Background Of The One

Under the basic rollover rule, you dont have to include in your gross income any amount distributed to you from an IRA if you deposit the amount into another eligible plan within 60 days ) also see FAQs: Waivers of the 60-Day Rollover Requirement). Internal Revenue Code Section 408 limits taxpayers to one IRA-to-IRA rollover in any 12-month period. Proposed Treasury Regulation Section 1.408-4, published in 1981, and IRS Publication 590-A, Contributions to Individual Retirement Arrangements interpreted this limitation as applying on an IRA-by-IRA basis, meaning a rollover from one IRA to another would not affect a rollover involving other IRAs of the same individual. However, the Tax Court held in 2014 that you cant make a non-taxable rollover from one IRA to another if you have already made a rollover from any of your IRAs in the preceding 1-year period .

You May Like: How Do You Roll Over Your 401k

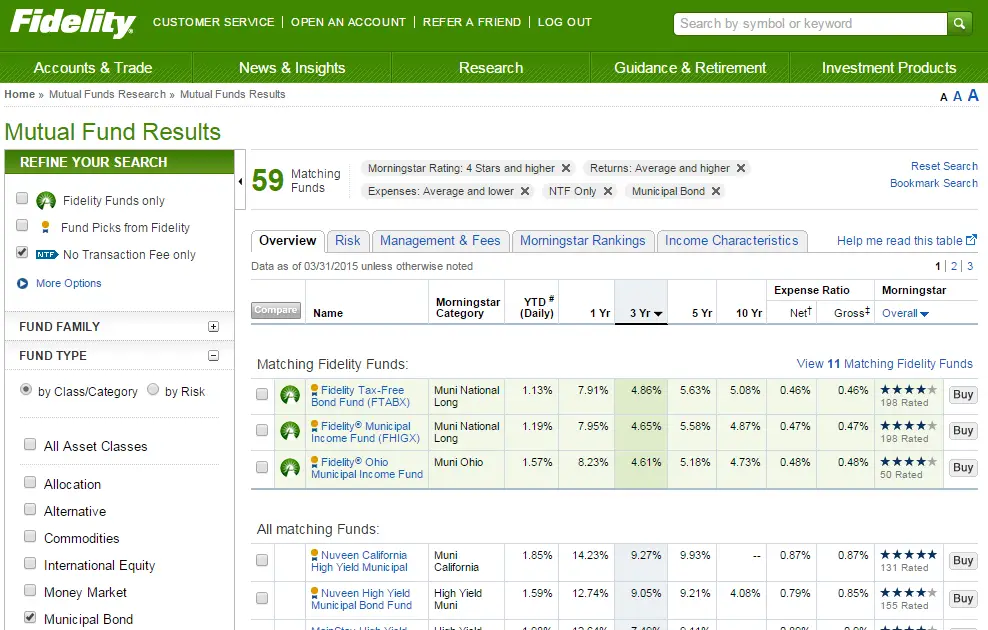

How Do You Find Your Expense Ratios

There are lots of companies that sponsor 401ks , and the steps to find the expense ratio are different for each of them. Generally you can find it by signing into your account online, and find the fund youve selected. Once you find the fund, you will see the expense ratio in the details of the fund.

Account -> Fund -> Expense Ratio

It took me about 15 minutes to find the funds and corresponding expense ratios in two different accounts. Remember that the 15 minutes it took to find the expense ratios, then plug them into the calculator above is how I found out I could save 6 figures in fees.

Heres where I found the expense ratios within my Roth IRA at Vanguard and my 401k at Merrill Lynch. Keep in mind that the funds in my account may be different than yours.

Merrill Lynch was a little more complicated. After signing in and selecting my 401k plan, I had to find the Average annual total returns tab under Investment Choices and Selection.

Dont Miss: How Do You Take Money Out Of 401k

How To Roll Over A 401

Perhaps youâve left your job but still have a 401 or Roth 401 with your former employer youâre retiring and are wondering if leaving your money in a 401 is the best option or perhaps you simply want to diversifynow what? The infographic, below, explains four options to consider: leave your assets in a previous employerâs plan, cash out your 401, initiate a 401 rollover into a new employerâs plan, or rollover into an IRA .

You May Like: What Is The Difference Between And Ira And A 401k

What Do I Request On The Call

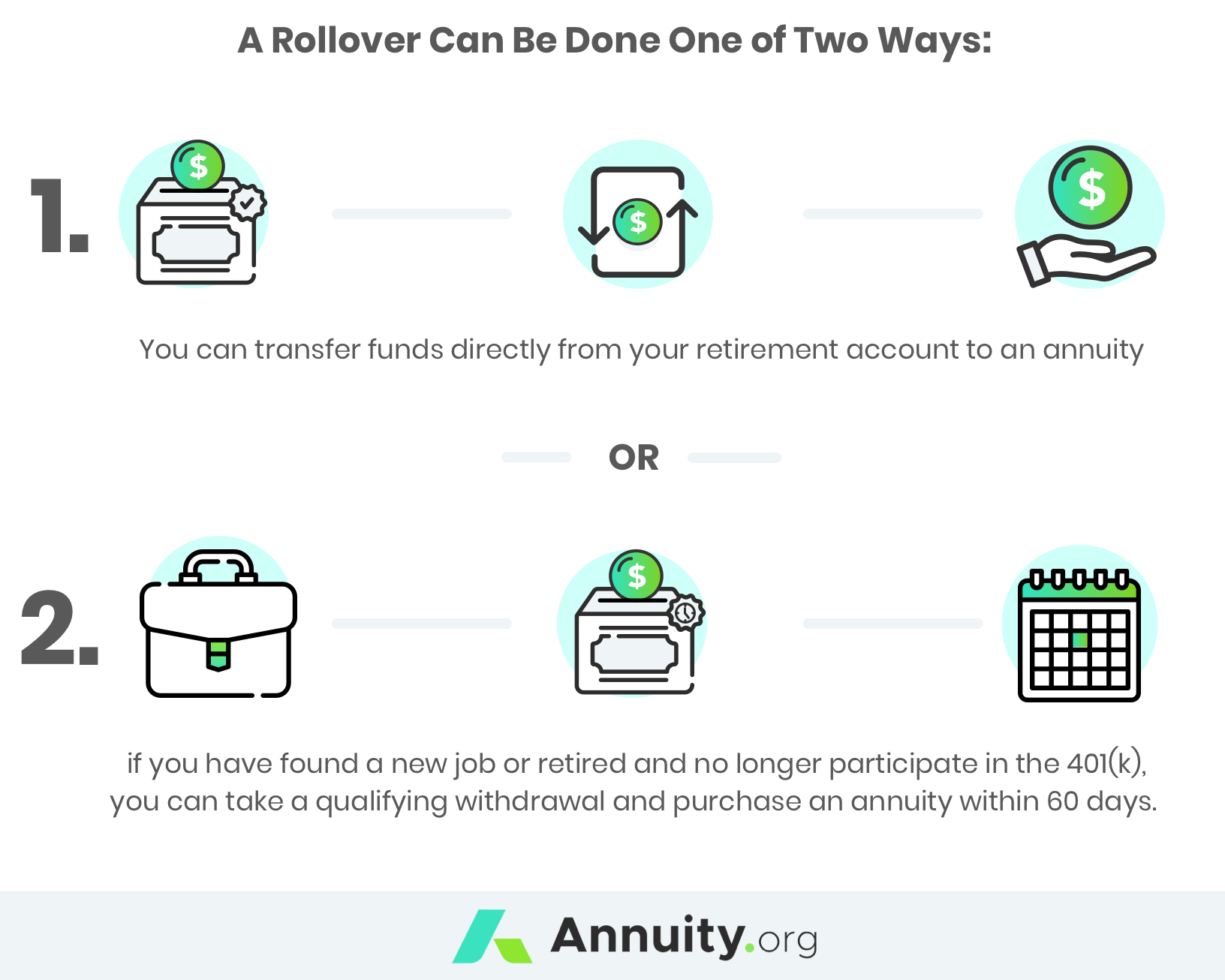

After your identity is verified, youll be able to tell the customer service representative that you want to do a direct rollover. A direct rollover is where your funds are directly transferred to your new IRA provider. It often means the check is made out in the name of that IRA provider but for the benefit of you. This is generally the simplest approach. Your 401 provider will usually ask you for the name and mailing address of your new IRA provider and your new IRA account number. We also recommend that you take this opportunity to update your mailing address since they may have an old address for you. Thats because youll be sent additional documents, including a tax-related document known as a 1099-R that tells the IRS youre doing a tax-free rollover.

An indirect rollover is where funds are first transferred to you, or a check is made out in your name. You deposit the funds in one of your own accounts, but then you have 60 days to send that money on to your IRA account if you want the rollover to be tax-free. This can create a little extra work for you which is why most people opt for a direct rollover.

Have a rollover expert on the call with you! Capitalize can handle your 401-to-IRA rollover for you and set up a call with your provider walking you through each step along the way. Get started

Fast And Easy Rollover From Schwab 401k To Fidelity Ira

October 22, 2019Keywords: 401k, Fidelity, IRA, rollover, Schwab

Now that my income isnt too high that requires a backdoor Roth , I finally rolled over my 401k from the former employer to an IRA. The 401k money was 100% Traditional. It went into a Traditional IRA. Charles Schwab as the 401k administrator and Fidelity as the IRA custodian did a great job. I was able to complete the rollover in only two days.

This is not a sponsored post. Neither Schwab or Fidelity paid me to write it. Im sharing my personal experience to show how easy it is to do a rollover. If you also wanted to rollover and consolidate but you dread the hassle, you will see its not difficult or time-consuming at all. If someone tells you it will take a few weeks to complete the rollover, thats not normal. It should only take a few days, not a few weeks.

When you transfer from one IRA to another IRA, you start from the receiving end because the financial industry has standardized the transfer process. When you do a rollover from a 401k, you start from the sending end because each plan has its own process and requirements. Some 401k administrators take the request online. Some administrators require a signed paper form. Some even require a signature from someone at your former employer.

You need to find out from the receiving IRA custodian how they want the check made out to. I was rolling over to an IRA at Fidelity. Fidelity says on their website:

Say No To Management Fees

Read Also: How To Pull Money From 401k

You Can Leave Your Money Where It Is

If you have more than $5,000 in your 401k, you can leave it in your old employers 401k plan and even if you have less than that, they still might let you leave the money where it is, but you should ask. If you have less than $5,000, your employer has the option to make you take a distribution, but not all employers will exercise that right.

This is the simplest option, and its the one many people choose when theyre fired suddenly. You usually cant plan for a job loss, so you might not even have time to decide what to do with your 401k money before you get fired or laid off. And you might need some time to process the layoff for a while before you even get around to worrying about the money in your retirement plan.

Well, you might ask, how long do I have to rollover my 401k from a previous employer? Thats a good question. If you want to do a direct rollover, in which your former employer writes a check directly to your new employer for deposit into your new employers 401k plan, you can pretty much wait as long as you want.

However, if you want to do an indirect rollover, where you cash out the money and then deposit it into another tax-advantaged account yourself, you have 60 days from the time you cash out to deposit the money into another such tax-advantaged account, like an IRA. If youre planning to roll over the money into another 401k, you want to avoid this option, since your old employer will be required to withhold 20% from your payout for taxes.

How To Transfer A Us Pension Into Canada

If you have been working in the U.S. for a period of time, you may have amassed retirement savings in a 401K or IRA. IF you are moving to Canada, you have four options:

Leave the funds in the U.S. account and have a financial advisor manage it for you. Canadian residents are allowed to defer tax on U.S. retirement accounts until they begin to withdraw the funds. However, if you have terminated employment, you may be required to transfer any 401K proceeds to an IRA, and there are taxes associated with that. If you are older than age 59.5, you could pay 20% in withholding taxes on the balance, and if you are under age 59.5, you may have to pay 30%. You should consult with a U.S. tax expert to determine your best option.

If you choose to collapse the account and withdraw it as a lump sum, this will trigger a taxable event. How much you will have to pay depends on your country of residence when the withdrawal is made. If you are still a U.S. resident, U.S. tax rates will apply. If you have moved to Canada, Canadian tax rates will apply. You may have to provide a W8-BEN to the U.S. plan administrator. Before considering this option, you should talk to a tax professional with expertise in US-Canada tax law.

Transfer your U.S. account to a Canadian RRSP. This gets complicated quickly so hang on:

Donât Miss: How To Make More Money With My 401k

Recommended Reading: How Does 401k Show On Paycheck

When Not To Transfer To An Ira

You now know some of the benefits of moving your 401 to an IRA. But control over your money isnt the only thing that matters, and you may have other priorities. Its impossible to list every potential pitfall, but a few examples may offer food for thought.

Between age 55 and 59.5

When youre at least 55 years oldbut not yet 59 1/2 years oldyou might want to leave at least some of your money in the 401 plan. 401s allow you to pull money out without penalty after age 55 . IRAs, on the other hand, require that you wait until age 59 ½ to avoid an early-withdrawal penalty of 10% on certain distributions. There are always exceptions and workarounds, but those are the basic rules. If you intend to spend your 401 savings between the ages of 55 and 59 1/2, keep this in mind before making a transfer.

Note: Some public safety workers can avoid early withdrawal penalties from a retirement plan as early as age 50. If you worked for a federal, state, or local government, be sure to explore your options.

Depending on state laws, money in IRAs might be treated differently, and a 401 might offer more protection . Federal law often applies to ERISA-covered 401 plans, while state laws cover IRAs. However, there is some federal protection for IRAs in bankruptcy. When you owe federal tax debts or assets are due to an ex-spouse, protection is usually limited.

Roth Conversions

RMD While Working

Stable Value Offerings

Fees and Expenses

What If I Have Both Pretax And After

Generally, pretax assets are rolled into a rollover IRA or traditional IRA. After-tax assets or after-tax savings) are rolled into a Roth IRA.

You can choose to roll pretax savings into a Roth IRA, but doing so would be treated as a taxable event. Similarly, you can roll after-tax savings into a traditional IRA, but this requires careful tracking of your assets for when you start taking distributions. Before deciding, please consult your tax advisor about your personal circumstances.

Read Also: Can My Wife Take My 401k In A Divorce

Report The Rollover On Your Taxes

In a direct rollover, you shouldnt owe any additional taxes, but you need to report the transaction on your taxes. If you roll over a 401k to an IRA, you should expect a 1099-R form from your 401k plan provider. This is the form youll use to report a direct rollover to the IRS. Fidelity will also send you a 5498 form if your rollover was a direct one. Simply add that information to your tax return at the end of the year.

More on 401k Investments:

The 10% Early Distribution Penalty

Ive mentioned this penalty a couple of times, so lets discuss it in some detail. Under IRS rules, retirement funds are eligible for distribution beginning at age 59 ½. If you take distributions before reaching that age, which can certainly happen in the case of a distribution or an unsuccessfully completed rollover, youll pay a penalty equal to 10% of the amount of the distribution, over and above the ordinary income tax owed.

But there are IRS exceptions to the early distribution penalty. It can be waived under any of the following circumstances:

- Automatic enrollment permissive withdrawals from a plan with auto enrollment features

- Death of the plan owner

- Disability total and permanent disability of the participant/IRA owner

- Medical amount of unreimbursed medical expenses

- Military certain distributions to qualified military reservists called to active duty

Unless you qualify for one of these penalty exemptions, you should avoid taking direct distribution of your 401 plan funds. Also remember that the exceptions apply only to the 10% penalty. You will still owe ordinary income tax on the amount distributed. Taxwise, a 401 rollover is by far your best strategy.

Recommended Reading: Can I Roll A Roth Ira Into A 401k

Preparing For A Backdoor Roth Ira Conversion

If you’re considering doing a Backdoor Roth IRA Conversion, one of the first things you need to do is eliminate any money you have in a traditional, SIMPLE, or SEP IRA. The reason for this is that you can run into complexities and potential tax consequences if you have pre-tax money in any of these accounts when you convert.

As we previously discussed in our ultimate guide on how to do a mega backdoor Roth IRA conversion, one of the simplest ways to eliminate money in these pre-tax accounts is to roll it into an employer sponsored 401k. Remember, though, that you can only roll over pretax money into a 401k, so any non-deductible contributions you have made to these accounts don’t qualify.

How Can A Rollover Ira Benefit Your Investment Plan

So what are the benefits of rolling over a 401 to an IRA at Fidelity?

First of all, youll likely have access to a broader array of investment options like mutual funds, low-cost exchange-traded funds , real estate investment trusts, and more. Such flexibility means you can create an investment plan and allocation strategy that is completely customized to you and your goals without having to cut corners due to a limited set of choices.

There are administrative fees associated with operating a 401. These sometimes get passed to plan participants, so its possible that your investment fees will be lower in an IRA as well. Investment fees are a major contributing factor to your long-term investment performance, so thats a big perk.

In exchange for assuming a small risk from creditor liability, rolling over an ERISA-protected 401 plan may provide you with greater diversification at a lower cost.

Then, there is the convenience and simplicity that come with investing in an IRA. Youll likely change employers multiple times throughout your working life. Combining retirement accounts into a single IRA each time makes things easier to track and manage.

It also reduces paperwork because each account comes with statements, investment information, and regular updates. Consolidating old 401s to IRAs also simplifies the withdrawal and required minimum distribution processes when the time comes.

Recommended Reading: How To Do Your Own 401k

Contact Your Old 401 Provider

First, identify the provider of your old 401. If you aren’t sure who your old 401 provider is, the name should be on your account statements. If you have trouble finding this information, call your former employer.

Is your old 401 with Fidelity? If so, you can do the entire rollover through your NetBenefits®. account. You don’t need any additional paperwork, and the money can be directly transferred.

Is your old 401 with a different provider? If so, they will need to start the rollover process, so you’ll need to either call them or initiate the process online. They may need some paperwork, such as a Letter of Acceptance from Fidelity, or their own paperwork completed and signed by you or a Fidelity representative. If you have multiple accounts or employers, you may need more than one LOA.

Here are some questions to ask when you contact them. If you’d like to have a Fidelity rollover specialist on the line with you when you call, call us first at 800-343-3548.

Covington, KY 41015-0037

Do you own company stock?

If you have shares of company stock, it’s easiest to give us a call at 800-343-3548 and one of our rollover specialists can help you understand your options and take action.

What Happens If I Leave My Employer And I Have An Outstanding Loan From My Plan Account

Keep in mind that most plans require that loans be repaid when you leave. If you roll over your remaining account balance to a new employers plan, you may also be able to roll over the outstanding balance of your loan to your new employers plan. Check with your new employer to find out if the loan will be accepted by the new plan. You cannot roll over your loan to an IRA.

If you cant move the loan to your new plan, and if you dont repay the loan within the time allotted, the outstanding balance will be treated as a withdrawal, subject to federal and applicable state and local taxes. If youre under age 59½, you may also have to pay a 10% early withdrawal penalty unless you qualify for an exception.

Read Also: When Can I Draw From My 401k Without Penalty

Read Also: Is There A Cap On 401k Contributions

Defining Terms: What’s A 401

A 401 plan is a tax-advantaged retirement account typically sponsored by an employer.

The traditional form of the 401 works much like a traditional IRA: Your contributions in a given year reduce taxable income for that year. In a simplified example, if you earn $75,000 and contribute $10,000, your earnings fall to $65,000, saving you tax dollars up front. Your withdrawals will eventually be taxed, though.

401s differ in a few meaningful ways from IRAs:

- Contribution limits: 401s have much higher contribution limits. These typically change annually, but generally you can contribute about three times as much money to a 401 as an IRA.

- Investment options: 401s typically provide limited investment options, with most offering a dozen or fewer mutual funds. In IRAs opened at brokerages, you can invest in virtually any stock exchange-traded fund , or mutual funds.

- Matching funds: Many employers match employee 401 contributions up to a certain percentage of pay.