Use Additional Government Document Recovery Tools

Lots of folks say the federal government is beholden to excessive paperwork and, in many ways, those people are right. But your hunt for an old 401 isn’t a good example of that mindset.

Exhibit “A” is the U.S. Department of Labor’s Abandoned Plan Database. The database can tell you if your company’s old 401 plan is still up and running, has been deep-sixed, or is being held by an outside administrator who can steer you to your old 401 account.

When using the website, the more information you can provide, the better. Your best bets include using the plan’s name, the name of your old employer, the city and state where the company resided, and the appropriate zip code.

S To Roll Over Your 401

Before you can roll over your 401, youll need to open an account to roll it into. Consider your options, like your new employers 401 or an IRA.

A Closer Look At Your Available Options

The good news is whatever money thats in your 401 is yours to do with as you like. But when you no longer work for a company, any retirement accounts you have through your former company might need to be moved to your new employer. Or you may need to roll it over or into a brokerage account that you own completely.

You May Like: Can You Cash Out 401k To Buy A House

Always Roll Over Into One Spot

Regardless of how much, or how little, you make its always best to keep your 401 in one place. There are two options: roll over your old 401 into your new employers 401 plan or roll your 401 into an individual IRA account.

Rolling over a 401 to a new employer is fairly straightforward you simply call the 401 provider at your old company and request the rollover yourself or your current employer plan can do it for you.

The other option, which is rolling over a 401 into an IRA, is also a popular choice. This move gives you more control over your assets in the long run. There are generally lower fees and more investment options. However, there could be tax consequences, depending on how you do it.

A 401 rollover to a traditional IRA account does not cause a taxable event, and your money will still remain tax-deferred. Often, your old 401 provider will mail you a check for the full amount of your 401 assets. Its very important that as soon as you receive these funds you forward them along to your IRA provider.

Gaurav Sharma, CEO and co-founder of retirement rollover platform Capitalize says, Once youve got that check, dont dilly-dally. Just forward it on to your IRA provider. If you dont know where, quickly check online. If you dont forward the check on within 60 days then the IRS can deem you to have withdrawn the 401 money permanently which could lead to you paying taxes and penalties.

Option : Roll It Into Your New 401

If your new employer offers a 401, you can possibly roll your old account into the new one. You may be required to be with the company for a certain amount of time before youre eligible to participate in their plan.

You can choose to do a Direct Rollover, whereby the administrator of your old plan transfers your account balance directly into the new plan. This only requires some paperwork.

Or, you can choose an Indirect Rollover. With this option, 20% of your account balance is withheld by the IRS as federal income tax in addition to any applicable state taxes. The balance of your old account is given to you as a check to deposit into your new 401 within 60 days. There is one catch, though. Youll need to deposit the entire amount of your old account into your new account, even the amount withheld for taxes. That means using personal cash to cover the difference and waiting until tax season to be reimbursed by the government.

Recommended Reading: Do You Need A Tpa For A Solo 401k

Find 401s With Your Social Security Number

All your 401s are linkedin to your social security number when you enrolled. Theoretically you should be able to find all your 401s with your SSN. However, in practice it’s pretty hard for one to do so. As far as we know, Beagle is the only company that simplifies this process and can conduct a comprehensive 401 search using your SSN. Once they find your 401s, they also help you with the tedious rollover process.

The Early Withdrawal Penalty

If you want to withdraw money from your 401 k, you must be aware of the withdrawal penalty. This applies to you if you’re younger than age 59 when you try to withdraw funds from your retirement plan. If you want to withdraw some of your contributions from your 401 k and you’re less than age 59, heavy restrictions could apply. You could expect up to 10% of the funds to be deducted as a penalty.

There are exceptions to this rule, though. One thing to keep in mind is your personal circumstances. For example, if you have to leave your job due to illness, you can generally get access to your 401 k funds without restriction. This also applies to members of the military in many instances. If you’re unwell and have to use your 401 k funds to finance medical treatment, this is usually allowed without your contributions being penalized.

Recommended Reading: How Long Do I Have To Rollover A 401k

If You’ve Contributed Between $1000

When you’ve made more than $1,000 in contributions to your 401 k, the company you work for generally doesn’t transfer you the funds as a lump sum. Instead, the company is often required to roll the funds over to a new retirement plan. The plan can be an IRA with your new employer, for example. This may take up to 60 days, depending on the circumstances surrounding your resignation. You often have to be patient with distributions like these.

Once the rollover is complete, you should have access to the money in the new employer’s plan in the same way that you would a regular 401 k. As such, if you’re not 59 years old yet, you may not be able to get access to the cash in the new account. If you have any doubts about this process, we recommend that you start working with a financial advisor. A financial advisor can explain the process to you further and provide personal guidance on the tax system.

If Youre Thinking Of Quitting Your Job

Timing is important here. If your company offers matching contributions, dont walk away and leave that money on the table. Check your plans vesting schedule to see whether working longer will let you vest more in your employer contributions. Also, find out when matching contributions are deposited into your account. Some companies make the deposit every pay period some only once a year. If you leave before that years contribution is made, youll lose it. *

You May Like: How Do I Stop My 401k

Taking The Cash Distribution May Cost You

Avoiding cash distributions can save you from taxes and penalties, because any amount you fail to roll over will be treated as a taxable distribution. As a result, it would also be subject to the 10% penalty if you are under age 59 1/2.

Since the taxable portion of a distribution will be added to any other taxable income you have during the year, you could move into a higher tax bracket.

Using the previous example, if a single taxpayer with $50,000 of taxable income were to decide not to roll over any portion of the $100,000 distribution, they would report $150,000 of taxable income for the year. That would put them in a higher tax bracket. They also would have to report $10,000 in additional penalty tax, if they were under the age of 59 1/2.

Only use cash distributions as a last resort. That means extreme cases of financial hardship. These hardships may include facing foreclosure, eviction, or repossession. If you have to go this route, only take out funds needed to cover the hardship, plus any taxes and penalties you will owe.

The CARES Act, enacted on March 27, 2020, provided some relief for those who need to make withdrawals from a retirement plan. It lifted penalties for withdrawals made through December 2020 and provides three years to pay back any early withdrawals.

You Have Four Main Options For An Old 401 Thats Tied To A Former Employer

At Capitalize we help our users move their legacy 401 account into an IRA. Dont worry if you dont already have one our online rollover process guides you through your different IRA options and helps you pick one thats right for you.

Recommended Reading: Should I Roll Over My 401k To A Roth Ira

Leave Your Money With Your Former Employer

For some people, the most plausible option is to leave their investment with their former employer. This option allows you to continue making investments with the money even if you are not working with that employer. In most cases, old employers allow you to leave your investment if you have more than $5,000 in your 401 retirement savings account. If your account holds less than this amount, your previous employer may decide to cash out your plan and send you a check for the balance.

The advantage of this option is that it allows you to leave your 401 with your former employer if they offer good terms. Leaving your retirement account with your previous employer allows you to wait for registration to open with your new employer.

When you leave your 401 savings with your former employer, your access to your money can be limited. Some employers can levy huge maintenance fees, implement restrictions on investment choices and prevent access to your savings until you reach retirement age. Unless you’re about to retire and you know you won’t change jobs often, avoid leaving your 401 with your former employer.

Option : Roll Over Your Old 401 Into An Individual Retirement Account

Still another option is to roll over your old 401 into an IRA. The primary benefit of an IRA rollover is having access to a wider range of investment options, since youll be in control of your retirement savings rather than a participant in an employers plan. Depending on what you invest in, a rollover can also save you money from management and administrative fees, costs that can eat into investment returns over time. If you decide to roll over an old 401 into an IRA, you will have several options, each of which has different tax implications.

Read Also: Can I Open A Roth Ira And A 401k

Can I Withdraw From 401k Without Penalty Due To Covid

Individuals affected by COVID-19 can withdraw up to $100,000 from employee-sponsored retirement accounts like 401s and 403s, as well as personal retirement accounts, such as traditional individual retirement accounts, or a combination of these. The 10% penalty will be waived for distributions made in 2020.

What Happens To Your 401 After You Leave A Job

It’s becoming increasingly common for professionals to switch jobs several times throughout their working careers, meaning that most people have to decide what to do with 401 after leaving the job. When you switch jobs or get laid off, you have to evaluate your options on what do you with your 401 account.

After leaving your current job, you have up to 60 days to decide what happens to your retirement savings. Otherwise, your savings will be automatically transferred to another retirement account. In most cases, employers have clear guidelines indicating what you can do with your 401.

Recommended Reading: Can You Take Out Your 401k To Buy A House

Too Complicated Get Some Help

If this process seems like a lot of work, youâre not alone. Locating your old 401 accounts and finding the proper place to transfer them to can get confusing.

Fortunately, Beagle can do all of the difficult work for you. The tasks of finding your accounts and facilitating their transfers are all done for you. Getting started is easy.

Discover Where Your Funds Are Transferred

If your former employer does not have your old 401, you can search on the Department of Labors abandoned plan database. You will be able to search for your plan using the information you already have, including your name, your employers name and more. If you had a traditional pension plan and it no longer exists, you can search the U.S. Pension Guaranty Corp. database to find your unclaimed pension.

Finally, you may want to search the National Registry of Unclaimed Retirement Benefits. This service is available nationwide and has records of account balances unclaimed by former retirement plan participants.

Recommended Reading: Should I Invest In 401k

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most how to save for retirement, understanding the types of accounts, how to choose investments and more so you can feel confident when planning for your future.

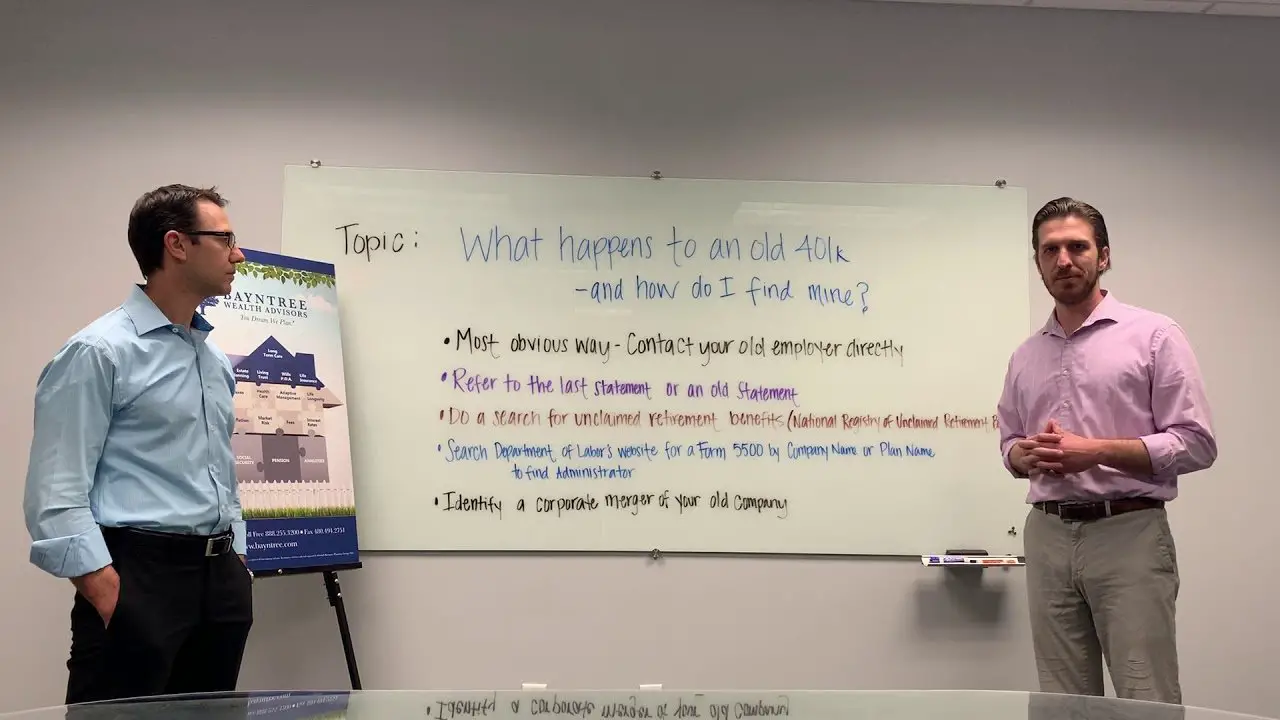

How To Reclaim Your Retirement Plan With A Previous Employer

- Retirement Planning

- How to Reclaim Your Retirement Plan with a Previous Employer

Millions of Americans accidentally or unknowingly leave money in retirement plans with previous employers. According to a study by the National Association of Unclaimed Property Administrators, Americans lost track of more than $7.7 billion in retirement savings in 2015.

If you’ve left a retirement plan with a previous employer, not to worry. Here are 6 tips you can follow to reclaim your money.

You May Like: How To Get Money From 401k After Retirement

Plan Your Retirement With Your 401 K

If you haven’t already, it’s crucial that you start to plan your retirement as soon as possible. Financial security is a vital part of having a healthy and happy retirement. The aim of having a 401 k in the first place is that it gives you freedom from work and acts as a nest egg. You might be working hard now, but you want to be able to truly enjoy your golden years. Having the proper retirement plans in place is the easiest way to ensure this. If you start planning to retire well before the time comes, you should be in a very strong position financially.

Take the time to come up with plans for your retirement while you still have a job. These plans don’t have to be concrete. All you have to do is get an idea of how your retirement may look financially. Then you can plan distributions from your 401 k, as well as any investments you may want to investigate.

Withdrawing From Your 401 Before Age 55

You have two options if you’re younger than age 55 and if you still work for the company that manages your 401 plan. This assumes that these options are made available by your employer. You can take a 401 loan if you need access to the money, or you can take a hardship withdrawal., but only from a current 401 account held by your employer. You can’t take loans out on older 401 accounts.

However, you can roll the funds over to an IRA or another employer’s 401 plan if you’re no longer employed by the company. But these plans must accept these types of rollovers.

Think twice about cashing out. You’ll lose valuable creditor protection that stays in place when you keep the funds in your 401 plan at work. You could also be subject to a tax penalty, depending on why you’re taking the money.

You May Like: What Is A Simple 401k