Irs Favorable Determination Letter

Providers and promoters of ROBS court prospective business owners, sometimes by requesting a Favorable Determination Letter from the IRS. The FDL is a way that providers try to assure a client that the IRS approves of the clients ROBS plan. The IRS typically issues a letter, but its based on acceptable compliance of the clients ROBS plan. This letter is neither a blanket approval of the plan nor legal protection if the plan is incorrectly set up or administered.

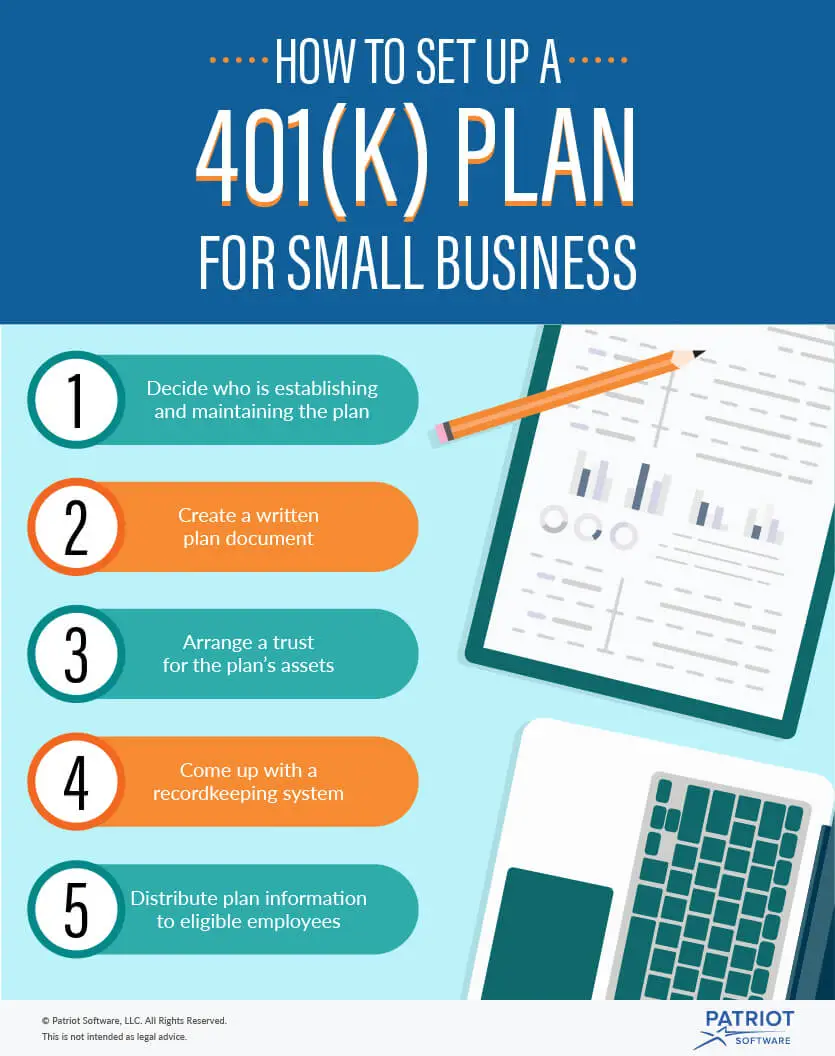

How To Set Up Your 401

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks or securities.

Every new job comes with a stack of documents to sign, initial and, months later, try to remember where they were hastily tossed. Race too quickly through this first-day ritual and you could be leaving thousands of dollars of employee perks on the conference room table.

If you missed the pitch for the company retirement plan during employee orientation, dont worry. Unlike some employee benefits, such as opting in for insurance or setting up a flexible spending account, you can enroll in a 401 year-round.

If you havent enrolled already, consider eating lunch at your desk today and taking care of this 401 business.

Using A 401 To Start A Business: What You Need To Know

If youre thinking about using a 401 to start a business, there are a few points youll want to keep in mind before you explore your different financing options.

To begin, youll want to remember that ordinarily, if you withdraw money out of a 401 or IRA before the age of 59 ½, you have to pay income taxes on the money, plus a 10% early withdrawal penalty. Therefore, if youre wondering how to use your 401 to start a business, youre taking on a considerable amount of risk in doing so.

Luckily, however, short of simply withdrawing money from your retirement account, there are two better options that allow you to tap into your retirement funds without having to pay income taxes or penalties. First, you can take out a 401 loan to finance your businessâor, second, you can rollover your balance into a new 401, called ROBS, or rollovers as business startups.

In both of these cases, although you wont face the same taxes and penalties as taking directly from your account, there will nevertheless be inherent risk involvedâyoull risk losing your retirement savings if your business doesnt do well. Ultimately, whether or not you decide on using a 401 to start a business will depend on your personal level of risk tolerance and what you think is best for your future.

Read Also: How Do You Repay A 401k Loan

The Basics Of A Small Business 401

First, lets discuss what a 401 plan is and why a small business might want to set one up. A 401 effectively is a retirement plan where employees can hold back a portion of their salary each paycheck and then that money is invested on a pre-tax basis in an investment plan. Many companies also offer to match the contributions employees make as an incentive for employees to use the 401.

One of the biggest reasons to add a 401 offering is to attract and retain talent. Retirement security is such an important concept for all employees, Ben Thomason, executive vice president of revenue at Vestwell, told CO last year. To me, that is the why of offering 401s to attract the right talent so your business can grow the right way. The right people make all the difference.

One other reason for companies to add one is that it can provide tax benefits for both employers and employees. The Setting Every Community Up for Retirement Enhancement Act of 2019, which was signed into law in the U.S. in December 2019, offers small businesses a tax credit up to $5,000 for three years for setting up a new retirement plan like a 401. On the employee side, 401 contributions are pre-tax, so their taxable income decreases and they pay less tax overall while saving for the future.

Companies have a fiduciary responsibility to make sure the selected 401 program is run appropriately. This means you should not offer a 401 without doing the proper planning and research.

Common Questions Plan Participants May Ask Employers About A New 401 Plan:

- What other plans were considered? How does this choice compare?

- When can I start contributing?

- What affect will this have on my taxes?

- Does the company match contributions? How does that work? What is the limit?

- What are the investment options? Can I manage my own investments?

- How often can I change my investment and contribution options?

- Can I access my plan online?

- When can I withdraw money? Can I make an emergency withdrawal from my plan?

Also Check: Should I Roll My Old 401k Into My New 401k

How Will You Finance Your New Business

What if we told you that you can start a business with a $0 budget? Its possible. If the point of starting your business is staying active or social, theres no need to invest a lot up front anyway. I wouldnt necessarily advise downsizing your living situation to fund your project. There are a few avenues to pursue if your project requires startup capital.

Tips:

- Plan ahead. If youre still a few years out from retirement, factor your business needs into your retirement planning, and start saving now.

- Start small. Dont invest a ton into a business idea simply because youre passionate about it. Test your idea with a small audience, and start with a little inventory. Bernie made a $1,000 investment and started with one product. We thought, We’ll just start out with socks and judge interests there, he says.

- Keep it lean. Forget hiring a designer or developer for nowuse a free Shopify theme, create simple designs with a tool like Canva, use a logo generator, and DIY your product photos using your smartphone.

- Borrow against retirement savings. In the US, you can borrow against your 401 like a small business loan, up to 50% of your total funds. Check with your local government for rules specific to your country or region.

- Consider a micro-loan. Keep an eye out on the SBAs website for small loans and grants specific to retirees or your age bracket.

- Get advice. Before starting any business, talk with your financial adviser, or tap into free small business advice resources.

Ready To Offer Benefits

Square Payroll partners with leading benefits providers so you and your team can access 401 as well as health insurance, workers comp, and more all in one place.

If you already use Square Payroll, you can enroll in benefits directly from the Square Payroll dashboard. You can choose the benefits that best suit your needs and budget, and well take care of everything else, from employee enrollment to calculating deductions and contributions for each pay run. Square Payroll also determines the taxability and reporting requirements for each benefit to make sure your taxes and tax forms are accurate.

Create an account with Square Payroll to learn more about signing up for benefits. Or, if you already have benefits that you want to sync with Square Payroll, learn about adding your benefits to Payroll in our Support Center.

You May Like: How To Rollover Ira To 401k

Saving For Retirement While Paying Down Debt

When youre in your 20s, the reality is that youll be making student loan payments, paying credit card bills, and juggling debt, all while making regular contributions to save for retirement. To devote the proper amount of attention to your savings and not put it off, youll need to be mindful of your budget.

Consider following a structure like the 50/30/20 rule of thumb, which calls for allocating 50% of your paycheck for needs, 30% for wants, and 20% for goals. The 20% dedicated to goal spending includes both making debt payments and saving for retirement. Whatever method you decide to use, the important thing is that its a plan you can stick with. If you dont follow through with your plan, you risk getting behind on your retirement savings.

What Are The Cost And Terms Of A 401 Loan

In most cases, the interest rate on a 401 business loan or other retirement plan loan is 1% plus the prime rate. The time to pay back this loan is usually 5 years, on par with a medium-term loan. Additionally, there might also be modest issuance or administration fees associated with a 401 loan, but these go to the provider . The specific details of your loan will vary based on your plan administrators rules.

This being said, the largest cost of a 401 loan is the lost opportunity from borrowing the funds, instead of keeping them in your retirement account. For instance, say the average return on your retirement account is 10% but the interest rate on your plan loan is 6%. This 4% difference can easily add up to thousands of dollars over time that youre losing by borrowing from your retirement savings. If, however, you believe that your business profits will counteract that loss, then the loan might be worthwhile.

Moreover, theres another important qualification of a 401 loan to keep in mind: If youre using an employer-sponsored retirement plan and lose your job , the entire balance plus interest is due within 60 days. If you cant pay back the money you borrowed in this very short period of time, the loan goes into default.

Don’t Miss: How Can I Borrow From My 401k Without Penalty

How Much Money Can You Use

One of the major differences between a 401 loan and a ROBS is the amount of money you can use. With a 401 loan, $50,000 is the maximum you can borrow. With a ROBS, on the other hand, $50,000 is the minimum you have to take out of your retirement account. Therefore, your choice between these two 401 business financing options will largely depend on the amount of money that you have in your retirement account and the percentage that youre willing to put toward your business.

Fully Legal And Irs Compliant

In 1974, Congress enacted the Employee Retirement Income Security Act to shift the burden of building retirement assets from the employer to the employee. ERISA, when paired with specific sections of the Internal Revenue Code, makes it legal to tap into your eligible retirement accounts without an early withdrawal fee or a tax penalty.

Read Also: When Can I Roll A 401k Into An Ira

Questions To Ask Before Starting Your Retirement Business

Once you have an idea, I dont have to tell you that the best way to get started is to just start. You can begin a free trial on Shopify and play with your new store before you go live. If the prospect of building a website is overwhelming, start with free resources to guide you through the process. Next, ask yourself a few important questions:

Other Startup Funding Options

Because of the high failure rate of business startups, the Wall Street Journal points readers away from using retirement money, such as a 401 to fund a business, if other funding is available. If possible, use nonretirement assets for your startup and preserve your nest egg. For example, after setting aside a six-month emergency savings fund, use taxable savings or brokerage accounts as seed money for your startup. Other non-401 options include home-equity credit and loans.

You May Like: What Is An Ira Account Vs 401k

What If I Don’t Have Access To A 401

If you don’t work for a company that offers a 401, you can save for retirement using one or more of these other accounts:

- 403: A 403 is similar to a 401, but it’s available only to public school employees, select ministers, and employees of tax-exempt organizations.

- SIMPLE IRA: A SIMPLE IRA is designed for self-employed individuals and small business owners. It offers fairly high contribution limits and has mandatory contribution requirements for employers.

- : A SEP IRA is available to self-employed individuals with or without employees. Contribution limits depend in part on annual income.

- Solo 401: A solo 401 is simply a 401 that a self-employed person can open for themselves. Contribution limits are higher than for traditional 401s because you can make contributions as both employee and employer.

- IRA: Anyone can open and contribute to an IRA if they’re earning income throughout the year, but these accounts have more restricted contribution limits.

Building The Fund Lineup

When we say fund lineup, were referring to the menu of investment options that are available to plan participants. Getting this right is arguably the most important part of building a successful 401 plan.

Having risky, poorly-performing, or unnecessarily expensive mutual funds can significantly limit the amount your employees have in their accounts come retirement. It may even expose you to costly lawsuits.

If you feel any uncertainty around how to build an optimal 401 fund lineup thatll protect you from costly lawsuits, consider hiring an advisor. Not only do the good ones take this off your plate, but theyll even assume legal responsibility for it as well!

Read Also: How Is A 401k Divided In A Divorce

The Federal Government Offers Tax Incentives To Start A 401

After finally recognizing that 77% of Americans dont have enough money to retire, Congress moved to expand existing tax incentives to help businesses close the retirement savings gap. The SECURE Act of 2020 provides:

-

Up to 10 times more than the previous amount of tax credits for businesses offering a new 401 plan. Depending on the size of your company the credits could cover a significant portion of the costs for starting a new plan.

-

An additional $1,500 in tax credits per year over three years for automatically enrolling participants.

Its important to note that the IRS also allows employers who offer matching programs to deduct those contributions on their taxes.

Reality: 401 Plan Administration Has Improved A Lot Over The Last Decade

While it used to be that the paperwork from starting a plan can overwhelm business owners, who already juggle many responsibilities throughout their day, thats no longer true.

Small and medium-sized businesses can find what they need: a 401 provider that uses automation to streamline the process of setting up and administering a plan with features like:

-

Seamless integration with popular payroll providers

-

Support with compliance testing and filling required IRS forms

-

Reporting functionality to monitor how employees are using and saving with the plan

Don’t Miss: When Can I Set Up A Solo 401k

Choose A Plan That Meets Your Business Goals

Plan design optionsThe big difference between 401 plan designs is how and when an employer makes contributions on behalf of its employees. Here are three types of plan designs, their requirements, and some other implications:

What other 401 plan features should I consider?Offering retirement benefits is a great way to attract and retain talent. But specific plan features can really boost participation and make your small business 401 plan even more enticing.

Traditional vs. Roth 401. Whats the difference?Generally speaking, the key difference between the two is when employee contributions are taxed. With traditional accounts, contributions are made before taxes are taken out of pay. Under Roth accounts, contributions are taxed first and then deposited. When an employee retires, withdrawals from traditional accounts are taxed at ordinary income rates, whereas Roth withdrawals can generally be made on a tax-free basis.* Read more about traditional vs Roth accounts.

Should I match employee contributions?Matching contributions can be hugely beneficial for both employees and employers. For employees, theyre an additional form of compensation that can help maximize their retirement savings.

No Interest No Collateral No Credit Score

401 business financing is an ideal method if you dont want to go into debt, dont qualify for a loan, or just dont have the cash on hand to start or purchase a business. Unlike other types of funding methods, your credit score, past experience, or on hand collateral play no role in eligibility. Instead, the main factors are the type of retirement account or IRA) and the amount of money you have in it .

Recommended Reading: How Do I Close Out My 401k Account

My Starting Over Story: I Cashed Out My 401 To Start A Businessand Save My Family

Entrepreneurs face mental health challenges just like everyone else. And the stress of running a business can lead to burnout and feelings of isolation. In honor of Mental Health Awareness Month, well be sharing inspiring stories and wellness resources to shine a spotlight on the issue.

Carl Churchills booming bean business launched on a special date in 2010: September 11. For this US Army vet, the day served as a reminder of his past and what he fought for.

Carls deployment days are behind him, and hes instead working side by side with his wife, Lori, on their Salt Lake City business, Alpha Coffee. But their giving-back effort, Coffee for Troopsa program thats already sent 16,000 bags of beans to overseas unitsensures that Carls heart is never far from the front lines.

Alpha Coffee started as a survival tactic. When the 2008 recession hit and Carl lost his job, his family lived on dwindling emergency savings, selling their possessions to stay afloat. Then, they changed their battle plan: theyd cash out their 401 and sell coffee beans.

The Churchills slowly grew their online business out of their basement and into two thriving physical storefronts. Theyve recovered much of their old lifestyle, tooand Carl and Lori hustle seven days a week to keep it that way.

Here, Carl explains the silver lining to losing almost everything, and how military life helped him put all of it into perspectiveand start over.