Make Sure Your Old 401s Are Still Working For You In The Meantime

While youâre working on paying back your 401 loans, make sure you donât have any old 401s still with former employers.

Rollover your old 401s into your current account. You can monitor its investment performance and reallocate your funds to match your risk tolerance. This will help you better manage your retirement savings to ensure your meeting your retirement goals.

Tags

Make A Lump Sum Payment

If you receive a windfall or a large payment, you can use part of the money to settle the loan in one lump sum payment. You will need to calculate how much loan is unpaid, including any interest payments, and settle any outstanding obligations. You wonât owe any prepayment penalties for paying off the loan early.

Alternatives To Borrowing From Retirement

Dipping into your 401 likely will lead to more troubles than its worth. There are other ways to get by while keeping your retirement funds intact. Learn more about prioritizing retirement vs paying off debt.

Here are some methods of dealing with a financial emergency:

- Home equity loan This is a good option for homeowners. It comes with a fixed interest rate that never changes. Right now, the average home equity loan rate is 7.74%.

- A personal loan Even if the interest is higher than youd like, its often better than interfering with the appreciation of your 401. If you have a credit score above 720, you may be able to find interest rates around 10%.

- Nonprofit credit counseling Maybe you dont feel comfortable putting your home up for collateral,or your credit is too low for a decent interest rate on a loan. Consider working with a nonprofit credit counseling agency. A credit counselor will take a look at your budget, walk you through your spending habits and help you establish a more manageable financial lifestyle.

A 401 is first and foremost a retirement account, not just a second savings or vacation fund. The tulips have been blooming in Holland for 400 years. Theyll be around down the line when youre financially ready and able.

In the meantime, keep making contributions to your 401. Let it sit. Watch it grow. Youll thank yourself later.

5 Minute Read

Recommended Reading: Can You Use 401k To Buy Stocks

Withdrawals From A 401

-

401 hardship withdrawals If you find yourself facing dire financial concerns and need cash urgently, your 401 plan may offer a hardship withdrawal option. Unlike a 401 loan, you wont have to repay the money you take out, but you will owe taxes and potentially a premature distribution penalty on the amount that you withdraw. In addition, IRS 401 hardship withdrawal rules state that you may not take out more money than what is needed to cover your hardship situation. In order to qualify for a 401 hardship withdrawal, your plan administrator must offer this option and you must be facing an immediate and heavy financial need. According to the IRS, approved 401 hardship withdrawal reasons include:

- Postsecondary tuition for you or your family

- Medical or funeral expenses for you or your family

- Certain costs related to buying, or repairing damage to, your primary residence

- Preventing your immediate eviction from or foreclosure of your primary residence

If you experience a financial hardship from a circumstance not on this list, you may still be able to qualify for a hardship withdrawal, so check with your plan administrator.

- In-service, non-hardship withdrawals

This type of withdrawal is only allowed under certain plans and is mainly used by those who would like to explore other investment options. Learn more about in-service distributions. An Ameriprise financial advisor can provide more detailed information on in-service 401 distributions.

Repayment Terms On 401 Loans

- You must pay back your loan within five years. You can do so via automatic payroll deductions, the same way you fund your 401 in the first place. There is no penalty for paying off the loan sooner than that.

- You must pay interest on the loan, at a rate specified by your 401 fund administrator. Typically the rate is calculated by adding one or two percentage points to the current prime interest rate.

Read Also: What Happens With My 401k When I Quit

What Are The 401 Loan Limits

Your 401 is subject to legal loan limits set by law. The maximum amount you can borrow is traditionally the lesser of $50,000 or 50% of your vested account balance, whichever is less. Your vested account balance is the amount that belongs to you. If your company matches some of your contributions, you may have to stay with your employer for a set amount of time before the employer contributions belong to you. Your 401 plan may also require a minimum loan amount.

Look For Creative Ways To Save

Before you even think about raiding your 401, you should take a good, hard look at your budget. The truth is there might be hundredsor even thousandsof dollars worth of savings hiding right there in plain sight. You just have to know where to look!

Here are some things you can do today to save some money and free up cash:

- Cancel automatic subscriptions and memberships.

- Pause contributions to your 401.

- Pack your own lunches .

- Check your insurance rates and shop around.

You May Like: Can I Pull Money From My 401k

What Happens To A 401 Loan When An Employee Changes Jobs

When an employee leaves your company, the outstanding loan balance becomes due. Unless the employee repays the loan, the outstanding balance will be considered taxable income the earlier of an employee taking distribution of their entire retirement account or the quarter after the quarter the last payment was received.

Again, the employee will be responsible for all tax consequences and penalties .

How To Borrow From Your 401k

If you’ve decided that borrowing from your retirement plan is right for you, here’s how to get money from a 401 loan.

Read Also: What Happens To 401k When You Leave Your Job

Can You Pay Off A 401 Loan Early

Yes, loans from a 401 plan can be repaid early with no prepayment penalty. Many plans offer the option of repaying loans through regular payroll deductions, which can be increased to pay off the loan sooner than the five-year requirement. Remember that those payments are made with after-tax dollars unlike contributions, which are made before taxes.

Option : Model The Repayment As An Expense

This approach assumes that your current 401k balance reflects the total after you repay the loan.

This approach also assumes that you know the duration of your loan repayment. If that is the case, model a debt with the description of loan repayment for the duration of your loan.

Step 1: Go to My Plan > Debts

Step 2: Open the Non-Mortgage Debts section

Step 3: Press “Add a non-mortgage debt +”

Step 4: Select that this is an “Other” debt

Step 5: Select that you will manually enter this loan

Step 6: Enter a descriptive name

Step 7: Enter the current balance

Step 8: Enter the interest rate, likely 0%

Step 9: Enter your monthly payment

Step 10: Press Save

You May Like: How Do I Invest In My 401k

What Happens When A Participant Is Late On A Payment Misses A Payment Or Employment Is Terminated

- Late or missed loan payments should be paid in a timely manner to avoid default, taxation and penalties.

- Defaulted loans are subject to an additional 10% excise tax if the participant is under age 59½.

- Upon termination, the outstanding loan balance becomes due.

- If not repaid promptly, the loan will be considered in default and may be deemed a taxable distribution to the participant.

Caveats To Borrowing From Your 401

Some 401 plans allow a withdrawal in the form of a loan, but some do not. You must check with your 401 plan administrator or investment company to find out whether your plan allows you to borrow against your account balance. You can usually find their contact information on your statement.

Some companies allow for multiple loans.

Don’t Miss: Can You Take Money Out Of 401k

How Long Do You Have To Repay 401 Loan If You Quit

Before the enactment of the Tax Cuts and Job Act in 2017 , 401 participants were required to pay off any outstanding loan balance within 60 days of leaving the employer. Otherwise, the unpaid loan balance was considered a distribution and taxed at the participantâs tax bracket rate.

With the enactment of the new law, 401 participants have until the tax due date for the year when the distribution is made to repay the outstanding 401 loan. For example, if you left your job in January 2021, you will have until April 15, 2022, to fully repay the loan. Once you have settled the outstanding 401 balance, you will not be required to pay tax or penalty on the distribution.

Tags

Repaying The 401 Loan

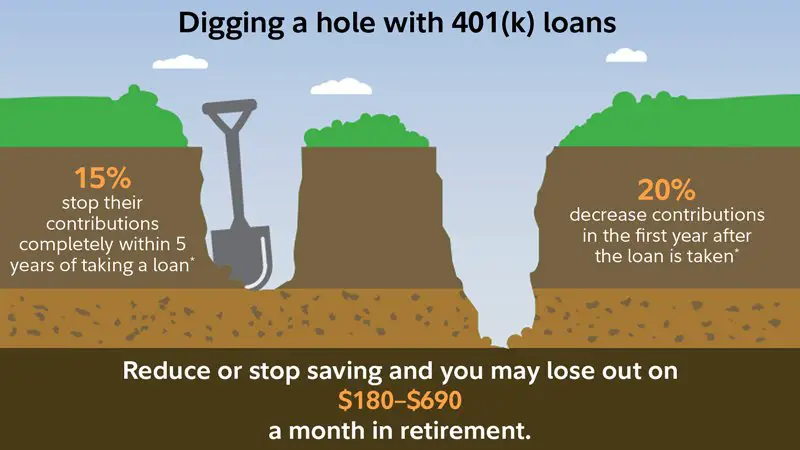

You should make payments at least quarterly, but commonly, this interval is manageable as you’ll repay your loan through payroll deductions. The longest repayment term allowed is five years, though there are exceptions. Some 401 plans do not allow you to contribute to the plan for a certain period after you take out a loan.

If you lose your job while you have an outstanding 401 loan, you may need to repay the balance in full or risk having it be categorized as an early distribution, which can result in both taxes owed and a penalty from the IRS.

Also Check: What Is A Robs 401k

Round Off Your Payments

Rounding off your payment to the nearest hundred or thousand is a smart way to shorten the loan term. For example, if you are paying $330 towards the loan every month, you can round off the payment to $400. The extra payment will amount to $840, which is enough to knock two and half months from the loan term.

Why Would You Want To Pay Your 401 Loan Off Quickly

Debt, whether a 401 loan or a loan through a bank, is relatively harmless until your financial situation changes. Having a goal to pay off debt faster is never a bad thing.

There are a few reasons why you would want to pay off your 401 loan faster:

- Youâre planning on changing jobs soon – rather than waiting until after you leave your job and repaying your loan within a couple of months, planning ahead and saving the lump sum paying over time will help ease the burden.

- Avoid scrambling in the case you get fired or laid off – we like to think our jobs are secure. However, our employment is only as reliable as our employer deems it to be. Paying off your 401 loan early eliminates having to come up with the balance at a momentâs notice while trying to find a new job.

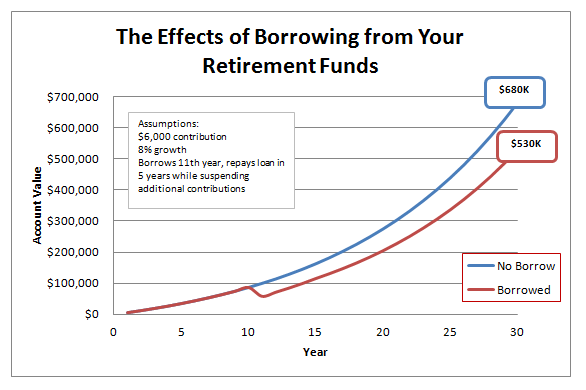

- Allow your retirement savings more time to grow – the more time your retirement savings arenât in the market, the more time they arenât earning compounding interest. Paying back your 401 loan early allows it more time to grow.

Recommended Reading: Can An Individual Open A 401k Account

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our investing reporters and editors focus on the points consumers care about most how to get started, the best brokers, types of investment accounts, how to choose investments and more so you can feel confident when investing your money.

Investing disclosure:

The investment information provided in this table is for informational and general educational purposes only and should not be construed as investment or financial advice. Bankrate does not offer advisory or brokerage services, nor does it provide individualized recommendations or personalized investment advice. Investment decisions should be based on an evaluation of your own personal financial situation, needs, risk tolerance and investment objectives. Investing involves risk including the potential loss of principal.

Late Repayment Is Potentially Costly

When you take a 401 loan, you pay no taxes on the amount received. However, if you don’t repay the loan on time, taxes and penalties may be due. Specifically, if the loan is not repaid according to the specific repayment terms, then any remaining outstanding loan balance can be considered a distribution. In that case, it becomes taxable income to you, and if you are not yet 59 1/2 years old, a 10% early withdrawal penalty tax will also apply.

If you leave employment while you have an outstanding 401 loan, your remaining loan balance is considered a distribution at that time, unless you repay it. However, you can avoid taking the tax hit by rolling over the outstanding balance into an IRA or another eligible retirement plan by the due date for filing your federal income tax return for the year in which the loan was characterized as a distribution.

You May Like: How To Open A 401k Account

What Are The Requirements For Repaying The Loan

Typically, you have to repay money you’ve borrowed from your 401 within five years by making regular payments of principal and interest at least quarterly, often through payroll deduction. However, if you use the funds to purchase a primary residence, you may have a much longer period of time to repay the loan.

Make sure you follow to the letter the repayment requirements for your loan. If you don’t repay the loan as required, the money you borrowed will be considered a taxable distribution. If you’re under age 59½, you’ll owe a 10 percent federal penalty tax, as well as regular income tax on the outstanding loan balance .

Weighing Pros And Cons

Before you determine whether to borrow from your 401 account, consider the following advantages and drawbacks to this decision.

On the plus side:

- You usually dont have to explain why you need the money or how you intend to spend it.

- You may qualify for a lower interest rate than you would at a bank or other lender, especially if you have a low credit score.

- The interest you repay is paid back into your account.

- Since youre borrowing rather than withdrawing money, no income tax or potential early withdrawal penalty is due.

On the negative side:

- The money you withdraw will not grow if it isnt invested.

- Repayments are made with after-tax dollars that will be taxed again when you eventually withdraw them from your account.

- The fees you pay to arrange the loan may be higher than on a conventional loan, depending on the way they are calculated.

- The interest is never deductible even if you use the money to buy or renovate your home.

CAUTION: Perhaps the biggest risk you run is leaving your job while you have an outstanding loan balance. If thats the case, youll probably have to repay the entire balance within 90 days of your departure. If you dont repay, youre in default, and the remaining loan balance is considered a withdrawal. Income taxes are due on the full amount. And if youre younger than 59½, you may owe the 10 percent early withdrawal penalty as well. If this should happen, you could find your retirement savings substantially drained.

You May Like: How Do I Transfer My 401k To A Roth Ira

What Happens To A 401 When You Quit Or Change Jobs

When you change jobs with an outstanding 401 loan, you must continue paying the balance until it is fully paid. Before the Tax Cuts and Jobs Act was passed in 2017, 401 loan borrowers had 60 days after leaving the employer to clear the outstanding balance. Under the TCJA law, you have until the due date of your tax return to repay the loan balance. For example, if you took a 401 loan in February 2021, you have until April 15, 2022, to repay the 401 loan fully.

If you are unable to repay the loan before the due date, the plan administrator will report the outstanding loan as a distribution. The loan balance will be considered a taxable income, and you will owe income taxes, and 10% penalty tax for early withdrawal if you are below age 59 ½. In this case, the employer will issue Form 1099-R to the IRS, and you will be required to report this amount in your tax return for the year.

Tags

What Are The Disadvantages Of Withdrawing Money From Your 401 In Cases Of Hardship

- Taking a hardship withdrawal will reduce the size of your retirement nest egg, and the funds you withdraw will no longer grow tax deferred.

- Hardship withdrawals are generally subject to federal income tax. A 10 percent federal penalty tax may also apply if you’re under age 59½. contributions, only the portion of the withdrawal representing earnings will be subject to tax and penalties.)

- You may not be able to contribute to your 401 plan for six months following a hardship distribution.

Also Check: What 401k Do I Have