Determine A 401k Provider

Determining a 401k provider may not be as difficult as it sounds. You may be thinking of reaching out to various financial institutions for their advice but consider first what youre looking for in a provider and ask these questions:

- Whats Your Investment Lineup Like? How many funds do you offer? How diversified is the portfolio and how well has it done previously? Best to ask these tough questions now, and see how the answers stack up to their competitors.

- What Are the Total Fees? Perhaps the funds the institution you are considering look attractive. But how much will the investing, record keeping and administration expenses cost you and your employees? Are there any surprise service fees or occasional costs that if you dont ask about now youll only find out about later? Great returns could be offset by heavy fees. Ask exactly what this is going to cost from month to month.

- How Easy Is the Administration of the Plan? How easy will this plan be to administer to your employees? Will it require a lot of day to day management or will it practically run itself? Will your employees be able to access their plans online? What digital tools will the institution offer that will help you and your employees get the information they need, or navigate the site?

How Much Can You Borrow

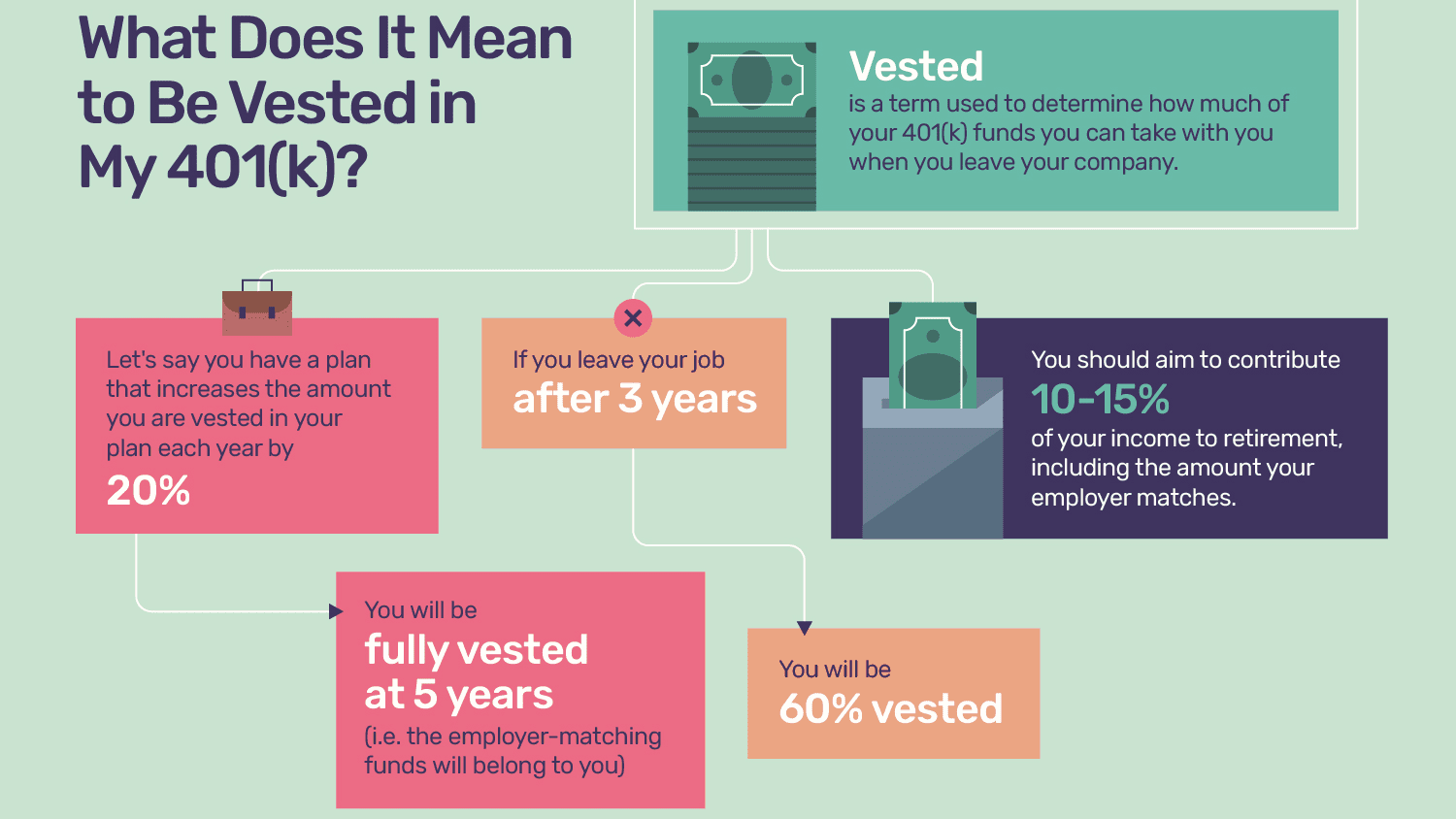

If a plan permits a 401 loan, the IRS lets you borrow 50% of your vested total account balance. This amount is capped completely at $50,000. If you have $40,000 in your account, for example, you can borrow a maximum of $20,000. But if you have $1 million in your account, you still cant borrow more than $50,000.

Rollovers As Business Start

What is a Rollover as Business Start-up ?AROBS is an arrangement in which prospective business owners use their retirement funds to pay for new business start-up costs. ROBS plans, while not considered an abusive tax avoidance transaction, are questionable because they may solely benefit one individual the individual who rolls over his or her existing retirement funds to the ROBS plan in a tax-free transaction. The ROBS plan then uses the rollover assets to purchase the stock of the new C Corporation business.

Promoters aggressively market ROBS arrangements to prospective business owners. In many cases, the company will apply to IRS for a favorable determination letter as a way to assure their clients that IRS approves the ROBS arrangement. The IRS issues a DL based on the plans terms meeting Internal Revenue Code requirements. DLs do not give plan sponsors protection from incorrectly applying the plans terms or from operating the plan in a discriminatory manner. When a plan sponsor administers a plan in a way that results in prohibited discrimination or engages in prohibited transactions, the plan can be disqualified, which can result in adverse tax consequences to the plans sponsor and its participants.

Also Check: Should I Invest In 401k Or Roth Ira

Businesses You Can Start Using A 401

bySeptember 3, 2020, 8:44 pm36 Views

If youre thinking about starting a business, finding and securing funding can be one of the most difficult challenges to overcome.

Many people consider using their 401 as a form of business financing.

But is this right for you?

If youre looking for some low-risk businesses you can start using a 401, youve come to the right place.

Robs Vs Retirement Plan Loans

All of this being said, however, one of the biggest and most important differences between a retirement plan loan and a ROBS is that a ROBS isnt a loan. The appeal of a ROBS, then, is that by using one you wont have any debt to pay backânot to yourself and not to a third party.

However, just as is the case with 401 loans, using a ROBS poses the risk of losing retirement funds. If you roll over money into your business and the business doesnt do well, you could lose your retirement savings. Plus, since theres no ceiling on the amount of money you can use with a ROBS, that actually creates greater risk. If your business doesnt do well, you could potentially lose all of your retirement savings, not just a subset.

Moreover, there are other disadvantages that are unique to a ROBS: Setting up a C-corp and a new retirement plan isnt simple, you need to comply with numerous legal rules to avoid hefty tax penalties, and theres a slightly elevated risk of an IRS audit when you do a ROBS.

You May Like: How To Find Out If I Have Old 401k

Borrowing From A 401 Or Ira To Start A Business

Those who have a 401 can borrow up to $50,000 or half of the vested plan, whichever is less. Loan terms on 401 loans are five years with interest paid to your retirement account. You can also withdraw funds from your 401 for up to 60 days without penalty, provided you fully repay the funds.

You are allowed to borrow money against your 401, and even though there are monthly interest payments of around 8%, the interest is repaid in the form of increased contributions to your retirement account. If you need less than $50,000, borrowing against your 401 makes sense. A ROBS is a more cost-effective choice if you need more than $50,000.

Rolling Over 401 Funds

When your C-corp is set up, and youve established its new retirement plan, its time to roll over your personal 401 funds to the new C-corp startup business. The custodian who currently holds your 401 funds will transfer funds to the new custodian of your C-corp’s retirement plan. Although this typically is a seamless transaction, call on your attorney if there are any bumps in the road with this process.

Also Check: Can I Take Out From My 401k

How To Use A 401 To Start Or Buy A Business

Tom has 15 years of experience helping small businesses evaluate financing options. He shares this expertise in Fit Small Businesss financing content.

There are three ways you can use your 401 to start or buy a business. You can cash out funds, borrow against your 401, or use a rollover for business startups . The only option that does not result in penalties, taxes, or interest charges is a ROBS, making it ideal for most situations.

If you are considering using retirement funds to start a business, a ROBS allows you to use savings in your 401 or individual retirement account with no penalties or immediate tax obligations. If you have at least $50,000 in your retirement accounts, Guidant will offer a free ROBS consultation.

Why Use Robs To Fund A New Business

Typically, withdrawing money from your retirement accounts before the age of 59 ½ results in penalties and income taxes to pay. But ROBS allows you to create a self-directed 401 retirement account that offers control over the investments in your portfolio so you can direct that money towards your new business venture tax free!

To get all of the benefits of ROBS business financing just takes is a little legal assistance and the right ROBS CPA firm to help manage your business!

Recommended Reading: Can You Rollover A 401k To Another 401 K

How A Robs Works

A ROBs makes sense for individuals with over $50,000 in retirement assets who intend to work in their business full time. A ROBS can be a great way to fund the establishment or expansion of your own business without borrowing money or raising equity.

For a ROBS to be a good financing option, you need to:

- Work full-time in the business: If you plan on keeping outside employment or investing passively in the business, you will not qualify for a ROBS.

- Have enough retirement assets to start or buy a business: A ROBS will help you finance your business without having to take out a loan or accumulating business debt. A ROBS can also work well with additional financing to lower your overall debt.

- Identify a good provider: Using a knowledgeable provider can make the process more efficient and help ensure that your ROBS is compliant.

Some additional ROBS qualifications include:

- You have an eligible retirement account: Both a traditional 401 and IRA are eligible, but you cannot use a Roth IRA for a ROBS. Your retirement account must be a tax-deferred account and needs to be more than $50,000 to be worth the setup fees.

- Your business is a C corporation: You must have your business registered as a C-corp. This is because the business is selling shares to a 401 account.

- You must offer a retirement plan to eligible employees in your business: A ROBS provider will help you set up and, in many cases, administer a retirement plan for your eligible employees.

What Is A Robs Rollover

ROBS is the acronym for Rollover as Business Startup. It is a financial means for a prospective business owner to use their own retirement funds to pay for costs associated with starting a new business. These retirement funds can be from a personal 401, 403, 457 or an individual IRA. However, keep in mind that Roth funds are not eligible for a ROBS rollover. A ROBS financing plan uses rollover assets from your retirement plan, in a tax-free transaction, to purchase the stock of your new businesss own C Corporation business. The stock can then be sold for cash, to invest in the new business.

Recommended Reading: Can I Rollover My 401k Into An Existing Ira

Consider The Tax Implications

Lets talk about the tax implications of borrowing from your 401 to start a business.

When you borrow from your 401, youre borrowing pre-tax money.

However, when you start paying back the loan to the 401, you pay back with after-tax money.

Thats not all.

The money is then taxed again when it comes out of your 401.

Basically, when you borrow from your 401 to start a business or for another purpose, you will be taxed twice.

Taking Normal 401 Distributions

But first, a quick review of the rules. The IRS dictates you can withdraw funds from your 401 account without penalty only after you reach age 59½, become permanently disabled, or are otherwise unable to work. Depending on the terms of your employer’s plan, you may elect to take a series of regular distributions, such as monthly or annual payments, or receive a lump-sum amount upfront.

If you have a traditional 401, you will have to pay income tax on any distributions you take at your current ordinary tax rate . However, if you have a Roth 401 account, you’ve already paid tax on the money you put into it, so your withdrawals will be tax-free. That also includes any earnings on your Roth account.

After you reach age 72, you must generally take required minimum distributions from your 401 each year, using an IRS formula based on your age at the time. If you are still actively employed at the same workplace, some plans do allow you to postpone RMDs until the year you actually retire.

In general, any distribution you take from your 401 before you reach age 59½ is subject to an additional 10% tax penalty on top of the income tax you’ll owe.

Also Check: How To Check My 401k Balance

Irs Favorable Determination Letter

Providers and promoters of ROBS court prospective business owners, sometimes by requesting a Favorable Determination Letter from the IRS. The FDL is a way that providers try to assure a client that the IRS approves of the clients ROBS plan. The IRS typically issues a letter, but its based on acceptable compliance of the clients ROBS plan. This letter is neither a blanket approval of the plan nor legal protection if the plan is incorrectly set up or administered.

Why You Would Need To Use Your 401

One of the major drawbacks to traditional funding is the amount of time it can take to secure funding depending on the organization, getting the money in your hands can take weeks or months. This is impractical when business-owners have time-sensitive deals putting off plans for a few weeks can financially destroy a startup.

Using your 401 allows for immediate funding without the hassle of dealing with loan offices. These offices may even deny you a loan after the process begins, slowing down funding even further.

Also Check: Am I Able To Withdraw Money From My 401k

Should I Borrow From My 401 To Start A Business

People often ask us about using their 401s for different purposes, and one of the most common questions is, Should I borrow from my 401 to start a business?

This is an understandable question.

According to the New York Times, From the second half of 2020 through May 2021, the Census Bureau tracked the highest number of applications to form businesses since the records started being kept in 2004.¹

However, the vast majority of these businesses got their funding from personal and family savings.²

If you dont have personal savings or family willing and able to help you start your new business venture, where will you get the funding?

Hence the reason many people ask, Should I borrow from my 401 to start a business?

Moreover, starting a business is a huge financial risk.

Forbes reports, Hundreds of thousands of small businesses open and close every year. In addition, about 20% of businesses fail in their first year, and about half of all businesses close after five years.³

When you ask, Should I borrow from my 401 to start a business? it means you are willing to risk losing financially on your new business and your financial future.

It Sounds Great But What Is The Catch In A Robs Rollover

ROBS rollovers are a great financing tool for specific business start-ups. Its important to know the following Rules and Regulations of a ROBS rollover:

- Retirement Risk: If your new business fails, you run the risk of losing the money you had planned for your retirement.

- Loss of retirement earnings: Once you rollover your 401k, you lose the potential for it to make additional money in the open stock market with tax-deferred savings.

- Your business must run as a C Corporation, which has different tax rules than an LLC or a sole proprietorship.

- The money you obtain from a ROBS rollover can only be used to fund an operating business.

- Higher Risk of IRS Audit: The IRS will look at all ROBS rollovers and how the money is utilized. It is important to use a company that specializes in these types of retirement conversions for business funding.

Don’t Miss: What Are The Advantages Of A 401k

Choosing A Skilled Robs Provider

ROBS providers are invaluable resources. If youre considering 401 business financing, a ROBS provider will not only help walk you through the setup phase, but the provider will also provide post-setup support. Because of the intricacies of this type of business financing, the IRS requires ongoing compliance, which includes monthly and annual reporting. Keeping up with these legal regulations is not for the inexperienced business person.

Consider these criteria when evaluating a potential ROBS provider:

- Setup fee. Each provider will quote you a setup fee for the initial cost of setting up your ROBS plan.

- Maintenance fees. These fees ensure that your ROBS plan maintains its compliance with IRS regulations, including any changes in tax legislation.

- Ongoing support. Look for a hands-on provider who stays on top of filing the proper paperwork on a timely basis and efficiently maintains your plan.

- Communication. Find a provider who will keep you in the loop by maintaining communication and one who is easy to contact when you have questions.

Some notable ROBS providers for 2019 are Guidant, FranFund, MySolo401k, Benetrends, Pango Financial, Catchfire Funding and Business Funding Trust.

How Much Money Can You Use

One of the major differences between a 401 loan and a ROBS is the amount of money you can use. With a 401 loan, $50,000 is the maximum you can borrow. With a ROBS, on the other hand, $50,000 is the minimum you have to take out of your retirement account. Therefore, your choice between these two 401 business financing options will largely depend on the amount of money that you have in your retirement account and the percentage that youre willing to put toward your business.

Also Check: How To Rollover Ira To 401k

Robs Can Fund Franchises

Senior tax analyst Dick O’Donnell notes that many people think 401 business financing is particularly suited to funding franchise startups. Franchises are typically associated with successful businesses that have proven track records, while a small mom-and-pop startup business leans more toward speculation and sentiment than concrete statistics.

Requesting A Loan From Your 401

If you do not meet the criteria for a hardship distribution, you may still be able to borrow from your 401 before retirement, if your employer allows it. The specific terms of these loans vary among plans. However, the IRS provides some basic guidelines for loans that won’t trigger the additional 10% tax on early distributions.

Whether you can take a hardship withdrawal or a loan from your 401 is not actually up to the IRS, but to your employerthe plan sponsorand the plan administrator the plan provisions they’ve established must allow these actions and set terms for them.

For example, a loan from your traditional or Roth 401 cannot exceed the lesser of 50% of your vested account balance or $50,000. Although you may take multiple loans at different times, the $50,000 limit applies to the combined total of all outstanding loan balances.

You May Like: Where To Roll Over My 401k