Home Equity Line Of Credit

Instead of fixed-term repayment, you get a variable repayment and interest rate. You may opt for an interest-only repayment, but most often that comes loaded with a balloon payment, Poorman says, and may be tough to afford. Keep in mind that with a variable interest rate loan, you could see your rates go up over time.

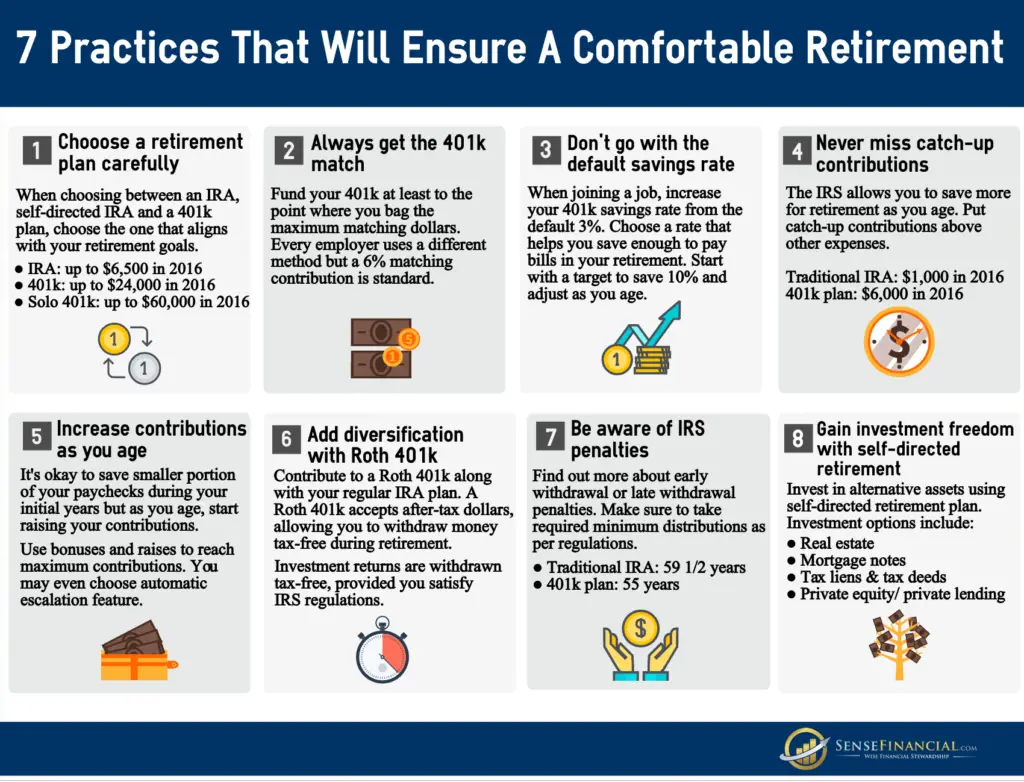

Withdrawal Age And Early Withdrawal Rules

Once you reach age 59.5, you may withdraw money from your 401 penalty-free. If you tap into it beforehand, you may face a 10% penalty tax on the withdrawal in addition to income tax that youd owe on any type of withdrawal from a traditional 401. But in some cases, your plan may allow you to take a penalty-free early withdrawal. Well cover the 401 early withdrawal rules and alternatives to dipping into your retirement savings. We can also help you find a financial advisor who can guide you through your options based on your individual needs.

How Much Tax Do I Pay On An Early 401 Withdrawal

The money will be taxed as regular income. That’s between 10% and 37% depending on your total taxable income.

In most cases, that money will be due for the tax year in which you take the distribution.

The exception is for withdrawals taken for expenses related to the coronavirus pandemic. In response to the coronavirus pandemic, account owners have been given three years to pay the taxes they owe on distributions taken for economic hardships related to COVID-19.

Also Check: What Is The Tax Rate On 401k After 65

Rolling Over Your 401k

If you roll over your 401k, you can do it directly from your 401k plan to your new IRA account. This way no taxes are withheld. Set up an IRA with the financial institution of your choice, and its representative will help you contact the institution that manages your 401k plan to request a direct rollover. When you do the rollover, you can choose to have a percentage of the account distributed to you in the form of a check, but this part is subject to tax and penalties. You can also withdraw cash from your IRA after you roll over funds, but you’ll pay taxes and the 10 percent penalty until you reach the age of 59 and six months.

What If You Cant Pay Back The 401 Loan

The main downside of a loan occurs if you either cant repay the loan or, in some cases, if you leave the employer prior to having paid off the loan.

If you default on the loan this becomes a distribution that is subject to taxes and to a 10% penalty if you are younger than 59 ½.

In some cases, leaving the company with an unpaid loan balance may trigger a distribution, but your plan may have repayment provisions that extend after you leave the company that allow for repayment without triggering taxes or a penalty.

Its always best to check with your companys plan administrator so you can fully understand the provisions of the loan.

You May Like: How To Open 401k For Small Business

You May Owe A Penalty In Addition To Any Taxes Due

Unless youre facing one of the IRS-defined hardships and youre below 59 ½ you will likely be liable for an additional 10% early withdrawal penalty. These costs can add up quickly and can take a huge bite out of your retirement savings, so make sure you really need the money before you opt to cash out.

Using The Calculator And Comparing The Results

Using this 401k early withdrawal calculator is easy. Enter the current balance of your plan, your current age, the age you expect to retire, your federal income tax bracket, state income tax rate, and your expected annual rate of return.

With a click of a button, you can easily spot the difference presented in two scenarios. A lump-sum distribution may save you on future taxes but it definitely cuts into your asset at the time of distribution. If you roll over your 401k, on the other hand, you may have to shell out a lot of money in future taxes but the growth in the account will make paying those taxes a good problem to have.

Related:Why you need a wealth plan, not an investment plan.

Easy, simple, and straightforward â that is what the 401k early withdrawal calculator offers. Unlike other calculators in the market, this calculator puts forward a detailed analysis of what you are getting into. It presents the taxes and penalties that you may incur as well as the opportunities each option brings.

Knowledge is power. Spending a few minutes contemplating the results of this calculator can lead you to make an educated decision resulting in thousands more saved at retirement.

Don’t Miss: What To Do With 401k When You Retire

Need Help With A Rollover Contactmyra For A Free Consultation On Your Unique Financial Planning Needs

Option B: 401K Loan – Certain 401K administrators offer 401K loans. Generally, if your plan allows it, you can take a loan for up to 50% of the vested 401K account balance to a maximum of $50,000. You must repay the loan within 5 years unless you use the loan to buy your primary residence. There may be other requirements about how frequently you must make payments on the loan . Your loan payments may be taken out of your paychecks. 401K loans are not usually considered taxable income but certain plans may treat them as taxable income. You will have to pay interest on the loan and the interest rate is usually the prime rate. In a 401K loan, you actually pay the interest to yourself. Some people have argued that this is a good investment but Michael Kitces explains in this blog post why that isnt the case.

If you quit your job before paying back the entire loan, you will owe income tax and a 10% penalty on any amount that is not repaid. Thus, if you are planning to leave your job and may have taken out a 401K loan, you may want to consider paying off the loan before leaving or shortly after leaving to avoid the penalty.

Qualifications For Hardship Withdrawals

The IRS defines some criteria for a hardship withdrawal. These include:

- The withdrawal is due to an immediate and heavy financial need.

- The withdrawal is necessary to satisfy this immediate and heavy financial need. This means that you dont have another source of funds available to you that will allow you to meet this need.

- The amount of the hardship withdrawal cannot exceed the amount that you need to satisfy this financial need.

Also Check: How To Manage Your 401k Yourself

Eligibility For Cashing A 401 Plan

In the event that you are still under the employment of the company that is paying for your 401, you wont be eligible for cashing out your 401 plan. The only exceptions to this would be if the plan, in particular, allows for a 401 loan, an in-service withdrawal, or a hardship withdrawal.

One piece of advice would be to avoid taking out a 401 loan as much as you can. The cash you have in your 401 needs to be given as much time as you can in order to grow. The loan is also required to be paid back with interest, so youll just end up losing money in the long run.

If you are no longer under the employment of the companies that sponsor your 401 plan, then you are indeed eligible to get the money. You can either cash it out, or you may roll it over through an IRA.

If you choose the rollover instead of the cash-out, then you will not have to pay any penalty or income taxes. Rollovers arent taxable transactions not if you do it correctly. If you roll your 401 plan over into another plan, then the IRS does not see this as cashing out.

Should You Take A 401 Loan Or 401 Withdrawal

Some plans allow loans from 401 plans as an option to get access to the fund for virtually any purpose. Maybe you want to travel, pay your childs college tuition, put a down-payment on a new house, or cover the cost of a divorce. There are many personal reasons to consider a loan.

Generally, you can take up to 50% of the balance to a maximum of $50,000. The good news is that there is no age restriction, and there are no taxes due when you take out a loan. However, the loan must be repaid over a five-year period, with interest owed back to your account.

There is risk involved in taking out a loan. Some plans allow you to roll over a 401 when changing employers. However, in other cases, you may have to pay your outstanding loan balance in full within 60 days of leaving an employer otherwise, it will be considered a 401 withdrawal, taxed as ordinary income and subject to the 10% withdrawal penalty.

Compared to a loan, an early 401 withdrawal:

- Must have an option that allows for in-service withdrawals, which may be restricted by age or hardship.

- Will be taxed as ordinary income .

- Can be subject to a 10% penalty if youre under 59.5 .

- Will not require repayment loan).

Don’t Miss: How To Find Out 401k Balance

How To Make An Early Withdrawal From A 401

When you have determined your eligibility and the type of withdrawal you want to make, you will need to fill out the necessary paperwork and provide the requested documents. The paperwork and documents will vary depending on your employer and the reason for the withdrawal, but when all the paperwork has been submitted, you will receive a check for the requested funds, hopefully without having to pay the 10% penalty.

Should You Withdraw Early From Your 401k

Ask yourself honestly . . . are you tempted to cash out your 401k early?

You probably have a long list of all the great things you can do with those funds right now. But is an early withdrawal from your 401k really a good idea?

This 401k Early Withdrawal Calculator will help you compare the consequences of taking a lump-sum distribution from your 401 â or even your IRA â versus rolling it over to a tax-deferred account.

Make a smart decision. Use the calculator to let the math prove which is the optimum choice.

You May Like: What Age Can You Take Out 401k

High Unreimbursed Medical Expenses

This particular exception is similar to the hardship distributions mentioned earlier, and these medical bills might qualify you under either category. You should know that a hardship withdrawal for medical bills will not entitle you to a waiver of the 10% penalty in all cases. To qualify for a penalty-free withdrawal, the amount of the bills must be greater than 7.5% of your adjusted gross income . You must also take the distribution in the same year in which the bills were incurred. You cannot take money for estimated future bills either. The bills must be currently due for services already provided.

Also note the requirement that the bills be unreimbursed. If your insurance covers part of the bills or will reimburse you for the payments, then you cannot use money from your 401 to pay them. Likewise, the bills must be for you, your spouse, or a qualified dependent. You cannot use the money to pay bills for a parent, sibling, or any other family member. The limit to the amount of money you can withdraw for medical bills was recently removed, so you are allowed to withdraw as much as is needed to cover all the expenses.

Home Equity Loan Or Heloc

If you own a home with equity built up, a home equity loan or home equity line of credit can be a low-interest alternative to a personal loan. This type of loan is often referred to as a second mortgage because the loan is secured by your home. In other words, if you default on the loan, your lender may have a right to foreclose on your home.

One of the major benefits of a home equity loan or HELOC over a personal loan is the interest rate. Loans that are secured by homes including mortgages, home equity loans, and HELOCs often have some of the lowest interest rates on the market. As a result, the loan will cost you less money over the long term.

Its important to proceed with caution if youre considering a home equity loan or HELOC. As we mentioned, these loans are secured by your home. If you cant make your monthly payments, you risk having the lender take your home. As a result, you should avoid this option if you think for any reason you may not be able to repay the loan on time.

You May Like: How Do I Close Out My 401k

Can Anybody Cash Out A 401 K Early

If you resign early, you might want to cash out your 401 k. However, you might face a financial penalty for doing so. If you haven’t reached retirement age, you can often expect to be charged 10% plus ordinary income tax on the amount in your 401 k for an early withdrawal. If you think you might want to take your 401 k money out of the IRA early, you should discuss this with your current employer.

Is There A Way To Get The Funds Out Of My 401k Early Without Paying A Penalty

Option A: Rollover to an IRA And Withdraw – You can rollover your 401K to an IRA but that will not give you early, penalty-free access to your retirement funds. It simply transfers the funds from your employers retirement account to a personal retirement account that also has early withdrawal restrictions. If you rollover your 401K to an IRA, no taxes are withheld . Rollover transactions are reported on Form 1099-R. You can rollover by having one institution pass the funds to another or you can actually withdraw the funds and move them yourself to a new institution within 60 days. If you choose this latter option, there will be mandatory withholding of 20%, so it is easier to do a direct institution to institution transfer. There may be an option to withdraw the funds early for specific reasons – IRAs are another type of retirement vehicle and have slightly different early withdrawal rules than 401Ks. If you rollover your 401K to an IRA, you may be able to withdraw money early penalty free for the following reasons: first time home purchase, tuition and educational expenses, disability, medical expenses, and health insurance

You May Like: Can I Move My 401k To Bitcoin

What Exactly Qualifies As A Hardship Withdrawal

Financial withdrawals are permitted when a certain event is in a dire need of financial aid. For example, emergency medical procedures fall into this category. The amount that you borrow must be used entirely to cover said hardship. In these circumstances, you wont have to pay any early withdrawal penalties, but youll still have to deal with the taxes.

How Long Does It Take To Cash Out Your 401 After Leaving A Job

If you opt to cash out your 401, youll need to contact your 401 plan provider and have them send you the money either electronically or via paper check. This process can take anywhere from a few days to a few weeks. In either case, you should have the money within a reasonable amount of time after requesting it.

Recommended Reading: How To Get Your 401k Out

K Early Withdrawal Hardship Or Loan: Whats The Difference

Knowing the differences between a 401k early withdrawal, a hardship withdrawal, and a 401k loan is crucial. Due to the many obstacles to make a 401k early withdrawal, you may find you want to keep it untouched. If youre convinced you still need to use your 401k for financial assistance, consult with a trusted financial advisor to figure out the best option.

|

When Does This Apply? |

||

| Your funds are withdrawn to pay off large debts or finance large projects. | Your 401k fund is typically subject to taxes and penalties. | |

|

Hardship Withdrawal |

Youre only eligible for this type of withdrawal under circumstances such as a pandemic or natural disasters. | Withdrawals cant exceed the amount of the need and the funds are still subject to taxes and penalties. |

|

401k Loan |

The loan must be paid back to the borrowers retirement account under the plan. | The money isnt taxed if the loan meets the rules and the repayment schedule is followed. |

What To Ask Yourself Before Making A Withdrawal From Your Retirement Account

There are many valid reasons for dipping into your retirement savings early. However, try to avoid the mindset that your retirement money is accessible. Retirement may feel like an intangible future event, but hopefully, it will be your reality some day. So before you take any money out, ask yourself: Do you actually need the money now?

Think of it this way: Rather than putting money away, you are actually paying it forward. If you are relatively early on in your career, your present self may be unattached and flexible. But your future self may be none of those things. Pay it forward. Do not allow lifestyle inflation to put your future self in a bind.

With all this talk of 10% penalties, and not touching the money until youre retired, we should point out that there is a solution if you feel the need to be able to access your retirement funds before you reach age 59 ½ without penalty.

Contribute to a Roth IRA, if you qualify for one.

Because contributions to Roth accounts are after tax, you are typically able to withdraw from one with fewer consequences. Keep in mind that there are income limits on contributing to Roth IRAs, and that you will still be taxed if you withdraw the funds early or before the account has aged five years, but some people find the ease of access comforting.

For some folks, however, a Roth-type account is not easily available or accessible to them.

You May Like: How Much Invest In 401k