Why Do 401 Limits Change Some Years And Remain Unchanged In Others

The 401 contribution limits are adjusted annually in accordance with changes in inflation. The effects of inflation are measured by the consumer price index for urban wage earners and clerical workers. If inflation increases significantly, 401 matching limits are increased by increments of $500 or $1,000. However, if the increase in inflation isnt significant enough, the limits remain unchanged.

Are There Separate Limits For Roth 401s

No. Roth 401s have the same contribution limit as regular 401s. For 2021, that limit is $19,500. For 2022, that limit is $20,500. You can contribute to both a traditional 401 and a Roth 401 account in the same year, as long as your total contributions dont exceed that amount. If youre choosing between the two, learn about the differences between a Roth and traditional 401.

|

no promotion available at this time |

Promotioncareer counseling plus loan discounts with qualifying deposit |

Promotionof free management with a qualifying deposit |

Understanding 401 Plan Contribution Limits

The 401 plan and the variations mentioned above are all long-term savings plans designed to help people build their retirement savings. They are all qualified plans, in IRS speak. That means they have certain tax benefits for the employee, the employer, or both.

The tax advantage for employees, in most cases, is that their contributions are deducted from gross income, not net income. That reduces take-home pay. Less take-home pay means lower taxes, softening the blow, and the money goes into an investment account week after week, building long-term net worth.

For some 401 plans, employers can match some percentage of their employees contributions, but its strictly voluntary. Among employers who offer a match, the average was about 4.7% of the employees gross salary at the end of the first quarter of 2020, according to Fidelity Investments. This is effectively a 4.7% salary bonus, and any personal financial advisor will tell you that its nuts not to take full advantage of it.

Contributions to 401s and other retirement plans are limited by the IRS to prevent highly paid workers from benefiting more than the average worker from the tax advantages they provide.

Read Also: How To Look Up An Old 401k Account

Can You Contribute More Than The Match

Its smart to contribute at least the amount your employer will match. But you can usually contribute more. In 2019, you can contribute up to $19,000. If youre turning 50 by years end, you can also make a catch-up contribution of $6,000, for a total of $25,000.1

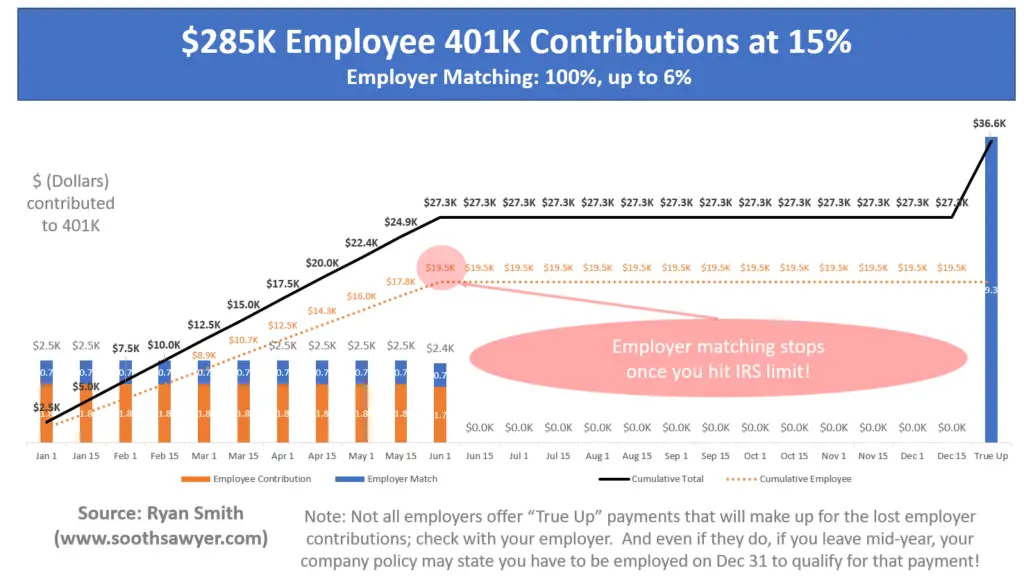

Check with your employer about the best way to size and schedule your contributions. In some cases, contributing the max before years end can cause you to miss out on matching for the rest of the year.

Donât Miss: Will Walmart Cash A 401k Check

Retirement Isnt Freebut Your 401 Match Is

Many of us herald this time of year as the arrival of summer, the end of the school year and seemingly longer days with more sunlight. Yet June is also a great time to check in with your employer-sponsored retirement plan.

Are you leaving free money on the table? In addition to offering the potential for free money through a match, employer-sponsored retirement plans can give you significant tax advantages.

Here are four steps to get the most out of your retirement savings.

Also Check: Does A 401k Rollover Count As A Contribution

Traditional 401 Vs Roth 401 Contributions

If you have a traditional 401 and Roth 401, these retirement accounts have different tax treatments. With a traditional 401, you will get a tax break on your income when you contribute to the retirement account. For example, if your annual salary is $50,000, and you contribute to a 401 up to the allowed limit of $19,500, your taxable income will be $30,500.

In contrast, if you contribute to a Roth 401, you will not get a tax break. This is because a Roth 401 is funded with after-tax money, meaning that you contribute money on which taxes have been taken out. If you take a distribution from a Roth 401 after attaining retirement age, you wonât pay any income taxes on the distribution. Also, if your employer offers a 401 match, the matching contributions cannot be added to a Roth 401. Instead, the employer contributions are added to a traditional 401.

How Does 401 Vesting Relate To 401 Matching

As an employer, you can take ownership of part or all of your employer match contributions through a practice known as vesting. The legal definition of vesting is the right to ownership over a future payment, benefit or asset. When applied to retirement accounts, vesting describes the process of employees earning greater rights to access their employer contributions as time passes. That’s why the vesting schedule you set for your 401 employer match is a crucial component of your program.

Your vesting schedule can incentivize your employees to stay with your company longer, because the longer your employees stay with you, the more their nonforfeitable rights to your employer contributions grow. After a set number of years, your employee can leave your company while taking all of your employer matching contributions with them, but employees who leave too soon may forfeit some or all of your employer matching contributions.

Key takeaway: To figure out how your 401 matching process will work, determine your employer match contribution limits, familiarize yourself with the IRS-mandated 401 contribution limits and determine a vesting schedule that drives employee retention while minimizing your financial risk.

Also Check: How To Rollover My 401k To New Employer

Tips On Saving For Retirement

- If navigating 401 rules and other retirement topics sounds complicated, a financial advisor can help guide you. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- To branch out a bit more in your retirement savings, you can open an IRA. An IRA, or individual retirement account, isnt sponsored by your employer. You have to open and fund it entirely yourself, but the upside is that you have more investment options. Of course, you can get an advisor to manage your accounts for you, as well.

What Happens If I Exceed My 401 Limit By Mistake

If you contribute too much to your 401 and notice your mistake before the tax filing deadline, you can probably correct it with your employer. Youll need to notify your plan administrator. Theyll return the excess money to you, and youll get a new W-2 and pay taxes on your new total taxable wages.

If you dont catch the mistake before tax day, you may have to pay taxes twice on the amount you contributed over the limit. Thats because the excess contribution cant be deducted from your taxes in the year it was made, and because the IRS will still count that money as taxable when its distributed too.

About the author:Arielle O’Shea is a NerdWallet authority on retirement and investing, with appearances on the “Today” Show, “NBC Nightly News” and other national media. Read more

Read Also: Can I Use My 401k To Purchase A Home

Annuities In Your Plan

Although companies have been permitted to include annuities in their 401 plans, the Secure Act aimed to eliminate companies’ fear of legal liability if the annuity provider were to fail or otherwise not meet its obligations.

Now, insurance companies, asset managers and employers are moving toward making these guaranteed lifetime income options more broadly available through 401 plans and similar workplace plans.

However, uptake by plan sponsors has been slow. Part of the problem is workers not understanding annuities, as well as aversion to the idea of handing over their retirement savings in one lump sum.

“But people also say they are interested in a guaranteed source of income in retirement,” Copeland said. “So, that makes it tough.”

Compensation Limit For Contributions

Remember that annual contributions to all of your accounts maintained by one employer – this includes elective deferrals, employee contributions, employer matching and discretionary contributions and allocations of forfeitures, to your accounts, but not including catch-up contributions – may not exceed the lesser of 100% of your compensation or $61,000 for 2022 . This limit increases to $67,500 for 2022 $64,500 for 2021 $63,500 for 2020 if you include catch-up contributions. In addition, the amount of your compensation that can be taken into account when determining employer and employee contributions is limited to $305,000 for 2022 $290,000 in 2021 .

Recommended Reading: Can You Roll A 401k Into A Roth

Start Making 401 Contributions Immediately

Some employers have a waiting period after you start a job before they begin matching your 401 contributions. However, Vanguard notes that 68% of plans let you start making contributions immediately as a new employee. Dont wait for the matching contribution to kick in start contributing when you begin your new job.

If youre intimidated by the investment options, take advantage of the plans target-date funds. The vast majority of employers have their default investments set up as a target-date fund, which is tied to your age and retirement year, said Taylor. You can put your money in there, and its a sort of do-it-for-me option where its allocated across equities appropriate for your age.

How To Maximize 401 Retirement Savings

Employees who utilize a workplace-sponsored retirement plan, such as a 401, are already on a path toward long-term saving for retirement. If an employer offers a contribution match on top of those elective deferrals, however, failing to take full advantage of this match can mean leaving money on the table.

Employees can consider adjusting their monthly 401 plan deferrals to maximize their annual contributions, which may ensure they receive the full match offered by their workplace.

Also Check: Does 401k Roll Over From Job To Job

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most how to save for retirement, understanding the types of accounts, how to choose investments and more so you can feel confident when planning for your future.

Can I Have A 401 And An Ira

Yes. IRAs make a great supplement to retirement savings in addition to a 401 if youre contributing enough to receive a full match from your employer, or youre planning on maxing out your 401. If you dont receive a match on your 401 or it has narrow investment options or high fees, it may be a good idea to invest primarily in an IRA. The annual contribution limit for an IRA in 2021 and 2022 is $6,000, or $7,000 if youre 50 or older.

» Ready to try an IRA? Check out our list of the best IRA accounts

Don’t Miss: What Happens To My 401k After I Quit

How Employer Matching Works

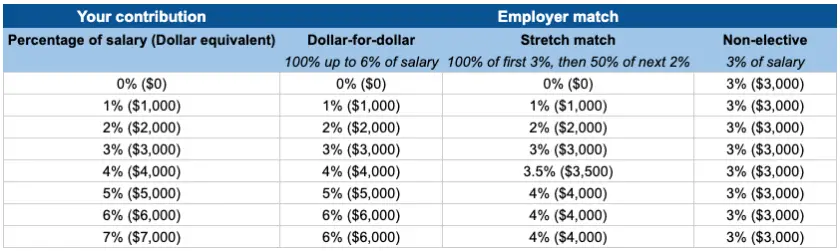

With employer matching, your employer will match your 401 contribution up to a certain match limit. Employers rarely match all of your contributions, and even if they do, theres a limit on how much you, as an individual, can contribute. The most common employer matching scheme is for the employer to match the first 6% of your contributions every year.

Because plans vary dramatically from company to company, its a good idea to talk to your HR department or your employer to learn precisely how much theyll match. Depending on your earnings, this amount can change from year to year as well. But even if your employer only matches part of your 401 contribution, its still a smart idea to contribute as much as you can, since all of those savings are tax-deferred in the meantime.

And 2021 Contribution Limits

If youre an employee, in 2021, you may contribute up to $19,500 of your own money to a 401 and $26,000 if youre 50 or older.

These are the 2020 and 2021 limits for specific retirement plans, including 401, 403, 457, and a Thrift Savings Plan.

The limit on total contributions from both the employee and employer cant exceed the lesser of 100% of the employees salary or $58,000 for employees younger than age 50 and $64,500 for those age 50 or older.

Recommended Reading: How Do You Max Out Your 401k

Is Offering A 401 Employer Match Mandatory

Although offering a 401 employer match for your employees’ retirement plans may benefit your business, there are no laws requiring employer matching. However, if you do offer a 401 employer match contribution program, you are legally required to conduct nondiscrimination testing to ensure your program equally benefits all of your employees. These IRS-created tests, known as the Actual Deferral Percentage and Actual Contribution Percentage tests, ensure that your company’s most highly paid employees benefit as much from tax-deferred contributions as your other employees.

Key takeaway: Employers are not required to offer a 401 employee match, but those that do must regularly test for compliance with nondiscrimination standards that ensure employees of all incomes benefit equally from tax-deferred contributions.

How To Maximize 401 Benefits

Although the IRS limits the amount your employer can contribute to your 401, taking advantage of tax-deferred retirement savings through your employer is often a great investment, especially if your employer offers matching funds. Here are a few tips to consider if you’re thinking of contributing to a 401:

You May Like: What Happens To 401k When Switching Jobs

Retirement Savings Plan Contribution Limits

The information below summarizes the retirement plan contribution limits for 2021.

| Plan |

|---|

More details on the retirement plan limits are available from the IRS.

457 Plans

The normal contribution limit for elective deferrals to a 457 deferred compensation plan is unchanged at $19,500 in 2021. Employees age 50 or older may contribute up to an additional $6,500 for a total of $26,000. Employees taking advantage of the special pre-retirement catch-up may be eligible to contribute up to double the normal limit, for a total of $39,000.

401 Plans

The total contribution limit for 401 defined contribution plans under section 415 increased from $57,000 to $58,000 for 2021. This includes both employer and employee contributions.

401 Plans

The annual elective deferral limit for 401 plan employee contributions is unchanged at $19,500 in 2021. Employees age 50 or older may contribute up to an additional $6,500 for a total of $26,000.

The total contribution limit for both employee and employer contributions to 401 defined contribution plans under section 415 increased from $57,000 to $58,000 .

403 Plans

The annual elective deferral limit for 403 plan employee contributions is unchanged at $19,500 in 2021. Employees age 50 or older may contribute up to an additional $6,500 for a total of $26,000.

The total contribution limit for both employee and employer contributions to 403 plans under section 415 increased from $57,000 to $58,000 .

IRAs

Employer Matching Contribution Formulas

Most often, employers match employee contributions up to a percentage of annual income. This limit may be imposed in one of a few different ways. Your employer may elect to match 100% of your contributions up to a percentage of your total compensation or to match a percentage of contributions up to the limit. Though the total limit on employer contributions remains the same, the latter scenario requires you to contribute more to your plan to receive the maximum possible match.

Some employers may match up to a certain dollar amount, limiting their liability to highly compensated employees regardless of income. For example, an employer may elect to match only the first $5,000 of your employee contributions.

The IRS requires that all 401 plans take a nondiscrimination test annually to ensure that highly compensated employees dont benefit more from tax-deferred contributions.

“Your employer could match 100% or even a dollar amount based upon some formula, but this can get expensive and normally owners want their employees to take some ownership of their retirement while still providing an incentive,” says Dan Stewart, CFA®, president, Revere Asset Management Inc., in Dallas, TX.

You May Like: What Is My Fidelity 401k Account Number

Using The Wrong Broker Could Cost You Serious Money

Over the long term, there’s been no better way to grow your wealth than investing in the stock market. But using the wrong broker could make a big dent in your investing returns. Our experts have ranked and reviewed the top online stock brokers – simply to see the results and learn how to take advantage of the free trades and cash bonuses that our top-rated brokers are offering.

Are There Any 401 Employer Match Rules

Along with the contribution limits and match percentages, there is another important catch when it comes to 401 matches: the vesting schedule. Some employers require you to work at the company for a set amount of time before youre fully vested.

Vested just means that you fully own the employer contributions to your 401. You always own the contributions you put into the account but if you leave a company early, you might not get to take the money your employer put in.

For example, say your companys vesting schedule works like this: youre 0% vested for the first year, 20% vested for the second year, 50% vested for the third year and 100% vested by year four. If your employer contributes $2,000 and you leave halfway through your second year of employment, youll only get to keep $400 of it , whether you cash it in or roll it over. This amount is known as your vested balance. But if you switch jobs 10 years in, youll get the full value of your 401 employer match in other words, youll be fully vested.

If youre not sure what you vested balance is or how your companys vesting schedule works, you can always check with an HR rep for further clarity.

Don’t Miss: Should I Roll My Old 401k Into My New 401k