Open An Ira Or 401k Account

Unless youre leaving your money where it is, you have to open an account before you can act on rollover options for a 401k. If youre transferring money into a new employer 401k plan, the transition is simple, but if youre rolling it into an IRA, you have to choose your IRA provider first. Hands-off investors should look for an automated investment management service. If you prefer taking an active role in your IRA investments, look for an online broker that allows you to buy and sell investments with minimal costs.

Roll Over 401 Into An Ira

For those who would prefer not to rely on their new companys 401 plan’s investment offerings, rolling over a 401 to an IRA is another option. Again, rollovers can be direct, direct trustee-to-trustee transfers, or indirect, with the distribution paid to the account owner. But either way, once you start the process, it has to happen within 60 days.

Ford generally favors rolling the money over into the new companys 401 plan, though: For most investors, the 401 plan is simpler because the plan is already set up for you safer because the federal government monitors 401 plans carefully less expensive, because costs are spread over many plan participants and provides better returns, because plan investments are typically reviewed for their performance by an investment advisor and a company 401 investment committee.

About The Authortrue Tamplin Bsc Cepf

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance , a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website, view his author profile on , or check out his speaker profile on the CFA Institute website.

Read Also: Can I Borrow Money From My Fidelity 401k

Follow These 3 Easy Steps

Step 1Select an eligible Vanguard IRA for your rollover*

- If youâre rolling over pre-tax assets, youâll need a rollover IRA or a traditional IRA.

- If youâre rolling over Roth assets, youâll need a Roth IRA.

- If youâre rolling over both types of assets, youâll need two separate IRAs.

Note: You can roll over your assets to a new or an existing Vanguard account.

Step 2Contact the financial institution holding your employer plan

Tell them you want to make a direct rollover from your employer plan to your Vanguard IRA®, and ask what information they need

Need a letter of acceptance?

Youâll be able to create and print a letter of acceptance during our online rollover process.

Note: You may not be eligible to roll over a plan account that youâre still contributing to.

What types of assets do I have in my employer plan account?

Knowing whether you have pre-tax or Roth assets will help you figure out what type of IRA you need to open at Vanguard. If you own company stock in your plan, that may add a layer of complexity to your rollover.

What name did I use on my employer plan account?

A common situation that can delay a rollover is when a check from the current financial institution is made payable to a name that doesnât match your Vanguard account registration. Examples include use of birth name versus married name, a missing suffix , differing middle initials , etc.

What are your rollover requirements?

Are e-signatures or faxed copies allowed?

You Can Invest With A Wider Choice Of Funds Tailored To Your Goals Interests And Risk Appetite

Unlike the typical 401, an IRA comes with the ability to select asset typesand possibly additional investment guidance individually. A broader range of available assets and types may include individual stocks and bonds, CDs, index funds, target-date funds, goal-specific mutual funds, and real-estate investment trusts . “Pick what types of investments make sense for you and your future, says Markwell.

Also Check: How To Transfer 401k From Old Job

Make Sure Your Ira Is Being Invested Appropriately

Remember there are two goals of rolling over an old 401 into an IRA the first is to consolidate your 401 assets, and the second is to grow those assets by allocating them into investments that will increase in value over time.

Your very last step in executing a rollover is to make sure that second goal is being met and that the funds in your IRA are being appropriately invested. If you chose an automated IRA then this should happen automatically. Thats because as soon as your funds arrive theyll be allocated into a portfolio that was created for you during the sign-up process for your new IRA account. You should still log in and check to make sure thats the case, but usually theres nothing more for you to do.

If you choose a self-directed account then youll have to invest the money yourself. Often the simplest option is to purchase a target-date retirement fund this is an investment vehicle that puts your money into a combination of higher-risk, higher-return stocks and lower-risk, lower-return bonds. The exact mix changes as you age so that you have more stocks when youre younger and less as you get older: because stocks generate higher returns but are more volatile we should own more of them early on when we can withstand their fluctuations in order to achieve their higher long-term returns.

Otherwise you can assemble a portfolio on your own by making trades.

Start Investing With Your New Ira

Ever IRA provider will have its own set of investments that it makes available to you. So hopefully during the account choosing process, you picked a brokerage that offers what you want. Once your account is open and fully funded, you can begin making investments as you see fit. Of course, if you go with a robo-advisor, this work is done for you.

In general, those close to retirement keep their investments on the safer side. This could involve investing in bonds or ETFs, both of which are typically reliable. On the other hand, someone further from retirement can afford to be riskier and more speculative. As a result, younger investors often include more stocks in their portfolio in an effort to achieve higher returns.

You May Like: Can I Withdraw From My Fidelity 401k

Can I Transfer The American Funds Shares Held In My Retirement Plan Account Into An Ira

It depends on your retirement plan. Check your plans SPD to see when youre allowed to take a distribution. If you qualify to take a distribution , you can request a direct rollover to an IRA.

Rollovers from retirement plans to IRAs are tax-reportable, however, direct rollovers are not taxable if completed as direct rollovers.

To determine if you may continue to hold your American Fund shares in the same share class, speak with your financial professional or you may call us at .

Roll It Into Your New 401 Plan

Some plans allow you to roll-in your previous employers plan. This can be an easy way to consolidate if you want to have everything in one place assuming the tax status of the two accounts is the same. For example, rolling a traditional, pre-tax 401 into a traditional pre-tax IRA would trigger no tax consequences.

Recommended Reading: Can You Rollover A 401k Into An Annuity

Is There A Service Out There Than Can Handle This Process For Me

Yes thats where Capitalize comes in!

Weve made it our mission to make this process easier for everyone. If you choose to do a 401-to-IRA rollover, we can handle the entire process for you. Most of the process can be done online and our rollover experts will guide you through any of the manual parts.

Its 100% free to you .

Here’s How Retirement Investors Should Consider Price When Rolling Over Accounts

One Industry Focus: Financials listener recently asked an interesting question about 401 rollovers: If you want to roll over your account, but the market has fallen rapidly, are you better off waiting for a rebound? In this clip, host Jason Moser and Fool.com contributor Matt Frankel, CFP, discuss why this shouldn’t be a concern.

To catch full episodes of all The Motley Fool’s free podcasts, check out our podcast center. A full transcript follows the video.

This video was recorded on June 3, 2019.

Jason Moser: Let’s jump into the second question here from Joseph Higgins. Joseph says, “I switched jobs recently. In trying to roll over an old 401 from the time of request until I actually received the forms in the mail, my balance dropped 5%. Would you wait until the market rebounds? Or does it not matter since I’ll be rebuying at lower prices anyway?”

Matt, as I said at the top of the show, you’re a certified financial planner. You run across this type of thing, I think, often in your job. What do you think about Joe’s question there?

Joe, I hope that’s helpful. Good question! Certainly, I don’t think there’s any one cut-and-dry answer there. But hopefully, we’ve given you a couple of extra things to think about, ways to look at it.

You May Like: How To Recover 401k From Old Job

How To Roll Over An Empower 401

If you have a 401 at Empower Retirement from a previous job, there are a few options for you to consider when doing a rollover. Depending on your plan, the process for Empower can be done over the phone or by filling out a form, and a check will either be mailed to your new account provider or sent directly to you to deposit into the new account.

You May Like: How To Grow 401k Fast

Understand The Rules Procedures And Tax Implications

The simplest and easiest way to transfer funds is through a direct transfer, also called a trustee-to-trustee transfer, according to Forbes. In this case, your current provider will wire your money directly to your new 401 or IRA administrator. If one or both parties dont allow direct transfers, youll have to do an indirect transfer, which is rarely the better of the two options.

With indirect transfers, your 401 provider will liquidate your account and send you a check minus 20%, which the IRS requires your employer to withhold which youll then deposit into your new account. You must deposit the check within 60 days or the IRS will treat it the same as an early cash-out and youll be hit with harsh penalties and taxes.

If you roll over your existing 401 into a new 401 or into a traditional IRA, you wont have to pay any taxes on the rollover amount, according to the Financial Industry Regulatory Authority , because those kinds of accounts are funded with pre-tax earnings. If you roll over a 401 to a Roth IRA, on the other hand, you will have to pay taxes on the funds that you convert.

Read Also: Can You Transfer An Ira Into A 401k

Rollover To An Ira Can Mean Tax

If you rollover to an IRA you may have a wide choice of investment options, including choices that employers might not offer, such as mutual funds, annuities and bank CDs. This option allows your funds to continue growing tax-deferred. And you can simplify your financial life by moving the account to a company where you already have funds or even into an existing IRA.

If you choose a Traditional IRA, you won’t pay any taxes when you conduct a rollover. If you roll money into a Roth IRA, you’ll be taxed on the money going into the account, but pay no federal income taxes when you withdraw the money . Money from a Roth 401k can be rolled into a Roth IRA tax-free.

When rolling over a 401k balance into an IRA it’s important to do a full comparison on the differences in the guarantees and protections offered by each respective type of account as well as the differences in liquidity/loans, types of investments, fees and any potential penalties.

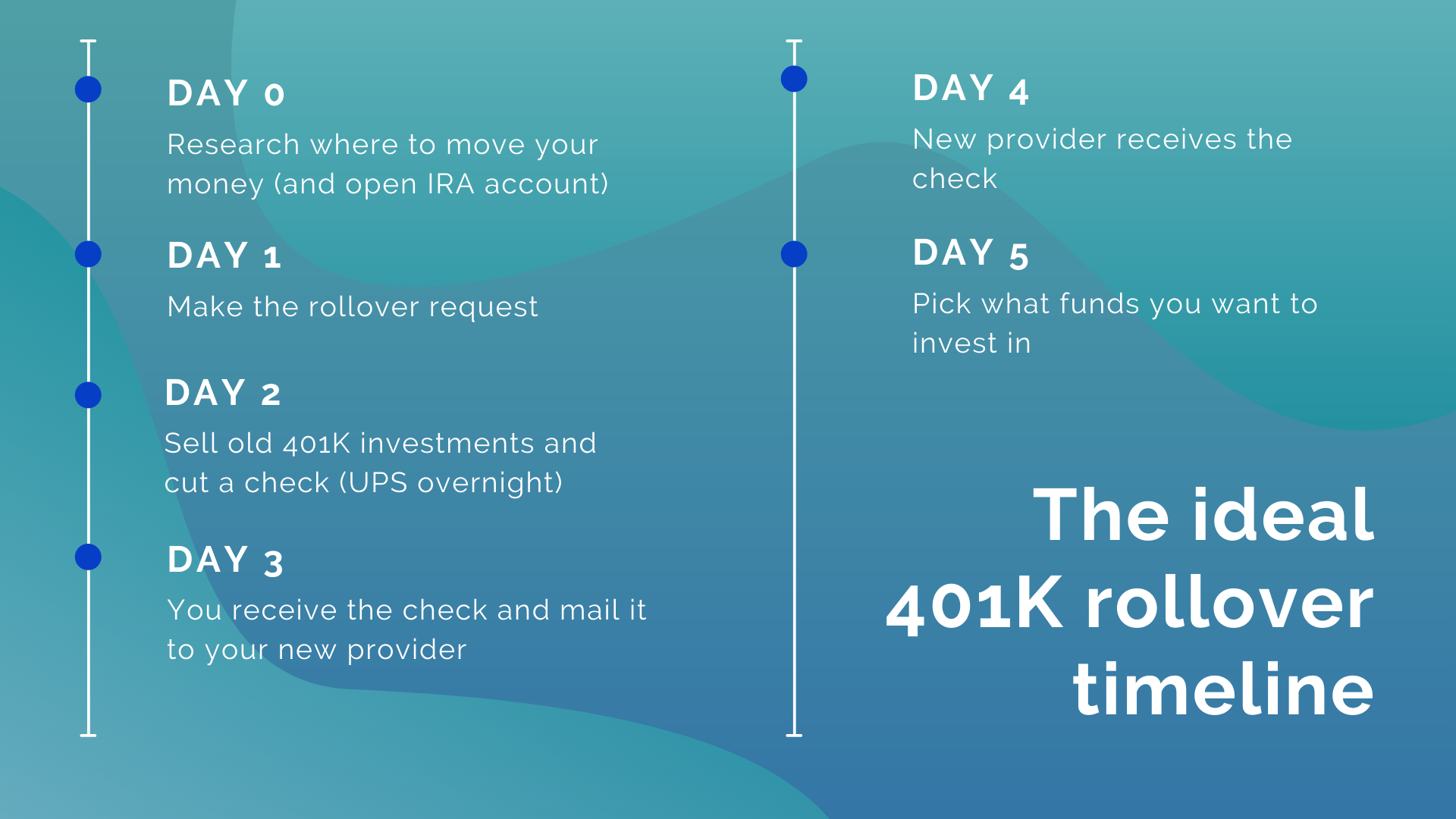

Finish Any Last Transfer Steps

Chances are that by this stage youre done, and your 401 provider has initiated the process of rolling over your 401 into your new IRA. If so, congrats on getting to the finish line!

But there can sometimes be a small extra step at this stage. Thats because some 401 providers will only distribute your 401 funds to you, not to your new IRA provider. If thats the case then theyll send a check with your money to your mailing address. Its then up to you to forward on that check to your new IRA provider using the mailing details that youd previously looked up.

Don’t Miss: What Is The Best Way To Roll Over 401k

Are There Exceptions To The 10% Early Withdrawal Penalty

If youre under 59½ when you cash out of your plan, you may also be subject to a 10% early withdrawal penalty. Certain exceptions include:

- If youre 55 or older when you leave your job.

- Distributions due to death, disability and certain medical expenses.

- You take the distribution as part of substantially equal payments over your lifetime.

Ask your financial professional for more information about these and other exceptions.

Read Also: Should I Open A 401k

Benefits Of A 401 To Ira Rollover

If your new employer doesnt offer a retirement plan or permit 401 rollovers, moving your money into an IRA is an alternative to leaving the assets with your former company.

More choices, more control: While your investment options will likely be limited within a 401 plan, an IRA will provide you virtually endless possibilities, including stocks, bonds, real estate investment trusts , mutual funds and more. An IRA gives much more control and freedom to invest your money how you want and when you want.

Lower fees: Because you will have myriad options for your money within an IRA, its possible that your investments will have lower fees than a 401 plan. By parking your money in passively-managed assets, like index funds and ETFs, you may reduce your expenses.

Don’t Miss: How To Borrow From 401k For Down Payment

How Much Should I Contribute To My 401

Most financial experts say you should contribute around 10%-15% of your monthly gross income to a retirement savings account, including but not limited to a 401.

There are limits on how much you can contribute to it that are outlined in detail below.

There are two methods of contributing funds to your 401.

The main way of adding new funds to your account is to contribute a portion of your own income directly.

This is usually done through automatic payroll withholding ).

The system mandates that the majority of direct financial contributions will come from your own pocket.

It is essential that, when making contributions, you consider the trajectory of the specific investments you are making to increase the likelihood of a positive return.

The second method comes from deposits that an employer matches.

Usually employers will match a deposit based on a set formula, such as 50 cents per dollar contributed by the employee.

However, employers are only able to contribute to a traditional 401, not a Roth 401 plan.

This is especially important to keep in mind if you want to utilize both types of plans.

A key variable to keep in mind is that there are set limits for how much you can add to a 401 in a single year.

For employees under 50 years of age, this amount is $19,500, as of 2020. For employees over 50 years of age, the amount is $25,000.

If you have a traditional 401, you can also elect to make non-deductible after-tax contributions.

Plan in Advance

Alternatives To Roth Ira Rollovers

If you want to move your old 401 account, there are other options that are available to you besides a Roth IRA.

If you have a new 401 plan offered to you at your new employer, you could roll the old 401 plan into your new plan. Similar to opening a Roth IRA, there are a few easy steps to take to move your old 401 into a new employers plan.

You could also roll over your 401 into a Traditional IRA. You wont pay taxes when you convert the money to a Traditional IRA, as you will be taxed when you withdraw the money in retirement. You may want to do this, as Traditional IRAs typically offer more investment choices than workplace 401s.

If you own your own business, then you could open a self-employed 401 plan and convert an old workplace 401 to this account. A self-employed 401 plan offers many of the same benefits as a traditional 401, except that, as a business owner, you could make contributions both as an employee and employer. This helps minimize your business income and maximize your retirement contributions.

You May Like: How Much Should I Put In My 401k Per Paycheck

Open Your New Ira Account

You generally have two options for where to get an IRA: an online broker or a robo-advisor. The option you choose depends on whether you’d rather have your investments managed for you, or you’d rather do it yourself.

-

If you’re not interested in picking individual investments, a robo-advisor can do that for you. Robo-advisors build personalized portfolios using low-cost funds based on your preferences, then rebalance those funds over time to help you stay on track, all for a much lower fee than a conventional investment manager.

-

If you want to build and manage your own investment portfolio, an online broker lets you buy and sell investments yourself. Look for a provider that charges no account fees, offers a wide selection of low-cost investments and has a reputation for good customer service.

» Ready to get started? Explore best IRA accounts for 2021