Retirement Funds Don’t Have To Be Off

Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

For those who invest in their 401 plan, the traditional thinking is to wait until retirement before taking distributions or withdrawals from the account. If you take funds out too early, or before the age of 59½, the Internal Revenue Service could charge you with a 10% early withdrawal penalty plus income taxes.

However, life events can happen, which might put you in a position where you need to tap into your retirement funds earlier than expected. The good news is that there are a few ways to withdraw from your 401 early without incurring a penalty from the IRS.

Withdrawing Money From A : Taking Cash Out Early Can Be Costly

An unexpected job loss, illness or other emergencies can wreak havoc on family finances, so its understandable that people may immediately think about taking a withdrawal from their 401. Tread carefully as the decision may have long-range ramifications impacting your dreams of a comfortable retirement.

Taking a withdrawal from your traditional 401 should be your very last resort as any distributions prior to age 59 ½ will be taxed as income by the IRS, plus a 10 percent early withdrawal penalty to the IRS. This penalty was put into place to discourage people from dipping into their retirement accounts early.

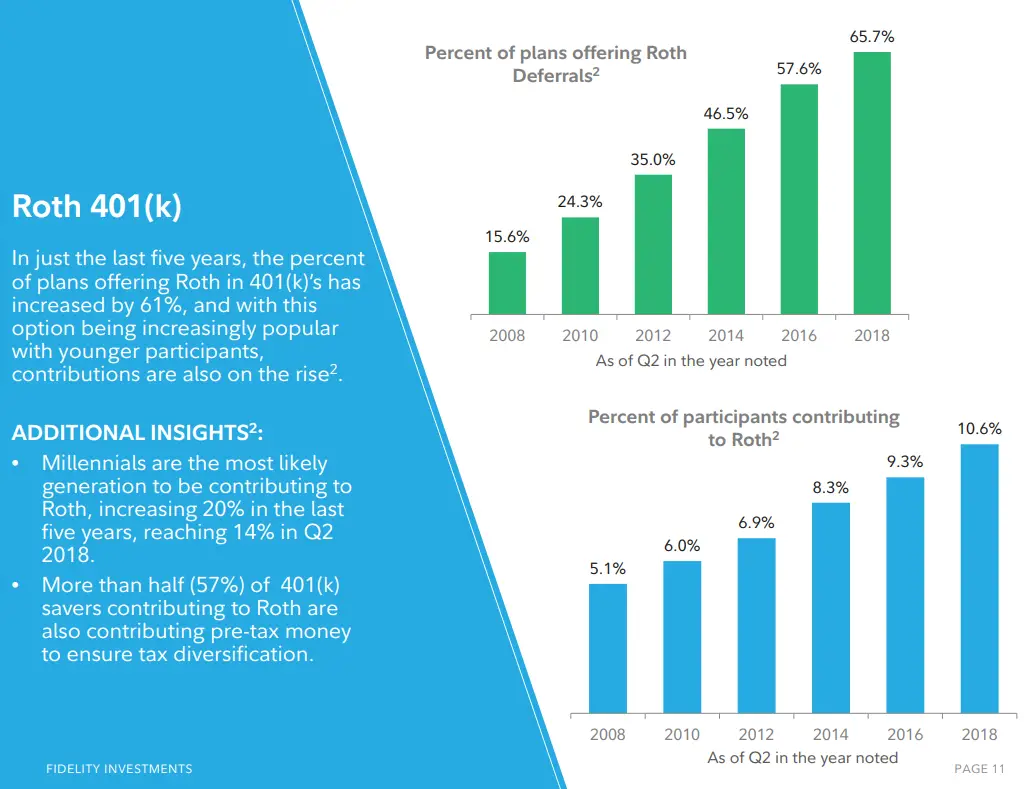

Roth contribution withdrawals are generally tax- and penalty-free contribution and youre 59 ½ or older). This is because the dollars you contribute are after tax. Be careful here because the five-year rule supersedes the age 59 ½ rule that applies to traditional 401 distributions. If you didnt start contributing to a Roth until age 60, you would not be able to withdraw funds tax-free for five years, even though you are older than 59 ½.

How Does Fidelity Make Money With No Fees

Fidelitymake moneyfundsfeefundfundHere’s how to avoid 401 fees and penalties:

You May Like: Can You Move Money From 401k To Roth Ira

Consider Mobile Check Deposit

If youre already a Vanguard client and youre registered for online access, remember that you can use our mobile check deposit option offered through the Vanguard app. Its faster than mailing a check!

When youre logged on and using the app, just tap the Mobile check option under the main menu and then follow the instructions. Learn more about mobile check deposit

Key Considerations With 401 Loans

- Some plans permit up to two loans at a time, but most plans allow only one and require it be paid off before requesting another one.

- Your plan may also require that you obtain consent from your spouse/domestic partner.

- You will be required to make regularly scheduled repayments consisting of both principal and interest, typically through payroll deduction.

- Loans must be paid back within five years .

- If you leave your job and have an outstanding 401 balance, youll have to pay the loan back within a certain amount of time or be subject to tax and early withdrawal penalties.

- The money you use to pay yourself back is done with after-tax dollars.

Although getting a loan from your 401 is relatively quick and easy, the benefit of paying yourself back with interest will likely not make up for the return on investment you could have earned if your funds had remained invested.

Another risk: If your financial situation does not improve and you fail to pay the loan back, it will likely result in penalties and interest.

Read Also: How Much Can I Put In My 401k Per Year

Loan Or 401 Withdrawal

While similar, a 401 loan and 401 withdrawal arent interchangeable and have a few key differences. While you can use either to access up to $100,000 of your retirement funds penalty- and tax-free as part of the Consolidated Appropriations Act, they each have their own rules.

As part of a 401 withdrawal:

- Repayment isnt required.

- Theres no withdrawal penalty.

- Distribution will be taxed as income, but you can pay it back within three years and claim a refund.

As part of a 401 loan:

- You must repay the loan within a specified time frame .

- The loan amount isnt taxed initially, and theres no penalty. If you cant pay it back within the specified time frame, the outstanding balance is taxed and youll also be assessed a 10 percent early withdrawal penalty, if you are under age 59 1/2.

- If you leave your job, you have until mid-October of the following year to offset the outstanding loan amount. Otherwise, you could owe 401 early withdrawal taxes and penalties.

Work with your plan sponsor to learn more about the pros and cons of a 401 withdrawal vs. 401 loan.

What Is Fidelity 401k

3.9/5

Simply so, what is a 401k plan and how does it work?

A 401k is a qualified retirement plan that allows eligible employees of a company to save and invest for their own retirement on a tax deferred basis. Only an employer is allowed to sponsor a 401k for their employees.

Beside above, does fidelity have a 401k? Fidelity’s 401 plans for small businesses through Fidelity Workplace Services can help you offer competitive benefits to your employees.

One may also ask, what are Fidelity 401k Fees?

For instance, Fidelity Investments is America’s biggest provider of 401s. A typical advisory fee for a Fidelity portfolio account starts at 1.7% and decreases from there by as much as half, depending on how much you put in.

How do I withdraw money from my Fidelity 401k?

Your 401k is your money, and making a withdrawal is as simple as contacting Fidelity to let them know you want it. The easiest way is to simply visit Fidelity’s website and request a check there. However, you can also reach out via phone if you prefer: Call 800-343-3543 with any questions about the process.

Don’t Miss: How Do You Transfer Your 401k

What’s The Maximum I Can Request To Withdraw From My Account

The maximum you can request to withdraw from your account online or by telephone is $100,000 per account. To request a withdrawal greater than $100,000, you must complete a paper form. You can obtain a copy of that form by going to Customer Service > Find a Form, or by contacting a Fidelity representative at 800-544-6666. If you’ve changed your mailing address within the past 15 days, the most you can request to withdraw by check online or by telephone is $10,000.

If I Make Contributions To My Rollover Ira Can I Still Roll The Ira Into An Employer Plan

You may be able to transfer your IRA balance into your new plan if the new plan accepts rollovers from IRAs. Before rolling your money into a new plan, you should compare the plans investment options and withdrawal rules with those of your IRA. You may give up some flexibility or face stricter requirements if you make the move.

If you rolled after-tax deferrals from an employers plan into a traditional IRA, you may not subsequently roll those after-tax deferrals to another employers retirement plan.

Recommended Reading: When Can I Start Using My 401k

Annuities Provide Growth Potential And Flexibility

American Fidelity offers a variety of annuities that can be used as investments within a 403, 457, IRA or Roth IRA plan to help individuals plan for retirement. American Fidelity also offers annuities as non-qualified, after-tax annuities for personal retirement savings. Annuities provide a valuable savings vehicle with growth potential and flexibility. A key advantage that annuities offer over typical methods of saving is the opportunity for guaranteed lifetime income. Annuities can provide benefits and features that may be beneficial to a diversified portfolio and can be a valuable retirement planning tool.

- Fixed Annuity: An insurance contract that allows the owner to accumulate interest with minimal risk. American Fidelity guarantees both the principal and interest on our fixed contracts and there is a guaranteed minimum rate of interest which the contract will never pay less than, as long as the contract is in force.

- Variable Annuity*: This contract allows the potential for greater returns on investments over the long term by allowing the owner the ability to invest in various market-based portfolios. In a variable contract, principal, interest, and market gains are not guaranteed and are therefore not suitable for everyone.

Traditional Approach: Withdrawals From One Account At A Time

To help get a clearer picture of how this could work, let’s take a look at a hypothetical example: Joe is 62 and single. He has $200,000 in taxable accounts, $250,000 in traditional 401 accounts and IRAs, and $50,000 in a Roth IRA. He receives $25,000 per year in Social Security and has a total after-tax income need of $60,000 per year. Let’s assume a 5% annual return.

If Joe takes a traditional approach, withdrawing from one account at a time, starting with taxable, then traditional and finally Roth, his savings will last slightly more than 22 years and he will pay an estimated $69,000 in taxes throughout his retirement.

Withdrawing from one account at a time can produce a “tax bump” midway in retirement

Note that with the traditional approach, Joe hits an abrupt “tax bump” in year 8 where he pays over $5,000 in taxes for 11 years while paying nothing for the first 7 years and nothing when he starts to withdraw from his Roth account.

In this scenario, a proportional withdrawal strategy in retirement cuts taxes by almost 40%

You May Like: Can I Transfer My 401k To Another Company

Rolling The Assets Into An Ira Or Roth Ira

Moving your funds to an IRA is the route financial experts advise in most instances. Now youre in charge and you have more investment flexibility, said Smith. Try not to go it alone, he advises. Once you roll the money over, its you making the decisions, but getting a financial professional should be the first step.

Your first decision: whether to open a traditional IRA or a Roth.

Traditional IRA. The main benefit of a traditional IRA is that your investment is tax-deductible now you put pre-tax money into an IRA, and those contributions are not part of your taxable income. If you have a traditional 401, those contributions were also made pre-tax and the transfer is simple. The main disadvantage is that you have to pay taxes on the money and its earnings later, when you withdraw them. You are also required to take an annual minimum distribution starting at age 70½, whether if youre still working or not.

Roth IRA. Contributions to a Roth IRA are made with post-tax income money you have already paid taxes on. For that reason, when you withdraw it later neither what you contributed nor what it earned is taxable you will pay no taxes on your withdrawals. Investing in a Roth means you think the tax rates will go up later, said Rain. If you think taxes will increase before you retire, you can pay now and let the money sit. When you need it, it is tax-free, said Rain.

Find The Mortgage Option Thats Right For You

Your 401 account may seem tempting as an untapped source of cash, especially if youre struggling to come up with the money for a down payment on your new home. While this is a viable option, and there are ways to mitigate the penalties, it should only be used as a last resort. Consider applying for a low down-payment loan like an FHA or VA loan, or, if you have one, making a withdrawal from your IRA.

Whatever you decide, make sure you consult with a mortgage specialist before committing to an option. Rocket Mortgage® has experts waiting to help you navigate the tricky waters of home loans. If youre ready to take that next step toward a mortgage, then get started with our experts today.

Take the first step toward the right mortgage.

Apply online for expert recommendations with real interest rates and payments.

Recommended Reading: What Is The Penalty For Taking Money Out Of 401k

Other Alternatives To Taking A Hardship Withdrawal Or Loan From Your 401

- Temporarily stop contributing to your employers 401 to free up some additional cash each pay period. Be sure to start contributing again as soon as you can, since foregoing the employer match can be extremely costly in the long run.

- Transfer higher interest rate credit card balances to a lower rate card to free up some cash or take advantage of a new credit card offer with a low interest rate for purchases .

- Take out a home equity line of credit, home equity loan or personal loan.

- Borrow from your whole life or universal life insurance policy some permanent life insurance policies allow you to access funds on a tax-advantaged basis through a loan or withdrawal, generally taken after your first policy anniversary.

- Take on a second job to temporarily increase cash flow or tap into family or community resources, such as a non-profit credit counseling service, if debt is a big issue.

- Downsize to reduce expenses, get a roommate and/or sell unneeded items.

Can I Use My 401 To Buy A House

For many would-be homeowners, the down payment is the biggest entry barrier to buying a house. While down payments can be as low as 3.5%, 20% is ideal if you want to secure a mortgage without monthly mortgage insurance fees.

If youre having trouble gathering funds for a down payment, you might find yourself considering using your 401 retirement fund as a convenient source of cash. While this is technically allowed, and could help you cover your down payment, there are some factors and drawbacks that you might want to consider.

Well break down the pros and cons of making a 401 withdrawal for a home purchase, as well as some alternatives.

Also Check: Can I Cancel My 401k And Cash Out

Roll Over Your Assets To An Ira

For more retirement investment options and to maintain the tax-advantaged status of the account, roll your old 401 into an individual retirement account . You will have greater flexibility over access to your savings .1 Before-tax assets can roll over to a Traditional IRA while Roth assets can roll directly to a Roth IRA. Review the differences in investment options and fees between an IRA and your old and new employers 401 plans.

Dividing Your 401 Assets

If you divorce, your former spouse may be entitled to some of the assets in your 401 account or to a portion of the actual account. That depends on where you live, as the laws governing marital property differ from state to state.

In community property states, you and your former spouse generally divide the value of your accounts equally. In the other states, assets are typically divided equitably rather than equally. That means that the division of your assets might not necessarily be a 50/50 split. In some cases, the partner who has the larger income will receive a larger share.

For your former spouse to get a share of your 401, his or her attorney will ask the court to issue a Qualified Domestic Relations Order . It instructs your plan administrator to create two subaccounts, one that you control and the other that your former spouse controls. In effect, that makes you both participants in the plan. Though your spouse cant make additional contributions, he or she may be able to change the way the assets are allocated.

Your plan administrator has 18 months to rule on the validity of the QDRO, and your spouses attorney may ask that you not be allowed to borrow from your plan, withdraw the assets or roll them into an IRA before that ruling is final. Once the division is final, your former spouse may choose to take the money in cash, roll it into an IRA or leave the assets in the plan.

Dont Miss: How Do I Set Up A 401k For My Employees

Read Also: Can You Use 401k To Buy Investment Property

Changing Or Leaving A Job Can Be An Emotional Time

How to cash out 401k from old job fidelity. If your retirement plan is with fidelity, log in to netbenefits ®. Find out your 401 rules, compare fees and expenses, and consider any potential tax impact. This video will help you learn how to evaluate your situation and assist you in making the most.

Otherwise, you can roll over the money from the previous 401k into the new version with your new employer or roll it into an individual retirement account . Say you have a $50,000 balance in your 401 account and you decide to cash it out. You will be subject to 10% early withdrawal penalty and the money will be taxed as regular income.

If youve explored all the alternatives and decided that taking money from your retirement savings is the best option, youll need to submit a request for a 401 loan or withdrawal. Thinking of cashing out my 401k from my previous employer. Generally speaking, you can cash out your 401 k retirement account if it contains less than $1000 in funds.

Once you log into netbenefits, choose the account from which you want to withdraw. Theyll close your account and mail you a check. Cash out if you withdraw the money from your 401 plan, your cash distribution will be subject to state and federal taxes and, before age 59½, a 10% withdrawal penalty may apply.

With a 401 loan, you borrow money from your retirement savings account. You can either cash it out, or you may roll it over through an ira. You can leave the account where you worked before.