Investing In Alternative Assets

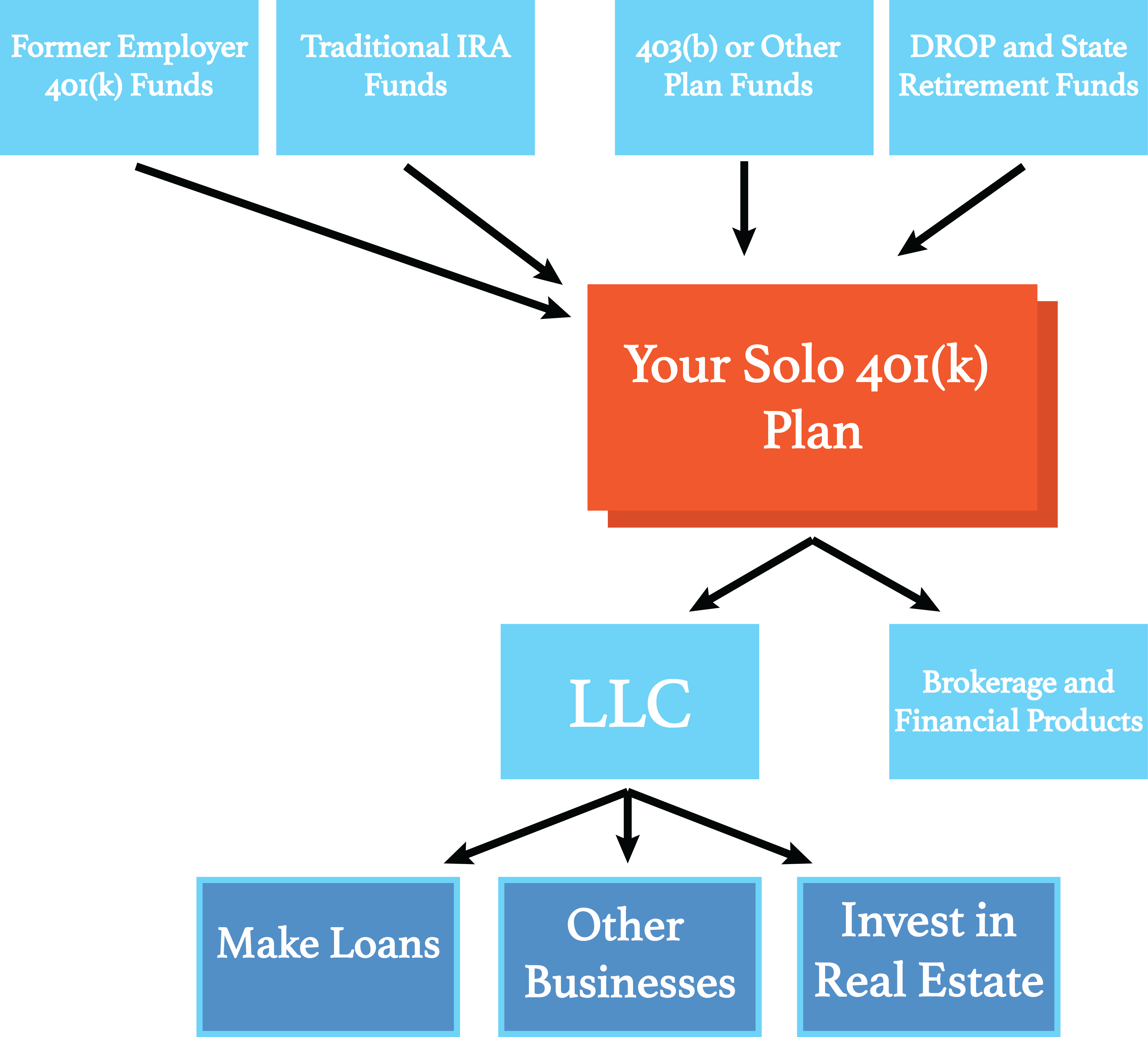

In addition to account freedom, where most traditional IRA and Roth IRAs through bank trusts are limited to stocks, bonds, and treasury, SDIRA accounts can take advantage of many other options. Self-directed IRA owners have the perk of exploring alternative assets. With the wealth youve already accumulated in your existing 401K, you can invest in real estate, private loans, small businesses, precious metals or many other options.

With so many alternative investments, you can build a strong, versatile portfolio that will not only utilize the funds youve already accumulated, but help their long-term growth.

While an SDIRA allows for many investment options, there are limitations. Most collectibles, artwork, and life insurance are considered off-limited by the internal revenue service. While the IRS doesnt have a direct list of assets you can invest in, they do have a list that states specifically what you cannot. After considering whether or not a self-directed IRA is right for you, you can take the steps to rollover your 401K.

How To Pick An Ira To Roll Over To

The most important question you need to ask is whether you want to start a traditional IRA or a Roth IRA. Traditional IRAs work much like traditional 401 plans. You contribute money before you pay taxes. The 2021 maximum contribution limit for traditional and Roth IRAs is $6,000.

With a traditional IRA, the money you contribute is deducted from your taxable income for the year. When you reach retirement, the money is taxable as you withdraw it. A Roth IRA, however, works differently. You contribute money post-taxes. The money is then not taxable when you withdraw it in retirement. If you think you might want to keep contributing to your new IRA after the rollover is complete, its important to decide which type of IRA you want.

Its also important to consider the tax implications. If you have a traditional 401 plan, that means you didnt pay taxes on the money when you contributed it to your account. If you want to move that money into a Roth IRA, youll have to pay taxes on it. You can roll over from a traditional 401 into a traditional IRA tax-free. Same goes for a Roth 401-to-Roth IRA rollover. You cant roll a Roth 401 into a traditional IRA.

Follow These 3 Easy Steps

Step 1Select an eligible Vanguard IRA for your rollover*

- If you’re rolling over pre-tax assets, you’ll need a rollover IRA or a traditional IRA.

- If you’re rolling over Roth assets, you’ll need a Roth IRA.

- If you’re rolling over both types of assets, you’ll need two separate IRAs.

Note: You can roll over your assets to a new or an existing Vanguard account.

Step 2Contact the financial institution holding your employer plan

Tell them you want to make a direct rollover from your employer plan to your Vanguard IRA®, and ask what information they need

Need a letter of acceptance?

You’ll be able to create and print a letter of acceptance during our online rollover process.

Note: You may not be eligible to roll over a plan account that you’re still contributing to.

What types of assets do I have in my employer plan account?

Knowing whether you have pre-tax or Roth assets will help you figure out what type of IRA you need to open at Vanguard. If you own company stock in your plan, that may add a layer of complexity to your rollover.

What name did I use on my employer plan account?

A common situation that can delay a rollover is when a check from the current financial institution is made payable to a name that doesn’t match your Vanguard account registration. Examples include use of birth name versus married name, a missing suffix , differing middle initials , etc.

What are your rollover requirements?

Are e-signatures or faxed copies allowed?

Do you need a letter of acceptance ?

Read Also: How Do I Find Previous 401k Accounts

Pick An Ira Provider For Your 401 Rollover

When moving your money, you need to figure out which brokerage will provide you with the services, investment offerings and fees you need. If youre a hands-on investor who wants to buy assets beyond stocks, bonds, ETFs or mutual funds, you need to look for a custodian that will allow you to open a self-directed IRA. On the other hand, if youre more hands-off, it might make sense to choose a robo-advisor or a brokerage that offers target date funds.

Considerations For Owners Of Roth Iras

Distributions from a Roth IRA are qualified, and thus tax-free and penalty-free, provided that the 5-year aging requirement has been satisfied and at least one of the following conditions has been met:

- You reach age 59½

- You pass away

- You are disabled

- You make a qualified first-time home purchase

All other distributions are non-qualified. Non-qualified distributions of converted balances are not taxed again , but they may be subjected to a 10% penalty unless it’s been at least five years since the beginning of the year of your conversion, you’ve reached age 59½, or one of the other exceptions applies.

RMDs are not required during the lifetime of the original owner of a Roth IRA. RMD amounts are not eligible to be converted to a Roth IRA.

Read Also: What Is The Difference Between 401k And 403b

Why You Might Not Want To Combine Your Ira With Your 401

On the flip side, there are plenty of areas where a traditional IRA has a leg up on a 401 that is, of course, why so many people roll a 401 into an IRA. Here are the biggest you should know:

-

Wider investment selection: Within an IRA, you can invest in nearly anything under the sun not just the mutual funds, index funds and exchange-traded funds that show up in 401 plans, but also individual stocks and even options . You can also shop around for the absolutely lowest-cost funds, which can save you money. As noted above, you should look closely at your 401 plan and its investments to see if youd save money by leaving your funds in your IRA.

-

More loopholes for early withdrawals: Aside from the aforementioned loans, a 401 may allow hardship withdrawals in certain situations the IRS defines hardship as an immediate and heavy need, which means things like unreimbursed medical expenses, funeral expenses or disability. Those will waive the 10% penalty on early distributions youll still owe income taxes on the withdrawal. But a traditional IRA casts a wider net, allowing early distributions without penalty but with taxes still owed for higher education expenses and a first-time home purchase .

-

Low-cost options for investment management: If your 401 plan doesnt come with anything in the way of investment advice, and you want that sort of thing, youll have more options for getting it on the cheap within an IRA if youre open to a robo-advisor. .)

Gain Control Of Your Self Directed Ira

Broad’s IRA LLC features unlimited free transactions with checkbook control, incredible client support, and no asset-based fees.

An IRA LLC allows you to purchase assets quickly without any transaction fees. It also offers multi-member investing and superior liability protection. The process works by setting up a specialized LLC for your IRA and then using that LLC to invest your retirement funds. An IRA LLC is most suited for assets like real estate whose upkeep and management involve numerous transactions.

Ready to start investing in your future?

Schedule a complimentary call with our IRA Specialists to learn more about Broad’s IRA LLC

Read Also: What To Do With 401k When You Retire

Benefits Of Rolling Over Your 401

Self Directed Ira Indirect Rollover: The 60

The indirect rollover process starts with the Self Directed IRA account holder receiving the funds from the original account. These funds could be a check made out to the account holder or they could be deposited directly in an unrelated account. Either way, the account holder must use this money to fund a retirement account within 60 days. If they are not placed in a new retirement account, they will lose their tax-advantaged status.

The time window for this rollover is tightly defined. The 60-day period begins the day after the account holder receives the distribution. At this point the funds must be placed in the Self Directed IRA by day 60. This is a hard deadline. The funds must be in the account and not just in the mail.

You May Like: How Much Tax On 401k After Retirement

Direct Rollover V Transfer

When transferring funds directly from a retirement account to a Self Directed IRA, the process can have different names. A transfer refers to moving funds in between two similar accounts. This could be from a Traditional IRA to a Traditional IRA, a Roth IRA to a Roth IRA, or between two qualified plans. A direct rollover refers to funds being moved between two different kinds of accounts, e.g. from a 401 to a Self Directed IRA. In either case there are no taxes due, but there are differences in the process.

One of the key differences between a transfer and a direct rollover is whether the event is reportable. A transfer from a standard IRA to a Self Directed IRA will not require any IRS reporting. This is not the case for a direct rollover into a Self Directed IRA. The institution that is sending the funds will have to file IRS Form 1099-R. The account receiving the funds will file IRS Form 5498. Additionally, the account holder will have to properly note the rollover on their tax return.

Another difference between a transfer and a direct rollover is whether or not the process can be used for a Required Minimum Distribution. RMDs may be included in a transfer but they may not be included in a direct rollover.

When Not To Transfer To An Ira

You now know some of the benefits of moving your 401 to an IRA. But control over your money isnt the only thing that matters, and you may have other priorities. Its impossible to list every potential pitfall, but a few examples may offer food for thought.

Between age 55 and 59.5

When youre at least 55 years oldbut not yet 59 1/2 years oldyou might want to leave at least some of your money in the 401 plan. 401s allow you to pull money out without penalty after age 55 . IRAs, on the other hand, require that you wait until age 59 ½ to avoid an early-withdrawal penalty of 10% on certain distributions. There are always exceptions and workarounds, but those are the basic rules. If you intend to spend your 401 savings between the ages of 55 and 59 1/2, keep this in mind before making a transfer.

Note: Some public safety workers can avoid early withdrawal penalties from a retirement plan as early as age 50. If you worked for a federal, state, or local government, be sure to explore your options.

Depending on state laws, money in IRAs might be treated differently, and a 401 might offer more protection . Federal law often applies to ERISA-covered 401 plans, while state laws cover IRAs. However, there is some federal protection for IRAs in bankruptcy. When you owe federal tax debts or assets are due to an ex-spouse, protection is usually limited.

Roth Conversions

RMD While Working

Stable Value Offerings

Fees and Expenses

You May Like: How To Use My 401k To Start A Business

Avoiding Taxes And Penalties On Self

The best way to avoid taxes and early 401k withdrawal penalties is to complete the rollover within sixty days. If you do this, you will not face any penalties or taxes. If you miss the deadline, you will owe a ten percent penalty as well as owe taxes on the amount that you withdrew. If you pay the taxes on a traditional to a Roth conversion from your 401k, you will need to pay the penalty on that money. Be sure to talk to a tax professional about this if you end up owing a penalty or taxes.

If you are ready to roll your self directed 401k into a self directed IRA, you can call 1-800-776-7253 to find a professional in your area to answer any questions about the process and to help you find the right options for you.

Can I Rollover Or Transfer Myexisting Retirement Account To Aself

|

Transfer/Rollover |

|

|---|---|

|

I have a 401 account with a former employer. |

Yes, you can rollover to a self directed IRA. If it is a Traditional 401, it will be a self-directed IRA. If it is a Roth 401, it will be a self-directed Roth IRA. |

|

I have a 403 account with a former employer |

Yes, you can roll-over to a traditional self-directed IRA. |

|

I have a Traditional IRA with a bank or brokerage. |

Yes, you can transfer to a self-directed IRA. |

|

I have a Roth IRA with a bank or brokerage. |

Yes, you can transfer to a self-directed Roth IRA. |

|

I dont have any retirement accounts but want to establish a new self-directed IRA. |

Yes, Yes, you can establish a new Traditional or Roth self-directed IRA, and can make new contributions according to the contribution limits and rules found in IRS Publication 590. |

|

I have a 401 or other company plan with a current employer. |

No, in most instances your current employers plan will restrict you from rolling funds out of that plan. However, some plans do allow for an in-service withdrawal if you are at retirement age. |

Don’t Miss: How Long Do You Have To Transfer 401k

When You Don’t Roll Over

Cashing out your account is a simple but costly option. You can ask your plan administrator for a checkbut your employer will withhold 20 percent of your account balance to prepay the tax youll owe. Plus, the IRS will consider your payout an early distribution, meaning you could owe the 10 percent early withdrawal penalty on top of combined federal, state and local taxes. That could total more than 50 percent of your account value.

Think TwiceThe repercussions of taking money out now could be enormous: If you took $10,000 out of your 401 instead of rolling it over into an account earning 8 percent tax-deferred earnings, your retirement fund could end up more than $100,000 short after 30 years.

If your former employers plan has provided strong returns with reasonable fees, you might consider leaving your account behind. You dont give up the right to move your account to your new 401 or an IRA at any time. While your money remains in your former employers 401 plan, you wont be able to make additional contributions to the account, and you may not be able to take a loan from the plan. In addition, some employers might charge higher fees if youre not an active employee.

Further, you might not qualify to stay in your old 401 account: Your employer has the option of cashing out your account if the balance is less than $1,000 though it must provide for the automatic rolling over of your assets out of the plan and into an IRA if your plan balance is more than$1,000.

Third: Complete The On

The self-directed solo 401k provider will need to issue a Form 1099-R to report the non-taxable transfer of the solo 401k and its assets to the self-directed IRA. For My Solo 401k Financial clients, the following form is used:

REPORTING THE FULL SOLO 401K DIRECT ROLLOVER TO A TRADITIONAL IRA

Form 1099R

The solo 401k provider will report the direct rollover from the solo 401k to the IRA on Form 1099-R. A 1099-R is a required document that must be completed and sent to the IRS for all distributions, including non-taxable direct rollovers to a TRADITIONAL IRA from a Solo 401k plan. The 1099-R will be issued in February of the year following the transfer, with a copy sent to you for filing with your taxes and a copy sent to the IRS. IMPORTANT: The direct rollover is not taxable only re-portable IF the funds are transferred to a TRADITIONAL IRA.

Recommended Reading: How To Start A 401k Account

What Does A Self

Lets start with the basics. A Self Directed IRA rollover is the process where funds are transferred from an existing retirement account into a self-directed account. The purpose of the Self Directed IRA rollover is to maintain the tax-advantaged status of the retirement funds. Without the concept of a rollover, then any time funds were taken out of the first account, they would be considered a distribution. Talk about creating paperwork! Luckily the IRS allows for the funds to keep their tax-advantaged status as long as they are rolled over in a timely manner.