Solo 401 Contribution Rules

Starting a Solo 401 plan in 2022 has even more benefits than it did in 2021. The Solo 401 plan is designed specifically for the self-employed or a small business with no full-time employees other than the other or the spouse. There are many features of the plan that make it so appealing and popular among self-employed business owners. However, the ability to make high annual maximum contributions is probably the most popular Solo 401 plan feature.

- For 2022, one can save a lot more money for retirement with a Solo 401 plan

- One can contribute as both the employee and the employer to a Solo 401

- The plan remains the best retirement savings vehicle for the self-employed and owner-only businesses

Solo 401k Contribution Limits And Types

IRS records show that, in Tax Year 2014, an estimated 53 million taxpayers contributed almost $255 billion to tax-qualified deferred compensation plans. A popular form of deferred compensation plans, known as a solo 401 plans, permits employees to save for retirement on a tax-favored basis.

Video Slides:2020 & 2021 Solo 401k Annual Contribution Deadline

Can I Have A Solo 401k And A Regular 401k

If you are a business owner and you have a second job, you could consider having a solo 401 and a regular 401. Find out if this is legal.

If you have a day job and you also run a small business on the side, you can have a retirement account at each job. The IRS allows employees and business owners to have multiple retirement accounts as long as there is no affiliated relationship or legal overlap between the two jobs. Also, you must keep watch of the contributions you make to each account since the contributions are calculated per person and not per plan. If you exceed the IRS contribution limit, you could be charged a penalty on the excess contribution.

The IRS allows workers to contribute to multiple retirement accounts if they have more than one job. You can have a traditional 401 at your day job, and a Solo 401 for your small business. In this case, you can increase your retirement savings while reducing your tax bill for the year. You can contribute up to $58,000 to your Solo 401 in 2021, and another $58,000 to the 401 account. This would result in a combined contribution of $116,000 for the tax year 2020.

Recommended Reading: Can I Pull Money From My 401k

Withdrawing Funds From A Self

As with traditional 401 plans, the self-employed 401 is intended to help you save money for retirement, and there are regulations in place to encourage you to do so. For example:

- Withdrawals prior to age 59½ may be subject to a 10% early withdrawal penalty, along with any applicable income taxes1

- You must take required minimum distributions from self-employed 401s beginning at age 722

- Plans can be structured to allow loans or hardship distributions3

- Plans can be structured to accept rollovers from other retirement accounts, including SEP IRAs and traditional 401s, into your self-employed 401

- You can roll your self-employed 401 assets into another 401 or an IRA

Because of its high contribution levels, flexible investment options, and relatively easy administration, the self-employed 401 is an attractive option for small-business owners or sole proprietors who want to be able to save aggressively for the future.

If there is the potential that your business might add employees at a later date, however, know that you will either have to convert your self-employed 401 plan to a traditional 401, or else terminate it. But if you’re confident that you will remain a one-person operation, and you want the high savings options that these plans offer, this type of account may be a good fit.

Contribute To Multiple Employer Plans Including A Self

The IRS rules allow annual contributions up to a certain limit regardless of the number of traditional IRAs and or/Roth IRAs the participant has. However, the rules are more favorable for qualified plans such as 401k plans in that the participant can maximize annual contributions to multiple qualified retirement plans including a solo 401k thereby, the participant may be able to shelter more of his or her earned income.

Recommended Reading: How Can I Save For Retirement Without 401k

Looking To Reduce Excessive 401k Fees

Sign up for Personal Capital for free and use their Portfolio Fee Analyzer tool. The tool will show you how much in fees youre paying. I had no idea I was paying $1,700 in 401 fees four years ago until I ran the tool.

Now Im only paying about $300 a year in fees. Excessive fees is one of the biggest drags on making more money and retiring earlier.

You can also use Personal Capital to track your net worth, track your cash flow, and optimize your investments.

For more nuanced personal finance content, join 100,000+ others and sign up for the free Financial Samurai newsletter. Financial Samurai is one of the largest independently-owned personal finance sites that started in 2009.

Filed Under: Entrepreneurship

I started Financial Samurai in 2009 to help people achieve financial freedom sooner, rather than later. Financial Samurai is now one of the largest independently run personal finance sites with 1 million visitors a month.

I spent 13 years working at Goldman Sachs and Credit Suisse. In 1999, I earned my BA from William & Mary and in 2006, I received my MBA from UC Berkeley.

In 2012, I left banking after negotiating a severance package worth over five years of living expenses. Today, I enjoy being a stay-at-home dad to two young children. In June 2022, Ill be publishing a new book entitled, Buy This, Not That Spending Your Way To Financial Freedom.

Current Recommendations:

You May Like: What Age Can You Take Out 401k

Timely Withdrawal Of Excess Contributions By April 15

- Excess deferrals withdrawn by April 15 of the year following the year of deferral are taxable in the calendar year deferred.

- Earnings are taxable in the year they’re distributed.

- There is no 10% early distribution tax, no 20% withholding and no spousal consent requirement on amounts timely distributed.

Read Also: How Many Loans Can You Take From Your 401k

How Can I Maximize My Solo 401k Contribution

How to Maximize Your Tax Savings With a Solo 401k Ten Times Higher Annual Contributions. With an annual contribution limit of up to $59,000, a Solo 401k retirement plan surpasses regular IRA contributions several times. Deferred Taxation on Capital Gains. Power of Roth Contributions. Purchase Real Estate Under Solo 401k Plan and Forget Rental Income Taxation.

Solo 401 Establishment Deadline:

For 2021, in order to make employee contributions for 2021, the self-employed business owner had to establish the solo 401k plan by December 31, 2021. However, if the plan was established on January 1, 2022 or after by your business tax return due date including the business tax return extension, then you cam make employer profit sharing contributions for 2021 but cannot make employee contributions. For example, an employer operating the plan on a calendar-year basis had to complete the solo 401k plan documentation no later than .

For makin 2021 solo 401k plan contributions, the solo 401k has to be adopted by December 31, 2021 for self-employed businesses operating the plan on a calendar-year basis in order to preserve the right to make both employee and employer contributions in 2022 for 2021 by the business tax return including business tax return extensions. Otherwise, if the solo 401k plan is adopted on January 1, 2022 or after but by your business tax return due date including extensions, you will only be allowed to make employer contributions not employee contributions to the solo 401k plan. To learn more about the December 31, 2021 plan adoption/establishment deadline VISIT HERE.

Recommended Reading: Can I Use My 401k To Buy Stocks

A Deeper Look At The Limitations And Requirements

To qualify for a SEP IRA, you must meet the following:

- Be at least 21 years old,

- Have worked at the business for three of the past five years, and

- Have earned at least $600 from the job in the past year.

Your SEP IRA contribution each year cannot exceed the lesser of 25% of your compensation or $58,000 for 2021. The maximum amount of self-employment compensation that applies for 2021 is $285,000. For self-employed individuals, the amount of compensation used for these purposes is your net earnings from self-employment less the deductible portion of self-employment tax, and the amount of your own retirement plan contribution deducted on form 1040.

For a Solo 401k plan, the 2021 limit is $19,500, plus a $6,500 catch-up contribution for those individuals over age 50. That contribution amount is up to 100% of your compensation. The employer profit-sharing contribution does not count toward this limit. However, the total contribution limit of both the employer and employee in 2021 is $58,000. If you are age 50 or older, the limit is $64,500.

How It Works: Solo 401 Contributions

Its important to re-stress that the Solo 401 allows for contributions from both the employee and the employer, acknowledging that both people are the same person, the self-employed business owner .

At the employee level, the participant is permitted to contribute up to 100% of their earned income or net income into the plan. However, there is a statutory cap on the employee contribution each year.

In 2022, that cap sits at $20,500. If the participant is over the age of 50 when they open their account, they are permitted to contribute up to an additional $6,500 as a catch-up contribution.

A spouse who works for you and earns compensation also has the same employee contribution limit.

At the employer level, the annual profit-sharing contribution is set at up to 25% of the employees earned income or $40,500.

Between the employee and employer amounts combined, the maximum contribution any participant can make is set at $61,000 in 2022, plus any portion of the $6,500 amount related to the over 50 catch-up provisions.

All contributions are usually made from pre-tax earnings , making the contributions tax-deferred.

In other words, the participant will not have to pay taxes on the income they contribute until those monies are taken as distributions.

Note: Contributions can be made at any time during the tax year. That includes going into the next year up until the point the individual files their tax return.

Read Also: How Do I Get A Loan From My 401k

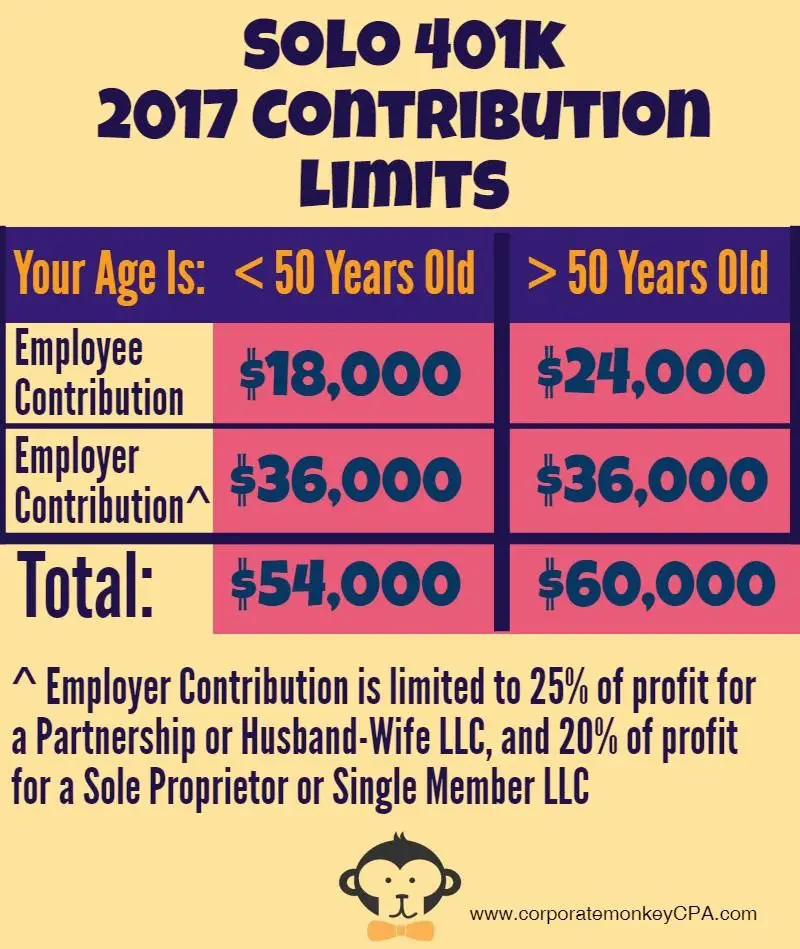

How Much Can You Contribute To A Solo 401

In 2021, individuals with a Solo 401 can contribute a maximum amount on the employee end and the employer side of the equation.

As an employee, individuals can defer all their compensation up to the annual contribution limit of $19,500 for 2021. The only exception is, individuals ages 50 and older can contribute up to $26,000 as an employee of their company.

Note: These figures are up from 2019, when employee contributions were capped at $19,000 or $25,000 for individuals ages 50 and older.

The rest of the contribution Solo 401 participants can make is on the employer side. Here, you can contribute up to 25 percent of your compensation as defined by the plan up to an annual limit of $58,000 total , or up to $64,500 if youre 50 or older.

How does this actually work in practice? Consider this succinct example:

Ashley, age 51, earned $50,000 in W-2 wages from her small business in 2020. She deferred $19,500 in regular elective deferrals plus $6,500 in catch-up contributions to the 401 plan. Ashleys business contributed 25% of her compensation to the plan for the year, or $12,500. Total contributions to the plan for the 2021 tax season were $38,500.

This is why I strongly recommend using the services of a CPA when you have a Solo 401 plan, or are contemplating establishing one.

For reference, heres how employee and employer contributions limits have changed for Solo 401 plans over the years for retirement savers under the age of 50.

| Contribution Year |

|---|

| $49,000 |

What Are The Tax Benefits Of A Solo 401

Solo 401s share the same tax benefits as their traditional 401 counterparts.

You can elect to contribute pre-tax earnings to your Solo 401 and pay taxes when you distribute your funds during retirement. In turn, youâll lower your immediate income tax obligation.

Or, you can choose to contribute after-tax earnings into a Roth Solo 401, then your distributions during retirement would be tax-free.

Additionally, any matching contributions you make as your employer are tax-deductible for your business, lowering its tax obligation as well.

Don’t Miss: Can I Keep My 401k If I Quit My Job

Excess Contribution Not Withdrawn By April 15

So what happens if you dont notice that youve over-contributed to one or more 401k plans until after April 15? In this situation, the excess contribution is taxed twice, once in the year when contributed and again when distributed .

Also, the earnings from the excess contribution will be taxable income for the following year. If the mistake is not corrected, then the IRS may disqualify the entire 401k plan retroactive to the beginning of year 1. This results in the employees entire 401k account balance to become income to the employee which would have massive adverse tax consequences.

But the main reason why you want to be more conservative in your self-employed 401k contribution is not the fine. Th main reason is the stress of getting an IRS audit letter in the mail. It will also take time to amend your tax returns. This process can take hours.

Id much rather miss out on contributing an extra $1,000 in my self-employd 401k than go through the torture of dealing with the IRS.

Remember, when in doubt, round down your self-employed 401k contribution amount.

Recommended Reading: How To Make A 401k

S To Set Up A Solo 401

There are specific steps that must be taken to properly open a solo 401 plan, according to the Internal Revenue Service .

First, you have to adopt a plan in writing, making a written declaration of the type of plan you intend to fund. The choices are the same as are given to an employee opening a 401 plan: you can choose a traditional 401 or a Roth 401. Each has distinct tax benefits.

A solo 401 must be set up by December 31st in the tax year for which you are making contributions.

You May Like: Is 401k The Best Way To Save For Retirement

Who Should Invest In A Solo 401

It’s also a good savings option for someone who works for a company that has a 401 plan but who also does contract work on the side, says Scott Frank, a certified financial planner in Encinitas, Calif.

Just keep in mind that 401 contribution limits apply per person, not per plan. If your solo 401 is for a side job, and you’re also participating in a 401 at your day job, the contribution limits apply across all plans, not each individual plan.

Solo And 401 Rules When You Have Employees And Multiple Businesses

A 401 is a great benefit normally associated with large companies where the employee makes contributions and the employer offers a match. The contribution limits are high and can allow for significant tax deferral on the income you earn each year. What a lot of people may not know is that you dont have to be a large company to have a 401 plan. In fact, you can be the only employee in your own business and have a retirement plan.

If it is just you in your business, your company can start a retirement plan known as a solo 401. The solo 401 allows you to adopt a retirement plan and make personal as well as company contributions to the plan for yourself and any of the owners of the company.

- You must have a business generating ordinary income to make to have a 401 plan.

- You can personally contribute up to $19,000 to the plan.

- Your company can contribute up to 25% of the income it pays you.

- For 2019 the total max 401 contribution is $56,000.

The 401 plan can be self-directed, which means you can invest the funds in almost any opportunity you find . The 401 also has a loan provision allowing you to borrow funds from the plan and use them for anything you want.

What If I have Multiple Businesses With Only Employees in Some?

Controlled Group Rules

| 100% |

Also Check: Can I Switch My 401k To A Roth Ira

What Are The Contribution Levels And Limits Of A Solo 401

To take full advantage of contributions to a Solo 401 plan you must understand your limits as an employee and employer, as well as contributions allowed on behalf of a spouse if applicable.

When contributing as the employee, you are allowed up to $19,500 or 100% of compensation in salary deferrals for tax years 2020 and 2021. If you are over 50, an additional $6,500 catch-up contribution is allowed for tax years 2020 and 2021. This is the type of contribution that can be made as pre-tax/tax-deferred or Roth deferral or a combination of both. Additionally, as the employer, you can make a profit-sharing contribution up to 25% of your compensation from the business up to $57,000 for tax year 2020 and $58,000 for tax year 2021. When adding the employee and employer contributions together for the year the maximum 2020 Solo 401 contribution limit is $57,000 and the maximum 2021 solo 401 contribution is $58,000. If you are age 50 and older and make catch-up contributions, the limit is increased by these catch-ups to be $63,500 for 2020 and $64,500 for 2021.

Compensation from your business can be a bit tricky. This is calculated as your business net profit minus half of your self-employment tax and the employer plan contributions you made for yourself plan). The limit on compensation that can be factored into your tax year contribution is $285,000 for 2020 and $290,000 for 2021.