What Percent Should I Contribute To A 401

Brewer suggests that your contributions should be based on a percentage of your income, depending on your age. She recommends that you stash away between 10 percent and 15 percent of your gross income if youre in your 20s and 30s, or if you started saving during those years. If youre behind in retirement savings in your 40s and 50s, Brewer encourages you to set aside between 15 percent and 25 percent of your income.

If youre not saving anything for retirement right now and want to get started, start with at least 3 percent to get going, Brewer says. Increase your contribution by at least 2 percent each year and do a larger increase in years where you get a big raise until you hit your target savings percentage.

Examples Of Highly Compensated Employees In 2022

The rules can be confusing because they depend on how the plan is drawn up. Heres an example to consider.

In a ten-person small business:

- CEO Mary earns $500,000 and owns 90% of the company: HCE

- Brett earns $350,000 and no ownership: HCE

- George earns $200,000 and no ownership: HCE unless the company makes a top-paid election

- Six other employees earning $40,000 or less: Not HCEs

Most of the time the rules are obvious, but some employees status is harder to determine. It depends on whether the employer elects for the top-paid rule to apply in order to pass their nondiscrimination assessment by reducing the number of individuals in the highly compensated group.

How much will you pay for 401? Get an instant quote.

Your 2021 Guide To Employer Match And 401 Contribution Limits

Offering a matching 401 plan to your team is a great way to attract high-quality employees to your company. An employer-matched 401 can also help reduce employee churn as individuals recognize the financial significance of this benefit.

Many companies now opt for a 401 employer match program, rather than the traditional pension plan. Employer-matched 401 contributions allow for tax deductions for the employer. For this reason, there are 401 matching limits for how much employers can contribute to their employees 401 savings plans.

Learn more about what a 401 plan is, how employer matching works and the max 401 contribution company match limits over the past few years, including 2021 limits.

Are you a job seeker? Find jobs.

Don’t Miss: How To Change 401k Investments

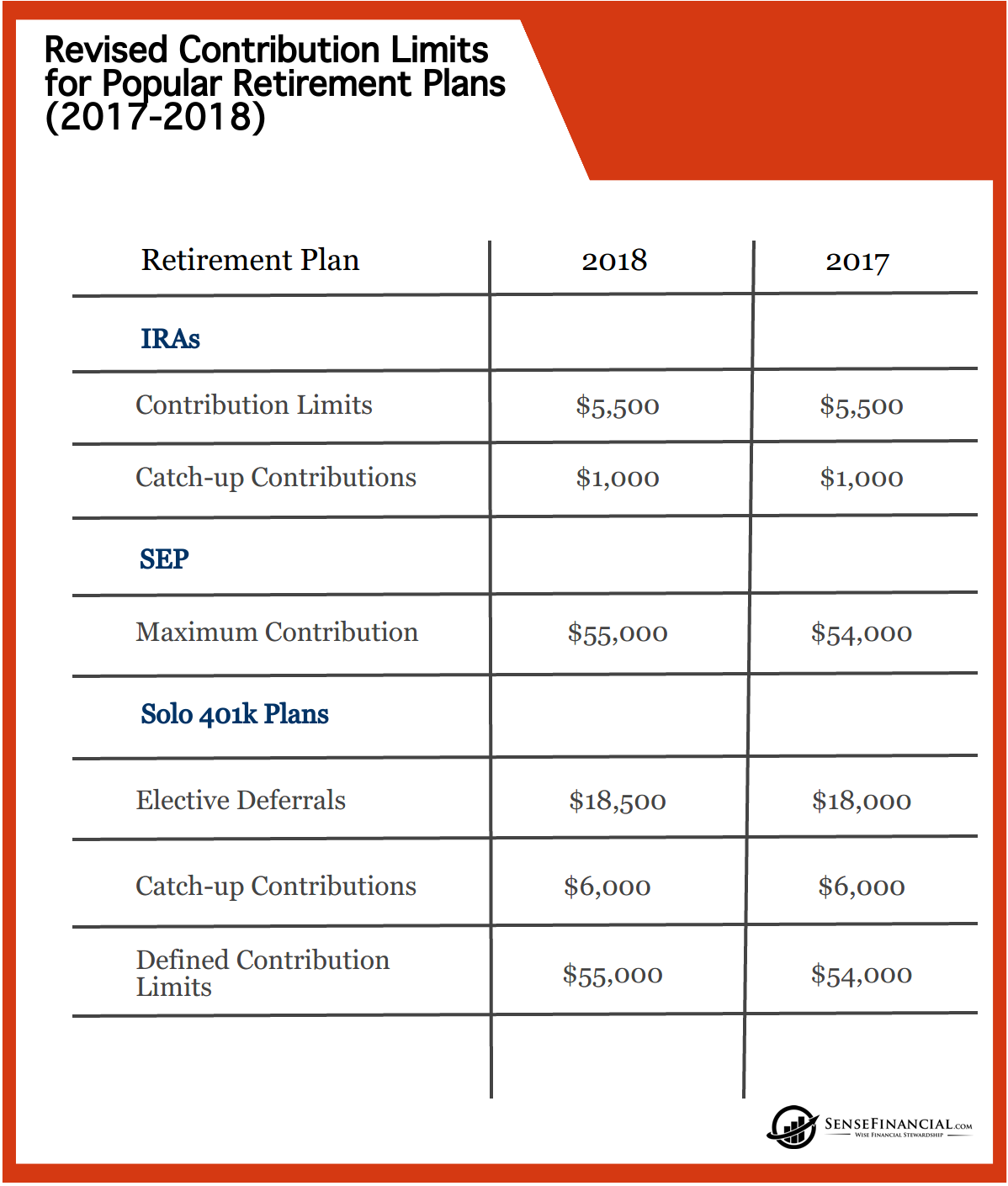

Other Irs Retirement Account Changes For 2022

In addition to contribution increases to 457, 403, and 401 plans, the IRS has additional 2022 updates:

-

Traditional and Roth IRA contribution limits remain the same at $6,000, with traditional and Roth IRA catch-up contribution limits staying at $1,000.

-

Income ranges for determining eligibility to make deductible contributions to traditional IRAs, to contribute to Roth IRAs, and to claim the Saver’s Credit all were raised for 2022.

Traditional Vs Roth 401

Some employers offer both a traditional 401 and a Roth 401. With a traditional 401 plan, you can defer paying income tax on the amount you contribute. In other words, if you earn $80,000 a year and contribute the maximum $20,500, your taxable earnings for the 2022 tax year would be $59,500.

With a Roth 401 plan, you dont get an upfront tax break, but when its time to withdraw that money in retirement, you wont owe any tax on it. All your accumulated contributions and earnings come out tax free.

Investing in both types of plans provides you with tax diversification, which can come in handy during retirement.

If you have access to both a Roth and a traditional 401 plan, you can contribute to both, as long as your total contribution to both as an employee doesnt exceed $20,500.

In addition to the Roth and traditional 401, some employers also offer an after-tax plan, allowing you to save up to the total annual limit of $61,000. With this account you can put away money after-tax and it can grow tax-deferred in your 401 account until withdrawal, at which point any withdrawn earnings become taxable.

Don’t Miss: How Much Should You Put In Your 401k

Solo 401k Contribution Limits

November 9, 2021 by Eric Restrepo

Solo 401k contribution limits are very high and they keep getting higher, year after year. Because of this its very advantageous for freelancers, independent contractors, and small businesses to save for retirement. These increases continue to encourage adoption of these Uni-k, Solo-k, or One participant 401k plans.

In addition to high contribution limits, there is also a lot of flexibility in how to contribute. You can do tax deductible traditional Solo 401k contributions to help lower your taxable income. Or you can also do after-tax Roth Solo 401k contributions. Or you can do a combination of both all within the same Solo 401k plan. High contribution limits can mean big changes for your financial future. The more money you put away, the more your money can grow. When you contribute funds to a retirement plan, they grow tax-deferred or tax-free. Therefore, you can grow your investment profits without paying taxes. This often results in meaningful improvements for your retirement goals.

Review The Irs Limits For 2022

The IRS has announced the 2022 contribution limits for retirement savings accounts, including contribution limits for 401, 403, and most 457 plans, as well as income limits for IRA contribution deductibility. Contribution limits for Health Savings Accounts have also been announced. Please review an overview of the limits below.

You May Like: How To Protect Your 401k In A Divorce

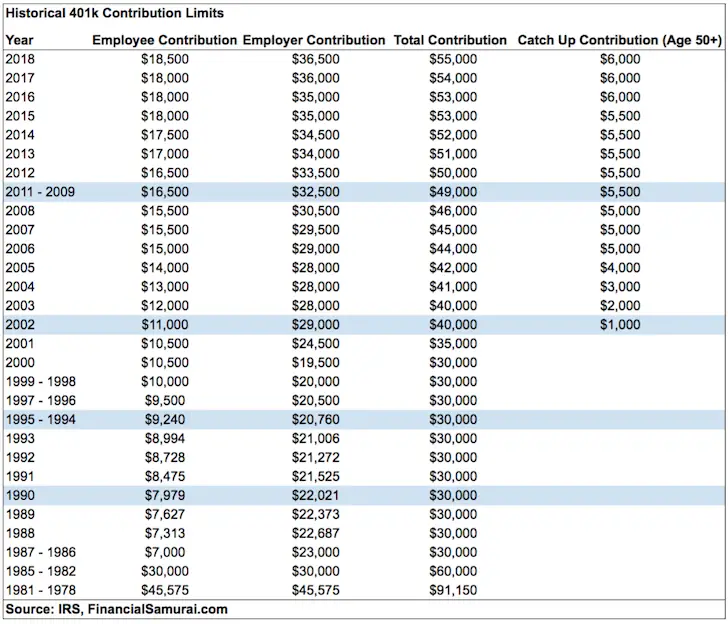

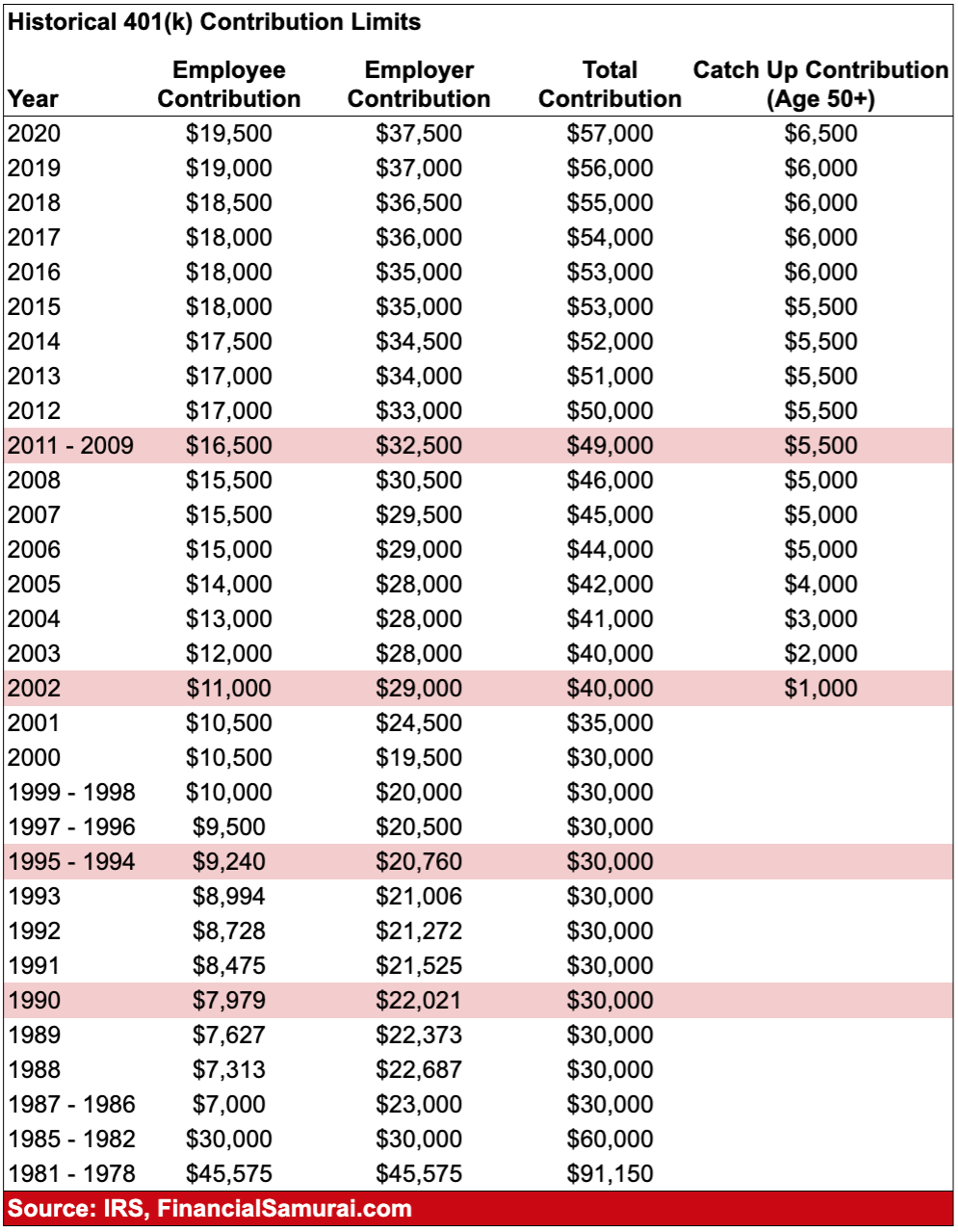

Contribution Limits For 2020 And 2021

When most people think of 401 contribution limits, they are thinking of the elective deferral limit, which is $19,500 in 2020 and 2021. This is the maximum amount you are allowed to voluntarily defer to your 401 for the year. Adults 50 and older are also allowed $6,500 in catch-up contributions, which are additional elective deferrals, in 2020 and 2021. This brings the maximum amount they can contribute to their 401s each year to $26,000.

The IRS also imposes a limit on all 401 contributions made during the year. In 2020, that limit is $57,000, or $63,500 if youâre 50 or older and therefore eligible for catch-up contributions. In 2021, it rises to $58,000 and $64,500, respectively. This includes all your personal contributions and any money your employer contributes to your 401 on your behalf. contributions, see the following section.)

Highly paid employees have some additional limitations to keep in mind. Companies can elect to stop a participantâs salary deferrals once that person has earned $285,000 in 2020 or $290,000 in 2021, and companies use only that first amount to calculate employer matching contributions.

For example, say your company matches up to 6% of your salary and you earn $300,000 in 2021. Six percent of $300,000 is $18,000 however, your company can only match you up to 6% of $290,000, the maximum employee compensation limit for 2021. So rather than up to $18,000, youâd get up to $17,400 as an employer match.

|

Type of Contribution |

|---|

Compensation Limit For Contributions

Remember that annual contributions to all of your accounts maintained by one employer – this includes elective deferrals, employee contributions, employer matching and discretionary contributions and allocations of forfeitures, to your accounts, but not including catch-up contributions – may not exceed the lesser of 100% of your compensation or $61,000 for 2022 . This limit increases to $67,500 for 2022 $64,500 for 2021 $63,500 for 2020 if you include catch-up contributions. In addition, the amount of your compensation that can be taken into account when determining employer and employee contributions is limited to $305,000 for 2022 $290,000 in 2021 .

Read Also: How Much Is The Max You Can Contribute To 401k

How To Max Out A 401k

For 2021, the 401k contribution limit is $19,500 in salary deferrals. Individuals over the age of 50 can contribute an additional $6,500 in catch-up contributions.

Yet, most people dont know how to max out a 401k. According to a Vanguard study , only 12% of plan participants managed to max out their 401k in 2019. Here are some strategies on how to max out your 401.

Limits For Highly Paid Employees

If you earn a very high salary, you may be considered a highly compensated employee , subject to more stringent contribution limits. To prevent wealthier employees from benefiting unfairly from the tax benefits of 401 plans, the IRS uses the actual deferral percentage test to ensure that employees of all compensation levels participate proportionately in their companies’ plans.

If non-highly compensated employees do not participate in the company plan, the amount that HCEs can contribute may be restricted.

Recommended Reading: What Are The Best Investments For My 401k

Tax Deductible Ira Contributions If I Have A Solo 401k Question:

My question: As my wife and I are *not* contributing to our solo401k plan, does that mean that we are not active participants and IRA contributions are tax deductible?

Good question. Yes, you are still considered covered by a retirement plan at work even if you are not making solo 401k contributions.

While you can still contribute to a traditional IRA, your traditional IRA contribution deductions will be reduced if your AGI is a certain amount.

For 2017, if you are covered by a retirement plan, your deduction for contributions to a traditional IRA is reduced if your AGI is:

- More than $99,000 but less than $119,000 for a married couple filing a joint return or a qualifying widow,

- More than $62,000 but less than $72,000 for a single individual or head of household, or

- Less than $10,000 for a married individual filing a separate return.

You May Like: How To Find My 401k Money

Roth Ira Income Limits

While you can’t take a tax deduction on a Roth IRA because contributions are made after-tax, Roth IRAs have income limits as well: They indicate how much you can contribute to a Roth, if at all, and they apply whether or not you participate in a 401. The Roth IRA contribution limit for 2022 is $6,000. Income limits, which are based on modified adjusted gross income, are as follows:

| Roth IRA Income Limits for 2022 | |||

|---|---|---|---|

| Full Contribution | |||

| Not applicable | Less than $10,000 | $10,000 and up | |

| Single, head of household, or married filing separately and did not live with spouse during the year | Less than $129,000 | $144,000 and up |

Want to calculate your reduced contribution? See IRS Publication 590-A, Contributions to Individual Retirement Accounts for a worksheet to figure it out.

You May Like: How Can I Take Money Out Of My 401k

What Are The Tax Benefits To The Employer For Offering A 401 Matching Plan

Employers can use the contributions to employee 401 accounts as tax deductions on their federal corporate income tax returns. These contributions may also be exempt from state and payroll taxes. As a result, the employer keeps their employees happy, sees reduced turnover and benefits financially with tax deductions.

Special Considerations For 401k 2022 Limits

Catch-up contributions

While $20,500 is the standard contribution limit for 2022, of course, there are some exceptions to the rule. For example, the IRS allows individuals that are 50 years or older to make contributions in excess of the $20,500 limit so that theyre able to speed up their savings as they near retirement. This is called a catch-up contribution. For 2022, the catch-up contribution limit for those 50 years old and over is $6,500.

Highly compensated employees

Contrary to catch-up contributions, there are also some circumstances that might limit your retirement contributions even further than the standard rule. According to the IRS, highly compensated employees are those that earn more than $135,000 per year. If you fall into this category, your 401k contribution limits may depend on how much other employees within your company are contributing to their retirement plans. The IRS imposes these additional restrictions to ensure that a company is not favoring their highly paid employees in regards to pension plans. Well discuss the purpose of contribution limits in a more general sense a little later on in this post.

Don’t Miss: What To Do With 401k When You Leave A Company

When You Havent Started Saving For Retirement

No matter how far you are from retirement, dont beat yourself up for not starting sooner. The important thing is to get started.

Take the first step by setting aside a small amount of money. Then increase it over time when you can afford it. Read 5 steps to creating your retirement plan to help you get started.

Of course, if your employer offers a matching contribution in its 401 plan, try to set aside enough to get that match by increasing your contribution rate, says Heather Winston, assistant director of financial advice and planning at Principal®. The company can help to grow your nest egg, and that free money can flow from them to you.

What Is A Solo 401k

According to the IRSs own website, a Solo 401k is simply a one participant 401k plan. It is no different than any other 401k, except that it only covers the owner and maybe also, his or her spouse. Its key that the sponsoring business compensates the spouse. These plans follow all of the same rules as any other 401k plan. Except no full time W2 employees are allowed in a Solo 401k.

Solo 401ks, just like other 401k plans are designed to help you save for retirement. In a Solo 401k, you play multiple roles, including, employee and employer. As such, you get additional benefits and control compared to a large group 401k plan. In the Solo 401k you have very high contribution limits and multiple ways to contribute. With certain Solo 401k providers, you also have full control over your retirement assets and investments. This means you can invest in stocks, bonds, gold & silver, ETFs, private companies, mortgage notes, and bitcoin. All inside your Solo 401k plan.

Also Check: How Much In 401k To Retire

What Is A Good 401 Contribution

Your ideal 401 contribution depends on several factors. If your employer offers a match, your first priority should be to contribute enough to get the full match. From there, you may want to max out a tax-free retirement account such as a Roth IRA before you finish maxing out your 401. If you’re able to do all three of these, it can help you get the most out of your investments.

Traditional Vs Roth 401k Contribution Limits

Some employers offer both a traditional 401k and a Roth 401k, but whats the difference between each? Lets walk through the differences between both account types so you can decide which type works best for your needs.

- Roth 401k: A Roth 401k refers to an employer-sponsored savings plan that gives you in which you can invest after-tax dollars for retirement. The perk to investing in a Roth 401k: You pay taxes on your money ahead of time, which means that you wont pay any taxes on your contributions after you take withdrawals after you reach age 59 ½ as long as the account has been funded for at least five years. All of your accumulated contributions and earnings come out tax free.

- Traditional 401k: A traditional 401k refers to an employer-sponsored plan that gives you the option to defer paying income tax on the amount you contribute for retirement. For example, lets say you earn $50,000 and max out your retirement plan at $19,500. Assuming you have no other deductions, your taxable earnings will reduce from $50,000 to $30,500. .

Wondering whether you should invest in both? You might want to take a tax-diversified approach because it could allow you to invest in many types of assets and allow you to diversify your savings. You can contribute to both a Roth and a traditional 401k plan as long as your total contribution doesnt go over $19,500 in 2021 and $20,500 in 2022.

You May Like: What Is A Solo 401k Plan

When Should You Avoid Maxing Out Your 401

Of course, not all people are in a position to add $20,500 a year to a retirement plan. If you earn $50,000 a year, that $20,500 represents 41% of your total incomeâsome of which you may need to meet your living expenses. Itâs okay that you may not have the excess cash flow needed to make this happen. Each year brings a new enrollment period, so you can always choose to increase your contribution over time if your financial situation improves.

There are other reasons to think about maxing out 401 contributions. Employer-sponsored plans come in many forms, but most are managed by outside investment firms with their own rate and package options. Your retirement plan at work may have a great track record with a past of steady growth, or it may be more modest. You may be able to have some say in whether your money is invested aggressively or cautiously, or you may have only one option.

It’s possible that your plan charges high fees. You can usually find these details in your summary plan description and annual report. You should think about all these factors when you sign up and decide how much of your earnings will be put toward your plan each pay period.

Lastly, your 401 is only one of many potential retirement vehicles. You can always opt out of your company plan and save for retirement in an independent fund, like an IRA through your bank or credit union.

Should You Max Out Your 401k

Retirement is important and many financial experts would suggest maxing out any employer match contributions.

But while you may want to take full advantage of any tax and employer benefits that come with your 401, you also want to consider other financial goals and obligations you have before maxing out your 401, including:

Is all high-interest debt paid off? High-interest debt like credit card debt should be paid off first, so it doesnt accrue additional interest and fees. Do you have an emergency fund? Life can throw curveballsits smart to be prepared for job loss or other emergency expenses. Is there enough money in your budget for other expenses? You should have plenty of funds to ensure you can pay for additional bills, like student loans, health insurance, and rent. Are there other big-ticket expenses to save for? If youre saving for a large purchase such as a home or a kids college fund, you may want to put extra money into this saving goal, at least for the time being.

Once youre comfortable with other savings strategies, it might be time to explore maxing out your 401. There are many reasons to do soits a way to take advantage of tax-deferred savings, employer matching , and its a convenient way to save, since the money gets deducted from your paycheck automatically, once you set up your contribution amount.

Don’t Miss: How To Invest In A 401k Plan