How Can A Rollover Ira Benefit Your Investment Plan

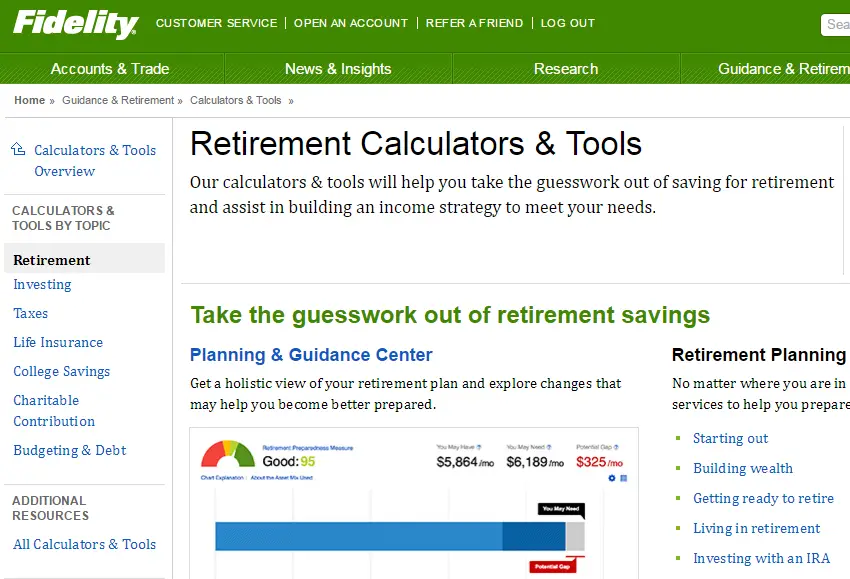

So what are the benefits of rolling over a 401 to an IRA at Fidelity?

First of all, youll likely have access to a broader array of investment options like mutual funds, low-cost exchange-traded funds , real estate investment trusts, and more. Such flexibility means you can create an investment plan and allocation strategy that is completely customized to you and your goals without having to cut corners due to a limited set of choices.

There are administrative fees associated with operating a 401. These sometimes get passed to plan participants, so its possible that your investment fees will be lower in an IRA as well. Investment fees are a major contributing factor to your long-term investment performance, so thats a big perk.

In exchange for assuming a small risk from creditor liability, rolling over an ERISA-protected 401 plan may provide you with greater diversification at a lower cost.

Then, there is the convenience and simplicity that come with investing in an IRA. Youll likely change employers multiple times throughout your working life. Combining retirement accounts into a single IRA each time makes things easier to track and manage.

It also reduces paperwork because each account comes with statements, investment information, and regular updates. Consolidating old 401s to IRAs also simplifies the withdrawal and required minimum distribution processes when the time comes.

Recommended Reading: How To Do Your Own 401k

What If I Have Both Pretax And After

Generally, pretax assets are rolled into a rollover IRA or traditional IRA. After-tax assets or after-tax savings) are rolled into a Roth IRA.

You can choose to roll pretax savings into a Roth IRA, but doing so would be treated as a taxable event. Similarly, you can roll after-tax savings into a traditional IRA, but this requires careful tracking of your assets for when you start taking distributions. Before deciding, please consult your tax advisor about your personal circumstances.

Read Also: Can My Wife Take My 401k In A Divorce

What States Do Not Tax Tsp Withdrawals

While most states tax TSP distributions, these 12 do not: Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, Wyoming, Illinois, Mississippi and Pennsylvania.

What state does not impose your 401k? Some of the states that do not impose 401 include Alaska, Illinois, Nevada, New Hampshire, South Dakota, Pennsylvania and Tennessee. You can save a lot of money if you live in these states, since your retirement income will be tax-free.

Recommended Reading: How To Do 401k Rollover

Open Your Rollover Ira In 3 Easy Steps Were Here To Help You Along The Way Too

Investment, insurance and annuity products are not FDIC insured, are not bank guaranteed, are not deposits, are not insured by any federal government agency, are not a condition to any banking service or activity, and may lose value.

Consumer and commercial deposit and lending products and services are provided by TIAA Bankî, a division of TIAA, FSB. Member FDIC. Equal Housing Lender.

The TIAA group of companies does not provide legal or tax advice. Please consult your tax or legal advisor to address your specific circumstances.

TIAA-CREF Individual & Institutional Services, LLC, Member FINRA and SIPC , distributes securities products. SIPC only protects customers securities and cash held in brokerage accounts. Annuity contracts and certificates are issued by Teachers Insurance and Annuity Association of America and College Retirement Equities Fund , New York, NY. Each is solely responsible for its own financial condition and contractual obligations.

Teachers Insurance and Annuity Association of America is domiciled in New York, NY, with its principal place of business in New York, NY. Its California Certificate of Authority number is 3092.

TIAA-CREF Life Insurance Company is domiciled in New York, NY, with its principal place of business in New York, NY. Its California Certificate of Authority number is 6992.

Donât Miss: How To Access An Old 401k Account

Considerations For Owners Of Roth Iras

Distributions from a Roth IRA are qualified, and thus tax-free and penalty-free, provided that the 5-year aging requirement has been satisfied and at least one of the following conditions has been met:

- You reach age 59½

- You pass away

- You are disabled

- You make a qualified first-time home purchase

All other distributions are non-qualified. Non-qualified distributions of converted balances are not taxed again , but they may be subjected to a 10% penalty unless it’s been at least five years since the beginning of the year of your conversion, you’ve reached age 59½, or one of the other exceptions applies.

RMDs are not required during the lifetime of the original owner of a Roth IRA. RMD amounts are not eligible to be converted to a Roth IRA.

You May Like: How Do I Check My 401k For Walmart

Cons Of Rolling Your Roth 401 Funds Into A Roth Ira

When it comes to Roth IRAs, the most important thing to keep in mind is the five-year rule. The clock starts ticking when you make your first contribution into your Roth IRA, not when you open the account. So even if youve had a Roth IRA for more than five years, you may still have to hold off withdrawals if it took you a few years to start contributing. Any Roth 401 contributions youve made dont make any difference in relation to this timeline.

If you need the money and dont plan to change jobs any time soon, remember that you may be able to get a Roth 401 loan from your plan administrator. To clarify, you could borrow up to $50,000 or 50% of your vested account balance, whichever is less, though the loan must be repaid within five years or immediately upon leaving your employers service to avoid it being treated as a taxable distribution. Roth IRAs dont offer this kind of flexibility, so a rollover would eliminate this option.

You should consider the investment options and fees of a Roth IRA before definitively deciding on a rollover. It may be that your Roth 401 program offers a better selection of possible investments or charges fewer fees than a Roth IRA would.

Pros And Cons Of Rolling Over 401k To Ira

Learn the pluses and the minuses of getting all of your IRA and 401k ducks in a row.

According to the Bureau of Labor Statistics, on average, individuals between the ages of 18 and 52 may change jobs as frequently as 12 times. Some of those jobs probably came with some type of employer sponsored retirement plan such as 401k or an IRA account . When switching jobs, many people choose to rollover any accounts to their new employers plan rather than taking them as a withdrawal. When you roll over a retirement plan distribution, penalties and tax are generally deferred. So lets look at a few of the pros and cons of consolidating them into one IRA with one institution.

Don’t Miss: How Do I Get Access To My 401k

How To Roll Over Your Fidelity 401k

Rolling over your Fidelity 401k is simpler than you might think. You and Your 401K

Leaving a job or getting laid off usually prompts a period fraught with tough choices and big changes. In the midst of everything else, managing your old 401k might be the last task you want to deal with.

The good news is, if your 401k is with Fidelity, the process for completing your rollover is actually simple and quite painless. You can convert your employer-sponsored 401k to an IRA or even move it into the 401k account of your new employer rather seamlessly if you know the correct steps to take.

Heres a quick look at how to roll over your Fidelity 401k.

Follow These 3 Easy Steps

Step 1Select an eligible Vanguard IRA for your rollover*

- If you’re rolling over pre-tax assets, you’ll need a rollover IRA or a traditional IRA.

- If you’re rolling over Roth assets, you’ll need a Roth IRA.

- If you’re rolling over both types of assets, you’ll need two separate IRAs.

Note: You can roll over your assets to a new or an existing Vanguard account.

Step 2Contact the financial institution holding your employer plan

Tell them you want to make a direct rollover from your employer plan to your Vanguard IRA®, and ask what information they need

Need a letter of acceptance?

You’ll be able to create and print a letter of acceptance during our online rollover process.

Note: You may not be eligible to roll over a plan account that you’re still contributing to.

What types of assets do I have in my employer plan account?

Knowing whether you have pre-tax or Roth assets will help you figure out what type of IRA you need to open at Vanguard. If you own company stock in your plan, that may add a layer of complexity to your rollover.

What name did I use on my employer plan account?

A common situation that can delay a rollover is when a check from the current financial institution is made payable to a name that doesn’t match your Vanguard account registration. Examples include use of birth name versus married name, a missing suffix , differing middle initials , etc.

What are your rollover requirements?

Are e-signatures or faxed copies allowed?

Do you need a letter of acceptance ?

Don’t Miss: How Much Will Be In My 401k When I Retire

Why It Works To Move Your Retirement Plan To A Self

There are numerous reasons people choose to transfer and/or rollover their retirement account to a self-directed IRA. The main reason is to protect their savings from a volatile stock market or unpredictable changes in the economy. By diversifying their investments, they have a greater opportunity to stay on track with their retirement goals.

Self-directed IRAs are also known to perform much better than stocks and bonds. A recent examination of self-directed investments held at IRAR suggests that investments held for 3 years had an ROI of over 23%. This is why most investors are self-directing their retirement.

Confirm A Few Key Details About Your Fidelity 401

First, get together any information you have on your Fidelity 401. Its okay if you dont have a ton, but any details like an old account statement or an offboarding e-mail from your former HR team can help. 401 paperwork can be confusing, so just focus on identifying the following items:

STEP 2

Don’t Miss: How Do I Know If I Have Money In 401k

Advantages To Rolling Tsp Funds Into An Ira

As outlined above, a couple benefits exist for keeping retirement savings in a TSP once you separate from the military. However, there are also some major advantages to rolling those funds into an IRA. If any of the below advantages resonate with your unique situation, moving your TSP funds into an IRA may make sense.

Advantage 1: Investment Options

While the TSP offers extremely low expense ratios, it also has very limited investment options. Within your TSP account, you can only choose from five individual funds or several life-cycle funds . This means that investors looking to purchase individual stocks, exchange-traded funds, or other common investment options cannot do so in a TSP.

Alternatively, IRAs typically offer a wide variety of investment options, limited only by the account custodian. For more sophisticated investors who prefer building a personalized retirement portfolio, IRAs simply offer far more flexibility. Additionally, some investors eventually choose to use retirement funds to invest in alternative assets . While you cannot do this with a TSP or normal IRA, you can with a self-directed IRA.

Advantage 2: Simplicity

As people approach retirement age, many try to simplify their financial situation. This may mean limiting the number of open retirement accounts you have. If you served in the military, worked in a civilian job, and started an IRA, you could potentially have three retirement accounts and that doesnt even include your spouses accounts.

Signs It Makes Sense To Roll Your 401 Into A Roth Ira

If youre thinking of rolling your 401 into a Roth IRA instead of a traditional IRA, you have plenty of reasons to do so. Not only do Roth IRAs let you invest your dollars in the same investments as traditional IRAs, but they offer additional perks that can help you save money down the line. Here are four signs that a Roth IRA might actually be your best bet.

Recommended Reading: How Do I Cash Out A 401k

Where To Transfer Your 401

posted on

When you leave a job, you typically get to choose what happens with your retirement savings. Thats the case with most 401, 403, and other retirement plans. You often have the opportunity to take control of your savings, but you might also have the option to leave assets with your former employer.

If you decide to move the money, where should you transfer your 401 savings? On this page, well cover the most common options available when you retire or change jobs:

- Transfer to an IRA that you control

- Move to your new jobs retirement plan

- Transfer to a bank account

- Buy an annuity if you want income guarantees

- Leave the money where it is

Taxes On Earnings From After

After-tax contributions to a 401 or other workplace retirement plan get a different tax treatment than their earnings. Since you’ve already paid taxes on the contributions, those withdrawals are tax-free in retirement. But the IRS considers the earnings to be pre-taxso they would be treated as pre-tax and you would owe income tax when you withdraw the earnings from the plan.

Earnings in Roth IRAs, however, aren’t subject to income tax as long as all withdrawals from the account are qualified withdrawals. So rolling after-tax money from a workplace plan to a Roth IRA means you can avoid taxes on any future earnings.

Don’t Miss: Where To Open A 401k

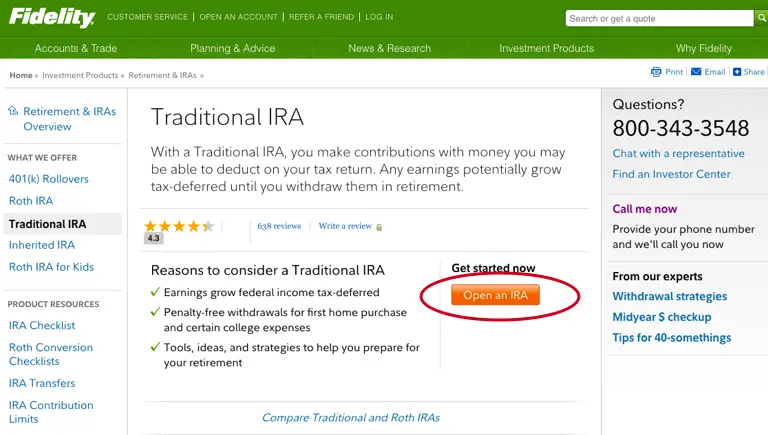

Making A Fidelity 401k Withdrawal

Your 401k is your money, and making a withdrawal is as simple as contacting Fidelity to let them know you want it. The easiest way is to simply visit Fidelitys website and request a check there. However, you can also reach out via phone if you prefer: Call 800-343-3543 with any questions about the process.

From there, you can download the appropriate withdrawal request form and then mail it to the address listed on the form. Fidelity will have your check for you in five to seven business days after receiving your request. There are no fees for requesting a check, but if you liquidate any holdings, there could be commissions or mutual fund fees associated with that.

Rolling A 401 Directly Into A Roth Ira

If you qualify, you can do an eligible rollover distribution from your old 401 directly to a Roth IRA. You’ll owe taxes on the amount of pretax assets you roll over.

Note also, if you have assets in a Designated Roth Account ) and would like to roll these to an IRA, the assets must be rolled into a Roth IRA.

As with Traditional IRA conversions to Roth IRAs, if you are required to take an RMD in the year you roll over into an IRA, you must take it before rolling over your assets.

Don’t Miss: How To Find 401k From Former Employer

How Do I Choose An Ira Provider

Many financial institutions offer IRAs, including brokerage firms, banks, and newer fintech companies. In order to pick the best account for you, theres one up-front question to answer:

Do you want to make your own investment decisions, or would you rather have the investing decisions made for you so you can just set-it-and-forget-it?

If you want to make your own decisions, then what youll want is a self-directed IRA. That allows you to make your own trading decisions and invest in whichever financial securities youd like.

The key features to compare when choosing among self-directed IRAs include:

- What do you want to invest in? The exact investment options among IRA providers varies. Most of them allow you to invest in stocks, ETFs and options. Other specialized IRA providers will let you invest in private assets and cryptocurrency.

- Access to research and data. Some brokers provide access to premium research and data. If youre a more hands-on investor, this might be important to you.

- Ease of use while user interfaces are getting better across the board, newer fintech providers tend to be more popular with those who really value an intuitive app experience.

The key features to compare when choosing an automated account include:

Get matched with an IRA provider based on your preferences! If you choose to do an 401-to-IRA rollover, well match you with a provider based on your preferences as part of our rollover process.