What Is A 401 Retirement Savings Plan

A 401 is a retirement savings plan some employers offer their team as a financial benefit for working at the company. The U.S. government established the 401 to incentivize workers to save for their retirement.

Employees volunteer to have a certain amount deducted from their paychecks each pay period to go toward their 401 savings accounts. While employees usually choose how much theyd like to deduct from their paycheck, they often have a limit on how much theyre allowed to contribute.

Employers can offer one of two plans: a traditional 401 plan or a Roth 401 plan. For traditional plans, 401 withdrawals are taxed at the employees current income tax rate. Roth 401 withdrawals arent taxable if the 401 account is five years old or older and the employee is over 59 years old. There are specific regulations to follow regarding how much and how often an employee can withdraw these funds for their 401.

Many employers use 401s as an employee benefit for working at the company and as an incentive to keep long-term employees. Some employers require employees to work at a company for a certain amount of time before they can start depositing their paycheck money toward a 401.

Employees can choose the specific types of investments from a selection their employer offers. Some of these investment types may include stock and bond mutual funds, target-date funds, guaranteed investment contracts or the employers company stock.

When To Use Matching Contributions

Employers commonly use matching contributions to meet the following 401 goals:

- Incentivize employees to make salary deferrals themselves.

- Meet safe harbor 401 contribution requirements with the least possible expense possible when low plan participation by employees makes a safe harbor matching contribution less expensive than the 3% safe harbor nonelective contribution.

However, nonelective contributions may be the superior alternative when trying to meet the following 401 goals:

- Provide a base retirement benefit to low wage workers that cant afford to save themselves

- Maximize business owner contributions with the least possible expense often, a new comparability profit sharing contribution is less expensive than a matching contribution in meeting this goal.

Re: Formula To Calculate A 401k Company Match

“Trish” wrote:> The company I work for will match employees 401K with the> following: The first 3% the company matches 100%, the 4th> and 5th % the company will match 50%. Does anyone know> a formula that will calculate this, I need to figure this> semi-monthly.I presume you mean that anything above 3% and less than orequal to 5% is matched at 50%. If the salary is A2 and thepercentage contribution is in B2:=A2*MIN + 50%*A2*MAX)or equivalently:=A2* + 50%*MAX))You probably want to put all that inside ROUNDDOWNor ROUNDDOWN to round down to dollars or cents.However, if you mean that anything under 4% is matched100% and anything between 4% and 5% inclusive is matchedat 50%, that is harder. Post again if this is your intent.

You May Like: Should I Move Money From 401k To Roth Ira

Safe Harbor Matching Contributions

Safe harbor 401 plans are the most popular type of 401 plan used by small businesses today. They automatically pass annual ADP/ACP and top heavy tests and allow business owners to make salary deferrals up to the legal limit without the risk of corrective refunds or contributions. For a 401 plan to achieve safe harbor status, the employer must make a qualifying contribution to eligible employees.

For a matching contribution to meet safe harbor 401 requirements, it must use one of the following three formulas:

An employer may also make discretionary a matching contribution on top of these contributions and remain exempt from ADP/ACP and top heavy testing if the match meets both of the following two requirements:

- Its formula is not based on more than 6% of compensation.

- Its dollar amount doesnt exceed 4% of compensation.

Other safe harbor match requirements

Recognize The Tax Advantages

In addition to potentially offering free money through a match, employer-sponsored retirement plans can give you significant tax advantages.

Contributions to tax-advantaged retirement accounts, such as a 401, are made with pre-tax dollars. That means the money goes into your retirement account before it gets taxed.* Plus, your contributions, any match your employer provides and any earnings in the account are all tax-deferred. That means you dont owe any income tax until you withdraw from your account, typically after you retire.

With pre-tax contributions, every dollar you save will reduce your current taxable income by an equal amount, which means you will owe less in income taxes for the year. But your take-home pay will go down by less than a dollar.

You May Like: How Do I Stop My 401k

You May Like: How To Withdraw Funds From 401k

Tips On Saving For Retirement

- If navigating 401 rules and other retirement topics sounds complicated, a financial advisor can help guide you. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- To branch out a bit more in your retirement savings, you can open an IRA. An IRA, or individual retirement account, isnt sponsored by your employer. You have to open and fund it entirely yourself, but the upside is that you have more investment options. Of course, you can get an advisor to manage your accounts for you, as well.

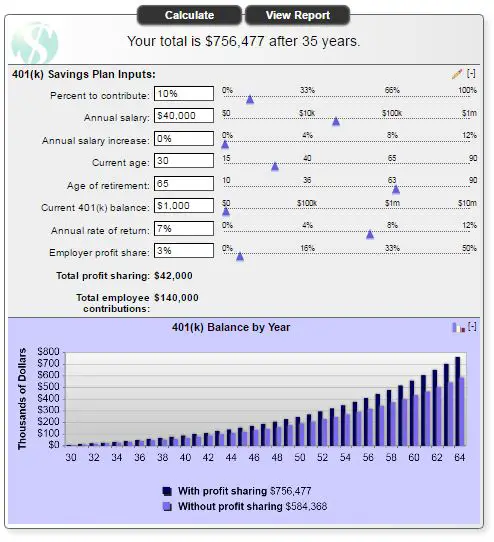

Could You Invest Just 2 Percent More

Use this calculator to see how much more you could accumulate in your employer retirement plan over time by increasing the amount that you contribute from each paycheck. Even 2 percent more from your pay could make a big difference. Enter information about your current situation, your current and proposed new contribution rate, anticipated pay increases and how long the money might be invested, as well as your own assumptions about the growth rate of your investments, and see the difference for yourself*. For additional information, see How to use the Contribution Calculator.

*This calculator is intended to serve as an educational tool, not investment advice. It enables you to enter hypothetical data. The variables you choose are not meant to reflect the performance of any security or current economic conditions. The examples are intended for illustrative purposes only and are not a prediction of investment results.

Calculations are based on the values entered into the calculator and do not take into account any limits imposed by IRS or plan rules. Also, the calculations assume a steady rate of contribution for the number of years invested that is entered.

Recommended Reading: Who Are The Top 401k Providers

When Does The Year End For A 401 Match

In terms of IRS contribution limits, the year resets on January 1. Any contributions and matches made during the year count toward your total contribution limit for the year. Your employer might choose to deposit its match each time you withhold your contribution from your paycheck, or it may deposit it at less frequent intervals, say, quarterly or yearly.

The Balance does not provide tax, investment, or financial services or advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. Past performance is not indicative of future results. Investing involves risk, including the possible loss of principal.

Also Check: How Can I Find My 401k

Safe Harbor Matching Formulas In 2021

Another type of 401 plan, popular particularly among small businesses with a handful of highly compensated employees, is the Safe Harbor plan which exempts them from annual ADP and ACP nondiscrimination testing, in exchange for agreeing to make generous and fully vested 401 contributions to all eligible employees.

The most common formulas for 401 matching contributions are:

- Basic Match: 100% match on the first 3% put in, plus 50% on the next 3-5% contributed by employees.

- Enhanced Match: 100% match on the first 4-6% put in.

- Nonelective Contribution: 3% of employee compensation, regardless of employee deferrals.

You May Like: What Is A Self Directed 401k Plan

Whats A Typical Employer Match To A 401

Ever wondered how employers calculate matched contributions? In 2018, Vanguard administered more than 150 distinct match formulas . With 71% of plans using it, the most popular formula is the single-tier formula, such as $0.50 per dollar on up to 6% of pay. Under this single-tier formula, an employee making $60,000 per year could get up to $1,800 in employer-matched contributions.

Here are the most common employer matching formulas per the Vanguard survey:

| Match Type | |

|---|---|

| Variable formula, based on age, tenure or similar vehicles | 2% |

There are literally hundreds of matching formulas out there, so contact your 401 plan administrator regarding the rules and specifics of the matching formula used by your employer.

-

The most common matching formula among Vanguard plan holders was $0.50 per dollar on the first 6% of pay.

-

The second most popular formula for employer matching contributions is $1.00 per dollar on the first 3% of pay and $0.50 on the next 2% of pay. Under this multi-tier formula, the same worker in our previous example would receive up to $2,400 in matching contributions.

Dont Miss: How Much Can You Put In Your 401k A Year

Can Employees Enroll In A 401 Employer Match Plan As Soon As They Are Hired

Employers are able to define their own specifications regarding when employees are eligible for 401 enrollment. Some companies choose to allow for registration immediately, while others require a certain amount of time to pass, such as the probation period, six months of employment and so on. Employers should make these regulations clear during the hiring process, so employees arent surprised if they need to wait.

Also Check: How To Check My 401k Plan

Should You Max Out Employer Matching

If your employer offers a match, you should definitely strive to contribute enough to take advantage of the full match. If you dont, youre leaving free money on the table, says ODonnell. It adds up over time.

Even if you dont want to max out your 401, getting the full employer match helps you save the most and take advantage of all the benefits available to you through your employer. Its therefore a good idea to at least contribute enough to get whatever your company is willing to match.

Its important to start small and start now because you can always increase the amount you save each year. Even a 1% increase will add up, especially if your company matches those contributions. That puts the power of compounding to work for you, adds Winston.

What Is Employer 401 Matching

Employer 401 matching is a contribution your employer makes to your 401 retirement account. The contribution matches what you have taken out of your paycheck, usually up to a defined amount. A 401 is an employee-sponsored retirement account that employers offer to help their employees save and invest for retirement in a tax-advantaged way.

The match is the money the employer contributes to the 401 account when the employee is also actively contributing, says Kelly ODonnell, executive vice president and head of workplace at Edelman Financial Engines, a financial planning firm. So in order to get the employer match, you need to contribute, too.

Also Check: How To Take A Loan From 401k

Solo 401k Contribution Example: Sole Proprietor

First, input your business entity type as the contribution limits vary slightly based on your business structure.

If you are a sole proprietor, this is the net compensation you were paid from your business. Generally this will show up on Line 31 in Schedule C of your income tax return.

Lets say your business earns a gross revenue of $250,000. You typically have about $95,000 in expenses, which leaves $155,000 as your net income as shown on Schedule C of your IRS Form 1040 tax return.

Input $155,000 into the calculator.

Finally, input your age. If you are age 50 or older, you get an extra $6,000 of catch-up contributions you can make to the Solo 401k plan. (Contribution limits have gone up slightly for 2020 cost of living increase. This blog post will use 2019 figures as many Solo 401k account holders are still making contributions for the 2019 tax year.

Also Check: How Do You Roll A 401k Into An Ira

Why Do 401 Limits Change Some Years And Remain Unchanged In Others

The 401 contribution limits are adjusted annually in accordance with changes in inflation. The effects of inflation are measured by the consumer price index for urban wage earners and clerical workers. If inflation increases significantly, 401 matching limits are increased by increments of $500 or $1,000. However, if the increase in inflation isnt significant enough, the limits remain unchanged.

Read Also: Am I Able To Withdraw Money From My 401k

Anything Else I Should Know

Yep. A few things, actually.

Once you contribute to a 401, you should consider that money locked up for retirement. In general, distributions prior to age 59½ will be hit with a 10% penalty and income taxes.

If you leave a job, you can roll your 401 into a new 401 or an IRA at an online brokerage or robo-advisor. The IRA can give you more control over your account and allow you to access a larger investment selection.

401s typically force you to begin taking distributions called required minimum distributions, or RMDs at age 72 or when you retire, whichever is later. You may be able to roll a Roth 401 into a Roth IRA to avoid RMDs.

How Do I Maximize My Employer 401 Match

Many employees are not taking full advantage of their employer’s matching contributions. If, for example, your contribution percentage is so high that you obtain the $20,500 limit or $27,000 limit for those 50 years or older in the first few months of the year then you have probably maximized your contribution but minimized your employer’s matching contribution.

This information may help you analyze your financial needs. It is based on information and assumptions provided by you regarding your goals, expectations and financial situation. The calculations do not infer that the company assumes any fiduciary duties. The calculations provided should not be construed as financial, legal or tax advice. In addition, such information should not be relied upon as the only source of information. This information is supplied from sources we believe to be reliable but we cannot guarantee its accuracy. Hypothetical illustrations may provide historical or current performance information. Past performance does not guarantee nor indicate future results.

Read Also: How Much Should You Put In Your 401k

Matching Contributions Can Be A Powerful Tool In Meeting Your 401 Goals

While 401 matching contributions can be very effective in motivating workers to make salary deferrals themselves, they can also help employers meet various 401 goals like passing the ADP test or meeting safe harbor 401 requirements at the lowest possible cost.

If youre a 401 plan sponsor, you should understand your match options and when nonelective contributions are the better alternative. This knowledge can help you design a 401 plan that best fits the needs of your company and employees.

About Eric Droblyen

Eric Droblyen began his career as an ERISA compliance specialist with Charles Schwab in the mid-1990s. His keen grasp on 401k plan administration and compliance matters has made Eric a sought after speaker. He has delivered presentations at a number of events, including the American Society of Pension Professionals and Actuaries Annual Conference. As President and CEO of Employee Fiduciary, Eric is responsible for all aspects of the companys operations and service delivery.

- Connect with Eric Droblyen

What Percentage Of My Income Should I Contribute To My 401

401 contributions are different for everyone, which means what works for some might not work for all. Earl Johnson, senior vice president and wealth manager at EverGreen Capital Management, said this figure is based on each person.

I dont usually discuss any rules of thumb because most peoples situations are so different, Johnson said. But I would say the first deciding factor is if your employer provides a matching contribution, you must contribute enough to get all matching funds.

Johnson said that instead of creating a budget line item for your 401 contributions, your budget should start when your paycheck hits your bank account after your contributions have been made. This should be used as a guide no matter what your income is.

Also Check: What’s A Good Percentage For 401k

What Else To Consider With A 401

There are a few other important things to keep in mind when it comes to 401 plans. Lets take a closer look.

- Early-withdrawal restrictions Generally, you wont be able to take money out of your 401 before age 59 ½ without facing a penalty though you may be able to borrow from your 401 without penalty. After you reach that age, you can begin accessing your savings. You may get a lump sum payment or periodic payments depending on your type of plan. And youll only pay taxes on your 401 once you take distributions.

- Rollovers If you leave your job, you may need to roll over your 401 into a new retirement plan or else you could face taxes and penalties if you havent reached 59 ½ and try to withdraw the funds.

Distributions Once you retire or reach age 72, youre required to begin taking distributions from your 401. The required minimum distribution is typically based on your age and the balance of your 401. But the rules can be different if your spouse is the 401s sole beneficiary and theyre 10 or more years younger than you. You can use these worksheets from the IRS to learn more. Youre allowed to take out more than the required minimum.