Withdrawing Money Early From Your 401

The method and process of withdrawing money from your 401 will depend on your employer, and which type of withdrawal you choose. As noted above, the decision to remove funds early from a retirement plan should not be made lightly, as it can come with financial penalties attached. However, should you wish to proceed, the process is as follows.

Step 1: Check with your human resources department to see if the option to withdraw funds early is available. Not every employer allows you to cash in a 401 before retirement. If they do, be sure to check the fine print contained in plan documents to determine what type of withdrawals are available, and which you are eligible for.

Step 2: Contact your 401 plan provider and request that they send you the information and paperwork needed to cash out your plan, which should be promptly completed. Select providers may be able to facilitate these requests online or via phone as well.

Step 3: Obtain any necessary signatures from plan administrators or HR representatives at your former employer affirming that you have filed the necessary paperwork, executed the option to cash in your 401 early, and are authorized to proceed with doing so. Note that depending on the size of the company, this may take some time, and you may need to follow up directly with corporate representatives or plan administrators at regular intervals.

Taxes For Making An Early Withdrawal From A 401

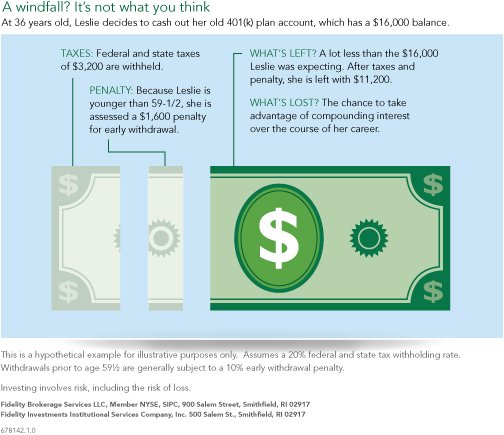

The minimum age when you can withdraw money from a 401 is 59.5. Withdrawing money before that age results in a penalty worth 10% of the amount you withdraw. This is in addition to the federal and state income taxes you pay on this withdrawal.

There are exceptions to this early withdrawal penalty, though.

If you want to remove money from a 401 account without paying taxes, you will need to meet certain criteria. According to the IRS, you generally dont have to pay income tax or an early withdrawal penalty if you experience an immediate and heavy financial need. One situation where this may apply is when you have medical expenses that arent reimbursed by your insurance and which exceed 7.5% of your adjusted gross income . If this happens, you dont have to pay taxes on the money you withdraw to cover that financial need. There are also other exceptions, such as for disabled taxpayers. The IRS provides a more complete list of situations where you wont pay tax on early withdrawals.

The big caveat here is that the amount you can withdraw tax-free is exactly enough to cover the cost of this financial need. And youll still pay the full income tax on your withdrawal only the 10% penalty is waived.

How Do You Take A Withdrawal Or Loan From Your Fidelity 401

If you’ve explored all the alternatives and decided that taking money from your retirement savings is the best option, you’ll need to submit a request for a 401 loan or withdrawal. If your retirement plan is with Fidelity, log in to NetBenefits®Log In Required to review your balances, available loan amounts, and withdrawal options. We can help guide you through the process online.

Read Also: Can I Use 401k Money To Start A Business

How Are 401 Withdrawals Taxed

If a rollover-eligible withdrawal is made to you in cash, the taxable amount will be reduced by 20% Federal income tax withholding. Non-rollover eligible withdrawals are subject to 10% withholding unless you elect a lower amount. State tax withholding may also apply depending upon your state of residence.

However, your ultimate tax liability on a 401 withdrawal will be based on your Federal income and state tax rates. That means you will receive a tax refund if your actual tax rate is lower than the withholding rate or owe more taxes if its higher.

If a 401 withdrawal is made to you before you reach age 59½, the taxable amount will be subject to a 10% premature withdrawal penalty unless an exception applies. This penalty is meant to discourage you from withdrawing your 401 savings before you need it for retirement. You can avoid the 10% penalty under the following circumstances:

- You terminate service with your employer during or after the calendar year in which you reach age 55

- You are the beneficiary of the death distribution

- You have a qualifying disability

- You are the beneficiary of a Qualified Domestic Relations Order

- Your distribution is due to a plan testing failure

A full list of the exceptions to the 10% premature distribution penalty can be found on the IRS website.

Special Considerations For Withdrawals

The greatest benefit of taking a lump-sum distribution from your 401 planeither at retirement or upon leaving an employeris the ability to access all of your retirement savings at once. The money is not restricted, which means you can use it as you see fit. You can even reinvest it in a broader range of investments than those offered within the 401.

Since contributions to a 401 are tax-deferred, investment growth is not subject to capital gains tax each year. Once a lump-sum distribution is made, however, you lose the ability to earn on a tax-deferred basis, which could lead to lower investment returns over time.

Tax withholding on pre-tax 401 balances may not be enough to cover your total tax liability in the year when you receive your distribution, depending on your income tax bracket. Unless you can minimize taxes on 401 withdrawals, a large tax bill further eats away at the lump sum you receive.

Finally, having access to your full account balance all at once presents a much greater temptation to spend. Failure in the self-control department could mean less money in retirement. You are better off avoiding temptation in the first place by having the funds directly deposited in an IRA or your new employer’s 401 if that is permitted.

Also Check: How To Borrow Against My 401k

If Im Eligible Should I Take A Distribution From My 401 Or Ira

Even with the new rules in place, its still advisable to exhaust most other resources, such as emergency funds or other easily accessible forms of savings, before tapping into your retirement accounts.

But if you are considering taking a distribution from your IRA or 401, think through the following first.

Debt Relief Without Closing My 401k

Before borrowing money from your retirement account, consider other options like nonprofit credit counseling or a home equity loan. You may be able to access a nonprofit debt management plan where your payments are consolidated, without having to take out a new loan. A credit counselor can review your income and expenses and see if you qualify for debt consolidation without taking out a new loan.

8 MINUTE READ

Recommended Reading: When Can You Take 401k Out

How To Avoid The Early Withdrawal Penalty

There are a few exceptions to the age 59½ minimum. The IRS offers penalty-free withdrawals under special circumstances related to death, disability, medical expenses, child support, spousal support and military active duty, says Bryan Stiger, CFP, a financial advisor at Betterments 401.

If you dont meet any of those qualifications, you arent entirely out of luck, though. Youve got a couple of options that may let you make penalty-free withdrawals, if youre slightly younger than retirement age or plan your withdrawals methodically.

If youre between age 55 and 59 ½ and you lose your job, the IRS will allow you to withdraw from your 401 plan penalty-free. This is called the Rule of 55, and it applies to everyone within this age group who loses a job, no matter whether youre fired, laid off or voluntarily quit. Stiger says. To qualify for the Rule of 55, the 401 you hope to take withdrawals from must be at the company youve just parted ways with. Note that the Rule of 55 does not apply to IRAs.

There is also the Substantially Equal Periodic Payment exemption, or an IRS Section 72 distribution, say Stiger. With SEPP you can take substantially equal payments from your 401 based on life expectancy. Unlike the Rule of 55, you may use SEPPs to tap an IRA early.

Taxes On Other Types Of 401 Plans

All of the information above applies to traditional 401 plans. However, there are variations on the traditional 401. Some of these have different rules on taxation.

SIMPLE 401 plans and safe harbor 401 plans function mostly the same as far as employee taxes are concerned. They differ mostly in that employers have to make certain contributions. SIMPLE 401 plans also have a lower contribution limit.

The other type of 401 to note is a Roth 401. These work quite differently from traditional 401 plans. All contributions you make to a Roth 401 come from money that you have already paid payroll and income taxes on. Since you pay taxes before you contribute, you do not need to pay any taxes when you withdraw the money.

Its advantageous to use a Roth 401 if you are in a low income tax bracket and expect that you will find yourself in a higher bracket later in your life. This is very similar to why you might want a Roth IRA.

Also Check: Is A Rollover From A 401k To An Ira Taxable

What Happens If I Take All My Money Out Of My 401k

The IRS will penalize you. If you withdraw money from your 401 before you’re 59½, the IRS usually assesses a 10% penalty when you file your tax return. … Between the taxes and penalty, your immediate take-home total could be as low as $7,000 from your original $10,000. It may mean less money for your future.

Your 401 K And Income Tax

You may be wondering if your 401 k is subject to income tax. Once you’ve withdrawn the money from the 401 k, you need to pay tax on it. It is considered part of your taxable estate. This is why you must check the terms of your 401 k before you get any money from it. Terms like these should be clearly outlined in the plan. Withdrawing funds without understanding the implications of doing so is one common mistake that people make when changing employers in the USA. It’s important to consider the other options you have.

If you’re changing employers, you still have plenty of time to build up passive capital via investment and your 401 k. You’re unlikely to get much out of rushing into a decision that you aren’t completely ready for. Roll all of the funds out of your 401 k at once, and you might end up drowning in taxes.

Read Also: How To Sign Up For 401k On Adp

How Do You Withdraw Money From A 401 When You Retire

After retirement, one of the common questions that people ask is âhow do you withdraw money from a 401 when you retire?â. Find out the options you have.

As you plan your retirement, you should think about how you are going to live off your retirement savings once you are out of employment. You will need to figure out how to withdraw your retirement savings in your 401 post-retirement, and the best withdrawal strategies so that you donât exhaust your retirement savings.

When withdrawing your retirement savings from a 401, you can decide to take a lump-sum distribution, take a periodic distribution , buy an annuity, or rollover the retirement savings into an IRA.

Usually, once youâve attained 59 ½, you can start withdrawing money from your 401 without paying a 10% penalty tax for early withdrawals. Still, if you decide to retire at 55, you can take a distribution without being subjected to the penalty. However, any distribution you take after retirement is taxed, and you must include the distribution as an income when filing your annual tax return.

How Do You Cash Out Your Old 401

Its an easy process with only a few steps:

Important note: Your 401 plan administrator will likely withhold 20% of the withdrawal amount for federal income tax. This is to ensure the IRS receives its share of your withdrawal. Procedure may vary here, so ask about tax withholdings when you contact the plan administrator.

Don’t Miss: How Can I Take Money Out Of My 401k

Exceptions To The Penalty

The IRS permits withdrawals without a penalty for certain specific uses. These include a down payment on a first home, qualified educational expenses, and medical bills, among other costs.

As with the hardship withdrawal, you will still owe the income taxes on that money, but you won’t owe a penalty.

How Do I Find My 401 Plan Administrator

All 401 plans involve several different parties.

The employer is the plan sponsor that established the plan and encouraged its employees to participate in it.

The custodian holds the funds that are contributed into the plan and keeps them safe.

And the administrator handles the day-to-day nuts and bolts operations of the plan.

The administrator handles tasks such as issuing loans from the plan, moving money around from one investment to another within the plan at the request of a participant and sending account statements to each participant, among other things.

Administrators have a long list of responsibilities related to administering the plan that typically go unnoticed by the vast majority of participants.

For this reason, many employers outsource this important function to a third-party administrator that is in the business of managing 401 plans.

Dont Miss: How Do I Stop My 401k

Recommended Reading: How To Open A 401k Plan

For Many This Relief Simply Isnt An Option

Only about half the workforce has a retirement account, says Olivia S. Mitchell, professor of insurance/risk management and business economics and public policy, and executive director of Whartons Pension Research Council at the University of Pennsylvania.

And many have far less than $100,000 saved. A recent report found pre-retirees, Americans 56 to 61, had a median balance of $21,000 in their 401 accounts in 2016, which is the most up-to-date data on file. That total reflects almost 30 years of savings. Younger generations do not fare much better. Older millennials have about $1,000 saved in their 401s.

Not only that, but employees with retirement accounts tend to be the higher paid, better educated and longer-term workers. Therefore allowing people to tap into their retirement accounts wont help the millions who have no accounts, Mitchell says. Those with no accounts are also likely to be the people that will be needing the most help.

Additionally, Mitchell predicts that the U.S. will see an increase in applications for early Social Security benefits, particularly if the recession is long and hard. People taking early benefits will end up with a lifetime of lower payouts, and if they already ate into their 401s, theyll be more likely to face shortfalls in their later years, she says.

Dont Miss: Can You Withdraw Your 401k If You Quit Your Job

How To Make An Early Withdrawal From A 401

When you have determined your eligibility and the type of withdrawal you want to make, you will need to fill out the necessary paperwork and provide the requested documents. The paperwork and documents will vary depending on your employer and the reason for the withdrawal, but when all the paperwork has been submitted, you will receive a check for the requested funds, hopefully without having to pay the 10% penalty.

Recommended Reading: How To Roll Over 401k To New Company

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

This Is What Happens To Your 401 When You Quit

When you quit your job, you have five options for your 401:

If youre considering quitting or transitioning jobs, you may be wondering what to do with your 401. Each of the options above has benefits and drawbacks, and you should carefully consider whats best for you.

Before you decide what to do with your 401, make sure you dont have a loan on your 401. 401 loans are appealing because they dont affect your debt-to-income ratio however, if you cant repay it by the tax due date after leaving your job, youll be taxed on the balance and charged an early withdrawal fee. Some companies offer special options here, so you should always check with your 401 administrator and plan documents.

Youll also want to keep in mind the fact that some account types only allow one rollover per year so if youre changing jobs frequently, this is something to be aware of. Refer to this chart from the IRS to learn more about account rollovers.

With this in mind, you have the following options for your 401 when quitting your job:

Also Check: How Much Money Do I Have In My 401k

Read Also: When Do You Have To Start Withdrawing From 401k