What Are Your Choices For A Rollover

In general, once you leave a job you have three choices for how to deal with your employer-sponsored retirement plan:

- Leave it with your old employers 401 plan: This approach requires the least amount of work, but may require you to have a minimum amount if you plan to maintain the account there.

- Roll it over into your new employers 401 plan: This approach will require you to file some paperwork, but youll have all your 401 money in one place. This choice can make sense if you like your new employers plan.

- Roll it over into an IRA: This move will require you to file some paperwork, but then youll have the complete freedom to invest the money as you see fit. If you liked the investment options you held in a previous plan, you may still be able to access those via an IRA.

, thats another option for a rollover. But this option is not typical for most individuals.)

If you roll over your 401 into an IRA, youll also want to consider the kind of rollover you need.

- With a Roth 401, youll likely be more interested in a Roth IRA, so that you can maintain the substantial advantages of that plan.

- If you have a traditional 401, then youll probably opt for a traditional IRA.

How Do I Complete The Account Transfer Form

– Open your new account online and follow the step-by-step tutorial.- To transfer to an existing TD Ameritrade account, print the Account Transfer Form and follow the instructions below:

Guidelines and What to Expect When TransferringBe sure to read through all this information before you begin completing the form. Contact us if you have any questions.

Information about your TD Ameritrade Account– Write the name/title of the account as it appears on your TD Ameritrade account. If you do not already know the number of the TD Ameritrade account into which you are transferring, leave the account number section blank.- You must complete the Social Security Number or Tax ID Number section because your transfer cannot be processed without this information.

Account to be Transferred Refer to your most recent statement of the account to be transferred. Be sure to provide us with all the requested information.

Transfer Instructions

– Please contact a New Client consultant if you want help completing the Account Transfer Form .

Do I Have To Leave My Job To Withdraw My Retirement Plan Money

Not necessarily, although thats what most plans require. If your employer terminates your retirement plan, or if you become disabled, you may be given an opportunity to take a distribution. Also, some retirement plans permit you to draw on your retirement plan money after a fixed number of years or upon reaching a certain age, such as 59½ or the plans designated retirement age.

Also Check: Can I Roll My 401k Into A Brokerage Account

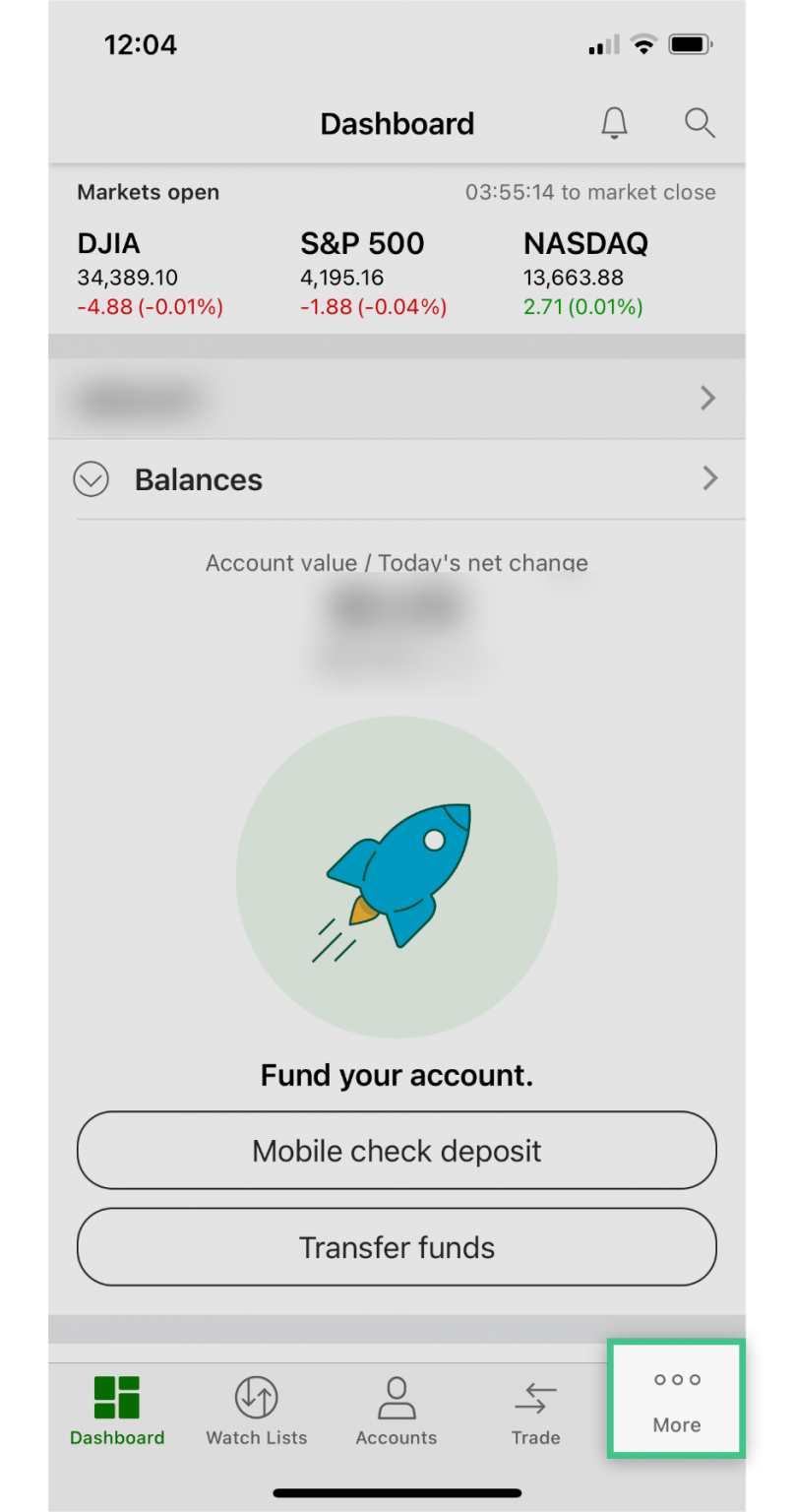

Open Td Ameritrade Investment Account: No Rollovers

If you’re simply opening the new investment-only account with TD Ameritrade to get into traditional equities, then your work is done! Fund your TD Ameritrade account with new contributions, calculated from your business income and you’re ready to go!

Complete the trust plan application:

In Section 1, denote you’ll be opening an account for the Solo 401k and that it’s a non-TD Ameritrade plan:

In Section 3: Trust Information – include the Trust name, and Trust Tax ID number. The grantor is generally understood to be the Adopting Employer and you are the employee participant:

In Section 13, tick the checkbox that the plan is not covered under ERISA:

You must complete that section as you are establishing an account for a tax-exempt trust/QRP .

Include the first 4 pages of your Adoption Agreement and your trust document. These documents can be found in your 401k documents, located on your 401k dashboard.

Note: It is not required you fund the account when submitting the trust account application.

Fax your application to TD Ameritrade at 866-468-6268.

If you’re opening the new investment-only account with TD Ameritrade so you can transfer funds from a pre-existing TD Ameritrade IRA or TD Ameritrade 401k account, the please follow the transfer/rollover tips below.

Can I Roll A Portion Of My Retirement Plan Balance To An Ira Or My New Employers Plan And Take The Remaining Portion In Cash

Yes, you can take a portion of your retirement plan balance in cash and either move the remaining balance to a new employers plan or roll to an IRA. However, the portion taken in cash will be subject to applicable taxes, and possible penalties. Check with your new employer to find out if the rollover will be accepted by the new plan.

Read Also: What Is The Maximum I Can Contribute To My 401k

No One Works For Free

Managing a 401 plan can be a challenge. Thats why most employers hire investment companies and other third-party providers to handle the work. These providers usually charge one or more of the following for their services:

- Plan fees cover the day-to-day operation of a plan, including the 800 number you call when you have a question and the website you use to check your account.

- Individual participant fees apply to the optional services a plan may offer, such as loans. You only pay the fee if you use the service, and its usually deducted directly from your account.

- Investment fees are generally asset-based fees used to cover an investments management and operating costs. Mutual funds and exchange-traded funds refer to these fees as the expense ratio. The amount can vary, from a fraction of a percent to 2% or more of your account balance. The fees are ongoing and deducted from the investments performance .

If you have a brokerage account, you may be assessed a transaction fee each time you place a trade in your account. And if youre investing in a managed portfolio, you may be charged an advisory fee based on your account balance to cover the services of the investment advisor.

Can I Transfer An Existing Debit Balance And/or Options Contracts To Td Ameritrade

If you are transferring a margin and/or options account with an existing debit balance and/or options contract, please make sure you have been approved for margin/options trading in your TD Ameritrade account. Please refer to your Margin Account Handbook or contact a TD Ameritrade representative to ensure that your account meets TD Ameritrade’s margin requirements.

IRA debit balances:Many firms will charge fees to transfer your account, which may result in a debit balance after your transfer is completed. Debit balances must be resolved by either:

– Funding your account with an IRA contribution

– Liquidating assets within your account. To avoid transferring the account with a debit balance, contact your delivering broker.

Transferring options contracts:If your account transfer includes options contracts, the transfer of your entire account could be delayed if we receive your properly completed transfer paperwork less than two weeks before the monthly options expiration date. In this case, your contracts may be exercised or assigned by the firm from which you are transferring your account. Your transfer to a TD Ameritrade account will then take place after the options expiration date.

Recommended Reading: How Do I Find If I Have A 401k

To Add Eft Using An Offline Form

If you prefer to add EFT offline, then heres what you can do.

- Download the PDF form here: Electronic Funds Transfer Authorization

- Be sure to fill out sections 1, 2, and 5, plus those sections that apply to you.

- Attach a copy of a void check, bank statement, or deposit slip

- Submit the form by following the instructions that you will find at the bottom of the form

If you want to set up EFT for a third party account , then here are the steps:

- Download the PDF form here: Electronic Funds Transfer Authorization

- Be sure you fill out sections 1, 3, and 5, plus those that apply to you.

- Attach a Medallion Signature Guarantee in part 5, or you may proceed to a Fidelity Investor Center with all involved parties present to sign documents.

- Submit the form by following the instructions at the bottom of the form

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most how to save for retirement, understanding the types of accounts, how to choose investments and more so you can feel confident when planning for your future.

Also Check: How To Roll An Old 401k Into A New 401k

Are Distributions From My Roth 401 And Roth 403 Accounts Taxable

Qualified withdrawals from Roth 401 or Roth 403 accounts, including earnings, are tax-free. Only the earnings portion of nonqualified withdrawals from Roth accounts is taxable. Withdrawals from Roth accounts are tax-free if the account was established at least five years before, and if youre at least 59½ years of age or if withdrawals are made because of disability or death. Withdrawals from non-Roth accounts are generally taxable.

Can I Move My Assets From One Type Of Plan To Another For Example From A 403 To A 401

You can generally move the vested portion of your account from one type of plan to another as long as the new plan accepts rollovers.

Your after-tax contributions are only transferable between similar plans plan to 403 plan), and you must move your money directly between plans.

Check your new plan to see if it accepts rollovers of Roth assets and/or after-tax contributions.

Read Also: What Is The Best Percentage To Put In 401k

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

M1 Finance Up To $2500 Rollover Bonus

Roll over a qualifying employer-sponsored retirement plan with a participating brokerage into a new M1 Finance IRA for the opportunity to earn up to $2,500 in bonus cash. The bonus thresholds are:

- $100 Bonus: Roll over an account worth $20,000 to $100,000.

- $250 Bonus: Transfer an account worth $100,000.01 to $250,000.

- $500 Bonus: Transfer an account worth $250,000.01 to $500,000.

- $1,000 Bonus: Transfer an account worth $500,000.01 to $1,000,000.

- $2,500 Bonus: Transfer an account worth more than $1,000,000.01.

You must initiate the rollover or transfer by , and maintain your account balance equal to or greater than the initial funding amount for 60 days following the rollover.

This offer does not apply to ACH deposits, wire transfers, IRA transfers , internal transfers, or direct account transfers. You should receive your bonus within 90 days of completing the rollover.

To learn more, read our M1 Finance review.

Sign up

Don’t Miss: How To Transfer Your 401k From One Company To Another

How Do I Rollover If I Receive The Check

If you receive a distribution check from your 401 rollover to a Roth IRA, then chances are good they will hold around 20% for taxes. If you want a direct 401 rollover to a Roth IRA, you may want to send that check back to your employer 401 provider and ask to be sent all of your eligible retirement distribution directly to your new Rollover IRA account .

You have 60 days upon receiving the check to get the money into the Roth IRA- no exceptions! So dont procrastinate on this one.

Betterment Up To 1 Year Managed Free

Get up to one year managed free when you open a traditional IRA, Roth IRA, or SEP IRA with Betterment and make a qualifying deposit including a qualifying rollover within 45 days of account opening.

The bonus thresholds are:

- One Month Free: Fund your account with $15,000 to $99,999 within the qualification period.

- Six Months Free: Fund your account with $100,000 to $249,999 within the qualification period.

- 12 Months Free: Fund your account with $250,000 or more within the qualification period.

Betterment is a low-cost robo-advisor whose management fees range from 0.25% of assets under management to 0.40% AUM annualized, depending on the plan.

As such, the value of this promotion increases proportionally to your account value. An account worth an average of $100,000 during the first six months qualifies for a minimum of $125 in waived management fees. An account worth an average of $500,000 during the first year qualifies for a minimum of $1,250 in waived management fees.

This offer is available to U.S. residents only and cant be combined with any other offers. For more about Betterments benefits, check out our lists of the best high-yield savings accounts and cash management accounts on the market today.

Sign up

Don’t Miss: What Is A Roth 401k Vs 401k

Costs Add Up Over Time

Lets look at a hypothetical example to better understand the connection between investment fees and savings. Figure 1 compares the impact of three different expense ratios on a $10,000 investment, assuming a 5% annual rate of return.

In 30 years, the value of the investment with a 0.50% annual fee is 35% higher than the investment with a 1.50% annual fee. And its more than 16% higher than the one with a 1.00% annual fee. Even a small change in expenses can make a big difference in savings.

FIGURE 1: IMPACT OF INVESTMENT FEES ON SAVINGS AFTER 30 YEARS. For illustrative purposes only. Not a recommendation for or indicative of any specific investment. Past performance does not guarantee future results.

Comparing The 5 Most Popular Solo 401k Providers

Now that we’ve covered the five major “free” solo 401k providers, let’s compare them in a chart side-by-side to see how their offerings compare to each other.

Sorry, the chart doesn’t display on mobile.

|

Comparing The Most Popular Solo 401k Providers |

|

|---|---|

|

Fidelity |

|

|

$0/trade |

$0/trade |

Some notes: Vanguard’s annual fees can be waived over $50,000 in assets. Also, all of these companies offer commission-free ETFs, so you could potentially invest for free within your Solo 401k. Vanguard also have a very odd pricing schedule. While they do offer their own products commission free, if you want to buy other stocks or ETFs, you’ll pay anywhere from $2-$7 depending on how much in assets you have.

Now you can see why the choice of solo 401k providers is so difficult. Each firm has strengths and weaknesses, and the selection depends really on what matters to you.

And if none of these really excite you, you can always create your own solo 401k with a third party provider.

Recommended Reading: How Can I Save For Retirement Without 401k

What Happens If I Already Took The Cash From My Account Can I Still Roll Over To An Ira Or To A New Plan

Yes, but you must do so within 60 days of receiving your distribution to keep the tax benefits. This is known as an indirect rollover.

Your employer withholds 20% of the taxable portion of your distribution for federal income taxes. State income taxes may also have been withheld.

If you replace this withholding with your own money, you can roll over the entire amount of your distribution. The IRS will apply the amount toward your tax liability for the year, and if applicable, youll get the withholding back from the IRS when you file your taxes.

If you roll over your distribution but dont replace the withholding, the amount withheld will be considered a distribution subject to taxes and possible penalties.

You can avoid this with a direct rollover, which goes straight from your old plans trustee to an IRA or your new plans trustee not through you. If the sending and receiving plan types are the same to 457 ), consider a transfer of assets, which is not a tax-reportable event.

How Much Will It Cost To Transfer My Account To Td Ameritrade

We do not charge clients a fee to transfer an account to TD Ameritrade. However, there are sometimes fees attached to holding certain types of assets in your TD Ameritrade account. For example, non-standard assets – such as limited partnerships and private placements – can only be held in TD Ameritrade IRAs and will be charged additional fees.

Delivering firms will usually charge fees to transfer the account out, which may result in a debit balance once your transfer is completed. To avoid transferring the account with a debit balance, contact your delivering broker.

Don’t Miss: What Is The Max Percentage For 401k