What Should I Do With My Lost Retirement Account

Once youve tracked down your lost retirement funds, you have some decisions you need to make. You can, of course, withdraw the funds and spend them, but there are a few reasons that might be a bad idea. If youre withdrawing funds from a forgotten 401 or other savings plan, take some time to research the taxes or penalties youll have to pay on any money you take out. Unless you put after-tax funds in, youll be taxed on the funds as you would with any type of income.

If youre 72 years old, though, youll need to pay attention to the Required Minimum Distributions to avoid a penalty. The amount youre required to take each year is based on a calculation that divides your account balance by your life expectancy factor. You can use the IRS Required Minimum Distribution Worksheet to help with that.

For the remainder of the amount, you may choose to leave it alone, withdraw it, or roll it into an IRA. You may find you can save on fees by rolling the amount over, but after retirement, the fees involved in doing that may eat into any cost savings. Weigh your options, including calculating the income taxes youll owe on any amount you withdraw, before making any decisions.

How To Use The Contribution Calculator

This calculator is designed to show you how you could potentially increase the value of your retirement plan account by increasing the amount that you contribute from each paycheck. The Growth Chart and Estimated Future Account Totals box will update each time you select the âCalculateâ or âRecalculateâ button.

Pre-filled amountsBased on our records, the following information may be pre-filled:

Salary

- Pay period. If the information is not available, the default pay period is weekly.

Contribution

- Your contribution rate. Note that we will use 8% as a default value if your contribution rate is not available or if your contribution is a dollar amount rather than a percentage.

Investment

Also Check: When Leaving A Company What To Do With 401k

You Are Leaving The Wells Fargo Website

You are leaving wellsfargo.com and entering a website that Wells Fargo does not control. Wells Fargo has provided this link for your convenience, but does not endorse and is not responsible for the content, links, privacy policy, or security policy of this website.

Here are some frequently asked questions about My Retirement Plan from Wells Fargo.

Don’t Miss: How Much Can You Put In 401k Annually

Search Databases For Unclaimed Assets

If you still cant find information on your lost 401 plans, you can also try searching one of the publicly available databases for unclaimed assets. The National Registry of Unclaimed Retirement Benefits is a good place to start. By entering your Social Security number, you can quickly see if there are any unclaimed retirement funds that belong to you. The money may still be held in the employers plan, or the company may have opened a special IRA account in your name to hold the funds.

You can also search using the National Association of Unclaimed Property Administrators site, which will help you track down unclaimed money you may be owed, not limited to retirement assets. Be sure to check in each state you have lived or worked. The site processes tens of millions of requests each year and has helped return more than $3 billion in unclaimed assets annually.

What Is A 401

A 401 is an employer-sponsored retirement plan enabling workers to save money in a tax-deferred way. Often employers will match contributions up to a percentage of salary. Its just like any other retirement plan in the sense that youre trying to save money and reduce taxes as you do it. Like an IRA, you will pay taxes once you start taking withdrawals in retirement.

If you opted for it when you were hired, every paycheck a percentage of your salary is taken out and put into a 401 retirement account. Your employer may add some more money, maybe even the same amount, on top of that. That money is usually invested, and has been accumulating. How much is in there?

There are different types of 401s. A Roth 401 operates much in the same fashion as a Roth IRA. While still employer-sponsored, it uses after-tax income to fund itself, so you pay the taxes now, and not later in retirement. While one can deliberate the merits of which to use, the general consensus is that a Roth format is useful if one believes they will be in an higher tax bracket later in life when withdrawing from their retirement accounts.

Conversely, a traditional 401 advocate might argue that the ability to put more money into an account in the beginning and through time, allows the saver to make the most of compound interest.

Read more about how a 401 works in this article from TheStreet.

Don’t Miss: What Is The Max You Can Put In A 401k

Looked For Unclaimed Money

Ghosted 401 money certainly qualifies as missing money, and it could be uncovered on digital money-funder platforms like missingmoney.com.

The site, run by the National Association of Unclaimed Property Administrators, runs free searches for not just retirement funds, but for money in old bank accounts, safe deposit boxes, escrow accounts, and insurance policies. According to the websites directions, if you get a hit on the site, just claim the property and fill out the requested details, then submit and you will receive instructions on the next steps from the state where you made the claim.

Dont Miss: How To Transfer 401k To Self Directed Ira

Search Form 5500 Directory

All employers that provide 401 plans to their employees are required to fill out a 5500 form every year with the DOL. Websites like FreeERISA* allow users to search by company name to locate the correct Form 5500. Another option is to search the DOLs 5500 database. Both simple searches will provide you with additional contact information.

For further assistance in finding lost 401 plans, the U.S. Department of Labor has an Abandoned Plan Search, which helps participants and others find out whether a particular plan is in the process of beingor already has beenterminated. The name of the Qualified Termination Administrator responsible for the termination will be listed as well, giving you a good idea of who to contact .

But beware: some companies, even legitimate ones, can acquire your information about unclaimed retirement accounts and offer to assist you with your search, often with a percentage fee for their services.

When it comes to planning and saving for retirement, its vital to have all your assets accounted for. Locating an old 401 plan is like finding cash in the pocket of an old pair of jeans. Its money you forgot you had but are happy you found. So if you know youve contributed funds to a 401 account but cant figure out where those funds are, the resources listed above may help you find past retirement accounts that may have been lost along your employment journey.

Read Also: Why Is It Called 401k Plan

How To Find Old 401 Accounts

To corral all your accounts, you first must locate all your retirement plans. This is often the most time-consuming step in the process of organizing and streamlining your retirement portfolio, as youll sometimes have to do a bit of legwork to identify and find your old plans. The more jobs youve held, the more work youll need to do if you havent already rolled over those plans into other retirement accounts.

These suggestions can help you figure out how to find your 401k.

Search Unclaimed Assets Databases

If your search is still coming up empty, your former employer has folded or was bought by another company, youâre not out of luck yet.

It may take a little more effort and research but there are many national databases that can help you track down your old 401 accounts:

- The Department of Laborâs Abandoned Plan database can help you identify what happened to your old plan and the contact information of the current administrator

- The National Registry of Unclaimed Retirement Benefits allows you to do a free search for any unclaimed retirement money using just your Social Security number

- FreeERISA is another free resource to search for any old account information that has been filed with the federal government

- The Securities and Exchange Commissionâs website or your stateâs Secretary of State can provide more information on your previous employer

Recommended Reading: How To Get Money From Your 401k

Follow These 3 Easy Steps

Step 1Select an eligible Vanguard IRA for your rollover*

- If youre rolling over pre-tax assets, youll need a rollover IRA or a traditional IRA.

- If youre rolling over Roth assets, youll need a Roth IRA.

- If youre rolling over both types of assets, youll need two separate IRAs.

Note: You can roll over your assets to a new or an existing Vanguard account.

Step 2Contact the financial institution holding your employer plan

Tell them you want to make a direct rollover from your employer plan to your Vanguard IRA®, and ask what information they need

Need a letter of acceptance?

Youll be able to create and print a letter of acceptance during our online rollover process.

Note: You may not be eligible to roll over a plan account that youre still contributing to.

What types of assets do I have in my employer plan account?

Knowing whether you have pre-tax or Roth assets will help you figure out what type of IRA you need to open at Vanguard. If you own company stock in your plan, that may add a layer of complexity to your rollover.

What name did I use on my employer plan account?

A common situation that can delay a rollover is when a check from the current financial institution is made payable to a name that doesnt match your Vanguard account registration. Examples include use of birth name versus married name, a missing suffix , differing middle initials , etc.

What are your rollover requirements?

Are e-signatures or faxed copies allowed?

Do you need a letter of acceptance ?

Find 401 Plan Information Through The Labor Department

Another option is to find plan information through the Department of Labors website. By locating the companys Form 5500, an annual report required to be filed for employee benefit plans, you should be able to find contact information and who the plans administrator was during your employment.

You may also be able to find information on lost accounts through FreeERISA. You must register to use the site, but it is free to search once youve set up your account.

Don’t Miss: Can I Roll My 401k To A Roth Ira

Use An Outside Company Like Beagle

If your search in the above databases doesnât provide any results, utilizing an outside company to find your old 401s and do the difficult work of consolidating them is a great option.

Beagle is the first company of its kind that will do the difficult work for you. We will track down your old 401s and find any hidden fees in your current 401 plan.

Then, they will provide you with options on how best to rollover your 401s into one convenient, low-cost investment option.

This is a great option for anyone who is not sure where to start or even where to begin looking.

Follow The Paper Trail

If you think you may have money in a company-sponsored retirement plan floating around somewhere, you should take all necessary measures to track it down. You worked hard for those dollars, and you want to make sure theyre working as hard as possible for you and your future.

The Find a Financial Advisor links contained in this article will direct you to webpages devoted to MagnifyMoney Advisor . After completing a brief questionnaire, you will be matched with certain financial advisers who participate in MMAs referral program, which may or may not include the investment advisers discussed.

Recommended Reading: Why Rollover Old 401k To Ira

What Are Average Fidelity 401 Fees

We have evaluated the fees of a few Fidelity plans over the years as part of our 401 fee comparison service. Below are the averages we found for these plans.

|

Average Fidelity 401 Fees |

|

|

All-In Fees |

0.71% |

While their per-capita admin fee was below the $422.30 average in our 2018 401 fee study, that number can easily grow much higher due to the way these fees are charged.

In our experience, about 70% of admin fees charged by Fidelity are paid by revenue sharing hidden 401 fees that lower the investment returns of plan participants. Not only are plan sponsors or participants often unaware that theyre paying them, but theyre always charged as a percentage of plan assets. That means plan participants will automatically pay Fidelity higher and higher administration fees for the same level of service as their account grows. Thats not fair!

When you factor in compound interest, these growing fees can make a huge dent in your retirement savings. As such, you want to do everything in your power to avoid paying them.

If youre currently using Fidelity for your 401, your first step to avoiding these fees is to find out whether or not youre paying them. Well show you how to do that next.

Dont Miss: How Much Can You Contribute 401k

I Cant Find My 401 Now What

Editorial Note: The content of this article is based on the authors opinions and recommendations alone and is not intended to be a source of investment advice. It may not have not been reviewed, commissioned or otherwise endorsed by any of our network partners or the Investment company.

Were all chasing the almighty dollar, but sometimes we leave behind a few hard-earned ones along the way.

In fact, billions of dollars are left in forgotten 401 plans in the United States that are waiting to be claimed by their rightful owners.

If youre in search of your old 401, here are some tips on how you can track it down.

Also Check: How Much Can You Put Into 401k Per Year

Move Your Old 401 Assets Into A New Employers Plan

You have the option to avoid paying taxes by completing a direct, or trustee-to-trustee, transfer from your old plan to your new employers plan, if the employers plan allows it.

It can be easy to pay less attention to your old retirement accounts, since you can no longer contribute. So, transferring old 401 assets to your new plan could make it easier to track your retirement savings.

You also have borrowing power if your new retirement plan lets participants borrow from their plan assets. The interest rate is often low. You may even repay the interest to yourself. If you roll your old plan into your new plan, youll have a bigger base of assets against which to borrow. One common borrowing limit is 50% of your vested balance, up to $50,000. Each plan sets its own rules.

Here are a few important steps to take to successfully move assets to your new employers retirement plan so as not to trigger a tax penalty:

Step 1: Find out whether your new employer has a defined contribution plan, such as a 401 or 403, that allows rollovers from other plans. Evaluate the new plans investment options to see whether they fit your investment style. If your new employer doesnt have a retirement plan, or if the portfolio options arent appealing, consider staying in your old employers plan. You could also set up a new rollover IRA at a credit union, bank, or brokerage firm of your choice.

The instructions you get should ask for this type of information:

What To Do When You Find An Old 401

Once youve reconnected with your old 401, its time to decide what to do with it:

- Leave it with your old employer. If you contributed at least $5,000 to your old 401, you might consider leaving it where it is. But this may only be worthwhile if the account has competitive fees or offers access to unique investments. Otherwise, itll be yet another account to keep track of come retirement, and you may be better off rolling it over.

- New 401 rollover. Has your new employer offered you a 401? Consider consolidating your retirement funds by rolling your old retirement account into a new 401.

- IRA rollover. If you dont have a new 401 to move your old retirement funds into, consider rolling over into an individual retirement account. That way, your funds retain their tax-advantaged status.

- Cash it out. Consider this a last resort because cashing out a 401 ahead of schedule can result in major penalties.

- If youre older than 59 ½, you can access funds without penalty.

- If youre under 59 ½, withdrawals are subject to a 10% tax penalty and other fees.

You May Like: How To Do Your Own 401k

Timing Of The Brokerage Account Setup

After submitting the Fidelity brokerage forms to Fidelity Investments, between 5-7 business days , you should receive an email from Fidelity Investments that their system has updated your email address. This indicates the application is in processing.

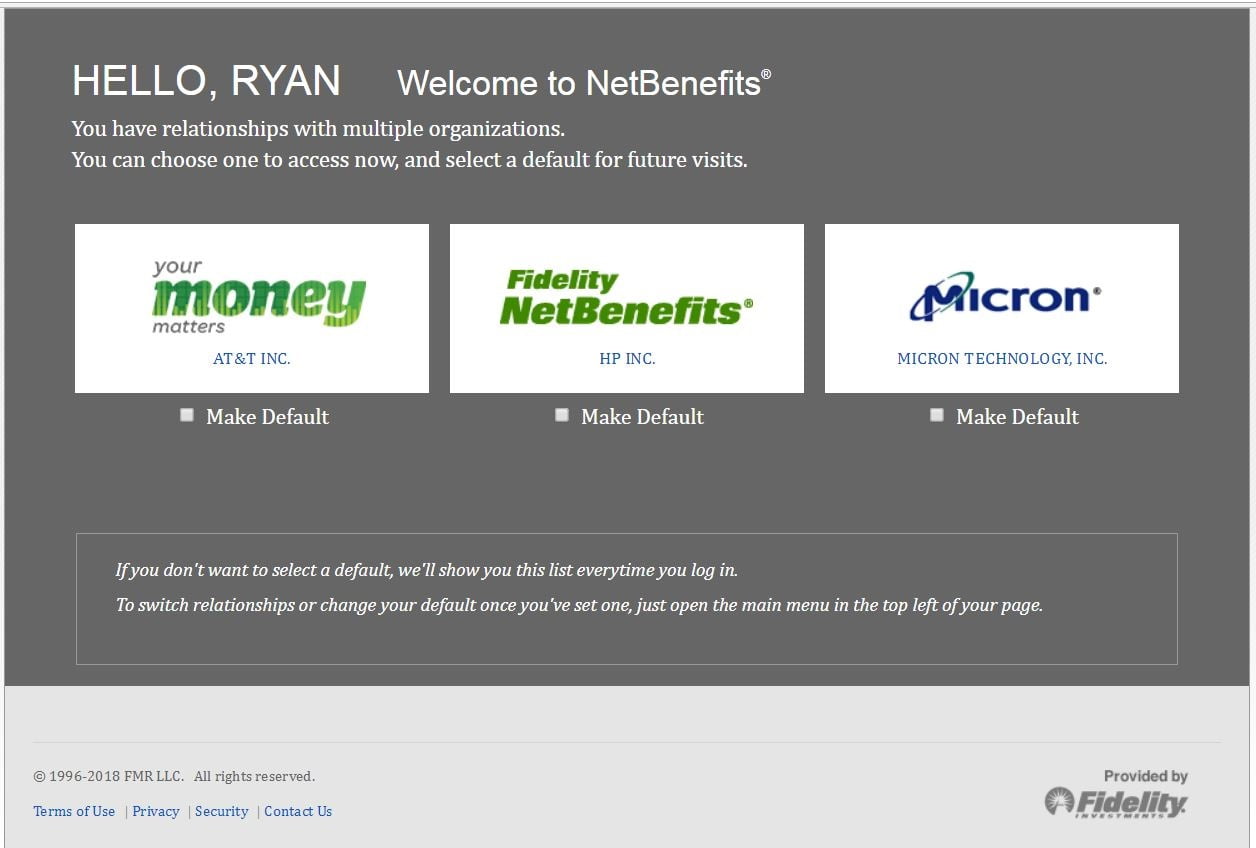

When you start receiving emails from Fidelity, you can check if the account has been fully setup without having to wait on the Fidelity Welcome Letter in the mail which includes your new account number. Please try to log in using one of the following methods:

- If you have an existing Fidelity login , you should see the new Non-Prototype account appear under your portfolio with an account number that starts with the letter Z.

- If you do not have an existing Fidelity login, you can try to register to Fidelity.com at the following link: You will need to create a username and password.