It There Was No Stars I Would Put None

If there was no stars I would put none! From day one nothing but issues with there service. Starting from couldnt get into the system , not receiving a check, to i am away from my desk or out of the country! Then being told i need something when i actually dont due to the number of employees. Now finally the kicker cant speak with a manager nor supervisor and one person pretending to be 3 different people . The lies all around make me sick. Terrible company to deal with and customer service is bad over seas as well! I wouldnt allow my my worst enemy to do business with this company ! On top of there threats of loosing workers comp if we dont resign to get there service . Then with giving them my number and still calling and texting the wrong one, also sending us the wrong business on our paper work .Telling is to read our paper work that will give us the answers! Glad to be done with them .

Reply from ADP

Hello Susie,I’m very sorry to hear about your experience with our service. I’d like to have a service leader reach out and get your feedback on this. I’m sending a request for more information that will help me make sure I get this in front of the right people.Thank you, NW-ADP Client Experience

Follow These 3 Easy Steps

Step 1Select an eligible Vanguard IRA for your rollover*

- If you’re rolling over pre-tax assets, you’ll need a rollover IRA or a traditional IRA.

- If you’re rolling over Roth assets, you’ll need a Roth IRA.

- If you’re rolling over both types of assets, you’ll need two separate IRAs.

Note: You can roll over your assets to a new or an existing Vanguard account.

Step 2Contact the financial institution holding your employer plan

Tell them you want to make a direct rollover from your employer plan to your Vanguard IRA®, and ask what information they need

Need a letter of acceptance?

You’ll be able to create and print a letter of acceptance during our online rollover process.

Note: You may not be eligible to roll over a plan account that you’re still contributing to.

What types of assets do I have in my employer plan account?

Knowing whether you have pre-tax or Roth assets will help you figure out what type of IRA you need to open at Vanguard. If you own company stock in your plan, that may add a layer of complexity to your rollover.

What name did I use on my employer plan account?

A common situation that can delay a rollover is when a check from the current financial institution is made payable to a name that doesn’t match your Vanguard account registration. Examples include use of birth name versus married name, a missing suffix , differing middle initials , etc.

What are your rollover requirements?

Are e-signatures or faxed copies allowed?

Do you need a letter of acceptance ?

The Overseas Customer Support Is

The overseas customer support is terrible and that is being kind. Do not use ADP to file any taxes. Their overseas customer service does not understand any of the US tax laws and can’t answer any questions! Don’t believe me try it and you will see.

Reply from ADP

Hello Rob,I’m sorry to hear about your experience with our support. I’d like to have a service leader look into this and reach out. I’m sending a request for more information that will help me make sure I get this in front of the correct people.Thank you, NW-ADP Client Experience

You May Like: Can I Withdraw From My Fidelity 401k

Trying To Access Pay Statements Or W

If you are trying to access your pay statements or W2s online and have a registration code from your employer, please register as a new user at My.ADP.com.

If you are locked out, please access this same site and click on Forgot Your Password. If you are still having trouble, please contact your current or former employer directly.

Is There A Service Out There Than Can Handle This Process For Me

Yes thats where Capitalize comes in!

Weve made it our mission to make this process easier for everyone. If you choose to do a 401-to-IRA rollover, we can handle the entire process for you. Most of the process can be done online and our rollover experts will guide you through any of the manual parts.

Its 100% free to you .

Don’t Miss: How To Use Your 401k To Buy A Business

Make Sure Your Ira Is Being Invested Appropriately

Remember there are two goals of rolling over an old 401 into an IRA the first is to consolidate your 401 assets, and the second is to grow those assets by allocating them into investments that will increase in value over time.

Your very last step in executing a rollover is to make sure that second goal is being met and that the funds in your IRA are being appropriately invested. If you chose an automated IRA then this should happen automatically. Thats because as soon as your funds arrive theyll be allocated into a portfolio that was created for you during the sign-up process for your new IRA account. You should still log in and check to make sure thats the case, but usually theres nothing more for you to do.

If you choose a self-directed account then youll have to invest the money yourself. Often the simplest option is to purchase a target-date retirement fund this is an investment vehicle that puts your money into a combination of higher-risk, higher-return stocks and lower-risk, lower-return bonds. The exact mix changes as you age so that you have more stocks when youre younger and less as you get older: because stocks generate higher returns but are more volatile we should own more of them early on when we can withstand their fluctuations in order to achieve their higher long-term returns.

Otherwise you can assemble a portfolio on your own by making trades.

Customer Service Wait Time

I needed copies of our 401K monthly fee invoices which are not available on the plan site. I had to call the customer service number as there are no contact numbers on the plan website that I could contact for help. I waited over an 1 hour and 15 minutes on hold. You should have the invoices on the plan website and a better way to contact where you are not forced to wait that long for someone to answer the call. Maybe leave your name so that the customer service rep can call you back.

Reply from ADP

Hello Jennifer,I’m sorry for the frustration this has caused. I’d like to have a 401k service leader reach out and assist. I’m sending a request for more information that will help us get in contact with you.Thank you, NW-ADP Client Experience

You May Like: Should I Move My 401k Into An Ira

What Do I Request On The Call

After your identity is verified, youll be able to tell the customer service representative that you want to do a direct rollover. A direct rollover is where your funds are directly transferred to your new IRA provider. It often means the check is made out in the name of that IRA provider but for the benefit of you. This is generally the simplest approach. Your 401 provider will usually ask you for the name and mailing address of your new IRA provider and your new IRA account number. We also recommend that you take this opportunity to update your mailing address since they may have an old address for you. Thats because youll be sent additional documents, including a tax-related document known as a 1099-R that tells the IRS youre doing a tax-free rollover.

An indirect rollover is where funds are first transferred to you, or a check is made out in your name. You deposit the funds in one of your own accounts, but then you have 60 days to send that money on to your IRA account if you want the rollover to be tax-free. This can create a little extra work for you which is why most people opt for a direct rollover.

Have a rollover expert on the call with you! Capitalize can handle your 401-to-IRA rollover for you and set up a call with your provider walking you through each step along the way. Get started

STEP 4

Contacting Adp Payroll And Benefits

While 844-227-5237 is ADP Payroll and Benefits’s best toll-free number, there are 2 total ways to get in touch with them. The next best way to talk to their customer support team may just be to tell GetHuman about your issue and let us try to find the best way to contact them or find help for that particular issue. Besides calling, the next favorite option for customers looking for help is via Online Help for Customer Service. If you think this information is inaccurate or know of other ways to contact ADP Payroll and Benefits please let us know so we can share with other customers.

Read Also: Should I Transfer 401k To New Employer

Research Retirement Options For Your Business

Its important to do your due diligence in researching firms that provide recordkeeping and third-party administration services for 401 plans. As you assemble your list, include a range of established, reputable mutual fund companies, brokerage firms, and insurance companies. Focus on providers that can serve you and your employees long-term with extensive resources and excellent customer service.

You may also want to hear from owners of businesses that are similar to yours, as they may be able to offer insights from their own experiences selecting 401 plan service providers.

Nondiscrimination Tests: How To Stay Compliant

Does your companys 401 plan benefit all your employees, or does it favor owners and executives who make more money? Thats what the two major 401 nondiscrimination tests try to assess each year.

What do you need to do to pass the tests? Well, our friends at the IRS have made that piece of the equation a little more complex, so lets take a closer look at what each nondiscrimination test measures, how to apply them, and what it means if your plan fails. As you read this, also keep in mind that its possible to set up a Safe Harbor 401 plan, thats exempt from nondiscrimination testing.

Also Check: How To Opt Out Of Fidelity 401k

Read Also: What Can I Invest My 401k In

You Can Still Roll Over Cash Outs From A 401

Dont spend that check! If you spend a $900 cash out instead of rolling it over into an account earning 8% tax-deferred earnings, your retirement fund could end up with more than $9,000 after 30 years*. The bigger your cash out you spend, the higher your opportunity cost.

If youre able to find a new employer offering you a 401 or IRA, or you open a new retirement account that accepts the cash out check within 60 days from your last day of employment, then take advantage of an indirect rollover to recoup withholding and avoid paying penalties.

Youll have to deposit the entire check and come up with the 20% that your employer withheld. By completing an indirect rollover within the time limit, the IRS will refund the entire withholding in your next tax return.

Recommended Reading: When Can I Borrow From My 401k

Option : Keep Your Savings With Your Previous Employers Plan

If your previous employers 401 allows you to maintain your account and you are happy with the plans investment options, you can leave it. This might be the most convenient choice, but you should still evaluate your options. Each year, American workers manage to lose track of billions of dollars in old retirement savings accounts, so you should make sure to track your account regularly, review your investments as part of your overall portfolio and keep the beneficiaries up to date.

Some things to think about if youre considering keeping your money in your previous employers plan:

Don’t Miss: How To Get Money From 401k Before Retirement

Confirm A Few Key Details About Your Adp 401

First, get together any information you have on your ADP 401. Its okay if you dont have a ton, but any details like an old account statement or an offboarding e-mail from your former HR team can help. 401 paperwork can be confusing, so just focus on identifying the following items:

STEP 2

Rolling Over To A New 401

The first step in transferring an old 401 to a new employers qualified retirement plan is to speak with the new plan sponsor, custodian, or human resources manager who assists employees with enrolling in the 401 plan. Because not every employer-sponsored plan accepts transfers from an outside 401, it is imperative for a new employee to ask if the option is available from the new employer. If the plan does not accept 401 transfers, the employee needs to select one of the three other options for the 401 account balance.

If the new employer plan accepts 401 transfers from other companies, there is often a substantial amount of paperwork that must be completed by the employee. The paperwork is provided by the new plan sponsor or human resources contact and requires the name, date of birth, address, Social Security number, and other employee identifying information.

In addition, the 401 transfer form must provide details of the old employer plan, including total amount to be transferred, investment selections held in the account, date contributions started and stopped, and contribution type, such as pre-tax or Roth. A new plan sponsor may also require an employee to establish new investment instructions for the account being transferred on the form. Once the transfer form is complete, it can be returned to the plan sponsor for processing.

A transfer from one 401 to another is a tax-free transaction, and no early withdrawal penalties are assessed.

Recommended Reading: Can I Access My 401k If I Lose My Job

What Is Gethuman’s Relationship To Adp Payroll And Benefits

In short, the two companies are not related. GetHuman builds free tools and shares information amongst customers of companies like ADP Payroll and Benefits. For large companies that includes tools such as our GetHuman Phone, which allows you to call a company but skip the part where you wait on the line listening to their call technology music. We’ve created these shortcuts and apps to try to help customers like you navigate the messy phone menus, hold times, and confusion with customer service, especially with larger companies. And as long as you keep sharing it with your friends and loved ones, we’ll keep doing it.

ADP Payroll and Benefits Contact Info

Catering To Big Corporations

This used to be a great company with a small business feel. I’m not sure what has happened but every time I go to make a change/hire/terminate an employee the website has changed so much it takes me twice as long. Every time there has been an “update” it becomes more user unfriendly. We are a small business with 24 employees and some of the field requirements are irrelevant. I was told by a representative that the updates are done to keep up with the large corporations! Basically that told me that small businesses are not a priority with them! Such a shame this company has changed to cater to large corporations. They’ve pushed aside the little people.

Reply from ADP

Hello Heather,I’m very sorry to hear this. I’d like to have a service leader reach out and connect with you on this. I’m sending a request for more information that will help me make sure I get this in front of the right people.Thank you, NW- ADP Client Experience

Also Check: How To Transfer 401k From Old Job

Taking Money Not Authorized

They have charged me for monies from my account when I never even put in payroll. Then they leave me on the phone and forget about me hoping I will go away cause they don’t want to deal with their mistakes. They have also overcharged me for fees far more than what they were supposed to and then couldn’t explain them. The worst experience ever and the worst customer service.I went against friends advice when they said they are no longer the same company and that they are terrible. I will never use these guys again!!!Still on the phone waiting for a response for now 20 minutes. They won’t even get back on the phone to check with me.

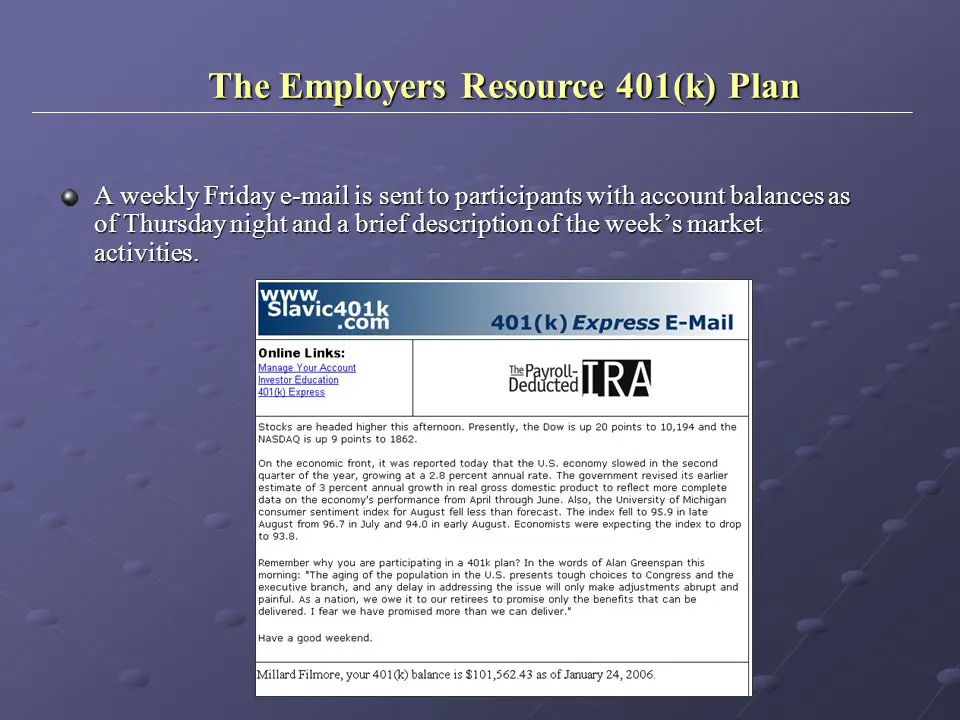

Adp Provides Online Plan Management

They also offer an online portal that makes it easy for plan participants to manage their plans.

Plan sponsors can use the portal to monitor participation rates, view contribution rates, and see plan allocations. Employees can use it to monitor their account balances. It also allows them to change contributions and make allocations to different funds. The portal is easy to access both online and through the ADP app.

Read Also: What Does It Mean To Rollover 401k