can allow you to borrow up to 50% and up to a maximum of $50,000, according to Fidelity. In addition, there is a limit to how many 401 loans you can take in a year. You must also pay interest on the loans.

The 401 loans will protect you from the early-withdrawal penalty and tax on the money you borrowed. The 401 loans must be paid within 5 years and defaulting on these loans could result in taxes on the money you borrowed plus a 10% penalty if you are under 59 1/2 years old.

Don’t Miss: What Is The Max You Can Put In A 401k

What Is A 401 Plan

Named after the federal tax code section that created them, 401 plans are voluntary savings programs. Employers provide them and employees choose to participate in them. When employees do, a defined amount is taken out of their paychecks and sent directly to their 401 investment accounts.

These contributions are pre-tax, which means they are deducted from your income before your income tax is calculated. Participation in 401s has risen as pensions have become less common.

What Is A 401 Retirement Plan

Traditional retirement accounts give you an immediate benefit by making contributions on a pre-tax basis.

A 401 is a type of retirement plan that can be offered by an employer. And if youre self-employed with no employees, you can have a similar account called a solo 401. These accounts allow you to contribute a portion of your paycheck or self-employment income and choose various savings and investment options such as CDs, stock funds, bond funds, and money market funds, to accelerate your account growth.

Traditional retirement accounts give you an immediate benefit by making contributions on a pre-tax basis, which reduces your annual taxable income and your tax liability. You defer paying income tax on contributions and account earnings until you take withdrawals in the future.

Roth retirement accounts require you to pay tax upfront on your contributions. However, your future withdrawals of contributions and investment earnings are entirely tax-free. A Roth 401 or 403 is similar to a Roth IRA however, unlike a Roth IRA there isnt an income limit to qualify. That means even high earners can participate in a Roth at work and reap the benefits.

Recommended Reading: Can I Roll My Ira Into My 401k

How Does The 401k Plan Work

401k plan is a feature of the eligible profit-sharing scheme, letting workers give away a part of their pay to personal accounts. Moreover, the Internal Revenue Service sets contribution limits to the plan for both employee and merged employee/employer, which differ yearly.

To clarify, employees aged 21 years or more qualify for the plan. Additionally, they must acquire one year of work experience or get covered by a collective bargaining contract not offering plan participation .

The employee elective deferral limit is $20,500 in 2022, based on cost-of-living arrangements. Other than the chosen Roth extension, optional salary deferrals are excluded from the employees net income.

So, here are four vital actions to possess the best 401k plan and relish tax benefits,

Apart from qualified distributions of assigned Roth accounts, distributions are included in taxable retirement payments.

Benefits Of A 401k Plan For A Business

- Tax credits and other incentives for starting a plan may reduce costs.

- A good retirement plan can attract and retain better employees. A business can save the cost of training a new employee.

- Assets in the plan grow tax-free.

- Flexible plan options are available.

- Employer contributions are tax-deductible.

Also Check: Can I Rollover 401k To Td Ameritrade

Plan Has More Flexible Options For Contributions

401 plans are built on certain assumptions, which include that employees are paid twice per month or 24 times per year.

401 plans can be adapted to fit an employeeâs pay schedule, which means that the participants donât have to wait for their next paycheck to put money into their accounts.

401 participants may contribute as little or as much as they want, and they can divide the contribution over a number of paychecks if they want.

401 participants can also specify how much of their contributions go to pre-tax and post-tax accounts, which means that 401s can fit both high and low incomes.

Top 401 Benefits For Employees

Saving for retirement is one of the most important things we must do during our working years. After all, nobody can work forever and living expenses dont stop after you stop earning a paycheck. The following 401 benefits can make it convenient and affordable for employees to achieve their retirement savings goal:

Don’t Miss: How To Take A Loan From 401k

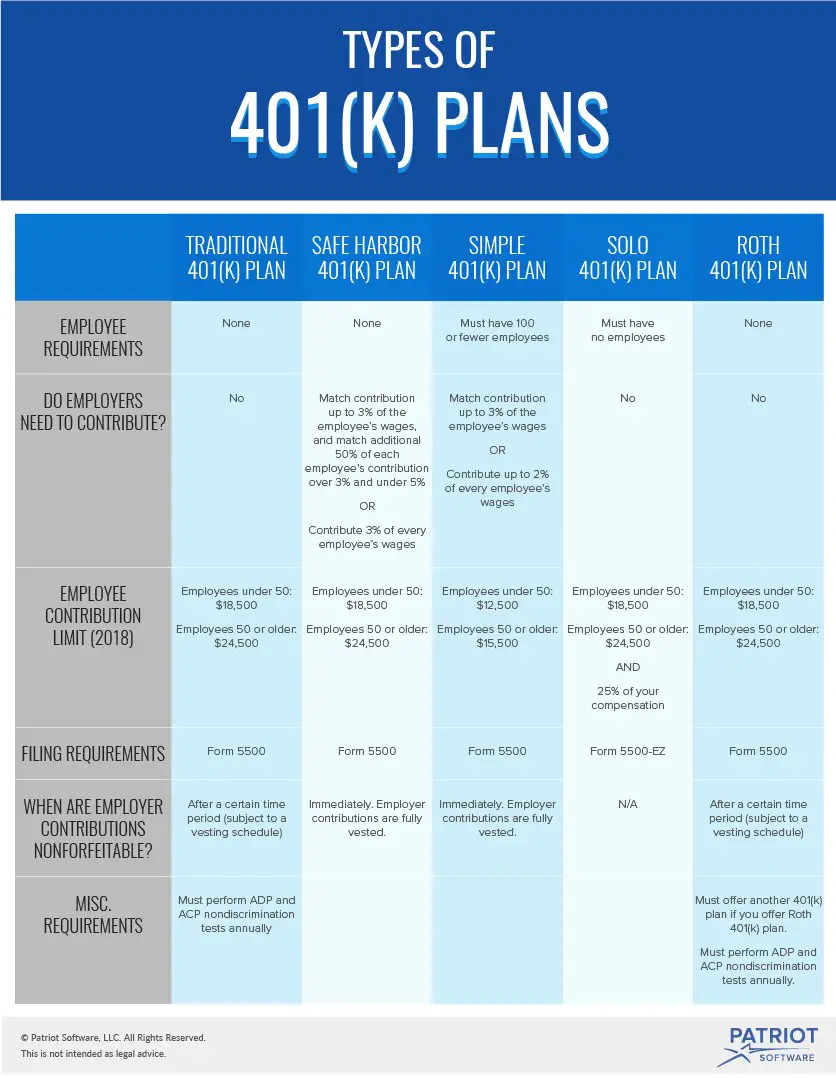

Safe Harbor 401 Plans

A safe harbor 401 plan is similar to a traditional 401 plan, but, among other things, it must provide for employer contributions that are fully vested when made. These contributions may be employer matching contributions, limited to employees who defer, or employer contributions made on behalf of all eligible employees, regardless of whether they make elective deferrals. The safe harbor 401 plan is not subject to the complex annual nondiscrimination tests that apply to traditional 401 plans.

Safe harbor 401 plans that do not provide any additional contributions in a year are exempted from the top-heavy rules of section 416 of the Internal Revenue Code.

Employers sponsoring safe harbor 401 plans must satisfy certain notice requirements. The notice requirements are satisfied if each eligible employee for the plan year is given written notice of the employee’s rights and obligations under the plan and the notice satisfies the content and timing requirements.

In order to satisfy the content requirement, the notice must describe the safe harbor method in use, how eligible employees make elections, any other plans involved, etc. Income Tax Regulations section 1.401-3 , contains information on satisfying the content requirement using electronic media and referencing the plan’s Summary Plan Description.

Both the traditional and safe harbor plans are for employers of any size and can be combined with other retirement plans.