How To Prepare For Your Retirement

Not everyone gets the opportunity to invest in a 401 early in life. As soon as it becomes available, its best to consider taking advantage of this benefit.

As of 2022, individuals under 49 can legally contribute $20,500 per year. Those 50 or older can save an additional $6,500 as a catch-up contribution. Starting early will allow you to have more saved by the time of retirement.

Can You Retire Early At 57

A worker can choose to retire as early as age 62, but doing so may result in a reduction of as much as 30 percent. Starting to receive benefits after normal retirement age may result in larger benefits. With delayed retirement credits, a person can receive his or her largest benefit by retiring at age 70.

Why Employers Offer 401s

In 1978, when the law authorizing the creation of the 401 was passed, employers commonly attracted and retained talent by offering a secure retirement through a pension . The 401 created an entirely new system, with more flexibility for both employer and employee. One of the ways it did so was by giving employers the option to match employee contributions.

Matching is a very transparent process: for every dollar you put into your 401, your employer also puts in a dollar, up to a certain amount or percentage of your income. Theres no mystery here. If your employer promises to match all 401 contributions up to 5% of your income, and you contribute that amount every month, your employer will match you dollar for dollar, every month. Its a win-win situation. You are doubling your money, and your employer is building a happy workforce.

Also Check: How To Calculate 401k Match

So How Much Income Do You Need

With that in mind, you should expect to need about 80% of your pre-retirement income to cover your cost of living in retirement. In other words, if you make $100,000 now, you’ll need about $80,000 per year after you retire, according to this principle.

The idea is that once you retire, you’ll be able to eliminate certain expenses. You’ll no longer have to save for retirement , and you might spend less on commuting expenses and other costs related to going to work.

Now, this retirement withdrawal strategy isn’t perfect for everyone, and you might want to adjust it up or down based on the type of retirement you plan to have and if your expenses will be significantly different.

For example, if you plan to travel frequently in retirement, you may want to aim for 90% to 100% of your pre-retirement income. On the other hand, if you plan to pay off your mortgage before you retire or downsize your living situation, you may be able to live comfortably on less than 80%.

Let’s say you consider yourself the typical retiree. Between you and your spouse, you currently have an annual income of $120,000. Based on the 80% principle, you can expect to need about $96,000 in annual income after you retire, which is $8,000 per month.

You Can Roll Over A 401 Account

Workers generally have four options for their 401 when they leave a company: You can take a lump-sum distribution you can leave the money in the 401 you can roll the money into an IRA or, if you are going to a new employer, you may be able to roll the money to the new employer’s 401.

It’s usually best to keep the money in a tax shelter, so it can continue to grow tax-deferred. Whether you roll the money into an IRA or a new 401, be sure to ask for a direct transfer from one account to the other. If the company cuts you a check, it will have to withhold 20% for taxes. And whatever money isn’t back in a retirement account within 60 days will become taxable. So if you don’t want that 20% to be considered a taxable distribution, you’ll have to use other assets to make up the difference.

Don’t Miss: Can You Do A 401k On Your Own

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

How Much Should I Put Into My 401 Out Of Each Paycheck

Aiming to put at least 15% of each paycheck into your 401 as long as you can still comfortably afford your living expenses is an excellent start on your way to saving for retirement. It’s suggested that if you can’t meet this amount, aim for the minimum amount to where your employer will match your 401 investment.

You May Like: Can I Roll My Pension Into My 401k

What Is The 4% Rule

The 4% rule assumes your investment portfolio contains about 60% stocks and 40% bonds. It also assumes you’ll keep your spending level throughout retirement. If both of these things are true for you and you want to follow the simplest possible retirement withdrawal strategy, the 4% rule may be right for you.

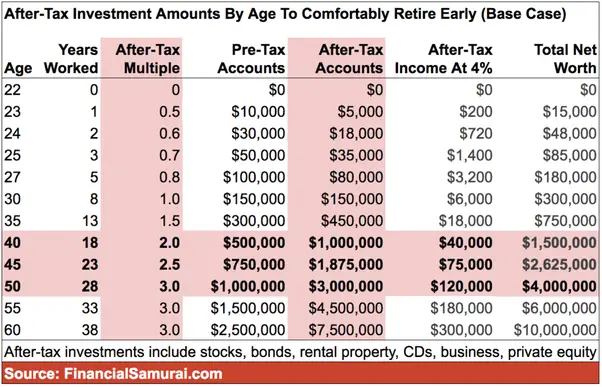

How Much Do I Need To Invest To Retire Comfortably

After a life spent working, you want to be able to retire comfortably. This begs the question: how much do you need to invest in order to be able to retire comfortably? This article will examine this question in order to help you to create a framework for investing during your working life.

There is an oft-quoted rule of thumb that applies to retirement investments. Most advisors agree that you want to have saved enough to provide you with a post-retirement income of 55 to 80 percent of your pre-retirement income for whatever term you think is rational, although most tend to base their estimates on a retirement term of between 20 and 25 years. Where you fall in the range of post-retirement income depends on your spending habits, the medical expenses you can reasonably predict, and the amount of flexibility you would like to have in terms of extending your retirement.

In order to arrive at this figure, the broad consensus is that you should save 15 percent of your salary per year throughout your working life. This figure is high for a lot of people, but the less you put in initially the harder it is to catch up. It is also advisable to start saving as early as possible in order to take advantage of compounding interest. Every year that you are not saving towards retirement, you are losing the benefit of this effect.

Read Also: How To Transfer Rollover Ira To 401k

How Much You Save Matters A Lot More Than Your Rate Of Return

As the charts above showed, if your goal is to have $1 million in your 401, the greater your rate of return, the faster your savings will grow.

That’s why most people estimate their savings using a potential rate of return after all, if you’re 30 and you average an 8 percent return you “only” need to save $436 a month. If you average a 4 percent return, you need to save $1,094 per month.

That’s a huge difference.

But that difference in investment returns is also something you have little control over.

But what you can control is how much you save.

Say you make $40,000 a year and save 3 percent of your salary. That means you save $1,200 the first year. If you earn a 4 percent return on that money, after one year you have $1,248. If you manage an 8 percent return, you have $1,296. That’s not only a better return, it’s two times better.

But if you increase your rate of savings by 1 percent, to 4 percent, you have $1,600 — even if you don’t generate any return at all.

And that’s why, if you want to build wealth, the most important thing you can do is to focus nearly all your attention on your rate of savings, not your rate of return.

The more you save, especially early on, the more you’ll have later.

We’re Building The Best Investment Platform Ever

Titan Global Capital Management USA, Inc is an investment adviser registered with the Securities and Exchange Commission . By using this website, you accept our Terms of Use and Privacy Policy. Titans investment advisory services are available only to residents of the United States in jurisdictions where Titan is registered. Nothing on this website should be considered an offer, solicitation of an offer, or advice to buy or sell securities. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections are hypothetical in nature and may not reflect actual future performance. Account holdings are for illustrative purposes only and are not investment recommendations. The content on this website is for informational purposes only and does not constitute a comprehensive description of Titans investment advisory services.

Read Also: What Is The Maximum Employer 401k Contribution For 2020

Rule : 4% Withdrawal Rate

The 4% withdrawal rule infers that you build up a retirement portfolio that provides a certain amount of income to you per annum at a 4% or so withdrawal rate. A 4% withdrawal rate is often referred to as a safe withdrawal rate.

For example, say you have figured out that you need $40,000 per year in retirement. Using a withdrawal rate of 4%, you should have a minimum of $1 million in retirement savings before you retire.

â $40,000 â 4% = $1,000,000

This rule of thumb works whether you plan to retire early at 35 or go the conventional route and retire at 65 years or later. Its the strategy often utilized by many early retirement enthusiasts or the movement popularly referred to as FIRE Financial Independence/Retire Early.

Note: For earlier retirement plans, consider that you will not be receiving a government pension or retirement benefits until later in life and adjust your income needs accordingly.

The general idea behind the funds lasting you for life is based on historical market returns. If we assume your investment portfolio generates approximately 7% annually in long-term returns, then real returns of approximately 4% are expected after accounting for inflation .

Essentially, a 4% withdrawal rate assumes your investment portfolio is not highly conservative .

What Kinds Of Investments Are Best For Retirement

You should talk with a certified financial planner who is a fiduciary. A fiduciary doesnt work for commissions. They are required by lay to put your best interests first.

In my opinion , you want to invest in liquid assets that cost you as little money as possible. Regardless of how much money you have to invest, you should seek investments that have reliable histories of building value or returning income. And keep in mind that grand old adage of investing, past performance does not guarantee future results.

If youve got a few hundred dollars to begin with, and you have no retirement account, I suggest you open a Roth IRA account. Because your Roth IRA contributions are after-tax deposits, you can withdraw the money at any time. But dont withdraw your earnings unless youre ready to pay taxes on them. Youve already paid taxes on the contributions you still have to pay taxes on the earnings, when you withdraw them.

You can withdraw earnings without paying taxes from a Roth IRA if youre at least 59 years and 6 months old AND you made your first contribution at least 5 years ago. So, the sooner you make a contribution to a Roth IRa account, the better. Start the clock ticking on that 5-year rule.

Also Check: How Does 401k Show On Paycheck

How Much Do You Need To Save To Retire

Financial advisorsâ rule of thumb is to determine the optimal savings rate based on the 4% sustainable withdrawal rule. This is the amount that you can withdraw from your retirement plan, and still expect the nest egg to last a minimum of 30 years.

To estimate the amount you will need in retirement, take the estimated annual expenses in retirement and divide by 4%. If you estimate you will need $50,000 to live comfortably, you will need to save $1.25 million i.e. 50,000/0.04. Similarly, if you estimate you will need $80,000 to live comfortably, you need to save $2 million to live a comfortable retirement life.

How To Calculate Your Monthly 401 Contribution

In 2021, the 401 contribution limit is $19,500 for those under age 50 this increases to $20,500 for 2022. Workers age 50 or older can make an additional catch-up contribution of $6,500 in both 2021 and 2022. You and your employers combined contributions cant exceed $58,000 in 2021 or $61,000 in 2022, excluding catch-up contributions.

However, few people actually contribute these amounts. Only 12% of plan participants made the maximum contribution in 2020, when the limit was $19,500, according to Vanguard’s 2021 How America Saves report.

To determine how much you should be saving, you can use Social Securitys retirement estimator and see what monthly benefit you can expect from that fund. You also can use a retirement calculator to estimate how much youll need each month on top of Social Security. Choose a calculator that allows you to personalize as many factors as possible, including your current age and account balance, anticipated contributions, other sources of income, and expected rates of return.

You May Like: Do I Need Life Insurance If I Have A 401k

Set A Specific Savings Goal

The primary savings vehicle for most Americans these days is a 401 retirement plan. Traditionally, retirees have been able to count on Social Securityand they still canbut the long-term outlook for this government benefits program is complicated by changing demographics. It was never intended to supply everything someone would need to fund their retirement.

All of this makes it more critical than ever for workers to save as much as possible for retirement.

Deciding how much to save first requires having a retirement goal in mind, such as an overall savings level or an annual income target like those mentioned above. Given your plan, you can attempt to reverse engineeror back intoa current level of savings.

You should also include your current age, current savings levels, and estimated retirement age in your calculations. Other primary inputs consist of estimating market return levels, such as the growth rates of stocks, bond interest rates, and inflation rates over the long term.

Evaluate Your Current Financial Situation

When planning for retirement, the next step is to work out how much money you need. To do this, evaluate your current financial situation. Here are some questions to help:

- What is your current household income?

- How much money do you spend on expenses each month?

- How much money are you saving and investing each month?

Once you know the answer to these questions, its time to do some math.

Recommended Reading: How To Retire At Age 62

Also Check: Who Do I Call About My 401k

But Do You Need A Tax

No, you do not need a 401, 403 or 457 tax-deferred plan to retire. Although few if any people could possibly hope to survive on their Social Security benefits , if you make any contributions to Social Security through payroll or self-employment taxes during your working life, youll get some retirement benefits from the government.

But Social Security is just a start. Think of it as the kind of Universal Basic Income that will help improve your retirement. If youre completely desperate and thats all you get in retirement, your best bet might be to find a retirement home that takes all your Social Security benefits and lets you live there. At least youll have a place to sleep, a roof over your head, and food to eat. But I cant promise youll enjoy the quality of life.

If you dont work for an organization that offers a tax-deferred retirement plan and it doesnt have an employee pension plan, you can still plan for your retirement. You can do that with a mix of tax-deferred and post-tax options.

Nor is it ever too late to begin saving for retirement, even if you only have a few working years left in your career. Save what you can now and plan to supplement your income with passive income strategies anyone can use. Passive income strategies include blogging, investing in stocks that pay dividends, real estate you rent out, and so on.

How Much Should I Have In My 401k

Laurie BlankSome of the links included in this article are from our advertisers. Read our Advertiser Disclosure.

If youre wondering how much money you should have in your 401k, your wait is over. Retirement savings is much of the talk in todays personal finance world.

You want to make sure youre saving enough to meet your retirement goals. Otherwise, you may have to find ways to save more or possibly delay retiring.

While each person has a different financial situation, these insights can improve your retirement plan.

In This Article

Recommended Reading: Can I Rollover My 401k Into An Existing Ira